Outdoor Furniture Market Outlook:

Outdoor Furniture Market size was valued at USD 54.7 billion in 2025 and is projected to reach USD 98.8 billion by the end of 2035, growing at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of outdoor furniture is evaluated at USD 58.4 billion.

The global outdoor furniture market is growing on account of rising consumer interest in outdoor living, home improvement, and lifestyle-oriented spaces across both residential and commercial settings. Also, the trade dynamics play a crucial role in shaping the market, particularly as the Europe and U.S. supply chains are mostly reliant on imports from China for furniture and related home goods. According to the article published by MERICS in October 2024, furniture is considered to be a structurally sensitive sector in Europe and the U.S. trade with China, with both regions showing sustained reliance on imports from China over the past two decades. It also mentioned that in 2022, furniture and related home goods accounted for a significant share of trade dependencies, wherein China supplied more than 92% of Europe's furniture dependencies and more than 81% in the U.S. Therefore, this concentration underscores ongoing supply chain exposure and reinforces the case for gradual imports and targeted domestic capacity building in furniture manufacturing.

Furthermore, the market also benefits from government initiatives that are enabling businesses to upgrade or expand their outdoor spaces even more affordably. In this regard, in 2023, the City of Mountain View announced that it had launched the small business outdoor furnishings grant program to support local small businesses that were impacted by COVID-19, allocating USD 200,000 to provide one-time grants of USD 5,000 for the purchase of outdoor-rated chairs, tables, umbrellas, heaters, or planters. It also mentioned that eligible applicants include restaurants and individually owned retail businesses with 1 to 25 employees operating from a physical storefront within the city. The program has already approved 28 applications and continues to accept submissions until funds are depleted, helping businesses enhance their outdoor spaces in compliance with city guidelines.

Key Outdoor Furniture Market Insights Summary:

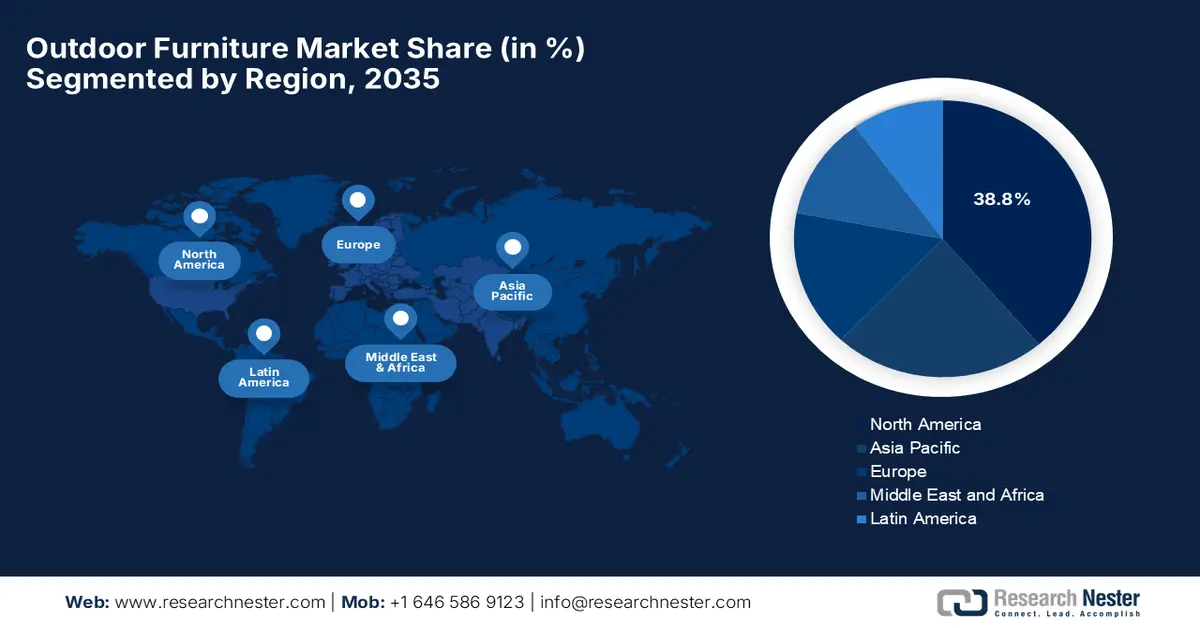

Regional Insights:

- North America is projected to command nearly 38.8% revenue share by 2035 in the outdoor furniture market, underpinned by strong outdoor living adoption and premium patio upgrades.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, supported by rapid urbanization and expanding middle-class households increasing demand for stylish outdoor furniture.

Segment Insights:

- The wood segment in the outdoor furniture market is projected to account for a dominant 69.9% revenue share by 2035, supported by its long-lasting durability, visual appeal, and natural compatibility with outdoor environments.

- The residential segment is expected to witness considerable growth by 2035, attributed to rising investments in outdoor living spaces driven by evolving lifestyle preferences and increasing disposable incomes.

Key Growth Trends:

- Lifestyle shifts & outdoor living trend

- Residential renovation & real estate development

Major Challenges:

- Seasonality and demand volatility

- Durability expectations and product liability

Key Players: Brown Jordan, IKEA, Ashley Furniture Industries, Dedon GmbH, Kettal Group, POLYWOOD LLC, Keter Group, Fermob SA, Gloster Furniture GmbH, Royal Botania NV, Roda Srl, TUUCI LLC, Lloyd Flanders Industries, Homecrest Outdoor Living, Treasure Garden Inc.

Global Outdoor Furniture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 54.7 billion

- 2026 Market Size: USD 58.4 billion

- Projected Market Size: USD 98.8 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Italy, China, Japan

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Malaysia

Last updated on : 8 January, 2026

Outdoor Furniture Market - Growth Drivers and Challenges

Growth Drivers

- Lifestyle shifts & outdoor living trends: Consumers across the globe treat outdoor spaces, i.e., patios, balconies, gardens, decks, as extensions of indoor living areas. This growing preference for comfort, leisure, and entertaining outdoors is efficiently fueling demand in the outdoor furniture market. In this regard, Surya in April 2025 announced that it has entered the outdoor furniture industry by making the debut of more than 60 pieces, which are designed to blend indoor and outdoor living with style, comfort, and durability. Therefore, this collection, including collaborations with designer Ashley Childers, features materials as responsibly sourced teak, recyclable aluminum, and Sunbrella fabrics, by emphasizing sustainability. The company also has collections such as Antibes, Cape Town, and Palma, and it aims to provide designers and homeowners with high-quality, elegant solutions for modern outdoor spaces.

- Residential renovation & real estate development: The continuously increasing investments in terms of home renovations, new housing projects, and real estate developments are expanding outdoor living spaces, which boost purchases in the market. Testifying to this, the U.S. Census Bureau in 2023 disclosed that in a span of two years, U.S. homeowners spent a total of USD 827 billion on home improvements, with a median spending of USD 6,500 per homeowner. It also states that more than half of homeowners, i.e., 51.6 million, undertook improvements, with major projects including kitchen and bathroom remodels, HVAC upgrades, and outdoor space enhancements such as porch, deck, patio, or terrace improvements. Porch/deck/patio/terrace projects had a median expenditure of USD 4,800, reflecting significant investment in outdoor living spaces.

U.S. Outdoor Home Improvement Statistics (2021-2023)

|

Outdoor Improvement Type |

Median Expenditure (USD) |

|

Porch/Deck/Patio/Terrace |

4,800 |

|

Driveways/Walkways |

2,900 |

|

Attached Garage/Carport |

4,600 |

Source: U.S. Census Bureau

- Rising disposable incomes: This aspect, especially in emerging nations, enables consumers to make more investments in premium outdoor furniture for both lifestyle enhancement and the resale value of homes. In its 2025-26 annual budget, the Government of India officially announced personal income tax cuts, thereby increasing the tax-free income threshold and lowering rates to leave more money in taxpayers’ hands, especially within the middle class. This policy was explicitly intended to increase household disposable income and boost consumption and savings, also enabling households to spend more on both essential and discretionary as well as premium goods. The reduction in terms of tax burden would leave more money in their hands, boosting household consumption, savings, and investment, benefiting the market.

Challenges

- Seasonality and demand volatility: This is a major drawback for the outdoor furniture market. The demand for outdoor furniture is mostly seasonal, and it peaks during spring and summer in almost all regions. Therefore, this creates challenges in terms of inventory planning, cash flow management, and production scheduling. Also, the aspect of weather uncertainty can disrupt demand, as extended winters, excessive rainfall, or extreme heat may delay or reduce outdoor spending. For manufacturers and retailers, forecasting inaccuracies can, in turn, cause overstocking or stockouts, both of which impact profitability. Furthermore, managing labor, warehousing, and logistics efficiently during peak and off-peak periods represents a persistent obstacle, particularly for companies that are operating across multiple geographic regions that have varied climatic conditions.

- Durability expectations and product liability: Consumers expect outdoor furniture to be resistant to harsh environmental conditions, which include sun exposure, moisture, temperature fluctuations, and corrosion. Failure to meet durability expectations can lead to customer dissatisfaction, warranty claims, and limit widespread adoption in the market. Therefore, manufacturers must make investments in product testing, material innovation, and quality control to ensure long product life cycles, which makes it challenging for small and medium-scale firms. In addition to commercial and hospitality clients, durability standards are even higher for frequent use, increasing the risk of product liability. Furthermore, balancing lightweight design aesthetics with structural strength and safety compliance adds more complexity to product development.

Outdoor Furniture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2025-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 54.7 billion |

|

Forecast Year Market Size (2035) |

USD 98.8 billion |

|

Regional Scope |

|

Outdoor Furniture Market Segmentation:

Material Segment Analysis

In the outdoor furniture market, wood is expected to garner the largest revenue share of 69.9% over the forecasted years. The dominance of the segment is mainly propelled by its durability, aesthetic appeal, and ability to blend with natural outdoor environments. Similarly, the teak, acacia, and eucalyptus are especially preferred for premium outdoor furniture. The U.S. Department of Agriculture, in October 2024, revealed that sustainably harvested wood supports forest health by providing materials for local economies, as seen with companies such as Freres Engineered Wood and Neal Creek Forest Products in Oregon. Besides, these companies use domestically sourced timber to create lumber, engineered wood, and mass timber for residential, commercial, and multifamily construction by ensuring that 100% of harvested wood is utilized. It also stated that by promoting sustainable forestry and innovative wood products, these initiatives enhance ecosystem health, reduce wildfire risks, and provide renewable building materials, hence supporting long-term growth in this segment.

End user Segment Analysis

By the end of 2035, the residential segment is anticipated to grow at a considerable rate in the market, owing to the lifestyle trends where homeowners make investments in patios, gardens, and terraces. Simultaneously, the segment also benefits from rising disposable incomes, which are enabling more households to spend more on premium furniture. The growing focus on wellness and leisure has made outdoor living spaces a top priority for relaxation, entertainment, as well as social gatherings. In addition, the continuously upgrading innovations in durable and sustainable materials, such as wood, synthetic rattan, and aluminum, are making outdoor furniture more appealing and long-lasting. The aspect of government initiatives that promote sustainable forestry and eco-friendly materials supports the production of quality wooden outdoor furniture, thereby boosting both consumer confidence and market growth.

Product Type Segment Analysis

Chairs & tables based on product type segment are predicted to capture a significant share in the outdoor furniture market since they are highly essential for both residential and commercial outdoor setups, enabling dining, entertainment, as well as leisure. In January 2025, Better Homes & Gardens announced that it had launched five new patio furniture sets at Walmart, which include sofas, lounge chairs, dining sets, and coffee tables, catering to a variety of outdoor spaces. The launch highlights the significance of chairs and tables in outdoor living for both relaxation and dining purposes. The company also stated that these sets are designed with weather-resistant materials, demonstrate real-world demand, and investment in outdoor furniture for residential use. Therefore, this trend reflects a major shift toward investing in durable, versatile furniture that supports both leisure and social gatherings.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

End user |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Price |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Outdoor Furniture Market - Regional Analysis

North America Market Insights

North America market is projected to dominate the entire global dynamics by accounting for approximately 38.8% of the total revenue share by 2035. The region’s progress in this field is efficiently driven by strong outdoor living demand and premium patio upgrades. In this regard, DecoScape in February 2025 announced that it had launched a 300,000-square-foot facility in Miami under industry veteran Steven Bramson. The company focuses on domestic production to reduce lead times, improve supply chain stability, and enable customization of high-end outdoor furniture. In addition, DecoScape integrates all manufacturing stages under one roof, employing over 225 people and emphasizing material research, design, and responsiveness to market demand. Hence, such instances solidify the region’s dominance and position it as a predominant leader in this field.

The U.S. outdoor furniture market is positively influenced by lifestyle-driven choices, with homeowners looking for multipurpose products that support dining, lounging, and entertainment. Retailers and brands in the country are introducing modular sets and premium materials that attract the interest of a varied audience group. In February 2025, RH announced that it had launched its 2025 Outdoor Sourcebook, which has more than 40 exclusive collections by internationally acclaimed designers, showcasing luxury outdoor furniture crafted from high-quality, weather-resistant materials. The firm also stated that this collection includes sculptural and artisan-designed pieces, such as handwoven rope, cane, travertine stone, and marine-grade umbrellas, blending aesthetic elegance with outdoor durability, hence making it suitable for standard market growth.

The focus on durability and seasonal adaptability, since products need to withstand the changing weather conditions, is an important factor propelling growth in the Canada market. Local artisans and smaller manufacturers in the country are gaining attention by combining traditional craftsmanship with modern outdoor living designs. In this regard, The Best Muskoka Chair Company in February 2025 announced that it is expanding production in Eastern Ontario, and it is prioritizing domestically sourced wood and recycled plastics. The company also mentioned that it aims to reduce reliance on imports by maintaining affordability and supporting jobs in the country by ensuring high-quality, hand-crafted outdoor furniture. This move highlights the company’s growing focus on sustainability, domestic supply chains, and locally made alternatives in the country’s outdoor furniture industry.

APAC Market Insights

The Asia Pacific outdoor furniture market is expected to represent the fastest growth, owing to the rising urbanization and expanding middle-class households, which are fueling interest in stylish outdoor furniture. The region’s market also benefits from e-commerce platforms that are accelerating reach, allowing smaller brands and startups to showcase unique furniture designs. In this regard, in November 2024, ITOKI Corporation announced it will begin selling Pavilion, which is a workplace product from a Spain-based outdoor furniture brand Kettal, in Japan. This modular, aluminum-based design encourages gathering and flexible work styles, whereas ITOKI will also offer all 103 items from Kettal’s living, contract, and workplace collections. Furthermore, this launch also highlights the integration of high-quality outdoor furniture into modern office environments by combining hospitality, durability, and environmentally friendly materials.

China outdoor furniture market is readily blistering growth, majorly facilitated by the ever-increasing disposable incomes and a cultural shift toward leisure-focused lifestyles. Manufacturers in the country are emphasizing large-scale production of durable, multi-functional sets by integrating smart features such as foldable and modular designs. In this regard, in November 2025, Express Garden, operating as an advanced solutions furniture set company, introduced its 2025 luxury outdoor furniture collection at Furniture China 2025, highlighting refined craftsmanship and durable, high-performance materials. It also stated that the collection includes modular sofas, dining sets, loungers, and daybeds by emphasizing proportion and integration with both residential and hospitality architecture. Furthermore, Express Garden has over 25 years of experience and production bases across China, Vietnam, and Indonesia, thereby reinforcing its position as a leading manufacturer of high-end outdoor furniture for global projects.

India outdoor furniture market is poised for extensive growth, facilitated by increasing urban housing projects and gated communities, where balconies, terraces, and courtyards are integral to residential designs. In addition, the rise of online retail and home décor platforms is enabling wider distribution of both luxury and affordable outdoor furniture lines. The Assistance for Furniture Sector is a sub-scheme under the Investment Promotion Scheme in Dadra & Nagar Haveli and Daman & Diu is aimed at supporting MSME furniture enterprises and developing the region as a hub for plastic, steel, brass, metal, cane, wooden, bamboo, fiberglass, and marble furniture. Besides, eligible units receive benefits such as capital and credit-linked subsidies, space rent and showroom cost reimbursements, power incentives, and training support to boost production, employment, and women’s participation. The scheme applies to new or expanding MSME units commencing production between 20 May 2022 and 19 May 2027, demonstrating government backing for the regional furniture sector.

Europe Market Insights

The Europe outdoor furniture market is progressing at a notable pace due to a strong focus on design, sustainability, and multifunctionality. The region’s market is positively influenced by café culture, outdoor dining, and seasonal events, efficiently driving demand for modular dining sets and weather-resistant lounge furniture. In October 2025, Plust Collection showcased its new VELA outdoor furniture family at Host Fiera Milano, which was designed by BrogliatoTraverso being inspired by wind-filled sails by combining comfort, elegance, and durability for both residential and contract settings. The company also mentioned that the collection features innovative details such as raised seams, built-in drainage, storage compartments, and optional lighting kits, reflecting Italy’s craftsmanship and sustainable design, hence making it suitable for standard market growth.

Germany outdoor furniture market is growing owing to the strong focus on precision engineering and quality materials, by also having a very strong preference for long-lasting outdoor furniture. Both residential and commercial sectors in the country value environmentally responsible manufacturing, thereby encouraging the adoption of recyclable or sustainably sourced materials. In addition, trade fairs and exhibitions in the country also play a key role in promoting innovative outdoor furniture concepts. The country’s market is also boosted by increasing urbanization and the rise of premium residential developments, which demand stylish yet durable outdoor solutions. The hospitality sector, including hotels, restaurants, and resorts, is making heavy investments in terms of high-quality outdoor furniture to enhance guest experiences and create appealing outdoor environments. Moreover, government incentives and sustainability regulations are motivating manufacturers to adopt eco-friendly production practices.

The U.K. outdoor furniture market is mainly driven by heightened demand, which is guided by lifestyle and garden culture, wherein homeowners are looking for compact, functional, and stylish designs suitable for urban gardens and terraces. Brands in the country are incorporating weatherproof fabrics and versatile layouts to suit the country’s unpredictable climate. Additionally, collaborative initiatives with local designers and artisans are enhancing the uniqueness. In June 2025, Bentley Home announced that it had launched its first-ever Hyde picnic collection, along with a refreshed Solstice outdoor furniture range, featuring sofas, sunbeds, armchairs, pouffes, and tables designed for elegant outdoor living. The company also stated that these collections are crafted with premium materials and weather-resistant finishes, emphasizing both functionality and luxury, catering to dining, entertaining, and leisure.

Key Outdoor Furniture Market Players:

- Brown Jordan (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IKEA (Netherlands/Sweden)

- Ashley Furniture Industries (U.S.)

- Dedon GmbH (Germany)

- Kettal Group (Spain)

- POLYWOOD LLC (U.S.)

- Keter Group (Israel)

- Fermob SA (France)

- Gloster Furniture GmbH (United Kingdom)

- Royal Botania NV (Belgium)

- Roda Srl (Italy)

- TUUCI LLC (U.S.)

- Lloyd Flanders Industries (U.S.)

- Homecrest Outdoor Living (U.S.)

- Treasure Garden Inc. (U.S.)

- IKEA is identified as the world’s largest furniture retailer, which has a very strong outdoor segment offering affordable, functional, and weather-resistant furniture. The firm was founded in Sweden, and it leverages its extensive global retail footprint, efficient supply chain, and modular product designs to appeal to a broad range of consumers who are seeking stylish, value-oriented outdoor solutions. In addition, IKEA has outdoor ranges such as ÄPPLARÖ and SOLLERÖN, which are staples in many regions, reflecting the brand’s strength.

- Brown Jordan Holdings is based in the U.S. and is a heritage premium outdoor furniture manufacturer that is known for high-end cast aluminum, woven collections. The company has also served luxury residential and hospitality markets by providing iconic products and craftsmanship. Brown Jordan is also focused on investments in sustainability programs and expanded manufacturing capacity to meet growing contract and hospitality demand.

- Ashley Furniture Industries is a major vertically integrated furniture producer and retailer. The company is best known broadly for indoor furnishings, whereas the company’s outdoor portfolio reaches customers through its extensive showroom network and online channels. Furthermore, Ashley is mainly focused on logistics integration and diversified product tiers, and it balances broad accessibility with distribution scale to compete across price segments.

- Herman Miller is yet another dominant force based in the U.S., and it is a design-centric furniture brand, extends its reputation for innovation outdoors. Although the company’s outdoor segment is smaller than some peers, its strongest emphasis on design excellence, sustainability, and partnerships resonates well with premium buyers who are looking for cohesive indoor-outdoor aesthetics and functional performance.

- Keter Group specializes in resin-based outdoor furniture and storage solutions, which have a strong international presence. Besides, the firm produces durable, low-maintenance outdoor pieces that are suited to both residential and commercial uses. In addition, Keter Group’s manufacturing footprint across multiple countries supports efficiency and regional availability, whereas the strategic partnerships are helping it integrate recycled materials and advance sustainability goals in its plastic outdoor product portfolio.

Below is the list of some prominent players operating in the global market:

The global market is extremely competitive, which has mass‑market producers, premium design specialists, and luxury artisanal brands who are competing in terms of residential, hospitality, and commercial segments. Leading players in this field are constantly putting efforts into design innovation, material technology, and expanded global distribution networks. In July 2023, Landscape Forms announced that it had acquired Summit with a prime focus on expanding its portfolio of handcrafted, sustainable outdoor teak furnishings across residential, hospitality, and marine markets. This acquisition strengthens strategic synergies between the two design-focused brands, combining Landscape Forms’ global reach with Summit’s craftsmanship and heritage. In addition, Miller Johnson served as legal advisor to Landscape Forms, supporting the transaction through its multidisciplinary M&A team, hence contributing to the overall market growth.

Corporate Landscape of the Outdoor Furniture Market:

Recent Developments

- In July 2025, Portica launched its standalone 2026 outdoor furniture label, i.e., the Lennon deep-seating and Clarkson dining collections with durable, stylish finishes. It utilizes contract-grade materials and Sunbrella fabrics, wherein the brand focuses on luxury, comfort, and lasting value.

- In May 2025, POLYWOOD announced the launch of Draper James by POLYWOOD Savannah Collection, which includes dining sets, deep seating, porch and poolside pieces, and kids’ furniture made with POLYWOOD lumber and quick-dry cushions for low-maintenance, long-lasting use.

- Report ID: 304

- Published Date: Jan 08, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Outdoor Furniture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.