Metal Polishing Compound Market Outlook:

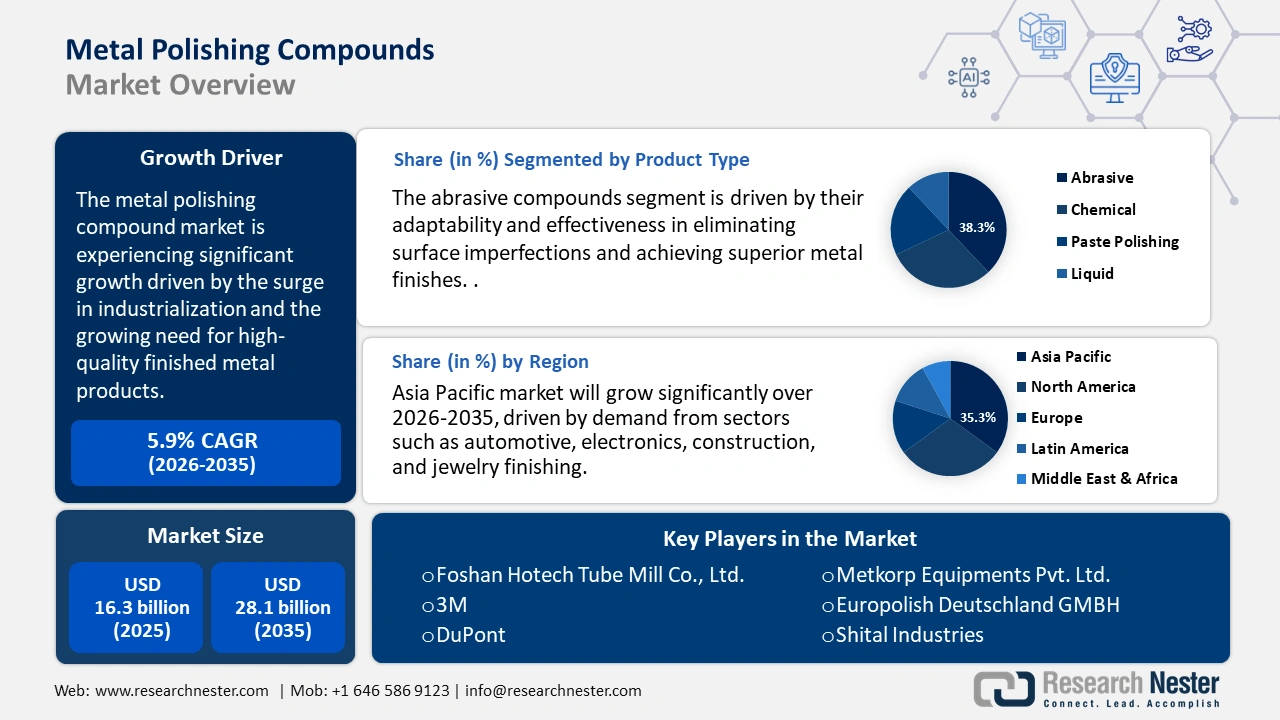

Metal Polishing Compound Market size was USD 16.3 billion in 2025 and is estimated to reach USD 28.1 billion by the end of 2035, registering a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of metal polishing compound is assessed at USD 17.5 billion.

The expansion of the metal polishing compound market is primarily influenced by the surge in industrialization and the growing need for high-quality finished metal products across various sectors, including automotive, aerospace, electronics, and construction. As manufacturers prioritize the enhancement of surface aesthetics, corrosion resistance, and functional performance, polishing compounds become essential in achieving precise finishes. Furthermore, the growth of the electronics industry, which requires finely polished metal components, is significantly contributing to the increasing market demand. Environmental regulations are also promoting the development and use of eco-friendly polishing compounds, thereby encouraging sustainable manufacturing practices without sacrificing efficiency or quality.

Leading companies such as BASF are pioneering innovation within the metal polishing compound market by providing advanced formulations designed for a range of industrial applications. BASF’s dedication to research and development facilitates the creation of high-performance, environmentally responsible polishing compounds that adhere to rigorous quality standards. Their extensive product portfolio assists manufacturers in boosting productivity and preserving surface integrity, thus fostering growth in the global metal finishing markets.

Key Metal Polishing Compound Market Insights Summary:

Regional Highlights:

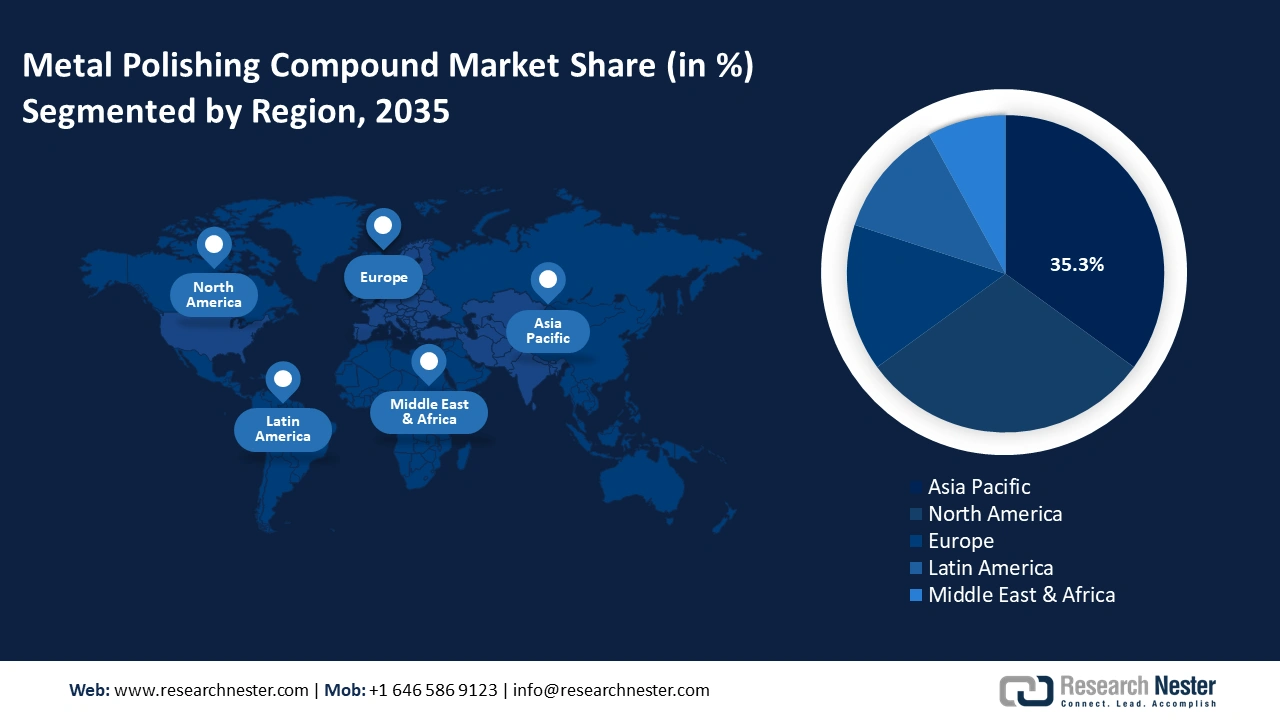

- The Asia Pacific metal polishing compound market is projected to hold a 35.3% share by 2035, supported by rapid urbanization, expanding automotive and electronics industries, and increasing exports from China and Southeast Asia.

- North America is anticipated to grow at a notable CAGR of 28.6% through 2035, driven by rising demand from automotive, aerospace, and EV sectors alongside the shift toward eco-friendly and water-based polishing compounds.

Segment Insights:

- The abrasive compounds segment is projected to capture a 38.3% revenue share of the metal polishing compound market by 2035, fueled by its versatility and superior performance in precision industries such as automotive and aerospace.

- The automotive segment is expected to account for a 33.7% share by 2035, driven by the growing demand for corrosion-resistant, durable, and visually refined metal components that meet stringent quality standards.

Key Growth Trends:

- Growing demand in the automotive and aerospace sectors

- Growth of electronics and semiconductor manufacturing

Major Challenges:

- Stringent environmental regulations

- Raw material price volatility

Key Players: 3M Company, DuPont de Nemours, Inc., Menzerna Polishing Compounds GmbH & Co. KG, Europolish Deutschland GmbH, Engis Japan Corporation, New Western Abrasive, Renegade Products USA, Maverick Abrasives, Shital Industries, Metkorp Equipment Pvt. Ltd., Koyo‑Sha Co., Ltd., Okuno Chemical Industries Co., Ltd., ARGOFILE Japan Ltd., JX Metals Trading Co., Ltd.

Global Metal Polishing Compound Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.3 billion

- 2026 Market Size: USD 17.5 billion

- Projected Market Size: USD 28.1 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Thailand, Indonesia, Mexico, Vietnam

Last updated on : 7 October, 2025

Metal Polishing Compound Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand in the automotive and aerospace sectors: The automotive and aerospace industries require high-quality surface finishes to improve the performance, safety, and visual appeal of metal components. Metal polishing compounds are essential for enhancing corrosion resistance, durability, and smoothness. As vehicle production and aerospace innovations increase, the demand for effective polishing solutions becomes more pronounced. Henkel provides these sectors with specialized polishing compounds that achieve precision finishes, adhering to strict quality standards and enhancing overall product reliability and longevity.

- Growth of electronics and semiconductor manufacturing: With the trend towards smaller and more intricate electronics and semiconductor devices, manufacturers need metal polishing compounds that offer outstanding surface smoothness and conductivity. These compounds are crucial for ensuring the reliable performance of metal components utilized in circuitry and enclosures. The rise in consumer electronics and sophisticated semiconductor applications drives the demand for such solutions. BASF supplies innovative metal polishing products tailored to meet the stringent requirements of electronics manufacturing, thereby enhancing efficiency and product quality in this rapidly changing industry.

- Movement towards eco-friendly and sustainable products: Increasingly stringent environmental regulations and consumer demand for greener products are steering the metal polishing compound market towards sustainable options. Manufacturers are focusing on creating biodegradable, water-based, and low-toxicity polishing compounds that reduce environmental impact while maintaining performance standards. This transition not only ensures compliance with regulations but also fulfills corporate social responsibility objectives. 3M stands at the forefront of producing eco-friendly polishing compounds, merging sustainability with high effectiveness to satisfy the changing market and regulatory requirements globally.

1. Metal Polishing Compound Market: Trade Dynamics

Growth of Aircraft Parts (2022-2023)

|

Country |

2022 ($) |

2023 ($) |

Growth |

Growth (%) |

|

U.S. |

22B |

5.9B |

3.84B |

17.4% |

|

France |

7.47B |

10.6B |

3.16B |

42.2% |

|

UK |

10.5B |

9.48B |

1.01B |

10.6% |

|

Germany |

7.55B |

8.36B |

804M |

10.6% |

|

Japan |

1.7B |

2.34B |

633M |

37.2% |

|

China |

2.02B |

2.32B |

296M |

14.6% |

|

Canada |

2.55B |

2.92B |

371M |

14.5% |

2. Overview of Semiconductor Devices

Trade Value of Semiconductor Devices in 2023

|

Leading Exporters |

Global Share |

Leading Importers |

Global Share |

|

Malaysia |

8.23% |

U.S. |

16.4% |

|

Japan |

5.88% |

Hong Kong |

10.5% |

|

Germany |

5.56% |

China |

8.36% |

|

Vietnam |

5.13% |

Germany |

6.91% |

|

Thailand |

4.86% |

India |

4.35% |

|

Singapore |

5.56% |

Japan |

2.85% |

Challenges

- Stringent environmental regulations: The market for metal polishing compounds is under growing pressure due to stringent environmental regulations designed to minimize the use of hazardous chemicals and manage waste disposal. Manufacturers are required to reformulate their products to be environmentally friendly and adhere to these regulations, which may result in increased production costs and restrict the use of certain effective yet toxic compounds. This situation necessitates ongoing innovation and investment in sustainable technologies.

- Raw material price volatility: The volatility in the prices of essential raw materials such as abrasives and chemical additives has a direct effect on manufacturing costs. Disruptions in the supply chain and geopolitical issues can intensify this volatility, resulting in inconsistent pricing and challenges to profitability. To sustain competitive pricing and ensure supply reliability, market participants must navigate these risks through strategic sourcing and effective inventory management.

Metal Polishing Compound Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 16.3 billion |

|

Forecast Year Market Size (2035) |

USD 28.1 billion |

|

Regional Scope |

|

Metal Polishing Compound Market Segmentation:

Product Type Segment Analysis

Abrasive compounds are projected to account for a 38.3% share of revenue in the global metal polishing compounds market, owing to their adaptability and effectiveness in eliminating surface imperfections and achieving superior metal finishes. They find extensive application in industries that demand precision, such as automotive and aerospace, where the quality of the surface is of utmost importance. Recent innovations, including nano-abrasives, have significantly enhanced their polishing efficiency and consistency. For instance, Engis Corporation, a frontrunner in abrasive polishing technology, provides a variety of advanced abrasive compounds specifically designed for high-precision metal finishing applications.

Application Segment Analysis

The automotive sector is expected to represent a 33.7% revenue share in the global Metal Polishing Compounds Market, driven by the rising demand for high-quality, corrosion-resistant, and aesthetically pleasing metal components. Polishing compounds are essential in improving the durability and finish of vehicle parts, allowing manufacturers to comply with stringent industry standards regarding performance and appearance. This increasing emphasis on lightweight, durable, and stylish automotive components continues to drive market expansion. For instance, 3M Company offers cutting-edge metal polishing solutions that are widely utilized in automotive manufacturing to achieve exceptional surface finishes.

End-user Segment Analysis

The electronics manufacturing sector is anticipated to capture a 28.6% revenue share in the global Metal Polishing Compounds Market, propelled by the essential requirement for extremely smooth, contaminant-free metal surfaces to guarantee optimal electrical conductivity and the longevity of devices. Metal polishing compounds are crucial in semiconductor fabrication and the assembly of consumer electronics, where precision and surface integrity are directly linked to performance. For instance, Dow Inc. provides specialized polishing compounds designed to meet the rigorous standards of the electronics industry, thereby supporting high-quality manufacturing processes.

Our in-depth analysis of the metal polishing compound market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Polishing Compound Market - Regional Analysis

Asia Pacific Market Insights

In 2035, the global market for metal polishing compounds was valued at approximately USD 7.4 billion, with the Asia-Pacific accounting for around 35.3% of this total. This expansion is driven by demand from sectors such as automotive, electronics, construction, and jewelry finishing. The primary factors propelling this growth include urbanization, the need for finer finishes, and increasing exports from China and Southeast Asia.

By 2035, it is projected that China will command the largest revenue share in the Asia-Pacific metal polishing compound market. With its extensive manufacturing capabilities across automotive, electronics, and electric vehicles (EVs), coupled with strong industrial output, rising exports, and enhanced quality standards, China is expected to contribute significantly, exceeding 50% of the market revenue in the Asia-Pacific. Its advantages in cost and scale further solidify its leadership position. A notable company in this sector is Zhengzhou Ruizuan Diamond Tool Co., Ltd., a major supplier of polishing tools and compounds.

Although China leads in revenue generation, India is forecasted to achieve the highest growth rate in the Asia-Pacific by 2035. The growth drivers for India include the “Make in India” initiative, increasing demand in the automotive, jewelry, and decorative metalwork sectors, as well as heightened infrastructure and housing activities. The potential for exports and the requirements for industrial finishing are additional factors that will support this expansion. A significant player in this market is Metkorp Equipment Pvt. Ltd., known for producing metal polishing compounds that serve both industrial and jewelry markets throughout the Asia-Pacific.

North America Market Insights

By 2035, the North American market for metal polishing compounds is anticipated to achieve a value ranging from USD 1.6 to 2.0 billion, propelled by demand from industrial, automotive, aerospace, and consumer sectors. The region is projected to experience a CAGR of approximately 28.6% until 2035. The primary factors driving this growth include more stringent surface finish standards, an increase in vehicle restorations and detailing markets, expansion in metal finishing related to electric vehicles (EVs), and a growing preference for eco-friendly and water-based compounds.

The U.S. is expected to maintain the largest revenue share in the North American metal polishing compound market by 2035. This is attributed to its extensive automotive, aerospace, and industrial metals sectors, robust research and development capabilities, and high per capita demand for both industrial and consumer polishing products. Consequently, the U.S. is projected to account for over 60 to 70% of the total market in North America. A notable player in this sector is 3M Company, recognized for its comprehensive range of metal polishing compounds and abrasives, which benefits from continuous innovation and a strong brand presence.

Canada is anticipated to emerge as the second-largest contributor in North America by 2035, with a modest yet consistent market share supported by its metal fabrication industry, demand for finishing metals in mining, renewable energy infrastructure (such as wind turbines), and regulatory initiatives aimed at enhancing safety and surface quality standards. Although smaller in scale compared to the U.S., Canada is expected to witness significant growth in niche and finishing segments. A prominent example of a Canadian company in this field is Kuntz Electroplating Inc., which specializes in polishing and plating services for the automotive, appliance, and specialty equipment industries.

Europe Market Insights

The European metal polishing compound market is experiencing consistent growth, bolstered by robust sectors such as automotive, aerospace, precision engineering, and luxury goods. In 2025, Europe represented approximately USD 282 million in the automotive polishing compounds segment, anticipated to account for 21.5% of the global market share by 2035. The demand is being driven by increasing regulations on VOC and emissions, advancements in technology, and the restoration of heritage and luxury items.

By 2035, Germany is projected to dominate the European metal polishing compound market in terms of revenue share. Its strong industrial foundation, particularly in automotive, machinery, and aerospace, coupled with cutting-edge manufacturing technologies and stringent quality standards for finishes, propels the demand for high-performance compounds. A prominent player in this sector is Menzerna Polishing Compounds GmbH & Co. KG, a well-established German company recognized for its premium pastes and emulsions, supported by a robust research and development framework and a significant global export presence.

The UK is forecasted to be one of Europe’s leading contributors by 2035, driven by its aerospace, electronics, luxury goods, and automotive detailing industries. The UK’s commitment to eco-friendly solutions, aftermarket care, and precision metal finishing is on the rise. A noteworthy instance is Akemi GmbH, a company of German origin that has established a strong market presence in the UK, providing high-quality polishing and protective compounds.

Trade Value of Jewellery in Europe (2023)

|

Leading Exporters |

Global Share |

Leading Importers |

Global Share |

|

Italy |

12.4B |

Switzerland |

9.41B |

|

France |

9.93B |

France |

4.55B |

|

Switzerland |

9.74B |

UK |

2.5B |

|

UK |

1.9B |

Italy |

2.32B |

|

Germany |

1.51B |

Germany |

1.94B |

Key Metal Polishing Compound Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Nemours, Inc.

- Menzerna Polishing Compounds GmbH & Co. KG

- Europolish Deutschland GmbH

- Engis Japan Corporation

- New Western Abrasive

- Renegade Products USA

- Maverick Abrasives

- Shital Industries

- Metkorp Equipment Pvt. Ltd.

- Koyo‑Sha Co., Ltd.

- Okuno Chemical Industries Co., Ltd.

- ARGOFILE Japan Ltd.

- JX Metals Trading Co., Ltd.

Leading manufacturers of metal polishing compounds employ various strategies to set themselves apart: they engage in intensive research and development to create compounds with optimized abrasives such as aluminum oxide, cerium oxide, or diamond slurries, and they adjust particle size distributions to achieve superior surface finishes. Additionally, they focus on developing environmentally friendly, water-based formulations with low volatile organic compounds (VOCs) to meet increasingly stringent regulatory standards. Furthermore, these manufacturers invest in process technologies to ensure consistency, utilizing controlled blending, sensor-monitored polishing baths, and automated delivery systems. They also provide technical support and tailor formulations to meet the specific needs of end-user sectors, including automotive, electronics, jewelry, and aerospace. Lastly, they enhance their geographic reach and raw material sourcing through strategic acquisitions or partnerships.

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In June 2025, NOF Metal Coatings Europe introduced its new PFAS-free Plus Series silver topcoats. These sustainable coatings fulfill the evolving environmental guidelines and safeguard stable friction performance tested up to 700 rpm for M6 screws. Designed for bearing surfaces such as aluminum, steel, and e-coat, these topcoats feature unique fluorescent pigments for easy UV-light identification, applied via safe, non-electrolytic procedures that avoid hydrogen embrittlement.

- In June 2024, Ronatec acquired ICF, expanding its product portfolio in the metal finishing industry. This strategic acquisition by Rontec enhances its ability to better serve its customer base in the chemical and metal finishing sector across North America. This move further reinforces the company’s commitment to a comprehensive solution and improved position in the market.

- Report ID: 7933

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Polishing Compound Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.