Global Ethylene Propylene Diene Monomer (EPDM) Market

- An Outline of the Global Ethylene Propylene Diene Monomer (EPDM) Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

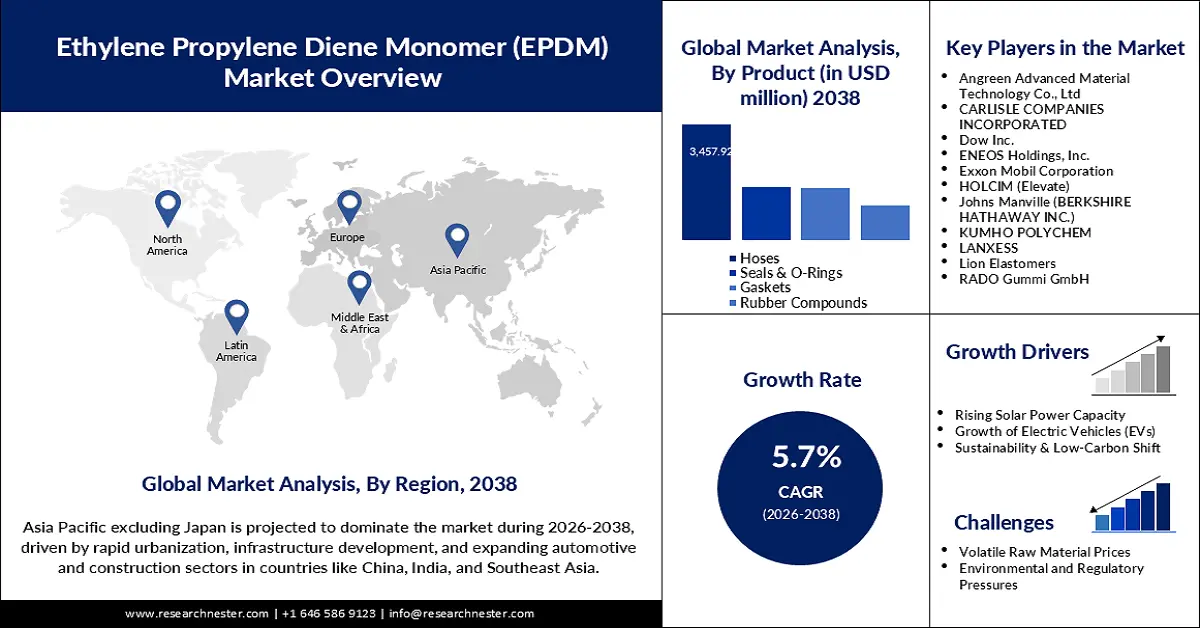

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Ethylene Propylene Diene Monomer (EPDM)

- Recent News

- Regional Demand

- EPDM Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: EPDM Demand Landscape

- EPDM Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2038)

- Root Cause Analysis (RCA) for discovering problems of the Ethylene Propylene Diene Monomer (EPDM) Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global EPDM Market – Key Player Analysis (2024)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2024 (%)

- Business Profile of Key Enterprise

- Angreen Advanced Material Technology Co., Ltd

- CARLISLE COMPANIES INCORPORATED

- Dow Inc.

- ENEOS Holdings, Inc.

- Exxon Mobil Corporation

- HOLCIM (Elevate)

- Johns Manville (BERKSHIRE HATHAWAY INC.)

- KUMHO POLYCHEM

- LANXESS

- Lion Elastomers

- RADO Gummi GmbH

- REDCO

- SABIC

- SAUDI ARAMCO (ARLANXEO)

- Versalis S.p.A.

- West American Rubber Company, LLC

- Business Profile of Key Enterprise

- Global Ethylene Propylene Diene Monomer (EPDM) Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Ethylene Propylene Diene Monomer (EPDM) Market Segmentation Analysis (2026-2038)

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Regional Synopsis, Value (USD Million), 2026-2038

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Segmentation (USD million), 2026-2038, By

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2038

- Increment $ Opportunity Assessment, 2026-2038

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2038, By

- By Product

- Hoses, Market Value (USD Million), and CAGR, 2026-2038F

- Seals & O-Rings, Market Value (USD Million), and CAGR, 2026-2038F

- Gaskets, Market Value (USD Million), and CAGR, 2026-2038F

- Rubber Compounds, Market Value (USD Million), and CAGR, 2026-2038F

- Roofing Membranes, Market Value (USD Million), and CAGR, 2026-2038F

- Connectors and Insulators, Market Value (USD Million), and CAGR, 2026-2038F

- Weather Stripping, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- By Application

- Building & Construction, Market Value (USD Million), and CAGR, 2026-2038F

- Wires & Cables, Market Value (USD Million), and CAGR, 2026-2038F

- Electrical & Electronics, Market Value (USD Million), and CAGR, 2026-2038F

- Lubricant Additive, Market Value (USD Million), and CAGR, 2026-2038F

- Plastic Modifications, Market Value (USD Million), and CAGR, 2026-2038F

- Automotive , Market Value (USD Million), and CAGR, 2026-2038F

- Tires & Tubes, Market Value (USD Million), and CAGR, 2026-2038F

- Others, Market Value (USD Million), and CAGR, 2026-2038F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2038F

- By Product

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Ethylene Propylene Diene Monomer Market Outlook:

Ethylene Propylene Diene Monomer Market size was valued at USD 4.9 billion in 2025 and is projected to reach a valuation of USD 10.2 billion by the end of 2038, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2038. In 2026, the industry size of ethylene propylene diene monomer is assessed at USD 5.2 billion.

The ethylene propylene diene monomer market is going through rapid shifts, fueled by a global drive toward sustainability and high-performance materials. Companies are developing bio-based feedstocks and environmentally friendly formulations to comply with stringent environmental regulations and reduce their carbon footprint. In February 2025, Bridgestone announced a new partnership with ENEOS and JGC Holdings to enhance the development and commercialization of bio-based rubber for tires. This is complemented by increasing demand from the automotive, construction, and consumer goods industries for materials with a lower environmental footprint without sacrificing performance.

One of the most significant opportunities is creating strategic partnerships and distribution networks in emerging and new markets. In April 2025, Biesterfeld expanded its partnership with ExxonMobil to market premium Vistalon EPDM grades across Europe, Turkey, and Africa, giving customers greater access to high-performance solutions. The partnership addresses the growing demand for specialty elastomers in the automotive and industrial segments. The market is also experiencing growth in niche areas, such as water-based dispersions and self-adhering membranes, as businesses strive to differentiate their products and meet specialized needs in construction and coatings.

Key Ethylene Propylene Diene Monomer Market Insights Summary:

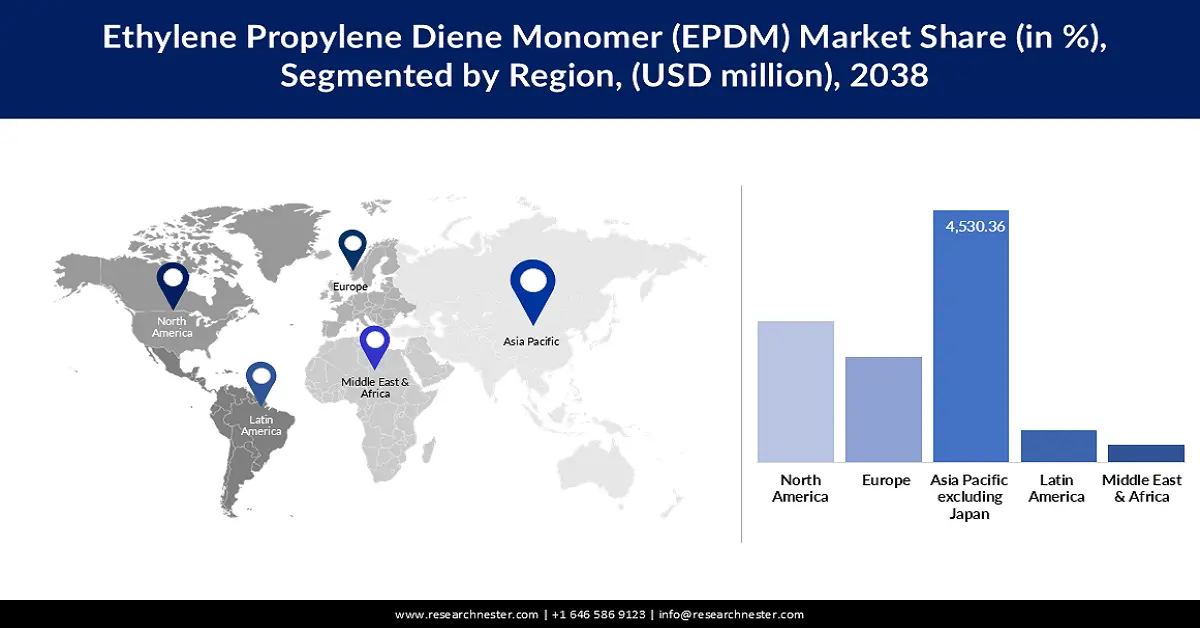

Regional Highlights:

- Asia Pacific excluding Japan is expected to dominate the ethylene propylene diene monomer market with a 44.1% share during the forecast period, owing to rapid industrialization, urbanization, and growing investments in infrastructure and automotive manufacturing.

- Europe is projected to witness notable expansion from 2026 to 2038, fueled by stringent environmental regulations, sustainable material innovation, and the continent’s leadership in circular economy initiatives.

Segment Insights:

- The hoses segment is expected to maintain a 40.4% share of the ethylene propylene diene monomer market during the forecast period, propelled by its extensive use in automotive, industrial, and construction applications requiring superior heat, weathering, and chemical resistance.

- The automotive segment is projected to command a 50.7% share by 2038, driven by rising vehicle production and the growing demand for durable, high-performance materials in seals, weatherstripping, and anti-vibration components.

Key Growth Trends:

- Increased demand for green buildings

- Demand for high-performance parts by the automotive industry

Major Challenges:

- Crossing regulatory barriers

- Availability of green EPDM alternatives

Key Players: ARLANXEO, Exxon Mobil Corporation, The Dow Chemical Company (Dow Inc.), Kumho Polychem Co., Ltd., SK geo centric (SK Chemical), Versalis S.p.A. (Eni Group), Lion Elastomers LLC, PetroChina Company Limited, SABIC (Saudi Basic Industries Corp.), PJSC Nizhnekamskneftekhim, SSME (Sichuan Shen Ma Industry), Jilin Xingyun Chemical, Johns Manville

Global Ethylene Propylene Diene Monomer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.9 billion

- 2026 Market Size: USD 5.2 billion

- Projected Market Size: USD 10.2 billion by 2038

- Growth Forecasts: 5.7% CAGR (2026-2038)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (44.1% Share during the forecast period)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: South Korea, Brazil, Thailand, Indonesia, Mexico

Last updated on : 23 September, 2025

Ethylene Propylene Diene Monomer Market - Growth Drivers and Challenges

Growth Drivers

- Increased demand for green buildings: One of the most significant factors of growth in the building and construction industry is the increasing popularity of sustainable building materials. With cities around the world investing in green infrastructure and climate-resilient buildings, the use of EPDM in membranes, seals, and insulation purposes will increase exponentially, with its durability and weather resistance being the driving force. For instance, Holcim acquired ZinCo, a leader in green roofs, in February 2024 to strengthen its nature-based urban solutions business. The acquisition indicates the increasing demand for durable, sustainable products like EPDM for climate-resilient construction and waterproofing.

- Demand for high-performance parts by the automotive industry: Another growth factor in the ethylene propylene diene monomer (EPDM) market is the auto sector's demand for lightweight, high-performance, and eco-friendly components. As the production of electric vehicles continues to grow in volume and the fuel efficiency requirements continue to tighten, demand for high-performance EPDM compounds that save weight and improve performance will continue to be a driving force behind market growth. In May 2024, KRAIBURG TPE launched new EPDM adhesion compounds specifically developed for the automotive sealing and exterior parts market with enhanced UV stability and durability. The products form the basis for the manufacture of lighter, fuel-efficient vehicles by enabling the migration to hybrid TPE-EPDM solutions.

Challenges

- Crossing regulatory barriers: One of the significant challenges of the ethylene propylene diene monomer market is increasing regulatory compliance complexity for new and emerging applications, particularly for applications that are subject to tighter health and safety regulations. For instance, Trelleborg launched its WaterPro EPDM line in May 2025 to address new global drinking water regulations, including the KTW-BWGL standard in Germany. Several international certifications for application in drinking water systems entail significant R&D and administrative costs and present challenges for smaller players, and inhibit new material grade entry to the markets.

- Availability of green EPDM alternatives: The development and sale of cleaner equivalents with comparable performance to traditional solvent-based systems is another growth barrier to the market. Lion Elastomers and Emulco NV partnered in February 2024 to produce water-based EPDM emulsions for green paints. While these low-VOC dispersions are cleaner, end-use customers must experience equivalent durability, adhesion, and cost savings versus traditional systems before they convert. The ethylene propylene diene monomer market must invest in R&D and consumer education to propel the conversion of these cleaner technologies into a variety of applications.

Ethylene Propylene Diene Monomer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2038 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 4.9 billion |

|

Forecast Year Market Size (2038) |

USD 10.2 billion |

|

Regional Scope |

|

Ethylene Propylene Diene Monomer Market Segmentation:

Product Segment Analysis

The hoses segment is likely to maintain 40.4% ethylene propylene diene monomer market share during the forecast period, with its significance in automotive, industrial, and construction applications where strength and heat, weathering, and chemical resistance are crucial. The high-performance characteristics of EPDM make it a material of choice for radiator hoses, hydraulic applications, and industrial fluid conveyance. In January 2025, Bellofram Elastomers developed new engineered foams, including closed-cell EPDM, for HVAC and automotive applications, demonstrating the versatility and ongoing innovation of the material. Industrial and automotive applications necessitate more reliable and long-lasting components, and the hoses market is likely to grow further.

Application Segment Analysis

The automotive sector is projected to hold a 50.7% ethylene propylene diene monomer market share by 2038, symbolizing the material's vital position in the production of cars. It is used predominantly in seals, weatherstripping, hoses, and anti-vibration parts due to its enhanced durability, thermal stability, and sealing ability. In May 2024, the introduction of new EPDM-adhesion compounds by KRAIBURG TPE for the car sealing system once again symbolized the importance of the material in the production of light and high-performance vehicles. The unbridled worldwide growth of car production, as well as the automotive industry's high quality and performance demands, ensures sustained demand for EPDM.

Our in-depth analysis of the ethylene propylene diene monomer market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ethylene Propylene Diene Monomer Market - Regional Analysis

APEJ Market Insights

Asia Pacific excluding Japan ethylene propylene diene monomer market is poised to hold a 44.1% share during the forecast period. This is attributed to the rapid rate of industrialization, urbanization, and increased investment in infrastructure and automotive manufacturing. Demand for quality EPDM products is also fueled by the increasing middle class and rising demand for consumer goods in the regional market. Moreover, strategic partnerships and domestic manufacturing are increasingly becoming critical to address the diverse needs of this fast-paced market.

China ethylene propylene diene monomer market is witnessing high growth, boosted by its huge-scale production base and developing automotive sector. China is a major consumer of EPDM for uses from automobile components, industrial hoses, to construction materials. In May 2025, the agreement between Biesterfeld and ExxonMobil to develop new Vistalon EPDM grades is likely to increase supply chain availability for China producers seeking high-performance elastomers for the automobile and industrial markets. China's emphasis on quality and technology is fueling demand for high-performance EPDM solutions.

India ethylene propylene diene monomer market is also garnering a robust growth trend, led by infrastructure development, a rapidly expanding automotive sector, and increasing demand for durable consumer products. Lion Elastomers' global distribution agreement with Emulco NV for water-based EPDM emulsions in February 2024 is predicted to influence the market by making environmentally friendly, low-VOC coatings available for the construction and industrial segments. As India continues to invest in green and modernization development, the demand for high-performance, eco-friendly EPDM products is expected to rise sharply.

Europe Market Insights

Europe ethylene propylene diene monomer market is predicted to drive significant growth from 2026 to 2038 as a result of stringent environmental legislation, a strong automotive industry, and a focus on circular economy thinking. The continent is leading sustainable material innovation, and many companies have launched bio-based and recyclable EPDM solutions. Sustainability and performance focus in the European market is driving the uptake of next-generation EPDM solutions across industries.

Germany ethylene propylene diene monomer market continues to grow steadily, spurred by its globally renowned automotive sector and widespread focus on sustainable building. Germany is a prime market for high-performance EPDM compounds used in motor vehicle seals, hoses, and profiles. The launch of Dow's NORDEL REN bio-based EPDM at the German Rubber Conference in July 2024 highlighted the industry's commitment to providing sustainable solutions to German automakers and builders. The country's high-quality requirements and regulatory environment continue to be the drivers of innovation and demand for premium EPDM materials.

UK ethylene propylene diene monomer market is experiencing robust growth, with the construction and roofing sectors taking the lead. In October 2023, Tectum Group launched the BossCover EPDM flat roof waterproofing system, a green and long-term waterproofing solution for flat roofs on industrial and residential buildings. The long lifespan of the product, stability under UV, and simplicity of installation are aligned with the growing need in the UK for long-term, high-quality building products. Increased investment in green infrastructure and a focus on energy-efficient building solutions are also driving the market.

North America Market Insights

North America is anticipated to register a 5.9% CAGR from 2026 to 2038, driven by a robust automotive sector, a growing construction industry, and increased investment in sustainable infrastructure. The market is seeing robust demand for high-performance EPDM for roofing, sealing, and industrial applications. Technological advancements in self-adhering membranes and green coatings are also gaining momentum. The market is also supported by strategic partnerships and local manufacturing to cater to region-specific customer needs.

The U.S. EPDM market is expanding, driven by the construction market, with increasing demand for high-performance, energy-efficient roofing materials. In October 2024, Johns Manville introduced the EPDM FIT Self-Adhered roofing membrane, designed to speed up installation and minimize VOC adhesives in institutional buildings. This introduction is part of a string of initiatives towards faster, safer, more sustainable building products. The U.S. market is also boosted by increased infrastructure spending and increased demand in residential and commercial buildings for high-quality, durable materials.

Canada EPDM market is transforming with a focus on sustainable infrastructure and high-performance materials in a variety of end markets. In May 2025, it was reported that a deal between Conica and Supersafe Industries of Malaysia would expand Southeast Asia EPDM rubber granule production, highlighting the international supply chains driving Canadian infrastructure projects. Green building, sport center, and public space investments are driving the Canada market, where sustainable and long-lasting materials like EPDM are being specified increasingly. The country's focus on sustainability and quality is driving adoption and innovation in a variety of industries.

Key Ethylene Propylene Diene Monomer Market Players:

- ARLANXEO

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- The Dow Chemical Company (Dow Inc.)

- Kumho Polychem Co., Ltd.

- SK geo centric (SK Chemical)

- Versalis S.p.A. (Eni Group)

- Lion Elastomers LLC

- PetroChina Company Limited

- SABIC (Saudi Basic Industries Corp.)

- PJSC Nizhnekamskneftekhim

- SSME (Sichuan Shen Ma Industry)

- Jilin Xingyun Chemical

- Johns Manville

The EPDM market is highly competitive, and multinational corporations are focusing on innovation, sustainability, and strategic growth in an attempt to achieve a strong position in the business. Several key players in the market are making investments in bio-based products, advanced processing technologies, and international distribution networks in an effort to meet the evolving demands of customers. One of the significant developments in the sector was Dow's July 2024 introduction of NORDEL REN, a bio-based EPDM rubber produced using renewable raw materials. The product allows customers in the automotive and construction sectors to use a more environmentally friendly material while maintaining performance. The introduction is reflective of the industry-wide move to circular economy thinking and decarbonization, driven by market and regulatory pressures. As the trend gains momentum, the companies that are positioned with sustainable innovation will be best placed for long-term success.

Here are some leading companies in the EPDM market:

Recent Developments

- In June 2025, Holcim acquired Langley Concrete Group in British Columbia, Canada, marking its entry into precast concrete markets. While focused on infrastructure, this move supports Holcim’s mission to integrate advanced materials, including durable roofing solutions like EPDM, across construction value chains in North America.

- In May 2025, Trelleborg introduced WaterPro, a dedicated EPDM sealing portfolio fully compliant with major potable water standards worldwide. The materials suit heating, valves, pumps, and smart meter applications, providing manufacturers with advanced, pre-qualified solutions for upcoming water regulations in markets like Germany and the EU. WaterPro helps streamline compliance and accelerate broad market adoption.

- In April 2025, Saudi Aramco entered a Joint Development Agreement with BYD to co-develop new energy vehicle (NEV) technologies. The collaboration emphasizes integrating Aramco’s chemicals expertise with BYD’s electric vehicle innovation, focusing on sustainability and performance in EV systems. This partnership signals strategic global expansion for Aramco in the next-generation mobility and elastomer markets.

- In March 2025, Freudenberg Sealing Technologies released the 70 EPDM 335DW compound, engineered for O-ring applications within drinking water systems. Meeting major health and safety certifications globally, this compound addresses the strictest standards and enables safer, longer-life potable water systems. The development strengthens EPDM’s suitability for regulated and eco-conscious infrastructure projects.

- Report ID: 7982

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.