Steel Strapping Market Outlook:

Steel Strapping Market size was valued at USD 1.56 billion in 2025 and is set to exceed USD 2.57 billion by 2035, expanding at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of steel strapping is estimated at USD 1.63 billion.

The market is flourishing as a result of the growing production of steel across the globe. Over the previous 50 years, population expansion, urbanization, and growing living standards have caused a more than threefold increase in global steel production, which may lead to a higher likelihood of goods and materials being transported using steel strapping. For instance, approximately 1 billion metric tons of crude steel were produced globally in 2022.

In addition, factors believed to fuel the market growth of steel strapping include the growing need for lightweight strapping materials. Due to its superior strength, durability, and resistance to environmental factors, steel strapping is used over other materials such as plastic or polyester and is chosen by industries including construction, mining, and shipping that are dealing with heavier and thicker materials or operating in harsh conditions for the safety of transport and storage of their products.

Key Steel Strapping Market Insights Summary:

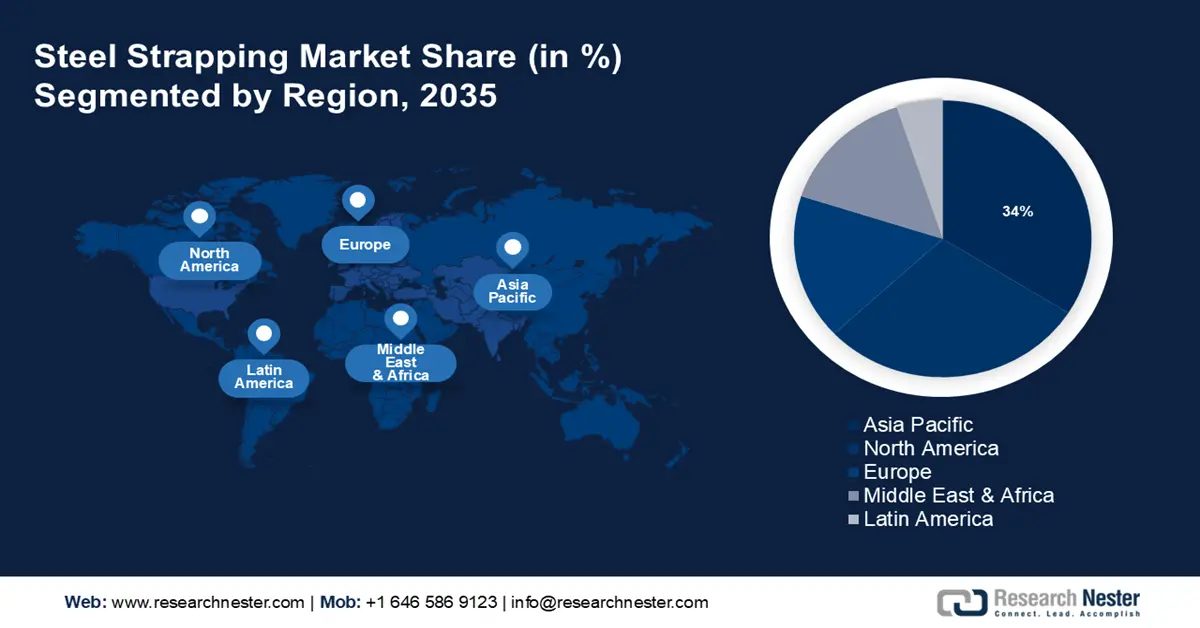

Regional Highlights:

- Asia Pacific steel strapping market will dominate around 34% share, fueled by rapid industrialization, urbanization, and increasing demand for steel in construction and infrastructure sectors, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by the increasing spending in the construction sector, driving demand for steel strapping in transport and storage, forecast period 2026–2035.

Segment Insights:

- The high tensile segment in the steel strapping market is anticipated to achieve strong growth through 2035, driven by demand for heavy-duty applications requiring strong, durable strapping materials.

Key Growth Trends:

- Growing e-commerce and global trade

- Increased industrial manufacturing globally

Major Challenges:

- Environmental concerns associated with the production process

- Fluctuating raw material and transportation costs may hinder market revenue

Key Players: Signode, Walter Surface Technologies, SMC Group, Arcelor Mittal, Acme Steel Company, Berry Global Inc., Fastenal Company, Polymer Group Inc., Rathi Steel Strips Inc, Pacific Steel Strapping Corporation.

Global Steel Strapping Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.56 billion

- 2026 Market Size: USD 1.63 billion

- Projected Market Size: USD 2.57 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Steel Strapping Market Growth Drivers and Challenges:

Growth Drivers

- Growing e-commerce and global trade - The need for security and resilience in strap solutions is increasing as e-commerce and international trade continue to rise, driven by the need to protect goods during transit, making them a key component of the supply chain. As per estimates, global e-commerce revenues increased by 6% in 2022.

Moreover, high-value goods such as electronics, appliances, and luxury products are often dealt with by online shopping platforms. Compared to other packaging materials, steel strapping provides superior protection against theft and tampering, making it an ideal choice for the protection of valuable goods during transit. - Increased adoption of sustainable packaging solutions - A greener and more environmentally friendly packaging strategy is facilitated by the sustainability features of steel packing strips since steel is one of the materials that can be recycled the most worldwide. As per a report, approximately half of US consumers and 82% of consumers in Europe, North America, and South America are willing to pay extra for sustainable packaging.

- Increased industrial manufacturing globally - Industrial production includes the manufacture of different products, such as heavy machinery, equipment, and components. These items often need to be packed in a secure manner for shipment to distribution centers and final consumers. To ensure that these industrial products reach their destination intact, steel strapping provides a robust and reliable solution for bundling and securing them.

Steel strapping is widely known for its durability and ability to hold up under tough conditions, which makes it a preferable choice in the packaging industry when reliability is of paramount importance.

Challenges

- Environmental concerns associated with the production process - The steel production process and the use of traditional steel strapping may be perceived as less environmentally friendly.

Nonetheless, there are environmental effects from the mining and manufacturing procedures involved in the manufacture of steel influenced by the substantial energy and resource requirements.

Recycling steel strapping is costly and detrimental to the environment, which can also raise the risk of worker injury. - Fluctuating raw material and transportation costs may hinder market revenue

- Increased competition from alternative materials may impede the market expansion

Steel Strapping Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.56 billion |

|

Forecast Year Market Size (2035) |

USD 2.57 billion |

|

Regional Scope |

|

Steel Strapping Market Segmentation:

Tensile Strength Segment Analysis

The high tensile segment in the steel strapping market is estimated to gain a revenue share of about 57% by the year 2035. The segment growth can be propelled by the rising usage of heavy-duty applications. High tensile steel strapping offers superior strength and durability compared to other materials and lower grades of steel. This makes it particularly suitable for heavy-duty applications where maximum load stability and security are required, such as in the construction, metalworking, and shipping industries.

Besides this, to comply with safety and security requirements for transport and storage, regulations and standards require the use of high-tensile steel strapping in certain industries.

Coating Segment Analysis

The painted & waxed strapping segment in the steel strapping market is set to garner a notable share in the coming years. To guarantee the safe transport of goods, there is a higher demand for strong and durable packaging materials such as paint and wax strapping. In the market, painted & waxed strapping is preferred because of its added protection characteristics.

The coating, whether it is paint or wax, serves as a barrier against environmental factors, reducing the impact of corrosion and rust on the strapping material.

In industries where steel strapping is subjected to different weather conditions during storage and transport, this increased resistance to corrosion is of particular importance. The protective coating not only prolongs the life of the strapping but also ensures that it maintains its integrity and strength over time.

Our in-depth analysis of the global steel strapping market includes the following segments:

|

Tensile Strength |

|

|

Coating |

|

|

Applications |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Steel Strapping Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to dominate majority revenue share of 34% by 2035. The market growth in the region is led by rapid industrialization and urbanization. Demand for steel in the construction, infrastructure development, and manufacturing sectors is stimulated by this growth. As a result, steel scrap is of major use as raw materials in the production of steel. For instance, in India, more than 460 million people live in urban areas, and this figure is increasing annually by about 2%.

In the Asia Pacific region, the adoption of recycling practices is driven by environmental legislation and sustainability initiatives. Recycling of steel helps to conserve natural resources, reduce energy consumption, and minimize carbon emissions associated with the manufacture of steel.

Furthermore, the growing awareness of environmental issues is increasing the pressure on industries to incorporate recycling into their operations, which leads to increased demand for scrap steel.

North American Market Insights

The North American region will also encounter enormous growth for the steel strapping market in the coming years and will hold the second position owing to the increasing spending in the construction sector. As this industry grows, the demand for steel strapping to bind and protect goods in transport and storage is increasing, which can be tailored in terms of width, thickness, or surface finish.

Steel Strapping Market Players:

- Signode

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Walter Surface Technologies

- SMC Group

- Arcelor Mittal

- Acme Steel Company

- Berry Global Inc.

- Fastenal Company

- Polymer Group Inc.

- Rathi Steel Strips Inc

- Pacific Steel Strapping Corporation

Recent Developments

- The new BPT Steel Strapping Tool from Signode, a top manufacturer of automated packaging tools, equipment, and consumables worldwide, is now available.

The battery-operated tool's lightweight and balanced design makes it perfect for a variety of steel strapping applications, such as heavy-duty stationary or mobile applications that demand high-tension force. With 500 cycles per battery charge, BPT enables smooth, uninterrupted operation and complete mobility across the plant, unrestricted by air hose reach or air quality. - Walter Surface Technologies to provide industrial clients with more automation and robotic solutions, has just introduced a new service. To create a quick but comprehensive automatization process, Walter, a member of the A3 - Association for Advancing Automation, collaborated with a wide range of North American system integrators and end-of-arm tool manufacturers that specialize in robotic systems and material removal operations.

This included assessing readiness, evaluating requirements and objectives, choosing the best technology, designing the new system, testing and integrating it, reviewing performance, providing training, and providing ongoing maintenance.

- Report ID: 5824

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Steel Strapping Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.