Calcium Carbide Market Outlook:

Calcium Carbide Market size was over USD 18.68 billion in 2025 and is anticipated to cross USD 29.57 billion by 2035, growing at more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcium carbide is assessed at USD 19.47 billion.

Acetylene gas, which is employed to create polymers such as nylon 66, polyesters, and polyethylene terephthalate (PET), as well as other plastic products, is produced using calcium carbide, which is a frequently utilized component of the process. The increasing demand for plastic products, particularly PVC, nylon 66, and polyesters, can therefore be mostly attributed to market expansion. The global annual output of plastic has grown by around 230 times, i.e. from 2 million tonnes in 1950, reaching 460 million tonnes in 2019. The worldwide production of plastics was over 390 million metric tons in 2021, with a rise of 4% annually.

Furthermore, it is anticipated that increased steel consumption across a number of industries will boost market growth. On account of its exceptional qualities, including durability and ductility, steel is mostly employed in the building and construction industry. It aids in the seismic resistance of buildings. The development of special railroads as a result of an increase in the number of high-speed trains in nations such as China, Japan, and India have increased the need for carbon steel. The need for crude steel is then anticipated to increase, propelling the calcium carbide market. Around 152 million tons (Mt) of crude steel were produced globally in September 2022, an increase of 4% from September 2021.

Key Calcium Carbide Market Insights Summary:

Regional Highlights:

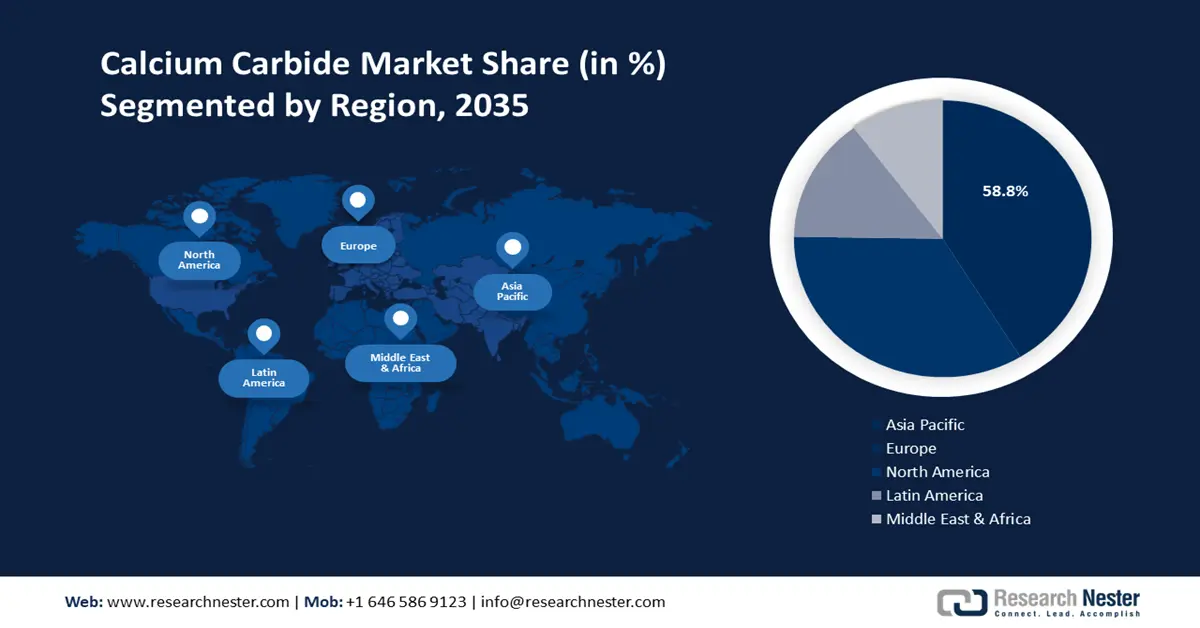

- Asia Pacific calcium carbide market will dominate more than 58.8% share by 2035, driven by expanding steel and plastic production in China.

Segment Insights:

- The acetylene gas segment in the calcium carbide market is anticipated to secure the highest market share by 2035, driven by the widespread industrial use of acetylene gas.

- The chemicals segment in the calcium carbide market is projected to capture the largest share by 2035, fueled by increasing applications and investments in the chemical industry.

Key Growth Trends:

- Large Number of Earthquakes Taking Place

- Growing Usage of Fertilizers

Major Challenges:

- Growing Environmental Awareness

- Stringent Government Regulations

Key Players: AlzChem Group AG, American Elements, Thermo Fisher Scientific Inc., Carbide Industries LLC, Inner Mongolia Baiyanhu Chemical Co., Ltd., Merck KGaA, Adani Enterprises Limited (AEL), Mil-Spec Industries, Corp., Santa Cruz Biotechnology, Inc.

Global Calcium Carbide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.68 billion

- 2026 Market Size: USD 19.47 billion

- Projected Market Size: USD 29.57 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Russia

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Calcium Carbide Market Growth Drivers and Challenges:

Growth Drivers

-

Large Number of Earthquakes Taking Place - Earth is a dynamic planet, and earthquakes are constantly occurring somewhere. The National Earthquake Information Center actually tracks approximately 13,000 earthquakes annually. Calcium carbide is used in manufacturing steel, which is further expected to be utilized in constructing buildings. Owing to the growing risk of earthquakes and floods, the need for strong construction is demanding. Hence, the demand for calcium carbide is anticipated to increase over the forecast period.

-

Growing Usage of Fertilizers - Around 200 million metric tonnes of fertilizers are anticipated to be consumed globally in 2021. By 2021, rising crop prices would result in more need for calcium cyanamide as a fertilizer, a trend that has been particularly noticeable recently.

-

Growing Oil Industry - By 2045, it is anticipated that India's oil consumption will increase to approximately 10 million barrels per day.

-

Introduction of New Technologies - CacliPro was introduced to the Russian steel industry in January 2020 by the chemicals business AlzChem Group, based in Germany. In addition to improving the castability and mechanical properties of final steel products, CalciPro is very effective at adding calcium to molten steel.

-

Rising Production of PVC- It was predicted that the quantity of PVC production would rise from 42,931 thousand tons seven years ago to 55,715 thousand tons in 2022 across the globe.

Challenges

- Harmful Effects of Calcium Carbide on Health - Long-term exposure to calcium carbide could be damaging to a person's health. The fact that it contains phosphate and arsenic particles and produces acetylene gas when dissolved in water makes it particularly harmful when used to cure food. Arsenic and acetylene gas can affect many physiological processes and cause a variety of health problems, such as headaches, exhaustion, mood swings, seizures, and chronic hypoxia. Consequently, it is anticipated that this issue will impede market expansion.

- Growing Environmental Awareness

- Stringent Government Regulations

Calcium Carbide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 18.68 billion |

|

Forecast Year Market Size (2035) |

USD 29.57 billion |

|

Regional Scope |

|

Calcium Carbide Market Segmentation:

Application Segment Analysis

The calcium carbide market is segmented and analyzed for demand and supply by application into acetylene gas, calcium cyanamide, reducing & dehydrating agent, and desulfurizing & deoxidizing agent. The acetylene gas segment is projected to hold the highest market share. The use of this colorless gas as a fuel and a component of chemicals is widespread. A variety of industrial and commercial uses calcium carbide for the manufacture of acetylene (C2H2). In addition, there has been surging use of dissolved acetylene gas for welding, that is further expected to boost the segment’s growth in the market. It is employed as a cylinder gas for the fabrication of metal, the production of synthetic rubber, the carburization of steel, the manufacture of glass, the brazing process, as a food preservation additive, and in the building industry. For instance, in the fiscal year from April 2021 to March 2022, India consumed 0.8 million metric tons of synthetic rubber, an increment of 17% over the prior fiscal year. Furthermore, it is also used as a feedstock to make vinyl chloride and polyurethane fibers, an intermediate in the production of antiseptics, tableted pharmaceuticals, and antiseptics, as well as to make acetic acid.

End-user (Chemicals, Metallurgy, Pharmaceutical, Food)

The global calcium carbide market is also segmented and analyzed for demand and supply by the end-use industry into chemicals, metallurgy, pharmaceutical, and food. Out of these, the chemicals segment is anticipated to garner the largest revenue by the end of 2035, backed by growing investments and applications in the chemical industry. In industrial settings, calcium carbide is generally used to produce acetylene and other chemical compounds. The chemical and metallurgical sectors both use it extensively. Moreover, it is used in the vinylation of biomass feedstocks as a producer of acetylene. When CaC2 is used as the catalyst (approximately 10%), up to 39%-56% of the overall product yield is attained. In addition, by 2025, it is anticipated that investments in the Indian chemicals and petrochemicals sector would total about USD 100 billion.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcium Carbide Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 58.8% market share by 2035, fueled by expanding steel and plastic production in China. Throughout the projected period, the region will continue to provide significant businesses with growth prospects. China is the biggest producer of steel in the Asia Pacific region. China produced around 95 Mt of steel in 2021, up from about 5% in 2020, according to the World Steel Association. In comparison to other regions, the region is predicted to experience greater expansion in the forthcoming years.

Calcium Carbide Market Players:

-

Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AlzChem Group AG

- American Elements

- Thermo Fisher Scientific Inc.

- Carbide Industries LLC

- Inner Mongolia Baiyanhu Chemical Co., Ltd.

- Merck KGaA

- Adani Enterprises Limited (AEL)

- Mil-Spec Industries, Corp.

- Santa Cruz Biotechnology, Inc.

Denka Company Limited

Recent Developments

-

In Canada, AlzChem Group AG released Perlka, a fertilizer made of calcium cyanamide. Potatoes are farmed for both immediate eating and additional processing in many Canadian provinces. Perlka's high lime content guarantees that the soil is loosening to its full potential.

-

Adani Group (Adani Enterprises Limited), an Indian conglomerate, intends to invest USD 4 billion in the construction of a 2 million tonne/year coal-to-polyvinyl chloride (PVC) factory at Mundra in the western Gujarat state.

- Report ID: 4663

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcium Carbide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.