Ammonia Market Outlook:

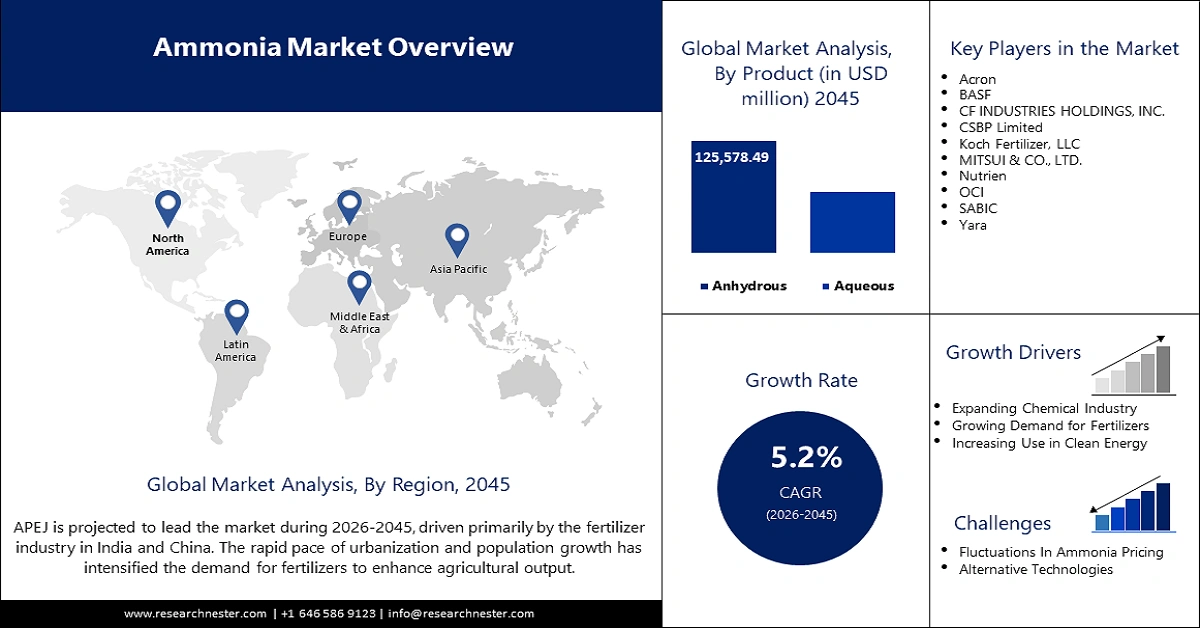

Ammonia Market size was valued at USD 90.6 billion in 2025 and is projected to reach a valuation of USD 254.3 billion by the end of 2045, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2045. In 2026, the industry size of ammonia is evaluated at USD 95.5 billion.

The ammonia market is steadily growing due to its widespread use in fertilizers, chemicals, and future energy solutions. Ammonia production from renewable hydrogen is changing the industry, lowering CO2 emissions, and increasing sustainability. In January 2025, LUPRO, a Korean green energy company, signed a USD 4.5 billion deal with Muscat House in Oman and MA Corporation in Thailand to advance and market green ammonia. This investment represents the increasing global focus on reducing carbon emissions in ammonia production to meet the increasing demand for fertilizers and industrial chemicals.

Governments across the globe are promoting the increase of ammonia production, including green and low-carbon ammonia. In December 2024, the European Union provided financial backing to Air Liquide for the development of the first large-scale renewable hydrogen production from ammonia project at the Port of Antwerp-Bruges in Belgium. Also, the two biggest consumers of ammonia, China and the U.S., are exploring ways to use capture technologies in order to cut emissions from ammonia production. As the world shifts towards clean energy sources and there is an increase in demand for fertilizer, ammonia continues to be a key industrial and agricultural product in the global market.

Key Ammonia Market Insights Summary:

Regional Highlights:

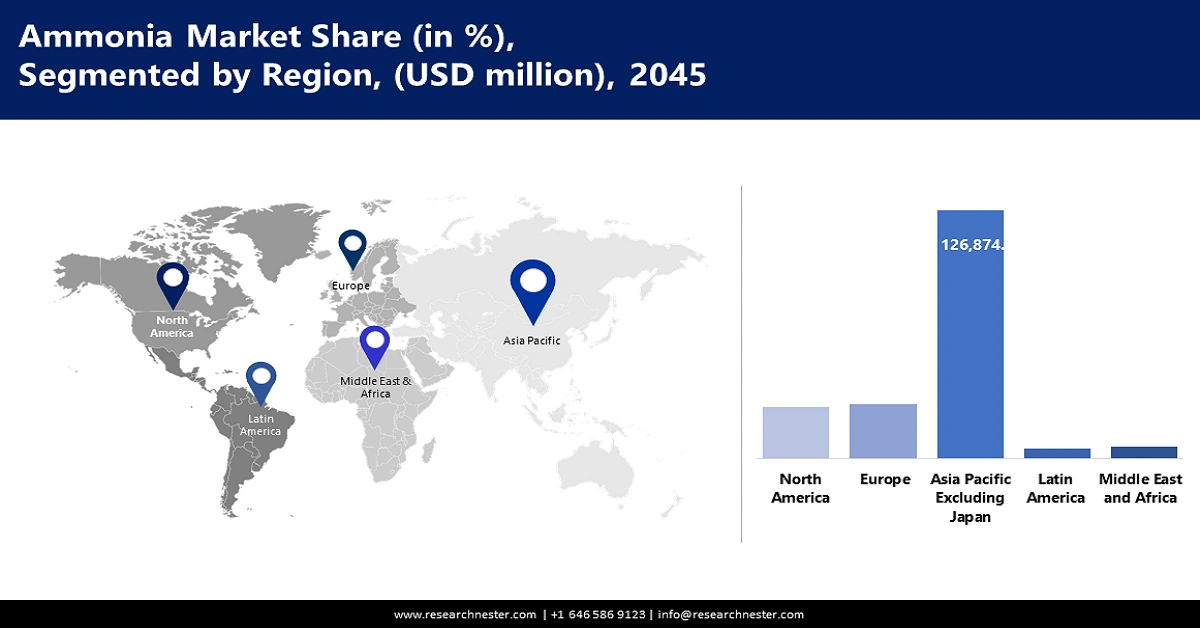

- The Asia Pacific excluding Japan ammonia market is predicted to command a 64.2% share by 2045, owing to escalating fertilizer consumption, industrial applications, and expanding investments in clean energy technologies.

- The North America region is projected to grow at a 5.9% CAGR from 2026 to 2045, underpinned by increasing adoption of low-carbon ammonia and advancements in carbon capture utilization and storage technologies.

Segment Insights:

- The anhydrous ammonia segment is projected to account for a 62.9% share by 2045 in the ammonia market, propelled by its high nitrogen content and extensive use across agricultural and industrial applications.

- The fertilizer segment is expected to hold a 60.2% share by 2045, supported by sustained agricultural demand and the growing adoption of low-carbon ammonia in fertilizer production.

Key Growth Trends:

- Expansion of green ammonia and renewable energy integration

- Increasing adoption of ammonia in the production of fertilizers

Major Challenges:

- Environmental concerns and carbon emissions from conventional production

- Supply chain and infrastructure challenges for green ammonia

Key Players: CF Industries Holdings, Inc., Yara International ASA, OCI Global, BASF SE, Koch Fertilizer LLC, Nutrien Ltd., SABIC, Chambal Fertilisers and Chemicals Limited, CSBP Limited, EuroChem Group, Group DF (Ostchem), IFFCO, JSC Togliattiazot, Sumitomo Chemical Co., Ltd., Petronas.

Global Ammonia Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 90.6 billion

- 2026 Market Size: USD 95.5 billion

- Projected Market Size: USD 254.3 billion by 2045

- Growth Forecasts: 5.2% CAGR (2026-2045)

Key Regional Dynamics:

- Largest Region: Asia Pacific excluding Japan (64.2% Share by 2045)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Russia, Germany

- Emerging Countries: Indonesia, Brazil, Saudi Arabia, Australia, Vietnam

Last updated on : 23 September, 2025

Ammonia Market - Growth Drivers and Challenges

Growth Drivers

-

Expansion of green ammonia and renewable energy integration: The increasing concern about decarbonization is pushing the need for green ammonia to be produced from renewable hydrogen. Currently, as governments and industries seek new ways of reducing emissions, ammonia is becoming more popular as a fuel and a fertilizer component. In June 2024, the Norwegian chemical firm Yara International started a renewable hydrogen plant in Herøya for green ammonia to support carbon-free farming. This shift aligns with net-zero emissions targets, thereby helping ammonia for the future of energy and industry solutions.

-

Increasing adoption of ammonia in the production of fertilizers: Fertilizers are the largest consumer of ammonia, especially nitrogen-based fertilizers, which are used in the agricultural industry to feed the world population. The world population is on the rise, and the depletion of the soil requires enhanced crop production, which, in turn, ensures the continuous demand for ammonia-based fertilizers. In May 2023, SABIC was able to deliver 5,000 metric tons of low-carbon ammonia to Indian Farmers Fertilizer Cooperative Limited IFFCO as a sign of low-carbon fertilizer usage. With countries working hard to provide food security, demand for ammonia-based fertilizers is set to rise further.

- Increasing use of ammonia in hydrogen transportation: Ammonia is gradually being accepted as a carrier for hydrogen due to its use in storage and transportation for fuel cells and power generation. Ammonia has a higher energy density and is easier to transport over long distances as compared to hydrogen, which makes it a feasible option for hydrogen economies. In March 2024, the Ammogen consortium began the largest ammonia-to-hydrogen conversion project at Tyseley Energy Park in the United Kingdom, putting the vector of clean energy into effect. Ammonia will be a critical enabler for efficient fuel delivery as hydrogen demand grows.

Challenges

-

Environmental concerns and carbon emissions from conventional production: Currently, ammonia production is closely associated with fossil energy sources, particularly natural gas, and is among the leaders in CO₂ emissions. The ammonia industry generates emissions of approximately 1.9% of the global CO₂ emissions, and the industry’s climate change concerns and potential regulation are becoming more apparent. The governments are increasing the emission standards, which have forced manufacturers to look for low carbon emitting materials. The shift towards green ammonia is still expensive and requires a lot of investment to meet green objectives.

-

Supply chain and infrastructure challenges for green ammonia: The use of green ammonia has some challenges, such as high costs of production and the fact that it requires a new infrastructure for transportation and storage. Currently, the ammonia supply chain is oriented towards conventional processes, and it is quite difficult to start using renewable-based processes. Governments of nations that are investing in green ammonia need to provide policy support and financing to advance the technology. However, the use of green ammonia may still be constrained if there is no infrastructure and investment for it.

Ammonia Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2045 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 90.6 billion |

|

Forecast Year Market Size (2045) |

USD 254.3 billion |

|

Regional Scope |

|

Ammonia Market Segmentation:

Product Segment Analysis

The anhydrous ammonia segment is expected to dominate the ammonia market, commanding a 62.9% share through 2045 due to its high nitrogen content and its use in agricultural and industrial applications. Anhydrous ammonia is increasingly favored as a component of fertilizers which is used as a hydrogen transport medium for energy uses. Several companies are capitalizing on this application to expand their share. In July 2024, CF Industries invested USD 100 million to establish a CO2 capture facility at the Yazoo City Complex and develop low-carbon anhydrous ammonia. Due to its cost-efficiency and applicability to various industries, the anhydrous segment is anticipated to remain dominant.

Application Segment Analysis

The fertilizer segment is anticipated to lead the ammonia market and hold 60.2% of the market share by 2045, as agriculture continues to be the largest consumer of ammonia. Ammonia is a constituent of almost all fertilizers, and farmers use it to enhance crop yields, hence driving the demand for ammonia. In April 2024, OCI agreed with COMPO EXPERT to obtain low-carbon ammonia for NPK fertilizer production, which testifies to the industry’s focus on the use of environmentally friendly products. Furthermore, the increase in food consumption and climate change is anticipated to continue promoting the adoption of ammonia in the agriculture sector.

Our in-depth analysis of the ammonia market includes the following segments:

|

Segment |

Subsegment

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ammonia Market - Regional Analysis

Asia Pacific Excluding Japan Market Insights

Asia Pacific excluding Japan ammonia market is expected to dominate with a share of 64.2% during the forecast period. This is attributed to the high consumption of fertilizer and industrial uses of ammonia and ammonia in clean energy technologies. The population of Asia is expected to reach more than 4.8 billion people in 2024, and therefore, the demand for food and energy in the region will be the key factors that are likely to spur the ammonia market growth. Governments across Asia are also increasing their investments in ammonia production facilities owing to their importance in decreasing the reliance on imported energy and increasing crop yields.

India ammonia market is experiencing a rise in green ammonia investments due to the country’s focus on renewable energy and eco-friendly fertilizers. In November 2024, Topsoe signed a deal with Hygenco to provide its dynamic ammonia technology for Hygenco’s green ammonia plant in Gopalpur, Odisha. This fits well with India’s efforts to transition to carbon-free fertilizers to cut the use of fossil fuels in ammonia production. Moreover, India’s National Green Hydrogen Mission is also promoting ammonia as a hydrogen carrier and making the country an important player in the transition to a cleaner economy.

China is the largest producer of ammonia globally, accounting for 30% of global production, as reported by the International Energy Agency. The country also consumes one-third of the global nitrogenous fertilizers and has been the largest consumer for the past three consecutive years. As a country that pays significant attention to food security and self-sufficiency, China has been increasing its ammonia production capacity while also taking efforts in low-carbon and hydrogen-based ammonia production in line with its carbon-neutrality goals. To enhance its ammonia production chain, China is incorporating more CCUS technologies to minimize emissions while retaining its ammonia production dominance globally.

North America Market Insights

The ammonia market in North America is expected to rise at a 5.9% CAGR between 2026 and 2045, attributed to rising demand in agriculture, hydrogen storage, and industries. The region is experiencing a transition towards low-carbon and green ammonia production through government policies and private investments. Carbon capture utilization and storage, or CCUS, is a relatively new innovation that is being implemented to minimize the emission of carbon from the production of ammonia.

The U.S. is a significant importer and consumer of ammonia, specifically for fertilizer and energy uses. The World Integrated Trade Solution (WITS) reported that in 2023, the U.S. imported anhydrous ammonia worth USD 1,345.8 million. Furthermore, the main suppliers were Canada (USD 788.75 million) and Trinidad and Tobago (USD 511.7 million). The rising dependence on imported ammonia also highlights the necessity to increase the production capacity of this important chemical in the country, especially green ammonia. These projects are aimed at reducing carbon emissions in industrial ammonia production and contributing to the development of hydrogen economy which also requires ammonia as a hydrogen vector. The increasing adoption of renewable energy sources is also expected to increase the use of ammonia in future energy storage and transportation systems.

Canada is also witnessing stable growth in the market. Ammonia production in Canada is mainly influenced by the strong fertilizer industry as agriculture is a major user of ammonia-based nitrogen fertilizers. Also, the country is progressing toward more sustainable ammonia production with CCUS technologies to decrease the emission of greenhouse gases. In August 2023, Nutrien announced that its Redwater facility in Alberta, Canada, had received a Certified Clean Ammonia certification from the Ammonia Energy Association (AEA). This extension is consistent with the nation’s dedication to reducing emissions to net zero by 2050, as ammonia that is green is expected to be a key input in the process of decarbonizing agriculture and industrial uses.

Key Ammonia Market Players:

- CF Industries Holdings, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Yara International ASA

- OCI Global

- BASF SE

- Koch Fertilizer LLC

- Nutrien Ltd.

- SABIC

- Chambal Fertilisers and Chemicals Limited

- CSBP Limited

- EuroChem Group

- Group DF (Ostchem)

- IFFCO

- JSC Togliattiazot

- Sumitomo Chemical Co., Ltd.

- Petronas

The ammonia market is in the early phase of a transition towards low-carbon ammonia production, and the major ammonia-producing and energy companies are at the epicenter of the change towards green ammonia for fertilizers, hydrogen carriers, and other uses. In September 2024, Woodside Energy entered a USD 2.35 billion deal to acquire OCI Clean Ammonia Holding B.V., which provides the company with access to OCI’s lower-carbon ammonia project in Beaumont, Texas. This strategic acquisition is an indication of the current and future need for low-carbon ammonia, especially in industrial processes and as a storage medium.

Here are some leading companies in the ammonia market:

Recent Developments

- In November 2024, Lloyd’s Register (LR) partnered with Samsung Heavy Industries (SHI) to co-develop a floating production, storage, and offloading (FPSO) system for green ammonia production. This project marks a significant advancement in the application of FPSO technology, traditionally used in oil and gas, to renewable ammonia production.

- In October 2024, BASF and AM Green B.V. signed a Memorandum of Understanding (MoU) to explore low-carbon chemical production using 100% renewable energy in India. The agreement includes a non-binding letter of intent for the annual offtake of 100,000 tons of renewable energy-based ammonia, integrating pumped storage energy solutions to support sustainable ammonia production.

- In June 2024, Yara International, in collaboration with Linde Engineering, inaugurated a 24-megawatt green hydrogen plant in Porsgrunn, Norway. The facility will serve as the cornerstone for green hydrogen-based ammonia production, enabling the manufacturing of low-carbon fertilizer and reducing CO₂ emissions by up to 41,000 tons per year.

- In July 2024, CF Industries Holdings, Inc. partnered with POET LLC, a global leader in sustainable bioproducts, to pilot the use of low-carbon ammonia fertilizer. The initiative aims to reduce the carbon intensity of corn production and ethanol, demonstrating ammonia’s role in decarbonizing agricultural supply chains.

- Report ID: 4518

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ammonia Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.