Anti-Seize Compounds Market Outlook:

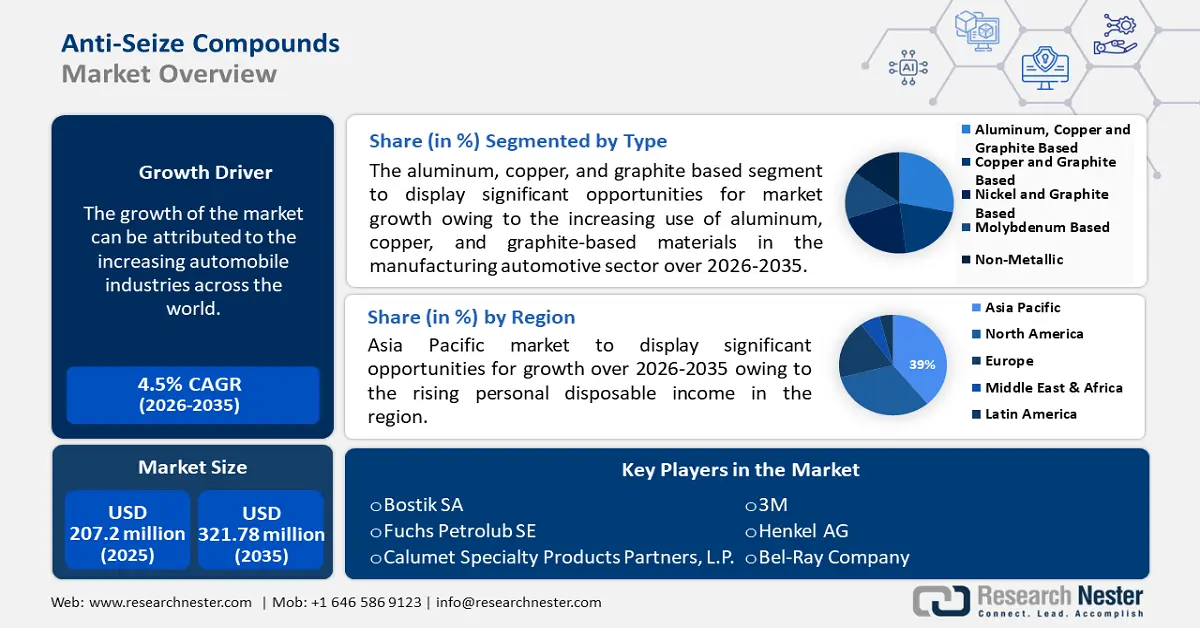

Anti-Seize Compounds Market size was valued at USD 207.2 million in 2025 and is expected to reach USD 321.78 million by 2035, expanding at around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-seize compounds is evaluated at USD 215.59 million.

The growth of the market can be attributed to the increasing automobile industries across the world. The increasing investments by the government in infrastructural developments and a growing number of constructions around the world are estimated to boost market growth in the coming years. The automobile sector uses anti-seize products to prevent corrosion and seizing in the bolts, fasteners, flanges, and other interfaces that are clamped. The rising number of vehicles across the world with increasing disposable income of people is also estimated to fuel the market growth as per the market analysis. The estimated reports for 2022 have shown that over 1.4 billion cars are being used in the world.

The increasing use in the petrochemical industries and transportation sector is estimated to drive market growth in the coming years. It was estimated that the petrochemicals production capacity across the globe reached over 2 billion metric tons as of 2021. The increasing incidence of corrosion and rust formation in the interfaces of metals is also anticipated to drive the growth of the market. The continuous use of machinery in production and manufacturing units increases the chances of corrosion. The use of anti-seize compounds helps to lubricate and tightly seal the threads and press fits of stainless-steel materials. Also, the market growth is attributed to the rising use of anti-seize compounds in pipelines to protect from acids, ammonia, acetylene, and other environmental chemicals.

Key Anti-Seize Compounds Market Insights Summary:

Regional Highlights:

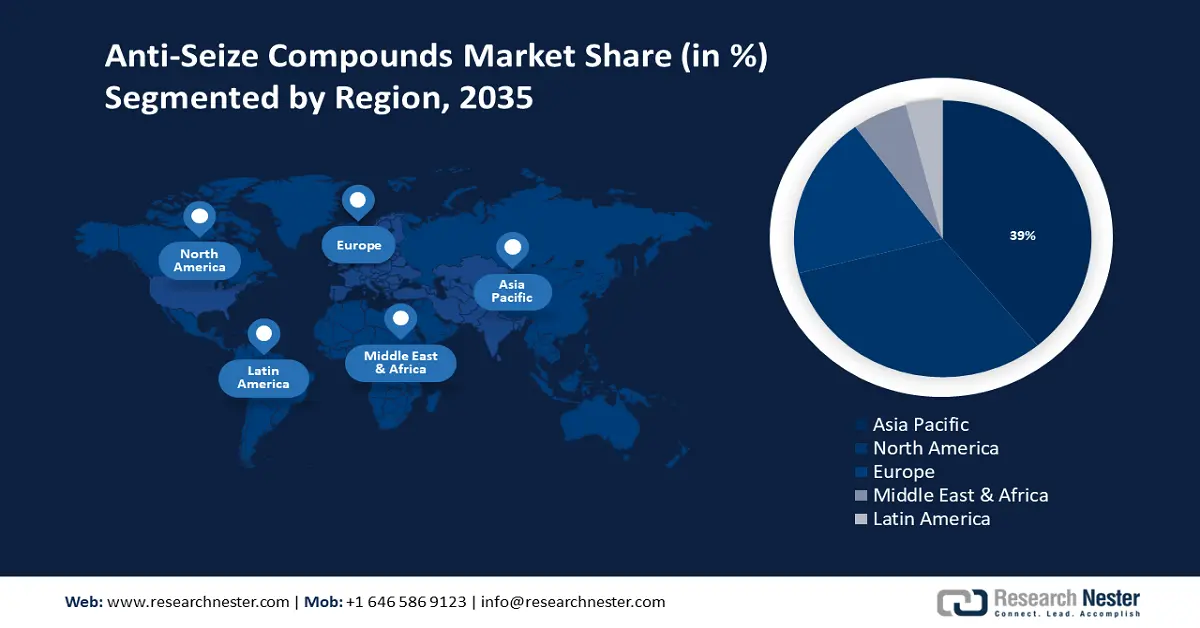

- The Asia Pacific anti-seize compounds market will hold around 39% share, poised for growth by 2035, driven by demand in automotive, mining, and construction sectors.

- The North America market will command a 32% share, set to expand by 2035, attributed to high vehicle production and investment in infrastructure.

Segment Insights:

- The aluminum, copper & graphite based segment in the anti-seize compounds market is anticipated to achieve a 28% share by 2035, attributed to increasing use in automotive and electrical manufacturing applications.

- The oil & gas segment in the anti-seize compounds market is projected to capture a 26% share by 2035, driven by growing demand for anti-corrosive solutions in energy infrastructure.

Key Growth Trends:

- Rapid Industrialization and Urbanization with Increasing Infrastructure Development

- Growing Need for Water Treatment Plants with Increasing Pollution Worldwide

Major Challenges:

- Low Awareness About the Benefits of Compounds in Underdeveloped Nations

- Incidence of the Pandemic Restricted the Supply Chain across the World

Key Players: 3M Company, Henkel AG, Bel-Ray Company, SAF-T-LOK International Corporation, Molytech Lubes Private Ltd., CRC NZ, DuPont de Nemours, Inc., Bostik SA, Fuchs Petrolub SE, Calumet Specialty Products Partners, L.P.

Global Anti-Seize Compounds Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 207.2 million

- 2026 Market Size: USD 215.59 million

- Projected Market Size: USD 321.78 million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Anti-Seize Compounds Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid Industrialization and Urbanization with Increasing Infrastructure Development – The increasing economic standards and spending capacity of people lead to rising investment in industries leading to an increase in the number of industries across the world. The increasing industries rises the demand for anti-seize compounds as they help to prevent damages caused by rusting, galling, corrosion, and friction. The anti-seize compounds lubricate and seal the threads and bolt decreasing the wear and tear disruptions in the machinery and increasing its lifespan. The World Bank Organization data stated that about 56% of the global population which is nearly 4.4 billion people are living in cities and was also projected to increase by twice the size by the end of 2050.

-

Growing Need for Water Treatment Plants with Increasing Pollution Worldwide – As of 2022, there are more than 100,000 municipal wastewater treatment plants in 130 countries providing nearly 3 billion population across the world.

-

Increasing Construction Sector across the World with Growing Disposable Income – The construction sector uses a huge variety of machinery for transport, mixing of concrete, building, motors, and generators. All these machinery use metal and iron parts which are prone to rusting and are estimated to drive the market growth. More than 4% of the U.S. GDP was obtained from the construction sector with a yearly turnover rate of more than 65% in the year 2020.

-

Hike in the Chemical Industries Owing to Increasing Use in Various Industries – The melting and boiling temperatures of various chemicals are different and affect the pipelines, and chambers in the chemical industries. This is estimated to hike the use of anti-seize compounds in the chemical sector. The value of total chemical shipments in the U.S. as of 2021 with the inclusion of all sectors was estimated to be over USD 750 billion.

-

Growth of the Aerospace Sector Owing to Increasing Risk of Corrosion and Galling of Titanium Bolts – The nickel-based anti-seize compounds are widely used in the aerospace sector for titanium bolts and fasteners. The export value of the worldwide aerospace sector was projected to reach USD 340 billion by 2026 with an annual rise of 0.2%.

Challenges

- Low Awareness About the Benefits of Compounds in Underdeveloped Nations

- Incidence of the Pandemic Restricted the Supply Chain across the World

- Incomplete Knowledge of Applications Leading to More Damage – The anti-seize compounds are not made for all situations, hence their applications have to be made carefully. The application of anti-seize compounds is limited to the mechanical assembly that needs lubricant, and the application of copper-based anti-seize compounds was found to cause damage to stainless materials. All these factors hamper the market growth during the forecast period.

Anti-Seize Compounds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 207.2 million |

|

Forecast Year Market Size (2035) |

USD 321.78 million |

|

Regional Scope |

|

Anti-Seize Compounds Market Segmentation:

Type Segment Analysis

The global anti-seize compounds market is segmented and analyzed for demand and supply by type into copper and graphite based, aluminum, copper and graphite based, nickel and graphite based, molybdenum based, non-metallic, and others. Out of these types, the aluminum, copper, and graphite based segment are estimated to gain the largest market share of about 28% in the year 2035. The growth of the segment can be attributed to the increasing use of aluminum, copper, and graphite based materials in the manufacturing automotive sector. Graphite utilization is increasing in the electronics and electrical industries owing to the high-temperature resistance and electrical conductivity nature. An increasing number of textile industries that manufacture heavy machinery and equipment is also estimated to boost market growth during the forecast period. As per the estimations, the export value of fiber, apparel, and textile in the year 2021 was more than USD 30 billion in the U.S.

End-user Segment Analysis

The global anti-seize compounds market is also segmented and analyzed for demand and supply by end-user into food and beverages, automotive, power generation, construction, oil and gas, and others. Amongst these segments, the oil and gas segment is expected to garner a significant share of around 26% in the year 2035. The increasing need for pipelines and equipment that are designed to resist high corrosion caused by acids, chemicals, and oxidizing agents is estimated to drive market growth. The market growth is attributed to the growing demand for oil and gas across the world for various purposes. The rising use of gas for household applications, heaters, machinery, vehicles, and electricity production is anticipated to fuel the market growth. Further, the demand for oil and oil products in the preparation of soaps, toothpaste, shaving creams, deodorant, shampoo, and perfumes is also estimated to increase the market growth in the coming years. The release of harmful gases as the by-product of oil distillation is expected to cause corrosion and damage to the chambers and pipelines.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-Seize Compounds Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to hold largest revenue share of 39% by 2035. The growth of the market can be attributed majorly to the increasing demand for anti-seize compounds in end-user verticals in the region, namely transportation, automotive, mining, marine, and construction sector. In addition, an abundance of raw materials and the availability of cheap labor is also predicted to drive the region’s market growth in the upcoming years. The anti-seize compounds are used in the mining industry to prevent and treat the seizure and corrosion of metal connections in machine interfaces. The growth of the market is also attributed to the increasing use of construction equipment across the world. The increasing transportation across the world for various purposes including passenger, material, goods and services, and food and beverages transport is estimated to increase the market demand in the coming years. According to the estimations, the complete revenue of transportation services in the year 2020 was estimated to be over UD 930 billion across the Asia-Pacific region.

North American Market Insights

The North American anti-seize compounds market is estimated to be the second largest, registering a share of about 32% by the end of 2035. The growth of the market can be attributed majorly to the high production of automobiles, and the growing investment of the government in construction and infrastructure projects in the region. According to the Bureau of Transportation Statistics, a total of 11,297 vehicles were produced in the United States in 2018. The production decreased in the year 2019, accounting for 10,893 vehicles. The rising use of battery poles, connections, springs, fittings, seals, suspensions, and screw connections in driving wheels and chains is estimated to drive market growth. The increasing production of automation of equipment and machinery utilized in the automobile sector is estimated to propel the market growth as per the market analysis. The growing adoption of heavy trucks, LCVs, and other automobile vehicles for transport and construction use is driving the automation sector. All these increase the use of lubricants in vehicles which in turn drives market growth.

Europe Market Insights

Europe region is set to witness significant growth till 2035. The growth of the market can be attributed majorly to the increasing use of drilling equipment, drag chains, gears, slides, guiding rails, bolts, fans of drilling equipment, and drawing machines. The rising production of the oil and gas industry and growing construction investment by private key players is estimated to drive the market growth. The escalating advancement in the petrochemical industry as well as food, marine, power, and other sectors are also anticipated to propel the market growth as per the market analysis. The growing metallic and nonmetallic grade anti-seize compounds across the world with new technological advancements were estimated to fuel the market growth. Also, the increasing online sales of food-grade anti-seize compounds are anticipated to propel market growth. The escalating need for anti-seize compounds such as seals is useful to cease harmful gas emissions and is estimated to hike the growth of the market.

Anti-Seize Compounds Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Henkel AG

- Bel-Ray Company

- SAF-T-LOK International Corporation

- Molytech Lubes Private Ltd.

- CRC NZ

- DuPont de Nemours, Inc.

- Bostik SA

- Fuchs Petrolub SE

- Calumet Specialty Products Partners, L.P.

Recent Developments

-

3M was announced as one of the “Top 100 Global Innovators” of 2023. The presence of over 60,000 products and considering science and innovation as the heart of the 3M was the reason it became the world’s most iconic brand.

-

Henkel AG & Co. KGaA. was acquired by the Harima Chemicals Group, Inc. with all the rights, and assets, including the solder materials business. Harima was a huge producer of solder pastes that are made of pine tree-derived rosin and metal powder.

- Report ID: 3630

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-Seize Compounds Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.