Precision Steel Fabrication Market Outlook:

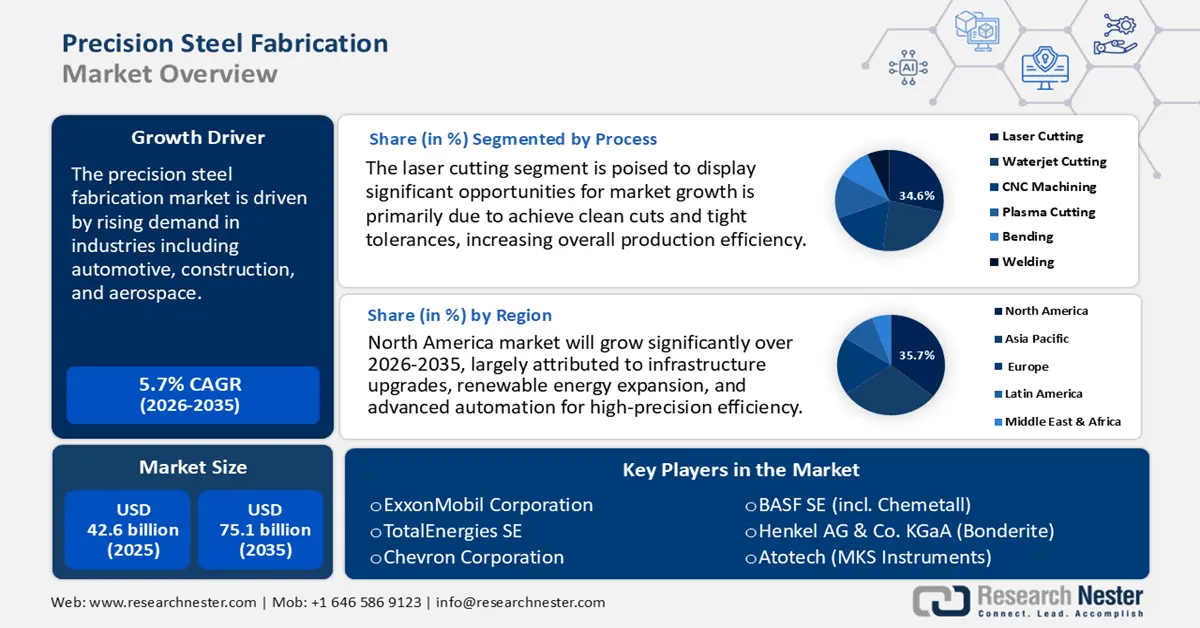

Precision Steel Fabrication Market size was valued at USD 42.6 billion in 2025 and is projected to reach USD 75.1 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, from 2026 to 2035. In 2026, the industry size of precision steel fabrication is estimated at USD 45.4 billion.

The precision steel fabrication market is witnessing substantial expansion, fueled by rising demand in industries including automotive, construction, and aerospace. Advancements in manufacturing technologies such as laser cutting, waterjet cutting, and automated welding have further improved the production speed and precision. For instance, the OMAX MicroMAX JetMachining Center is an ultra-precision abrasive waterjet machining centre with a linear axis accuracy and repeatability of ±0.0001 inches (±0.0025 mm) and allows a highly accurate cut in most materials, including stainless steel and titanium. Its highly developed vibration isolation, thermal control system, and IntelliTRAX drive system assist in regular and high-speed production with minimum distortion and propel substantial growth in precise steel fabrication using cleaner and quicker cutting.

In addition, the automotive and aerospace industry specifically targets lightweight but high-strength materials, whereas the construction industry is interested in personalized and complex steel parts. By 2025, the automotive light weighting market is expected to increase to USD 99.3 billion with a CAGR of 7.3% by 2020, and the metals, such as high-strength steels, will allow a reduction of vehicle body mass of up to 30-40 percent. This pushes the growth of precision steel fabrication by creating demand for high-tolerance and lightweight steel products in the automotive production.

Innovations in steel alloys and fabrication techniques, along with the integration of digital technologies, are reshaping the industry. Notable trends include the increased use of robotics and artificial intelligence in fabrication processes, the implementation of sustainable production strategies, and the increasing need for precision steel components in healthcare and renewable energy sectors. For instance, Benteler International is a global company specializing in automotive and steel/tube divisions. Benteler Automotive specializes in the development and production of components, including lightweight optimized chassis, engine and exhaust systems, as well as solutions for electric vehicles, which encompass scalable battery trays and electrified axles. Their steel/tube division produces customized seamless and welded steel tubes for various applications, including the energy sector. With a strong focus on innovation and sustainability, Benteler continues to play a pivotal role in advancing precision steel fabrication technologies.

Raw steel (billets, plates, coils) is recorded in the supply chain of precision fabrication. Growth of primary steel production in China, India, and Southeast Asia guarantees the supply of feedstock and the relative stability of costs. In 2022, U.S. imports of fabricated steel products amounted to 12,679,442 metric tons worth 18,337,195 thousand dollars. This large number of imports is a growing demand, and it has a direct influence on the growth of precision steel fabrication by providing the necessary raw materials and components. Additionally, in the U.S., the Producer Price Index (PPI) in fabricated structural metal manufacturing is 285.11 in June 2025, which is a high index and indicates a high demand and thus growth in precision steel fabrication by increasing manufacturing capacity and rising material costs. The NIST Manufacturing Extension Partnership helps small and medium enterprises upgrade fabrication capabilities and maintain tolerances. Moreover, the directed funding via advanced manufacturing programs suggests nontrivial capital is flowing into precision metal fabrication development.

Key Precision Steel Fabrication Market Insights Summary:

Regional Highlights:

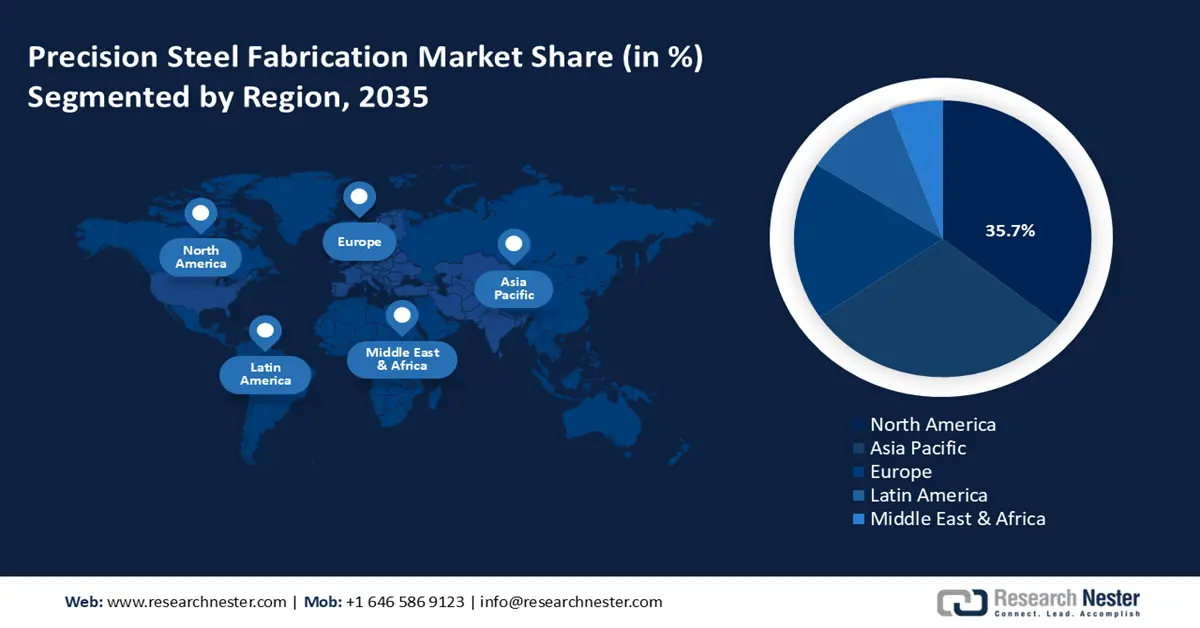

- North America is projected to lead the Precision Steel Fabrication Market with the largest 35.7% revenue share by 2035, owing to surging infrastructure modernization, renewable energy initiatives, and industrial upgradation.

- Asia Pacific is expected to account for a 29.7% revenue share by 2035, driven by rapid industrialization, urban expansion, and increased demand for lightweight, high-strength steel components.

Segment Insights:

- The laser cutting segment is projected to hold the largest share of 34.6% by 2035 in the Precision Steel Fabrication Market, propelled by the rising adoption of high-accuracy and automation-driven cutting technologies across automotive, aerospace, and medical sectors.

- The machine building segment is anticipated to capture a 28.6% revenue share by 2035, supported by increasing emphasis on high-precision manufacturing, robotization, and versatile production capabilities.

Key Growth Trends:

- Rising demand for steel fabrications in the automotive industry

- Increasing focus on sustainability

Major Challenges:

- High initial capital investment

- Fluctuating raw material prices

Key Players: Quaker Houghton, FUCHS Petrolub SE (FUCHS Group), ExxonMobil Corporation, TotalEnergies SE, Chevron Corporation, BASF SE (incl. Chemetall), Henkel AG & Co. KGaA (Bonderite), Atotech (MKS Instruments), BP plc (Castrol Industrial), Lubrizol Corporation, PETRONAS Lubricants International, Idemitsu Kosan Co., Ltd., Yushiro Chemical Industry Co., Ltd., SK Lubricants / GS Caltex, Dorf Ketal Chemicals Pvt. Ltd.

Global Precision Steel Fabrication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.6 billion

- 2026 Market Size: USD 45.4 billion

- Projected Market Size: USD 75.1 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 24 October, 2025

Precision Steel Fabrication Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand for steel fabrications in the automotive industry: The automotive industry’s increasing need for lightweight, yet robust components is significantly propelling the growth of the precision steel fabrication market. Steel fabrications play a crucial role in the production of numerous automotive components, such as body panels, chassis, and engine parts. As the emerging market witnesses a surge in automobile demand, the need for high-quality steel fabrications escalates correspondingly. Moreover, the industry’s shift towards fuel-efficient and lightweight vehicles amplifies the reliance on advanced steel materials, given their strength-to-weight advantages. For instance, ArcelorMittal's plan to establish a state-of-the-art steel production facility in Calvert, Alabama. Unveiled in February 2025, this plant is designed to manufacture up to 150,000 metric tons per year of high-quality non-grain-oriented electrical steel (NOES), which is mainly utilized in large vehicles such as full-size pickups and SUVs. This strategic initiative responds to the increasing demand and constraints on the domestic supply of advanced NOES within the U.S. automotive sector.

- Increasing focus on sustainability: The steel fabrication industry is increasingly prioritizing sustainability, driven by environmental concerns and regulatory pressures. Key strategies include utilizing recycled steel and adopting energy-efficient processes to reduce carbon footprints. For instance, CELSA Group, a leading European steel manufacturer, employs electric arc furnaces powered by renewable energy, enabling the production of steel with 97% recycled steel. This approach has significantly curtailed CO2 emissions and minimized the extraction of natural resources. Additionally, CELSA’s circular production model achieves a 95.1% recovery rate for production waste, underscoring its commitment to environmental stewardship. Such initiatives not only align with global sustainability goals but also position companies competitively in markets increasingly valuing eco-friendly practices. As the industry continues to evolve, the integration of sustainable methods in steel fabrication is expected to become standard practice, fostering both environmental and economic benefits.

- Government investment in infrastructure and renewable energy: One of the major aspects of growth in the precision steel fabrication is government-supported investment in infrastructure and renewable energy. These industries demand extremely precise and bespoke steel fabrications to be used in the transmission towers, wind turbine bases, bridges, and transport structures. Infrastructure Australia has reported that the country will require around 3.8 million tonnes of manufactured steel structural components in 2023-24 and 2027-28. However, the current fabrication capacity in Australia is only 1.4 million tonnes/year, which shows that there is a significant supply gap in Australia. In order to bridge this gap and make domestic manufacturing contemporary, the Australian Government has introduced an AUD 500 million Future Made in Australia Innovation Fund, where assistance has been given to steelmakers and advanced fabrication technologies. This government spending increases capacity and spurs accurate fabrication as it demands greater standards of structural performance, quality management, and observance in large-scale infrastructure and renewable energy programs.

Challenges

- High initial capital investment: Advanced fabrication technologies like laser cutting, robotic welding, and CNC machinery require significant capital outlay. These technologies, while essential for enhancing accuracy, productivity, and efficiency, come with high acquisition and maintenance costs. For small and mid-sized enterprises, such investments may pose financial constraints, limiting their ability to adopt state-of-the-art equipment and compete with larger players. This capital intensity can also extend the return on investment period, making it more difficult for newer or resource-limited firms to enter and thrive in the market.

- Fluctuating raw material prices: Steel prices are often volatile due to global supply-demand dynamics, tariffs, geopolitical tensions, and disruptions in supply chains. Such volatility makes it difficult for manufacturers to maintain stable pricing strategies and accurate cost forecasts, directly impacting profit margins and long-term planning. Fabricators often operate on tight margins, and sudden increases in raw material costs affect competitiveness. To mitigate these risks, companies may rely on hedging strategies or long-term supply agreements, but these measures are not always feasible or sufficient in a rapidly changing global economic environment.

Precision Steel Fabrication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 42.6 billion |

|

Forecast Year Market Size (2035) |

USD 75.1 billion |

|

Regional Scope |

|

Precision Steel Fabrication Market Segmentation:

Process Segment Analysis

The laser cutting segment is expected to grow with the largest market share of 34.6% over the projected years by 2035. Laser cutting is valued for its exceptional accuracy, rapid processing, and capability to create complex designs while minimizing material waste. These benefits make it particularly essential in sectors such as automotive, aerospace, and medical devices, where accuracy and detail are paramount. The process enables fabricators to achieve clean cuts and tight tolerances, increasing overall production efficiency. For example, Amada Co., Ltd., is a distinguished Japanese producer of laser cutting machinery and metal fabrication equipment. The company continues to innovate within the laser cutting space, recently introducing advanced fiber laser systems with enhanced automation features to meet the rising need for high-performance cutting solutions.

Fiber laser cutting is a crucial technology in the precision fabrication of steel, as it is highly efficient when it comes to cutting thin metals to medium-thickness steel with tremendous speed and reduced operational costs, and industries such as the automotive and aerospace industries, where high-volume production that is complex is required. The technology will minimize areas of heat influence to improve the quality of products and minimize post-processing needs. Meanwhile, the CO2 laser cutting is an effective technology in cutting heavier steel plates due to its excellent edge quality and finish. Its capability to work on complicated shapes as well as give consistent accuracy in the heavy fabrication work makes it remain relevant. The fiber and CO2 laser cutting segments both individually contribute to the expansion of the high-precision steel fabrication by fulfilling the numerous needs of the industries with high accuracy and affordable performance.

Application Segment Analysis

The machine building segment is expected to grow with a revenue share of 28.6% by 2035, attributed to growing demand in high precision, robotization, and production versatility. The CNC machining, robotic welding, and laser cutting are technological advancements that have improved the efficiency and accuracy of production, which is highly demanded in industries such as automotive, aerospace, and construction. The transition to multi-purpose CNC machining centers enables the machining of complicated geometries on a few setups to enhance throughput. Additionally, more complex designs and rapid prototyping are enabled by the incorporation of new materials and additive technologies, which are driving the market growth. National Institute of Standards and Technology (NIST) states that these innovations enhance accuracy, shorten the production time, and allow for cost savings, which strengthens the competitiveness in the global manufacturing sector.

The industrial automation systems are one of the main contributors towards the growth of machine building in the market, owing to the improvement in robotics, CNC controls, and AI integration that has increased precision and efficiency in manufacturing in the automotive and aerospace industries. Such technologies lower the cost of labor and raise the production throughput to drive the market demand. The material handling equipment segment allows effective flow and handling of steel elements. This segment benefits from the rising industrial infrastructure and automation acceptance, which aid in minimizing downtimes and streamlining the work processes. Conveyors and assembly line frames are technologies that enhance the manufacturing scale and productivity. These segments together enhance the development of machines that will be important in the changing precision steel fabrication environment.

Type Segmentation Analysis

The carbon steel segment is expected to expand steadily during the projected years, driven by its wide application in construction, the motor industry, and other industries. The shift to electric arc furnaces and green DRI can lower the carbon intensity to 22% to 31% by 2050, which will force low-emission carbon steel in precision fabrication products in the global world market. Additionally, the constant infrastructural developments and industrialization activities, particularly within North America and Asia, are further stimulating the growth of the segment. Improvement in the processing technologies has also optimized the properties of carbon steel to the extent that it is now suitable for the precision fabrication processes, which demand durability and cost effectiveness. This strong development facilitates market growth, which is in line with the advancement in technology and the rising demand for steel globally.

Our in-depth analysis of the precision steel fabrication market includes the following segments:

|

Segment |

Subsegment |

|

Process

|

|

|

Application

|

|

|

Component

|

|

|

Type |

|

|

End Use

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Precision Steel Fabrication Market - Regional Analysis

North America Market Insights

North America's market is anticipated to dominate the global market with the largest revenue share of 35.7% over the forecast years from 2026 to 2035. This growth is mainly attributed to the increasing need for developed infrastructure, energy change, and modernization of industries. Significant infrastructure projects and renewable energy investments drive the demand for tight-tolerance steel structures in bridges, turbines, and transmission lines. For instance, the Cardinal Hickory Creek 345kV Transmission Line Project in North America involves the construction of 100 to 125 miles of 345kV transmission lines and several substations, necessitating the use of fabricated steel structures, to accommodate tight tolerances in order to make it reliable and efficient. This large-scale infrastructure project indicates the increased demand for high-quality steel fabrication owing to significant renewable energy and grid modernization endeavors in the region.

Additionally, the manufacturers introduce automation, laser cutting, robot welding, and CNC machining to increase throughput, lessen wastes, and achieve finer tolerances. For example, as reported by the Office of Science of the U.S. Department of Energy, the U.S.-based company CEMCO is applying CNC machining and robot welding to enhance throughput and minimize waste in the custom metal fabrication. Moreover, to ensure high precision and consistent quality components, the Federal Highway Administration (FHWA) puts emphasis on the widespread use of automation in the process of fabricating steel bridges, such as NC laser cutting and robotic welding. In addition, value-added differentiation is made possible by precision fabrication, and the companies are more competitive in contrast to imports, further driving the preference for local, high-precision fabrication capacity.

The U.S. market is expected to lead the North American region with the highest revenue share by 2035, owing to the increasing demand in defense, aerospace, and infrastructure. Global imports in the industry are creating competitive issues; however, the industry is highly crucial to national security and sophisticated production. According to the 2021-2024 Quadrennial Supply Chain Review, since 2021, more than USD 1 trillion in investments of the private sector have been announced to bolster U.S. manufacturing, including the steel sector. This surge has been induced by federal legislation, such as the Bipartisan Infrastructure Law and CHIPS Act, which have facilitated modernization and resiliency in the essential supply chains that may play a critical role in the expansion of the market in the country.

Additionally, according to the Washington State Institute for Public Policy report, the penetration rate of steel imports in Washington was 28%, compared to the national 26.6% and the steel mill jobs were held by 234 workers in 19 facilities in 2021. Buy American policies to boost domestic steel production further influence the fabrication costs, though proposing the use of U.S.-made steel, directly boosting the growth of the precision steel fabrication industry by improving supply chain security and local sourcing. Moreover, the U.S. Department of Energy favors the emphasis on modernizing steel fabric capacity by robotization and CNC machining programs, improving the capacity and precision.

By 2035, the market in Canada is projected to grow steadily due to strong infrastructure investment, such as in big transit projects, such as the Ontario Line and the REM network in Montréal. Canada Infrastructure Bank committed CAD 1.28 billion to the Réseau express métropolitain (REM), an automated light rail system in Montréal, Quebec that has 26 stations covering 67 kilometres and that is projected to reduce greenhouse gas emissions by 100,000 tonnes every year. This is the biggest public transportation project in Québec in 50 years that will generate 34,000 jobs in the construction process, enhance economic growth, and increase the efficiency of transit in the region.

In addition, the Ontario Line in Ontario, operated by Metrolinx, is a significant transit infrastructure project that would add 15 new stations to the Toronto transit system and improve urban-wide transport, as well as promote the economic development of the country. Such major infrastructure works are a direct boost to the demand for precision steel fabrication in Canada by building strong and enduring transit structures and infrastructure elements. Furthermore, the fabricated metal product manufacturing industry in Canada has an assembly of 13,000 companies with 162,000 workers contributing to the GDP of CAD 16.5 billion, hence a good basis for the expansion of precision steel fabrication in Canada. The close concentration of skilled labour and wide fabrication infrastructure, with Ontario and Quebec at the forefront at 42% and 29% of employment, respectively, is an endorsement of the growing demand for high-precision steel parts, thereby fuelling the growth of the market in Canada.

Asia Pacific Market Insights

The Asia Pacific market is expected to grow with a revenue share of 29.7% during the projected years from 2026 to 2035, mainly driven by the rapid industrialization, urbanization, and the development of infrastructure in the region. The higher requirement in automotive, construction, and manufacturing industries drives the desire to have lightweight high-strength steel components. Additionally, according to the 2022 Life Cycle Assessment of Asian engineering steel provided by the World Steel Association, the consumption of external scrap per unit tonne of steel product equals 0.898 metric tonnes, indicating a robust recycling system that upholds sustainable steel manufacturing, which underlies the development of precision steel fabrication in the region.

Furthermore, the development of the technologies of fabrication, such as laser cutting, CNC machining, and robotic welding, increases the precision and efficiency of production. For example, the 3rd Generation 3D Robotic Arm Fiber Laser Cutting and Welding System by Kanfon is both a cutting and a welding machine in a single unit, thereby saving time and increasing efficiency. It has a high level of control with 11 axes and a synchronized rotating table that enhances precision and speed. These innovations also promote the development of precision steel fabrication in the region due to their ability to increase flexibility and accuracy of production. The recyclable and environmentally friendly steel products are also promoted through government programs that encourage sustainable and green building practices. For example, the Asia Pacific Circularity Readiness Framework by the World Green Building Council provides the policy formulators and industry players with guidance on how to embrace sustainable and recyclable materials, such as steel, to facilitate the increase in precision steel fabrication by encouraging green business practices in the construction sector of the region.

China’s market is anticipated to dominate the Asia Pacific region over the forecast year by 2035, due to the growing changes in direction towards the high-value manufacturing industries. In 2024, China continued to be the largest steel exporter in the world, producing a heavy output of 1,005.1 million metric tons. This robust production platform favors the growth of precision steel fabrication in some major industries, such as the automotive and infrastructure industries. Additionally, the growth in the automotive, aerospace, and heavy machinery industries requires strict tolerances and complicated steel parts, which accelerates the fabrication of precision. The emphasis of China on industrial transformation, emphasized by more than 400 innovative projects and the 100-billion-yuan investment in industrialization in 2024, directly stimulates the market in the country.

Additionally, digital transformation, being driven by the Ministry of Industry and Information Technology, with over 10,000 digital workshops and smart factories by 2023, creates 30% more efficient production power, which can convert production into an advanced manufacturing facility. This modernization aids in the manufacture of more intricate, high-tolerance steel parts needed in automotive, aerospace, and heavy machinery industries. Such efforts propel China to the lead in terms of precision steel fabrication innovation and capacity. Moreover, more investment in intelligent factories with CNC machining and robotic welding will contribute to the improvement of productivity and product uniformity, which will contribute to the sustainable development of the precision steel fabrication industry.

The market in India is likely to grow with the fastest CAGR during the projected years, backed by increasing infrastructure and production industries. In FY25, India’s crude steel output of 132.57 million tons was aided by the healthy domestic consumption and large-scale infrastructure projects. Specialty steel manufacturing investments in the government programs, such as the Production-Linked Incentive (PLI) scheme, were projected to reach over USD 1.9 billion by the end of FY24, driving the precision steel fabrication industry, which allows the manufacture of steel components of high quality and complexity, used in the automotive, construction, and industrial industries. The recent projects by the government, including Make in India and higher investment in the transportation industry, energy, and defense, have stimulated the demand for high-precision steel products.

The use of new fabrication technology, such as laser cutting, CNC machining, and robotic welding, is also on the rise due to the skilled labor force and the rise of automation. Sahajanand Laser Technology Ltd (SLTL) project commercializes fiber laser cutting systems with a government loan facility given by the Technology Development Board (TDB), Ministry of Science and Technology. SLTL invented fiber laser cutting machines in India, which increased the output level of the country and enhanced the concept of automation. Moreover, CNC programming and machining, as well as advanced welding technologies, are available as specific training programs at the National Skill Training Institute (NSTI). These government-based programs are meant to produce a skilled workforce capable of helping automation grow in areas such as steel fabrication, spurring the creativity and competitiveness of the steel fabrication sector in India.

Europe Market Insights

The European market is predicted to experience steady growth during the projected years, strongly supported by countries like the UK and Germany, where robust industrial infrastructure and advanced manufacturing capabilities drive demand for precision-fabricated steel components. In the UK, the market is primarily fuelled by ongoing investments in infrastructure, defense, and energy sectors, along with a growing emphasis on sustainable and automated fabrication processes. For instance, the 2025 steel strategy has observed the importance of steel in wind turbines, electric vehicles, and defence equipment, with offshore wind alone requiring 25 million tonnes of steel, which is worth 21 billion pounds in 2050.

Meanwhile, Germany, widely recognized as Europe's industrial powerhouse, maintains a leading role due to its expansive automotive sector, mechanical engineering excellence, and high standards for precision components. German manufacturers are increasingly adopting digital fabrication technologies and robotics to improve production efficiency and meet stringent quality specifications. For instance, Schuler Group is a worldwide leader in metal forming technology and precision fabrication solutions. The company supplies advanced systems for cutting, forming, and processing steel components, which are widely utilized in the automotive, appliance, and industrial machinery sectors. Schuler's consistent focus on innovation and sustainability has helped it remain competitive in the European precision steel fabrication market.

Key Precision Steel Fabrication Market Players:

- Quaker Houghton

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FUCHS Petrolub SE (FUCHS Group)

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- BASF SE (incl. Chemetall)

- Henkel AG & Co. KGaA (Bonderite)

- Atotech (MKS Instruments)

- BP plc (Castrol Industrial)

- Lubrizol Corporation

- PETRONAS Lubricants International

- Idemitsu Kosan Co., Ltd.

- Yushiro Chemical Industry Co., Ltd.

- SK Lubricants / GS Caltex

- Dorf Ketal Chemicals Pvt. Ltd.

Key players in the precision steel fabrication market leverage advanced technologies such as laser cutting, CNC machining, robotic welding, and digital twin simulation to enhance precision, efficiency, and scalability. These innovations enable faster production, reduce waste, and improve product quality, positioning companies as leaders in a highly competitive market landscape.

Top Global Precision Steel Fabrication Manufacturers

Recent Developments

- In May 2024, Live Ventures Inc. acquired Central Steel Fabricators (CSF), a fabricated metal products manufacturer, which mostly processes data centers and communications. CSF has a long history of being in business since its inception in 1969, and it provides more than 2,300 distinct SKUs, such as cable racks, auxiliary framing, and network bays, and serves a large number of customers in the major communications companies. Live Ventures. This acquisition is in line with the steel manufacturing strategy of Live Ventures as the company increases investment in AI and data infrastructure. A combination of precision fabrication features of CSF facilitates greater product diversification and operational efficiency in the fabrication of steel to be used in important infrastructures, thereby increasing the impact of Live Ventures in precision steel fabrication.

- In April 2024, Nippon Steel Corporation, together with the National Institute of Maritime, Port and Aviation Technology and Imabari Shipbuilding, came up with a very ductile hull steel plate that improves the safety of collisions and marine environment protection. This high-end steel plate, which has been developed with the help of the most sophisticated numerical and large-scale experiments, can provide better ductility without the loss of strength, toughness, and weldability. It has also been embraced in 63 vessels, eight of them ultra-large crude oil carriers, which have led to industry competitiveness. The technology is consistent with accurate steel fabrication in that the highest performance steel parts that meet the strict safety and quality requirements are manufactured to support sustainability and regulatory objectives. This technology emphasizes the integration of the high level of metallurgy and the accuracy of fabrication methods, which are the prerequisites of the modern needs of the maritime industry.

- In March 2024, EVS Metal, a precision metal fabrication powerhouse, developed a 175,000-square-foot advanced manufacturing plant in the One Thirty Business Park in Pflugerville. The plant is projected to be ready in 2025 and will replace their old location, which will meet the high demand in their emerging markets, such as semiconductors. The plant, which is located on 14.5 acres, will streamline the logistics of the operation, increase the production capacity, and create and retain more than 80 jobs. The investment shows the positive trend in precision steel fabrication, where advanced infrastructure and automation are key requirements in achieving smaller tolerances and increasing volumes of production. The relocation is through greater industry trends toward localized, efficient, and scalable precision fabrication capacity to willingly meet changing industrial and technological utilizations.

- Report ID: 7600

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Precision Steel Fabrication Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.