Acrylonitrile Market Outlook:

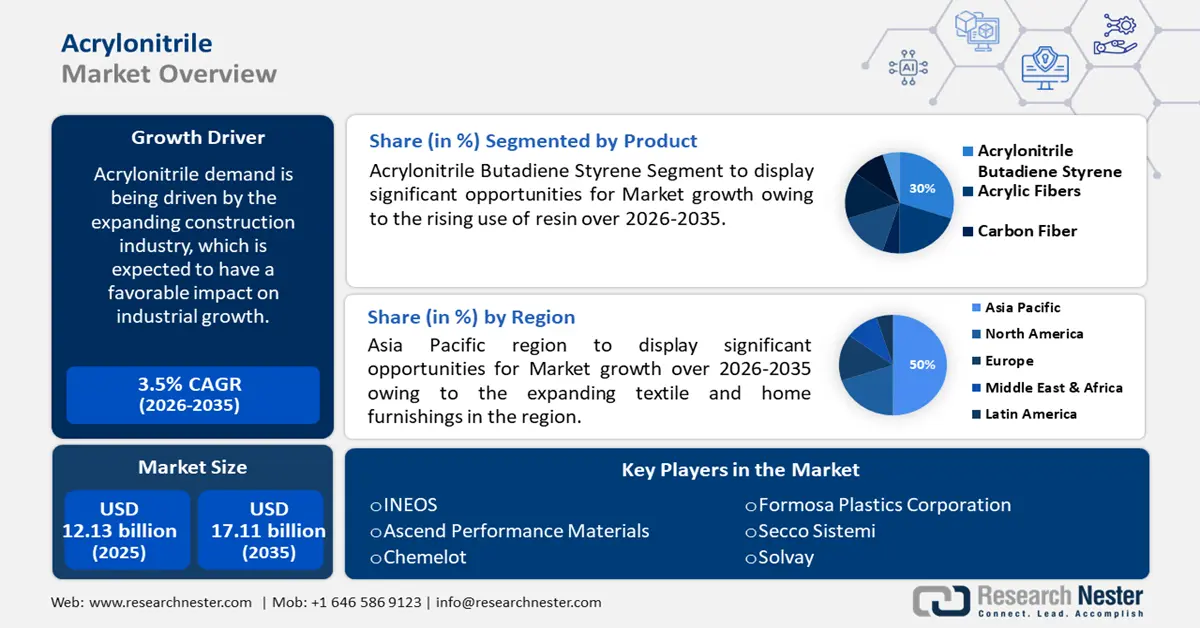

Acrylonitrile Market size was over USD 12.13 billion in 2025 and is anticipated to cross USD 17.11 billion by 2035, witnessing more than 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acrylonitrile is assessed at USD 12.51 billion.

Acrylonitrile demand is being driven by the expanding construction industry, which is expected to have a favorable impact on industrial growth. Derivatives of acrylonitrile are used in the construction sector to make products such nitrile rubber, acrylonitrile butadiene styrene, acrylic fiber, acrylamide, and carbon fiber. The US Census Bureau stated that construction industry spending in March 2024 is predicted at a seasonally adjusted value of USD 2,083.9 billion.

Key Acrylonitrile Market Insights Summary:

Regional Highlights:

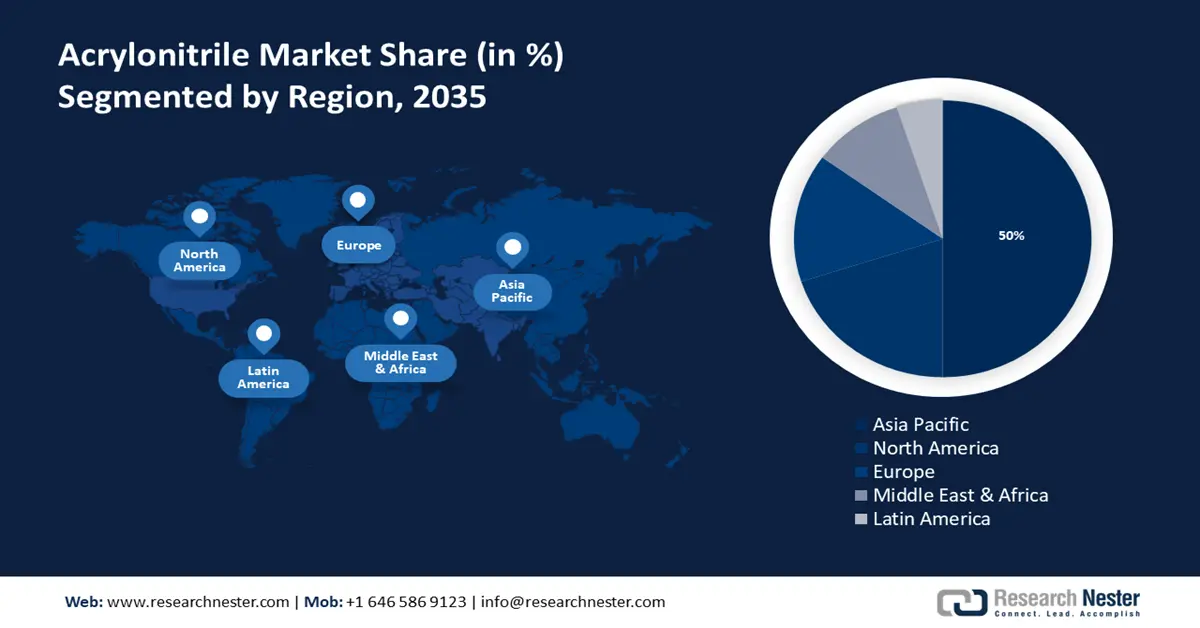

- Asia Pacific acrylonitrile market is expected to capture 50% share by 2035, driven by rising textile demand and infrastructure development in China.

- North America market is set for huge growth from 2026 to 2035, fueled by eco-friendly initiatives and increasing demand for bio-based materials.

Segment Insights:

- The acrylonitrile butadiene styrene segment in the acrylonitrile market is anticipated to secure a 20% share by 2035, fueled by high use in electronics and automotive due to durability and strength.

- The consumer goods segment in the acrylonitrile market is anticipated to see moderate growth through 2035, attributed to increasing demand for lightweight and durable appliances like smart TVs.

Key Growth Trends:

- Growing need in the medical field

- Prosperous development in the electronics sector

Major Challenges:

- Negative effects of acrylonitrile

- Price fluctuations for basic materials

Key Players: INEOS, China Petrochemical Development Corporation, Ascend Performance Materials, Chemelot, Formosa Plastics Corporation, Secco Sistemi, Solvay, Trillium Renewable Chemicals, Taekwang Industrial Co., Ltd., Lenntech B.V.

Global Acrylonitrile Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.13 billion

- 2026 Market Size: USD 12.51 billion

- Projected Market Size: USD 17.11 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (50% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Acrylonitrile Market Growth Drivers and Challenges:

Growth Drivers

- Growing need in the medical field - Propylene and other materials are used to manufacture acrylonitrile, which finds extensive use in the pharmaceutical and medical industries for a variety of products including drug delivery systems, insulin pens, tiny implants, and respiratory devices. The India Brand Equity Foundation (IBEF) projects that the country's pharmaceutical industry would grow to be worth USD 65 billion by 2024 and USD 120–130 billion by 2030.

Acrylic fibers find application in a range of medical contexts, including surgical gowns, bed linens, and wound dressings. The requirement for acrylonitrile, a necessary component in the creation of acrylic fibers utilized in various applications, is rising along with the demand for healthcare products, leading to acrylonitrile market expansion. - Prosperous development in the electronics sector - Because of its exceptional qualities, including its high impact resistance, insulation, and lightweight nature, acrylonitrile finds extensive use in the electrical and electronics industry for products such as computer cases, electronic devices, and home appliances.

Urbanization, a rising production base, and the strong demand for consumer electronics are all contributing to the electronics industry's rapid expansion. Globally, the number of people living in cities increased dramatically from 751 million in 1950 to 4.2 billion in 2018.

- Increasing use of acrylic fiber - The growing use of acrylic fibers is driving up demand in acrylonitrile market. Furthermore, the Asia Pacific region's expanding textile and apparel sectors will aid in the development of the industry due to the region's fast urbanization.

Acrylic fibers are very resistant to UV damage, microbiological attack, and laundry bleach. Because they are lightweight, these fibers are great choices for clothing. It serves as the primary raw material in the production of acrylic fibers. The textile and apparel industries employ acrylic fiber because of its excellent performance and lightweight nature.

However, the emergence of new, less priced polyester fibers may cause the demand to decline. Additionally, it is predicted that the market for acrylic fibers will be hampered by the desire for bio-based polymers, especially in developed nations. Polymers made from renewable "raw materials" may soon challenge over-the-counter plastics as annual sales increase by 20% to 30%.

Challenges

- Negative effects of acrylonitrile - When acrylonitrile comes into contact with open flames, it can catch fire and explode. Environmental exposure to acrylonitrile has negative effects on soil, air, water, and other substances. It forms photochemical smog, which harms the environment, when it combines with formaldehyde and other volatile organic compounds (VOCs), hydrogen cyanide, and other substances.

Furthermore, acrylonitrile poses a serious risk to human health because it can cause serious side effects as breathing difficulties and skin irritations, among others. The increasing amount of acrylonitrile trash being disposed of outdoors has an effect on the atmosphere. The market thus faces a significant slowdown as a result of the preventative and environmental restrictions that impact the applicability and expansion scope for acrylonitrile and other types.

- Price fluctuations for basic materials - Propylene and ammonia are needed to produce acrylonitrile, and their costs might fluctuate because of a number of causes, including imbalances in supply and demand, geopolitical unrest, and natural calamities. These price swings may have an impact on manufacturers' profit margins and consumer prices, which in turn may have an effect on the acrylonitrile market.

Acrylonitrile Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 12.13 billion |

|

Forecast Year Market Size (2035) |

USD 17.11 billion |

|

Regional Scope |

|

Acrylonitrile Market Segmentation:

Application

Acrylonitrile butadiene styrene segment is poised to capture acrylonitrile market share of around 20% by the end of 2035. Within the consumer appliances sector, acrylonitrile butadiene styrene resin usage is rising. Several end-user sectors, such as food handling and equipment, oil and gas, aircraft, defense, and aerospace, employ acrylonitrile butadiene styrene. Due to its remarkable properties, including as strength and endurance at low temperatures, acrylonitrile butadiene styrene is widely used in the electronics and automotive industries.

It is widely used in the electronics and automotive industries because of its remarkable qualities, which include strength, low-temperature durability, and lightweight nature. According to the International Energy Agency 2021 Outlook, sales of electric vehicles will double from 2020 levels to 6.6 million worldwide in 2021. 2 million electric vehicles were sold globally in the first quarter of 2022, indicating a sharp increase in sales. Furthermore, acrylonitrile butadiene styrene is expected to find more uses in the near future as a result of global advancements in 3D printing, leading to market expansion in this segment.

End-use Industry

Consumer goods segment in the acrylonitrile market is set to observe moderate growth through 2035. The segment's growth can be attributed to the increasing demand for appliances such as refrigerators and televisions. Globally, there were approximately 660 million smart TVs in use in 2021. In 2019, the size of the worldwide smart TV industry was estimated to be USD 191.6 billion. Acrylonitrile is an excellent choice because of its exceptional chemical resistance and superior tensile strength.

By using acrylonitrile components, appliance manufacturers can drastically lower the overall weight of their products while also improving design and heat resistance. Additionally, the corrosion resistance of acrylonitrile guarantees strength and durability, prolonging the life of consumer items. Additionally, the electrical insulation and ultraviolet (UV) stability of acrylonitrile enable the precise and complex manufacture of electrical components, promoting design flexibility and innovation in kitchenware and electrical appliances.

Our in-depth analysis of the market includes the following segments:

|

Manufacturing Process |

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrylonitrile Market Regional Analysis:

APAC Market Insights

Asia Pacific acrylonitrile market is set to account for revenue share of more than 50% by the end of 2035. The textile and home furnishings sectors' growing demand are anticipated to have a beneficial impact on the market segment. It was predicted by World Bank that between 2024 and 2028, consumer expenditure in Asia on apparel and footwear will rise steadily by a total of USD 27.8 billion (+35.8%). It is predicted that fashion-related spending would reach 105.4 billion dollars in 2028, marking a new peak following eight years of growth.

China is prioritizing the development of new residential and commercial structures, and this trend is anticipated to continue. The regional market is also driven by elements like the growing need for energy-efficient building materials and developments in civil construction. Government statistics indicates that 77% of China's 2020 new urban construction projects were classified as green buildings.

Two examples of acrylonitrile-based polymers used in consumer goods packaging in the Japanese region are acrylonitrile butadiene styrene (ABS) and styrene acrylonitrile (SAN). These polymers are robust and resistant to impacts. By 2024, value added from Japan's consumer products sector is expected to reach USD 359.30 billion.

The transition towards sustainable and bio-based chemical products is anticipated to be a significant driver of growth for acrylonitrile enterprises in the Korean peninsula. Renowned Korean chemicals manufacturer LG Chem revealed plans to introduce new plant-based raw material-based acrylonitrile butadiene styrene (ABS) products.

North America Market Insights

The North America region will also encounter huge growth for the acrylonitrile market in this region. The strong presence of important corporations like Ascend Performance Material in the U.S. Over the projection period, market growth is anticipated to be aided by the aforementioned companies' primary focus on new product advancements in the industries of construction and automobiles. Approximately 10 million units are produced annually by American manufacturers. Two notable outliers were the 5.7 million cars produced in 2009 and the 8.8 million cars produced in 2020 as a result of the global COVID-19 pandemic.

In the United States, there is a growing need for environmentally friendly materials, which may support the future sales of bio-based acrylonitrile. A renewable acrylonitrile pilot production facility was being built in Charleston, West Virginia, in April 2022. Trillium Renewable Chemicals was constructing the facility, which was anticipated to cut gas emissions for acrylonitrile produced from petroleum feedstock by 70% when compared to conventional manufacturing methods.

Acrylonitrile Market Players:

- INEOS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- China Petrochemical Development Corporation

- Ascend Performance Materials

- Chemelot

- Formosa Plastics Corporation

- Secco Sistemi

- Solvay

- Trillium Renewable Chemicals

- Taekwang Industrial Co., Ltd.

- Lenntech B.V.

A selected group of companies, notably Sinopec Group, Sumitomo Chemicals, Ascend Performance Materials, and Mitsubishi Chemical Corp., control a disproportionate amount of the global sector. Businesses are investing large sums of money in R&D to create new products and improve existing processes.

Recent Developments

- INEOS Nitriles, called InvireoTM, acrylonitrile's first bio-attributed product line. The state-of-the-art INEOS Nitriles factory in Cologne, Germany, will produce the recently announced product. InvireoTM is produced by using bio-attributed propylene, which allows traditional fossil fuel resources to be substituted. This product is revolutionary because it uses renewable feedstock, which lowers greenhouse gas emissions and helps conserve natural resources. INEOS has been certified by both the International Sustainability & Carbon Certification (ISCC Plus) and the Roundtable on Sustainable Biomaterials (RSB).

- Solvay unveiled LTM 350, a cutting-edge carbon fiber epoxy prepreg tooling material intended to save a great deal of time and money for the race car, automotive, aerospace, and industrial sectors. The carbon fiber epoxy tooling material provides a low-temperature, quick-curing cycle (three hours at 60°C). Additionally, can also be allowed to cure for longer periods of time at temperatures as low as 45°C. LTM 350 tools are capable of being repeatedly cycled at temperatures as high as 150°C to create composite parts with exceptional precision.

- Report ID: 5973

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrylonitrile Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.