Feldspar and Nepheline Syenite Market Outlook:

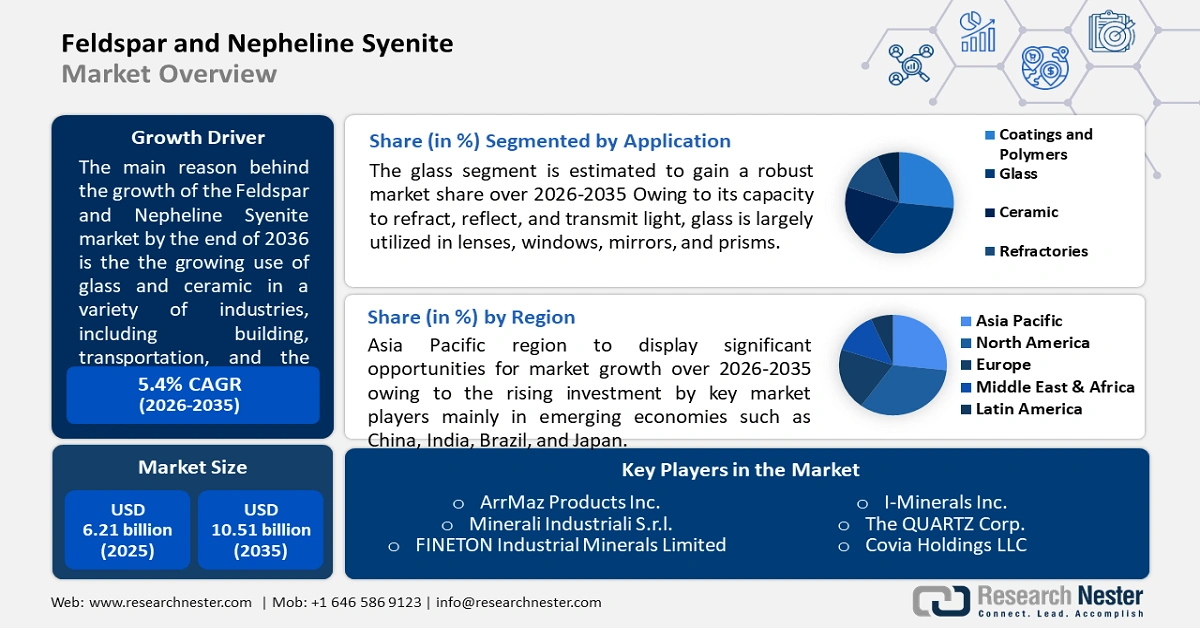

Feldspar and Nepheline Syenite Market size was valued at USD 6.21 billion in 2025 and is set to exceed USD 10.51 billion by 2035, expanding at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of feldspar and nepheline syenite is estimated at USD 6.51 billion.

The growth of the market can be attributed to the growing use of glass and ceramic in a variety of industries, including building, transportation, and the automobile industry, backed by the rising sales and production of automobiles and the growing construction sector. As per the data from the International Energy Agency (IEA), electric vehicle sales reached 2.1 million in 2019 worldwide, increasing from the sales of the year 2018, and rising the electric vehicles stocks to 7.2 million.

Further, with the rise of the pandemic, the increased demand for feldspar and nepheline syenite is estimated to rise due to their special qualities and used as an important element in the manufacturing of fillers, paints, and coatings. Moreover, the rising manufacturing of paints worldwide and increasing utilization of paint in many architectural coatings are expected to drive market growth. As per the reports, an estimated total amount of 860 million gallons of architectural paint was utilized in the United States in 2020, and over 350 million gallons of architectural paint was consumed in the United States by the DIY ('do it yourself') segment.

Key Feldspar and Nepheline Syenite Market Insights Summary:

Regional Highlights:

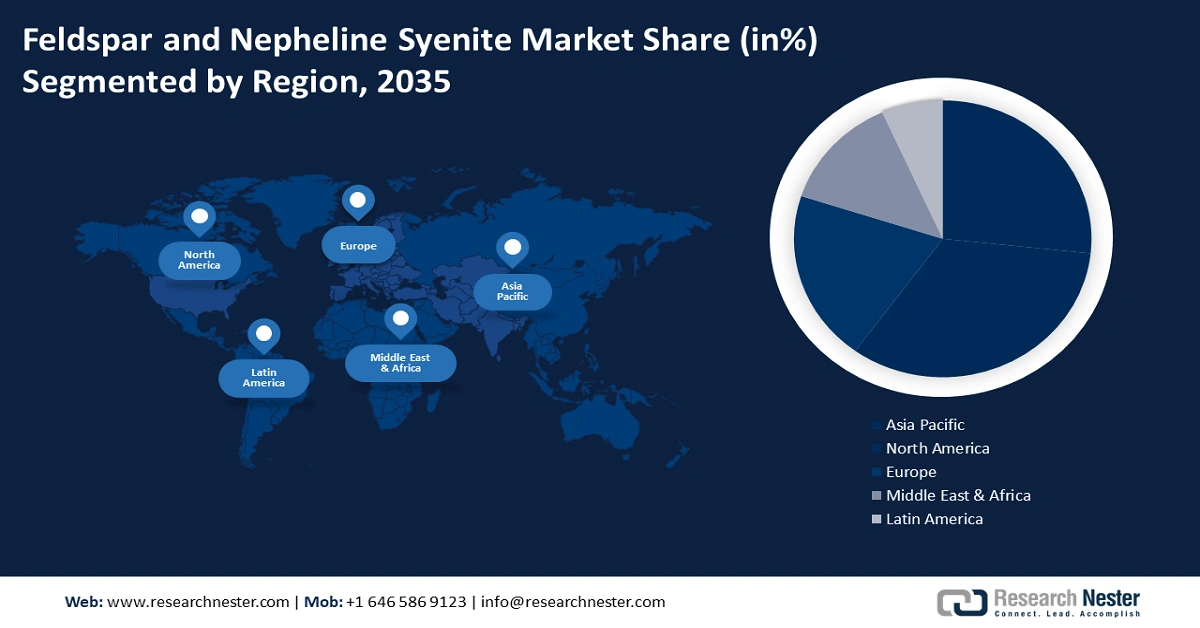

- Asia Pacific feldspar and nepheline syenite market holds the largest share by 2035, driven by growth in end-user industries like ceramic and automobile, backed by investments.

- North America market will secure the second largest share by 2035, driven by migrants, cultural adoption, and nepheline deposits boosting production.

Segment Insights:

- The ceramic (application) segment in the feldspar and nepheline syenite market is anticipated to hold a significant share by 2035, driven by the growing use of ceramic tiles, sanitary ware, and decorative items in residential and commercial buildings.

- The glass segment in the feldspar and nepheline syenite market will hold the largest share, driven by rising production and export of glass for construction and packaging, forecast period 2026-2035.

Key Growth Trends:

- Growing Construction Sector with Rising Demand for Residential and Commercial Buildings

- Rising Plastic Production and Consumption with Increasing Sales Industry

Major Challenges:

- Growing Recycling of Glass Products

- Stringent government Norms for Real Estate and Construction Sector

Key Players: SCR-Sibelco NV, I-Minerals Inc., The QUARTZ Corp., Covia Holdings LLC, Anglo Pacific Minerals (APM), Imerys, Pacer Minerals, LLC, ArrMaz Products Inc., Minerali Industriali S.r.l., FINETON Industrial Minerals Limited.

Global Feldspar and Nepheline Syenite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.21 billion

- 2026 Market Size: USD 6.51 billion

- Projected Market Size: USD 10.51 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Italy, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Feldspar and Nepheline Syenite Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Construction Sector with Rising Demand for Residential and Commercial Buildings – It was noticed that the economy in the USA is greatly influenced by the construction sector. The sector employs more than 745,000 people and produces structures valued at close to USD 1.4 trillion annually. The rising urbanization across the globe, backed by the growing construction sector across the world is anticipated to boost market growth over the forecast period. Moreover, the sale of construction goods worldwide is also growing as a result of the increasing number of residential and commercial premises. This expansion is caused by both new and restored buildings.

-

Rising Plastic Production and Consumption with Increasing Sales Industry – In 2018, the United States produced 35.7 million tons of plastic.

-

Increasing Ceramic Sector Owing to Rising Use of Ceramics – India exported a record number of ceramics and glassware in 2021–2022, totaling USD 3,464 million.

-

Rising Urbanization with Digitalization and Migration of People to Cities – It is believed that China's permanent residency urbanization rate reached 64.72 percent in 2021, and from 2021 to 2025, the country intends to raise that rate to 65 percent.

-

Increasing Production of Sanitary Ware Products with Increasing Residential and Public Cleanliness – According to reports, the worldwide sanitary ware products market increased from 173 million pieces in 2020 to more than 206 pieces in 2021.

Challenges

- Growing Recycling of Glass Products - Glass products are cheaper compared to ceramic products and glass is widely used and raw materials are more easily available than ceramic raw materials. This is estimated to hinder market growth in the coming years. Further, glass is more stable than ceramics and can withstand surface damage, with a low thermal coefficient and high tensile strength.

- Stringent government Norms for Real Estate and Construction Sector

- Increasing Environmental Concerns Regarding Plastic Usage

Feldspar and Nepheline Syenite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 6.21 billion |

|

Forecast Year Market Size (2035) |

USD 10.51 billion |

|

Regional Scope |

|

Feldspar and Nepheline Syenite Market Segmentation:

Application Segment Analysis

The global feldspar and nepheline syenite market is segmented and analyzed for demand and supply by application into coatings and polymers, glass, ceramic, refractories, and others. Out of these, the glass segment is estimated to hold the largest market share by 2035. Glass is a transparent, non-crystalline, amorphous solid that has many uses in the packaging, construction, telecommunication, electronics, automotive, and transportation sectors. Owing to its capacity to refract, reflect, and transmit light, glass is largely utilized in lenses, windows, mirrors, and prisms. Further, the rising production and import-export of the glass are estimated to drive segment growth. It was found that in 2021, China exported glass and glassware of more than USD 23.80 billion. The increasing use of glass in the construction industry for windows, doors, ventilation, walls, and roofs improves the elegance of buildings.

Amongst these segments, the ceramic segment is expected to garner a significant share. The increasing use of ceramic in decorative items eating plates, bowls, and many household products is estimated to boost the market growth. As per the estimations, the consumption of ceramic tiles in 2021 in the United States was about 3 billion square feet of ceramic tile. The growing use of ceramic tiles, toilet seats, and other ceramic sanitary ware products such as wash basins, and bathtubs in both commercial and residential buildings. Also, the use of ceramics in industries such as chemical, pharmaceutical, beverages, food, and other sectors. The increasing number of laboratories, clinical institutions, and research and development institutions is also anticipated to boost market growth. The rising government initiatives to enhance public access to toilets to promote cleanliness and public facilities increase the demand for the ceramic industry.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By Functional Fillers |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Feldspar and Nepheline Syenite Market Regional Analysis:

APAC Market Insights

The Asia Pacific feldspar and nepheline syenite market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the favorable growth of end-user industries including ceramic, glass, automobile, and paint industries in the region, backed by the rising investment by key market players mainly in emerging economies such as China, India, Brazil, and Japan. For instance, China’s exports of ceramic products increased to USD 236 billion in August from 230 billion in July 2022. The increasing production of advanced ceramic products to protect ancient art and monuments and growing utilization in households are also estimated to propel the market growth. Also, people prefer ceramic products as they are eco-friendly and help to prevent the use of plastic at restaurants and hotels. Most hotels these days use ceramic plates and bowls to serve food, especially in Asian countries as it is a traditional way. Additionally, it is believed that pickles and any food items will stay longer when stored in ceramic vessels.

North American Market Insights

Further, the North American region is estimated to share the second largest market share during the forecast period. The increasing migrants, adoption of different cultures among people, and presence of nepheline deposits in the U.S. is expected to contribute to the market growth. The availability of key players and prominent production sectors is also estimated to drive the market growth as per the market analysis. The U.S. imported value of tiles was estimated to rise by more than 20% in the year 2021 reaching a value of USD 3 billion.

Feldspar and Nepheline Syenite Market Players:

- SCR-Sibelco NV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- I-Minerals Inc.

- The QUARTZ Corp.

- Covia Holdings LLC

- Anglo Pacific Minerals (APM)

- Imerys

- Pacer Minerals, LLC

- ArrMaz Products Inc.

- Minerali Industriali S.r.l.

- FINETON Industrial Minerals Limited

Recent Developments

-

SCR-Sibelco NV - Sibelco announced the launch of a new glass recycling plant in San Cesario sul Panaro, Modena (Italy). This new plant was an addition to Sibelco’s glass recycling business which will support Sibelco to maintain its leadership in Italy.

-

Minerali Industriali S.r.l. - acquired the Sassuolo company Manfredini e Schianchi which is under the direction of Minerali Industriali through the Green Tech Engineering vehicle, will contribute significant expertise in the area of plants for the processing of soft raw materials and dry grinding of ceramic mixtures to the group.

- Report ID: 4574

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.