Flat Steel Market Outlook:

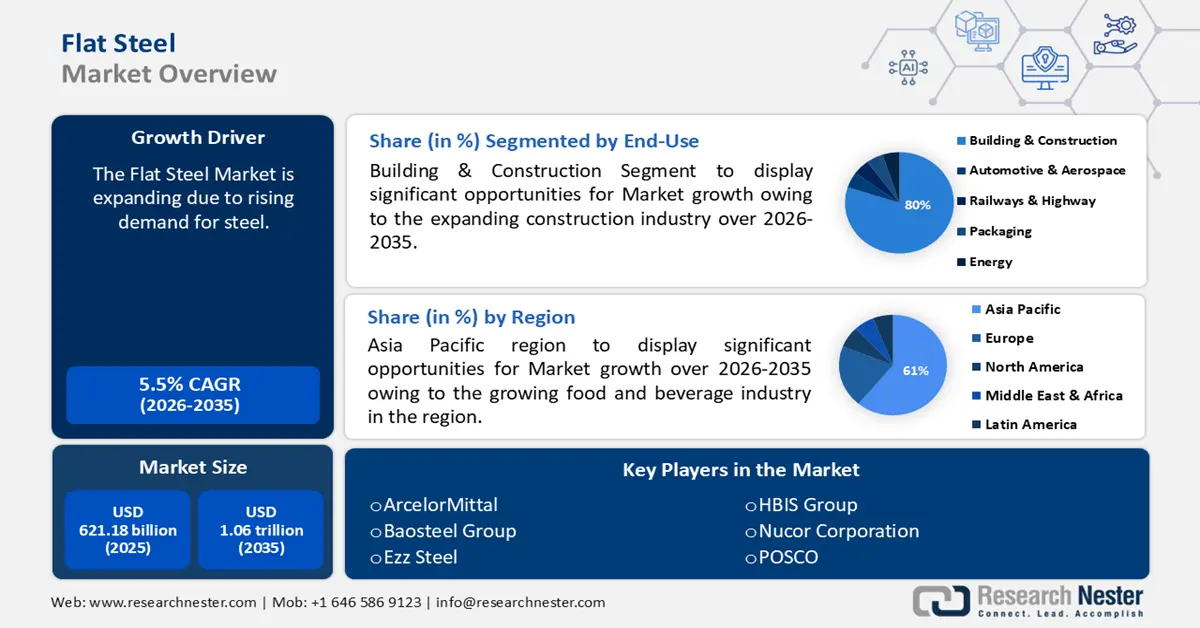

Flat Steel Market size was over USD 621.18 billion in 2025 and is poised to exceed USD 1.06 trillion by 2035, witnessing over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of flat steel is estimated at USD 651.93 billion.

The rising demand for steel is believed to drive this market expansion. As a result, demand for flat steel goods that are stronger and thicker would likely rise and be used in demanding applications where high strength and load-bearing capacity are necessary. As per the World Steel Association, the demand for steel increased by 2.2% in 2023 to reach 1 881.4 Mt.

Key Flat Steel Market Insights Summary:

Regional Highlights:

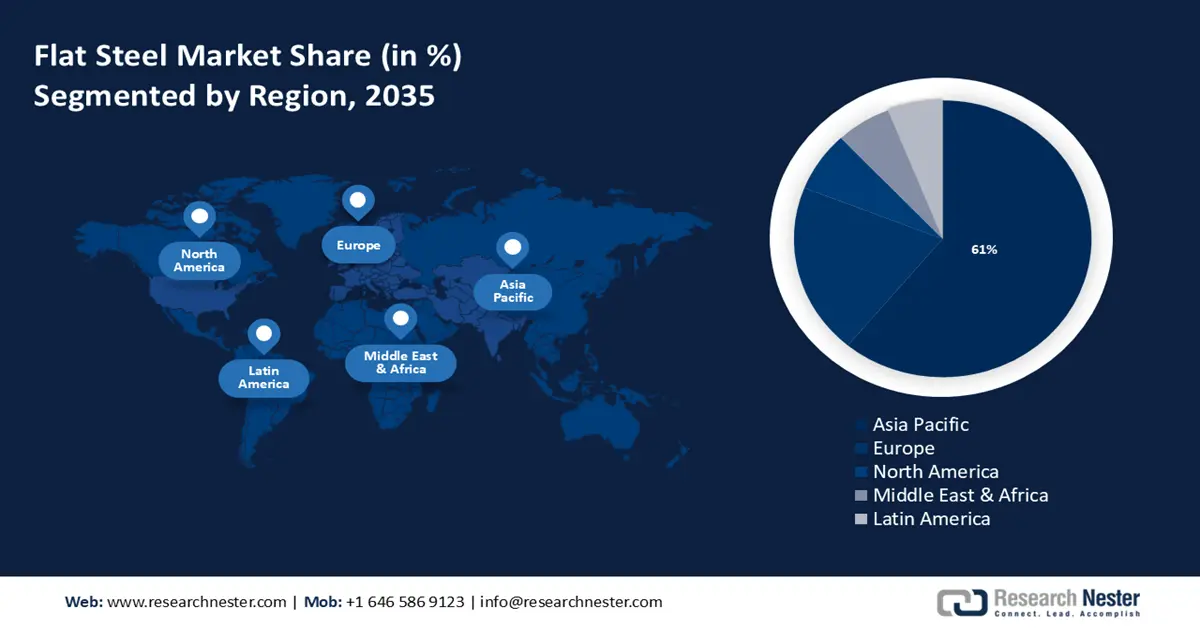

- Asia Pacific flat steel market will dominate around 61% share by 2035, driven by the growing food and beverage industry requiring flat steel for safety and hygiene.

- Europe market will experience significant CAGR during 2026-2035, driven by increasing demand for flat steel products across various industries.

Segment Insights:

- The building & construction segment in the flat steel market is anticipated to secure an 80% share by 2035, driven by the demand for environmentally friendly flat steel materials.

- The plates segment in the flat steel market is anticipated to witness significant growth till 2035, attributed to rising investments in road construction projects.

Key Growth Trends:

- Growing marine sector

- Rising production of automobiles

Major Challenges:

- Varying prices of steel

- Environmental concerns

Key Players: ArcelorMittal, Baosteel Group, Ezz Steel, HBIS Group, Nucor Corporation, POSCO, Tata Steel Limited, ThyssenKrupp AG, United States Steel Corporation.

Global Flat Steel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 621.18 billion

- 2026 Market Size: USD 651.93 billion

- Projected Market Size: USD 1.06 trillion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (61% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Flat Steel Market Growth Drivers and Challenges:

Growth Drivers

- Growing marine sector - Flat steel is extensively used in shipbuilding for the fabrication of ship hulls and also acts as a crucial part of the stiffeners in different areas of a ship.

With ships carrying over 85% of all goods, the maritime sector is essential to world trade. - Rising production of automobiles - Among the biggest consumers of flat steel goods is the automotive industry, which uses them to make exhaust systems, frames, chassis, and vehicle bodywork. For instance, more than 85 million motor vehicles were produced globally in 2022, a 5% increase from 2021.

- Flourishing oil and gas business - Flat steel is a type of steel that is mainly comprised of coal, scrap steel, and iron ore, which is also used in the oil, gas, and manufacturing sectors.

In 2023, the worldwide oil and gas sector brought in around USD 5,928 billion in revenue.

Challenges

- Varying prices of steel - The cost of flat steel is impacted by changes in steel prices, which vary at various periods of the year.

The term "steel market price" refers to the total cost of steel in the worldwide market determined by a complex interplay of elements, such as supply and demand dynamics, global economic conditions, and geopolitical events which may impact project budgets in a variety of industries. - Environmental concerns - The process of making steel uses a lot of energy and has several negative effects on the environment that account for a sizable portion of global CO2 emissions.

For instance, one of the manufacturing processes with the highest carbon footprints is the production of steel, which accounts for more than 5% of worldwide carbon dioxide emissions.

Flat Steel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 621.18 billion |

|

Forecast Year Market Size (2035) |

USD 1.06 trillion |

|

Regional Scope |

|

Flat Steel Market Segmentation:

End-Use Segment Analysis

Building & construction segment is estimated to capture flat steel market share of around 80% by the end of 2035. This growth of the segment is set to be encouraged by the expanding construction industry.

The construction industry's adoption of flat steel is driven by the growing demand for environmentally friendly building materials since they are strong, flexible, and cheap, and are frequently used as supports, brackets, and structural elements.

Moreover, flat steel bars are utilized in many additional home construction components, such as heaters, latches, and garage doors, and are also used for cladding roofing, and structural purposes.

Before the coronavirus pandemic, the construction industry had grown to a spending value of over USD 10 trillion, and it is predicted to expand by around 2% per year.

Product Segment Analysis

In flat steel market, plates segment is projected to capture revenue share of around 67% by the end of 2035. The major factor for the expansion of the segment is rising investment in road construction projects. For instance, the significant ongoing road upgrades are valued at around USD 0.6 trillion, while new road construction projects are anticipated to be worth over USD 3 trillion globally.

Steel plates are typically flat, rectangular steel components that are utilized to replace potholes, trenches, excavations, damaged pedestrian walkways, and newly constructed roads.

Steel plates are thicker than flat steel and are typically used to handle larger loads or give more structural integrity to highways, railroads, and pipelines and enhance site access and safety.

Process Segment Analysis

By the end of 2035, the basic oxygen furnace segment is predicted to have the largest share. The growing use of this process for the production of steel is the primary driver of the segment's growth.

The Basic Oxygen Furnace (BOF), alternatively referred to as the Oxygen Converter Process, Linz-Donawitz Steelmaking (LD), Basic Oxygen Process (BOP), or Basic Oxygen Furnace, is a fundamental steelmaking technology is, where molten steel scrap and pig iron are converted to steel by the oxidizing effect of oxygen pushed into the melt beneath a basic slag.

For instance, these days, a basic oxygen steelmaking processing pathway accounts for more than 65% of the global crude steel manufacturing output.

Our in-depth analysis of the flat steel market includes the following segments:

|

Product |

|

|

End-Use |

|

|

Process |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flat Steel Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 61% by 2035. The market growth in the region is propelled by the growing food and beverage industry. Strict health and safety requirements and regulations must be adhered to by the food processing business in the region which necessitates the usage of flat steel since it upholds the highest standards of food safety and hygiene, and is utilized in processing machinery, storage tanks, and other pieces of equipment.

The largest high-speed rail network in the world is found in China, which is also considered special since it is the only nation in the world expanding its rapid rail network. This may drive the demand for flat steel in the country as it gives railway tracks stability and reinforcement by acting as ties or track sleepers.

Half of South Korea's stainless steel imports are flat goods, and the majority of the flat steel plates imported into the region come from Germany, Belgium, and Vietnam.

In 2023, Korea imported over 9 million tons of flat steel, around a 21% increase.

Similarly, Japan became the 36th highest importer of flat-rolled steel in the world in 2022 after importing over USD 175 million worth of the material.

European Market Insights

Europe region is set to witness significant growth till 2035 and will hold the second position owing to the increasing demand for flat steel products in this region. It is anticipated that in 2024 the demand for flat steel goods in Europe will rise by around 3%.

In addition, with an estimated 31 million metric tons produced in 2022, Germany was the EU's top producer of hot-rolled steel. Particularly, more than 9 million tons of steel goods were sold in Germany in total in 2023. About 59% of sales were made up of flat items, over 25% of long products, and 9% of other steel products.

Furthermore, Acciaierie d'Italia (ADI), an Italian integrated flat steel producer, has announced that it will increase crude steel production to around 3 million metric tons in 2023 and over 4 million metric tons in 2024, and has also stated that it intends to reopen Blast Furnace 2 this year and begin relining Blast Furnace 5 in the second half of 2023.

Flat Steel Market Players:

- Voestalpine Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ArcelorMittal

- Baosteel Group

- Ezz Steel

- HBIS Group

- Nucor Corporation

- POSCO

- Tata Steel Limited

- ThyssenKrupp AG

- United States Steel Corporation

It is anticipated that the top five companies will control the majority of the flat steel market through constant growth, joint ventures, agreements, and cooperation. Some significant businesses in the flat steel sector are starting strategic activities to solidify their positions within the industry.

Recent Developments

- Nucor Corporation received approval for the installation of a galvanizing line at Nucor Steel Berkeley in South Carolina that will be able to produce galvanized steel up to 72 inches wide and have an annual capacity of about 500,000 tons.

- ThyssenKrupp AG announced to sell of ecologically friendly steel to Thyssenkrupp Materials Services, who will thereafter distribute the goods to additional warehouses in Western and Eastern Europe in addition to German domestic consumers.

- Report ID: 6203

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flat Steel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.