Procurement as a Service Market Outlook:

Procurement as a Service Market size was valued at USD 7.86 billion in 2025 and is likely to cross USD 23.34 billion by 2035, expanding at more than 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of procurement as a service is assessed at USD 8.67 billion.

During the COVID-19 pandemic, the need for remote working policies contributed to the growth of the global remote access solution and automated solutions industry, including procurement services and solutions. This in turn fuelled the demand for the procurement as a service market. According to the U.S. Census Bureau, 5.7% of US workers were working from home in 2019, prior to the COVID-19 pandemic. In two years, however, this figure increased to 17.9% on the back of nearly 19 million new jobs.

Key Procurement As A Service Market Insights Summary:

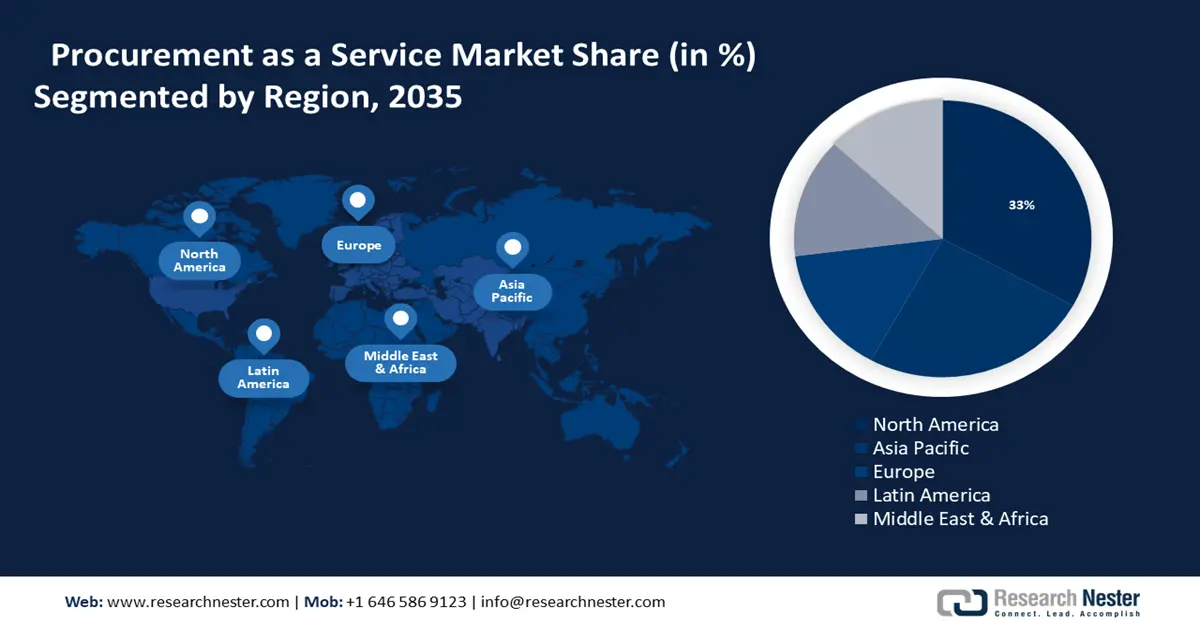

Regional Highlights:

- North America procurement as a service market will hold more than 33% share by 2035, driven by high adoption of procurement outsourcing and strong government investment in business digitization.

Segment Insights:

- The large enterprises segment in the procurement as a service market is expected to experience significant growth till 2035, driven by cost reduction and simplified business operations offered to large enterprises.

- The manufacturing segment in the procurement as a service market is anticipated to achieve substantial growth till 2035, driven by the ability of technology to mitigate supply chain risks in manufacturing.

Key Growth Trends:

- Global supply chain optimization is crucial

- Need for procurement and demand management solution

Major Challenges:

- Security concerns associated

- Complexities with cloud-based programs

Key Players: Infosys Limited, International Business Machines Corporation, Tata Consultancy Services Limited, Wipro Limited, WNS (Holdings) Ltd., Corbus LLC.

Global Procurement As A Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.86 billion

- 2026 Market Size: USD 8.67 billion

- Projected Market Size: USD 23.34 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Singapore, Brazil

Last updated on : 17 September, 2025

Procurement as a Service Market Growth Drivers and Challenges:

Growth Drivers

- Global supply chain optimization is crucial - Supply chain managers can monitor the performance of their operations with the help of procurement management services to better anticipate potential problems in the future and to allocate resources accordingly. In addition, it has developed reliable solutions based on data. It is possible to apply this approach to improve the efficiency of business processes.

To improve the management of stable, functional processes and to provide greater cross-functional visibility, procurement management software provides process management platforms that are based on exceptions. Consequently, more and more consumers are getting into procurement management software. At the end of 2022, 60% of respondents to the KPMG Global Supply Chain Survey indicated that they were planning on increasing their supply chain processes and optimizing them through digital technologies.

- Need for procurement and demand management solution - One of the major factors that is driving procurement as a service industry growth is an increasing need for efficient demand and supply management solutions. Demand management is a practice within the organization that enables businesses to adjust their capacity for meeting variations in demand, or manage levels of demand through strategies such as marketing and procurement. According to a survey published in 2024, the implementation of automation in their processes, more than 55% of businesses have a faster recovery across the globe.

Challenges

- Security concerns associated - The expansion of the procurement as a service market could be slowed down by concerns about the security and confidentiality of personal data. Due to the intrinsic complexity of category management and its various subsystems, this situation will be exacerbated. Since so many sectors need to know about this technology, there will be a lack of space in the market for further growth.

- Complexities with cloud-based programs - The adoption of cloud-based deployment methods is complex and slows down the growth of the procurement as a service market. In addition, the uptake of cloud-based procurement as a service is restricted to larger businesses due to its high costs and market growth is likely to be hampered.

Procurement as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 7.86 billion |

|

Forecast Year Market Size (2035) |

USD 23.34 billion |

|

Regional Scope |

|

Procurement as a Service Market Segmentation:

Component Segment Analysis

Based on the component segment, the strategic sourcing segment in the procurement as a service market is predicted to hold the largest share by 2035. Technological progress has made it more efficient for businesses to source and manage their supply chain, allowing them to lower costs and increase profits. The growing demand for the development of procurement functions within enterprises using technology will lead to procurement as a service market growth over the coming years. For example, TATA Consultancy Services Limited entered into a partnership with the Financial Ombudsman Service of the United Kingdom in April 2022.

In addition, the Ombudsman and TATA Consultancy Services have worked together to improve and develop TCS's digital services in a way that would make them more effective at eliminating complaints and discrimination as well as better serving and supporting clients. In order to ensure that the Ombudsman's technology capabilities are futureproofed, TCS will develop a new digital experience platform that is designed to improve the user experience of complainants and their responses.

Enterprises Size Segment Analysis

Large enterprises segment is set to account for procurement as a service market share of more than 70% by the end of 2035. In order to manage complex contractual agreements and bag agreements, large companies will continue to use these services, taking a significant part of the overall revenue. These services are preferred by large companies, as they reduce operating costs and remove the complexity of doing business. Service providers are chosen by large enterprises because they reduce operating costs and simplify their operations.

Vertical Outlook Segment Analysis

In procurement as a service market, manufacturing segment is likely to showcase substantial growth rate till 2035. The ability of the technology to mitigate supply chain risks can be attributed to the growing use of PaaS solutions in the manufacturing sector. In addition, several companies are entering into strategic partnerships to develop novel solutions that help end users anticipate and mitigate supply chain problems.

For example, in November 2022, Corbus entered into a partnership with GIS for the procurement of supply chain services to enable customers in Europe, Latin America, North America, Asia, and the Middle East & Africa to benefit from infrastructure and resources.

Our in-depth analysis of the procurement as a service market includes the following segments:

|

Component |

|

|

Enterprises Size |

|

|

Vertical Outlook |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Procurement as a Service Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate majority revenue share of 33% by 2035. The region is experiencing a marked increase in the adoption of procurement outsourcing given its large number of small and medium-sized enterprises. Furthermore, government investments in the digitization of businesses are massive. For example, Amazon, Oracle, Microsoft, and Google were awarded a USD 9 billion cloud contract reported as per data.

A significant procurement as a service market driver in the US is expected to be the adoption of procurement as a service by public sector organizations, which will allow for greater transparency and control of costs.

Escalating technological advancement and integration of cutting-edge technologies are to boost the market growth in Canada.

APAC Market Insights

The Asia Pacific procurement as a service market region will also encounter notable growth through 2035. The demand for procurement services in the Asia Pacific region as a service is projected to increase over the forecast period due to the growing economies of developing countries, which are expecting growth in their infrastructure sectors. To support the growth of various sectors, such as manufacturing, automobile, and food & beverage among others, the Indian Government has launched its "Make in India" initiative.

The Indian government is launching Make in India 2.0, which is the next phase of Make in India, and this initiative will focus on futuristic sectors such as robotics. In India, the development of different sectors has benefited from procurement as a service market support and led to exponential growth in procurement as a service for Indian industry in the upcoming years.

In India, demand for new sources of supply has been rapidly increasing. Demand for procurement as a service solution is set to increase significantly by 2035 in order to deal with new sources.

Increased demand for advanced technologies in China has been created by the constant increase in population. Service providers of procurement services have an excellent opportunity to increase their procurement as a service market shares in the region due to increased sales of modern technologies in different sectors.

The opportunity for the electronics market development lies in Japan, which is among the world's most innovative countries.

Procurement as a Service Market Players:

- Bain & Company Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HCL Technologies Ltd

- Accenture plc

- Aegis Company

- Infosys Limited

- International Business Machines Corporation

- Tata Consultancy Services Limited

- Wipro Limited

- WNS (Holdings) Ltd.

- Corbus LLC

The vendors follow the trend of providing their clients with subscription-based, industry-specific, and custom-tailored services and solutions. To gain market shares in various regions and markets as a whole, the competitor also uses organic and inorganic growth strategies such as mergers, acquisitions, product launches, or partnerships.

Recent Developments

- Bain & Company completed the acquisition of ArcBlue, a leading provider of procurement services throughout the Asia Pacific region on February 22, 2022. ArcBlue will operate independently as Bain's special procurement execution service line in the acquisition.

- HCL Technologies has extended its partnership with Google Cloud in March 2021. The expansion is intended to integrate HCL Software Digital Experience and Unica Marketing cloud-native platforms into Google Cloud.

- Report ID: 6187

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Procurement As A Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.