Cell Counting Market Outlook:

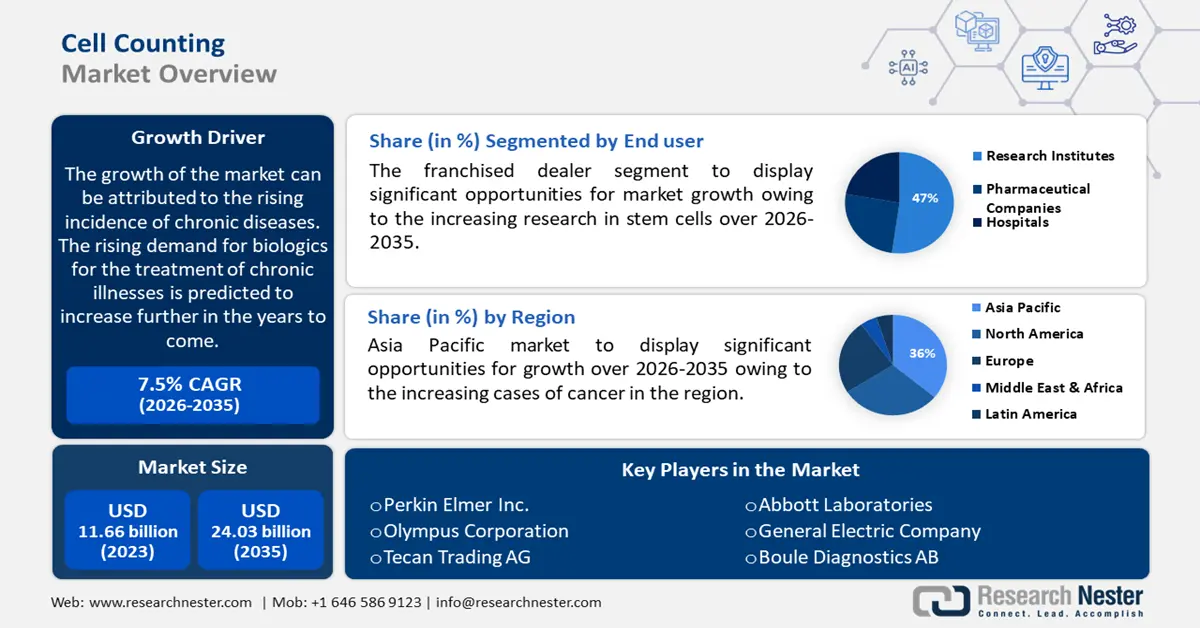

Cell Counting Market size was valued at USD 11.66 billion in 2025 and is likely to cross USD 24.03 billion by 2035, registering more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell counting is assessed at USD 12.45 billion.

The growth of the market can be attributed to the rising incidence of chronic diseases. The rising demand for biologics for the treatment of chronic illnesses is predicted to increase further in the years to come. For instance, different cell counting tools are employed during the creation of biologics. Further, an increase in the consumption of unhealthy foods, and rising stress levels among people across the globe are also expected to add to the market growth. As per estimates, more than 50% of individuals in the US had at least one chronic illness in 2018.

In addition to these, factors that are believed to fuel the market growth of cell counting include the growing popularity of cell counting instruments. For instance, the use of cell counting tools is expanding across a wide range of academic fields, including neurology, cancer biology, and immunology. Further, they are widely utilized in cancer research. Additionally, the growing technological advancements in cell counting devices are predicted to present the potential for market expansion over the projected period.

Key Cell Counting Market Insights Summary:

Regional Highlights:

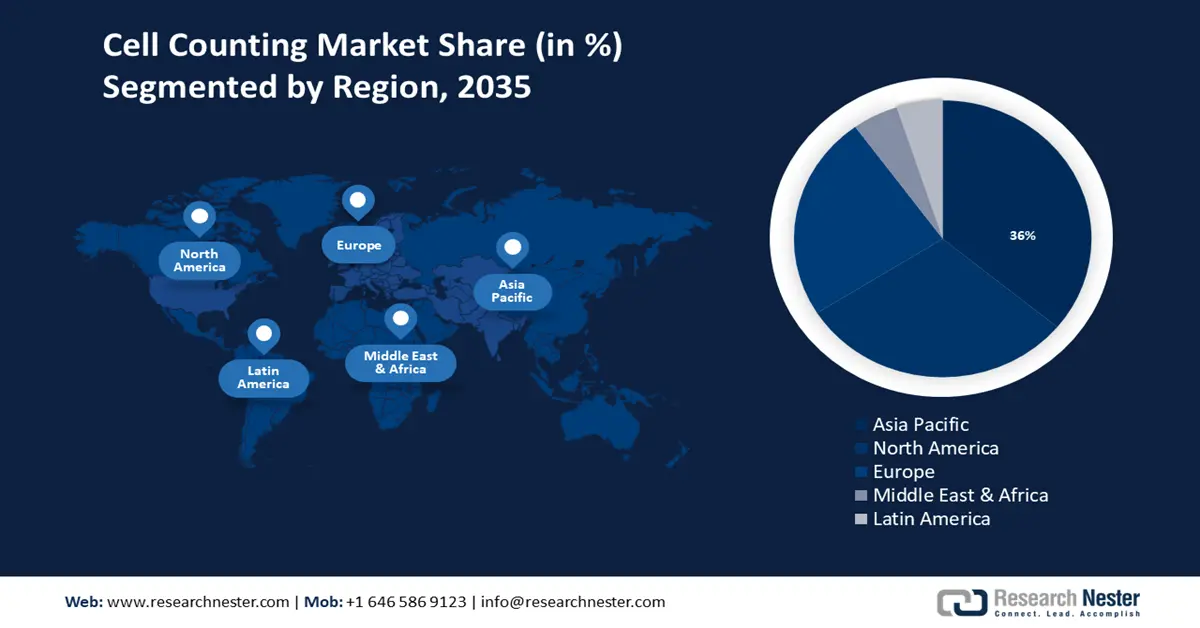

- The Asia Pacific cell counting market is projected to capture a 36.00% share by 2035, driven by rising cancer cases and increased stem cell therapy applications.

- The North America market is expected to achieve the highest CAGR during 2026-2035, attributed to growing cardiovascular disorders and enhanced focus on cell research.

Segment Insights:

- The research institutes segment in the cell counting market is forecasted to secure a remarkable share by 2035, fueled by increasing research in stem cells and widespread usage in cancer research.

- The reagents segment in the cell counting market is anticipated to achieve a substantial share by 2035, attributed to frequent reagent purchases for automated cell counting and related technologies.

Key Growth Trends:

- Growing Prevalence of Infectious Diseases

- Rising Geriatric Population

Major Challenges:

- Exorbitant Cost of Cell Analysis

- Lack of Knowledgeable Medical Professionals

Key Players: Merck KgaA, Thermo Fisher Scientific Inc., Perkin Elmer Inc., Olympus Corporation, Tecan Trading AG, Abbott Laboratories, General Electric Company, Boule Diagnostics AB, Becton, Dickinson, and Company, Sysmex Corporation.

Global Cell Counting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.66 billion

- 2026 Market Size: USD 12.45 billion

- Projected Market Size: USD 24.03 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Cell Counting Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Prevalence of Infectious Diseases – On account of the increasing population density, the market is expected to expand more in the upcoming years. As of 2018, more than 30% of people in India had infectious illnesses.

-

Rising Geriatric Population – Elderly population is more prone to chronic illness, which is estimated to drive market growth. The percentage of individuals over 60 in the world will nearly double from 12 to 22% between 2015 and 2050.

-

Rising Number of Blood-Related Problems – Specific nutrient deficiency resulting from poor diet, and unhealthy lifestyle among people, is estimated to drive the market growth. Further, blood problems are caused by a variety of factors, such as genes, side effects of certain drugs, and other illnesses. In Australia, blood cancer and other associated blood illnesses are predicted to claim the lives of over 5,000 persons in 2022.

-

Increasing Health Spending – According to the most recent expenditure data, health spending in the US rose by over 9% in 2019.

-

Surging Incidences Target Diseases such as HIV – HIV (human immunodeficiency virus) targets immune system cells. After being diagnosed with HIV, the CD4+ cell count is routinely assessed. An immunosuppressed state from HIV is indicated by a low CD4 level, which is anticipated to drive market growth. It was discovered that there were over 38 million HIV-positive individuals worldwide in 2021.

Challenges

-

Exorbitant Cost of Cell Analysis - The high cost of automated cell counting technologies, is one of the major factors predicted to slow down the market growth. For instance, many are unable to afford cell counting techniques for medical or research purposes owing to the high prices of the apparatus, equipment, and procedures.

-

Lack of Knowledgeable Medical Professionals

-

Absence of Knowledge

Cell Counting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 11.66 billion |

|

Forecast Year Market Size (2035) |

USD 24.03 billion |

|

Regional Scope |

|

Cell Counting Market Segmentation:

End-user Segment Analysis

Research institutes segment in cell counting market is expected to account for remarkable revenue share by 2035, attributed to the increasing research in stem cells. For instance, stem cell treatment has emerged as a very promising and sophisticated scientific research issue, it is believed that these may one day be used to cure severe ailments including paralysis and Alzheimer’s treatment. Further, widespread usage of cell counting in cancer research, and in other areas is anticipated to create numerous opportunities for the growth of the segment in the coming years. Between 2018 and 2022, there were over 500 publications on stem cell precision medicine research.

Product Segment Analysis

Reagents segment in cell counting market is poised to capture substantial revenue share by 2035. Fluorescence-based cell counting reagents are used for precise cell counting. Further, purchasing reagents regularly for use in automated cell counting, flow cytometry, and spectrophotometry is anticipated to create numerous opportunities for the growth of the segment.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Counting Market Regional Analysis:

APAC Market Insights

Asian Pacific region is anticipated to capture lucrative cell counting market share by 2035, attributed majorly to the increasing cases of cancer. Low blood counts are most frequently a side effect of chemotherapy in cancer patients, which is expected to boost the demand for cell counting. A full cell count can assist assess whether or not a patient's disease will progress under certain conditions. Cell counting is also used for determining primary tumors, circulating tumors, and others. Further, the expanding use of stem cell treatment in nations including China, Japan, India, and others, is also anticipated to contribute to the market growth in the region. In addition, the region's expanding healthcare industry is also anticipated to boost market growth . As per data, in Southeast Asia, there were over 150 thousand new cases of breast cancer in 2020.

North American Market Insights

The North American cell counting market,, is projected to grow with the highest CAGR during the forecast period, attributed majorly to the growing prevalence of cardiovascular and blood disorders. Almost half of all Americans suffer from cardiovascular disease, which can be brought on by factors including diabetes, smoking, high blood pressure, poor diet, and inactivity. Many risk factors for cardiovascular disease are connected to WBC count, which is anticipated to increase the region's demand for cell counting. For instance, smokers have a greater WBC count, which increases the risk of dying from coronary heart disease. Further, the increasing focus on medical research aimed at enhancing techniques to determine the number of cells in the human body is also anticipated to contribute to the market growth.

Europe Market Insights

Europe region is anticipated to hold lucrative revenue share by 2035, attributed majorly to the increasing frequency of chronic illnesses. The use of biologics to treat chronic illnesses is becoming more popular in the region. The usage of cell counting tools, including flow cytometers and spectrophotometers, helps in regulating the cell content in biologics. In addition, immune health in patients is also indicated by their CD4 cell count. Further, the rising government funding and efforts for cancer research, are also anticipated to contribute to the market growth in the region. In addition, the surging adoption of cell counting devices in various areas of research such as immunology, cancer biology, and neuroscience in the region, is also anticipated to boost the market growth.

Cell Counting Market Players:

- Merck KgaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- Perkin Elmer Inc.

- Olympus Corporation

- Tecan Trading AG

- Abbott Laboratories

- General Electric Company

- Boule Diagnostics AB

- Becton, Dickinson, and Company

- Sysmex Corporation

Recent Developments

-

Becton, Dickinson, and Company introduced BD FACSymphony A1 Cell Analyzer, which provides labs of all sizes access to powerful flow cytometry capabilities. Further, it is a fluorescence-activated cell analyzer that provides cutting-edge research capabilities in a small-footprint design, making it easier for more labs to obtain instruments for difficult scientific research.

-

Sysmex Corporation, a leading diagnostic solutions provider, received FDA approval for residual white blood cell counts, which will be added to its XN-10 Automated Hematology Analyzer with Blood Bank mode. Further, this analyzer offers residual white blood cell counts, red blood cell (RBC), and platelet (PLT) component testing in a single sample aspiration.

- Report ID: 3546

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Counting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.