Transition Metals Market Outlook:

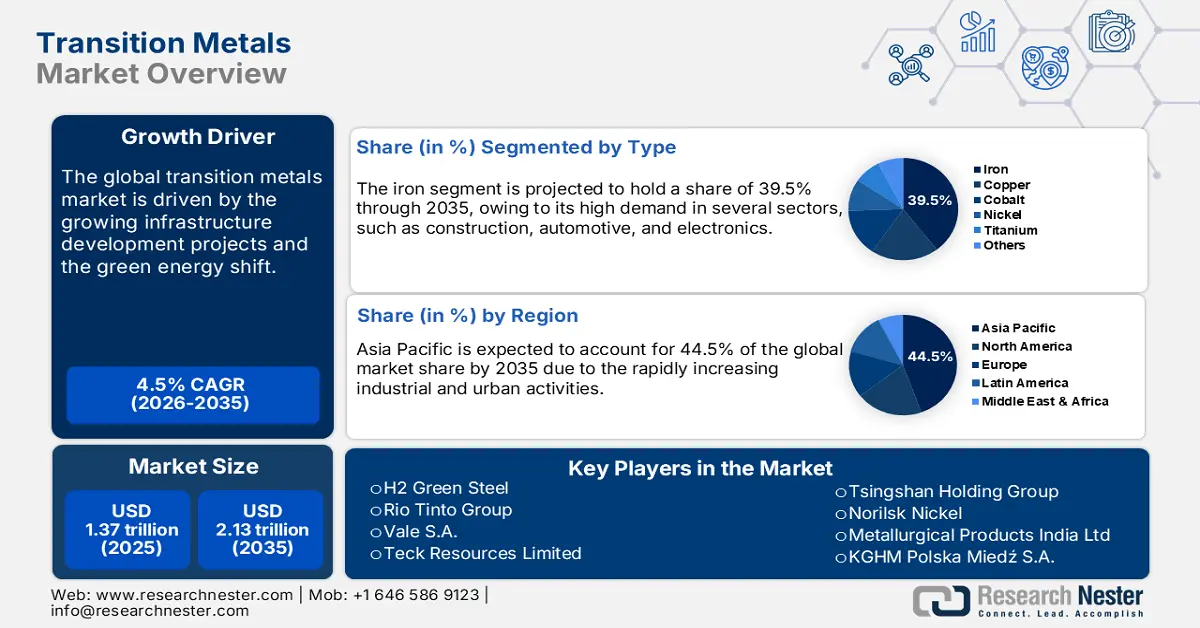

Transition Metals Market size was valued at USD 1.37 trillion in 2025 and is set to exceed USD 2.13 trillion by 2035, registering over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of transition metals is estimated at USD 1.43 trillion.

The robust infrastructure development activities happening across the world are set to offer lucrative gains to transition metal producers in the years ahead. The developed and developing countries are more focused on new infrastructure development and old upgrades to stay competitive in the global landscape. The high potential regions, such as Asia Pacific, Latin America, and the Middle East & Africa, are more likely to drive the transition metal trade at a significant pace. The supportive government policies and positive public-private investments are anticipated to fuel the production and commercialization of transition metals such as nickel, cobalt, iron, and zinc. These developments are foreseen to bring new entries to the transition metals market and aid in boosting the supply chain.

The investments in new metal & mineral supply are gaining traction around the globe. According to the analysis by the International Energy Agency (IEA), mineral mining increased by 10% year-over-year in 2023. The exploration spending also grew by nearly 15.0%, mostly driven by Australia and Canada. The investments in lithium also witnessed a sharp 60.0% rise in 2023, despite low prices. Many countries are also entering into cross-border partnerships to expand transition metal production. In the last 10 years, China has been leading the overseas mine acquisition, with high spending. Australia increased its Critical Minerals Facility’s investment, financing extraction and processing projects with around USD 1.3 billion in 2023.

Key Transition Metals Market Insights Summary:

Regional Highlights:

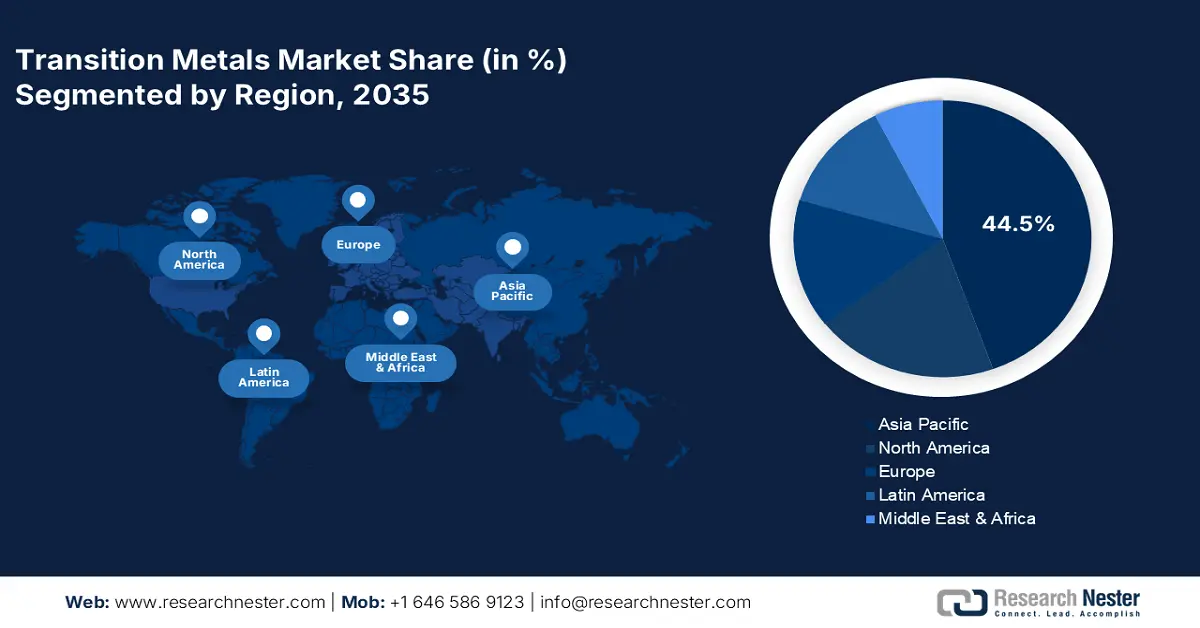

- Asia Pacific leads the transition metals market with a 44.5% share, propelled by robust industrial and urban development and green energy transition, positioning it as a global hub through 2026–2035.

- North America's Transition Metals Market is projected to experience rapid growth through 2035, driven by strong mining investments and clean energy demand.

Segment Insights:

- The Iron segment is anticipated to grow significantly from 2026 to 2035, propelled by high demand from global infrastructure and industrial sectors.

- The Construction & Building segment is expected to capture a 39.9% market share by 2035, fueled by urbanization and reliance on durable, corrosion-resistant metals.

Key Growth Trends:

- Increasing applications in EV batteries

- Green energy shift

Major Challenges:

- Strict environmental regulations and concerns

- Uncertain and capital-intensive business

Key Players: H2 Green Steel, Rio Tinto Group, Vale S.A., Teck Resources Limited, Tsingshan Holding Group, and Norilsk Nickel.

Global Transition Metals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.37 trillion

- 2026 Market Size: USD 1.43 trillion

- Projected Market Size: USD 2.13 trillion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Russia, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Transition Metals Market Growth Drivers and Challenges:

Growth Drivers

- Increasing applications in EV batteries: The transition metals are finding high importance in the automotive sector, particularly in electric vehicle manufacturing. The metals, including cobalt, nickel, and lithium, are being extensively used in EV battery production. Good thermal and electrical conductivity is accelerating the demand for transition metals in innovative EV battery production. The increasing adoption of zero-emission vehicles is creating a high-earning environment for transition metal manufacturers.

- Green energy shift: The clean energy transition is set to propel the sales of critical metals during the projected period. Copper, titanium, and platinum are essential components in the manufacturing of solar panels, hydrogen fuel cells, and wind turbines. The clean energy transition is estimated to increase the long-term demand for metals such as copper, cobalt, nickel, lithium, and graphite. The IEA study states that the total demand for copper in the announced pledges scenario, particularly solar PV and wind, is expected to increase from 1,685 kt and 724.1 kt in 2025 to 2,049 kt and 939.1 kt by 2040, respectively.

The same source also states that the transition metals market value of copper in the energy transition was calculated at USD 220.0 billion in 2023 and is expected to witness a boom in the announced pledges scenario and the net-zero scenario by 2040. The World Economic Forum (WEF) analysis reveals that the copper demand is projected to reach 55.1 million tonnes by 2050. Chile dominates the copper reserves with 23.6%, followed by the Democratic Republic of Congo (10.0%), Peru (10.0%), and China (8.6%).

Source: IEA

Challenges

- Strict environmental regulations and concerns: The strict mining regulations in certain regions, owing to environmental concerns, are likely to lower the production of the transition metals. Excess mining activities lead to soil erosion, biodiversity loss, and pollution. Strict environmental, social, and governance (ESG) compliance often delays or halts projects. Thus, environmental regulations and concerns are major drawbacks for the mining and refining of transition metals. Strategic partnerships with public entities are likely to aid metal manufacturers in overcoming this issue.

- Uncertain and capital-intensive business: Mining of transition metals is capital capital-intensive business due to the uncertainty of results. The high upfront investments, long gestation periods, and changes in policies and regulations act as a major obstacle for investors. To cut the uncertainty of mining results, market players are intending to invest in digital technologies. The integration of artificial intelligence, machine learning, and predictive analysis helps in effective decision-making, leading to high profit gains.

Transition Metals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 1.37 trillion |

|

Forecast Year Market Size (2035) |

USD 2.13 trillion |

|

Regional Scope |

|

Transition Metals Market Segmentation:

Type (Iron, Copper, Cobalt, Nickel, Titanium, Others)

By 2035, iron segment is estimated to capture over 39.5% transition metals market share. Iron, being the backbone of every sector, is witnessing high exploration and commercialization. Infrastructure developments, automotive, and other manufacturing sectors are driving a high demand for iron. IEA states that the worldwide iron production by commercial BF and DRI technologies is expected to reach 1181.6 Mt and 157.3 Mt per year by 2030, respectively. The robust rise in the rails, roads, and energy projects is estimated to fuel the demand for iron and its pellets.

End use (Construction & Building, Automotive, Electronics, Paints & Coatings, Others)

In transition metals market, construction and building segment is expected to dominate over 39.9% revenue share by 2035. Transition metals are exhibiting high demand in construction activities, owing to their durability and corrosion resistance properties. The swift rise in urbanization worldwide is creating a high demand for construction metals. The UN Environment Programme (UNEP) states that the construction and building sector is highly dependent on steel. The building equipment manufacturing sector also drives the sales of transition metals such as iron, copper, and nickel.

Our in-depth analysis of the global transition metals market includes the following segments:

|

Type |

|

|

Form |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transition Metals Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific transition metals market is estimated to account for revenue share of more than 44.5% by the end of 2035. The robust industrial and urban activities are fueling a high demand for transition metals. The green energy shift is also augmenting the increasing the trade of nickel, cobalt, and iron across Asia Pacific. China is leading the iron production owing to its domestic and overseas production strategies. India, Japan, and South Korea are also set to be profitable marketplaces for transition metal manufacturers, owing to high ongoing and plant construction activities.

China’s dominance in electric vehicle manufacturing is anticipated to fuel the sales of transition metals in the coming years. Continuous innovations in EV battery production are set to increase the application of lithium, nickel, and cobalt. The growth in EV production and sales is projected to boost the revenue of transition metal manufacturers. The IEA study estimates that the plug-in hybrid electric vehicle (PHEV) in China accounted for 1/3rd of the total electric car sales and nearly 18.0% of battery demand in 2023. The electric vehicle battery demand amounted to 417 GWh/year in the country during the same period.

The supportive government policies and funding are set to propel the transition metal production in India. The report by the Observatory of Economic Complexity (OEC) estimates that India’s metal export trade was calculated at USD 39.1 billion in 2023, holding the 4th position as the most traded product in the country. The main metal export areas were the U.S. (USD 5.5 billion), Italy (USD 2.7 billion), United Arab Emirates (USD 2.1 billion), Saudi Arabia (USD 1.8 billion), and South Korea (USD 1.6 billion). The India Brand Equity Foundation (IBEF) states that the zinc demand is projected to double in the next 5 to 10 years. The infrastructure development activities, such as rails, roads, and airports, are likely to drive the steel demand at a growth rate of 10.0%.

North America Market Statistics

The North America transition metals market is forecast to increase at the fastest CAGR from 2026 to 2035. The increasing public investments in mining projects and government support are anticipated to augment the transition metal sales in the region. The strong presence of industries such as automotive, construction, and electronics is opening lucrative doors for transition metal exporters. The clean energy trend is also a game changer for the production and commercialization of transition metals such as cobalt, nickel, iron, and copper.

The metal mining activities are gaining a boom in the U.S. owing to increasing demand for electric vehicles and smart electronics. The U.S. Geological Survey (USGS) states that the 7 open pit iron ore mines in the country, particularly Michigan and Minnesota, shipped around 98.0% of domestic usable iron ore products to the steel sector. Nearly USD 7.5 billion worth of iron ore was produced in 2023 within the country. The expanding infrastructure development projects and residential construction are also backing the trade of transition metals.

The clean energy trend is having a strong influence on the sales of transition metals in Canada. The increasing use of solar and wind renewables for energy production is likely to fuel the sales of copper, iron, coal, and nickel in the country. The increasing registrations of electric vehicles are also representing lucrative opportunities for transition metal producers in the country. For instance, Statistique Canada states that in the fourth quarter of 2024, around 81,205 units of zero-emission vehicles were registered in the country. The rise in construction activities is also poised to fuel the demand for iron, nickel, zinc, and cobalt in the coming years.

Key Transition Metals Market Players:

- H2 Green Steel

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rio Tinto Group

- Vale S.A.

- Teck Resources Limited

- Tsingshan Holding Group

- Norilsk Nickel

- Metallurgical Products India Ltd

- KGHM Polska Miedź S.A.

- Rhenium Alloys

- Reliance Steel & Aluminum Co

- Transition Metals Corp

- Fortescue Metals Group Limited

- Samancor Chrome

- Vedanta Resources plc

The leading companies are employing various organic and inorganic marketing strategies such as integration of advanced technologies, partnerships and collaborations, mergers and acquisitions, and regional expansions to earn high revenues. The industry giants are forming strategic partnerships with other players to increase their market reach. They are also collaborating with public entities for smooth regulation compliance and increased production. Many companies are also investing in overseas mining activities to uplift transition metals market dominance.

Some of the key players include in transition metals market:

Recent Developments

- In April 2024, Vale S.A. announced the successful completion of its around USD 2.5 billion sales to Manara Minerals. The joint venture of Ma’aden and Saudi Arabia’s Public Investment Fund, Manara Minerals, acquired 10% of Vale.

- In August 2023, H2 Green Steel entered into a strategic partnership with Rio Tinto Group for the supply of direct reduction iron ore pellets. These pellets are being supplied to H2 Green Steel’s Sweden-based plant.

- Report ID: 7534

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transition Metals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.