Bioplastics Market Outlook:

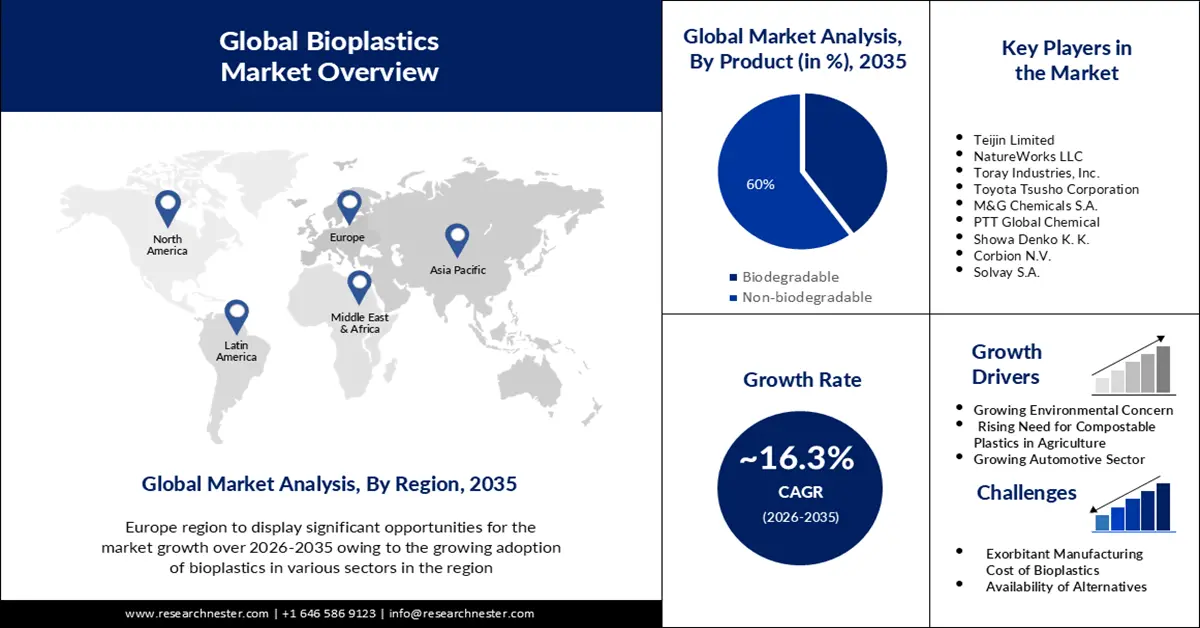

Bioplastics Market size was over USD 16.96 billion in 2025 and is anticipated to cross USD 76.78 billion by 2035, growing at more than 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioplastics is assessed at USD 19.45 billion.

The worldwide production capacity of bioplastics in 2024 was 2.47 million tons and is projected to cross 5.73 million tons by the end of 2029. The comparative analysis of 2024’s production capacities and true production suggests that the market has been operating at about 60% capacity. However, this rate varies significantly based on polymer type, ranging between 35% and 100%. The average utilization rate was 58% in 2024 (2.47 million tons in capacity vs. 1.44 million tons yield). The global bioplastics manufacturing industry resurfaced in 2023 after stagnation over the past few years, and massive growth is expected by 2028, when the yield is likely to reach 7.43 million tons from 2.18 million tons in 2023. Additionally, it is notable that more than 50% of bioplastics are biodegradable, with polylactic acid (PLA) being the most popular alternative.

Global Production Capacities of Bioplastics 2024-2029

Source: European Bioplastics

Bioplastics Production at Close to 60% Capacity in 2024

Source: European Bioplastics

Production volumes, leading suppliers, and main applications for some of the most important commercial bio-based polymers, 2020

|

Bio-based polymer |

Global capacity (tons) |

Major producer |

Application |

|

Starch and blends |

435K |

Futerro, Novamont, Biome |

Flexible packaging, consumer goods, and agriculture |

|

Polylactic acid (PLA) |

435K |

NatureWorks, Evonik, Total Corbion PLA |

Flexible packaging, Rigid packaging, consumer goods |

|

Polyhydroxyalkanoates (PHA) |

40K |

Yield10 Bioscience, Tianjin GreenBio Materials, Bio-on |

Flexible packaging, Rigid packaging |

|

Polyethylene (PE) |

244K |

Neste, LyondellBasell |

Flexible packaging, Rigid packaging |

|

Polyethylene terephthalate (PET) |

181K |

Toray Industries, The Coca-Cola Company, MSG Chemicals |

Rigid packaging |

|

Polybutylene adipate terephthalate (PBAT) |

314K |

Algix, BASF |

Flexible packaging, Rigid packaging, agriculture |

|

Polybutylene succinate (PBS) |

95K |

Roquefte, Mitsubishi Chem., Succinity |

Flexible packaging, agriculture |

Source: CAS

The bioplastic traction is primarily supported by government aid and grants to foster sustainability-focused businesses. In October 2024, the U.S. National Science Foundation (NSF) and partner agencies in Canada, the U.S., Finland, the Republic of Korea, Japan, and the UK announced funding awards worth USD 82 million toward advancing bioeconomy research. The NSF Global Centers 2024 program provisions multidisciplinary yet holistic projects that bring together public engagement and international scientific disciplines to boost manufacturing processes, including the operations of the Global Center for Sustainable Bioproducts (GCSB) at the University of Tennessee. It leverages international collaborations and their expertise to diversify the approaches for utilizing waste biomass.

NSF Global Centers 2024 program partner agencies comprise the Canada’s Natural Sciences and Engineering Research Council (NSERC) and the Social Sciences and Humanities Research Council (SSHRC), the U.S.-based National Endowment for the Humanities, Innovation Funding Agency Business Finland, the Research Council of Finland (RCF), the Japan Science and Technology Agency (JST), the Republic of Korea and the National Research Foundation, the Ministry of Science, and the U.K. Research and Innovation (UKRI) Biotechnology and Biological Sciences Research Council.

In September 2024, the U.S Department of Defense (DoD) announced an addition of 12 awards as part of its Distributed Bioindustrial Manufacturing Program (DBIMP) to bioindustrial firms, thereby bringing the award count to 25, worth USD 42 million. As part of the awarded projects so far, Nebraska-based Bluestem Biosciences received USD 2.16 million to build an anaerobic fermentation plant for developing an organic acid as a precursor for defense-related polymers/bioplastics and adhesive fabrication.

Key Bioplastics Market Insights Summary:

Regional Highlights:

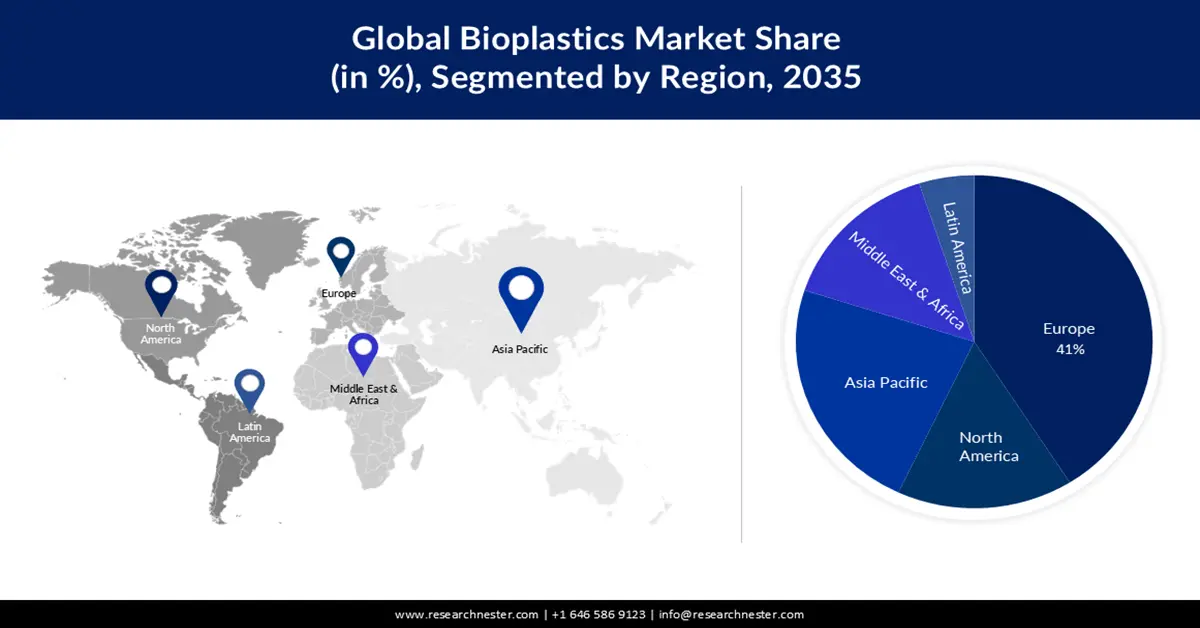

- Europe bioplastics market will secure around 41% share by 2035, fueled by the growing adoption of bioplastics in various sectors and supportive legislation promoting sustainable alternatives.

Segment Insights:

- The packaging segment in the bioplastics market is projected to hold a 60% share by 2035, fueled by the push to reduce environmental impact using biodegradable food packaging.

Key Growth Trends:

- High R&D scope in material development

- Standardizing in labeling helps streamline packaging and market adoption

Major Challenges:

- Exorbitant manufacturing cost of bioplastics

Key Players: BASF SE, Teijin Limited, NatureWorks LLC, Toray Industries, Inc., Toyota Tsusho Corporation, M&G Chemicals S.A., PTT Global Chemical, Showa Denko K. K., Corbion N.V., Solvay S.A.

Global Bioplastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.96 billion

- 2026 Market Size: USD 19.45 billion

- Projected Market Size: USD 76.78 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Bioplastics Market Growth Drivers and Challenges:

Growth Drivers

- High R&D scope in material development: Presently, bioplastic alternatives exist for all types of conventional plastic materials. Polyhydroxyalkanoates (PHA), polylactic acid (PLA), and biobased polyethylene (PE), and a steady growth of biobased polypropylene (PP) bio-based polymers have witnessed robust R&D, fostering production capacities to surge in the next five years. In October 2024, the Woods Hole Oceanographic Institution (WHOI) scientists developed a new version of cellulose diacetate (CDA)- the fastest degrading bioplastic material.

CDA foam has the potential to replace single-use plastic packaging. The foam’s properties make it suited for several insulation and packaging applications, and the WHOI research showcases that the CDA foam can be prepared from biodegradable materials and can easily degrade in marine bodies, should they inadvertently end up there. Furthermore, such foam- and petroleum-based bioplastics, including polyhydroxyalkanoates (PHAs) and CDAs, help mitigate economic and environmental costs. As per a September 2024 report by the U.S. National Science Foundation (NSF), purple bacteria from Rhodomicrobium udaipurense and Rhodomicrobium vannielii can produce PHA using eco-friendly carbon sources, light energy, and minimal nutrients.

Similarly, in October 2024, the Shapiro Administration announced research funding of USD 2.2 million across 27 projects to help Pennsylvania adapt to novel technologies and marketplace trends. During the same period, the Pennsylvania State University was granted USD 100,000 for converting low-value trees and mushroom substrate to agricultural sprayable bioplastics. In July 2024, the U.S. DOE granted up to USD 206,500 each for this Phase I FY 2024 SBIR award to Capro-X, Inc. for converting organic waste-based fatty acids to cellulose ester bioplastics.

- Standardizing in labeling helps streamline packaging and market adoption: The EU in 2023 mentioned that roughly 73% of customers are inclined toward purchasing sustainable products. Biobased plastics offer clear advantages over single-use plastics, and this makes them a viable choice for environmentally conscious consumers. This has impelled the need for voluntary commitment to certify compostable items and packaging complying with the EU EN 13432 / EN 14995 standards to gain commercial advertising rights. The European Committee for Standardization (CEN) has rolled out the EN 16785-1 and EN 16640 to highlight biobased elements. The EN 16640 categorizes biobased products based on the carbon content using the radiocarbon method. Depending on the results, products are certified as OK biobased by TÜV Austria,NEN biobased, and DIN geprüft biobased by DIN Certco.

Challenges

- Exorbitant manufacturing cost of bioplastics: The high production cost is one of the major factors predicted to slow down market growth. Owing to economies of scale, cost of research & development, varying cost of raw materials, and high cost of polymer plant construction, most bioplastics are now more expensive to create than fossil-based plastics, and there is also not enough production. For instance, the cost of PET or PE made from sugar cane or bio-ethanol is over 10% higher than that of traditional plastics. As a result of the high costs required, the manufacture of bioplastics is still very limited.

Bioplastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 16.96 billion |

|

Forecast Year Market Size (2035) |

USD 76.78 billion |

|

Regional Scope |

|

Bioplastics Market Segmentation:

Product Segment Analysis

The non-biodegradable segment in bioplastics market growth can be attributed to its increasing demand in vehicle interiors. Bio-based polymers are highly suited for this use and as a result, have seen considerable demand from the automobile sector, and it is expected that they have a bright future for car interiors. A variety of bioplastics are utilized for automobile component production and assembly, including bio-based PA, PBS, and PLA. One of the most popular amongst these is PLA, which is manufactured from maize with minimum energy and resource utilization.

Biodegradable & Non-biodegradable Material Development and Diversification (2024 & 2029)

Source: European Bioplastics

Application Segment Analysis

The packaging segment is set to garner over 60% of the bioplastics market share in the near future. To reduce the environmental impact of food and beverage packaging, they are stored in biodegradable bags made from biodegradable substances such as gelatin, starch, chitosan, cellulose, and polylactic acid. For instance, meat, dairy products, baked goods, and other products are packaged in biodegradable food packaging films and containers composed of biodegradable polymers, including poly (vinyl alcohol) PVA, a different bioplastic, which is widely used for food packaging owing to its excellent film-forming and biodegradability properties. As per European Bioplastics, the packaging sector used 1.12 million tons of the overall yield, capturing a staggering 45% market share in 2024.

Global Production Capacities of Bioplastics 2024, by Application

Source: European Bioplastics

Our in-depth analysis of the global bioplastics market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioplastics Market Regional Analysis:

Europe Market Insights

Europe is likely to hold over a 41% bioplastics market share by the end of 2035. The expansion of the market can be driven by the growing adoption of bioplastics in various sectors. The plastic prohibition and to meet the growing demand for sustainable alternatives to traditional plastics, Europe is poised to become a major producer of bioplastics. For instance, one of the main consumers of plastic packaging in the area is the food and beverage industry, since it has benefits, including minimal environmental impact. In addition, bioplastics are used in the production of consumer items, including toys and electronics, which are becoming more and more popular in the area.

Developments in compostable bioplastics are proportionately affected by the evolution of legislation. Owing to the collection of organic waste, which is obligatory across the EU by 2030, the market presents opportunities for repurposing waste bags and converting them to bioplastics for agricultural purposes. The Single Use Plastic (SUP) Directive, even before its commencement in January 2022, largely impacted the single-use plastic generation in Italy, resulting in a dip of 31.7% between 2020 and 2021.

The Italy bioplastics market landscape is shaped by the EU’s CO2 reduction targets that boost the adoption of bio-based and renewable polymers. Prominent investments in biorefineries and infrastructure development are set to facilitate another 100 kilotons of production of renewable polymers by 2030. According to the 2023 report by the International Trade Administration (ITA), Italy had 275 companies comprising 20 granule producers and distributors, 5 chemical producers, 250 processors, with 2,895 employees and a revenue of USD 1.08 billion in 2021.

Asia Pacific Market Insights

Bioplastics market in Asia Pacific, is estimated to be the second largest during the forecast timeframe. The market progress in the region is impelled by rising consciousness about plastic trash in developing nations. For instance, countries in the region are working harder to combat plastic pollution and have implemented bans on the usage of single-use plastics, which is expected to raise the demand for alternatives, including bioplastics. As people are becoming more conscious about plastic trash and their negative environmental impacts, they are increasingly shifting towards the use of bioplastics. Moreover, along with the U.S., Brazil, Germany, and Canada, China is one of the top five nations producing bioplastics, and it is predicted that China will produce over 6 million and 1 million tons, respectively, of the two primary forms of biodegradable plastic, PBAT, and PLA, by the end of 2025, that will make up two-thirds of the world's output.

The Australia bioplastics market is driven by the shift in government focus to ban the usage of single-use plastics to the adoption of bio-based counterparts. For instance, in August 2024, the Government of Tasmania committed USD 1 million for a tenure of four years to cater to the adverse impacts of single-use plastics. This includes incorporating a policy reform to accelerate the phase out and render USD 100,000 to support businesses through the transition. According to the Tasmania Department of Natural Resources and Environment, plastic usage in Australia has surged by 40% over the last decade and is estimated to cross 9.5 million tons by 2049‑50. Furthermore, in a business-as-usual scenario, this metric will surpass 66 million metric tons annually by 2050, thereby underscoring the need for a swift transition.

Bioplastics Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teijin Limited

- NatureWorks LLC

- Toray Industries, Inc.

- Toyota Tsusho Corporation

- M&G Chemicals S.A.

- PTT Global Chemical

- Showa Denko K. K.

- Corbion N.V.

- Solvay S.A.

With a notable number of big brands such as Danone, Tetra Pak, Procter & Gamble, Lego, Heinz, IKEA, and Toyota turning to bioplastic solutions to emphasize the importance of ESG in business operations, the bioplastics market has observed massive opportunities, and its penetration is well on its way. The market players have identified this trend and are engaging in strategic partnerships, expansions, and innovations to strengthen their positions on the global map.

Some of the prominent players include in bioplastics market:

Recent Developments

- In September 2024, CSIRO and Murdoch University announced the launch of the Bioplastics Innovation Hub. This joint venture of USD 8.0 million focuses on the development of a new generation of 100% compostable plastic.

- In November 2023, Sulzer revealed the launch of a new end-to-end licensed technology, CAPSUL, for the continuous manufacturing of polycaprolactone. Through this innovative biodegradable polymer, the company is expanding its portfolio of bioplastics.

- Report ID: 3923

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioplastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.