A Robust Research Methodology for Strategic Market Intelligence

Ensuring Data Accuracy & Insight-Driven Decision Making

Discover Research Nester’s proven methodology, combining rigorous processes, expert analysis, and cutting-edge analytics to deliver transparent, reliable insights for global businesses. Unlock your strategic advantage today.

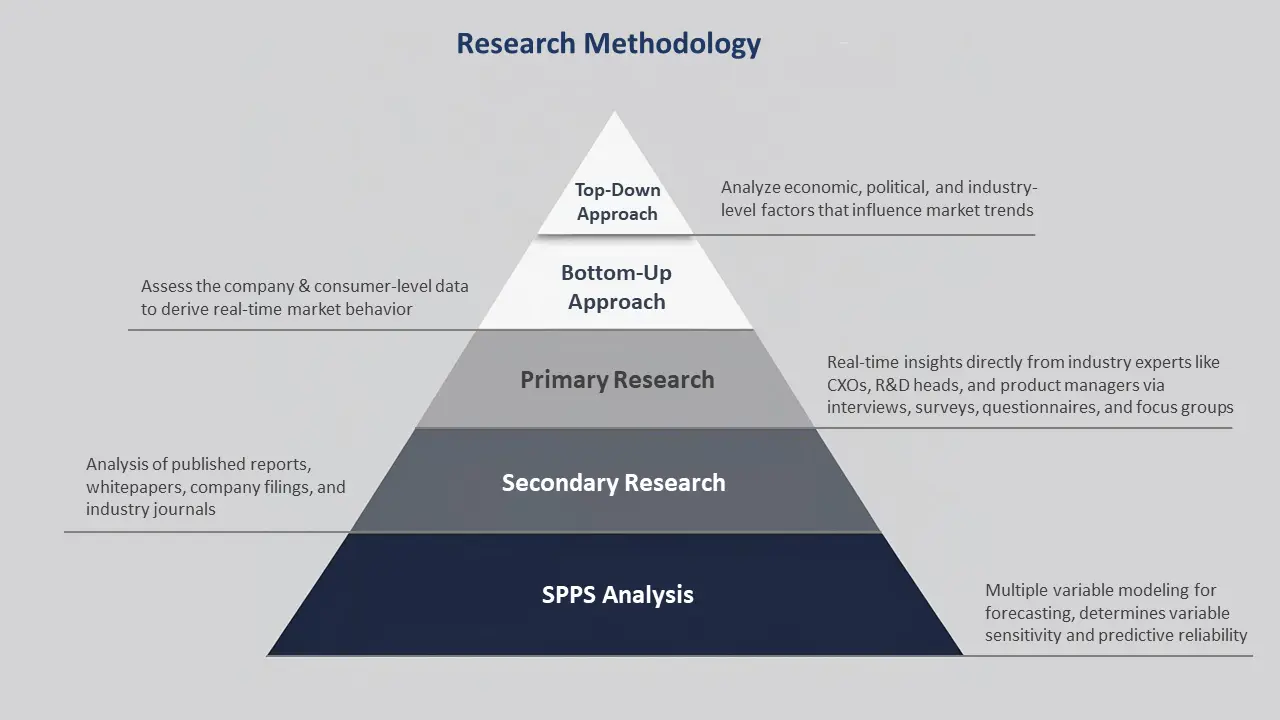

Research Methodology

Research Nester focuses on providing transparent, data-driven research and actionable insights through a blend of structured research processes, expert analysis, and advanced, efficient statistical tools. We follow a multi-layered approach that ensures reliability and accuracy across all market forecasts and strategic reports. First, we collaborate with stakeholders and clients to understand the problem, such as product launch feasibility, declining market share, or gaps in consumer satisfaction. We then conduct a preliminary environmental scan to contextualize the problem within broader market dynamics by formulating testable hypotheses based on initial client discussions to guide data collection and develop contingency plans.

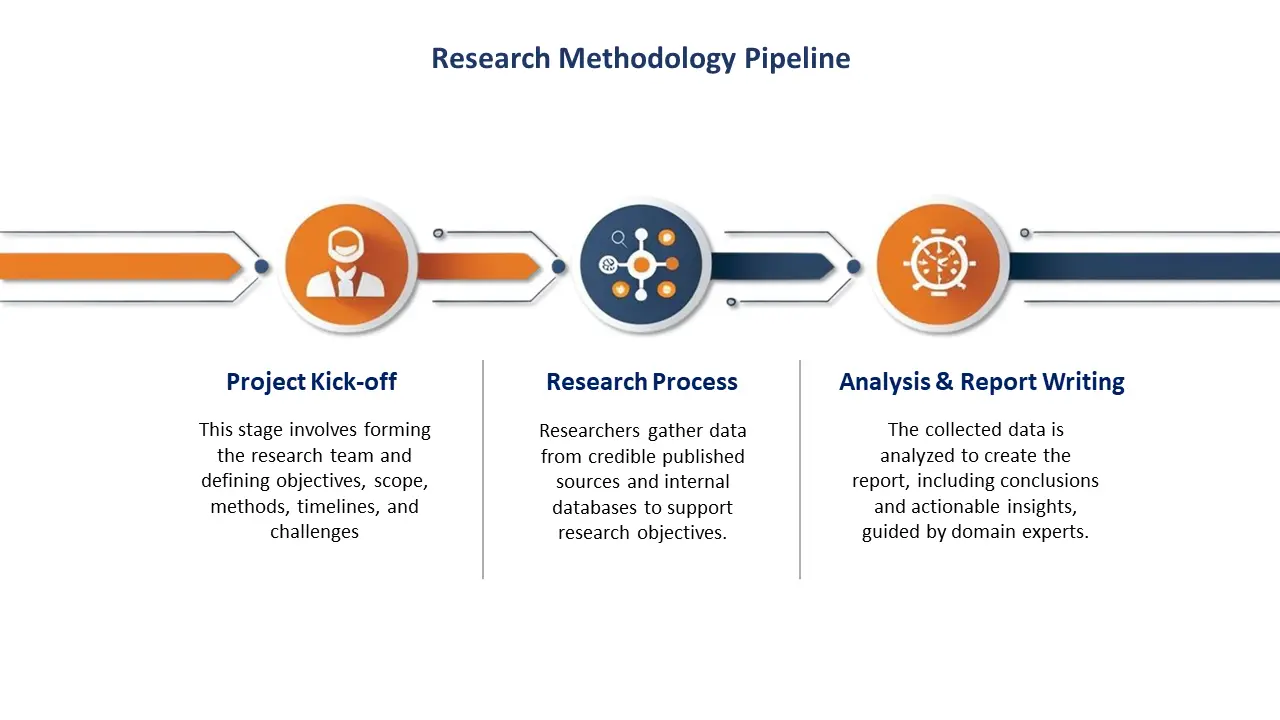

Research Methodology Process

The research methodology pipeline outlines a systematic process for conducting research, from defining the problem to delivering actionable insights. It is a well-structured, step-by-step process that offers transparency, data accuracy, and actionable insights, designed to be iterative, adaptable, and scalable for various market research projects. Thus, we ensure that our reports are insightful and predictive by conducting primary and secondary research, integrating rigorous top-down and bottom-up approaches, and utilizing tools such as SPSS modeling and data integration.

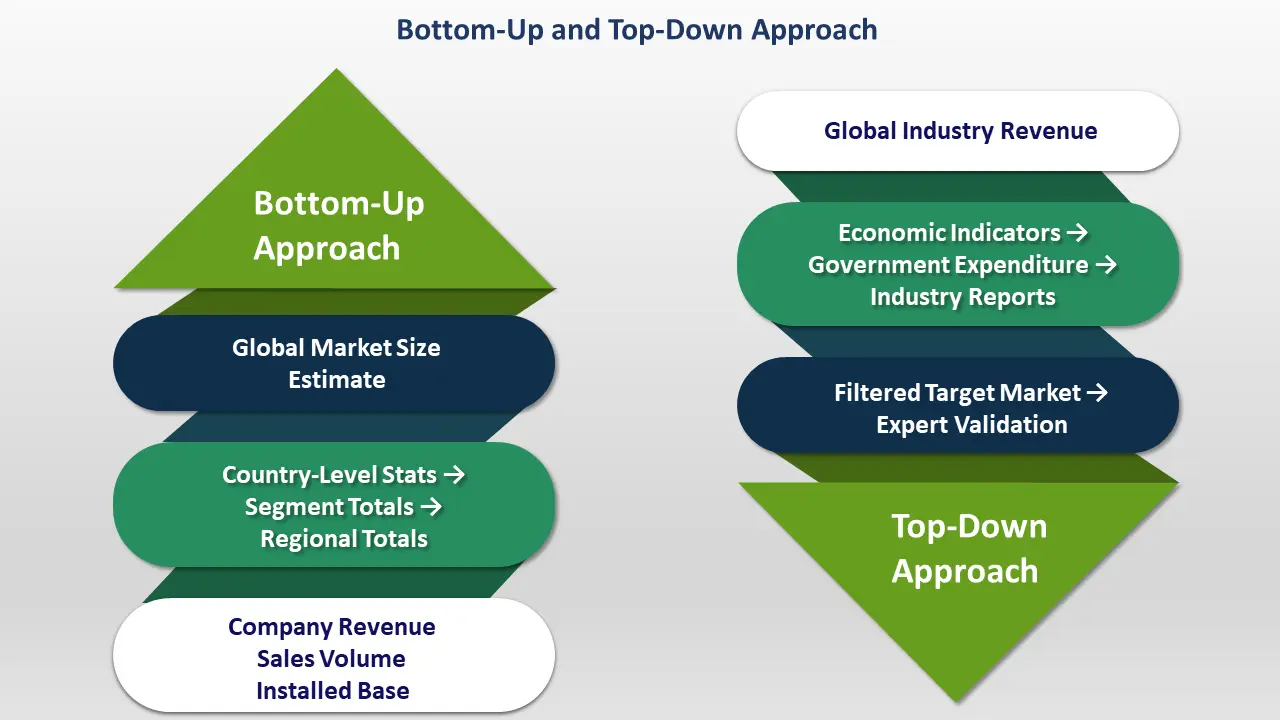

Bottom-Up and Top-Down Approach

Bottom-Up Approach

In this approach, we focus on collecting data on individual players, sales volumes, products, and pricing trends.

- Company revenues (product-wise, region-wise)

- Sales volumes and pricing

- Installed base, units sold, and average usage

- Country-level data from regulators and trade bodies

These micro-level insights are aggregated to estimate the market size and forecast growth. The bottom-up method is particularly effective for analyzing niche markets, competitive landscapes, and product-specific growth.

Top-Down Approach

In the top-down estimation model, we begin by assessing the total addressable market (TAM) and strategic positioning using macro-level data, such as:

- Global industry revenue

- Government expenditure

- Economic indicators (GDP, population, healthcare spending, etc.)

- Publicly available databases and industry forecasts

We then break down this data across market segments, subsegments, and regions, based on relevant ratios and historical trends. This method is ideal when global or regional market size data is available and needs to be segmented further for greater granularity.

Primary Research

Primary research involves direct collection of data from sources such as consumers, businesses, and industry experts through surveys, in-depth interviews, expert panels, focus groups, or even voice of customer (VoC) programs. It provides specific insights relevant to the product, service, or target group and reduces guesswork in decision-making by relying on real-time and directly sourced data. Primary research is tailored to the specific objectives of the study, providing firsthand insights into market trends, consumer preferences, competitive positioning, product performance, and market demand. Moreover, it offers a competitive edge by uncovering insights that are not readily available for others.

Secondary Research

Secondary research plays a key role in market research by providing a foundation that helps in more targeted and cost-intensive primary studies. It allows businesses to understand the broader market landscape, including identifying emerging trends, analyzing consumer demographics, and evaluating regulatory environments. It involves collecting and analyzing existing data collected by third parties, academic studies, government databases, or online sources. Unlike primary research, which generates original data, secondary research uses publicly available data to identify historical trends, benchmark competitors, product positioning, investment planning, or validate market dynamics. Through this, it forms a data-driven base before primary insights are integrated.

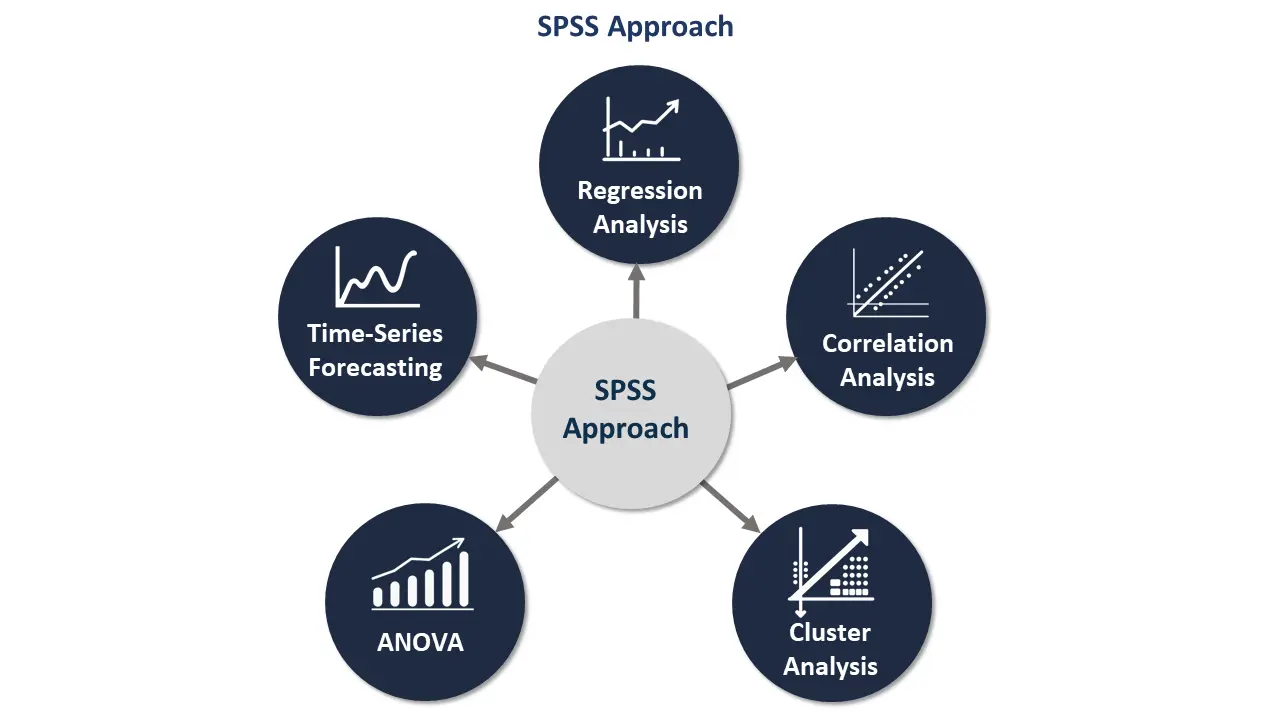

SPSS Approach

We employ SPSS software to conduct regression analysis for market forecast, perform correlation analysis and evaluate variable relationships, for instance, R&D investment vs. product launches. The approach typically begins with data entry and coding, where raw survey responses or numerical data are organized into variables and data sets. The SPSS software also offers powerful visualization tools like bar graphs, scatter plots, or histograms to support data interpretation. .

SPSS provides :

- Descriptive and inferential statistical analysis

- Trend forecasting and regression modeling

- Consumer behavior segmentation

- Market correlation analysis

This is used to analyze large data sets and identify patterns, actionable trends, and anomalies with higher precision.

Variables: Dependent & Independent

Dependent Variable:

| Variable | Description |

|---|---|

| Industry Market Value (USD billion/million) | Represents the combined valuation of all active entities in the industry. This serves as the outcome variable in the SPSS model. |

Independent Variables:

| Variable | Description |

|---|---|

| GDP Growth Rate | Indicator of national economic expansion and its influence on industry demand |

| Industry Trends | Metrics capturing the sector’s growth rate, innovation level, and competitiveness |

| Consumer Confidence Index | Proxy for household spending capacity and future demand outlook |

| Regulatory Environment | Scoring index reflecting regulatory pressure and compliance impact |

Data Triangulation

Triangulation and Transformation of Information

Source of Data :

- Primary Phase : Expert interviews, field surveys, stakeholder feedback

- Secondary Phase : Reports, databases, regulatory portals

Factors Collected :

- Endogenous : Company strategies, pricing, capacity, product availability

- Exogenous : Government policy, demographics, economic indicators

Validation of Market Assessment Estimates

Estimation Approaches:

- Top-Down :

- Start with global/sector-level data

- Narrow down to regions, countries, segments

- Bottom-Up :

- Aggregate company-level data

- Build up to segment, region, and global totals