Propylene Oxide Market Outlook:

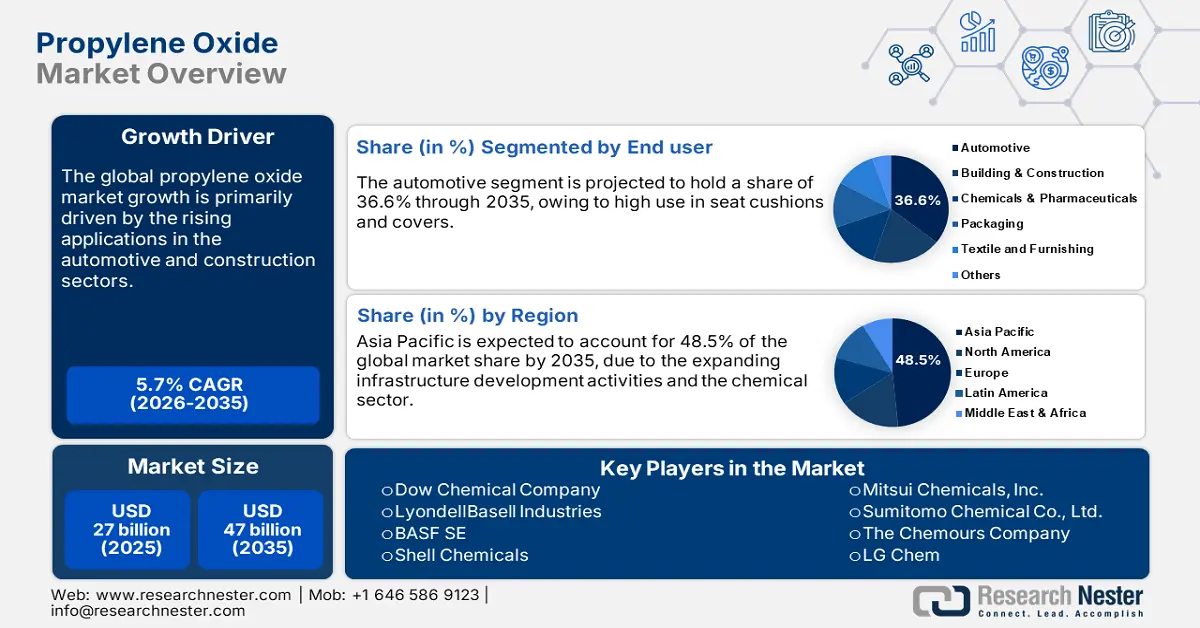

Propylene Oxide Market size was USD 27 billion in 2025 and is estimated to reach USD 47 billion by the end of 2035, expanding at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of propylene oxides is evaluated at USD 28.5 billion.

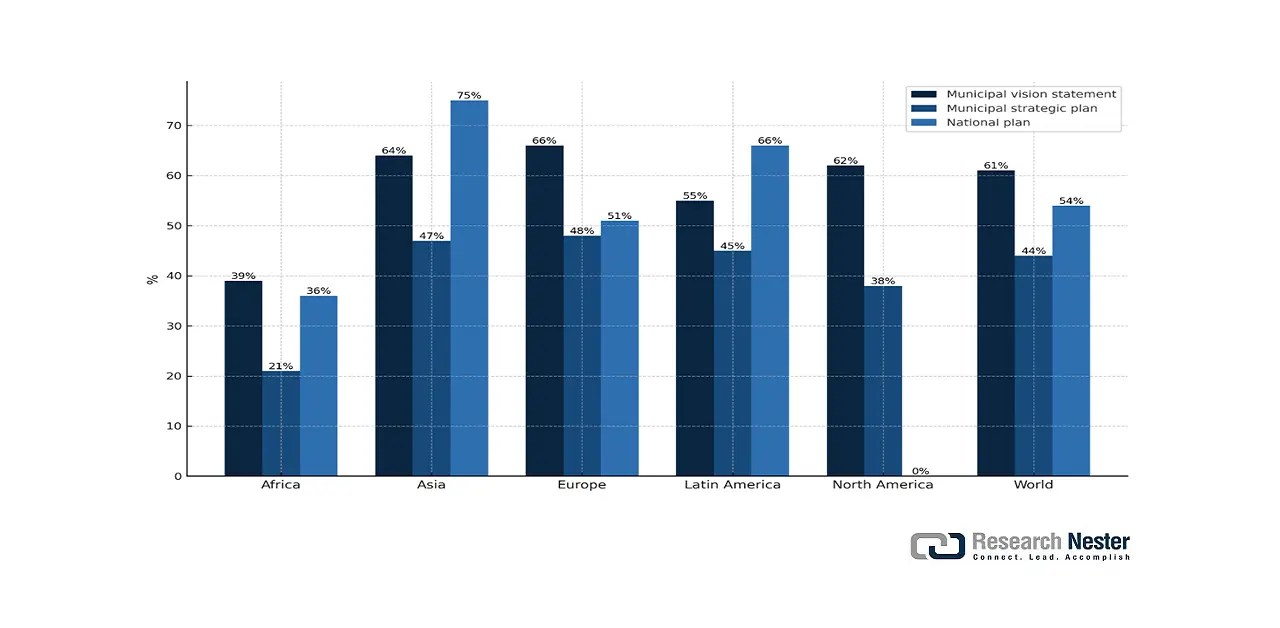

The aggressive construction and infrastructure development activities are projected to fuel the demand for propylene oxides (PO). The polyurethane foams derived from PO are extensively used in insulation materials for residential, commercial, and industrial buildings. The World Smart Cities Outlook 2024 by UN-Habitat discloses that nearly 54% of all countries have issued a nationwide smart city plan. The stricter building codes and regulations emphasizing energy efficiency are likely to increase the use of specialized materials, including propylene oxides, also known as methyloxirane. The modern construction projects are further estimated to boost the application of propylene oxide-derived products for flooring purposes.

Percentage Of Municipalities and Countries with Strategic Documents for Smart City Development

Source: UN-Habitat

Key Propylene Oxide Market Insights Summary:

Regional Insights:

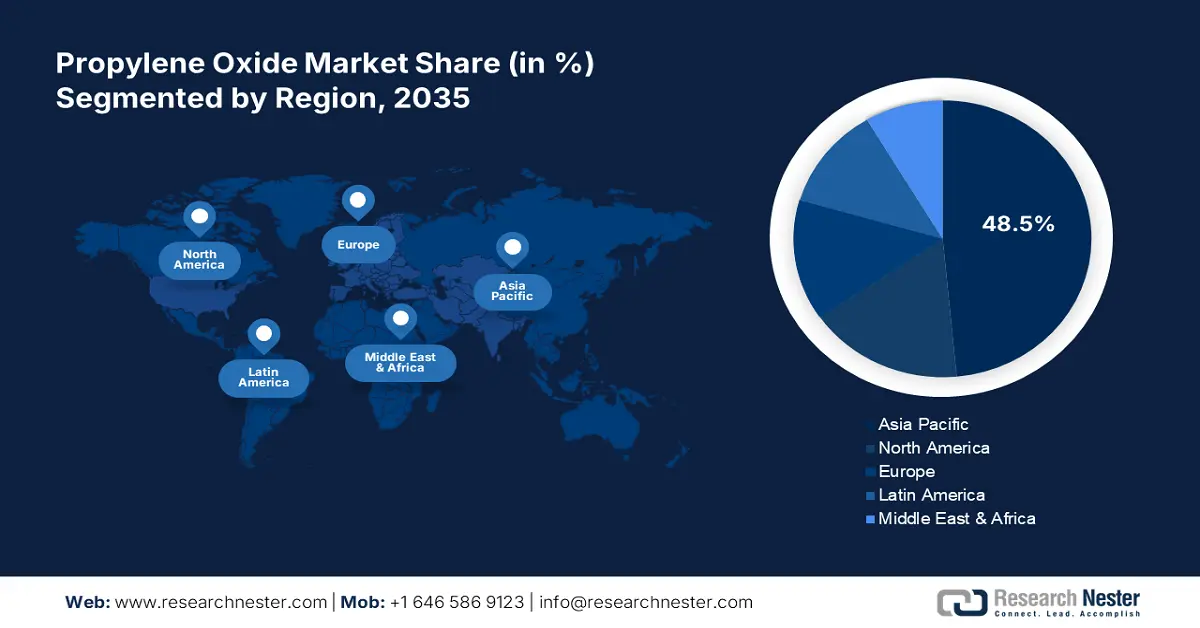

- The Asia Pacific propylene oxide market is projected to capture 48.5% of the global revenue share by 2035, owing to increasing investments in construction and infrastructure development.

- The North American propylene oxide market is estimated to hold the second-largest global revenue share by 2035, fueled by rising demand for energy-efficient insulation and lightweight vehicle components.

Segment Insights:

- The chlorohydrin process segment is anticipated to capture 46.5% of the global market share by 2035, impelled by its long-standing commercial maturity.

- The polyether polyols segment is projected to account for 69.1% of the global market share by 2035, driven by the expanding automotive and construction sector.

Key Growth Trends:

- Packaging & consumer goods expansion

- Increasing demand for bio-based derivatives

Major Challenges:

- Raw material price volatility

- High capital investments

Key Players: Dow Chemical Company, BASF SE, Ashland Inc., Thermo Fisher Scientific Inc., Sumitomo Chemical Co., Ltd., Huntsman International LLC, LyondellBasell Industries Holdings B.V., Eastman Chemical Company, Tokuyama Corporation, Repsol S.A.

Global Propylene Oxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27 billion

- 2026 Market Size: USD 28.5 billion

- Projected Market Size: USD 47 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: India, China, Brazil, Mexico, South Korea

Last updated on : 22 September, 2025

Propylene Oxide Market - Growth Drivers and Challenges

Growth Drivers

- Packaging & consumer goods expansion: The packaging and consumer goods industries are likely to increase the use of propylene oxide products in the coming years. These products are commonly used in coatings, adhesives, sealants, and stretchy materials, which are vital for effective packaging. The World Packaging Association states that the global market for flexible paper packaging was valued at USD 287.7 billion in 2025. Thus, the increasing demand for flexible packaging and the rise of e-commerce activities are anticipated to double the revenues of propylene oxide manufacturers.

- Increasing demand for bio-based derivatives: The move toward sustainability is expected to open innovation opportunities in the propylene oxide sector in the coming years. The strict rules pushing for carbon neutrality and eco-friendly chemistry are also encouraging companies to develop bio-based propylene oxide. Further, trends in green buildings and sustainable packaging are likely to double the earnings of propylene oxide producers. Additionally, advancements in bio-based polyurethanes are anticipated to expand their application areas, increasing profits for major companies.

- Integration with downstream industries: The market players are focused on working closely with related industries to boost profits and reduce exposure to market volatility. Propylene oxide is a key ingredient for making polyurethanes, propylene glycols, and other products, which is driving companies' attention to investing in operations that connect PO production directly to processing these products. This is expected to allow them to earn more by controlling the entire process instead of just commercializing propylene oxide. Thus, the strategic production and commercialization of propylene oxide and its derivatives is likely to boost revenue shares of key players.

Challenges

- Raw material price volatility: The supply chain disruptions and fluctuations of raw material prices are anticipated to hinder the production and commercialization of propylene oxide to some extent. The raw materials are mainly derived from crude oil and natural gas, which are often influenced by global prices are expected to hamper the sales of propylene oxides. The major challenge is witnessed by the emerging markets, as they are highly vulnerable due to their heavy reliance on imported feedstocks.

- High capital investments: The production of propylene oxide is a capital-intensive process, which acts as a major barrier to small and new companies. The budget-constrained companies often refrain from investing in specialized equipment, advanced safety systems, and large-scale infrastructure due to their low CAPEX capacity. Thus, this factor majorly limits the smaller companies from earning lucrative shares from trending opportunities.

Propylene Oxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 27 billion |

|

Forecast Year Market Size (2035) |

USD 47 billion |

|

Regional Scope |

|

Propylene Oxide Market Segmentation:

Production Process Segment Analysis

The chlorohydrin process is anticipated to capture 46.5% of the global market share through 2035, owing to its long-standing commercial maturity. Effectiveness and reliability are prime factors boosting the installation of chlorohydrin processing technologies. Also, the flexibility in terms of feedstock availability and operational scale is contributing to the segmental growth. Further, the stricter regulations in Europe and North America regarding chlorinated waste are fueling the demand for chlorohydrin processing systems.

Application Segment Analysis

The polyether polyols segment is projected to account for 69.1% of the global market share by 2035. The polyether polyols are key building blocks for polyurethane production, which aid them in capturing the largest market share. Polyether polyols play a vital role in the production of flexible and rigid polyurethane foams, contributing to their sales growth. The expanding automotive and construction sector is poised to directly fuel the sales of polyether polyols in the years ahead.

End user Segment Analysis

The automotive segment is estimated to hold 36.6% of the global market share throughout the study period. The automobile accessories, such as seat cushions and covers, are made from propylene oxide derivatives. Also, the extensive reliance on polyurethane materials derived from PO-based polyether polyols and propylene glycols for the production of headrests, armrests, and interior trims is contributing to the segmental growth. The Federal Reserve Bank of St. Louis discloses that the producer price index for motor vehicle seating and interior trim manufacturing stood at 114.594 in Jul 2025. This indicates that the automotive sector is set to lead the sales of propylene oxides during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Production Process |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Propylene Oxide Market - Regional Analysis

APAC Market Insights

The Asia Pacific propylene oxide market is projected to capture 48.5% of the global revenue share through 2035. The construction, automotive, packaging, and consumer goods sectors are leading the consumption of propylene oxide derivatives. The increasing investments in construction and infrastructure development projects are anticipated to fuel the trade of propylene oxide in the years ahead. The strong presence of the chemical producers is also contributing to the overall growth.

The India market is estimated to expand at the fastest CAGR from 2026 to 2035. The booming automotive sector and the rise of energy-efficient buildings are poised to double the revenues of key players. The India Brand Equity Foundation (IBEF) reveals that the food direct investment (FDI) inflows in the chemical sector totaled USD 23.3 billion in FY 2025. The rapidly expanding chemical and petrochemical sector is further accelerating the production and commercialization of propylene oxide.

North America Market Insights

The North American propylene oxide market is estimated to hold the second-largest global revenue share throughout the forecast period. This market benefits from a well-established chemical manufacturing infrastructure and advanced production technologies. The rising demand for energy-efficient insulation and lightweight vehicle components is also opening lucrative doors for propylene oxide manufacturers. Furthermore, the supportive government policies and rise in public-private investments are likely to accelerate the production of propylene oxide in the region.

The sales of propylene oxides in the U.S. are expected to be driven by the automotive and construction sectors. The advanced industrial base and high consumption in downstream polyurethane production are likely to attract several international giants. The U.S. Bureau of Labor Statistics data shows that the producer price index for automotive parts and accessories retailers stood at 302.790(P) in July 2025. This denotes that the increasing trade of automotive parts and accessories in the country is likely to fuel the consumption of propylene oxides in the years ahead.

Europe Market Insights

The Europe propylene oxide industry is forecast to increase at the fastest CAGR between 2026 and 2035. The strong existence of automakers is directly accelerating the demand for propylene oxide derivatives. The rise of green building projects and supportive government policies and subsidies is also contributing to the market growth. The U.K., Germany, and France are some of the leading marketplaces for propylene oxide manufacturers.

The German propylene oxide market is poised to be driven by its increasing advancements in the chemical and premium automobile manufacturing. The European Automobile Manufacturers Association (ACEA) reveals that in the first 7 months of 2025, Germany captured a 38.4% share of the electric car sales. The automotive interiors and accessories customization trends propel the sales of propylene oxide derivatives. Furthermore, the strict energy efficiency and green building regulations are set to amplify the demand for propylene oxides.

Key Propylene Oxide Market Players:

- Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LyondellBasell Industries

- BASF SE

- Shell Chemicals

- SABIC

- Mitsui Chemicals, Inc.

- Sumitomo Chemical Co., Ltd.

- The Chemours Company

- LG Chem

- Covestro AG

- INEOS Oxide

- Evonik Industries AG

- Reliance Industries Limited

- Mitsubishi Chemical Corporation

- Asahi Kasei Corporation

The market is highly dominated by the big producers, due to their extensive global networks. The industry giants are employing both organic and inorganic strategies to hold strong market positions. They are focused on investing heavily in research and development activities to introduce next-gen solutions and attract a new consumer base. Leading companies are also entering into strategic partnerships with other players to boost their product offerings and increase their market reach. Some of the companies are also expanding their operations in the emerging markets to earn high shares from untapped opportunities.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2025, LyondellBasell announced plans to increase propylene production at its Channelview Complex near Houston. Construction is set to start in late 2025, and the project is expected to be completed by the end of 2028.

- In January 2024, Karthish Manthiram, a Caltech professor and William H. Hurt Scholar, announced a discovery. His team developed a catalyst to produce propylene oxide as a key material in plastic production.

- Report ID: 2804

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Propylene Oxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.