Ceramic Sanitary Ware Market Outlook:

Ceramic Sanitary Ware Market size was over USD 45.58 billion in 2025 and is projected to reach USD 93.94 billion by 2035, witnessing around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ceramic sanitary ware is evaluated at USD 48.66 billion.

The primary growth factor of the market is the rising adoption of ceramic sanitary ware in the construction processes of buildings and other infrastructures. This high spending on construction is anticipated to expand the market size. Furthermore, the increasing population is also boosting the demand for extensive expansion of residential areas and places which is directly contributing to the ceramics sanitary ware market. As per the U.S. Census Bureau July 2024, the U.S. population reached 340.1 million, up 0.98% from 336.8 million on July 1, 2023.

Continuous product innovations and new launches by key manufacturers are also driving the ceramic sanitary ware market. Companies are introducing advanced designs, smart features, and eco-friendly solutions to cater to evolving consumer preferences. For instance, in November 2023, Utopia announced the launch of Corr designed and engineered to meet the demand for elegance and contemporary styling with practical and ergonomic USPs. Additionally, premium product lines with aesthetic appeal and durability are gaining traction, further fuelling market expansion across regions.

Key Ceramic Sanitary Ware Market Insights Summary:

Regional Highlights:

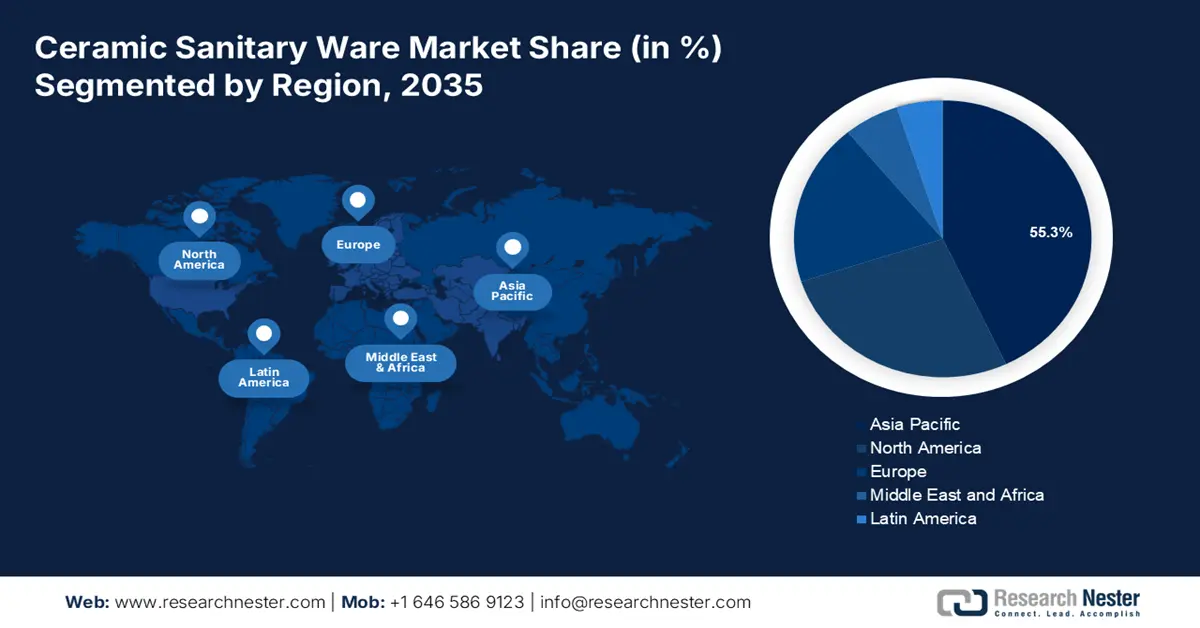

- Asia Pacific ceramic sanitary ware market will secure around 55.30% share by 2035, driven by construction industry growth and government housing initiatives.

Segment Insights:

- The residential segment in the ceramic sanitary ware market is projected to hold the largest share by 2035, driven by the large presence of residential properties and urbanization boosting housing demand.

- The offline distribution channel segment in the ceramic sanitary ware market is forecasted to grow considerably over 2026-2035, attributed to customer preference for in-store product inspection and expert guidance.

Key Growth Trends:

- Expanding population

- Boom in commercial construction activities

Major Challenges:

- High production cost

- Competition from substitutes

Key Players: Roca Sanitario, S.A, Kohler Co., TOTO LTD., Geberit International AG, LIXIL Corporation, RAK Ceramics PJSC, Villeroy & Boch AG, Grohe AG, DURAVIT Aktiengesellschaft, Hansgrohe Deutschland Vertriebs GmbH.

Global Ceramic Sanitary Ware Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.58 billion

- 2026 Market Size: USD 48.66 billion

- Projected Market Size: USD 93.94 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (55.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Ceramic Sanitary Ware Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding population: Rapid urbanization, population growth, and rising disposable incomes has boosted the demand for extensive residential constructions. According to the U.S. Census Bureau, the residential construction in 2024 was USD 917.9 billion, 5.9% in comparison to the 2023 with USD 866.9 billion. As homeowners seek durable and innovative sanitary ware products demands continues to surge. Government initiatives promoting affordable housing and the growing trend of home renovations further contribute to market expansion.

-

Boom in commercial construction activities: Rising demand for commercial spaces, such as offices, hotels, shopping malls, and healthcare facilities, is fuelling the adoption of high-quality sanitary ware products to meet the need for functional and aestheticalliy pleasing restroom solutions. Government investments in smart city projects and public infrastructure further contribute to the surge in commercial construction, creating lucrative growth opportunities for market players. For instance, as per the IBEF, the capital investment outlay for infrastructure has been increased by 11.1% to Rs.11.11 lakh crore in the Interim Budget 2024-25.

Challenges

-

High production cost: Energy-intensive manufacturing processes and fluctuating raw material prices pose a significant challenge in the market. The expenses associated with advanced manufacturing technologies, compliance with environmental regulations, and maintaining product quality further strain profit margins, compelling manufacturers to seek cost-effective solutions.

-

Competition from substitutes: Stainless steel, glass, and composite materials is another hurdle for the market. These alternatives often offer durability, lighweight features, and contemporary designs, appealing to consumers seeking innovative options. The growing preference for smart and eco-friendly materials adds to the competitive pressure, urging traditional ceramic manufacturers to continuously innovate.

Ceramic Sanitary Ware Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 45.58 billion |

|

Forecast Year Market Size (2035) |

USD 93.94 billion |

|

Regional Scope |

|

Ceramic Sanitary Ware Market Segmentation:

Application Segment Analysis

The residential segment is expected to garner the highest in ceramic sanitary ware market share by 2035, owing to the large presence of residential properties across the globe. American Community Survey 2022 stated that 125.7 million housing units were occupied in the U.S. As per the United States Census Bureau 2025, 698,000 new single-family homes were sold in the year 2024, in the U.S. Furthermore, the residential segment is forecasted to gather the highest revenue due to the increased demand for houses by the burgeoning population owing to urbanization. The shift towards high-quality living spaces further propels the demand in this segment, making it a key driver for market growth.

Distribution Channel Segment Analysis

Based on the distribution channel, the offline segment is projected to grow considerably by 2035 owing to the preference for in-store experiences, where customers can physically inspect products and seek expert guidance. Showrooms, specialty stores, and dealer networks play a crucial role in building brand visibility and customer trust. The expansion of brick-and-mortar outlets in urban and semi-urban areas, along with personalized customer service has further fuelled the growth of the distribution channel.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Technology |

|

|

By Application |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ceramic Sanitary Ware Market Regional Analysis:

Asia Pacific Market Insights

The APAC in ceramic sanitary ware market is projected to hold the largest market share of 55.3% by the end of 2035, owing to the rapid expansion of construction industry, growing consumer demand, and presence of leading market key players in the regions. Countries such as China and India dominate the market, driven by government housing initiatives, industrial and infrastructure development, and a surge in home renovations. For instance, as per IBEF India's infrastructure sector is set for robust growth, with planned investments of USD 1.4 trillion by the end of 2025.

India is a key market for ceramic sanitary ware, majorly due to evolving consumer preferences for stylish bathroom fixtures. In September 2024, the Prime Minister of India launched Pradhan Mantri Awas Yojana 2.0, in addition to which the Government of Maharashtra issued the implementation of Pradhan Mantri Awas Yojana (Urban) 2.0 based on the concept of Housing for All across the state. These initiatives by the government are supporting people with residential constructions, ultimately boosting the market.

North America Market Insights

Increasing awareness about water conservation and smart home technologies are driving the ceramic sanitary ware market in North America. The region’s focus on green building initiatives and energy-efficient solutions has prompted the demand for eco-friendly sanitary ware products. The growing preference for luxury bathroom designs further boosts market growth.

In the U.S., demographic factors such as an aging population and rising demand for home remodeling projects are significant market drivers. The U.S. government offers several single-family housing repair loans & grants with a maximum loan is USD 40,000, a maximum grant is USD 10,000, and a combination of two extending up to USD 50,000 in assistance. The trend of multi-family housing developments and investments in commercial spaces such as hotels and office buildings also contribute to the growing demand for ceramic sanitary ware products.

Ceramic Sanitary Ware Market Players:

- Roca Sanitario, S.A

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kohler Co.

- TOTO LTD.

- Geberit International AG

- LIXIL Corporation

- RAK Ceramics PJSC

- Villeroy & Boch AG

- Grohe AG

- DURAVIT Aktiengesellschaft

- Hansgrohe Deutschland Vertriebs GmbH

- VitrA

In the market, companies are adopting strategies focused on design innovation, product customization, and the integration of smart technology to meet consumer demands for modern and functional bathroom solutions. These companies are emphasizing on usage of recyclable materials and water-saving technologies to align with the rising awareness of sustainability among the consumers. Furthermore, expanding brand presence through collaborations with architects, interior designers, and builders has become a critical approach to market penetration.

Recent Developments

- In May 2024, VitrA launched the first and only washbasin using 100% recycled manufacturing waste, intending to reduce the global warming potential by 30% per product, transforming waste into valuable resources.

- In April 2024, Roca Group announced the acquisition of Nosag and IneoCare, reinforcing Roca Group's position in Central Europe.

- In December 2021, Roca Sanitario, S.A. launched Ona, its new complete bathroom collection in a global event held streamed from the Joan Miró Foundation in Barcelona.

- In January 2021, Kohler Co. introduced four new products using touchless technology i.e. touchless bathroom faucet, modernlife touchless toilet, kumin touchless soap dispenser, and touchless kitchen faucet.

- Report ID: 4666

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ceramic Sanitary Ware Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.