High Alloy Steel Market Outlook:

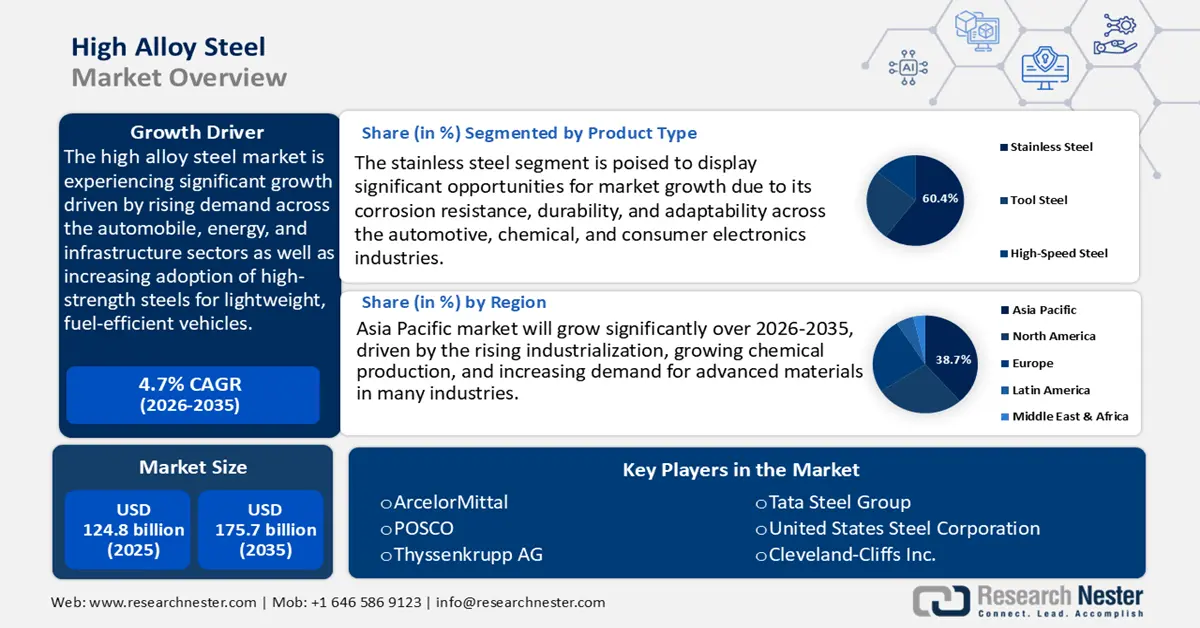

High Alloy Steel Market size was valued at USD 124.8 billion in 2025 and is projected to reach USD 175.7 billion by the end of 2035, rising at a CAGR of 4.7% during the forecast period, from 2026 to 2035. In 2026, the industry size of high alloy steel is evaluated at USD 141.5 billion.

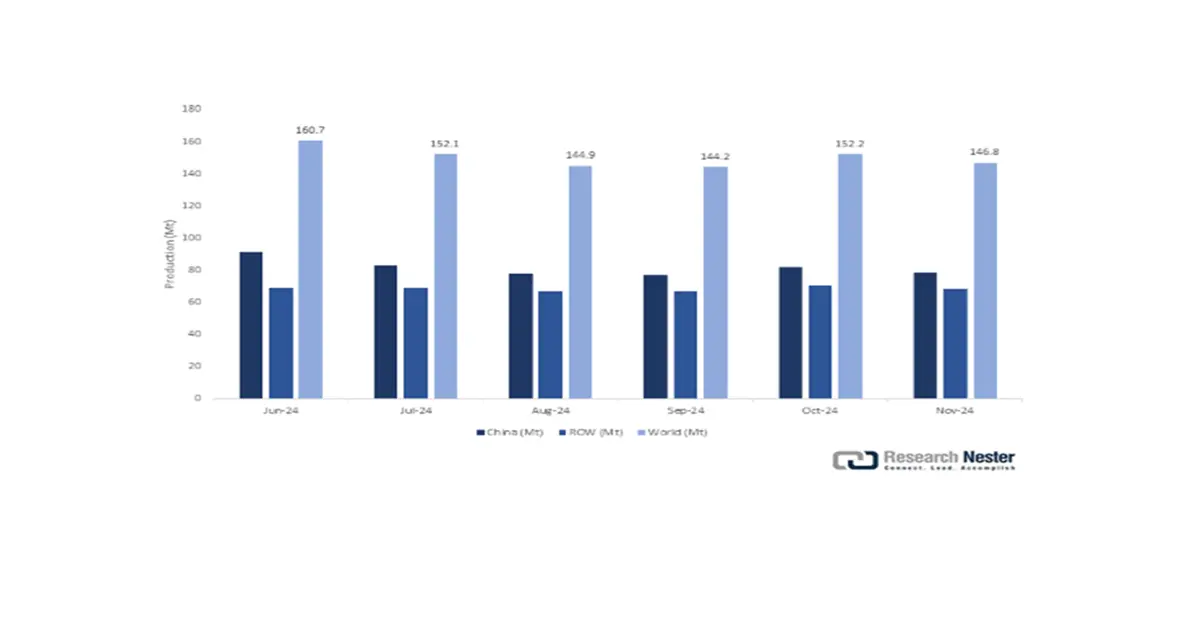

The high alloy steel market is anticipated to grow at a significant rate over the projected years, primarily driven by the increased demand in the automobile, energy, and infrastructure markets. According to the World Steel Association, the crude steel production in the 71 countries reporting was 146.8 million tonnes in November 2024, 0.8% higher than in November 2023. China generated 78.4 million tonnes, marking an increase of 2.5%. Meanwhile, 12.4 million tonnes were generated by India, with a 4.5% growth. Asia and Oceania led the regional production with 107.4 million tonnes, growing by 2.0% per annum. These numbers illustrate changing patterns of production among the big economies. The foundation of this growth is the increasing use of superior high-strength steels in the production of lightweight vehicles with superior safety and efficiency, which is pivotal amidst current governments taking the initiative to reduce emissions and adopt energy-saving technologies.

In addition, the U.S. Department of Energy’s Advanced Manufacturing Office is actively involved in research and development of specialty alloys, including high-alloy steels, to enhance performance in energy-intensive applications like turbines and power plants. For instance, the National Energy Technology Laboratory (NETL) of the U.S. Department of Energy is working on the scaling of nickel superalloy components toward Advanced Ultrasupercritical (AUSC) power plants. The goal of this initiative is to make the power plants more efficient by up to 25% for a typical coal-fired plant. The project includes the component fabrication such as the assemblies of the superheater tubes and turbine rotors made of nickel superalloys, that operates at a minimum pressure of 238 bar and at of 760 C of the steam temperatures. With a total project cost of USD 26.8 million, the DOE is contributing USD 20 million, while other project participants are contributing USD 6.8 million.

On the manufacturing and supply chain front, data in the industry reveal continued investment in process innovation and capacity building. According to the World Steel Association, around 7.25% of steel industry revenues are reinvested in research and development to improve the alloy quality and production efficiencies. In addition, NIST develops quality standards together with the manufacturers to define the reliability of the materials, which are crucial in high-alloy steels of critical infrastructure and in aerospace applications. For example, NIST manufactures and certifies steel composition, hardness, and toughness reference materials that enable manufacturers to manage quality and performance in the manufacturing process and ensure consumers that products fit their requirements.

These are essential in areas like bridges, pressure vessels, and nuclear power plants. NIST also engages and leads the ASTM and ISO committees and shares its knowledge, research, and experience with the community. These are some of the working relations between government departments and industry players contributing to the success of increasing demand and maintaining quality and sustainability in the high alloy steel market.

Key High Alloy Steel Market Insights Summary:

Regional Highlights:

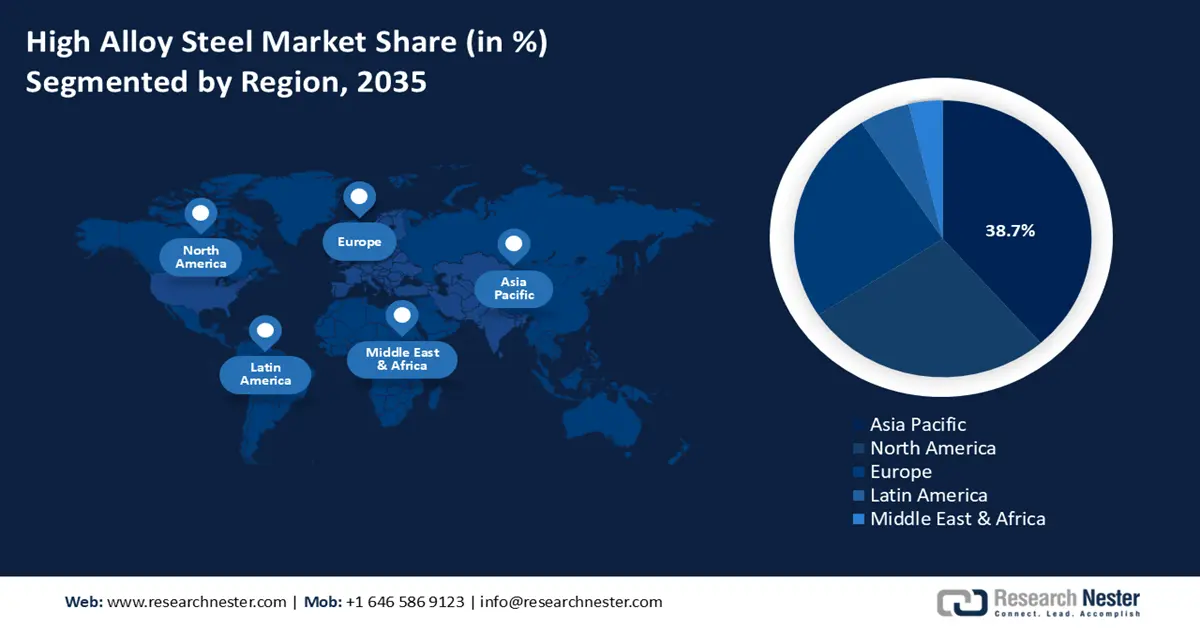

- The Asia Pacific high alloy steel market is projected to hold the dominant 38.7% revenue share by 2035, owing to rising industrialization, chemical production, and demand for advanced materials across energy-intensive industries.

- North America is anticipated to secure a 27.3% share by 2035, spurred by growing utilization of corrosion- and wear-resistant materials across chemical manufacturing, energy, and advanced industrial sectors.

Segment Insights:

- The stainless-steel segment in the high alloy steel market is anticipated to capture the largest 60.4% revenue share by 2035, propelled by its corrosion resistance, durability, and adaptability across key industries.

- The flat products segment is expected to account for a 58.2% share by 2035, supported by expanding applications in automotive panels, industrial machinery, and chemical containers.

Key Growth Trends:

- Demand for corrosion-resistant materials

- Recent catalytic technology development

Major Challenges:

- Poor infrastructure in developing areas

- Energy consumption and cost of sustainability

Key Players: ArcelorMittal, POSCO, Thyssenkrupp AG, Tata Steel Group, United States Steel Corporation, Cleveland-Cliffs Inc., Hyundai Steel Co. Ltd., Voestalpine AG, SSAB AB, OM Holdings Ltd., E Steel Sdn. Bhd., JFE Holdings Inc., Nippon Steel Corporation, Kobe Steel, Ltd., Daido Steel Co., Ltd.

Global High Alloy Steel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 124.8 billion

- 2026 Market Size: USD 141.5 billion

- Projected Market Size: USD 175.7 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 1 October, 2025

High Alloy Steel Market - Growth Drivers and Challenges

Growth Drivers

- Demand for corrosion-resistant materials: The chemical industry often handles a wide variety of corrosive materials like acids, alkalis, and solvents that can easily damage regular steel materials. Enriched chromium, nickel, and molybdenum-based high alloy steels provide greater corrosion resistance and mechanical strength needed in dependable chemical processing equipment. The stainless-steel production in the U.S. was 178,000 metric tons in June 2025, marking a 5% increase from June 2024. Imports of chromite ore were more than six times greater than in June 2024, and chromium metal averaged 625 per pound per month, 17% higher than in June 2024. Imports of chromium ferroalloy increased by more than double in May.

The market has been driven by replacement and new installation of high alloy steel reactors, pipelines, and heat exchangers as chemical plants' emphasis on durability and the reduced maintenance cost. The longer service life of equipment manufactured using these alloys translates into savings in operational costs as well as higher safety compliance, particularly in areas with stringent industrial requirements. - Recent catalytic technology development: Recent developments have made the chemical manufacturing processes effective and less harmful to the environment. The DOE’s Advanced Manufacturing Office focuses on the efficiency of chemical production by developing dynamic catalysts, science, and data analytics to facilitate significant energy and productivity improvements. Its research and development support new catalyst formulations and designs of processes to reduce the energy intensity of large volumes of chemical manufacturing. The manufacturing in the U.S. is competitive and sustainable through the work.

High alloy steels are essential in the construction of reactors and catalyst supports because these substances have to be subjected to high temperatures, pressure, and a corrosive environment. Durability and reliability of such alloys allow chemical producers to use state-of-the-art catalytic systems not only to maximize throughput but also to meet more stringent environmental emission requirements. As a result, there is an increase in investment in high-alloy steel components as companies seek to modernize infrastructure in order to remain competitive and sustainable. - Resilience of supply chain globally: Supply chain resilience is also one of the new tendencies that have been caused by the recent COVID-19 disasters and the need to manufacture durable and reliable materials during the manufacture of equipment. The U.S. International Trade Commission reports that the disruptions to global trade in 2020-2022 encouraged most chemical manufacturers to localize their operations and improve the infrastructure of their plants to overcome the risks. The high alloy steels are used due to their robustness, resistance to corrosion, and durability to minimize downtime and maintenance costs incurred in critical chemical processing processes. Application of these alloys improves continuity in operations that are extremely necessary in industries with a volatile market. Investing in high-alloy steel equipment will help to construct strong manufacturing systems that can absorb future shocks of the supply chain.

Global Crude Steel Production

Source: worldsteel.org

Crude steel production by region

|

Region |

Nov 2024 (Mt) |

% change Nov 24/23 |

Jan-Nov 2024 (Mt) |

% change Jan-Nov 24/23 |

|

Africa |

1.8 |

-5.0 |

20.4 |

1.3 |

|

Asia and Oceania |

107.4 |

2.0 |

1,251.5 |

-1.8 |

|

EU (27) |

10.7 |

3.9 |

119.9 |

2.2 |

|

Europe, Other |

3.4 |

-5.5 |

39.9 |

5.2 |

|

Middle East |

5.1 |

2.7 |

49.2 |

1.4 |

|

North America |

8.5 |

-5.2 |

97.1 |

-4.1 |

|

Russia & other CIS + Ukraine |

6.5 |

-7.8 |

77.9 |

-4.1 |

|

South America |

3.4 |

-3.4 |

38.8 |

0.9 |

|

A total of 71 countries |

146.8 |

0.8 |

1,694.6 |

-1.4 |

Source: worldsteel.org

Top 10 steel-producing countries

|

Country |

Nov 2024 (Mt) |

% change Nov 24/23 |

Jan-Nov 2024 (Mt) |

% change Jan-Nov 24/23 |

|

China |

78.4 |

2.5 |

929.2 |

-2.7 |

|

India |

12.4 |

4.5 |

135.9 |

5.9 |

|

Japan |

6.9 |

-3.1 |

77.1 |

-3.6 |

|

United States |

6.4 |

-2.8 |

72.9 |

-2.2 |

|

Russia |

5.5 |

-9.2 |

64.9 |

-7.0 |

|

South Korea |

5.2 |

-3.6 |

58.3 |

-4.9 |

|

Germany |

2.9 |

8.6 |

34.5 |

5.3 |

|

Türkiye |

3.0 |

0.7 |

33.9 |

11.2 |

|

Brazil |

2.8 |

1.9 |

31.2 |

5.6 |

|

Iran |

3.1 |

0.1 |

28.0 |

0.5 |

Source: worldsteel.org

1. Capacity & Demand Trends of Global Steel

As per the Global Forum on Steel Excess Capacity, from 2019 to 2027, the global steel excess capacity is expected to be characterized by an increasing gap between demand and output. Capacity in 2024 had reached 2,472 million metric tonnes (mmt), and demand was 1,870 mmt, resulting in an excess of 602 mmt. In addition, capacity is projected to increase to 2,637 mmt by the end of 2027 as compared to the projected demand of 1,916 mmt, resulting in a gap of 721 mmt. This means that there has been a trend of oversupply in the world steel market despite a slight recovery in demand.

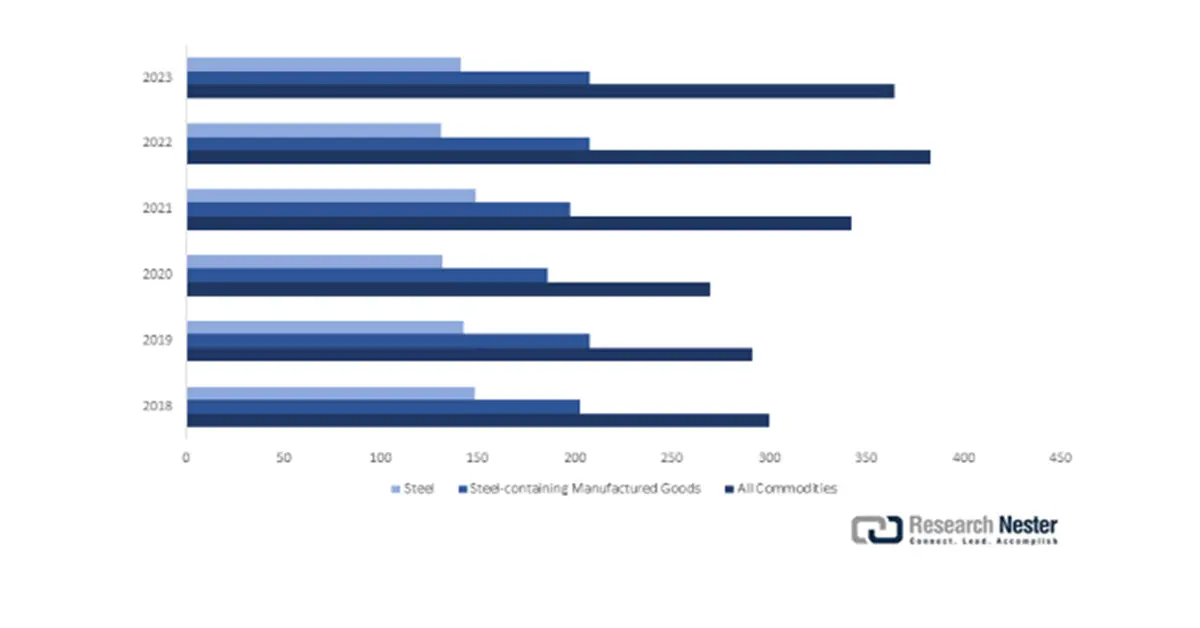

- Trade & Import/Export Trends

Global Trade Volume, 2018 to 2023

Source: worldsteel.org

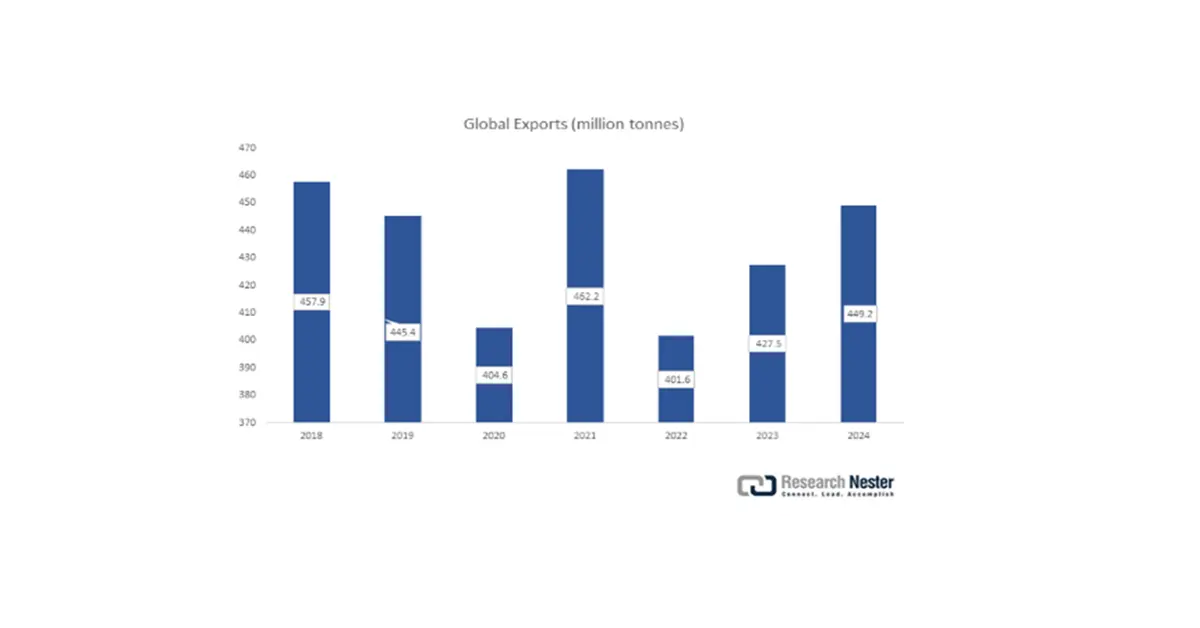

Global Steel Trade in Products, 2018 to 2024

Source: worldsteel.org

Global steel exports by product, 2020 to 2024

|

Product |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Ingots and semi-finished material |

55.7 |

61.1 |

44.6 |

53.1 |

54.6 |

|

Railway track material |

2.6 |

2.8 |

2.6 |

3.1 |

3.2 |

|

Angles, shapes, and sections |

19.6 |

20.3 |

19.0 |

20.3 |

21.7 |

|

Concrete reinforcing bars |

19.2 |

22.0 |

15.4 |

15.5 |

17.7 |

|

Bars and rods, hot-rolled |

12.8 |

15.3 |

12.7 |

12.3 |

12.0 |

|

Wire rod |

25.2 |

29.0 |

25.5 |

22.8 |

23.8 |

|

Drawn wire |

8.7 |

9.6 |

8.6 |

9.9 |

8.9 |

|

Other bars and rods |

4.5 |

6.1 |

7.4 |

8.4 |

7.7 |

|

Hot-rolled strip |

2.8 |

3.4 |

3.0 |

3.1 |

3.2 |

|

Cold-rolled strip |

3.7 |

4.8 |

4.1 |

4.0 |

3.9 |

|

Hot-rolled sheets and coils |

74.6 |

79.3 |

68.0 |

76.0 |

82.0 |

|

Plates |

29.4 |

30.9 |

32.2 |

34.6 |

35.5 |

|

Cold-rolled sheets and coils |

19.0 |

36.7 |

30.8 |

30.1 |

31.9 |

|

Electrical sheet and strip |

3.9 |

5.1 |

5.2 |

4.5 |

4.6 |

|

Tinmill products |

7.0 |

6.8 |

6.9 |

5.9 |

6.9 |

|

Galvanised sheet |

37.0 |

45.3 |

38.4 |

41.0 |

43.2 |

|

Other coated sheet |

18.1 |

20.2 |

16.5 |

18.3 |

21.2 |

|

Steel tubes and fittings |

32.3 |

34.3 |

34.2 |

36.5 |

37.2 |

|

Wheels (forged and rolled) and axles |

0.7 |

0.9 |

0.8 |

1.0 |

1.3 |

|

Castings |

1.1 |

1.4 |

1.5 |

1.4 |

1.4 |

|

Forgings |

0.9 |

1.0 |

1.1 |

1.1 |

0.9 |

|

Total |

378.8 |

436.3 |

378.4 |

402.9 |

422.7 |

Japan Steel Production, July 2025

|

|

|

Jul-2025 |

|

Jun-2025 |

Year to date (CY) |

Year to date (FY) |

||

|

Volume |

Jul-2025/ |

Jul-2025/2024 |

|

|

|

|||

|

Jan-2025~ |

Apr-2025~ |

|||||||

|

Volume |

2025/2024 |

Volume |

FY2025/2024 |

|||||

|

Pig Iron Production |

5,064.4 |

106.4 |

98.5 |

4,759.0 |

34,339.6 |

95.9 |

19,519.8 |

95.7 |

|

Crude Steel Production |

6,917.9 |

103.1 |

97.5 |

6,709.8 |

47,462.0 |

95.3 |

27,065.6 |

95.5 |

|

(L.D. converter) |

5,199.7 |

107.8 |

99.5 |

4,823.2 |

35,031.1 |

96.1 |

19,925.7 |

96.0 |

|

(Electric arc furnace) |

1,718.2 |

91.1 |

91.8 |

1,886.6 |

12,431.0 |

93.1 |

7,139.9 |

94.0 |

|

(Ordinary steel ingot) |

5,303.7 |

103.0 |

97.0 |

5,151.1 |

36,696.3 |

94.9 |

20,833.8 |

94.6 |

|

(Specialty steel ingot) |

1,598.2 |

103.8 |

99.1 |

1,539.9 |

10,642.7 |

96.9 |

6,160.2 |

98.6 |

|

(For castings) |

16.0 |

85.1 |

81.0 |

18.8 |

123.1 |

91.6 |

71.5 |

93.7 |

|

(Total: Ordinary steel) |

5,312.2 |

102.9 |

97.0 |

5,161.5 |

36,760.8 |

94.9 |

20,872.3 |

94.6 |

|

(Total: Specialty steel) |

1,605.7 |

103.7 |

99.0 |

1,548.3 |

10,701.3 |

96.9 |

6,193.2 |

98.6 |

|

Total Hot-Rolled Steel Products |

6,131.6 |

103.9 |

95.9 |

5,901.0 |

42,248.6 |

95.9 |

24,088.8 |

96.6 |

Source: Japan Iron and Steel Federation

Challenges

- Poor infrastructure in developing areas: Infrastructure is also a major obstacle to the efficient delivery of high alloy steel products in most of the developing areas. According to the Logistics Performance Index report by the World Bank, poor transportation networks and logistics systems add up to 30% to delivery time and costs. For instance, in developing countries, around one billion people live over 2 km without an all-weather road, which makes access difficult and is directly related to poverty. These costs and the problems of increasing transport demand and environmental issues can be solved through better transport infrastructure.

With these inefficiencies, manufacturers are limited in achieving their capacity in scheduled projects and disrupt supply chains, especially chemical plants that require materials delivered on a just-in-time basis. Additionally, some countries have low port capacity and old-fashioned handling equipment, leading to delays and hence putting the sensitive products made of high alloy steel at risk of damage. The costs associated with this infrastructure deficit are not only inflated but also prevent market penetration by suppliers seeking to grow in the new economies where the chemical industry is developing. - Energy consumption and cost of sustainability: The production of high alloy steel is a very energy-consuming process, and manufacturers are highly sensitive to the increasing cost of energy and carbon regulation policies. Carbon pricing has been raising production costs by about 10% since 2022, since the European Union introduced its climate policy, the Emissions Trading Scheme (ETS). These extra expenses drive manufacturers to make massive investments in cleaner technologies to achieve emissions targets and stay afloat.

According to the Rocky Mountain Institute, the cost of transition to low-carbon steel production technologies (e.g., hydrogen-based direct reduced iron, carbon capture) is expected to increase by approximately 10%, resulting in a green premium of between USD 100 and USD 200 per ton. This premium affects pricing competitiveness in the high alloy steel segment, where the cost of raw materials and alloying is already quite high. These laws force the high alloy steel industry to give equal attention to sustainability and to control the cost of its operations.

High Alloy Steel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 124.8 billion |

|

Forecast Year Market Size (2035) |

USD 175.7 billion |

|

Regional Scope |

|

High Alloy Steel Market Segmentation:

Product Type Segment Analysis

By 2035, the stainless-steel segment in the high alloy steel market is projected to grow with the largest revenue share of 60.4% during the forecast years from 2026 to 2035, attributed to its corrosion resistance, durability, and adaptability in industries. The European Chemicals Agency (ECHA) notes that higher regulatory attention to the safety and hygiene of chemical plants has increased the demand for stainless steel piping and equipment. The U.S. Geological Survey has also indicated that there is a consistent supply of nickel and chromium in the world that are required in the manufacture of stainless steel, and the same will drive the market growth in the future. The prevalence of stainless steel in the automotive, chemical manufacturing, and consumer electronics industries serves as the foundation of its market leadership qualities due to its critical contribution to the achievement of high environmental and performance levels.

Austenitic stainless steel is the most suitable stainless steel in chemical processing equipment and car components due to its high ductility, excellent corrosion resistance, and superior strength. According to the U.S. Geological Survey, more than 65% of the nickel used in the Western world is consumed in the production of austenitic stainless steel, which is commonly used in many industries because of its excellent corrosion resistance. In addition, ferritic stainless steel is more economical and resistant to stress corrosion cracking, common in automotive exhaust and kitchen appliances. According to the European Chemicals Agency (ECHA), registration dossiers on a range of substances involved in the production of stainless steel, e.g., ferrochromium and ferrosilicon, show that these compounds are incorporated in the manufacture of stainless steel, including ferritic types. The materials are used to form stainless steel that is durable and can be recycled.

Product Form Segment Analysis

Flat products segments in the high alloy steel market are projected to expand with a revenue share of 58.2% during the forecast years, due to their wide range of automotive panels, industrial machinery, and chemical container applications. The U.S. Department of Energy emphasizes that fuel economy can be enhanced by 6% to 8% simply by reducing 10% of the vehicle's weight. High-strength steel, aluminum, or carbon fiber, the most advanced types of lightweight materials, can cut component weights by up to 75%. If used on a quarter of the U.S. vehicle fleet by 2030, they could save more than 5 billion gallons of fuel each year. Flat products (sheets and plates) have better strength-to-weight ratios that allow manufacturers to improve performance and sustainability.

Sheets and coils form the dominant sub-segments under flat products and promote substantial revenue growth based on wide applications in the automotive, construction, and chemical sectors. Sheets are particularly valued in automobile body panels and chemical processing equipment, where appearance and resistance to corrosion are crucial factors. As the U.S. Department of Energy is highlighting the growing need for lightweight sheet metals to enhance fuel efficiency in cars, future consumption of flat sheets is also projected to rise steadily. Meanwhile, coils offer flexibility in manufacturing and low cost, and are used to produce consumer electronics and industrial machinery in large quantities. Their coils are of high strength, uniform in quality, and widely used in the production of automotive and appliance parts, as they possess inflexible tolerances and a superior surface finish. In addition, the widespread use of steel coils in building, transport, and energy devices also reinforces the significance of steel coils in the industrial supply network throughout the world.

Application Segment Analysis

The automotive segment is expected to grow substantially by 2035, with a high alloy steel market share of 53.8%, owing to the rising trend of corrosion resistance, light weight, and durability requirements in materials. Regulatory requirements in the automotive markets around the world are compelling automotive manufacturers to trim down their vehicle emissions and enhance fuel efficiency, including using more high-alloy steel parts like engine components, exhaust systems, and body panels. The International Energy Agency states that innovations made in alloy steels are playing a role in vehicle lightweighting efforts, helping to meet tougher emissions requirements without sacrificing safety. Automobile is the largest usage area, as this trend is driving faster adoption in electric and non-electric internal combustion engine vehicles.

Our in-depth analysis of the high alloy steel market includes the following segments:

|

Segment |

Subsegment |

|

Product Form |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Alloy Steel Market - Regional Analysis

North America Market Insights

The North America high alloy steel market is expected to grow steadily, with the revenue share of 27.3% over the projected years, as demand is constantly rising in the chemical manufacturing, energy, and advanced industrial sectors. The regulatory bodies, especially the Environmental Protection Agency (EPA), have been making efforts to increase the requirements for corrosion-resistant, wear-resistant materials, which have increased the demand for high alloy steel that is used in processing chemicals and in the manufacture of equipment. This trend is backed by substantial government investment, such as the Department of Energy, which in 2022 announced it was investing USD 2.6 billion in carbon capture demonstration and CO₂ transportation infrastructure projects.

Moreover, the safety standards of the Occupational Safety and Health Administration (OSHA) in their interpretation of the standard, 29 CFR 1910.184, have only sanctioned the use of alloy steel chain slings in overhead hoisting operations. This highlights the importance of high-quality alloy steel in the provision of safe lifting equipment in the workplace. These regulatory and financial obligations, combined with technological improvements in production, support the strong demand prospects in the region.

The high alloy steel market in the U.S. is anticipated to lead the North American region with the highest revenue share over the projected years, attributed to the development of the chemical industry and the strict regulations. The federal initiatives designed to encourage green technology have increased the use of high-performance alloys in chemical facilities. For instance, existing Toxic Substances Control Act (TSCA) regulations of the U.S. Environmental Protection Agency (EPA) have obligated producers to use corrosion-resistant materials to comply with the safety demands. In addition, the Department of Energy's investment in clean energy production has promoted the modernization of steel production plants to increase new alloy mix design that improves durability and efficiency. To ensure that the U.S. technological development in high alloy steel, the National Institute of Standards and Technology (NIST) further assists in research on other advanced materials, making high alloy steel attractive to those industries that consider sustainability and technological revolution.

Canada’s high alloy steel market is likely to witness an upward trend from 2026 to 2035, mainly due to the government policies on clean technology and resource efficiencies. In 2023, the Canadian government announced that its Strategic Innovation Fund will provide CAD 1.2 billion in support of advanced manufacturing, including steel innovation projects that improve the quality of alloys and manufacturing processes. In addition, Environment and Climate Change Canada has also established tighter limits to reductions of emissions into the environment by providing incentives to adopt more long-lasting and corrosion-resistant alloys in the chemical and energy industry.

In Canada, a strong R&D partnership between academic institutions and industry is another advantage that supports the development of material science addressing cold climates and corrosive environments. Industrial steel standards are updated regularly by the Canadian Standards Association (CSA), which maintains product reliability and safety within all industries. These initiatives will together generate demand in high alloy steel products tailored to unique industrial requirements in Canada.

Asia Pacific Market Insights

Asia Pacific is projected to dominate the global high alloy steel market with the largest revenue share of 38.7% over the forecast years, owing to the rising industrialization, growing chemical production, and increasing demand for advanced materials in many industries. According to the International Energy Agency (IEA), more than 40% of the energy consumption by industries in the region will rise by the year 2030, which implies that the energy-intensive industries within the region are on the rise and will require the usage of corrosion-resistant and durable steel products. In addition, governments are significantly encouraging sustainability programs and cleaner production technologies, which is increasing investment in high alloy steel solutions to improve process efficiency and lower environmental footprints.

Furthermore, the booming electronics and semiconductor industry in the region is stimulating the demand for alloy steel, since these industries require high-performance materials with strict quality and safety provisions. Environmental and safety laws are being intensified by regulatory agencies, and this is stimulating the manufacturers to use corrosion-resistant alloy that meets the current industrial safety standards. The growth of infrastructure and chemical plants in the area is also helpful in maintaining a high level of demand. All these elements make the Asian Pacific the fastest rising high alloy steel market in the world with a projected CAGR of over 5 percent in the next 2035.

China’s high alloy steel market is predicted to dominate Asia Pacific, driven by a large base of chemical production and the government strongly working towards the sustainable development of its industries. The 14th Five-Year plan of China focuses on the development of high-quality materials, such as high alloy steel, to facilitate high-technology chemical processing and infrastructure development. Restrictive environmental regulations by the Ministry of Ecology and Environment affect the adoption of corrosion-resistant alloys by firms to reduce emissions and improve the effectiveness of plants. Moreover, in recent years, ChemChina and the China Petroleum and Chemical Industry Federation have significantly invested in research and development, which has enabled them to innovate their alloy steel formulations and technologies to produce cleaner products. As well, increasing exports of high alloy steel products to Southeast Asia and Europe increases the market penetration of China. These factors position China as a leader in the APAC market, underpinned by huge government subsidies and an integrated upstream to downstream supply chain.

The high alloy steel market in India is projected to grow with the fastest CAGR during the forecast years from 2026 to 2035, driven mainly due to the strong development of the chemical segment and growing governmental investments aimed at the modernization of the steel production and the promotion of sustainable technologies are the reasons for this strong growth. The Ministry of Chemicals and Fertilizers stated that the number of financial resources allocated to green chemical processes, such as using high alloy steel, has steadily increased in 2023.

Programs by the Department of Science & Technology are hastening the use of high-tech materials in chemical production, and FICCI is pointing to a boom in the number of domestic firms that are adopting corrosion-resistant alloys as a way of meeting increasing environmental standards. The infrastructure development and technological improvements are supported by the Make in India campaign and by increased foreign direct investment (FDI) in the Indian steel industry. In addition, owing to the favor of the government toward renewable energy and emission reduction schemes, there has been an increase in the demand for long-life span and environmentally friendly steel alloys. These dynamics put India in the category of the rapidly growing markets with good policy frameworks and growing industrial capabilities.

Europe Market Insights

The Europe high alloy steel market is anticipated to witness a healthy growth over the projected years, due to robust demand in the chemical industry, automotive industry, aerospace industry, and heavy machinery industry. The sustainability agenda, circular economy concepts, and conservation of the environment in the region are driving the adoption of corrosion-resistant and durable alloy steels that can improve energy efficiency and minimize operation costs. As per the Cefic (2024) report, the European chemical industry is well-established with a positive balance of trade and continuous utilization of capacities.

Europe is still investing in sustainability and innovation in line with the EU Green Deal despite global competition. The intentions of these efforts are to improve the position of Europe in the world chemical market as well as to provide high-quality employment in the future. The European Chemicals Agency (ECHA) has imposed strict regulations on REACH mandating all manufacturers to comply with safety and environmental regulations, and it has triggered new creative approaches to alloy compositions and eco-friendly production.

As the biggest steel manufacturer in Europe, Germany is putting a lot of investment into research and development to come up with high alloy steels that are technologically advanced to suit the dynamic demands of other industries such as automotive and aerospace. Meanwhile, the UK government is undertaking ambitious green manufacturing programs that seek to decarbonize steel manufacturing and advance sustainable industrial processes. Additionally, the high demand for alloys that provide longevity and environmental compliance in a wide variety of industrial implementations further drives the market.

Key High Alloy Steel Market Players:

- ArcelorMittal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- POSCO

- Thyssenkrupp AG

- Tata Steel Group

- United States Steel Corporation

- Cleveland-Cliffs Inc.

- Hyundai Steel Co. Ltd.

- Voestalpine AG

- SSAB AB

- OM Holdings Ltd.

- E Steel Sdn. Bhd.

- JFE Holdings Inc.

- Nippon Steel Corporation

- Kobe Steel, Ltd.

- Daido Steel Co., Ltd.

The high alloy steel market is dominated by multinational corporations in Europe and Asia, and Asian companies, essentially Japanese and South Korean producers, seek innovation by developing superior processing and automation. European players are centering on sustainability, specialty products, and strategic integrations as a way of staying ahead in the face of increasing global and environmental pressures. As the U.S. firms are driving the domestic demand and technology development, the Indian and the Australian firms are capitalizing on the vertical supply chain and the new domestic markets. Potential strategic directions include capacity expansion, ESG-compliant production, the creation of ultra-high-strength-based applications, and digitalization as new demands emerge in the automotive, infrastructure, and energy industries.

Below is the list of some prominent players operating in the market:

Recent Developments

- In January 2025, Tata Steel becomes the first steel manufacturer in India to demonstrate end-to-end operations in the production of steel pipes specially designed to transport 100% hydrogen. The API X65 ERW pipes produced by the company based in Khopoli, through steel produced at its Kalinganagar plant, passed hydrogen qualification tests by RINA-CSM S.p.A., Italy. The innovation complements the National Hydrogen Mission in India and allows pure hydrogen gas to be transported through the air safely and efficiently (100 bar). These pipes have been developed fully in-house, which is a major milestone in the Indian clean energy transition and the use of hydrogen infrastructure worldwide.

- In January 2025, Alleima reintroduced high-strength, corrosion-resistant steel bars, Alleima HighN50, aimed at the demands of high-energy and chemical industries. These products are appropriate for applications with high demands, such as maritime equipment and hydrogen infrastructure. Alleima’s influence in the high-performance environment is demonstrated by the new range, which is more mechanically developed and has a longer life cycle. Higher uptake of renewable energy and chemical processing was also part of this relaunch and is also reflective of increased market uptake of durable, sustainable steel solutions in Europe and Asia in Q1 2025.

- Report ID: 8157

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

High Alloy Steel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.