Flame Retardants Market Outlook:

Flame Retardants Market size was valued at USD 8.46 billion in 2025 and is expected to reach USD 14.59 billion by 2035, expanding at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flame retardants is evaluated at USD 8.89 billion.

The growth of the market can be attributed to the increasing usage of flame-resistant products in various end-user industries such as electronics, construction, and others. For the sake of compliance with fire safety and prevention regulations, these sectors are increasingly using flame-retardant materials. Increased awareness among consumers about the improved fire safety of combustible materials and products is also anticipated to drive flame retardants market growth in the forecast period. Flame retardants in offices and homes prevent an increasing number of electrical or consumer goods from being exposed to fire. Research cites that in the USA, flame retardants were used in television casings to reduce the risk of electronic fire by 54%.

In addition to these, factors that are believed to fuel the market growth of flame retardants include the rise in the production of plastic and its use in multiple products. The use of plastics has grown drastically over the years and sustainable flame retardants are required for effective fire treatment. For instance, between 2008 and 2019, world plastic production rose steadily by nearly 10 million metric tons. As plastics are easy to handle and have low density, more plastics are being incorporated into buildings. In a very short time, the plastics fire load may cause buildings to be at high-temperature levels. All these factors are predicted to present the potential for market expansion over the projected period.

Key Flame Retardants Market Insights Summary:

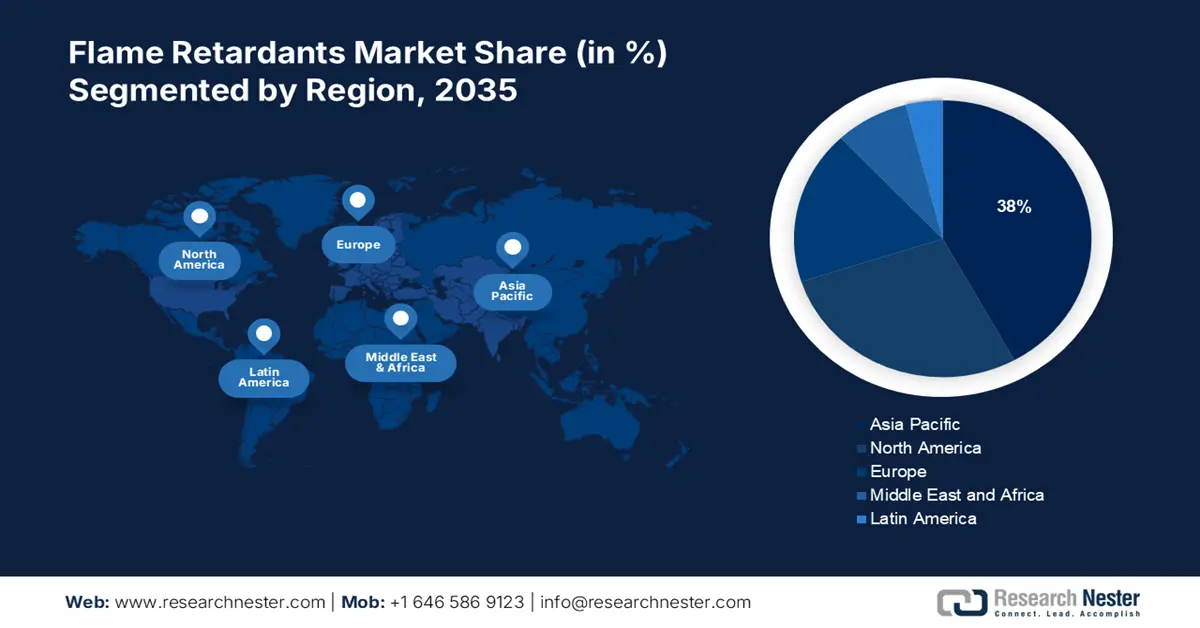

Regional Highlights:

- The Asia Pacific flame retardants market is projected to capture a 38% share by 2035, attributed to increasing electronics industries and construction activity.

- The North America market is expected to achieve significant revenue share by 2035, attributed to increasing industrialization, construction activities, and fire safety regulations.

Segment Insights:

- The electronics & appliances segment in the flame retardants market is expected to achieve a 34% share by 2035, driven by growing demand for electronics requiring flame retardants to prevent chemical hazards.

- The aluminum trihydrate segment in the flame retardants market is projected to hold a significant share by 2035, driven by environmental benefits and stringent legislation favoring ATH over halogen compounds.

Key Growth Trends:

- Growing Fire & Safety Regulations to Aid in Expansion

- Rising Development of Innovative Flame Retardants

Major Challenges:

- Environmental and health concerns

- High loading levels that alter the final products

Key Players: Clariant, LANXESS, ICL Group, Albemarle Corporation, Dow, BASF SE, ASIA PA, Nabaltec AG, Akzo Nobel N.V., Italmatch Chemicals S.p.A., Kisuma Chemicals.

Global Flame Retardants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.46 billion

- 2026 Market Size: USD 8.89 billion

- Projected Market Size: USD 14.59 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Flame Retardants Market Growth Drivers and Challenges:

Growth Drivers

- Growing Fire & Safety Regulations to Aid in Expansion – Increased risks of explosions and fire-related accidents have been generated by the increasing number of households and businesses. Due to that, stringent fire safety legislation and protocols have been introduced in a number of countries across North America and Europe. This has led to a growing use of flame retardants in buildings for the purpose of complying with these government regulations. Due to increasing consumer demand for household appliances, electronic equipment, and motor vehicles, regulations on fire protection have been drawn up by bodies such as the National Fire Protection Association NFPA and the International Code Council. In October 2020, the EU Green Deal and the subsequent Chemical Strategy for Sustainability were launched to promote the use of halogen-free flame retardants HFFRs, and smoke suppressants.

- Rising Development of Innovative Flame Retardants – Market players are developing synergists that are anticipated to boost the market growth. The quantity needed to achieve the same level of flammability can be reduced by including synergists in these products. Synergists are also designed to overcome problems such as corrosivity and impart properties such as excellent dispersion and UV stability. In order to improve mechanical performance, allow lower phosphorous levels, and reduce corrosion, Dow Corning has developed a flame-retardant synergist named Dow Corning 43821.

- Increasing Bromine Production Capacity– In June 2021 Tosoh Corporation announced that it will expand the capacity to produce bromine by 30 % at its plant situated in Nanyo, Shunan City, Japan, for use in flame retardants and a variety of applications. It should be completed by January 2023, which will allow the company to grow its business and become more profitable.

- Increasing Demand for Flame Retardants in Construction Sector– It is expected that flame retardants are used in the construction sector to create buildings that are more immune to fire. Studies and trials conducted in Europe, the US, and India found that flame retardants incorporated into upholstered furniture have been shown to provide useful escape time as a way of reducing the spread of fire. For example, the European Commission has estimated that over the last 10 years in Europe, there will be a 20 % reduction in fire deaths due to the use of flame retardants.

Challenges

- Environmental and health concerns – Flame retardant substances may enter the water, soil, or air from products, and may come into contact with humans. They are known to have severe health effects on humans such as thyroid disruption, cancer, reproductive toxicity, cancer, and neurologic dysfunction. These additives are persistent pollutants that can bioaccumulate food chains. This is estimated to be the growth-hindering factor of the market.

- High loading levels that alter the final products

- Supply chain challenges in the Asia Pacific region

Flame Retardants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 8.46 billion |

|

Forecast Year Market Size (2035) |

USD 14.59 billion |

|

Regional Scope |

|

Flame Retardants Market Segmentation:

End-user Segment Analysis

The global flame retardants market is segmented and analyzed for demand and supply by end-use industry into building & construction and electronics & appliances. Out of the two types of flame retardants, the electronics & appliances segment is estimated to gain the largest market share of about 34% in the year 2035. The growth of the segment can be attributed to the growing demand for computers, tablets, smartphones, and other new electronics in order to prevent any chemicals from reaching the environment or affecting consumers' health through the use of flame retarders while they are being manufactured. This is estimated to contribute to the growth of the market in the forecast period. India's domestic electronics production grew by more than 23% from $29 billion to $81.5 billion with a compound annual growth rate of 23 %. In the global market for flame retardants, this may lead to an increase in the electronics segment.

Type Segment Analysis

The flame retardants market is also segmented and analyzed for demand and supply by type into aluminum trihydrate, antimony oxide, and brominated. Amongst these three segments, the aluminum trihydrate segment is expected to garner a significant share in the year 2035. In order to minimize the flames' intensity, ATH is formed by releasing water molecules through an endothermic reaction. When using ATH, because it does not release toxic smoke during the burning process, it is preferred over halogen compounds. Demand for ATH compounds will increase as a result of the reduced impact on the environment and stringent legislation governing the use of halogens, which will help to make this part one of the main segments in the forecast period.

The combustibility and flammability of the products in which they are contained are reduced by Brominated compounds. In clothing, electronics, and furniture, these compounds are the most effective. The market is expected to be driven by the increasing demand for brominated compounds in the Asia Pacific. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global flame retardants market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flame Retardants Market Regional Analysis:

APAC Market Insights

The share of flame retardants market in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 38% by the end of 2035. The growth of the market can be attributed majorly to the increasing presence of significant electronics industries and increasing construction activity. The region is estimated to have around 61.0% of the world's population and has a rapidly growing manufacturing and processing sector. The Asia Pacific has the largest flame retardants market, with China accounting for most of them. which is expected to double in size. The demand for various sectors such as construction, electronics & appliances, and automotive is also being increased by the increasing population in this region that has a more diversified income stream. Flame retardants are applied to textiles, inhibiting or suppressing the combustion process. Reports cite that the Indian textile sector is, on the other hand, attracting FDI of over $3.75 billion from April 2000 to March 2021, as stated in a report. In addition, owing to lower labor prices, reduced costs of building production units, and cost-efficient flame retardants, manufacturers across the globe have come to view Asia as a promising market. These factors are anticipated to contribute to the growth of the market in the forecast period.

North American Market Insights

The North American flame retardants market is estimated to be the second largest, registering a significant share by the end of 2035. The growth of the market can be attributed majorly to the increasing industrialization and construction activities in the region. The growth of the market is also by the implementation of rigorous rules and regulations for fire safety is a contributing factor to the US position in the market. The regulation imposes a requirement on manufacturers to use these stabilizers in their finished products. Continued research and technological advances in fire resistance polymer composites, which provide excellent durability and heat resistance down to the point of low thickness are other factors contributing to the growth of the market.

Europe Market Insights

Europe region is expected to observe significant growth till 2035. The growth of the market can be attributed majorly to the increasing use of flame retardants in the construction industry. Fire retardants are mainly used to provide structural insulation in the European building and construction industry. For the purpose of maintaining optimum temperatures and energy savings, insulation is being used in homes and buildings. In addition, flame retardants are of major use to polyolefin foam in buildings for heating, ventilation, and air conditioning purposes as well as a thermal insulation material for pipes or other materials.

Flame Retardants Market Players:

- Clariant

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LANXESS

- ICL Group

- Albemarle Corporation

- Dow

- BASF SE

- ASIA PA

- Nabaltec AG

- Akzo Nobel N.V.

- Italmatch Chemicals S.p.A.

- Kisuma Chemicals

Recent Developments

- Huber Engineered Materials completed its acquisition of MAGNIFIN on January 22, 2022. Magnesiaprodukte GmbH & Co. KG, also known as MAGNIFIN. MAGNIFIN’s products are sold globally by Martinswerk GmbH as part of the HEM Fire Retardant Additives’ (FRA) strategic business unit, which produces a wide range of halogen-free fire retardants, smoke suppressants, and specialty aluminum oxides.

- The acquisition of the Solvay polyamide 6.6 PA business was concluded by BASF SE on 1 January 2020. This transaction further expanded BASF's capacity to produce innovative products in the field of polyamide. With the acquisition of Solvay’s polyamide business, BASF had its first Underwriter Laboratories (UL) certified lab in Asia

- Report ID: 4870

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flame Retardants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.