Steel Powder Market Outlook:

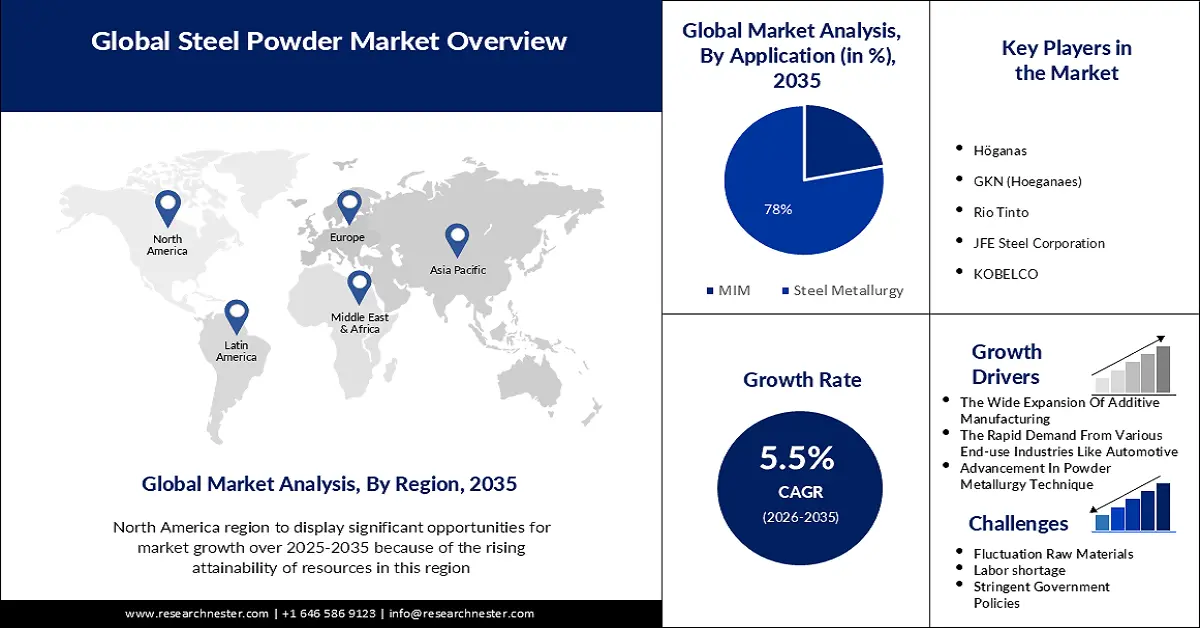

Steel Powder Market size was over USD 6.26 billion in 2025 and is anticipated to cross USD 10.69 billion by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steel powder is assessed at USD 6.57 billion.

The primary reason behind the growth of the market is the wide expansion of additive manufacturing. The commercial application in this event will be molds, e.g., for plastic injection. However, technologies that generate metal parts offer a straight dispute to metal casting (and other generation processes, too). As such, the latest X line 1000R laser metal sintering machine co-created by Concept Laser GmbH and Fraunhofer Institute for Laser Technology is a debate-changer. Its 630×400×500-mm create envelope is now reported as the biggest commercially accessible for laser melting.

Another reason that will propel the steel powder market by the end of 2036 is the rapid demand from various end-use industries like automotive. Today, the use of these highly precise components per automobile is increasing by between 6% and 7% per year. One of the factors for this powerful growth is the amalgamation of favorable cost and the properties of the components, both acknowledging intricate shape, accuracy and suitable physical properties. Low cost is given by the comfort with which the PM technique is machine-driven. The intricate shape is given by the domestic contour of the die and the profile of the other equipment members. Cutting, drilling turning, and other expensive forming operations can be eradicated. This not only helps to lower costs but also outcomes in essentially total eradication of waste. The PM technique presents great resilience also in providing custom-made component properties. The fact that the component is composed of a compilation of small particles of iron and other metals or elements, gives an additional degree of liberty for the materials engineer.

Key Steel Powder Market Insights Summary:

Regional Highlights:

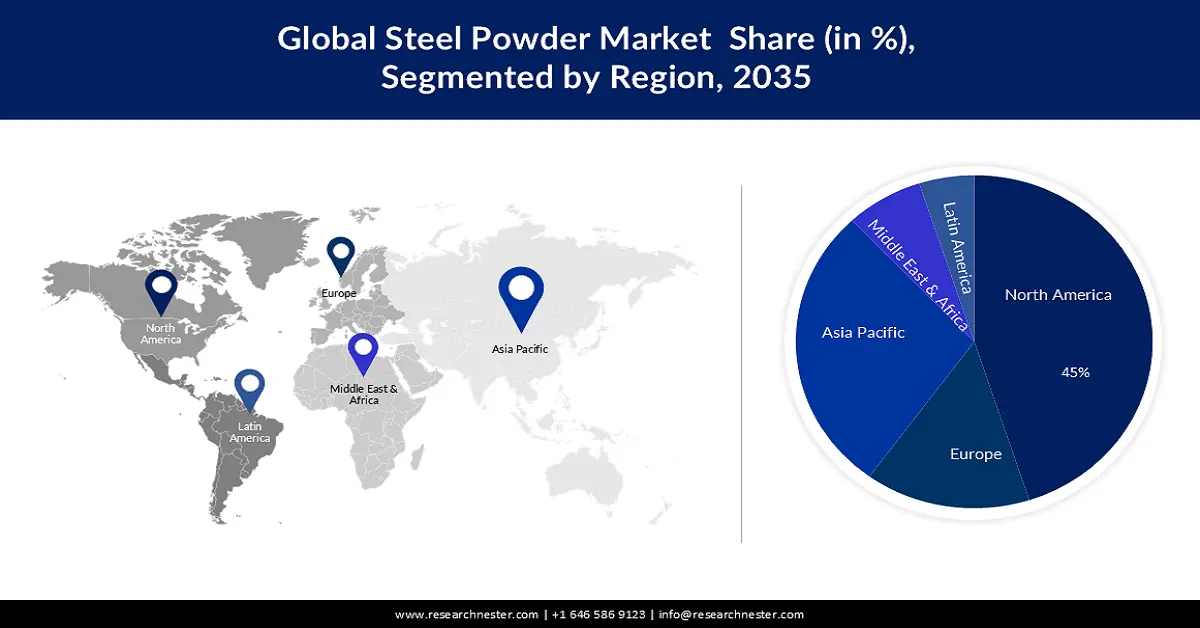

- North America steel powder market is expected to capture 45% share by 2035, driven by the rising attainability of resources in the region.

- Asia Pacific market will secure the second largest share by 2035, driven by the rising advancement in technologies to assist track, allotting, and maximizing assets in the yard.

Segment Insights:

- Powder metallurgy segment in the steel powder market is expected to achieve 78% growth by the forecast year 2035, driven by the automotive industry's reliance on powder metallurgy for durable components.

- The stainless steel powder segment in the steel powder market is projected to hold a 35% share by 2035, driven by its corrosion resistance and hygienic properties across industries.

Key Growth Trends:

- Advancement in Powder Metallurgy Technique

- Food and Drug Administration Approved Additives

Major Challenges:

- Fluctuation Raw Materials

- Labor shortage

Key Players: Höganas, GKN (Hoeganaes), Rio Tinto, JFE Steel Corporation, KOBELCO, Metal Powder Products, Sandvik Group, Pellets, Daido Steel, AMETEK, Teikoku Carbon Industry Co.

Global Steel Powder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.26 billion

- 2026 Market Size: USD 6.57 billion

- Projected Market Size: USD 10.69 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Steel Powder Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in Powder Metallurgy Technique - With the quick modification in technology in each sector, powder metallurgy requires more progress. For instance, because of the diesel crisis, governments worldwide are encouraging electric or hybrid cars. So, there is a requirement to substitute the internal burning engine. For this, the powder metallurgy industry has to stay ready for the basic transformation. The more essential for the powder metallurgy industry is to generate cheap materials with high execution. Moreover, it is noticed that most metal powder parts are breakable so industries are looking for the choices to create parts with increased power. Agents such as vanadium, tungsten, molybdenum, etc. that require balling at high temperatures are now being utilized by some manufacturers to generate high-resistance materials. Therefore, powder metallurgy, which has been utilized by mankind for a long time, is quickly making improvements to the transforming requirements of different sectors. Working on the fresh fronts, manufacturers of PM materials are advancing to present powerful and high-executing materials at the lowest possible cost.

- Food and Drug Administration Approved Additives - Specific chemical essences have been recognized and used for centuries through different cultures and advancements either to enhance or preserve flavor, impertinence, look, taste, consistency, or quality characteristics of foods. A lot of these substances are of little or no nutritious value but are added in small quantities at the time of food processing, flavoring, packaging, storage, or presentation of both human and animal foods for a particular wanted influence. Food additives give a scope to feed the world by keeping the attainability of suitable nutritious and pocket-friendly food for human intake, while also giving an avenue to reduce food loss and waste.

- Increasing Use of 3-D Prints - Soft magnetic composite materials can be created into complicated, 3d shapes and hence many industries are demonstrating a raised interest in such components. From its conception, 3D printing has had the potential to transform the way materials are manufactured. The benefits have strategic implications: resilience, design release, time-to-market, mass personalization, distributed manufacturing, and much more. Although challenges remain, the results of implementing 3D printing are demonstrating their value.

Challenges

- Fluctuation Raw Materials - Plenty of stainless steel has been sourced for making furniture meant for settings like cleanrooms, and laboratories, along with hospitality settings, like food service kitchens. As part of our Made-in-America manufacturing philosophy, they utilize locally sourced steel and other metals, which gives them substantial lead time benefits over other manufacturers that are dependent on overseas metal suppliers. Nevertheless, there is rising pressure on steel and other metal supply chains generally because of production cutbacks during the epidemic, which caused inventory levels to fall off substantially. As an outcome, a lot of steel mills and aluminum foundries and mills - mainly those in overseas locations where vaccination rates are still very low - are fighting to reboot generation levels to carry on with quickly rising requirements. US tariffs on foreign steel and metal imports, first presented by the Trump administration to promote American steel manufacturing, are still in place. The tariffs have provided domestic metal manufacturers with raised pricing power.

- Labor shortage

- Stringent Government Policies

Steel Powder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 6.26 billion |

|

Forecast Year Market Size (2035) |

USD 10.69 billion |

|

Regional Scope |

|

Steel Powder Market Segmentation:

Type Segment Analysis

The stainless-steel powder segment in the steel powder market will grow the most by the forecast period and will hold almost 35% because of its extensive use in different sectors as it’s a non-corrosive product. Stainless steel powder is a low-carbon steel, which comprises a nominal of 10.5% chromium. It’s the chromium that reacts with oxygen to form a persistent oxide bond on the surface to hinder rust. The more chromium, the stronger to oxidation. Stainless steel also comprises some nickel, which reduces corrosion opposition, but this can be balanced with the accumulation of molybdenum. This bond is a film and if impaired, will self-heal. This is crucial for applications in healthcare, as impairment in the type of fissures shows a breeding ground for bioload bacteria. Stainless steels are also simple to wash and impenetrable, which assists in managing a hygienic ecology. Chemically inactive, stainless steel can also be securely germ-free without struggling corrosion or deterioration. The inactivation layer on stainless steel is one of the biggest factors why it is so famous in all sectors.

Application Segment Analysis

The powder metallurgy segment in the steel powder market will have superior growth during the forecast period and will hold around 78% of revenue share owing to its increasing popularity and use in the industries of the world. For instance, in the automotive sector, approximately 70% of the structural parts made by powder metallurgy (PM) have been utilized by the automotive industry, and although the reduction in depletion is because of the current international economic crisis. Powder metallurgy (PM) is specifically utilized due to its comparatively close capacity and cost-accomplishment ratio. The automotive industry is acknowledged as a major market for the powder metallurgy industry, as it requires products having supreme mechanical or part of the use on an international level. PM technology is experiencing significant transformation in manufacturing and components research as automobile technologies shift beyond classic gasoline-motorized vehicles to fresh energy vehicles. Transformations in automobile technologies have developed both impediments and scopes for PM.

Our in-depth analysis of the global steel powder market includes the following segments:

|

Production Method |

|

|

Particle Size |

|

|

Type |

|

|

Application |

|

|

End-Use Industries |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steel Powder Market Regional Analysis:

North American Market Insights

The steel powder market in the North America region will have the biggest growth during the forecast period with a revenue share of around 45%. This growth will be noticed owing to the rising attainability of resources in this region. In the period of consideration, steel production in the United States fluctuated considerably. In particular, the production level decreased from 87.8 million in 2019 to 72.7 million metric tons in 2020 due to the narrowing-down impacts of the coronavirus epidemic on the American metal industry. The following year, the manufacturing level increased to 85.8 million metric tons before reducing to 82 million in 2022. Over the last several years, the global production of crude steel has experienced consistent growth. Since 2003, yearly crude steel generation has risen from 971.02 million metric tons to approximately 1.9 billion metric tons in 2022, although a dip in international requirement in 2020 because of the coronavirus epidemic.

APAC Market Insights

The steel powder market in the Asia Pacific region will also encounter huge growth during the forecast period and will hold the second position owing to the rising advancement in technologies. The trend is pushing the agreement with technologies to assist track, allotting, and maximizing assets in the yard. ABI Research anticipates that the installed base of artificial intelligence (AI) offered cameras in the yard will touch 11.2 million internationally by 2030, and the consumption of self-governing yard trucks will increase substantially at an international CAGR of 52.7% from 2022 to 2030.

Steel Powder Market Players:

- Höganas

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GKN (Hoeganaes)

- Rio Tinto

- JFE Steel Corporation

- KOBELCO

- Metal Powder Products

- Sandvik Group

- Pellets

- Daido Steel

- AMETEK

Recent Developments

- February 2, 2024: Sandvik Group has fulfilled the earlier declared acquirement of pro-micron GmbH, a German-located supplier of censored equipment and automation software. The organization will be reported in Sandvik Coromant, a part of Sandvik Manufacturing and Machining Solutions.

- 1st January 2024: Höganäs is a non-profit entity whose intention is to generate scopes for social and economic growth in the Mogi das Cruzes region, which is where Höganäs’ Brazilian operations are situated. Annually, AGFE acknowledges organizations in the region and the kind of environmental care, Höganäs' plastic pallet project was accepted.

- Report ID: 5756

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steel Powder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.