Deodorant Market Outlook:

Deodorant Market size was valued at USD 28.7 billion in 2025 and is projected to reach USD 51.8 billion by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of deodorant is estimated at USD 30.4 billion.

The deodorant market constitutes a significant segment of the personal care production industry. In 2023, according to OEC data, worldwide trading of personal deodorants and antiperspirants was worth USD 4.91 billion. The import demand is largely concentrated in the emerging economies, mainly in Asia and Latin America, where the increase in disposable incomes and urbanization are the main factors that drive consumption. On the other hand, the WITS 2021 report depicts that the top exporters of personal deodorants and antiperspirants to the Netherlands were the UK, Germany, and the Russian Federation. This data reflects the rising demand and reliance on multinational supply chains. Further, these numbers demonstrate the industry's resiliency in the face of wider consumer goods instability and emphasize the significance of trade diversification tactics for producers and distributors.

Personal Deodorants and Antiperspirants Exports to the Netherlands in 2021

|

Country |

Trade Value (1000 USD) |

Quantity (Unit) |

|

United Kingdom |

61,700.22 |

8,617,820 |

|

Germany |

29,045.29 |

4,781,380 |

|

Russian Federation |

27,223.32 |

6,698,250 |

|

Italy |

15,718.39 |

2,639,660 |

|

France |

10,588.62 |

1,064,550 |

Source: WITS 2021

The operational landscape for manufacturers is actively redefined by the supply chain considerations and regulatory shifts concerning specific ingredients and packaging. The monitoring of the imports of the raw material, such as aerosol propellants, is vital for production planning and cost forecasting. The EPA provides data and guidelines affecting the lifecycle of these products from the sourcing of the materials to the environmental impact of packaging and volatile compound emissions from the aerosol variants. These factors are supporting the industry-wide evaluation of product formats and ingredient transparency. Furthermore, the FDA's ongoing review of OTC monographs, including those for antiperspirants, represents a potential driver for reformulation initiatives, requiring manufacturers to adapt to evolving regulatory standards and invest in relevant research and development to ensure continued compliance and market access.

Key Deodorant Market Insights Summary:

Regional Highlights:

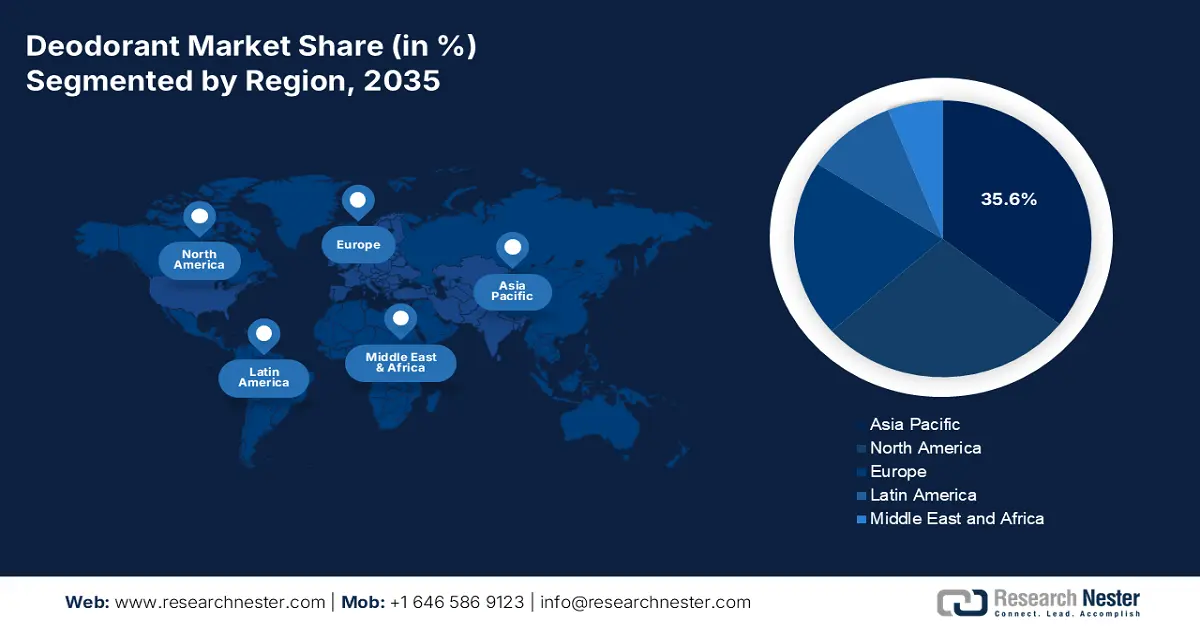

- Asia Pacific is projected to command a 35.6% share by 2035 in the deodorant market, attributed to rising disposable incomes and increasing Western cultural influence.

- By 2035, North America is expected to grow at a significant CAGR, supported by strong consumer demand for natural formulations and stringent FDA-aligned ingredient transparency.

Segment Insights:

- The natural and organic segment is forecast to capture a 55.6% share by 2035 in the deodorant market, propelled by rising consumer awareness of health and environmental impact.

- By 2035, the online retail segment is anticipated to secure a considerable share, reinforced by expanding digital marketing influence and broad product accessibility.

Key Growth Trends:

- Rising personal care expenditure

- Growth of health and personal care retail

Major Challenges:

- Consumer shift toward natural or organic formulations

- Marketing, branding and customer acquisition costs

Key Players: Procter & Gamble (U.S.), Unilever (UK/Netherlands), L'Oréal (France), Beiersdorf (Germany), Colgate-Palmolive (U.S.), Henkel (Germany), Church & Dwight (U.S.), Shiseido (Japan), Kao Corporation (Japan), Lion Corporation (Japan), Estée Lauder (U.S.), Godrej Consumer Products (India), Amway (U.S.), Edgewell Personal Care (U.S.), Natura &Co (Brazil), Coty Inc. (U.S.), Lush (UK), Aesop (Australia), LG Household & Health Care (South Korea), The Body Shop (UK).

Global Deodorant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.7 billion

- 2026 Market Size: USD 30.4 billion

- Projected Market Size: USD 51.8 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, Mexico, Vietnam, Turkey

Last updated on : 25 November, 2025

Deodorant Market - Growth Drivers and Challenges

Growth Drivers

- Rising personal care expenditure: Nowadays, consumers are spending more on personal care products, strengthening the deodorant demand across various regions. The U.S. Bureau of Labor Statistics data released in September 2025 depicts that the personal care expenditure increased by 9.7% in 2023. This data reflects the sustained purchasing power that benefits the deodorant consumption directly. Moreover, companies are actively expanding their footprint in the emerging economies, which further supports the category expansion. The trend is further reinforced in emerging deodorant markets, where rising middle-class income increases affordability. The spending patterns data, which is reported by the government, indicates a stable demand even during inflation cycles. This further highlights the evolution from a discretionary item to a daily-use which is essential in modern grooming routines.

- Growth of health and personal care retail: The demand for deodorant is shaped by the expanded availability across the retail formats. The U.S. Census data in September 2025 depicts that the total retail sales, which include personal care products, increased by 4.8% indicating a strong consumer purchasing behavior that supports the higher sales via supermarkets, convenience stores, and online retail channels. Growth in organized retail in India and Southeast Asia is driven by national infrastructure programs and has increased shelf space for personal care products. These expansions in retail support manufacturers with huge sales pipelines in the metropolitan and rural markets. This expanded distribution network is crucial for driving impulse purchases and ensuring brand visibility in a highly competitive deodorant market.

- Climate conditions and heat exposure trends: Rising temperature and heatwave occurrences influence deodorant usage frequency. The U.S. NOAA reported that 2023 was the warmest year, with the temperature affecting the regions across Asia, North America, and Europe. Mostly, warmer climates increase the perspiration levels, driving the consumption of deodorants and antiperspirants. Further, the government climate trend data helps manufacturers forecast on-demand spikes in heat-exposed regions such as Australia, India, Brazil, and Southeast Asia. The urban heat island effects documented by national meteorological departments correlate with higher deodorant usage, creating seasonal sales opportunities.

Challenges

- Consumer shift toward natural or organic formulations: The rising demand for natural deodorants has been redefined by the deodorant market, but sourcing of certified organic ingredients is costly, and audits are robust. The Organic Trade Association data in May 2024 reported that the organic products grew to USD 70 billion, which includes the organic ingredients in deodorants. Brands such as Schmidt’s had to reformulate after consumer complaints about irritation from baking soda-based products. The new entrants also face skepticism based on the efficacy of natural deodorants versus aluminum-based antiperspirants. Meeting the stability, safety, and long-lasting performance expectations while staying natural remains a difficult challenge.

- Marketing, branding and customer acquisition costs: The deodorant category requires heavy advertising to build trust and brand recall. The expenditure on advertising a new deodorant brand under the personal care brands has increased the digital ad spending. New brands such as Hume Supernatural and Corpus invest hugely in influencer and social media marketing, with costs rising across platforms. Consumers are loyal to long-standing brands, increasing the difficulty of convincing them to switch. For new entrants, balancing customer acquisition costs with profitability is a major barrier.

Deodorant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 28.7 billion |

|

Forecast Year Market Size (2035) |

USD 51.8 billion |

|

Regional Scope |

|

Deodorant Market Segmentation:

Ingredient Segment Analysis

Under the ingredient segment, natural and organic are expected to dominate and are poised to hold a share value of 55.6% during the forecast period, 2026 to 2035 in the deodorant market. The segment is driven by the rising consumer awareness of health and environmental impact. The shift towards natural and organic deodorants from synthetic deodorants is mainly due to the potential risks to health with the ingredients such as parabens and aluminum. Further, the demand for transparency is based on product labeling and sustainable sourcing, which is pushing manufacturers to innovate with plant-based and biodegradable ingredients. Government agencies such as the FDA monitor consumer complaints and guide cosmetic ingredient safety, hence fueling the public discourse. On the other hand, the environmental organization highlights the ecological impact of the packaging and synthetic chemicals, forcing brands to adopt for greener alternative to address the expectations of the consumer base.

Distribution Channel Segment Analysis

By 2035, online retail is expected to fuel the distribution channel segment and is poised to hold a considerable share value during the provided timeline period. The dominance of the segment is due to the rising influence of digital marketing and the wider availability of product selection when compared to physical stores. The e-commerce platform allows consumers to compare the ingredients easily, read reviews, and discover the niche brands that are not available in the physical store. The International Trade Administration data in 2024 depicts that the e-commerce market is rising actively and is projected to reach USD 36 trillion by 2026. The growth of influencer marketing in social media and targeted online advertising directly surges the traffic to these digital storefronts. Organizations such as the Consumer Brands Association track these shifts in purchasing behaviors and note the permanent change in how customers seek their personal care products in online channels.

Product Type Segment Analysis

Deodorant sprays and aerosols are leading the product type segment during the forecast period. Their dominance is mainly due to their convenience, widespread consumer familiarity, and rapid application. The segment is boosted by strong brand marketing and a perception of superior efficacy in odor control. Aerosol propellant production is a crucial indicator of this category's volume and environmental impact. The EPA data in September 2024 states that the hydrofluorocarbons surged to 7.58 million lbs in 2022. These hydrofluorocarbons are mainly used as propellants in aerosols, reflecting the sustained demand for spray-based consumer goods, including deodorants. This pattern demonstrates how consumers still favor this format in spite of mounting environmental concerns.

Our in-depth analysis of the global deodorant market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Ingredient |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Deodorant Market - Regional Analysis

APAC Market Insights

Asia Pacific is set to be the dominant in the deodorant market and is expected to hold the market share of 35.6% by 2035. One of the main characteristics of the market growth is the rising influence of Western culture. The main factor leading the market is the increasing disposable incomes, tracked by entities like China's National Bureau of Statistics, which reports steady growth in consumer goods retail sales, expanding the consumer base. Urbanization and Western influences are changing the way people take care of themselves and thus generating demand for deodorants used daily. The deodorant market is very diverse, with the range of trends going from the consumer preference of natural ingredients in South Korea to value-oriented products targeting price-sensitive regions. E-commerce is a critical distribution channel, enabling brands to reach vast, geographically dispersed populations efficiently.

China is leading the APAC deodorant market and is experiencing rapid growth fueled by the rising awareness of personal grooming specially among the younger population. The country is surging quickly as global domestic brands invest heavily in marketing and education. The primary driver is the expansion of modern retail and e-commerce, making products widely accessible. According to the OEC data in 2023, China imported USD 32.9 million worth of personal deodorants, highlighting the demand for the market. Further, the People’s Republic of China data in January 2022 depicts that the total retail sales of consumer goods hit 44.08 trillion yuan in 2021. This data demonstrates the strong consumer spending power that highlights this market expansion. This robust import and domestic spending data stimulates a mature and rapidly expanding deodorant market with significant opportunities for both international and local brands.

The deodorant market in India is one of the rapidly expanding markets and is propelled by a massive youth population, rising middle-class affordability, and the transition from traditional substitutes to branded products. The deodorant market is highly competitive and price sensitive during the innovation in value-sized and mass market segments. Growth is further accelerated by the deep penetration of organized retail and e-commerce into tier-2 and tier-3 cities. India has exported over USD 50.4 million worth of personal deodorants and antiperspirants, based on the OEC data in 2023. This export data shows India's growing role as a major manufacturing hub for personal care products. This production capability aids in both domestic brand growth and international market access, further driving the market expansion.

North America Market Insights

By 2035, North America is expected to be the fastest-growing deodorant market and is projected to grow at a significant CAGR during the forecast period. The market is defined by the high penetration rate and the shift towards premiumization and ingredient transparency. The growth is driven by consumer demand for natural and aluminum-free formulations, which is propelled by health consciousness and FDA regulatory frameworks. The market is highly consolidated, with innovation focused on skin sensitivities, multifunctional benefits, and sustainable packaging. E-commerce remains a significant growth channel with robust logistics that are supported by established infrastructure in Canada and the U.S. The market maturity in the region results in incremental growth to emerging economies, with brand loyalty and efficacy being key purchase drivers.

The U.S. deodorant market is characterized by a strong consumer shift towards the rising awareness of ingredients in the products and a search for aluminum-free and natural formulations. The growth in the country is propelled by the dominance of e-commerce, which has consistently outpaced the total retail sales, indicating a permanent shift in the purchasing channels. The FDA's regulatory regulation of antiperspirants as over-the-counter medications, which controls component safety and labeling claims and promotes consumer confidence in product efficacy, highlights this development. Recently, in June 2025, PAPATUI Men’s Care introduced a full-body deodorant spray that is paraben-free and aluminum-free. This new product offers long-lasting odor protection in the brand’s signature scents. Further, the deodorant is available in three different scents, such as Lush Coconut, Cedar Sport, and Sandalwood Suede.

In Canada, the deodorant market trends are highly influenced by the robust regulatory frameworks and national emphasis on environmental sustainability. The government initiative from the Environment and Climate Change Canada, such as the Zero Plastic Waste Agenda, is pushing manufacturers to adopt sustainable packaging solutions that accelerate the development of refillable and plastic-free deodorant formats. Further, a multicultural demographic is driving the demand for diverse fragrance profiles for various skin types. The powerful NIVEA Men Deodorant, which launched in March 2024, is coming to Canada. It is a revolutionary roll-on format that is the first of its type for Canadian men. This invention is expanding the grooming for men's market and addresses the need for efficient, skin-friendly, and practical application formats.

Europe Market Insights

The deodorant market in Europe is expanding rapidly and is driven by the rising consumer base seeking sustainability, health, and ingredient transparency. The growth is mainly driven by the premiumization and innovation in organic and natural formulations, as people increasingly look for products that are free from synthetic ingredients and aluminum salts. This trend is further integrated by robust EU-wide regulations overseen by the European Medicines Agency, which classifies the antiperspirants as cosmetics with safety and labeling requirements. The deodorant market faces pressure to develop sustainable packaging in alignment with the EU’s Circular Economy Action Plan, and surging investment in recycled and refillable materials. The overall growth is modest compared to other regions. Further, the demand is stable and driven by the product innovation that caters to specific customers' concerns such as sin sensitivity and environmental impact.

Germany is projected to hold the highest share in Europe and is driven by its focus on ingredient safety, product efficacy and environmental sustainability. Consumers in the country determine high sensitivity to product composition which is a trend aided by the robust work of the German Federal Institute for Risk Assessment which provides scientific evaluations on the safety of cosmetic ingredients, including deodorants. This further boosts the deodorant market with clinically approved products gaining a significant traction. Germany imported more over USD 296 million worth of personal goods, indicating the country's growing need for deodorant products, according to the OEC 2023 data. Germany's well-established discount and drugstore channels, such as DM and Rossmann, provide massive distribution for these premium mass-market products, ensuring widespread availability and consumer access.

The UK is going to be at the forefront and is mainly driven due to the energetic retail environment, brand innovation, and consumer engagement with health trends. In spite of Brexit, the UK's Cosmetics Regulation largely mirrors EU regulations relevant regulatory authority being the UK Health and Safety Executive. The total export share of the UK’s deodorant in 2023 is 11.7%, highlighting the rising customer base. One of the important growth drivers is the dynamic Direct-to-Consumer and online beauty sector that enables agile brands to launch innovative formats such as cream and paste deodorants, quickly and market them. The UK's Office for National Statistics regularly reports on the strong growth in online retail sales, which is one of the important channels for the discovery and purchase of deodorants.

Key Deodorant Market Players:

- Procter & Gamble (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Unilever (UK/Netherlands)

- L'Oréal (France)

- Beiersdorf (Germany)

- Colgate-Palmolive (U.S.)

- Henkel (Germany)

- Church & Dwight (U.S.)

- Shiseido (Japan)

- Kao Corporation (Japan)

- Lion Corporation (Japan)

- Estée Lauder (U.S.)

- Godrej Consumer Products (India)

- Amway (U.S.)

- Edgewell Personal Care (U.S.)

- Natura &Co (Brazil)

- Coty Inc. (U.S.)

- Lush (UK)

- Aesop (Australia)

- LG Household & Health Care (South Korea)

- The Body Shop (UK)

- Procter & Gamble is the top most player in the deodorant market, as it uses deep consumer insights and material science to stay ahead. Their strategic initiative aims at superior product efficacy and long-lasting odor protection via patented technologies. Brands such as Secret and Old Spice integrated improved antiperspirant compounds and scent release systems, which ensure the clinical level protection with skin-friendly customized formulations for various demographics.

- Unilever is another leading player in the deodorant market and is focused on sustainability and purpose-driven branding. The key initiative is the global rollout of refillable deodorant formats and packaging made from recycled plastics. Their brands, such as Axe and Dove, are constantly innovating with 100% plastic-free paper sticks and concentrated refill cartridges, which respond directly to environmental concerns. The total turnover of the company in 2024 in the beauty and well-being category is € 13,157 million

- L’Oréal brings its dermatological expertise to the deodorant market as it mainly focuses on skin health and ingredient transparency. In 2024, the company recorded a sales achievement of €43.48 billion with a 5.6% growth percentage. Their strategic advancement involves enhancing the microbiome-friendly and dermatologically tested formulations. Further, brands such as La Roche Posay are leading in creams and roll-ons that use prebiotics and soothing agents to secure the skin's integrity.

- Beiersfeld leads the deodorant market with the skin compatibility and scientific innovation. Their main initiative is the development of protective formulas for 24 hours that are free from aluminum salts and alcohol. Their NIVEA brand uses natural mineralizers to provide reliable odor control without compromising the natural moisture barriers in skin, for sensitive skin customers.

- Colgate Palmolive in the deodorant market capitalizes on its strong presence in emerging economies and value-based innovation. Their main goal is to create accessible and highly efficient products that are customized to local preferences and climates. Their Speed Stick and Lady Speed Stick brands often integrate a long-lasting and budget-friendly portfolio, ensuring a strong brand loyalty and deep market penetration.

Here is a list of key players operating in the global deodorant market:

The above listed global deodorant market players are very competitive and is defined by the dominance of established players such as P&G and Unilever. These giant players use massive R&D and marketing budgets to build powerful brands and secure prime retail shelf space. A key strategic initiative across the board is a pivot towards natural and aluminum-free formulations, which is driven by the rising consumer base seeking health and environmental consciousness. Further, players are expanding their market growth in emerging markets via acquisitions and product localizations while investing in direct-to-consumer e-commerce channels to improve customer engagement and data collection. To justify this, Unilever announced the acquisition of the personal care brand Wild in April 2025. This step highlights the optimization of Unilever’s portfolio towards premium and high-growth. This dynamic landscape pushes for continuous innovation in ingredients, scent portfolios, and packaging.

Corporate Landscape of the Deodorant Market:

Recent Developments

- In July 2025, Rexona launched the whole-body deodorant down under with Martha Stewart in Australia. The launch of the product is aimed at full-body freshness with its Whole-Body Deodorant, now available in Australia.

- In January 2025, Unilever revealed the latest deodorant innovation and ambitions to deliver incremental growth to the deodorant category with the launch of new whole-body deodorant products. Unilever is expanding its deodorant business in the UK with the launch of new whole-body collections for Sure and Lynx.

- In October 2024, Priskila Company launched the Casablanca perfumed deodorant body spray 150ml. This product is crafted with advanced antibacterial agents, double refreshing active agents and it is halal certified.

- Report ID: 4151

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Deodorant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.