Global Precious Metal Catalyst Market

- An Outline of the Global Precious Metal Catalyst Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Precious Metal Catalyst

- Recent News

- Regional Demand

- Precious Metal Catalyst by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Global Precious Metal Catalyst Demand Landscape

- Global Precious Metal Catalyst Demand Trends Driven by Dominance of Automotive Emission Control, Rapid Growth in Green Hydrogen, Focus on Recycling and Sustainability (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Precious Metal Catalyst Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Precious Metal Catalyst – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- NEOCAT

- Johnson Matthey

- DCL International

- CLARINET

- Evonik Industries

- BASF

- American Elements

- Business Profile of Key Enterprise

- Global Precious Metal Catalyst Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Precious Metal Catalyst Market Segmentation Analysis (2026-2036)

- By Metal Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Metal Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Type

- Platinum, Market Value (USD Million), and CAGR, 2026-2036F

- Rhodium, Market Value (USD Million), and CAGR, 2026-2036F

- Palladium, Market Value (USD Million), and CAGR, 2026-2036F

- Irridium, Market Value (USD Million), and CAGR, 2026-2036F

- Ruthenium, Market Value (USD Million), and CAGR, 2026-2036F

- By Catalyst Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Pallet/Bead, Market Value (USD Million), and CAGR, 2026-2036F

- Extrudate and Honeycomb, Market Value (USD Million), and CAGR, 2026-2036F

- Wash Coated Monolith, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturing Process

- Electroless and Electrochemical Depositions, Market Value (USD Million), and CAGR, 2026-2036F

- Incipient Wetness Impregnation, Market Value (USD Million), and CAGR, 2026-2036F

- Chemical Vapor/Atomic Layer Deposition, Market Value (USD Million), and CAGR, 2026-2036F

- Sol-Gel/Precipitation, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Automotive, Market Value (USD Million), and CAGR, 2026-2036F

- Petrochemical, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceutical, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Precious Metal Catalysts Market Outlook:

Precious Metal Catalysts Market size was valued at USD 14.89 billion in 2025 and is projected to reach USD 31.18 billion by the end of 2036, rising at a CAGR of 7.02% during the forecast period, i.e., 2026-2036. In 2026, the industry size of precious metal catalysts is expected to be USD 15.81 billion.

The primary growth driver of the global precious metal catalysts market is tightening vehicle-emission regulations and the resulting demand for catalytic converters that use platinum-group metals (Pt, Pd, Rh) to meet stricter NOx, CO, and HC limits. As governments worldwide ratchet standards and extend useful-life and on-road durability requirements, automakers must either load more active precious metals or adopt more advanced formulations, directly increasing catalyst metal demand. At the same time, the growing global vehicle fleet and continued high penetration of catalytic systems (today >90% of new cars worldwide and roughly 600 million vehicles fitted with catalysts historically) sustains large, ongoing replacement and aftermarket demand.

Beyond road transport, catalysts for petroleum refining and chemical processing (which also rely on PGMs) add a steady industrial baseline to precious metal catalysts market growth. Recycling and recovery partially offset raw-metal demand. USGS reports that about 120,000 kg of palladium and platinum were recovered globally from scrap in 2024, including approximately 45,000 kg of palladium and around 8,500 kg of platinum recovered from U.S. vehicle catalytic converters, yet primary consumption levels remain significant. Price volatility and supply-risk concerns for major PGM producers (South Africa, Russia) further push buyers toward securing supply chains and recycling, which influences investment and pricing dynamics across the catalyst market. Taken together, stricter global emissions regulations, the expanding vehicle fleet, continuous replacement cycles, and steady industrial catalyst usage, coupled with evolving supply and recycling dynamics, reinforce emissions-driven automotive applications as the dominant growth engine for the precious metal catalysts market.

Key Precious Metal Catalysts Market Insights Summary:

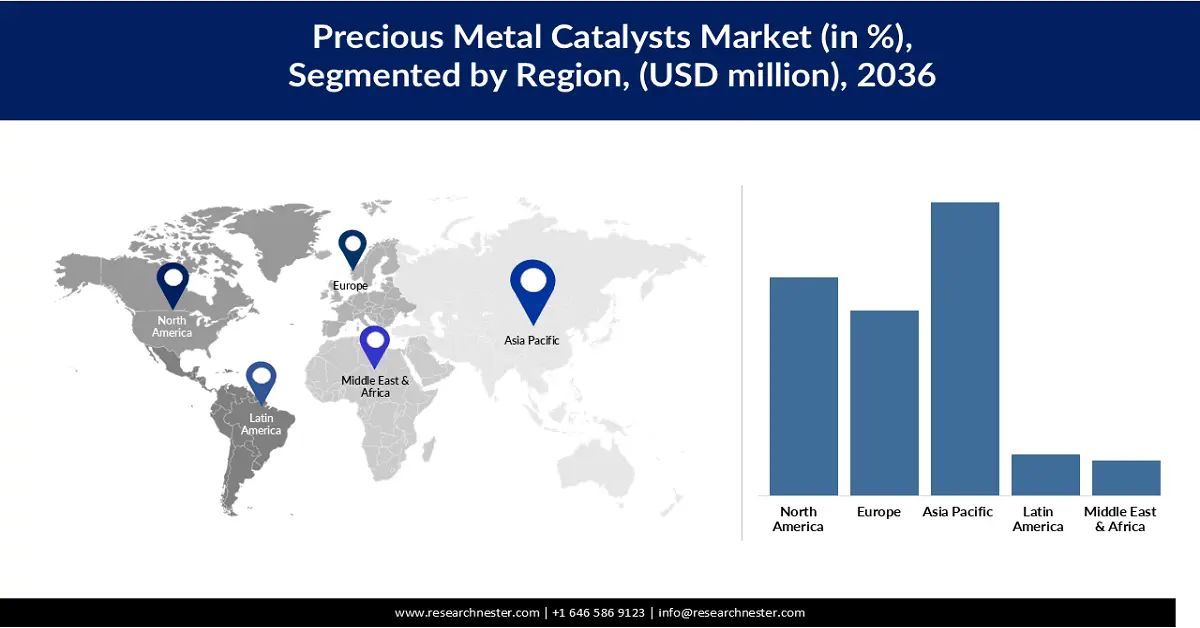

Regional Highlights:

- By 2036, the Asia Pacific precious metal catalysts market is expected to secure a 40.50% share, supported by expanding automotive production, petrochemical capacity additions, and accelerating hydrogen and fuel-cell investments.

- The North America region is poised to capture 27.20% of the global share by 2036, upheld by its large vehicle parc, steady catalytic-converter demand, and growing hydrogen-technology deployment.

Segment Insights:

- By 2036, the platinum segment in the precious metal catalysts market is projected to command a 43.12% share, reinforced by rising petrochemical capacity additions, fuel-cell adoption, and stricter vehicle-emission regulations.

- The powder segment is anticipated to grow at a 7.39% CAGR through 2026-2036, strengthened by its high surface area, superior dispersion, and adaptability across industrial catalytic applications.

Key Growth Trends:

- Increasing demand for catalytic converter

- Expansion in chemical and petrochemical products

Major Challenges:

- Material volatility and price fluctuations

- Supply chain constraints

Key Players: Johnson Matthey (UK), Heraeus Holding (Germany), Evonik Industries (Germany), Umicore (Belgium), Clariant International (Switzerland), TANAKA Holdings / Tanaka Kikinzoku (Japan), Alfa Aesar / Alfa Chemistry (USA), American Elements (USA), Haldor Topsøe (Denmark), Sino-Platinum Metals Co., Ltd. (China), Kaili Catalyst & New Materials Co. (China).

Global Precious Metal Catalysts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.89 billion

- 2026 Market Size: USD 15.81 billion

- Projected Market Size: USD 31.18 billion by 2036

- Growth Forecasts: 7.02% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.50% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 2 December, 2025

Precious Metal Catalysts Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for catalytic converter: As internal combustion engine (ICE) vehicles proliferate and emission standards tighten, more platinum-group metals (PGMs), especially palladium, platinum, and rhodium, are required per converter. According to the U.S. Geological Survey, catalytic converters accounted for around 83% of primary palladium demand and 92% of rhodium demand in 2021. Additionally, the OECD reports that catalytic converters make up about 40% of global platinum demand. This strong correlation between vehicle emissions-control requirements and PGM usage in converters underpins much of the current precious metal catalysts market expansion.

- Expansion in chemical and petrochemical products: Growing petrochemical production, particularly the build-out of para-xylene (PX) and propane dehydrogenation (PDH) plants, is directly increasing the need for platinum-based catalysts used in dehydrogenation, isomerization, and reforming processes. The World Platinum Investment Council (WPIC) reports that platinum demand in chemical applications has risen at a 3.4% CAGR since 2013, mirroring the steady expansion of petrochemical capacity worldwide. In Q2 2023, industrial platinum demand climbed 12% year-on-year, largely driven by higher catalyst offtake from the chemical industry amid growing PX production. Precious-metal catalysts enhance reaction efficiency, delivering higher yields and lowering energy consumption, making them indispensable in modern, large-scale chemical plants and firmly positioning the chemical and petrochemical sector as a key driver of market growth.

- Expansion in fuel cells and hydrogen formulation: Growing investment in hydrogen infrastructure and fuel-cell deployment is significantly boosting demand for precious-metal catalysts, especially platinum-group metals. According to the IEA, global hydrogen demand reached 97 million tons in 2023, driven in part by policy support for low-emissions hydrogen technologies. Proton-exchange membrane (PEM) electrolyzers and fuel cells, widely used in both mobility and stationary power sectors, require platinum (around 0.3 kg Pt per MW in present PEM electrolyzers), according to IEA estimates. As hydrogen deployment scales, the incremental precious-metal demand for electrolyzers and fuel cells creates a new and growing market for platinum. This expansion is reshaping the precious-metal catalyst landscape: manufacturers are exploring ways to reduce PGM loading, while recyclers and suppliers are adjusting to rising, long-term demand.

Challenges

- Material volatility and price fluctuations: Volatile prices of platinum-group metals (PGMs), including platinum, palladium, and rhodium, create major uncertainty for catalyst producers and end-use industries. Sharp swings in metal prices raise production costs and complicate long-term contract planning for automotive, chemical, and refinery customers. High price instability also affects inventory strategies, often forcing manufacturers to delay purchases or reduce catalyst loading. This unpredictability lowers profit margins and limits market expansion. Overall, persistent price volatility acts as a strong deterrent to investment across the precious-metal catalyst value chain.

- Supply chain constraints: Global precious metal catalysts markets face structural supply chain risks due to heavy reliance on a few mining regions, especially South Africa and Russia, for primary PGM production. Any disruption from labor strikes, geopolitical tensions, logistics issues, or mining outages leads directly to supply shortages. Limited refining capacity and long lead times further constrain availability for catalyst manufacturers. These bottlenecks raise procurement risks, elevate costs, and delay product development. As a result, supply chain fragility significantly restricts steady and reliable growth for the precious metal catalysts market.

Precious Metal Catalysts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

7.02% |

|

Base Year Market Size (2025) |

USD 14.89 billion |

|

Forecast Year Market Size (2036) |

USD 31.18 billion |

|

Regional Scope |

|

Precious Metal Catalysts Market Segmentation:

Type Segment Analysis

The platinum segment in the precious metal catalysts market is expected to grow with a revenue share of 43.12% by 2036. Platinum drives the type segment of the market by serving as the core active material across major applications such as automotive catalytic converters, petrochemical reforming, hydrogen fuel cells, and chemical processing. Its exceptional catalytic properties, including high thermal stability and strong resistance to poisoning, make it indispensable in reactions like dehydrogenation, oxidation, and isomerization. Rising petrochemical capacity additions and greater adoption of fuel-cell technologies continue to lift platinum demand, while tighter vehicle-emission regulations further reinforce its dominance in catalyst formulations. Even with efforts to reduce platinum loading through advanced designs and recycling, its performance advantages sustain strong consumption. As a result, platinum remains the largest and most influential catalyst type, shaping overall growth trends in the precious metal catalysts market.

Catalyst Form Segment Analysis

The powder segment in the precious metal catalysts market is projected to expand at a CAGR of 7.39% during the forecast period. Catalyst powder dominates the market by offering high surface area, excellent dispersion, and superior reaction efficiency, making it a preferred choice for numerous industrial processes. Its fine particle structure ensures optimal contact between reactants and active precious metals, significantly enhancing catalytic performance in chemical synthesis, petroleum refining, pharmaceuticals, and emission-control applications. Manufacturers value powder catalysts for their adaptability, as they can be easily blended into formulations or coated onto substrates. With rising demand for high-performance, flexible catalyst solutions, catalyst powders continue to strengthen their position as a key growth driver within the catalyst form segment.

Manufacturing Process Segment Analysis

Incipient wetness impregnation drives the manufacturing process segment of the global precious metal catalysts market by enabling precise and uniform deposition of platinum-group metals onto catalyst supports, which enhances catalytic activity and stability. This method allows manufacturers to achieve optimal metal dispersion with minimal waste, making it highly cost-effective given the high value of precious metals. Its versatility supports a wide range of catalyst formulations used in automotive, petrochemical, chemical, and environmental applications. The process also offers strong scalability, making it suitable for both laboratory development and large-scale industrial production. As industries increasingly demand high-performance catalysts with controlled loading and consistent quality, incipient wetness impregnation continues to reinforce its position as a preferred and growth-driving manufacturing technique.

Our in-depth analysis of the global precious metal catalysts market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Catalyst form |

|

|

Manufacturing process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Precious Metal Catalysts Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific precious metal catalysts market is expected to hold the largest revenue share of 40.50% by 2036, led by large automotive manufacturing, rapid petrochemical capacity additions, and accelerating hydrogen/fuel-cell investments. Vehicle production and fleet growth in the region keep aftermarket and OEM demand for PGM-based emission controls high. Expanding refinery and petrochemical projects, which rely on platinum-based reforming and dehydrogenation catalysts, will further lift industrial demand. Rapid policy support and manufacturing for electrolysers and fuel cells amplify platinum requirements for the low-carbon transition. Supply-side risk from geographically concentrated PGM mining also shapes procurement and recycling activity across APAC.

Platinum-group catalyst demand in China is being driven by an enormous and growing vehicle fleet, rapid industrial expansion, and large petrochemical investments that need high-performance catalysts. The National Bureau of Statistics reports the total number of motor vehicles for civilian use reached 336.18 million at the end of 2023, up 17.14 million year-on-year, supporting sustained OEM and aftermarket demand for catalytic converters. Strong refinery and petrochemical output (rising ethylene and crude-processing volumes) increases requirements for platinum-based reforming and dehydrogenation catalysts. Ambitious hydrogen and fuel-cell programs alongside large electrolyser manufacturing scale-ups create an emerging additional channel for platinum demand. Concentration of primary PGM supply outside the region and active recycling programs in China further shape procurement and pricing strategies. Overall, China’s large vehicle base, accelerating industrial expansion, and strong clean-energy investments position the country as the most influential driver of precious-metal catalyst demand in the region.

India’s precious metal catalysts market is expanding rapidly on the back of strong vehicle production, rising refinery/petrochemical capacity, and growing policy support for cleaner fuels and hydrogen. SIAM reports total vehicle production for FY 2024–25 at 31,034,174 units, with passenger vehicle sales and two-wheeler volumes at record levels, bolstering both OEM catalyst uptake and aftermarket replacement demand. The government plans to raise refining capacity (targeting higher MMTPA by 2030), and recent petrochemical investments are increasing demand for platinum-based catalysts in reforming and dehydrogenation units. Early-stage hydrogen and fuel-cell initiatives, plus a rising electric-vehicle transition that still relies on PGM use in some segments, add further complexity to metal demand. Supply-chain considerations and recycling initiatives are shaping procurement choices as manufacturers balance cost, availability, and performance. Together, India’s rising vehicle volumes and industrial build-out position it as a fast-growing market for precious-metal catalysts in APAC.

North America Market Insights

North American precious metal catalysts market, estimated to account for 27.20% of global market share by 2036, is supported by a very large vehicle parc and steady OEM/aftermarket demand for catalytic converters, ongoing petrochemical and refining activity that uses platinum catalysts, and growing hydrogen/fuel-cell investments that add new platinum demand. Tight vehicle-emissions regulations and industrial efficiency requirements keep PGM-based catalysts central to compliance and operational performance. Recycling and supply-security measures are becoming increasingly important amid price volatility and concentrated primary supply. Overall, government data on vehicle registrations and industrial catalyst usage underscore the region’s position as a stable, demand-intensive market.

The U.S. precious metal catalysts market is anchored by a very large vehicle fleet, 284.6 million motor vehicles registered in 2023, which underpins strong OEM and aftermarket demand for catalytic converters. Catalytic converters remain the dominant end-use for PGMs globally (e.g., a large share of palladium and rhodium consumption), keeping automotive emissions control the main growth engine for catalysts. Rapid expansion in petrochemical output and exports (including record ethane/ethane-based petrochemical exports in 2023) supports industrial catalyst demand for reforming and dehydrogenation processes. Parallel investments in hydrogen and fuel-cell technologies add a nascent but growing channel for platinum use. Together, vehicle parc scale, industrial activity, and energy-transition policies sustain steady PGM catalyst demand across the U.S. market.

Canada’s market growth is driven by a mature vehicle base and rising new-vehicle registrations, with 25.7 million road motor vehicles registered in 2023 and about 1.85 million new motor vehicle registrations in 2024, supporting both OEM and aftermarket catalyst demand. Light-duty vehicles account for most registrations, while the share of electric vehicles is increasing (3.9% of light-duty registrations in 2023), a trend that will gradually shift PGM demand patterns but leave replacement and industrial channels intact. Canada’s refining and petrochemical activity, together with North American supply-chain linkages, sustain industrial catalyst requirements for reforming and related processes. Recycling and sourcing strategies are important given PGM price volatility and global supply concentration.

Europe Market Insights

European precious metal catalysts market, projected to account for 22.30% of the global market by 2036, is expanding due to stringent emissions standards (e.g., Euro 6/Euro 7), a mature automotive sector, and growing chemical and refining industries that rely on platinum-group metals (PGMs). Additionally, increasing investment in hydrogen technologies, particularly fuel cells, is creating new demand for precious-metal catalysts. Strong regulatory pressure to decarbonize and circular-economy initiatives (including advanced PGM recycling) continue to support both primary and secondary catalyst markets. These trends, coupled with Europe’s high technological maturity, firmly position the region as a leading hub for catalyst innovation, deployment, and next-generation technology adoption.

Germany plays a central role in Europe’s precious metal catalysts market, due to its large vehicle fleet and highly developed chemical industry. As of January 2024, there were approximately 49.1 million passenger cars registered in Germany. Stringent automotive emissions regulations (e.g., under EU law) drive heavy usage of PGM-based catalysts in both gasoline and diesel vehicles. Its strong chemical and pharmaceutical sectors, supported by robust R&D investments (e.g., €13.2 billion in German chemical/pharma R&D), further sustain demand for homogeneous platinum and palladium catalysts. Moreover, Germany’s role in hydrogen technology is growing, and PGM catalysts for fuel cells and electrolysers are increasingly relevant. The combination of regulatory pressure, industrial capacity, and innovation makes Germany a linchpin in Europe’s catalyst demand.

In France, the precious metal catalysts market is supported by strong demand from both the automotive sector and a broad base of industrial applications. New passenger car registrations reached 1,774,729 units in 2023, driving demand for PGM-based catalytic converters in OEM and aftermarket segments. While electric vehicle adoption is rising with 291,143 BEVs registered in 2024, representing 16.9% of new car sales, internal combustion engines still form a significant portion of the fleet, sustaining catalyst demand. On the industrial side, France’s advanced chemical and refining sectors require platinum and palladium catalysts for high-performance reactions. Stricter European emissions standards and clean-energy policies further propel PGM catalyst uptake, while recycling and supply-security strategies are shaping long-term market dynamics.

Key Precious Metal Catalysts Market Players:

- Johnson Matthey (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Heraeus Holding (Germany)

- Evonik Industries (Germany)

- Umicore (Belgium)

- Clariant International (Switzerland)

- TANAKA Holdings / Tanaka Kikinzoku (Japan)

- Alfa Aesar / Alfa Chemistry (USA)

- American Elements (USA)

- Haldor Topsøe (Denmark)

- Sino-Platinum Metals Co., Ltd. (China)

- Kaili Catalyst & New Materials Co. (China)

- Johnson Matthey is one of the world’s largest producers of precious-metal catalysts, especially for automotive emission control and industrial processes. The company develops advanced platinum, palladium, and rhodium catalyst technologies to meet tightening global emission standards. Its strong presence in chemical processing, hydrogen, and fuel-cell catalyst segments further expands market influence. JM also operates major PGM recycling facilities, improving supply security and sustainability. Continuous R&D investment positions the company as a technological leader in catalyst innovation.

- Heraeus is a major global supplier of platinum-group metal catalysts for chemical, petrochemical, pharmaceutical, and environmental applications. The company is known for high-performance catalyst materials, precision refining, and strong metal-management capabilities. Its advanced recycling operations support circular-economy models and reduce reliance on primary PGM supply. Heraeus also supports hydrogen technologies through catalysts for fuel cells and electrolyzers. Strong industrial partnerships help expand its presence in high-value catalyst applications.

- Evonik supplies precious-metal catalysts primarily through its Catalysts business line, offering solutions for hydrogenation, dehydrogenation, and fine-chemical synthesis. The company provides both fresh and recycled PGM catalysts, strengthening cost efficiency for customers. Its global catalyst labs focus on improving activity, selectivity, and metal dispersion for industrial reactions. Evonik’s recycling and catalyst-life-cycle services enhance sustainability and supply reliability. The company’s innovation-driven portfolio supports key sectors such as pharmaceuticals, petrochemicals, and automotive.

- Umicore is a leading global supplier of precious-metal catalysts for automotive, chemical, and hydrogen applications. The company specializes in emission-control catalysts for light-duty and heavy-duty vehicles, leveraging strong expertise in PGM chemistry. Its robust closed-loop recycling system recovers and refines PGMs at large scale, supporting sustainable sourcing. Umicore also invests significantly in hydrogen fuel-cell catalysts and green-transition technologies. Broad application coverage makes it a major driver of global catalyst advancements.

- Clariant provides a wide range of precious-metal catalysts used in petrochemical processing, hydrogen production, specialty chemicals, and environmental applications. Its portfolio includes platinum, palladium, and rhodium catalysts tailored for dehydrogenation, oxidation, reforming, and synthesis processes. The company focuses on catalyst efficiency, stability, and optimized metal distribution to improve industrial reaction performance. Clariant also offers PGM recovery services, supporting cost reduction and sustainability. A strong research pipeline and global manufacturing footprint enhance its competitiveness in the catalyst market.

Here are a few areas of focus covered in the competitive landscape of the precious metal catalysts market:

Leading companies in the global precious metal catalysts market are driving growth through advanced catalyst formulations, improved durability, and higher metal-utilization efficiency to meet stricter emissions and sustainability standards. Major players are expanding recycling and closed-loop refining capabilities to secure PGM supply and reduce cost volatility. Investments in hydrogen technologies, fuel cells, and green-chemistry processes are opening new demand avenues beyond traditional automotive uses. Strategic partnerships with automakers, chemical producers, and energy companies are accelerating the commercialization of next-generation catalysts. Together, these efforts strengthen technological leadership and expand market adoption across automotive, industrial, and clean-energy segments.

Corporate Landscape of the Precious Metal Catalysts Market:

Recent Developments

- In November 2024, BASF announced plans to expand production capacity for its X3D technology, an advanced 3D-printing–based additive manufacturing process for catalysts. The new facility will enable industrial-scale catalyst production and is expected to begin operations in 2026.

- In April 2024, Umicore launched Nexyclus, the world’s most comprehensive portfolio of fully recycled precious metals, including platinum-group metals (PGMs), supported by three distinct certification options. This innovative offering addresses growing resource scarcity and rising demand for recycled, responsibly sourced, and low-carbon metals. It also leverages Umicore’s long-standing global leadership in precious-metal recovery and its established circular business model.

- Report ID: 7514

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Precious Metal Catalysts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.