Contact Center as a Service Market Outlook:

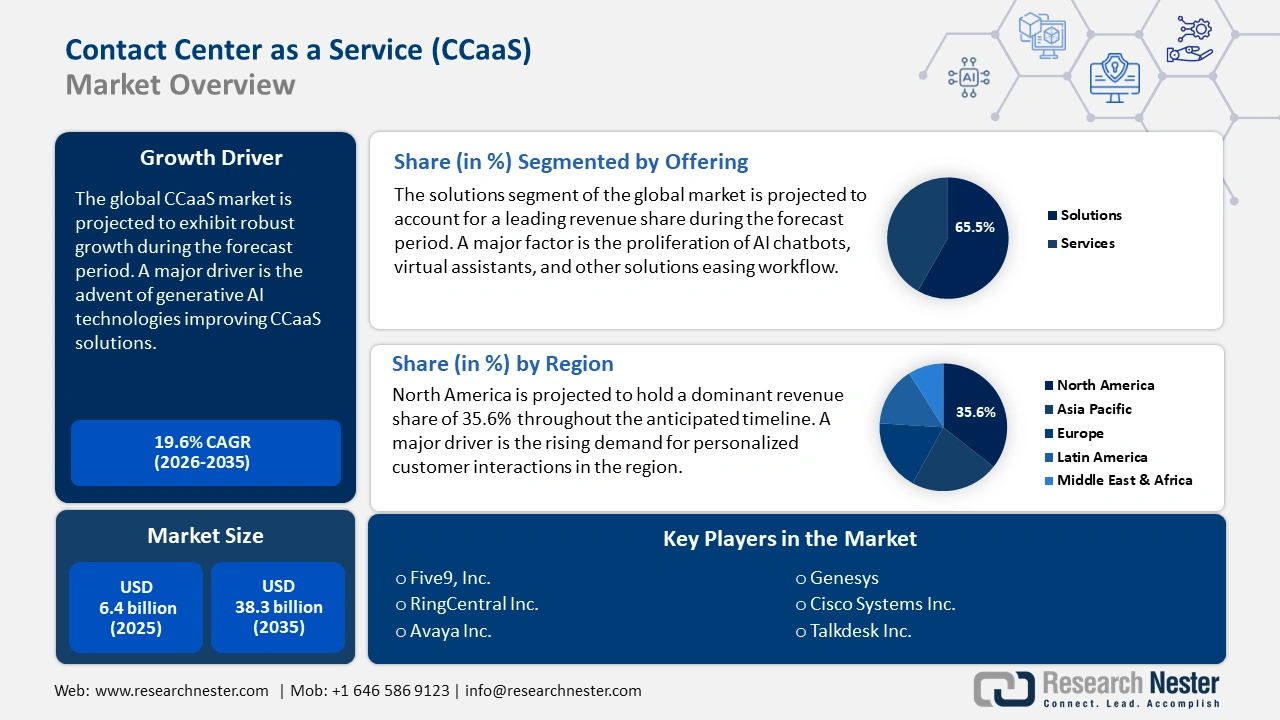

Contact Center as a Service Market was valued at USD 6.4 billion in 2025 and is projected to reach USD 38.3 billion by 2035, expanding at a CAGR of 19.6% during the forecast period from 2026 to 2035. In 2026, the industry size of contact center as a service is assessed at USD 7.6 billion.

The advent of generative AI technologies has enabled the delivery of hyper-personalized customer interactions, allowing for context-aware responses in real-time and improving consumer interactions. This has improved the CCaaS solutions tremendously, boosting the sector’s expansion. In terms of quantifiable data, the European Commission highlighted that more than 42.5% of enterprises in the EU invested in cloud computing services by the end of 2023 to improve customer-facing operations.

The CCaaS market operates in an established supply chain. The supply chain includes the procurement of raw materials for hardware components, software applications, and cloud infrastructure. To quantify the trade activities impacting the sector, the U.S. Census Bureau reported that the U.S. imported approximately USD 629.9 billion in electronics and telecommunications in 2022. The future outlook of the CCaaS market is promising, with lucrative segments set to provide sustained opportunities by the end of 2035.

Key Contact Center as a Service (CCaaS) Market Insights Summary:

Regional Highlights:

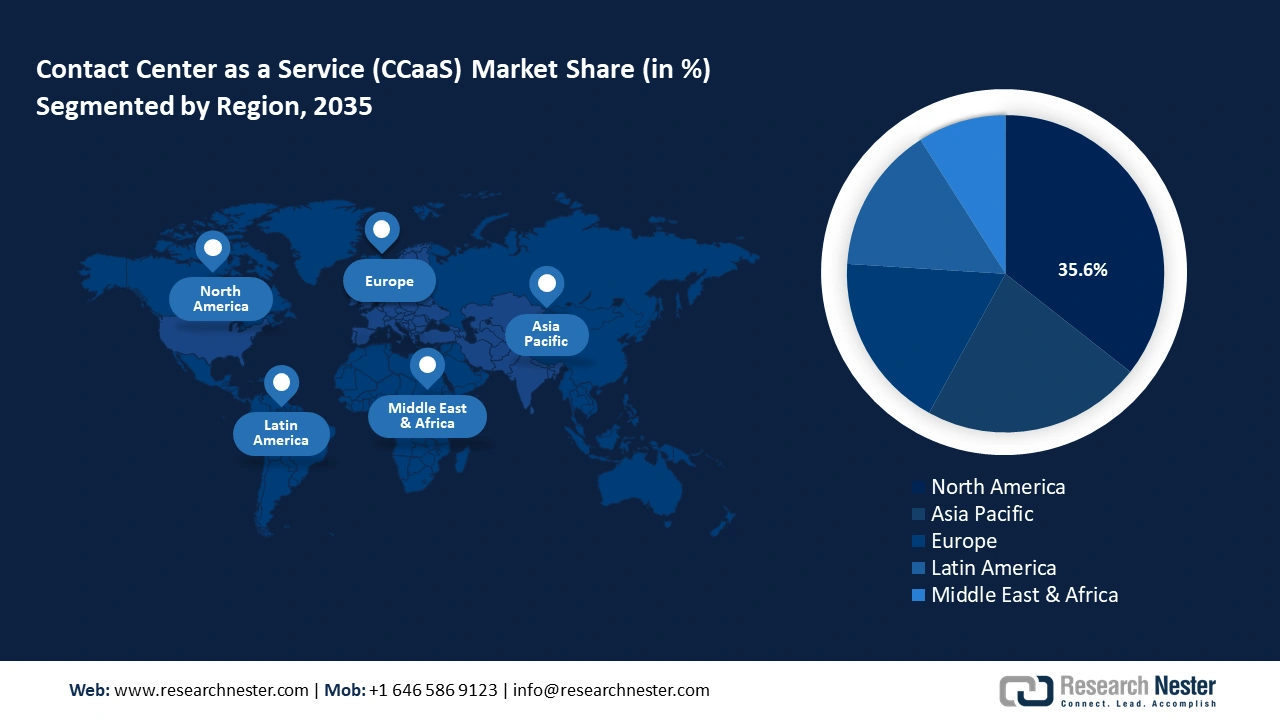

- By 2035, the North America contact center as a service market is projected to secure a 35.6% share, underpinned by accelerating adoption of AI-enabled customer engagement solutions.

- Asia Pacific is anticipated to expand at the fastest CAGR through 2026-2035 as rising digital-transformation investments across major economies stimulate CCaaS uptake.

Segment Insights:

- The solutions segment in the contact center as a service market is expected to command a 65.5% revenue share by 2035, reinforced by escalating integration of virtual assistants, AI chatbots, predictive analytics, and machine learning capabilities.

- The cloud deployment model is forecast to contribute around 78.3% share by 2035, supported by its cost advantages, heightened security, and workforce flexibility.

Key Growth Trends:

- Increase in omnichannel customer support demand

- Shift toward remote and hybrid work models

Major Challenges:

- Integrating legacy systems with cloud-based CCaaS solutions

- Data security, privacy, and compliance risks

Key Players: Five9, Inc., RingCentral, Inc., Avaya, Inc., Genesys, Cisco Systems, Inc., Talkdesk, Inc., 8x8, Inc., TTEC Holdings, Inc., Alcatel-Lucent Enterprise, Voxbone, NEC Corporation, Nokia Corporation, Freshdesk (Freshworks Inc.), M2M Solutions, Eureka Technologies.

Global Contact Center as a Service (CCaaS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.4 billion

- 2026 Market Size: USD 7.6 billion

- Projected Market Size: USD 38.3 billion by 2035

- Growth Forecasts: 19.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 7 October, 2025

Contact Center as a Service Market - Growth Drivers and Challenges

Growth Drivers

- Increase in omnichannel customer support demand: The global CCaaS market is favorably impacted by the rising demand to improve customer support solutions. The demand is rising due to changing consumer preferences, leading to a greater call for seamless experiences across varied communication platforms. In addition, marketing trends highlight that B2C brands with customer-facing omnichannel solutions are experiencing heightened customer retention rates. With the calls for AI-backed omnichannel solutions increasing, the adoption of CCaaS solutions is set to allow companies to provide improved service regardless of the platform.

- Shift toward remote and hybrid work models: The proliferation of remote and hybrid work models is a significant factor in the CCaaS market’s expansion. The advent of hybrid and remote work models was propelled by the COVID-19 pandemic. Another key trend supporting the market is the convergence of cloud-based platform deployment with the demand for contact centers, providing flexibility for agents working from home and bolstering business continuity. In May 2025, Helport AI launched a tool known as Helport Remote, which was developed as a solution for managing remote and hybrid workforces in all contact centers. As contact centers increasingly move agents off-site, i.e., working from home or distributed across locations, companies face challenges around oversight, scheduling, especially over time zones, performance monitoring, assuring compliance, and training. Helport Remote is built to address exactly those issues. With a greater percentage of enterprises predicted to embrace hybrid work models, the demand for CCaaS solutions is positioned to increase.

- Adoption of AI / ML / generative & conversational AI: AI allows automation in the form of chatbots, virtual assistants, predictive routing, sentiment detection, and real-time agent assistance. This improves customer experience and reduces operational costs/agent load. For instance, in October 2024, Cisco introduced AI innovations such as AI Agent Studio, Cisco AI Assistant, and Webex AI Agent functionalities in Webex Contact Center Europe, using conversational intelligence and automation to improve issue resolution and customer satisfaction. Thus, the convergence of AI, ML, and generative or conversational AI into CCaaS platforms is notably transforming customer engagement models.

Challenges

- Integrating legacy systems with cloud-based CCaaS solutions: A major hindrance of the CCaaS market is the challenge of integrating cloud-based platforms with legacy on-premise contact center infrastructure. Numerous organizations tend to be reliant on legacy on-premise solutions. A key factor of the reliance is the significant investment associated with a complete system overhaul. A key facet of the CCaaS market is real-time communication, which itself faces impediments from constraints in the integration of legacy systems.

- Data security, privacy, and compliance risks: While CCaaS platforms grant flexibility and scalability, moving sensitive customer data to the cloud introduces significant security and compliance challenges. Contact centers routinely handle personal identifiable information (PII), financial details, and, in some cases, health-related data. Any breach or unauthorized access can lead to reputational damage and hefty regulatory penalties. With regulations such as GDPR in Europe, CCPA in California, and evolving data localization laws in the Asia Pacific, CCaaS providers must continually upgrade security protocols and ensure compliance across multiple jurisdictions. For instance, organizations in sectors like BFSI and healthcare are cautious about adopting CCaaS unless providers can demonstrate robust encryption, secure data residency options, and adherence to global as well as local compliance standards. This creates a barrier for vendors and slows adoption in highly regulated industries.

Contact Center as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.6% |

|

Base Year Market Size (2025) |

USD 6.4 billion |

|

Forecast Year Market Size (2035) |

USD 38.3 billion |

|

Regional Scope |

|

Contact Center as a Service Market Segmentation:

Offering Segment Analysis

The solutions segment is poised to hold a leading revenue share of 65.5% throughout the forecast timeline. A key driver is the proliferation of virtual assistants, AI chatbots, predictive analytics, and machine learning-based solutions that have automated routine tasks. The advent of these solutions has reduced the burden on human agents as well as improved workflows. Key players are rapidly adopting the solutions to ensure heightened opportunities in the market for deployment. For instance, in April 2024, Zendesk, a major player in the CCaaS market, launched an AI-powered chatbot that is designed to improve customer service by automating repetitive tasks and ensuring personalized customer interactions.

Deployment Mode Segment Analysis

The cloud deployment model in the contact center as a service is projected to remain as a leading segment throughout the forecast period by accounting for around 78.3% revenue share. The cloud-based deployment is at the forefront of expansion due to the cost-effectiveness associated. Industries are at the forefront of the adoption of cloud-based CCaaS platforms. Additionally, cloud-based deployment offers improved security features and the flexibility of supporting a hybrid or remote workforce, bolstering the growth curve.

Industry Vertical Segment Analysis

The BFSI segment is emerging as one of the fastest-growing adopters of contact center as a service, fueled by the rising need for safe, real-time, and omnichannel customer engagement. Banks, insurers, and financial institutions are taking up CCaaS to streamline digital interactions, enhance fraud detection, and deliver personalized services through AI-driven chatbots and voice assistants. The sector also benefits from the scalability and compliance features of cloud-based platforms, allowing them to handle seasonal surges in customer inquiries while meeting strict regulatory requirements.

According to recent industry reports, BFSI organizations are increasingly moving to cloud contact centers to reduce costs and improve customer retention. For instance, in July 2024, SS&C Technologies Holdings, Inc. established a new contact center platform to revolutionize customer engagement in the asset management, life insurance, pensions, and retirement sectors. The unified global platform enables clients to deliver personalized, round-the-clock customer communications. Beyond voice, email, and secure messaging, it incorporates intelligent automation that allows investment managers to quickly access customer data and provide seamless experiences across diverse products and markets.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Offering |

|

|

Deployment Mode |

|

|

Industry Vertical |

|

|

Function |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contact Center as a Service Market - Regional Analysis

North America Market Insights

The North America contact center as a service market is estimated to hold a dominant revenue share of 35.6% during the forecast period. The regional market’s growth is supported by the rising adoption of AI-based customer-facing solutions across various industries. Additionally, trends in North America highlight a heightened rate of cloud migration, which paves the continued adoption of CCaaS. With consumer trends shifting, the opportunities in the North America CCaaS market are rising for the deployment of advanced AI-based solutions.

The market in the U.S. is expanding rapidly, driven by strong adoption of AI-driven customer engagement, cloud migration, and the need for omnichannel experiences. U.S. enterprises are emphasizing enhancing customer satisfaction while lowering operational costs, making cloud-based contact centers a strategic choice. Industries such as retail, healthcare, and BFSI are top adopters, combining CCaaS platforms to optimize customer journeys and achieve real-time insights. The rise of remote and hybrid work culture further promotes demand for scalable and secure CCaaS solutions. For instance, in March 2025, Zoom Video Communications revealed the expansion of its Zoom Contact Center with AI Companion features, helping U.S. businesses to offer smarter, personalized, and efficient customer support. Additionally, the U.S. market has been at the forefront of embracing cloud-based solutions, which have assisted enterprises in leveraging cost-effective solutions to streamline workflows.

In Canada, the contact center as a service market is poised to grow due to the country's increasing digital transformation initiatives, customer experience, and rapid cloud adoption in enterprises. Organizations in Canada are looking for scalable solutions that can integrate multiple communication channels and support remote agents efficiently. The market is also fueled by the rising presence of fintechs and e-commerce players, which depend heavily on agile customer support platforms. Additionally, compliance with Canadian data privacy regulations is forcing CCaaS providers to offer secure, locally compliant services. A notable example came in March 2024, when TELUS International improved its CCaaS offerings in Canada by integrating generative AI capabilities, helping Canadian businesses improve efficiency and deliver faster, personalized customer interactions.

APAC Market Insights

The APAC contact center as a service market is rising at the fastest CAGR during the forecast period from 2026 to 2035. The lucrative growth is associated with the rising investments to hasten the digital transformation initiatives across multiple economies in the region. Additionally, APAC has large-scale consumer-centric economies such as India, where customer support outsourcing trends are rife, creating opportunities for the deployment of CCaaS services. As the disposable income in multiple APAC economies increases, the focus on creating improved customer service solutions has heightened, ensuring a steady demand for CCaaS within the regional sector.

The India contact center as a service market is predicted to expand at a rapid CAGR during the forecast period, driven by digitalization, e-commerce expansion, and demand for 24/7 support. This digitalization can be understood as top key players are expanding CCaaS solutions to remain competitive market. In June 2025, Zoom developed its AI-first, video-optimized Contact Center in India, alongside expanding Zoom Phone services to top regions including Mumbai, Bengaluru, Hyderabad, Andhra Pradesh, and Delhi-NCR. Rising hybrid work adoption, supportive government cloud policies, and a rising tech-savvy workforce further strengthen the country’s market presence.

In China, the contact center as a service market is increasing as enterprises largely adopt AI-driven conversational tools, cloud-native platforms, and omnichannel engagement models to fulfill rising consumer expectations. The country’s expanding e-commerce and fintech ecosystems necessitate highly flexible and efficient customer service infrastructures, which CCaaS platforms provide. Government support for cloud adoption and digital transformation initiatives is also supporting the trend. Companies in China are also focusing on local compliance and security, making domestic CCaaS providers very competitive. For instance, in July 2024, Alibaba Cloud upgraded its Intelligent Contact Center with next-generation AI and real-time analytics features, helping Chinese businesses to manage peak shopping season demands while granting personalized customer interactions.

Europe Market Insights

The market in Europe is predicted to hold a notable share during the forecast period as enterprises across sectors embrace AI-driven automation, omnichannel engagement, and cloud-first strategies to enhance customer experience. Regulatory requirements like GDPR are also pushing companies toward secure and compliant CCaaS platforms. The growing e-commerce industry, together with demand for multilingual and personalized services, is further driving adoption. European businesses are increasingly investing in AI chatbots and agent-assist tools to reduce operational costs while improving customer satisfaction.

In the UK, the contact center as a service market is growing due to rising demand for scalable cloud-based contact centers that can support hybrid work models and cost-efficient operations. The retail, BFSI, and healthcare sectors are primary adopters, looking to offer seamless digital-first customer journeys. With well-defined digital transformation initiatives, businesses are merging AI-powered analytics and conversational tools to improve agent productivity and personalization. The UK’s fintech and e-commerce platforms are also pushing CCaaS adoption to fulfill rising customer engagement expectations. For instance, in August 2025, 8x8 expanded its UK CCaaS solutions with AI and automation potential, enabling businesses to optimize workflows and offer quicker, more efficient support.

The CCaaS market in Germany is expanding fast, owing to the rising trend of data security and AI-enabled consumer engagement. Businesses are adopting CCaaS to manage a huge number of digital interactions while adhering to strict data protection and compliance standards. The country’s manufacturing and automotive industries are also deploying CCaaS solutions to control customer support, dealer communication, and after-sales services. The increase in remote and hybrid work further indicates the demand for scalable and reliable platforms.

Key Contact Center as a Service Market Players:

- Five9, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RingCentral, Inc.

- Avaya, Inc.

- Genesys

- Cisco Systems, Inc.

- Talkdesk, Inc.

- 8x8, Inc.

- TTEC Holdings, Inc.

- Alcatel-Lucent Enterprise

- Voxbone

- NEC Corporation

- Nokia Corporation

- Freshdesk (Freshworks Inc.)

- M2M Solutions

- Eureka Technologies

The CCaaS market is exhibiting growth and maturity through established technologies and increasing market penetration. The market is competitive with leading players such as Five9, RingCentral, Genesys, etc., leading the revenue share. Trends highlight that major players are partnering with local providers to expand their market footprint. The table below highlights the major players in the global contact center as a service market:

Recent Developments

- In July 2025, Japan’s leading BPO provider, transcosmos inc., entered into a strategic partnership with India-based Cogent E-Services Limited to deliver contact center services across both the Indian domestic market and international markets.

- In April 2025, NICE announced that it had been named a Leader in Contact Center as a Service by Forrester Research. The Forrester Wave: Contact-Center-as-a-Service (CCaaS) Platforms, Q2 2025 report highlights NICE as one of the most prominent cloud contact center platforms in the industry.

- Report ID: 3007

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contact Center as a Service (CCaaS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.