Web3-as-a-Service Market Outlook:

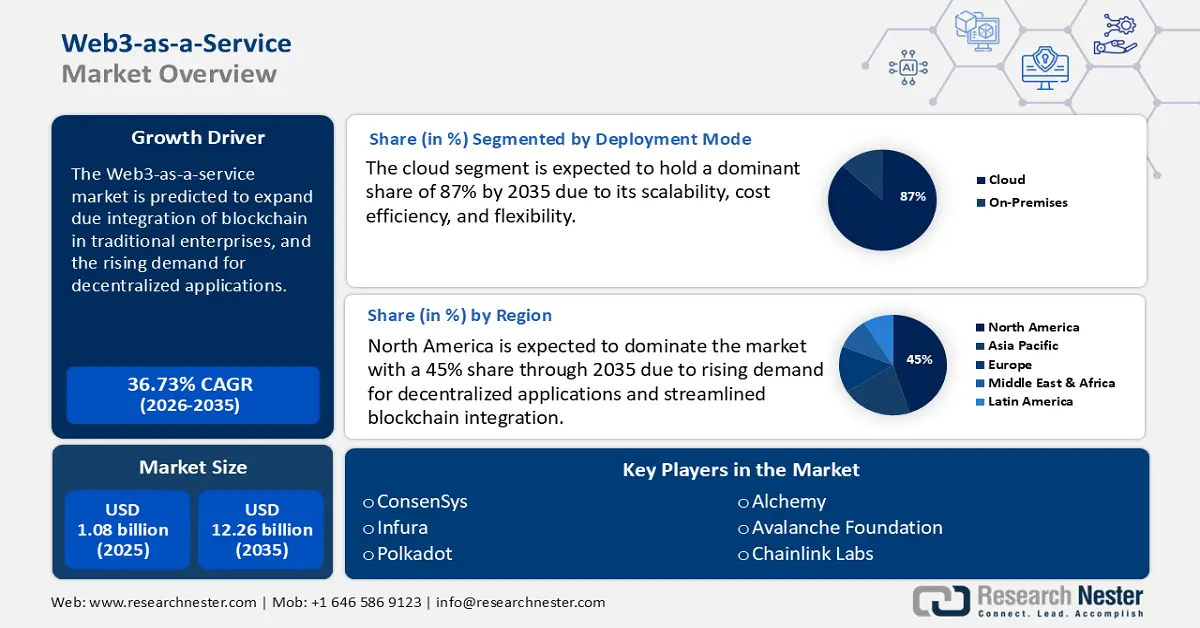

Web3-as-a-Service Market size was valued at USD 1.08 billion in 2025 and is projected to reach USD 12.26 billion by the end of 2035, rising at a CAGR of 36.73% during the forecast period, i.e., 2026-2035. In 2026, the industry size of web3-as-a-service is evaluated at USD 1.36 billion.

The market is primarily driven by the rising demand for decentralized applications. Decentralized applications are gaining traction across finance, gaming, supply chain, and social media due to their potential to reduce censorship, enhance transparency, and increase user control over data. However, decentralized applications (dApps) development requires access to complex infrastructure and secure blockchain environments. W3aaS platforms bridge this gap by offering scalable backend services, such as smart contract deployment, decentralized storage, and blockchain node hosting. As dApps evolve from niche tools to enterprise-grade solutions, demand for W3aaS offerings is predicted to increase.

The rising demand for decentralized apps propels the growth of W3aaS platforms. For instance, Chainstack, a prominent Web3-as-a-service provider, has been instrumental in enhancing the scalability and performance of decentralized applications such as The Graph. By offering managed infrastructure and services such as Elastic Subgraphs, Chainstack enables developers to efficiently deploy and scale their dApps across multiple blockchains, including Ethereum and Polygon. This support allows developers to focus on user experience and innovation while Chainstack handles complex backend operations.

Key Web3-as-a-Service Market Insights Summary:

Regional Highlights:

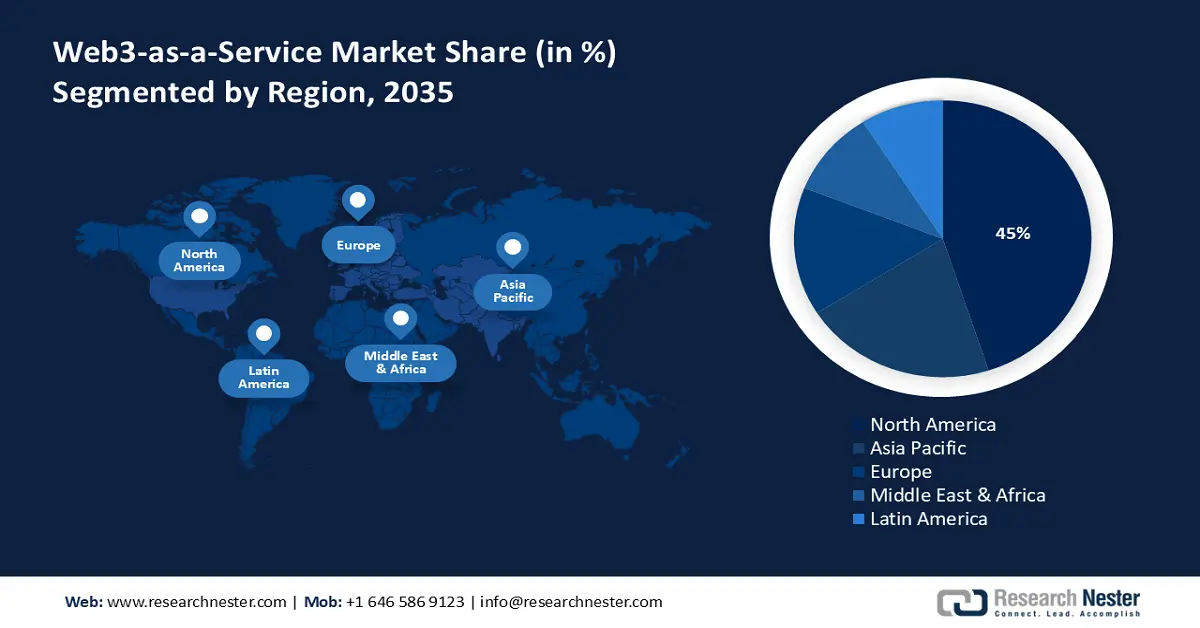

- North America is projected to command a 45% share of the web3-as-a-service market, underpinned by rising demand for decentralized applications and streamlined blockchain integration.

- Asia Pacific is anticipated to capture a substantial share of the market, sustained by its tech-savvy population and accelerating digital transformation.

Segment Insights:

- By 2035, the cloud segment is projected to command an 87% share in the web3-as-a-service market, supported by its scalability, cost efficiency, and flexibility.

- Financial Services segment is expected to secure a 40% share, bolstered by rising demand for decentralized financial solutions that reduce dependence on traditional intermediaries.

Key Growth Trends:

- Integration of blockchain in traditional enterprises

- Expanding ecosystem of tokenization and digital identity

Major Challenges:

- Interoperability across blockchains

- Regulatory uncertainty and compliance risks

Key Players: Alchemy, ConsenSys, Infura, Bison Trails, Ethereum Foundation, Polkadot, Solana Labs, Avalanche Foundation, Binance Smart Chain, Cardano, Chainlink Labs

Global Web3-as-a-Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.08 billion

- 2026 Market Size: USD 1.36 billion

- Projected Market Size: USD 12.26 billion by 2035

- Growth Forecasts: 36.73% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region:North America (45% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, United Arab Emirates, Brazil

Last updated on : 1 October, 2025

Web3-as-a-Service Market - Growth Drivers and Challenges

Growth Drivers

- Integration of blockchain in traditional enterprises: Mainstream enterprises are increasingly exploring blockchain to enhance transparency, automate trust through smart contracts, and ensure tamper-proof recordkeeping. W3aaS providers simplify this transition by offering plug-and-play blockchain components compatible with existing IT environments. This significantly reduces time-to-market and capital expenditure for blockchain integration, making W3aaS a strategic enabler for logistics, insurance, manufacturing, and financial services sectors. For instance, in April 2024, EY launched OpsChain, a blockchain-based supply chain and procurement platform built on Ethereum, using a W3aaS framework. OpsChain enables enterprise clients to track goods, verify supplier credentials, and process payments via smart contracts.

- Expanding ecosystem of tokenization and digital identity: Tokenization of assets ranging from real estate and intellectual property to art and loyalty programs is becoming more prevalent and a key strategy for asset management and customer engagement. Simultaneously, decentralized digital identity systems are gaining regulatory support and are popular as W3aaS platforms support these trends by offering secure, compliant, and interoperable services for token issuance, identity verification, and wallet management. For instance, in January 2025, zkMe introduced zkKYC, a decentralized Know Your Customer solution that leverages zero-knowledge proof technology to verify user identities without exposing sensitive personal data. This innovation aligns with the global compliance standards, including those set by the Financial Action Task Force (FATF), and addresses the growing demand for privacy-preserving identity verification in the web3 ecosystem.

- Surge in venture funding and government support for Web3 initiatives: Global investment in Web3 startups has catalyzed innovation and rapid deployment of W3aaS platforms. For instance, in February 2024, Hack VC raised a USD 150 million fund to invest in early-stage Web3 startups focused on infrastructure and DeFi. This move accelerates the development of foundational Web3-as-a-service platforms and reinforces their role as key infrastructure in the digital economy. Additionally, supportive regulations such as blockchain-friendly legislation and regulatory sandboxes are encouraging enterprise-level experimentation, solidifying W3aaS platforms as key infrastructure providers in emerging digital economies.

U.S. Households' Cryptocurrency Holdings

|

Percentile |

Value |

90% Confidence Interval |

Lower Bound |

Upper Bound |

|

25th Percentile |

$648 |

$227 - $1,069 |

$227 |

$1,069 |

|

50th Percentile |

$2,000 |

$1,269 - $2,731 |

$1,269 |

$2,731 |

|

75th Percentile |

$10,000 |

$7,142 - $12,858 |

$7,142 |

$12,858 |

|

90th Percentile |

$30,800 |

$12,391 - $49,209 |

$12,391 |

$49,209 |

|

95th Percentile |

$92,400 |

$37,342 - $147,458 |

$37,342 |

$147,458 |

Source: 2022 Survey of Consumer Finances and authors’ calculations

Challenges

- Interoperability across blockchains: The fragmented nature of the Web3 ecosystem presents a major challenge as each blockchain network, Ethereum, Solana, Polkadot, and others operate with distinct protocols, consensus mechanisms, and smart contract standards. For W3aaS providers, ensuring seamless interoperability between these networks is technically complex and resource-intensive. Thus, without standardized cross-chain communication and data portability, enterprises may face integration challenges and limited scalability when adopting a decentralized infrastructure.

- Regulatory uncertainty and compliance risks: The ambiguity in regulatory policies poses a significant challenge concerning data privacy, financial compliance, and digital identity standards. As governments move to regulate digital assets and decentralized platforms, W3aaS providers must adapt quickly to evolving rules. This uncertainty poses operational and reputational risks, especially for providers servicing cross-border clients or DeFi protocols.

Web3-as-a-Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

36.73% |

|

Base Year Market Size (2025) |

USD 1.08 billion |

|

Forecast Year Market Size (2035) |

USD 12.26 billion |

|

Regional Scope |

|

Web3-as-a-Service Market Segmentation:

Deployment Mode Segment Analysis

The cloud segment is expected to hold a dominant share of 87% by 2035 due to its scalability, cost efficiency, and flexibility. By leveraging cloud infrastructure, businesses can quickly deploy decentralized applications without large upfront investments in hardware. Cloud platforms also offer enhanced security and reliability, critical for blockchain-based services. This combination, including easy scalability and global access, makes cloud as a deployment mode an attractive choice for Web3 solutions.

Industry Vertical Segment Analysis

By 2035, the financial services segment is anticipated to hold a 40% share due to the increasing demand for decentralized financial solutions that reduce reliance on traditional intermediaries. Blockchain technologies enable faster, cheaper, and more secure transactions, which are highly attractive to consumers and businesses. Additionally, innovations such as smart contracts, tokenization of assets, and decentralized finance (DeFi) are opening up new opportunities for automation, transparency, and liquidity in financial services. For instance, in April 2024, XEROF, a Swiss crypto company, launched a Web3 financial service platform. Its new services include third-party payments and investment tools, helping Web3 and crypto companies reduce the gap between digital and regular money. These services help companies that struggle to access traditional banks. XEROF allows same-day crypto and fiat payments to any third party globally, removing the need for Web3 companies to keep bank accounts. As a result, financial institutions and startups are adopting Web3 technologies to improve efficiency, reduce costs, and provide more inclusive financial products.

Our in-depth analysis of the web3-as-a-service market includes the following segments:

|

Segments |

Subsegments |

|

Deployment Mode |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Web3-as-a-Service Market - Regional Analysis

North America Market Insights

North America is expected to dominate the market with a 45% share through 2035 due to rising demand for decentralized applications and streamlined blockchain integration. Enterprises across the finance and healthcare sectors are adopting blockchain to enhance transparency and data security. A supportive regulatory environment and strong venture capital backing further fuel innovation and platform development. These trends position North America as a leading hub for W3aaS growth.

The U.S. Web3-as-a-Service market leads in enterprise adoption of Web3 technologies, supported by a robust technological infrastructure and a skilled workforce. The presence of major technological hubs, such as Silicon Valley, has fostered innovation and the development of blockchain-based solutions across various sectors, including finance, healthcare, and e-commerce. This environment has enabled businesses to integrate decentralized applications, enhancing transparency and efficiency in operations.

The Web3-as-a-Service market in Canada is driven by the government’s support for the growth of Web3 technologies. Initiatives such as the Canadian Web3 Council’s advocacy for regulatory clarity aim to create a favorable environment for blockchain innovation. Additionally, the increasing adoption of blockchain by small and medium-sized enterprises reflects the country’s commitment to embracing decentralized technologies for economic development.

Asia Pacific Market Insights

Asia Pacific is poised to hold a significant market share during the stipulated period fueled by a tech-savvy population and rapid digital transformation. Countries in the region are adopting blockchain for financial inclusion and decentralized services. Additionally, governmental support in Web3 development through funding and regulatory clarity have been a key driver for growth. This combination of grassroots adoption and institutional support positions Asia Pacific as a leading force in the global Web3 landscape.

China’s Web3-as-a-Service market is expanding rapidly due to government-backed initiatives and a robust digital infrastructure. The Ministry of Industry and Information Technology (MIIT) has introduced a national framework to promote the development of non-fungible tokens, and decentralized applications, aiming to accelerate Web3 innovation across various sectors. Furthermore, the establishment of the National Blockchain and Distributed Accounting Technology Standardization Technical Committee highlights China’s commitment to standardizing blockchain technologies and fostering a conducive environment for Web3 growth. These strategic efforts tend to place China as a significant player in the global Web3 landscape.

In South Korea, the Web3-as-a-Service market is growing due to government initiatives and private-sector investments. In 2022, the government committed over USD 187 million to develop a world-class metaverse ecosystem to position the country among the top five global metaverse markets by 2026. Additionally, private enterprises also contribute significantly to the development of Web3 solutions. For instance, in July 2022, Dunamu invested USD 380 million in Web3 startups to create 10,000 job opportunities. This initiative highlights South Korea’s commitment to becoming a leading player in the global Web3 as a service market.

Europe Market Insights

The Web3-as-a-Service (W3aaS) market in Europe has grown at an unprecedented clip, for a number of reasons. First, the EU has provided strong clarity around projects, particularly through legislation (e.g., Markets in Crypto-Assets (MiCA)) that enables companies to create an environment conducive to the adoption of blockchain, as well as providing regulations for security and consumer protection. Regulatory clarity allows a business to engage fully in emerging technologies like Web3 without regulatory anxiety. Second, Europe has a strong digital infrastructure and a business-friendly ecosystem, in particular in countries like Estonia and Switzerland, that support a strong culture of innovation.

France has rapidly emerged as a focal point for blockchain innovation because of its extensive government support and positive regulatory environment for digital transformation to take place. The national government supports blockchain technology through the France Blockchain Initiative and through public sector incentives to attract firms and start-ups that are in the Web3 space. The fintech ecosystem and interest from luxury brands exploring NFTs and the metaverse have also provided some demand around Web3.

Germany's W3aaS market is growing as the largest economy in Europe with a robust industrial economy. The German government has engaged in some funding and research to treasure blockchain opportunities in decentralized identity and digital assets. Germany's environment for regulation protects security while allowing for innovation. Germany as well is looking at DeFi and tokenization in its financial sector, which is increasing demand for W3aaS.

Key Web3-as-a-Service Market Players:

- Alchemy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ConsenSys

- Infura

- Bison Trails

- Ethereum Foundation

- Polkadot

- Solana Labs

- Avalanche Foundation

- Binance Smart Chain

- Cardano

- Chainlink Labs

The Web3-as-a-Service market is led by companies such as Alchemy, Chainlink Labs, and ConsenSys, which provide robust infrastructure and developer tools essential for building decentralized applications. These firms offer scalable solutions that facilitate the integration of blockchain technologies across various industries, driving the adoption of Web3 services.

Recent Developments

- In March 2025, EOS Network, known for its strong blockchain platform, is changing its name to Vaulta as it shifts focus to Web3 banking. The change includes a token swap by the end of May. It also involves the launch of the Vaulta Banking Advisory Council, made up of financial and blockchain industry experts from Systemic Trust, Tetra, and ATB Financial. Their goal is to connect traditional banking with decentralized systems.

- In January 2025, Moonbeam, a platform for smart contracts, introduced DataHaven, a new decentralized storage system. It’s built to help Web3 developers store data in a secure, censorship-resistant, and trustworthy way with enhanced Ethereum alignment.

- Report ID: 7668

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Web3-as-a-Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.