Acetylene Market Outlook:

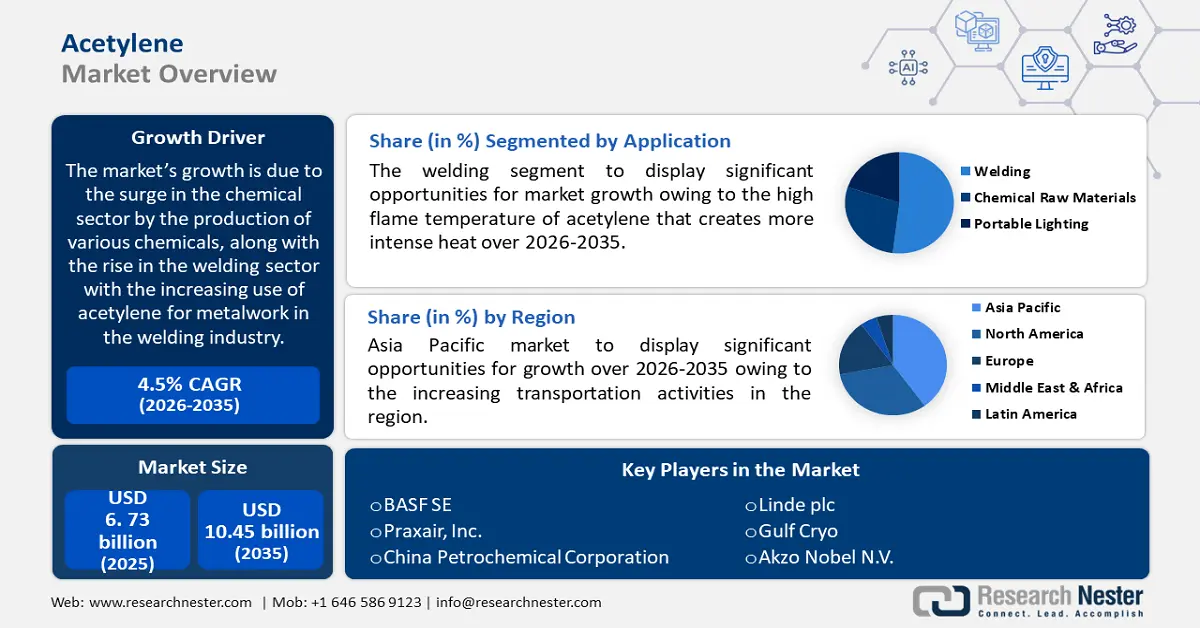

Acetylene Market size was over USD 6.73 billion in 2025 and is projected to reach USD 10.45 billion by 2035, witnessing around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acetylene is evaluated at USD 7 billion.

The growth of the market can be attributed to the surge in the chemical sector by the production of various chemicals, along with the rise in the welding sector with the increasing use of acetylene for metalwork in the welding industry. For instance, around USD 4.9 trillion in revenue was generated by the chemical sector worldwide in 2021. Further, the escalating use of acetylene as a fuel in oxyacetylene metal cutting, and its increasing application in various end-use industries are some further factors that are anticipated to drive the growth of the global acetylene market over the forecast period.

In addition to these, factors that are believed to fuel the market growth of acetylene include its rising application in gas welding steel as of its extreme temperature as compared to other compounds such as propane. For instance, when propane is burned in oxygen, it creates a flame temperature of around 2800°C. But together with oxygen, acetylene creates a higher flame temperature of nearly 3300°C. As a result of its high combustion temperature, acetylene is an extremely appropriate choice for gas welding steel. In addition to this, the soaring investments in the chemical industry are also a major factor that is projected to propel the growth of the market over the forecast period. Additionally, worldwide proliferating applications of metalworking in various sectors, along with the radically increasing construction activities throughout the world are also predicted to present the potential for market expansion over the projected period.

Key Acetylene Market Insights Summary:

Regional Highlights:

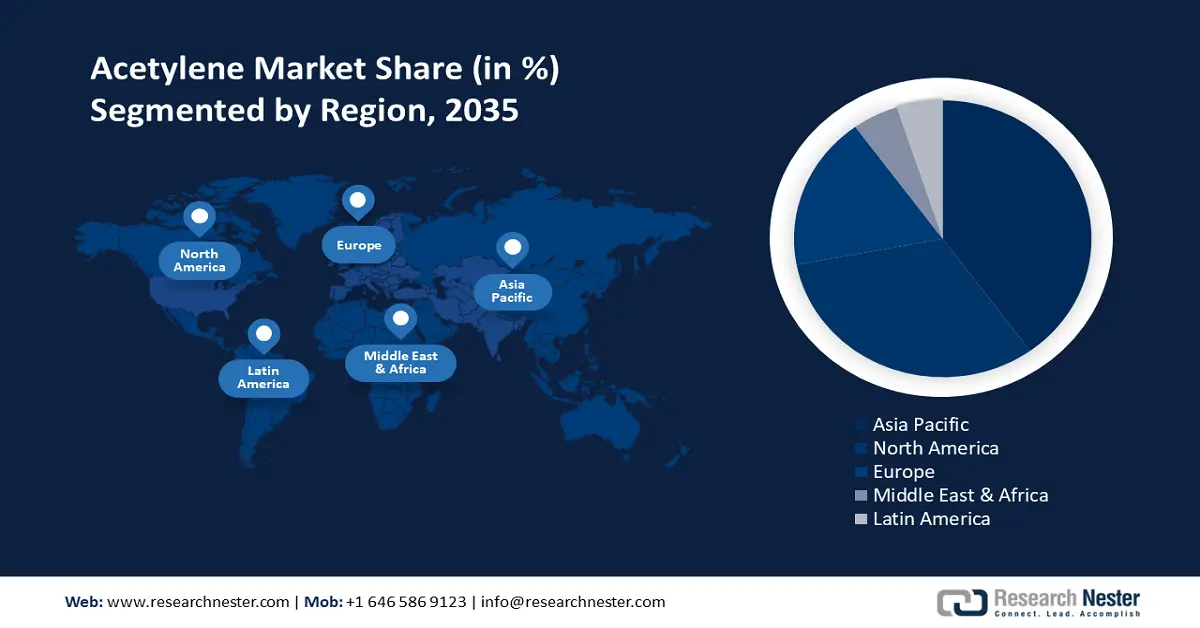

- Asia Pacific acetylene market will secure around 40% share by 2035, driven by increasing transportation and booming chemical industry.

- North America market will achieve the highest CAGR from 2026 to 2035, attributed to proliferating manufacturing in aircraft and auto sectors.

Segment Insights:

- The automotive segment in the acetylene market is expected to secure a significant share by 2035, fueled by rising vehicle production and acetylene usage in auto manufacturing.

- The metal fabrication segment in the acetylene market is anticipated to achieve a notable revenue share by 2035, influenced by increasing metalworking demand across multiple industries.

Key Growth Trends:

- Growth in Automotive Industry

- Worldwide Rising Production of Synthetic Rubber

Major Challenges:

- Hazardous Effects of Acetylene

- Highly Unstable Nature of Acetylene

Key Players: BASF SE, Praxair, Inc., China Petrochemical Corporation, Linde plc, Gulf Cryo, Akzo Nobel N.V., AmeriGas Propane, L.P., Ferrellgas Partners, L.P., Messer SE & CO. KGaA, Airgas, Inc.

Global Acetylene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.73 billion

- 2026 Market Size: USD 7 billion

- Projected Market Size: USD 10.45 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Acetylene Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in Automotive Industry – Transportation activities have been growing as a result of dynamic growth in the automotive industry. The demand and production of commercial and passenger vehicles have been growing which is also boosting the growth of this sector at a larger scale. The growth of the automotive sector is directly anticipated to encourage the growth in the demand for acetylene, as acetylene is used for making the body and other metallic parts of vehicles. Therefore, worldwide growth in the automotive industry is estimated to boost the growth of the acetylene market in the projected time frame. For instance, from April 2021 to March 2022, the Indian automobile industry manufactured an aggregate of 23,945,350 vehicles, comprising passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 22,552,607 units in April 2020 to March 2021.

-

Worldwide Rising Production of Synthetic Rubber – Acetylene is widely employed in the manufacturing process of synthetic rubber. Natural rubber is derived from natural sources, whereas synthetic rubber is derived from petroleum products. It is utilized in tires, hoses, and other items that require flexibility and durability. Acetylene is utilized in the vulcanization process, which imparts strength and flexibility to rubber. It is the procedure of heating and chemically treating rubber to make it more durable and resilient. Hence, the radically increasing production of rubber is also anticipated to fuel the growth of the acetylene market in the coming years. For instance, the previous decade has witnessed a significant rise in the worldwide manufacturing of synthetic rubber. In the year 2000, around 11 million metric tons of synthetic rubber were manufactured. Whereas by 2020, this figure had increased to more than 14 million metric tons.

-

An Upsurge in Construction Activities - For instance, in 2021, construction projects in the United States were estimated to be worth USD 1.8 trillion.

-

Worldwide Growth in Pharmaceutical Sector - Many medicinal products are made using acetylene. It is a crucial material in the production of several types of painkillers including acetaminophen, aspirin, and other painkillers. Several antibiotics, such as penicillin and ampicillin, are also manufactured by using it. Hence, the worldwide growth in the pharmaceutical sector is also projected to spur the growth of the global acetylene market over the projected time frame. As per a report, in 2021, global pharmaceutical revenue exceeded around USD 1.50 trillion.

-

Rising Demand for Polymers and Resins – Polymers and resins are widely used in various industries. They are frequently employed as raw materials in the molding and fabrication of plastics. Acetylene is frequently used in the production of polymers and resins that are very robust and durable and are utilized in various applications including construction materials, automotive components, medical devices, and so on. Hence, the rising application of these polymers is potentially increasing the demand for polymers and resins. Therefore, such an increasing demand for polymers and resins is anticipated to boost the growth of the market over the forecast period. For instance, approximately 11 million metric tons of polymers were manufactured in India during the year 2021.

Challenges

- Hazardous Effects of Acetylene - Acetylene inhalation can trigger anxiety, difficulty speaking, fatigue, nausea, vomiting, and headache. Excessive levels can cause difficulties breathing, seizures, high blood pressure, and irregular cardiac rhythms. The presence of toxic impurities causes such harmful effects in acetylene. Therefore, this factor is anticipated to inhibit market growth in the coming years.

- Highly Unstable Nature of Acetylene

- Rigorous Environmental Regulations Imposed by the Government of Nations

Acetylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 6.73 billion |

|

Forecast Year Market Size (2035) |

USD 10.45 billion |

|

Regional Scope |

|

Acetylene Market Segmentation:

Application Segment Analysis

The welding segment is estimated to gain the largest market share over the projected time frame. attributed to the high flame temperature of acetylene that creates more intense heat and thus assists in creating a stronger weld on metals. Combustion of acetylene with oxygen produces an extreme flame of over 3,330°Celsius, which is highly suitable for welding and other metal works. which is estimated to boost the segment growth. In addition to this, increasing demand for welding products, along with the globally rising production of steel is also anticipated to surge the growth of the segment For instance, the worldwide production of crude steel increased from 1.875 billion metric tons in 2020 to 1.960 billion metric tons in 2021.

End-user Segment Analysis

The automotive segment is expected to garner a significant share, attributed to the surging production of automotive vehicles throughout the world. The demand for passenger and commercial vehicle is radically rising. This rising demand for vehicles is also fueling the utilization of acetylene at a larger scale as acetylene is highly used for making the body and other metallic parts of vehicles. Besides this, the metal fabrication segment is also anticipated to grasp a notable market share. The growth of this segment is credited to the escalating application of metalworking in various industries throughout the world. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the projected time frame

Our in-depth analysis of the global market includes the following segments:

|

By Production |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetylene Market Regional Analysis:

APAC Market Insights

The Asia Pacific acetylene market is projected to hold the largest market share by the end of 2035, attributed majorly to the increasing transportation activities in the nations including India, Japan, China, and so on, coupled with the growing sale of automobiles, the higher surge in the sale of vehicles, along with the presence of major automobile manufacturers in the region. For instance, over 3.50 million units of passenger and commercial vehicles were sold in India in 2020. Further, the major boom in the chemical industry is also estimated to potentially accelerate the acetylene market in the region as acetylene is highly used in the production of various major chemicals such as vinyl acetate, acetaldehyde, acrylonitrile, polyacetylene, polydiacetylene, and so on. In addition to this, the region's expanding construction industry and rising real estate investment are also anticipated to boost market growth in the APAC region

North American Market Insights

The North American acetylene market is projected to grow with the highest CAGR during the forecast period. The growth of the market can be attributed majorly to the proliferating manufacturing of aircraft, and automobiles. Based on a report, the general aviation aircraft fleet in the United States is projected to increase from 205,670 in 2021 to 210,898 by 2041. Moreover, the growing sale of vehicles in the U.S. and Canada, along with the surge in the welding, and metal fabrication industries are further estimated to raise the acetylene market growth in the region.

Acetylene Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Praxair, Inc.

- China Petrochemical Corporation

- Linde plc

- Gulf Cryo

- Akzo Nobel N.V.

- AmeriGas Propane, L.P.

- Ferrellgas Partners, L.P.

- Messer SE & CO. KGaA

- Airgas, Inc.

Recent Developments

-

Linde plc started a new syngas processing plant in the U.S., which can convert the by-product Acetylene Off-Gas (AOG), into high-value products to supply to chemical manufacturers.

-

Ferrellgas Partners, L.P., announced the Acquisition of Wylie LP Gas, Inc., to expand its distribution in Texas, U.S. This acquisition is anticipated to exhibit the organization’s commitment to expanding its primary propane business.

- Report ID: 3842

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetylene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.