Amorphous Alloy Band Market Outlook:

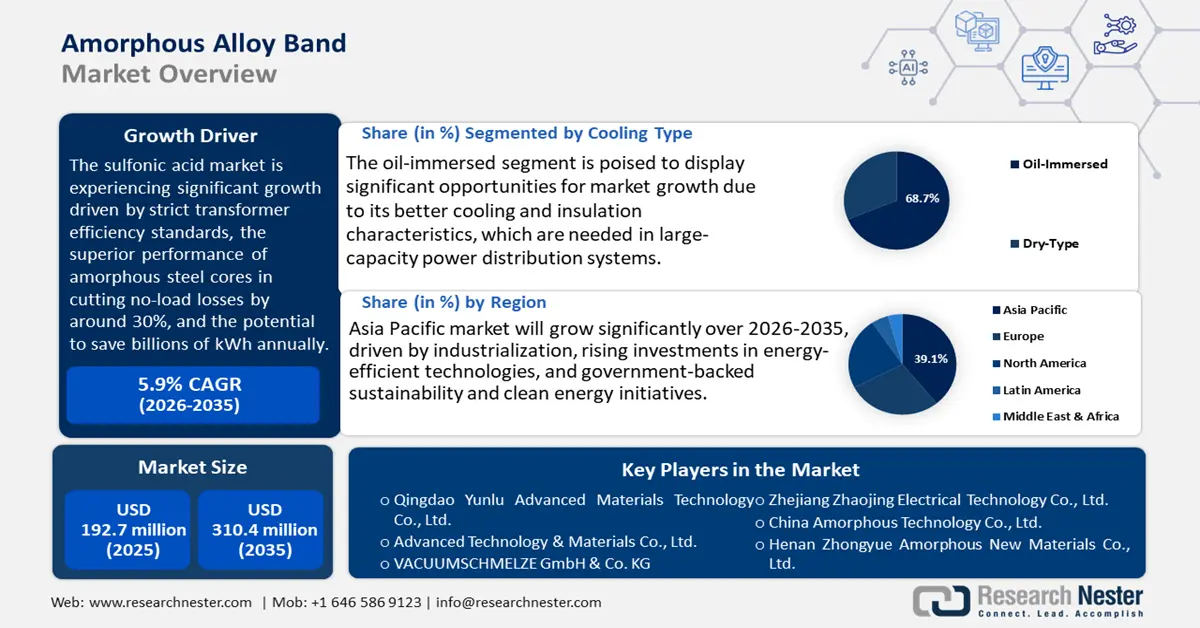

Amorphous Alloy Band Market size was valued at USD 192.7 million in 2025 and is projected to reach USD 310.4 million by the end of 2035, growing at a CAGR of 5.9% during the forecast period from 2026 to 2035. In 2026, the industry size of the amorphous alloy band is evaluated at USD 197.3 million.

The global amorphous alloy band market is anticipated to grow significantly over the forecast period, primarily driven by the imposition of stringent energy-efficiency regulations on electrical distribution transformers. The U.S. Department of Energy (DOE) has suggested efficiency standards from 2027 that implicitly mandate the use of amorphous steel cores due to their lower no-load losses than traditional grain-oriented electrical steel. In supporting this, a Canadian study demonstrates that by substituting about four million conventional transformers with amorphous-core transformers, up to 5.25 billion kWh of electricity could be saved annually. Laboratory testing shows that the no-load losses in amorphous core transformers are 30% lower than the losses in traditional units, which also contributes to the efficiency benefit. These regulations and experimental findings lead energy operators and infrastructure developers to consider amorphous alloys to provide energy savings and lower the cost of operation.

As far as the supply chain and the production capacity are concerned, the costs of the relevant upstream materials are monitored. The Producer Price Index (PPI) of other alloy steel castings, except investment, was 209.203 in July 2025, indicating that the prices have remained stable since April 2025. Meanwhile, the PPI of nickel and nickel-base alloy mill shapes registered a steady increase of 153.606 in July 2025. These indices offer important guidelines to follow changes in prices of alloy steel castings and nickel-based alloys that can be used to examine market behavior in high-end metal components. The inclusion of these PPIs provides a good idea of the cost changes in the amorphous alloy band market. The DOE states that the global manufacturing capacity of over 190,000 metric tons of amorphous metals was aided by specialized processes such as ribbon castings, annealing, and coil winding. Historic deployments have demonstrated stability over time and high failure rates, including general electricity installations such as more than 1,000 amorphous-core transformers installed in Canada since the 1980s by General Electric. On the research and development side, the DOE is investing in innovations, including laser scribing technologies that can reduce core losses by up to 20%, improve material performance, and achieve efficiency improvements.

Key Amorphous Alloy Band Market Insights Summary:

Regional Insights:

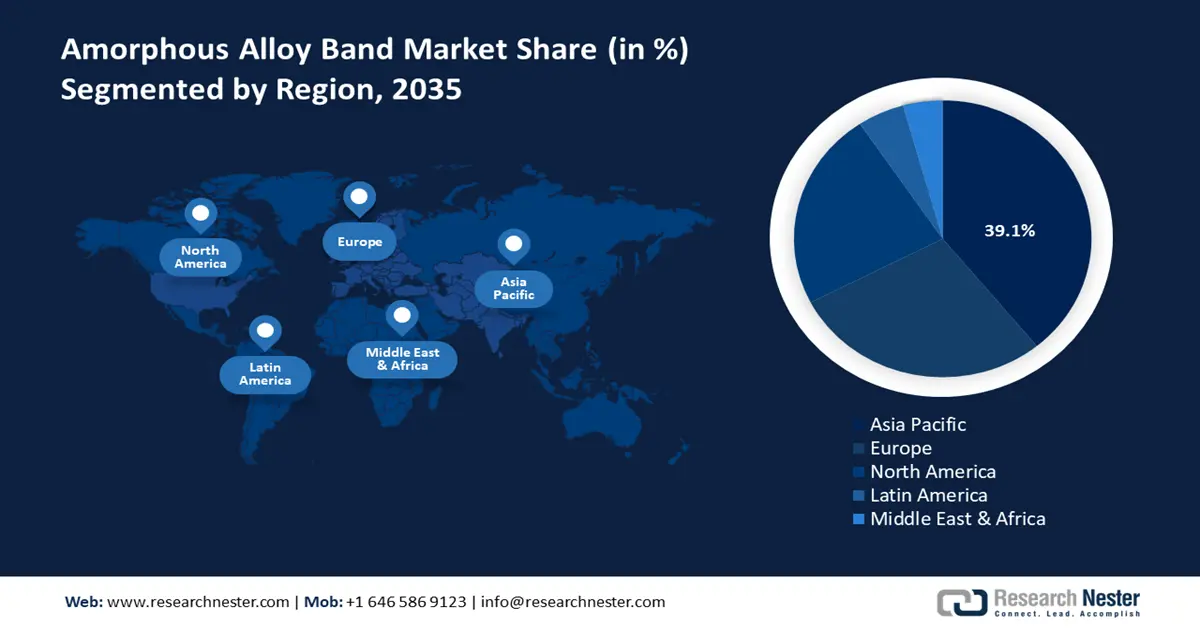

- The Asia Pacific Amorphous Alloy Band Market is anticipated to dominate with a 39.1% revenue share by 2035, owing to rapid industrialization and rising investments in energy-efficient technologies.

- The North American market is forecast to secure a 23.2% share from 2026 to 2035, sustained by government-backed decarbonization programs and growing adoption of sustainable materials across industries.

Segment Insights:

- The oil-immersed segment is projected to account for the largest 68.7% share of the Amorphous Alloy Band Market by 2035, propelled by its superior cooling and insulation efficiency supporting large-capacity power distribution systems.

- The iron-based alloy segment is expected to capture a 59.2% share during 2026–2035, impelled by its excellent magnetic properties and cost-effectiveness enhancing transformer energy efficiency.

Key Growth Trends:

- The innovations of chemical recycling

- Sustainability and carbon reduction initiatives

Major Challenges:

- Infrastructure and technological constraints

- Large production costs and operational costs

Key Players: Qingdao Yunlu Advanced Materials Technology Co., Ltd., Advanced Technology & Materials Co., Ltd. (AT&M), VACUUMSCHMELZE GmbH & Co. KG (VAC), Zhejiang Zhaojing Electrical Technology Co., Ltd., China Amorphous Technology Co., Ltd., Henan Zhongyue Amorphous New Materials Co., Ltd., Metglas, Inc. (subsidiary of Proterial), Foshan Huaxin Microlite Ribbon Co., Ltd., Usha Amorphous Metals Ltd., Mettler Electronics, Magnetec GmbH, Proterial, Ltd. (formerly Hitachi Metals), Daido Steel Co., Ltd., Toshiba Materials Co., Ltd., JFE Steel Corporation.

Global Amorphous Alloy Band Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 192.7 million

- 2026 Market Size: USD 197.3 million

- Projected Market Size: USD 310.4 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Mexico, Brazil

Last updated on : 1 October, 2025

Amorphous Alloy Band Market - Growth Drivers and Challenges

Growth Drivers

- The innovations of chemical recycling: Chemical recycling is rapidly becoming a promising method to deal with plastic waste and salvage useful resources. Chemical recycling is one of the keys to the sustainable materials management plan incorporated by the U.S. Environmental Protection Agency (EPA), which emphasizes its potential capability to prevent the dumping of millions of tons of plastic in landfills and environmental pollution. This trend is leading to higher demand for energy-saving electrical components, such as amorphous alloy bands in transformers and motors in the recycling plant. In addition, such alloys provide better magnetic characteristics, due to which considerably less energy is lost and is reflected in better operating efficiency and reduced maintenance charges. With a rise in regulation on waste management in different parts of the world, chemical recycling plants will increase, driving the further growth of demand for higher-grade materials that can enable sustained and consistent operation and sustainability in the chemical industry.

- Sustainability and carbon reduction initiatives: Greenhouse gas emissions from the industrial processes sector include emissions from mineral products, chemical industries, metal production, and product use. These emissions comprise carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and various fluorinated gases released during manufacturing and processing activities, as per the United Nations Framework Convention on Climate Change (UNFCCC). This has created increased attention to lowering carbon emissions and sustainable functioning within industries. Energy-efficient transformers and electric motors have amorphous alloy bands in their cores, with core losses as much as 70% lower than in conventional materials, which further decreases the overall energy usage and emissions.It is an efficiency that fosters compliance with strict regulatory standards and corporate sustainability commitments. The amorphous alloys will be in high demand as the firms will tend to invest heavily in renewable energy infrastructure and various energy-saving technologies. Their contribution to the realization of sustainable growth is not out of place since there are global initiatives to meet the goals of net-zero emissions and decrease negative impact on the environment in the sphere of chemical manufacturing.

- Unpredictability in raw material supply: The manufacturing industry is experiencing increased challenges based on the variability in the supply of raw materials, especially important raw materials like iron ore and silicon. According to the U.S. Geological Survey (USGS), the production and prices of iron ore show a considerable level of variability due to geopolitical tension and global disruptions in the supply chain, raising the production and supply risks. Amorphous alloy bands offer better efficiency in magnetism, as manufacturers use less energy and offset the variability of input costs. Utilizing them increases the stability of production costs, with the ability to respond to supply disruptions. With resource and raw material limitations continuing, organizations are increasingly turning towards using energy-efficient and resource-optimized materials such as amorphous alloys in order to stay competitive and to continue with uninterrupted and economical operations in the chemical sector.

Challenges

- Infrastructure and technological constraints: The amorphous alloy band manufacturers face a large challenge of modernizing production infrastructure to adapt to new, effective, and environmental regulations. Modern annealing and casting methods necessary to create high-quality amorphous alloys need large capital investments that can be in the tens of millions of dollars range. For example, in 2023, Siemens spent about USD 50 million to modernize its manufacturing plants with more efficient and environmentally cleaner production technologies, leading to a substantial market share growth in the European Union due to compliance with strict environmental standards. However, not all smaller manufacturers can afford such upgrades, leading to slower adoption of advanced materials and technologies. The lack of infrastructure development also inhibits capacity growth in production, which leads to an imbalance in supply and demand and hinders the ability to timely meet the order requirements of the global amorphous alloy band market.

- Large production costs and operational costs: The production processes of an amorphous alloy band are energy-intensive, which increases both operational costs, especially in areas where power costs are high and where there are carbon price schemes. The European Union emission trading system (ETS) is a monetary penalty on the CO2 emissions of industries, which makes it costly for manufacturers in terms of operation. The European Commission estimates that the ETS will increase the cost of industrial energy by 10-15% in 2023. These higher prices make it less competitive unless countered by efficiency gains through new materials such as amorphous alloys, which reduce core losses in electrical gear. Consequently, producers in those governments with strict carbon regulations are put on a stricter margin, hindering market growth and reducing investments in innovation and capacity.

Amorphous Alloy Band Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 192.7 million |

|

Forecast Year Market Size (2035) |

USD 310.4 million |

|

Regional Scope |

|

Amorphous Alloy Band Segmentation:

Cooling Type Segment Analysis

The oil-immersed segment is expected to grow with the largest revenue amorphous alloy band market share of 68.7% during the projected years by 2035, attributed to its better cooling and insulation characteristics, which are needed in large capacity power distribution systems. According to a published study, oil-immersed transformers can provide a greater load capacity and extended service life, which helps to ensure the reliability and efficiency of the grid. Moreover, to achieve a decrease in energy use in transmission and distribution sectors, the deployment of efficient transformer technologies is encouraged by global governments. These forces continue to fuel investments in oil-immersed transformer infrastructure in oil-immersed grids around the world, especially in those areas that are both retrofitting an aging grid and increasing the renewable energy integration.

Mostly used in industrial and utility power systems, sealed tank transformers are preferred due to their high moisture and contaminant protection, which aids in the safe delivery of power in the worst environments. Sealed tank units help improve the longevity of transformers because they will reduce oxidation and hence the costs of maintenance. Meanwhile, free-breathing oil-cooled transformers continue to see demand in outdoor service because of their low cost and minimal maintenance requirements, especially in rural and developing countries where grid development measures are being pursued. These transformers make all installations of oil-immersed transformers a key factor in supporting the growing demands of effective and reliable power infrastructure.

Product Type Segment Analysis

The iron-based alloy segment is expected to grow with a significant amorphous alloy band market share of 59.2% from 2026 to 2035, owing to its superior magnetic performance and low costs. According to the U.S. DOE, iron-based materials contain no-load loss in transformers that is reduced significantly towards the objective of energy efficiency. This is in line with international regulations to minimize electrical losses and carbon footprints in power networks, and policies of global bodies such as the European Chemicals Agency (ECHA) on sustainable use of materials. The extensive use of iron-based alloys in distribution transformers can also be attributed to their contribution to the development of the modern and energy-saving power networks of the world.

Fe-Si-B alloys are popular due to their effective magnetic characteristic and low core losses, which result in energy-efficient transformers and electric machines. Fe-Si-B alloys can reduce no-load losses significantly, helping to meet tough energy efficiency standards. Amorphous Fe-Ni metals are becoming increasingly popular with uses that demand greater thermal and mechanical performance, especially in renewable energy devices. The European Chemicals Agency says that their increasing use is in line with global sustainability efforts of reducing carbon footprints in power distribution. These sub-segments cooperate to drive demand because they offer performance and cost-efficiency to the iron-based amorphous alloy band market.

Application Segment Analysis

The distribution transformers segment is likely to grow significantly with a revenue amorphous alloy band market share of 52.2% over the projected years, due to the need to make power distribution more energy-efficient. The U.S. Department of Energy highlights that the replacement of transformers with amorphous alloy cores remarkably lowers no-load losses to enhance grid efficiency. Such technologies are encouraged by higher efficiency standards imposed upon utilities by regulatory agencies like the EPA and ECHA. Also, the U.S. International Trade Administration notes the rising investments in smart grid infrastructure and renewable integration, driving the need for advanced distribution transformers.

Our in-depth analysis of the amorphous alloy band market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

End-Use Industry |

|

|

Core Construction Type |

|

|

Voltage Level |

|

|

Cooling Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amorphous Alloy Band Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific amorphous alloy band market is projected to experience the highest growth in the world, with a revenue share of 39.1%, due to the high rate of industrialization and growth of investments in energy-saving technologies. The activities of regional governments focus on sustainable production and development of new materials. APEC member economies are accelerating their clean energy transition while promoting sustainable and inclusive growth. Despite fossil fuels still dominating the energy mix, the region is ahead of schedule in doubling renewable energy and improving energy efficiency. The area is focused on addressing carbon emissions reduction, and it is a goal of the UN Sustainable Development Goals to adopt low-loss magnetic materials, like amorphous alloys. Moreover, government-sponsored initiatives are supporting smart grid and renewable energy programs that increase the need for high-performance transformers and electrical parts. For instance, the Tonga Outer Island Renewable Energy Project, supported by the Asian Development Bank (ADB), installs grid-connected solar photovoltaic power plants on Tonga’s outer islands to reduce dependence on imported fossil fuels and promote sustainable energy use. These policies, coupled with the chemical recycling developments and green production processes, are major factors towards the successful expansion of the Asia Pacific amorphous alloy band market by 2035.

The amorphous alloy band market in China is predicted to dominate the region, driven by sound government policies that seek to promote advanced manufacturing and the clean energy industry. Moreover, the 14th Five-Year Plan of the State Council of China has identified the acceleration of green and low-carbon development, the enhancement of energy efficiency, and the share of non-fossil fuels in the energy mix. It focuses on energy technological innovations, reinforcing the infrastructure of renewable energy, and the principles of the circular economy. These programs encourage innovation in the use of amorphous alloys, especially in power transformers and electric equipment, and help promote sustainable development. Iron-based amorphous alloys are being developed at a faster rate through collaboration with the domestic research institutes, further entrenching China in the global market.

India’s amorphous alloy band market is likely to grow notably during the projected years from 2026 to 2035, supported by growing industrial electrification and renewable energy programs promoted by the government. The Ministry of Power and the industry organizations, like the Indian Transformer Manufacturers Association (ITMA), are actively engaged in efforts to increase the efficiency of the transformers by adopting new, efficient materials like amorphous metal ribbons. These super alloys are capable of minimizing 60-70% of no-load losses, as compared to the traditional cold-rolled grain-oriented (CRGO) steel. Currently, India uses around 400,000 metric tons of electrical steel to supply the transformer-making industry in India, with amorphous metal taking about 15-18% of that usage. The environmental laws issued by the Central Pollution Control Board facilitate the production of chemicals in the most sustainable way, which improves market opportunities. Research in institutes such as the Council of Scientific and Industrial Research (CSIR) through public-private partnerships and investments encourages innovation in nanocrystalline and iron-based amorphous alloys. Such initiatives make India an emerging producer and adopter of amorphous alloy bands.

North America Market Insights

The North American amorphous alloy band market is projected to grow at a steady rate with a revenue share of 23.2% from 2026 to 2035. This growth is driven by the increased demand for energy-saving materials in power generation, automotive, and electronics industries. The Biden-Harris Administration announced to provide funding to 49 projects in 21 states in the amount of USD 254 million aimed at reducing industrial greenhouse gas emissions and developing decarbonization technologies. These initiatives focus on the major sectors, which include chemicals, iron and steel, cement, food and beverage, and forest products. It is funded to enhance the process of decarbonizing industrial heat, low-carbon fuel, and cross-sector research and development to achieve greater levels of energy efficiency and to aid the achievement of the U.S. objective of a net-zero emissions economy by 2050. This investment makes America more industrially competitive while tackling climate objectives. In addition, in 2021, the Environmental Protection Agency, through its Green Chemistry Program, encouraged more than 50 sustainable chemical processes, 15% less hazardous waste. Further, NIST and OSHA regulatory support uphold manufacturing safety and quality standards. These government programs, in conjunction with the development of sustainable materials, are driving the increasing market share and innovation potential in the production of amorphous alloy bands in the region.

The U.S. amorphous alloy band market is expected to lead the North American region, with a substantial share by 2035, owing to considerable federal investments in clean energy technology and advanced manufacturing. The Department of Energy invested USD 12 billion in innovations in the chemical industry that promote energy efficiency and sustainability in 2022. Additionally, the 2023 Green Chemistry Challenge Awards by EPA identified innovations that have produced a total of almost 1 billion pounds of hazardous chemicals, saved over 20 billion gallons of water, and prevented close to 8 billion pounds of carbon dioxide emissions. These awards emphasise sustainable chemical process innovations in industries. Moreover, OSHA implements stringent workplace safety regulations in the chemical manufacturing industry to safeguard employees and ensure that operations remain dependable. The U.S. promotes research as well, via NIST, advancing innovation in amorphous alloy applications and materials performance. All these combined efforts make the U.S. a leader in promoting amorphous alloy technologies in the chemical industry.

The amorphous alloy band market in Canada is likely to expand steadily, supported by the efforts of the government to promote green technology and sustainable manufacturing. In 2023, Natural Resources Canada proposed a Clean Hydrogen Investment Tax Credit that provides 15%40% refundable credits based on lifecycle emissions, and amounts up to USD 1.5 billion to the Clean Fuels Fund, up to USD 8 billion through the Net-Zero Accelerator, and directing 500 million dollars through the Canada Infrastructure Bank to hydrogen infrastructure. Innovation is also encouraged by the Canadian government via tax benefits and grants related to decreasing industrial emissions and adopting a circular economy approach. Health Canada regulatory controls maintain safe chemical handling and environmental protection standards, which influence amorphous alloy band production. In addition, partnerships with educational institutions and industry advance R&D on high-performance materials, which will place Canada on the road to expand in high-alloy markets.

Europe Market Insights

The European amorphous alloy band market is set to grow steadily during the projected years due to strict environmental laws and the importance of energy efficiency in many industries. Increased demand for amorphous alloys in transformers and electric machinery due to green materials and energy saving technologies, the European Union Green Deal seeks the goal of carbon neutrality by 2050. According to Eurostat, EU expenditure on research and development (R&D) in 2023 amounted to 381.4 billion, a 6.7% increase over the last year. The biggest proportion of the total expenditure on R&D was in the business sector (253.1 billion), and a huge amount is invested in green and climate-related technologies in different EU programs. The strong regulatory body that oversees and enforces the standards of the REACH in Europe is the European Chemicals Agency (ECHA), which is shaping the way manufacturing companies are operating and the choice of the materials used in the amorphous alloy industry. Government projects aimed at achieving net-zero targets have increased the use of energy-efficient alloys in power distribution in the UK. Meanwhile, Germany is a robust manufacturing hub and focuses on Industry 4.0 technologies, which contribute to innovation and requirements in the amorphous alloy band market.

Key Amorphous Alloy Band Market Players:

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advanced Technology & Materials Co., Ltd. (AT&M)

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Zhejiang Zhaojing Electrical Technology Co., Ltd.

- China Amorphous Technology Co., Ltd.

- Henan Zhongyue Amorphous New Materials Co., Ltd.

- Metglas, Inc. (subsidiary of Proterial)

- Foshan Huaxin Microlite Ribbon Co., Ltd.

- Usha Amorphous Metals Ltd.

- Mettler Electronics

- Magnetec GmbH

- Proterial, Ltd. (formerly Hitachi Metals)

- Daido Steel Co., Ltd.

- Toshiba Materials Co., Ltd.

- JFE Steel Corporation

A combination of strategic consolidation and technology innovation defines the global amorphous alloy band market. The Japanese firms, especially Proterial, Ltd., lead the pack with their highly developed production units and vast patent holdings. Chinese producers, such as Qingdao Yunlu and ATM, are growing faster because they are relying on vertical integration and mass production plants to provide competitive pricing. Additionally, German companies like VACUUMSCHMELZE and Magnetec are concentrating on high-frequency applications and making strategic alliances in new markets like India. Indian firms like Usha Amorphous Metals Ltd. are benefiting through government schemes like the Production Linked Incentive (PLI) scheme to enhance their capacity and cut down on their dependency on imports to supply the growing demand of energy-efficient solutions. This dynamic landscape determines the importance of innovation, strategic alliances, as well as government funding in defining the future of the market.

Top Global Amorphous Alloy Band Manufacturers

Recent Developments

- In February 2024, Proterial, Ltd. developed a laminated bonded amorphous alloy ribbon designed to be used as a radial-gap motor core, a typical setup in xEV (electric vehicle) drive motors. This innovation attains a comparable thickness of the electromagnetic steel sheets, allowing better handling and over 90% packing density without compromising the magnetic properties of amorphous alloys. The bonded ribbon ameliorates past manufacturing difficulties based on thinness and hardness and is currently being supplied as samples to motor companies in an attempt at mass production.

- In October 2023, Aar Partners acquired Vacuumschmelze (VAC), a major global manufacturer of advanced magnetic materials and the largest manufacturer of rare earth permanent magnets in the Western Hemisphere. VAC is a fully vertically integrated magnetic solutions company that develops and produces mission-critical soft and hard magnetic material used in a multitude of industrial applications within the automotive, renewable energy, industrial automation, medical, and aerospace industries.

- Report ID: 8141

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amorphous Alloy Band Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.