Pyridine and Pyridine Derivatives Market Outlook:

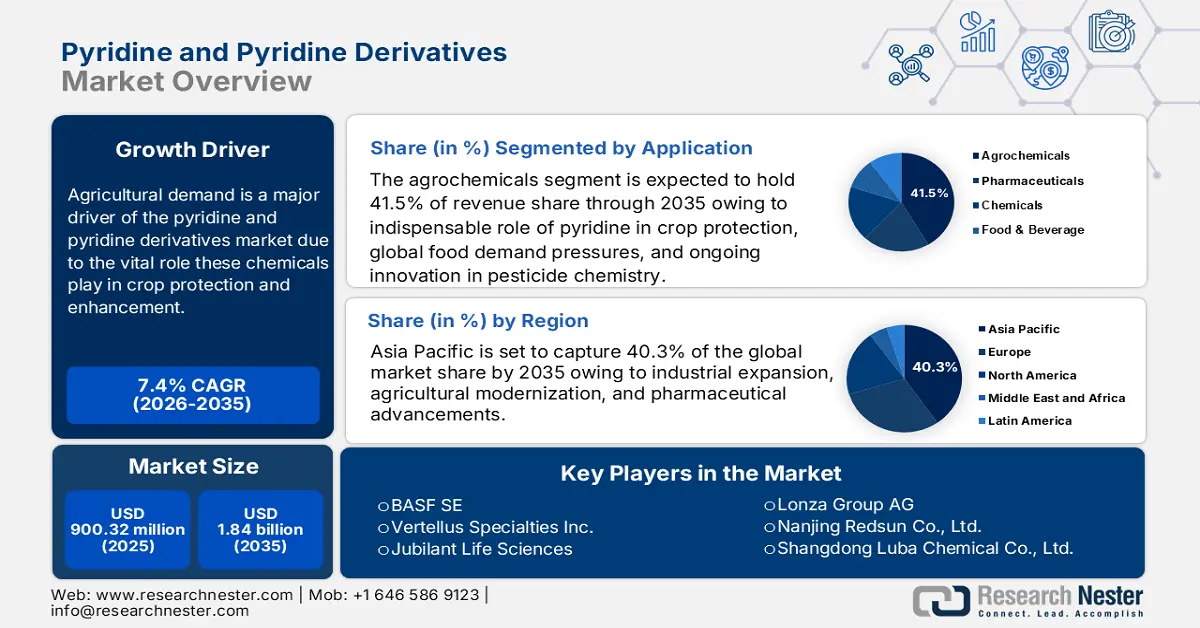

Pyridine and Pyridine Derivatives Market size was valued at USD 900.32 million in 2025 and is likely to cross USD 1.84 billion by 2035, registering more than 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of pyridine and pyridine derivatives is assessed at USD 960.28 million.

Agricultural demand is a major driver of the pyridine and pyridine derivatives market due to the vital role these chemicals play in crop protection and enhancement. Pyridine is a precursor or intermediate in the production of widely used herbicides such as paraquat and diquat. These herbicides are essential for controlling weeds, which helps increase crop yields, especially in large-scale farming operations.

Additionally, with a growing global population and shrinking arable land, there’s pressure to improve crop yields per hectare. This pushes farmers to adopt more efficient agrochemicals, many of which are synthesized using pyridine derivatives. Pyridine-based compounds are also used in fungicides and insecticides, helping protect crops from diseases and pests. Genetically modified (GM) crops are often engineered to be resistant to specific herbicides like paraquat, leading to increased demand for such pyridine-derived chemicals.

Key Pyridine and Pyridine Derivatives Market Insights Summary:

Regional Highlights:

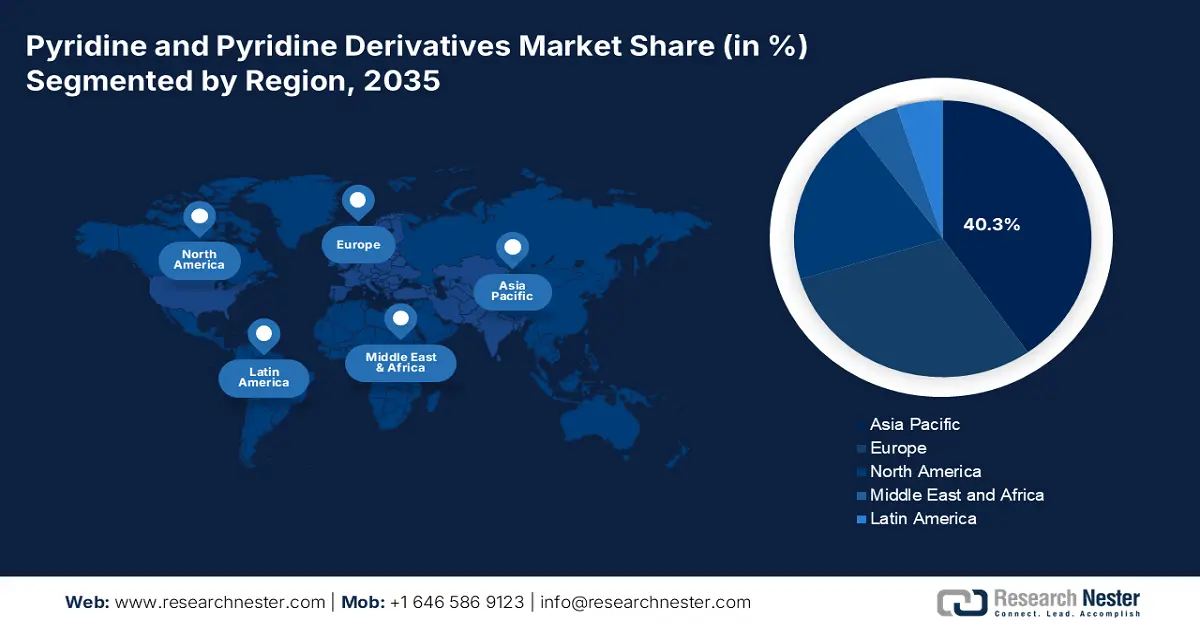

- Asia Pacific commands a 40.3% share in the Pyridine and Pyridine Derivatives Market, propelled by industrial expansion, agricultural modernization, and pharmaceutical advancements, driving growth from 2026–2035.

- Europe's pyridine and pyridine derivatives market is set for the fastest growth by 2035, attributed to demand in pharmaceuticals, agrochemicals, and industrial applications.

Segment Insights:

- The agrochemicals segment is projected to hold a 41.5% share by 2035, driven by the indispensable role of pyridine in crop protection and global food demand pressures.

Key Growth Trends:

- Growth of the pharmaceutical industry

- Growing industrial use

Major Challenges:

- Stringent environmental regulations

- Availability of alternatives and supply chain disruptions

- Key Players: BASF SE, Vertellus Specialties Inc., Jubilant Life Sciences, Lonza Group AG, Nanjing Redsun Co., Ltd., Shangdong Luba Chemical Co., Ltd., Hubei Sanonda Co., Ltd., Chang Chun Petrochemical Co., Ltd., C-Chem Co., Ltd., Resonance Specialties Limited, Evonik Industries AG, Merck KGaA.

Global Pyridine and Pyridine Derivatives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 900.32 million

- 2026 Market Size: USD 960.28 million

- Projected Market Size: USD 1.84 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Malaysia

Last updated on : 12 August, 2025

Pyridine and Pyridine Derivatives Market Growth Drivers and Challenges:

Growth Drivers

- Growth of the pharmaceutical industry: Pyridine and its derivatives are critical intermediates in the manufacture of various Active Pharmaceutical Ingredients (APIs). They are used in drugs like antihistamines, anti-inflammatory drugs, local anaesthetics, and tuberculosis medications. Moreover, increasing R&D investments by pharma companies are driving the development of new drug molecules, many of which require pyridine-based compounds. Custom synthesis and contract manufacturing often include pyridine in their processes.

Pyridine derivatives are preferred for their stability, reactivity, and compliance with pharmaceutical-grade purity standards. Their well-established use in regulated processes supports continued pyridine and pyridine derivatives market growth. Also, rising global healthcare demand leads to a higher demand for chemical intermediates like pyridine derivatives. - Growing industrial use: Pyridine is widely used as a solvent and reagent in organic synthesis and chemical manufacturing. Its ability to dissolve a wide range of compounds makes it valuable in the paint, dye, and rubber industries. Pyridine acts as a catalyst or reaction intermediate in the production of adhesives, textiles, insect repellents, and water repellents. Further, certain pyridine derivatives are used as flavoring agents or in food additive synthesis, especially in trace amounts, due to their distinct aroma.

Growth in sectors like biotechnology, electronics, and green chemistry is opening new avenues for pyridine-based materials and chemicals. Pyridines are also used in the metal finishing and electroplating industry to prevent corrosion and improve metal surfaces.Pyridine’s role as a multipurpose chemical agent is making it indispensable in several industrial applications, which is a key factor driving its pyridine and pyridine derivatives market expansion.

Challenges

- Stringent environmental regulations: Pyridine and its derivatives are toxic and can have adverse environmental effects. Many countries, especially in North America, Europe, have strict regulations regarding the use, handling, and disposal of these chemicals. Pyridine exposure can lead to health issues such as skin and eye irritation, respiratory problems, and central nervous system effects.

- Availability of alternatives and supply chain disruptions: In some applications, such as agriculture or pharmaceuticals, alternatives to pyridine-based compounds are emerging. Companies may shift toward safer, more sustainable, or cost-effective substitutes. Moreover, global events such as pandemics, geopolitical tensions, or trade restrictions can disrupt the supply chain, leading to delays and increased costs.

Pyridine and Pyridine Derivatives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 900.32 million |

|

Forecast Year Market Size (2035) |

USD 1.84 billion |

|

Regional Scope |

|

Pyridine and Pyridine Derivatives Market Segmentation:

Application (Agrochemicals, Pharmaceuticals, Chemicals, Food & Beverage, and Nutritional Supplements)

Agrochemicals segment is expected to hold over 41.5% pyridine and pyridine derivatives market share by the end of 2035. The market growth is due to the indispensable role of pyridine in crop protection, global food demand pressures, and ongoing innovation in pesticide chemistry. Pyridine and its derivatives are crucial intermediates in the synthesis of herbicides, insecticides, and fungicides. Notable agrochemicals such as paraquat and diquat are directly derived from pyridine.

Increasing global population and shrinking arable land are pushing farmers to maximize yields using efficient pest control and nutrient management, boosting demand for pyridine-based agrochemicals. Pyridine compounds are valued for their broad-spectrum effectiveness and chemical stability. Continuous R&D in agrochemicals has led to the creation of advanced pyridine-based compounds that are more target-specific, reducing environmental impact and increasing safety. This innovation helps sustain and expand the use of pyridine derivatives in the sector. Moreover, emerging economies are investing more in agriculture and modern farming practices.

Production Process (Chemical Synthesis and Extraction from Coal Tar)

The chemical synthesis segment is expected to hold a dominant position in the pyridine and pyridine derivatives market. Chemical synthesis, especially Chichibabin synthesis and ammoxidation of picolines, allows for economical large-scale production of pyridine and its derivatives. This makes it favorable for industries like agrochemicals and pharmaceuticals, which require pyridine in bulk quantities.

Modern chemical synthesis methods offer high selectivity and better yields, reducing waste and production costs. Techniques such as continuous flow synthesis and catalytic processes improve productivity and purity, making the products more competitive in the global pyridine and pyridine derivatives market. Further, innovations in heterogeneous catalysis and green chemistry have improved the sustainability of pyridine production via chemical synthesis. These advancements align with stricter environmental regulations and industry demand for eco-friendly processes.

Our in-depth analysis of the global pyridine and pyridine derivatives market includes the following segments:

|

Product Type |

|

|

Production Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pyridine and Pyridine Derivatives Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific pyridine and pyridine derivatives market is set to capture revenue share of around 40.3% by the end of 2035, driven by industrial expansion, agricultural modernization, and pharmaceutical advancements. Pyridine derivatives are essential in producing herbicides and pesticides. Countries like India and China are major consumers due to their large agricultural sectors.

China’s extensive agricultural sector relies heavily on agrochemicals, with pyridine derivatives being crucial in the synthesis of pesticides, herbicides, and fungicides. The country’s growing pharmaceutical sector utilizes pyridine derivatives as intermediates in the production of various drugs, including vitamins and anti-infectives. Moreover, the country’s chemical manufacturing base facilitates large-scale production of pyridine and its derivatives, meeting both domestic and international demand. Further, in India, the pyridine and pyridine derivatives market is set for moderate growth, underpinned by diverse industrial applications and regional agricultural demands. Punjab, Haryana, Nagpur, and Kolhapur are significant consumers due to intensive agricultural activities.

Europe Market Analysis

Europe is rapidly emerging as the fastest-growing pyridine and pyridine derivatives market, driven by demand in pharmaceuticals, agrochemicals, and industrial applications. Europe produced approximately 320,000 tons of pyridine in 2023, highlighting its significant role in the global market. Germany is leading the market, followed by France and the UK, with strong pharmaceutical sectors and ongoing research in chemical applications.

Key Pyridine and Pyridine Derivatives Market Players:

- Eastman Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Vertellus Specialties Inc.

- Jubilant Life Sciences

- Lonza Group AG

- Nanjing Redsun Co., Ltd.

- Shangdong Luba Chemical Co., Ltd.

- Hubei Sanonda Co., Ltd.

- Chang Chun Petrochemical Co., Ltd.

- C-Chem Co., Ltd.

- Resonance Specialties Limited

- Evonik Industries AG

- Merck KGaA

Companies are heavily investing in research to develop new derivatives with enhanced efficiency or broader applications, especially in pharmaceuticals, agrochemicals, and food additives. The development of bio-based pyridine is a rising trend to meet sustainability goals. Players are forming strategic alliances or acquiring smaller firms to gain pyridine and pyridine derivatives market share and technological capabilities.

Here are some of the key players:

Recent Developments

- In December 2023, Jubilant Ingrevia Limited announced that its cutting-edge multipurpose agro intermediate plant has been put into service, producing value-added derivatives at its manufacturing location in Bharuch, Gujarat. The factory wants to meet the world's expanding need for agricultural intermediates.

- In June 2023, at the Bahia Farm Show 2023, the multinational Yara introduced the new YaraVita NRhizo line, which was created for seed treatment and was covered exclusively by AgroPages. As a seed treatment for crops like corn, soybeans, and beans, YaraVita NRhizo was created. The producer claims that by mixing nutrients with seaweed extracts, the product has the potential to boost profitability and productivity.

- Report ID: 7527

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.