Duplex Stainless Steel Market Outlook:

Duplex Stainless Steel Market size was valued at USD 1.62 billion in 2025 and is projected to reach USD 3.15 billion by the end of 2035, growing at a CAGR of 7.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of duplex stainless steel is assessed at USD 1.73 billion.

The primary growth driver for the global duplex stainless steel market is the rapidly increasing demand from the oil and gas sector, particularly for high-pressure and offshore applications. Government reports indicate that the rising global exploration and production equipment for oil and gas demands corrosion-resistant and mechanically strong materials. For example, according to the U.S. Energy Information Administration, crude oil production is projected to increase from approximately 13.2 million barrels per day in 2024 to 13.4 million barrels per day in 2025, placing additional demand on pressure vessels and subsea pipeline equipment. Duplex plate equipment, like flowlines, manifolds, risers, and heat exchangers, needs perfect operating integrity in CO₂ and H₂S-containing environments, causing material usage in this category to grow.

The raw material supply chain for duplex stainless steel is based on alloying elements such as chromium, molybdenum, and nickel. These were more susceptible to being volatile and, of course, at geopolitical concentrations, thereby increasing their prices as well as potential sourcing problems. According to the FRED, the producer price index for fabricated steel plate was 257.949 in July 2025. Producer price index of iron and steel pipe and tube manufacturing from purchased steel, pipe, and tube, alloy was 140.643 in January 2024. Capacity for manufacturing is rising in top manufacturing countries with investment in specialty mills and vacuum-oxygen decarburization. Governments within nations such as the U.S. and Canada are offering incentives under domestic procurement law (e.g., Buy American Act) to enhance domestic processing lines and reduce import reliance. Japan initiated an anti-dumping probe into Taiwanese and Chinese imports of cold-rolled stainless products in 2025, unveiling enhanced protection aspects of trade policy affecting global price formation and supply strategy.

Key Duplex Stainless Steel Market Insights Summary:

Regional Highlights:

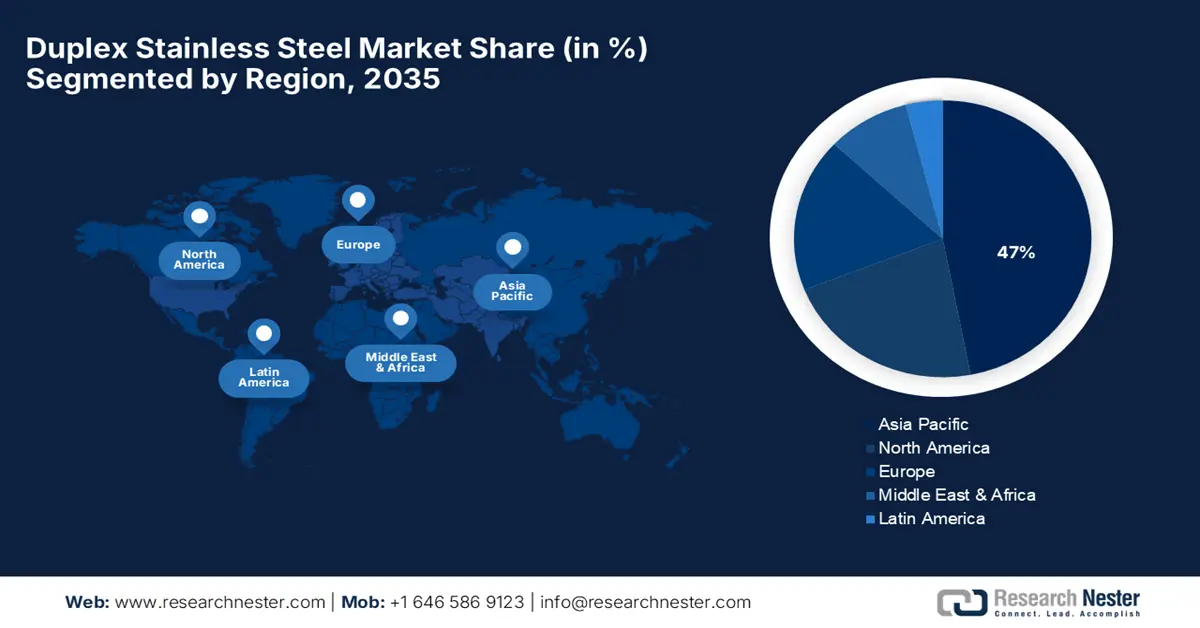

- Asia Pacific is expected to account for about 47% share of the duplex stainless steel market by 2035, stimulated by expanding infrastructure projects and rising oil & gas investments across emerging economies.

- North America is projected to retain around 22% market share by 2035, supported by strong demand from the oil & gas, shipbuilding, and infrastructure sectors.

Segment Insights:

- The direct sales segment in the duplex stainless steel market is anticipated to capture 53% share by 2035, propelled by its capacity to strengthen manufacturer–end-user relationships and streamline supply chain efficiency.

- The plates sub-segment is expected to hold a dominant 48% share by 2035 owing to its extensive application in pressure vessels, tanks, and shipbuilding projects requiring superior corrosion resistance and mechanical integrity.

Key Growth Trends:

- Rising offshore oil & gas exploration

- Expansion of infrastructure projects

Major Challenges:

- Raw material price volatility

- Geopolitical uncertainties

Key Players: Outokumpu (Finland), Aperam (Luxembourg), Sandvik (Sweden), Jindal Stainless (India), Thyssenkrupp AG (Germany), POSCO (South Korea), Nippon Steel Corporation (Japan), Acerinox (Spain), Outotec (now part of Metso) (Finland), Gerdau (Brazil), YUSCO (Malaysia), Sandhar Technologies (India), BlueScope Steel (Australia).

Global Duplex Stainless Steel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.62 billion

- 2026 Market Size: USD 1.73 billion

- Projected Market Size: USD 3.15 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, Japan, United States, South Korea

- Emerging Countries: Indonesia, Vietnam, Saudi Arabia, Brazil, Mexico

Last updated on : 11 September, 2025

Duplex Stainless Steel Market - Growth Drivers and Challenges

Growth Drivers

- Rising offshore oil & gas exploration: Offshore operations require materials that can withstand extreme pressure, high salinity, and corrosive environments, making stainless steel plates an essential choice due to their strength, durability, and corrosion resistance. The expansion of deepwater and ultra-deepwater projects increases demand for stainless steel plates in rig construction, subsea pipelines, topside processing equipment, and pressure vessels. Additionally, ongoing investment in offshore energy projects enhances long-term demand, positioning stainless steel plates as a critical material for maintaining safety, reliability, and performance in harsh offshore conditions. In 2022, the Federal Offshore Gulf of America accounted for 15% of all crude oil output and 2% of all dry natural gas production in the U.S. The vast majority of federal offshore oil and gas wells are located in the Gulf of Mexico, which accounts for 97% of all oil and gas production in the OCS. Their use significantly reduces the potential for failure and maintenance costs, having a direct impact on duplex stainless steel market growth in all upstream energy sectors.

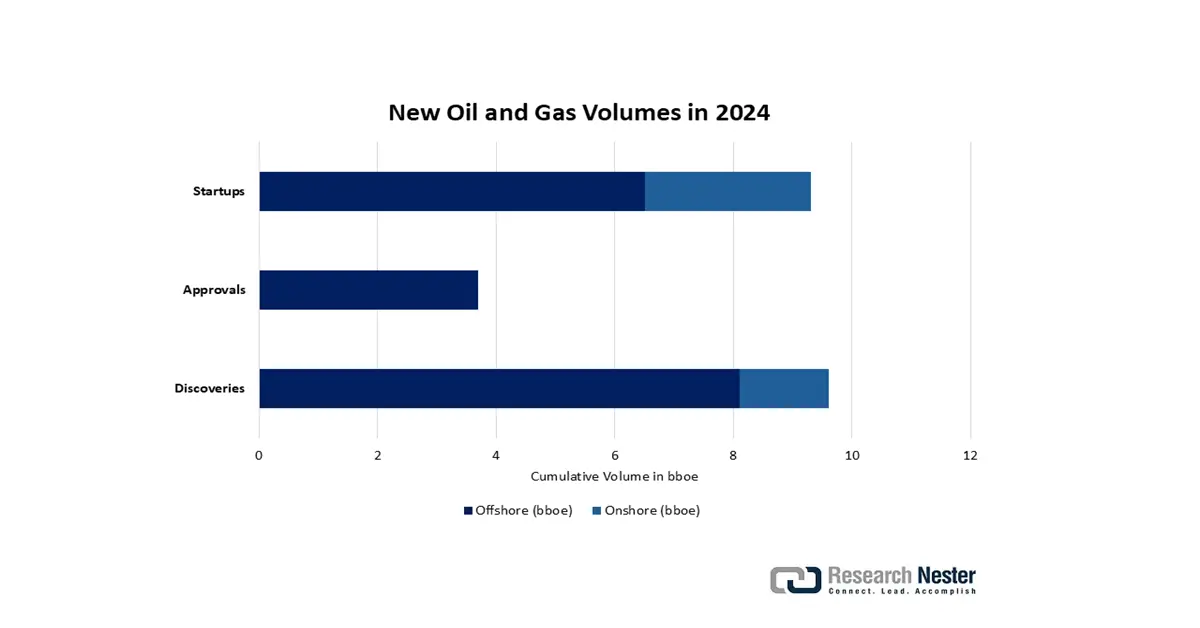

Further, globally, both onshore and offshore, at least 9 billion barrels of oil equivalent (bboe) were announced through discoveries, nearly 4 bboe of reserves were sanctioned for development, and around 6.5 bboe entered production as projects commenced. Discoveries, project approvals, and startups all recorded marginal increases in offshore volumes compared to 2023, reflecting the longer-term trend of offshore developments gaining greater prominence.

Source: Global Oil and Gas Extraction Tracker, Global Energy Monitor

- Expansion of infrastructure projects: With global infrastructure spending anticipated to grow, the Asia-Pacific is expected to produce maximum demand in the future. According to the Global Infrastructure Outlook, it will cost US$94 trillion by 2040 to build infrastructure to support global economic growth and begin filling in infrastructure gaps. An additional $3.5 trillion will be required to meet the UN Sustainable Development Goals (SDGs) for universal household access to electricity and drinking water by 2030, for a total estimated cost of $97 trillion. In turn, these investments are opening up newer application avenues that help channel steady demand into the civil engineering and construction industries.

Expansion of infrastructure projects significantly drives the global duplex stainless steel market, as stainless steel plates are widely used in bridges, railways, airports, commercial complexes, and industrial facilities. Their high strength, corrosion resistance, and durability make them ideal for structural components and heavy-duty applications. Rapid urbanization and government investments in smart cities, transportation networks, and energy infrastructure further boost demand. As a result, infrastructure growth directly supports long-term consumption of stainless steel plates across both developed and emerging economies. - Demand for cost-efficient corrosion-resistant alloys: The rising need for cost-efficient corrosion-resistant alloys is propelling the global duplex stainless steel market. Industries such as oil & gas, marine, construction, and chemical processing seek materials that deliver long-term durability while reducing maintenance and replacement expenses. Stainless steel plates provide an effective balance of strength, corrosion resistance, and affordability, making them a preferred alternative to more expensive alloys. This trend is strengthening their adoption across infrastructure and industrial applications worldwide.

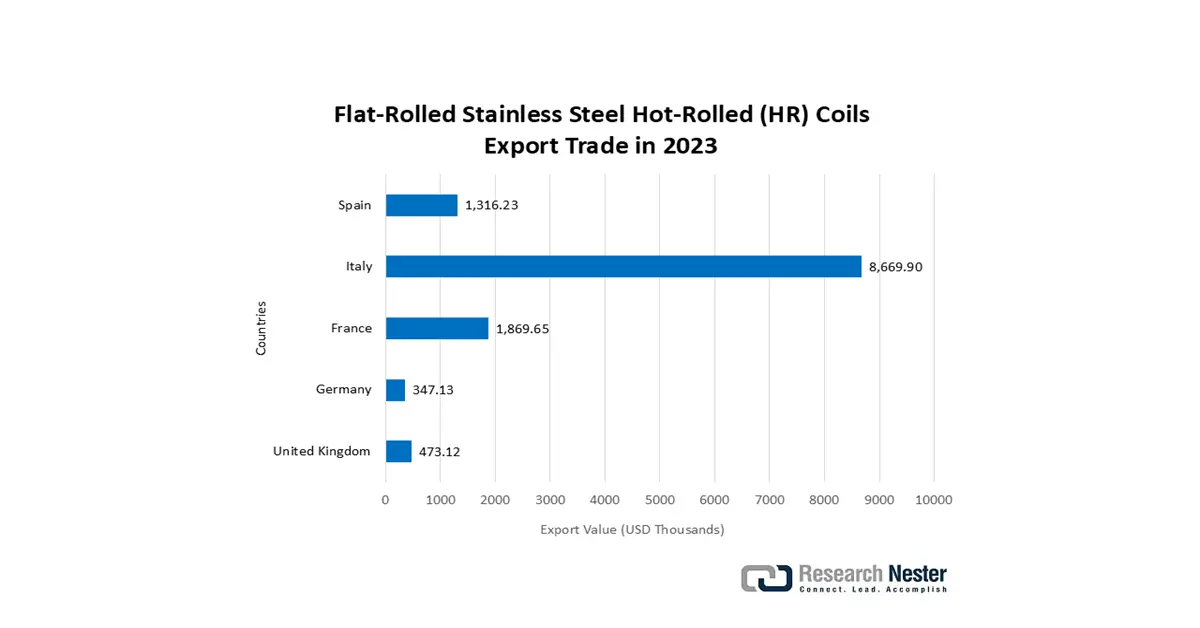

Global Trade Dynamics of Hot Rolled Stainless Steel Coil

Trade dynamics of hot rolled stainless steel coil are strongly influencing the growth of the global duplex stainless steel market. Fluctuations in import-export volumes, tariff policies, and regional supply-demand balances directly impact raw material availability and pricing for plate manufacturers. Competitive sourcing of hot rolled coil from key producing regions enhances supply chains and supports downstream plate production at cost-efficient levels. At the same time, trade liberalization and strategic partnerships between major steel-producing countries are creating opportunities for wider market access, thereby reinforcing stainless steel plate consumption across construction, energy, and industrial sectors.

Import/Export Data for Hot Rolled Stainless Steel Coil (>600mm, t3-475mm) in 2023

|

Top Exporter |

Trade Value (USD) |

Top Importer |

Trade Value (USD) |

|

Indonesia |

$1.78 B |

Chinese Taipei |

$741 M |

|

China |

$743 M |

Vietnam |

$724 M |

|

Belgium |

$662 M |

France |

$508 M |

Source: OEC

Challenges

- Raw material price volatility: Price volatility of major raw materials like nickel and steel scrap significantly contributes towards the production cost of duplex stainless steel. Volatility is a cause for pricing stability disruption, leading to unplanned production costs. Subsequently, manufacturers are not in a position to set competitive prices, leading to low margins and a delay in investment in capacity expansion. Uncertainty also discourages long-term contracts, thus discouraging the development of the market and disrupting supply chain efficiency.

- Geopolitical uncertainties: Conflicts such as the Russia-Ukraine conflict have generated sharp imbalances in the supply of energy and availability of raw materials, especially in Europe. Tariffs, sanctions, and trade restrictions add higher costs of transportation and slow orders, leading to blockages in supply chains. They encourage operational risks and reduce market access. Businesses are significantly tested to provide businesses with stable supply channels and market access, thereby hampering market growth and making the product more expensive overall.

Duplex Stainless Steel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 1.62 billion |

|

Forecast Year Market Size (2035) |

USD 3.15 billion |

|

Regional Scope |

|

Duplex Stainless Steel Market Segmentation:

Distribution Channel Segment Analysis

The direct sales segment is projected to capture 53% market share, driven by its ability to help manufacturers establish stronger relationships with end-users, particularly across construction, oil & gas, shipbuilding, and manufacturing industries. Through direct engagement, suppliers can offer customized grades, timely deliveries, and competitive pricing, which enhances customer loyalty and reduces reliance on intermediaries. This streamlined approach not only improves supply chain efficiency and profit margins but also ensures better market penetration, thereby accelerating the overall growth of distribution channels for stainless steel plates.

Form Segment Analysis

The plates sub-segment is expected to dominate with 48% in 2035 as a result of global use in pressure vessels, tanks, and shipping constructions. The corrosion integrity and mechanical characteristics of duplex stainless-steel weldment in a 3.5% NaCl environment using newly created electrodes that were specifically designed without adding alloying components to the flux samples. Plates are structurally stronger and are used where corrosive conditions prevail. The offshore oil and gas industry supports over 220,000 jobs and in 2022 generated almost £30bn in gross value added, representing around 1.5% of the whole UK GDP. The Japanese and South Korean maritime and chemical processing industries were the largest investors by putting massive investments into the duplex plate used for the large plate.

Finishing Segment Analysis

Hot rolled is expected to have overall dominance of the sub-segment with 43% duplex stainless steel market share in 2035 due to additional strength and dimension stability for heavy-duty applications. Production of hot-rolled coil was 9.95 Lakh tons in 2024 to 4.84 Lakh tons in 2025, representing an increase in year-on-year. Hot-rolled plates are key inputs for structural frameworks and subsea plants. Major hot-rolled duplex usage in 2023 alone was sourced from Asia-Pacific, with increasing shipbuilding and oil rig manufacturing inducing steady demand.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Distribution Channel |

|

|

Grade |

|

|

End use |

|

|

Application |

|

|

Form |

|

|

Thickness |

|

|

Finishing |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Duplex Stainless Steel Market - Regional Analysis

Asia Pacific Market Insight

Asia Pacific is estimated to share a size of about 47% of the global duplex stainless steel market in 2035, based on the major impact of increased infrastructure development and increasing oil & gas investment throughout the region. With offshore drilling, urban infrastructure projects, and energy construction facilities increasing in demand. The use of high-strength corrosion-resistant duplex plates across the region thus remains driven by strategic industrial expansion in developing countries with large marine construction and repair works.

China is predicted to hold approximately 75.3% of the Asia Pacific share of the global duplex stainless steel market by 2035. According to Rystad, China extracted 489 billion cubic feet of natural gas and 410,000 barrels per day of petroleum liquids from the South China Sea in 2023. In the South China Sea, CNOOC produced an average of 394,000 barrels of crude oil per day and 1.1 billion cubic feet of natural gas per day in 2022, according to its annual report. Nearly 60% of CNOOC's natural gas production and 43% of its crude oil production came from activities in the South China Sea. Government-backed green steel initiatives and stricter environmental regulations are accelerating the adoption of high-grade duplex stainless steels. Additionally, the booming shipbuilding industry, rising repair and maintenance activities, and increasing imports of super duplex grades are expected to further propel market demand.

India is expected to hold about 12% market share of the global duplex stainless steel market, having an approximate CAGR from 2025 to 2035 of 7.3%. The National Infrastructure Pipeline provides aggressive demand behind aggressive capacity additions in the power generation and refinery sectors. Steel shipments stood at 7.6 million tons in FY24, a rise of 11.4% y-o-y, on the back of aggressive domestic production coupled with export competitiveness. The Government of India is undertaking programs such as Make in India, which continue to increase the growth in manufacturing and local consumption of steel. Investment in the petrochemical, power, and construction infrastructure sectors further energizes the demand for corrosion-resistant and long-lasting duplex stainless steel .

India Hot-Rolled Stainless Steel Bars in 2023

|

Export Destination |

Value (USD Million) |

Import Origins |

Value (USD Million) |

|

Italy |

42.4 |

Chinese Taipei |

14.5 |

|

Germany |

22.1 |

Japan |

10.4 |

|

United Arab Emirates |

20.3 |

China |

5.49 |

|

Brazil |

16.6 |

South Korea |

4.57 |

|

Mexico |

10.1 |

United States |

0.819 |

Source: OEC

North America Market Insight

North America is projected to retain about 22% of the global duplex stainless steel market share in 2035, fueled by robust demand from oil & gas, shipbuilding, and infrastructure projects. Investment in the renewal of production facilities and the increased need for corrosion-resistant products for infrastructure are still driving incremental market growth. Expanding offshore and onshore energy industries and infrastructure development are the main drivers of growth.

The U.S. is anticipated to capture around 70.5% of the duplex stainless steel market share in North America by 2035. Offshore shale drilling and investment in energy infrastructure strongly increase consumption. The United States consumes slightly more than 19 million barrels of liquid fuels a day, or roughly 22% of the global total, according to the U.S. Energy Information Administration (EIA). By 2035, this amount is expected to rise to almost 22 million barrels. Government investments in infrastructure renovations and energy transformation also support demand. Furthermore, growing focus on corrosion-resistant products for use in the marine and energy sectors drives the market's consistent expansion.

Canada is expected to contribute 17.3% of the share of North America, valued at approximately 4.2% of the overall global duplex stainless steel market by 2035. Demand is driven by mining, pulp & paper, and rising energy infrastructure industries. Industry steel demand is stable with a PMI of over 50 in 2024 and GDP growth of almost 2.3%. Duplex plates see more utilization in infrastructure projects and midstream energy ventures. The emphasis of the Canadian government towards the development of environmentally sustainable resources and investments in pipeline maintenance remains to fuel demand for high-end corrosion-resistant material, thus expanding the market.

Europe Market Insight

Europe is expected to hold about 18% of the total duplex stainless steel market share by 2035, owing to strict environmental regulations, green infrastructure spending, and robust demand from construction, marine, and oil & gas sectors. Increasing Europe revenue in global duplex stainless steel owing to high adoption of corrosion-resistant alloys in high-performance applications throughout Northern and Western Europe. Additional offshore energy installations and facility upgrades also boost local demand.

Source: WITS

Key Duplex Stainless Steel Market Players:

- Outokumpu (Finland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aperam (Luxembourg)

- Sandvik (Sweden)

- Jindal Stainless (India)

- Thyssenkrupp AG (Germany)

- POSCO (South Korea)

- Nippon Steel Corporation (Japan)

- Acerinox (Spain)

- Outotec (now part of Metso) (Finland)

- Gerdau (Brazil)

- YUSCO (Malaysia)

- Sandhar Technologies (India)

- BlueScope Steel (Australia)

The global duplex stainless steel market is dominated by established manufacturers primarily from Europe and Asia, with companies like Outokumpu and Aperam leading through strong production capabilities and innovation. Key players are adopting strategies including capacity expansions, mergers and acquisitions, and investment in advanced manufacturing technologies to improve product quality and reduce costs. Emphasis on sustainable production and development of higher-grade alloys addresses growing industry demands in the oil, gas, and construction sectors. Japanese firms, including Nippon Steel and Kobe Steel, focus on R&D to enhance corrosion resistance and mechanical properties, strengthening their market position.

Top global manufacturers in the duplex stainless steel market:

Recent Developments

- In March 2024, Outokumpu introduced its new DSS 2304 super duplex stainless steel designed for harsh chemical processing environments. This launch led to a 15% increase in global market share within chemical pipelines and reactors. The product’s enhanced corrosion resistance supports infrastructure longevity and aligns with rising industry sustainability standards, indicating robust growth prospects worldwide.

- In January 2024, Thyssenkrupp AG unveiled its automated duplex steel rolling system, reducing energy consumption by 25% and increasing production throughput by 30%. Rapid adoption across European manufacturing plants has helped companies comply with stricter environmental regulations while improving efficiency. This technology is set to redefine sustainable steel production globally, benefiting oil, gas, and chemical industries.

- Report ID: 8091

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Duplex Stainless Steel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.