Device as a Service (DaaS) Market Outlook:

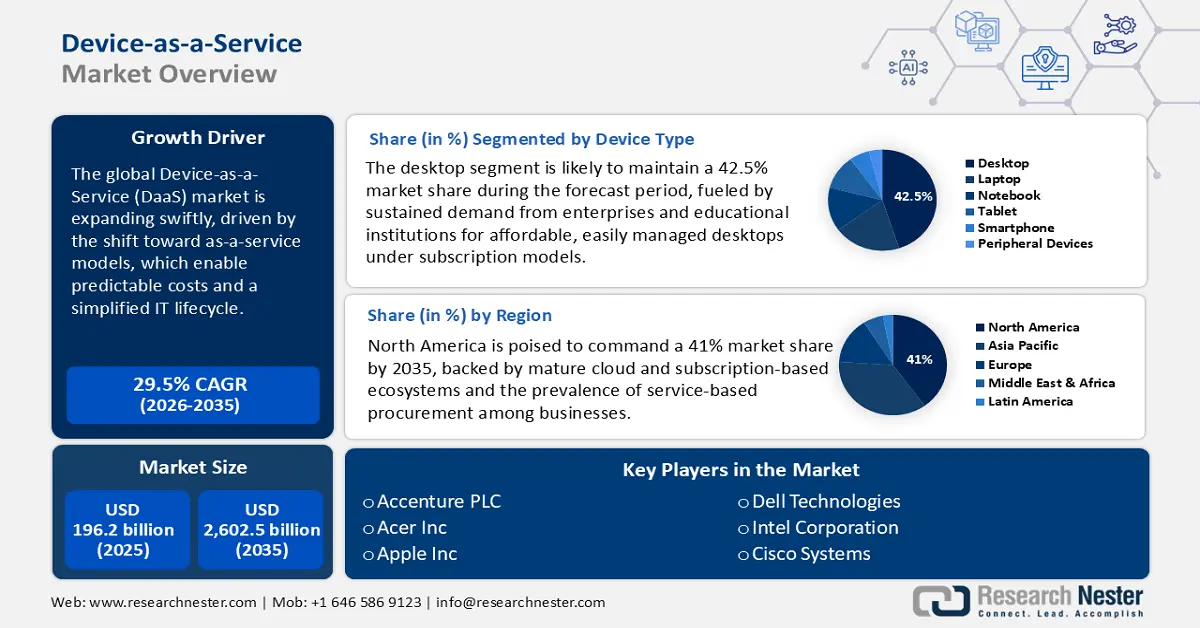

Device as a Service (DaaS) Market size is valued at USD 196.2 billion in 2025 and is projected to reach a valuation of USD 2,602.5 billion by the end of 2035, rising at a CAGR of 29.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of device as a service (DaaS) is estimated at USD 254 billion.

The Device-as-a-Service (DaaS) industry is expanding at a rapid pace as companies increasingly favor flexible, subscription-based IT procurement. The transition is intended to enhance scalability and move from capital to operational expenses. Providers today are differentiating themselves by incorporating sustainability, an evolution highlighted by HP Inc.'s March 2024 introduction of a DaaS solution focused on refurbished devices and responsible end-of-life recycling. The move is a device as a service market shift toward matching technology lifecycle management to business sustainability goals.

Government bodies are also propelling DaaS adoption through revised procurement frameworks, looking for service-focused paradigms. In April 2025, the General Services Administration (GSA) launched the OneGov Strategy, a long-term initiative to modernize how federal agencies acquire goods and services, beginning with IT. The strategy aims to move federal procurement away from agencies purchasing in silos and toward leveraging the government's buying power as a single, large customer. Such adoption on a government level vindicates the DaaS model as functional and cost-effective, establishing it as part of organizational IT planning of the future.

Key Device-as-a-Service Market Insights Summary:

Regional Highlights:

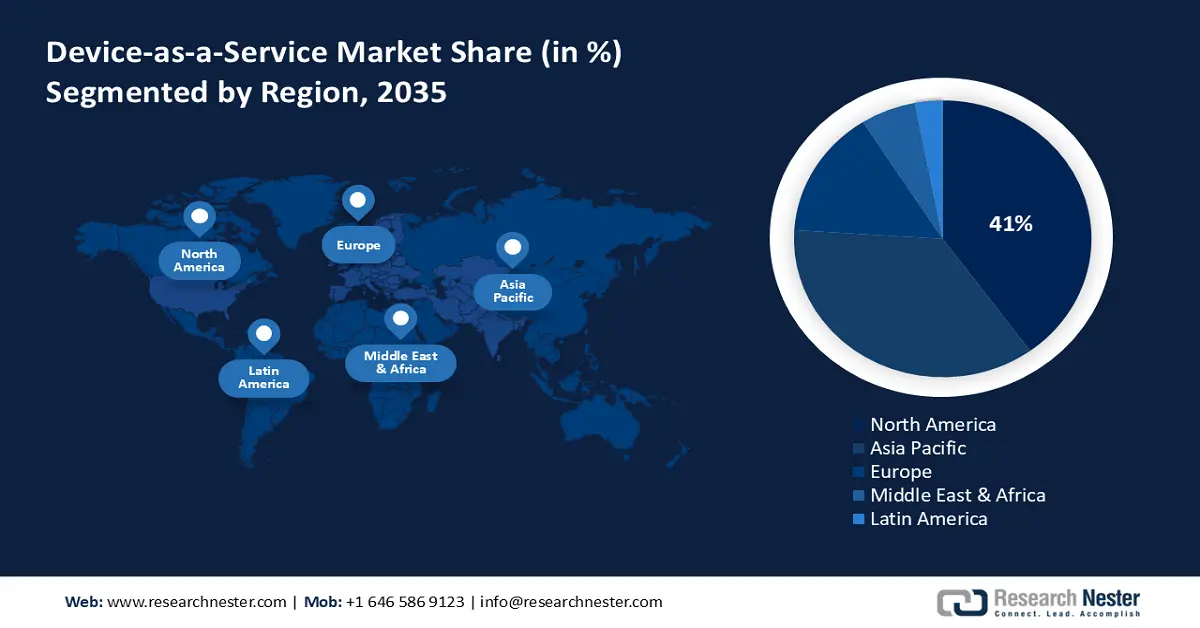

- North America is anticipated to secure a 41% share of the device as a service (DaaS) market by 2035, supported by a mature IT ecosystem and the widespread shift toward hybrid and remote work models that stimulate demand for scalable subscription-based device management solutions.

- Asia Pacific is projected to record a 20.0% CAGR from 2026–2035, propelled by rapid digital transformation and rising government investment in IT infrastructure.

Segment Insights:

- The desktop segment is set to retain a 42.5% share of the Device as a Service (DaaS) Market by 2035, sustained by enterprise demand for secure, high-performance fixed systems and reinforced by the emphasis on sustainable lifecycle management.

- The enterprises segment is forecast to command a 62.0% share by 2035, bolstered by the shift toward scalable consumption models that streamline global device procurement and deployment.

Key Growth Trends:

- AI integration for lifecycle management

- Enterprise focus on sustainability

Major Challenges:

- Changing cybersecurity and data privacy regulations

- Securing a distributed and heterogeneous device estate

Key Players: Accenture Plc, Dell Technologies Inc., HP Inc., Lenovo Group Limited, Microsoft Corporation, Cisco Systems, Inc., CompuCom Systems, Inc., Atea Global Services Ltd., Telstra Corporation Limited, Samsung SDS, HCLTech, Maxis Berhad, Fujitsu Limited, NEC Corporation, Hitachi Vantara.

Global Device-as-a-Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 196.2 billion

- 2026 Market Size: USD 254 billion

- Projected Market Size: USD 2,602.5 billion by 2035

- Growth Forecasts: 29.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Indonesia, Brazil, UAE

Last updated on : 3 October, 2025

Device as a Service (DaaS) Market - Growth Drivers and Challenges

Growth Drivers

- AI integration for lifecycle management: AI integration into DaaS platforms is a major growth driver, which makes predictive device health analytics, refresh cycles optimized, and robust endpoint security. This cognitive layer of management takes DaaS from a simple hardware subscription service to an intelligent, data-driven service. In May 2025, during its annual Think conference, IBM announced new hybrid cloud technologies, including advancements for its watsonx AI portfolio and AI-powered database management features. This software is designed to help businesses, particularly those with complex hybrid cloud environments, manage and scale enterprise AI applications and resources more efficiently.

- Enterprise focus on sustainability: Corporate sustainability goals and circular economy thinking are increasingly influencing IT purchasing, rendering DaaS an attractive model. Solution providers are responding by incorporating sustainability elements into their offerings, including device refurbishment, environmentally responsible recycling, and carbon footprint tracking. An example is Lenovo's launch of its TruScale DaaS with modular sustainability features in August 2025. The solution allows organizations to manage their carbon footprint and reduce IT costs by including carbon tracking and offset credits, linking directly IT operations to overall environmental objectives.

- Streamlined and bundled solutions: Businesses are seeking streamlined buying arrangements that combine hardware, software, connectivity, and managed services into a single, predictable subscription. It simplifies the administration of complexity while providing a single point of contact for IT support, particularly for remote workers. Highlighting this trend, Honeywell partnered with Verizon in January 2025 to offer a bundled DaaS solution. Such a solution, one that integrates hardware, 5G connectivity, and managed services, simplifies tech procurement for retail and logistics companies by providing an end-to-end, plug-and-play solution.

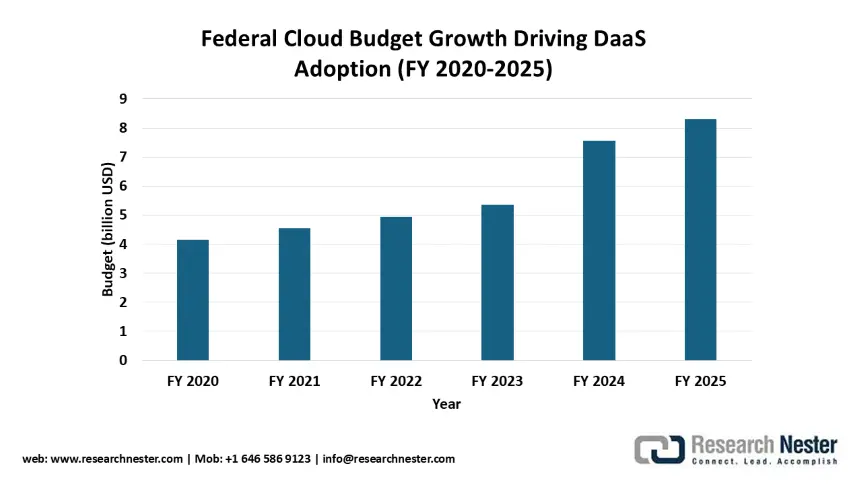

Federal Cloud Budget Growth Driving DaaS Adoption (FY 2020-2025)

The significant growth in federal cloud budgets, reaching $8.3 billion for FY 2025, directly accelerates Device-as-a-Service adoption by creating the infrastructure necessary for modern device management. This funding surge enables agencies to transition from capital-intensive device purchases to operational expense models that include regular refreshes and comprehensive support. The $2.2 billion budget jump between FY 2023-2024 particularly signals increased prioritization of digital transformation initiatives where DaaS plays a critical role.

Source: GovWin

Challenges

- Changing cybersecurity and data privacy regulations: The DaaS model, wherein third-party management of devices storing sensitive corporate and individual data occurs, is greatly threatened by the evolving nature of cybersecurity and data privacy regulations. Providers are confronted with a knotty mess of rules, which may vary significantly geographically. The release of India's draft Digital Personal Data Protection Rules in July 2025, for instance, imposes strict guidelines on the handling of personal data. This matters to DaaS providers, who must ensure their device management and data processing processes are fully compliant to provide services to clients in regulated sectors like BFSI and healthcare.

- Securing a distributed and heterogeneous device estate: DaaS vendors and their end-users have to deal with the constant challenge of protecting a distributed fleet of devices against an increasingly broad array of cyber threats. With hybrid work becoming the reality, the attack surface widens, requiring robust, multi-layered security solutions able to protect devices on and off the corporate network. Governments also exert pressure in the form of demanding higher security standards. In 2024, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) released updated guidelines for endpoint and mobile device security, which in turn obliges DaaS providers in the public sector to offer pre-configured devices that meet these high-level security requirements.

Device as a Service (DaaS) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

29.5% |

|

Base Year Market Size (2025) |

USD 196.2 billion |

|

Forecast Year Market Size (2035) |

USD 2,602.5 billion |

|

Regional Scope |

|

Device as a Service (DaaS) Market Segmentation:

Device Type Segment Analysis

The desktop segment is likely to maintain a considerable 42.5% of the device as a service market share during the forecast period. Despite the ubiquity of mobile devices, desktops remain a cornerstone of enterprise IT, valued for their speed, security, and cost-effectiveness in fixed environments. The DaaS model allows for more simplicity in managing many desktops and ensuring they are kept current with the newest software and security patches. The value proposition of lifecycle management for such devices is highlighted by joint efforts like the April 2024 joint announcement by NTT DATA and HP to provide a Sustainable Device-as-a-Service solution with hardware CO2 offset services. The focus on sustainable lifecycle management highlights the value proposition of DaaS for large-scale desktop deployments.

Organization Size Segment Analysis

The enterprises sector is predicted to dominate the DaaS market, holding a 62.0% share by 2035. Businesses are the primary adopters as DaaS offers a scalable and affordable means of managing huge, usually worldwide dispersed device fleets, thereby streamlining procurement, deployment, and end-of-life cycles. The ability to move from enormous capital costs to controllable operating costs is the primary financial driver. The popularity of the model among large enterprises is evident in the development of enterprise-specific solutions, such as IBM's announcement to introduce IBM Storage Ceph as a Service in March 2025, which added its DaaS solution to respond to the large customers' demand for flexible on-premises consumption models. This is evidence of how the providers are tailoring their solutions to cater to the complex demands of large-scale organizations.

Component Segment Analysis

The services segment, including deployment, management, security, and end-of-life services, is expected to hold a firm 43% device as a service market share through 2035. With IT ecosystems growing more complex, the demand for comprehensive managed services is on the rise to allow in-house IT professionals to delegate day-to-day device handling and focus on strategic initiatives. The value of expert service providers is being recognized in the form of industry consolidation, as demonstrated by Ameresco's March 2025 purchase of ASA Controls. The move, which further situates Ameresco to deliver advanced smart building and controls solutions, reinforces the growing relevance of a strong service component within the DaaS model.

Our in-depth analysis of the device as a service (DaaS) market includes the following segments:

|

Segment |

Subsegments |

|

Device Type |

|

|

End use |

|

|

Component |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Device as a Service (DaaS) Market - Regional Analysis

North America Market Insights

North America is anticipated to maintain a commanding 41% device as a service market share during the forecast period, fueled by a mature IT market, a high rate of adoption of cloud and subscription offerings, and the strong establishment of prominent DaaS vendors. The region's vibrant business environment and the dominance of hybrid and remote work models fuel a high demand for scalable and adaptable device management solutions.

The U.S. boasts a developed market in North America, boasting a very competitive device as a service market that promotes constant innovation in DaaS products. Government agencies at the federal and state levels are increasingly adopting the DaaS model to refresh their IT infrastructure and improve efficiency. For instance, Louisiana's Office of Technology Services (OTS) highlighted its in-house Device-as-a-Service (DaaS) approach in 2024. This model positions OTS as a managed service provider for the state's executive branch, overseeing the entire device lifecycle from procurement to asset recovery.

Canada DaaS market is experiencing robust growth with the backing of government programs for facilitating the adoption of digital technology among small and medium-sized businesses (SMEs). These initiatives are facilitating improved availability of current IT solutions, including DaaS, to a larger number of businesses. In April 2024, following the early closure of the Boost Your Business Technology stream of the Canada Digital Adoption Program (CDAP), Canadian policy experts analyzed the program's mixed success, noting that a large portion of the budgeted $4 billion remained unspent. This analysis highlights ongoing government efforts to improve digital technology adoption among SMEs, a trend that continues to support the broader IT hardware market.

APAC Market Insights

Asia Pacific device as a service market is predicted to witness a CAGR of 20.0% between 2026 and 2035, led by increasing digital transformation, expanding mobile workforce, and increasing government expenditure in IT infrastructure. Increasing and diverse economies of the region provide immense opportunities for DaaS players. This growth is expected to be extremely strong in emerging economies, where businesses are progressively adopting innovative technologies to enhance efficiency and productivity.

China market is also characterized by the high government assistance given to its domestic technology industry, making domestic hardware producers like Lenovo highly competitive in the global DaaS industry. In October 2024, China's Ministry of Industry and Information Technology (MIIT) announced measures to support the growth of domestic technology companies, including enhanced financial backing through mergers, acquisitions, and listings, as well as efforts to help firms expand their device as a service market reach. This policy is aimed at boosting the country's technology sector and increasing its global competitiveness.

India is a rapidly rising DaaS market, driven by the government's vision for an ambitious Digital India and a fast-emerging startup environment. The government is promoting the adoption of digital solutions aggressively to improve governance and public services, resulting in high demand for low-cost IT procurement models. In August 2024, the Government e-Marketplace (GeM) celebrated its 8th Foundation Day, highlighting significant milestones in streamlining government procurement and fostering digital transformation in India. This initiative has made it simple for DaaS providers to offer their subscription device packs to the public sector, and acceptance is gaining, at a rapid pace.

Europe Market Insights

Europe DaaS market is likely to experience consistent growth sustained by a strong regulatory appetite for sustainability and cybersecurity, and a well-developed business culture in which operational efficiency is valued. Regulatory mandates for compliance with pan-European regulations are one of the key drivers compelling business organizations to look toward managed device services. This continued emphasis on security controls that are aggressive in nature and environmentally friendly practices will make DaaS an increasingly central part of European business strategies for the current age and create competitiveness and innovation.

Germany is a key device as a service market in Europe, wherein there is considerable emphasis placed on green IT and data protection. The administration heavily promotes green procurement practices, which align with the lifecycle management benefits of DaaS. In late 2024, the German Federal Cabinet adopted the National Circular Economy Strategy (NCES), consolidating various goals and measures. While not exclusively focused on IT, the strategy emphasizes resource efficiency and includes ICT & electronic devices as a key field of action, with public procurement identified as a tool to promote these goals.

The UK market is characterized by an extensive use rate of flexible work patterns and sound public sector preference for low-cost IT acquisition. The government actively encourages the use of service-based approaches to IT infrastructure modernization across various industries. In October 2023, the UK Crown Commercial Service (CCS) launched its new Technology Products and Associated Services framework, including enhanced scope to cover new and future technologies, alongside sector-specific lots for health and education. The framework allows public sector organizations to procure a wide range of IT products and services, including subscription-based models like DaaS, and supports sustainable IT practices through options for refurbished hardware.

Key Device as a Service (DaaS) Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The device as a service market is dominated by the global top IT and consulting vendors such as Accenture Plc, Dell Technologies Inc., HP Inc., Lenovo Group Limited, and Microsoft Corporation. Leaders in the marketplace are vying for share by expanding into new services, adding emerging technologies such as AI, and focusing on high verticals such as healthcare and government. Competition is not about leasing hardware, but the richness and excellence of the overall lifecycle management offering, establishing a dynamic and innovative market.

Strategic acquisitions and investments in AI are leading trends shaping the competitive landscape as vendors seek to differentiate their offerings. In a significant move, HP Inc. acquired Humane's AI software business in February 2025. The initiative, which includes the creation of the HP IQ innovation lab, aims to bring HP's AI-powered DaaS solutions to more enterprise customers, pointing to the industry-wide competition to add intelligence to device management and deliver greater value to customers.

Here are some leading companies in the device as a service market:

|

Company Name |

Country |

Market Share (%) |

|

Accenture Plc |

Ireland |

23.0 |

|

Dell Technologies Inc. |

U.S. |

15.0 |

|

HP Inc. |

U.S. |

14.0 |

|

Lenovo Group Limited |

China |

12.0 |

|

Microsoft Corporation |

U.S. |

8.0 |

|

Cisco Systems, Inc. |

U.S. |

xx |

|

CompuCom Systems, Inc. |

U.S. |

xx |

|

Atea Global Services Ltd. |

Norway |

xx |

|

Telstra Corporation Limited |

Australia |

xx |

|

Samsung SDS |

South Korea |

xx |

|

HCLTech |

India |

xx |

|

Maxis Berhad |

Malaysia |

xx |

|

Fujitsu Limited |

Japan |

xx |

|

NEC Corporation |

Japan |

xx |

|

Hitachi Vantara |

Japan |

xx |

Below are the areas covered for each company in the device as a Service (DaaS) market:

Recent Developments

- In September 2025, Cisco partnered with Tata Communications to advance global eSIM and IoT connectivity services, enhancing device management capabilities and offering seamless activation and scaling for enterprises. This collaboration aimed to accelerate the adoption of IoT solutions across various industries.

- In March 2025, Dell Technologies launched new subscription-based Device-as-a-Service packages that combine hardware, software, and AI-driven maintenance. These offerings are designed for the education and healthcare sectors, helping them manage their device lifecycle more efficiently.

- In January 2025, Lenovo completed its Microsoft Solutions Partner designations, enhancing its cloud and AI solutions and solidifying a long-term alliance. This builds on existing offerings like Lenovo TruScale Hybrid Cloud with Microsoft Azure Stack HCI.

- Report ID: 3703

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Device-as-a-Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.