Chrome Ore Market Outlook:

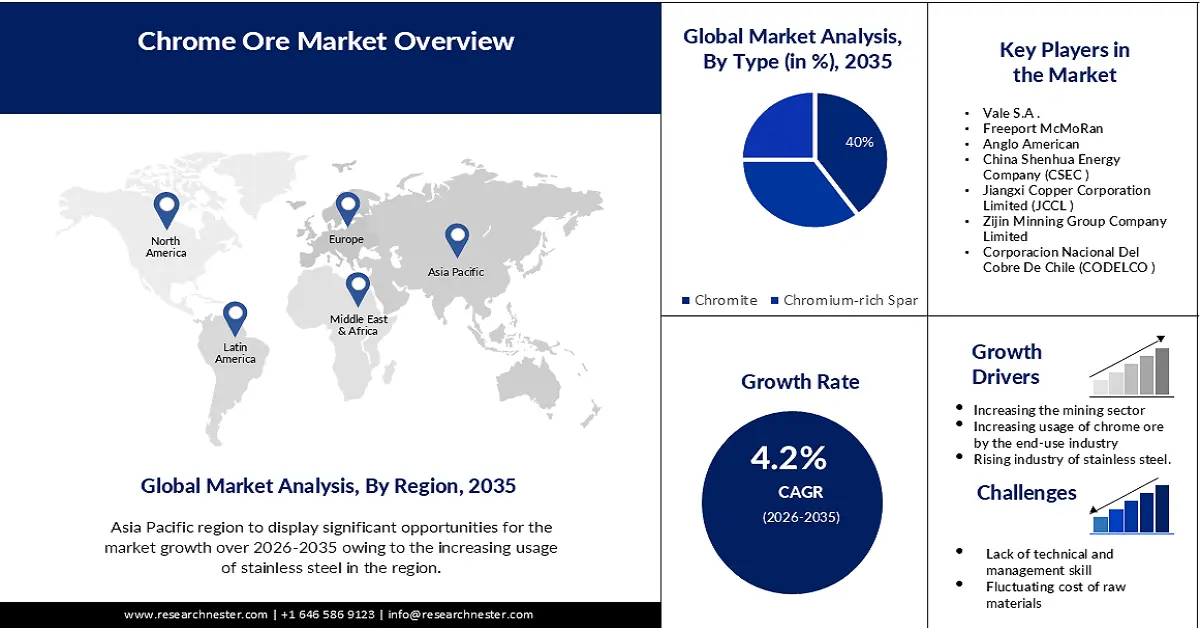

Chrome Ore Market size was valued at USD 4.96 billion in 2025 and is set to exceed USD 7.48 billion by 2035, registering over 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of chrome ore is evaluated at USD 5.15 billion.

The demand for stainless steel in areas such as construction is driving the growth of the market. According to the American Institute of Architects, non-residential building construction in the United States is expected to boost by 3.1 % by 2022. Hotel construction is expected to increase by 8.5% in 2022, while office space construction by 0.2%.

Governments in many regions have implemented policies to promote chrome ore mining. Such efforts are increasing the chrome ore market growth. In 2021, Chromium Ore was the world's 696th most traded product, with a total trade of $2.63B. Between 2020 and 2021 the exports of Chromium Ore grew by 28.3%, from $2.05B to $2.63B. Trade in Chromium Ore represents 0.012% of total world trade.

Key Chrome Ore Market Insights Summary:

Regional Highlights:

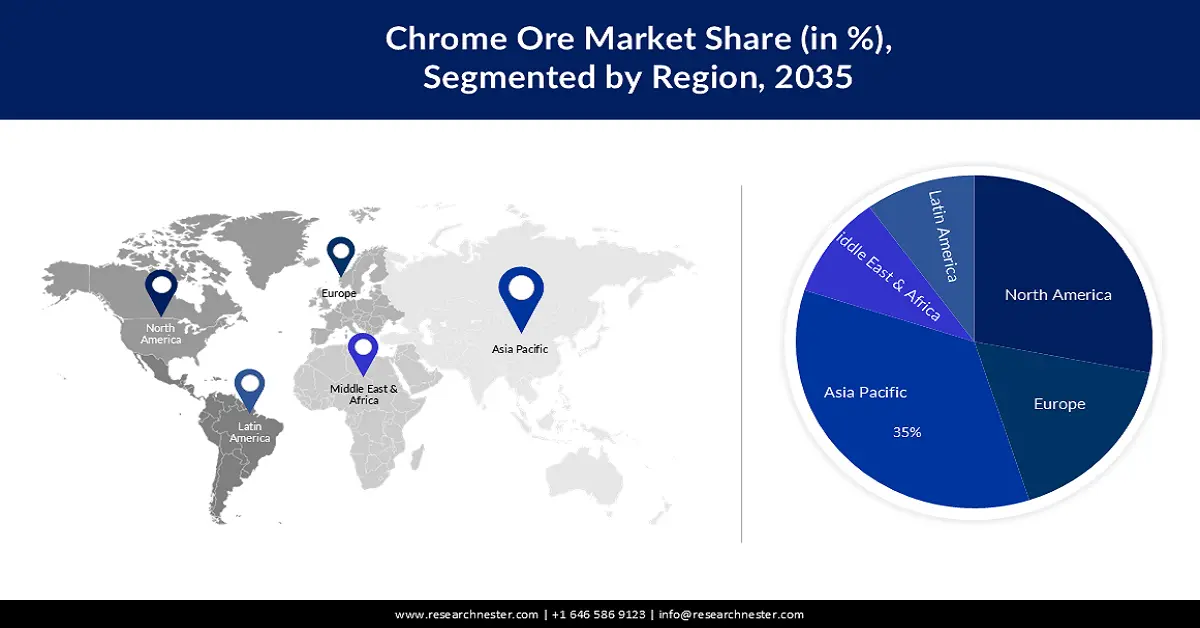

- Asia Pacific chrome ore market is poised to capture 35% share by 2035, driven by the expansion of the stainless-steel industry and relaxed mining policies.

- Middle East & Africa market will secure 28% share by 2035, driven by rising mining activities and technological advancements in automation.

Segment Insights:

- The stainless steel segment in the chrome ore market is forecasted to capture a 75% share by 2035, driven by chromite’s role as a primary component in steel production.

- The chromite segment in the chrome ore market is anticipated to achieve a 40% share by 2035, driven by its critical use in stainless steel and industrial applications.

Key Growth Trends:

- Rising Mining Industry

- Increased Use of Chrome Ore by the Automotive Sector

Major Challenges:

- Volatility in Raw Material

- Soil Erosion and Groundwater Pollution Arise due to the Mining Process.

Key Players: Glencore, Rio Tinto, BHP, Vale S.A., Freeport McMoRan, Anglo American, China Shenhua Energy Company (CSEC), Jiangxi Copper Corporation Limited (JCCL), Zijin Minning Group Company Limited, Corporacion Nacional Del Cobre De Chile (CODELCO).

Global Chrome Ore Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.96 billion

- 2026 Market Size: USD 5.15 billion

- Projected Market Size: USD 7.48 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Australia, Brazil, Russia

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Chrome Ore Market Growth Drivers and Challenges:

Growth Drivers

- Rising Mining Industry- With an increase in steel production, India became the world's 4th largest producer of flat steel and sponge iron. In GDP, the steel industry plays an important role of around 2%. There is very fast growth in the mining sector. As chrome forms a thin and stable oxide film on steel’s surface making it corrosion-resistant. Also, it is widely used in steel industries which is anticipated to be the main reason for the growth of the chrome ore market .

- Increased Use of Chrome Ore by the Automotive Sector- It is because of the automobile industry's rising day-by-day that metal alloys grow, and this plays a role in growth. 85 million automobiles were produced worldwide in 2022. Comparing this number to the prior year, a rise of around 6% may be calculated.

- Surging Investment in R&D - One of the main factors that are driving market growth is more competition in R&D for safer and faster mining processes. In addition, there is also more scope for increased competition and innovation between the main players in the market for the extraction of iron ore which will lead to its growth.

Challenges

- Volatility in Raw Material- The volatility in raw materials hampers the growth of the global chrome ore market. This often results to supply and disruptions, repressed demand, and fluctuation in prices.

- Soil Erosion and Groundwater Pollution Arise due to the Mining Process.

- Lack Of Technical and Management Skills

- Low Productivity and Under-Capitalization can be Challenging Factors for the Market to Grow.

Chrome Ore Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 4.96 billion |

|

Forecast Year Market Size (2035) |

USD 7.48 billion |

|

Regional Scope |

|

Chrome Ore Market Segmentation:

Type Segment Analysis

The chromite segment accounts for the largest revenue and has a 40% share of the chrome ore market. Chromite is an essential element that is used in the manufacture of stainless steel, to harden steel and to form iron-free high-temperature alloy. They are also used for chromium plating for surface protection. The chemical industry uses it in the production of chromium compounds for the tanning of leather.

Application Segment Analysis

Stainless steel dominates the segment and accounts for approximately 75% share of the chrome ore market whereas, 25% is being used for manufacturing chemicals, pigments, and refractories. Chromite is a primary component in the production of stainless steel. The chrome ore market is growing at a rapid pace due to its demand in the chemical, refractory, and pigment industries.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Chrome Ore Market Regional Analysis:

APAC Market Insights

On the basis of region, Asia Pacific industry is likely to dominate majority revenue share of 35% by 2035. The growth of the market in the region is due to the growth in the stainless-steel industry, and fewer restrictions imposed on the mining and exporting of ores for its wider application. For instance, Australia has the largest mining sites and rich rock formations for mineral extraction by end users can also drive the growth of the market during the predicted year. South Africa, India, Finland, Turkey, and Kazakhstan are the leading producers of chrome ore. In the forecast period of 2023 to 2029, the global market for refractories is estimated to grow from $33.01 billion in 2023, rising to $44.82 billion and reaching a compound annual growth rate of 4.5%.

Middle East and Africa Market Insights

The Middle East and Africa chrome ore market is expected to showcase significant CAGR during the predicted year with a 28% market share. South Africa being one of the leading producers is a major supplier of chromite ore and ferrochromium to European Countries. Development in technology has also played a crucial role in increasing the growth of the market in the region as automatic machines and robots have made the mining process safe. 88% of companies plan to invest in adding automotive robotics to their organizations. In the world, over 3 million production robots are in use. Rise in the mining and exploration activities has also contributed to the growth of the market.

Chrome Ore Market Players:

- Key Players

- Glencore

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rio Tinto

- BHP

- Vale S.A.

- Freeport McMoRan

- Anglo American

- China Shenhua Energy Company (CSEC)

- Jiangxi Copper Corporation Limited (JCCL)

- Zijin Minning Group Company Limited

- Corporacion Nacional Del Cobre De Chile (CODELCO)

- Glencore

Recent Developments

- Glencore-Merafe Chrome Venture is expected to benefit from energy deregulation in South Africa. A new report by Roskill states that the Glencore-Merafe Chrome Venture, which runs seven chrome mines and five ferrochrome plants in South Africa, may benefit in terms of market share from the progressive deregulation of the country’s energy landscape.

- Chile’s Codelco closes troubled Ventanas metal smelter. The company now intends to shift its focus to producing more sustainable copper to meet surging demand.

- Report ID: 1403

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Chrome Ore Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.