Elastomeric Foam Market Outlook:

Elastomeric Foam Market size was valued at USD 3.78 billion in 2025 and is likely to cross USD 6.83 billion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of elastomeric foam is assessed at USD 3.99 billion.

The market is growing on the back of the growing use of elastomeric foam in the HVAC (heating, ventilation, and air conditioning) and plumbing industry. For instance, there is an estimated 151 million HVAC units to be sold in 2024. The elastomeric foam is used in the production of HAVC products as it can regulate heat and cold temperatures and prevent condensation on equipment. The insulation made from elastomeric foam helps protect building owners from the issue caused by corrosion under the insulation. This type of insulation also protects the mechanical systems and pipelines from water or water vapor.

Rising use in various sectors including hospitals and residential places owing to the rising need for health and safety with changing climate. A hospital is a place of mixed environment where various types of patients visit for treatment. Many of them may have infections that can be transmitted to an inpatient who is more prone to diseases with weak immunity. So, there is a need to prevent these types of contaminations from entering sterile environments such as intensive care units, operation theaters, and newborn care facilities. In such cases, the use of an HVAC system will prevent the spread of germs, promote proper air conditioning and ventilation, and provide heat to sterilize the protected area. Moreover, the use of HVAC reduces the energy consumption of hospitals, and it is anticipated to boost the growth of the market. It is estimated that replacing separate heating and cooling systems with HVAC systems can save 50% of the energy for electric heating and cooling systems and up to 10% for gas furnace heating systems.

Key Elastomeric Foam Market Insights Summary:

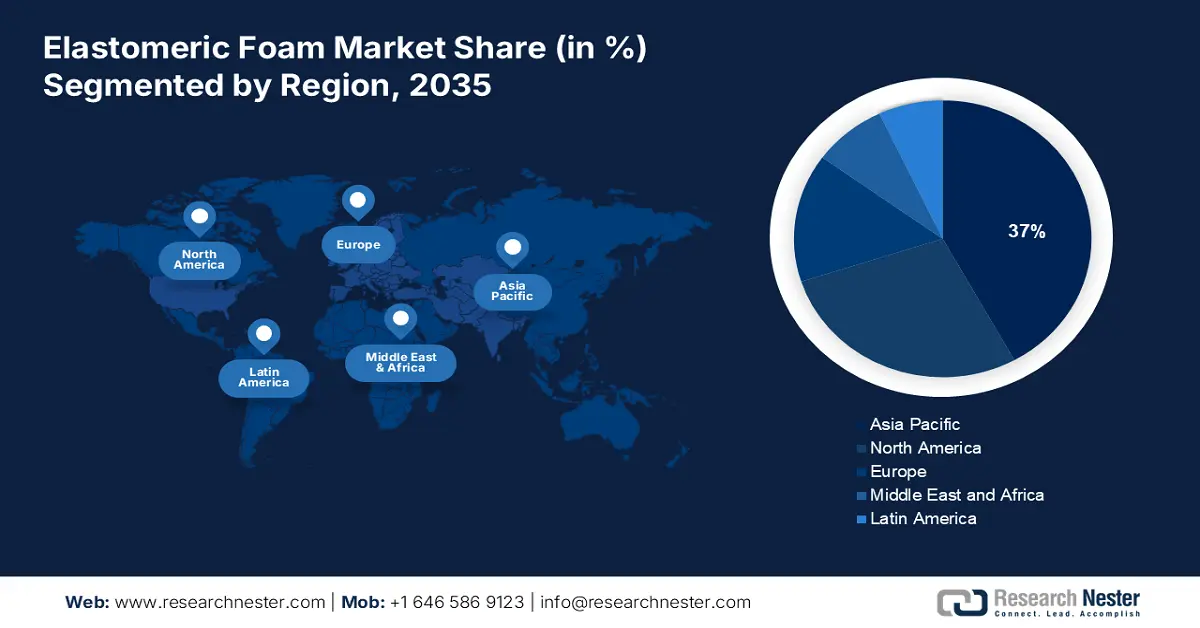

Regional Highlights:

- Asia Pacific elastomeric foam market is predicted to capture 37% share by 2035, driven by HVAC demand and rising disposable incomes.

Segment Insights:

- The hvac segment in the elastomeric foam market is expected to exhibit the fastest growth from 2026-2035, influenced by increasing demand for safe and hygienic environments in hospitals and buildings.

- The nitrile butadiene rubber segment in the elastomeric foam market is projected to achieve a significant share by 2035, driven by its resistance to acid, fuel, and fire, and flexibility in insulation applications.

Key Growth Trends:

- Increasing Use in Automotive Industry Owing to the Heat Resistance Property of the EPDM

- Widespread Use of HVAC systems in Air Conditioning As It Reduces Energy Consumption

Major Challenges:

- Environmental Concerns Regarding Proper Manufacture and Disposal

- Poor Chemical Compatibility in Certain Conditions and with Certain Chemicals

Key Players: Rogers Foam Corporation, Hira Industries LLC, Armacell International S.A., Zotefoams plc, L'ISOLANTE K-FLEX S.p.A., Rubberlite, Inc., NMC SA, Kaimann GmbH, Jacobs & Thompson Inc., Aeroflex USA, Inc.

Global Elastomeric Foam Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.78 billion

- 2026 Market Size: USD 3.99 billion

- Projected Market Size: USD 6.83 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 10 September, 2025

Elastomeric Foam Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Use in Automotive Industry Owing to the Heat Resistance Property of the EPDM – Ethylene propylene diene monomer (EPDM) and nitrile butadiene rubber are often used as insulation in the automotive industry. EPDM is UV-resistant and owing to its exceptional resistance to heat and UV exposure, many automotive components (straps, tubing, weather stripping, and windshield wipers) are made from this material. Global sales of automobiles increased from 62 million units in 2020 to approximately 67 million in 2021.

-

Widespread Use of HVAC systems in Air Conditioning As It Reduces Energy Consumption – The use of elastomeric foam pipes is widespread and growing, as 88% of American households use air conditioning, according to the 2020 Residential Energy Consumption Survey by the U.S. Energy Information Administration. The primary AC system used by two-thirds of American households is a central air conditioner or heat pump.

- Growing Use of Elastomeric Foam in Plumbing Owing to its Capacity to Withstand Water Temperature – Elastomeric foams are required in plumbing, owing to their water-resistant and temperature-preserving capabilities. The plumbing industry is currently employing over 469,000 people and growing at a rate of 2%, as per the U.S. Bureau of Labor Statistics.

- Rising Use in Electricals with Increasing Demand for Home Appliances and Electronics – Elastomeric foams are often used in electrical compartments and enclosures. Their doors are sealed against the elements by means of mechanical components called enclosure gaskets. As per the U.S. Bureau of Labor Statistics, the workforce in electrical equipment, appliance, and component manufacturing grew from 380,000 in September 2020 to 414,000 in September 2022 in the United States.

- Need for Eco-Friendly Materials with Rising Concern Among People About Environment – Flame retardants have been linked to neurological harm, hormonal disruption, and cancer. One of the most serious risks of some flame retardants is that they accumulate, causing chronic health problems such as toxic chemicals. Newer manufacturing and research techniques have ruled out the use of such chemicals to prevent harm to humans and the environment. Chemicals such as Hexabromocyclododecane (HBCD), Organophosphate flame retardants (OPFRs), Tetrabromobisphenol A (TBBPA), Polybrominated diphenyl ethers (PBDE’s), and Brominated flame retardants are under constant study to further assess the damage they are causing to the environment.

Challenges

- Environmental Concerns Regarding Proper Manufacture and Disposal

- The lack of disability options and lack of awareness among people is inhibiting the growth of the market owing to the emission of harmful gases and smoke that cause health hazards. Burning is one of the disposable options which release poisonous gases into the environment with an unpleasant odor.

- Poor Chemical Compatibility in Certain Conditions and with Certain Chemicals

- High Competition Among Major Market Players

Elastomeric Foam Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 3.78 billion |

|

Forecast Year Market Size (2035) |

USD 6.83 billion |

|

Regional Scope |

|

Elastomeric Foam Market Segmentation:

Application Segment Analysis

The HVAC segment is projected to grow the fastest by the end of 2035 and provide the most opportunities. For instance, it is anticipated that by 2050, over 65% of all homes will have an air conditioning system. The HVAC system is used to insulate or maintain the internal conditions of vehicles or buildings. The HVAC controls the heat, vapor, humidity, ventilation, sterilization, condensation, temperature, and airflow of the surrounding area. The rising number of hospitals, automotive, residential, and commercial buildings with the need for a safe and hygienic environment is increasing. The indoor air quality is also maintained by the HVAC systems.

Type Segment Analysis

The nitrile butadiene rubber (NBR) or polyvinyl Chloride (PVC) segment is expected to garner a significant elastomeric foam market share. The increasing use of NBR in place of other types of rubber owing to its resistance towards, acid swelling, fuel, fire, and lower cost. NBR insulation is very flexible insulation and is used in various sectors including the insulation industry, air conditioning, HVAC industry, and plumbing sector. The NBR is a closed-cell elastomeric insulation, which is an oil-resistant synthetic rubber that can be used to insulate any curved shape material owing to its flexible nature. Usually, nitrile rubber is used in the automotive and aerospace sectors in the making of gas, petrol, and oil or any fuel hoses, seals, gaskets, and rollers. As per the estimations, in 2021 USD 1,300,400 worth of NBR is imported in the form of plates, sheets, or strips up from USD 90,000 in 2020.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Elastomeric Foam Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to hold largest revenue share of 37% by 2035. This can be owed to the fact that India and China, the two largest Asian economies, are expanding rapidly. Moreover, the region now has the largest global demand for air conditioning. The rapid changes in the climate and increasing population in the region increase the need for HVAC systems in the region. Also, the increasing concern regarding greenhouse gases and rising solutions for growing carbon dioxide emissions. Additionally, the increasing automotive and construction sectors in the region owing to the increasing spending capacity of people with rising disposable income.

Elastomeric Foam Market Players:

- Rogers Foam Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hira Industries LLC

- Armacell International S.A.

- Zotefoams plc

- L'ISOLANTE K-FLEX S.p.A.

- Rubberlite, Inc.

- NMC SA

- ​Kaimann GmbH

- Jacobs & Thompson Inc.

- Aeroflex USA, Inc.

Recent Developments

-

Armacell International S.A. - With the acquisition of Austroflex Rohr-Isoliersysteme GmbH, an Austrian specialist in flexible pre-insulated pipe systems and thermal solar pipe systems, Armacell has expanded its product portfolio.

-

Rogers Foam Corporation - The 75-year-old Rogers Foam Corporation from Somerville, Massachusetts, will shortly expand its network of facilities around the United States and Mexico to include Albuquerque, in collaboration with Tempur Sealy International.

- Report ID: 4659

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Elastomeric Foam Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.