- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Client-specific Requirements and Tailored Solutions

- Executive Summary

- Global Industry Overview (1/2)

- Market Overview

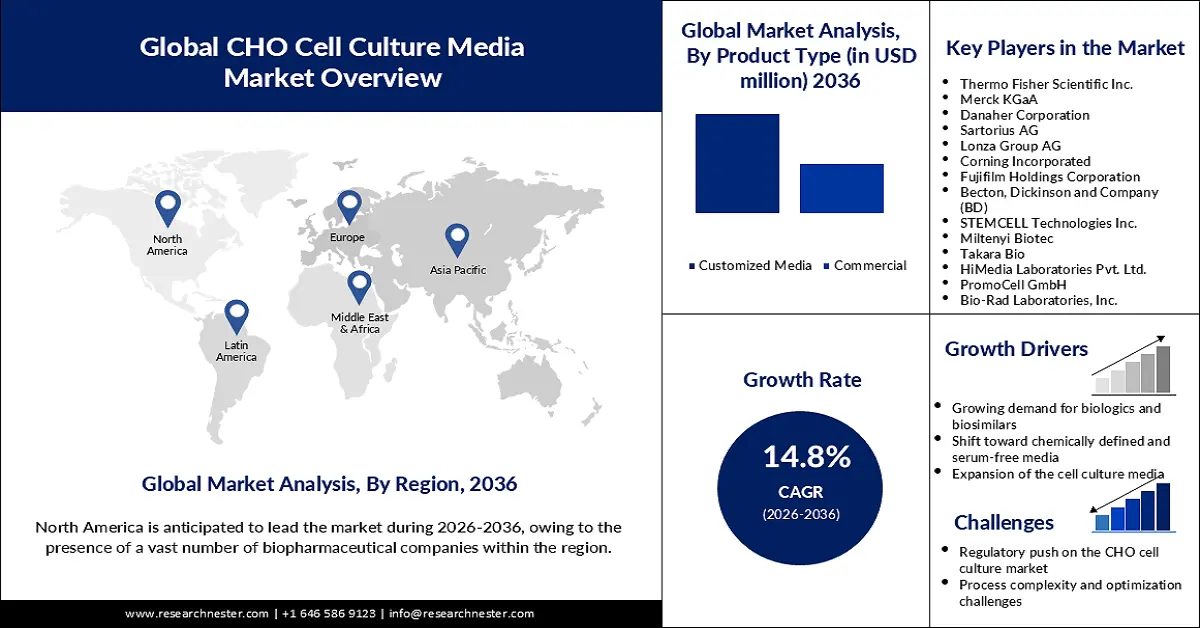

- Regional Synopsis

- Market Dynamics (Drivers, Restraints, Opportunities, Trends)

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Recombinant Cell Line Development Market Insights

- CHO Cell-based Biopharmaceuticals: Product Category Growth

- Global & Regional CHO Media Market Sizing & Forecast

- Ongoing Technological Advancements

- Recent M&A/Partnerships (2022–2024)

- Value Chain — Global CHO Cell Culture Media Market

- Recent Developments (Jan 2024 — Jan 2025)

- Therapeutic Pipeline Analysis

|

|

|

|

|

|

|

|

|

|

- Global Outlook and Projections

- Global Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Powder / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Regional Synopsis (USD Thousand), 2020-2036

- North America, Value (USD Thousand)

- Europe, Value (USD Thousand)

- Asia Pacific, Value (USD Thousand)

- Latin America, Value (USD Thousand)

- Middle East and Africa, Value (USD Thousand)

- Biopharmaceutical Production

- Product Type, Value (USD Thousand)

- Global Overview

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Power / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Biopharmaceutical Production

- Country Level Analysis

- US

- Canada

- Product Type, Value (USD Thousand)

- Overview

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Power / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Biopharmaceutical Production

- Country Level Analysis

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Turkey

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product Type, Value (USD Thousand)

- Overview

- Asia-Pacific Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Power / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Biopharmaceutical Production

- Country Level Analysis

- China

- Japan

- India

- South Korea

- AAustralia

- Indonesia

- Taiwan

- Thailand

- Singapore

- PPhilippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Product Type, Value (USD Thousand)

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Powder / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Biopharmaceutical Production

- Country Level Analysis

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Product Type, Value (USD Thousand)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2020-2036

- Increment $ Opportunity Assessment, 2020-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2020-2036, By

- Product Type, Value (USD Thousand)

- Commercial

- Customized Media

- Media Type, Value (USD Thousand)

- Serum-based Media

- Serum-Free Media

- Chemically Defined Media

- Protein-Free / Hybrid Media

- Formulation Form, Value (USD Thousand)

- Liquid Media

- Powder / Lyophilized Media

- Semi-Solid Media

- End Use, Value (USD Thousand)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research & Academic Institutes

- Research & Academic Institutes

- Hospitals & Diagnostic Laboratories

- Media Application, Value (USD Thousand)

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Recombinant Protein Production

- Diagnostics & Drug Development

- In-vitro Diagnostics (IVD)

- Drug Screening & Development

- Advanced Therapies

- Cell Therapy

- Gene Therapy

- Tissue Engineering Applications

- Biopharmaceutical Production

- Country Level Analysis

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Product Type, Value (USD Thousand)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

- Legal Disclaimer

CHO Cell Culture Media Market Outlook:

CHO Cell Culture Media Market size was valued at USD 21,17,140.7 thousand in 2025 and is projected to reach USD 96,59,760.7 thousand by the end of 2036, rising at a CAGR of 14.8% during the forecast period, i.e., 2026-2036. In 2026, the industry size of CHO cell culture media is assessed at USD 24,24,620.1 thousand.

The burgeoning biopharmaceutical industry is the primary factor behind the growth of the global market. As reported by the Press Information Bureau in March 2025, the government of India is ambitious to achieve a USD 300 billion bioeconomy, seeking to lead the global pharmaceutical market. With the growth of the biopharmaceutical industry, the demand for CHO (Chinese hamster ovary cells) cells increases. The cells are actively used as a mammalian host in the production of recombinant protein therapeutics. Rising production of CHO cells is expected to lead to a growing use of CHO cell culture media.

The rising focus of companies on the production of personalized medicine is also fueling the market growth. Regulators are also providing significant support for research and development on the advancements of personalized healthcare and medicine, indicating the chance of rising use of CHO cell culture media in the production of antibodies and therapeutic proteins used in the provision of personalized treatments. As disclosed by the Press Information Bureau in July 2025, the government of India launched the Framework for Exchange of Data Protocols (FeED) and the Indian Biological Data Centre (IBDC) Portals, leading to the rising accessibility to 10,000 whole genome samples among researchers across the globe. A report by the Personalized Medicine Coalition, published in February 2024, reveals that for the fourth consecutive year from 2020 to 2023, personalized medicines topped one third of approvals by the U.S. Food and Drug Administration.

Key CHO Cell Culture Media Market Insights Summary:

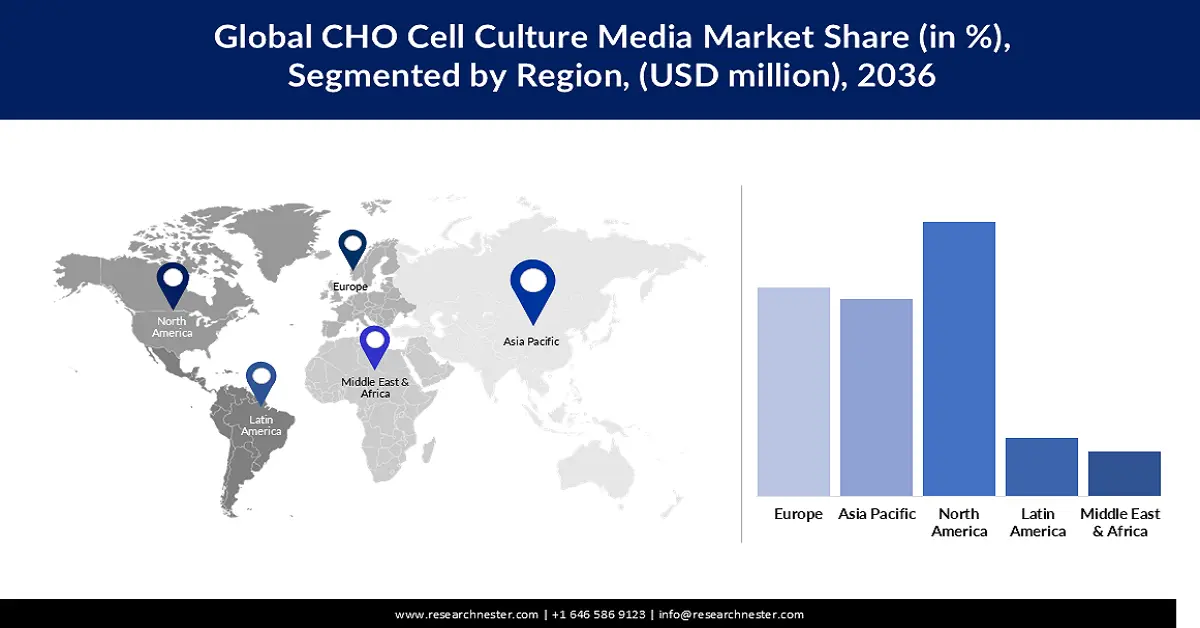

Regional Insights:

- North America is anticipated to hold a 39.8% share by 2036, owing to the presence of a vast number of biopharmaceutical companies and rising adoption of alternatives to animal derivatives.

- Europe is expected to account for a 30.8% share by 2036, due to the growing prevalence of rare and chronic diseases and increasing demand for therapeutic proteins.

Segment Insights:

- The customized media segment is projected to account for a 66.1% share by 2036, propelled by the expansion of the biopharmaceutical industry, increasing focus on biomanufacturing, and surging investment in relevant research and development in the cho cell culture media market.

- The serum-free media segment is expected to achieve a 43.8% share by 2036, impelled by rising demand in the biopharmaceutical sector to achieve sustainability and eliminate animal-derived serum.

Key Growth Trends:

- Growing demand for biologics and biosimilars

- Shift toward chemically defined and serum-free media

Major Challenges:

- Regulatory push on the CHO cell culture market

- Process complexity and optimization challenges

Key Players: Merck KGaA (Germany), Danaher Corporation (U.S.), Sartorius AG (Germany), Lonza Group AG (Switzerland), Corning Incorporated (U.S.), Fujifilm Holdings Corporation (Japan), Becton, Dickinson and Company (BD) (U.S.), STEMCELL Technologies Inc. (Canada), Miltenyi Biotec (Germany), Takara Bio (Japan), HiMedia Laboratories Pvt. Ltd. (India), PromoCell GmbH (Germany), Bio-Rad Laboratories, Inc. (U.S.), Cell Applications, Inc. (U.S.).

Global CHO Cell Culture Media Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21,17,140.7 thousand

- 2026 Market Size: USD 24,24,620.1 thousand

- Projected Market Size: USD 96,59,760.7 thousand by 2036

- Growth Forecasts: 5.7% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 4 November, 2025

CHO Cell Culture Media Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for biologics and biosimilars: The growing demand for biologics and biosimilars, driven by the rising prevalence of disease and autoimmune disorders, is boosting the market growth significantly. Regulators are also supporting the development of biologics and biosimilars. As reported by the Food and Drug Administration in October 2025, it not only approves biosimilar products but also assists with scientific and regulatory advice required in the development of safe and effective biosimilars. This is likely to fuel the demand for CHO cell culture media as CHO cells are the primary mammalian cell lines used in the production of monoclonal antibodies (mAbs), which are biosimilars.

- Shift toward chemically defined and serum-free media: The global shift towards chemically defined and serum-free media is projected to boost the use of CHO cell culture media in the upcoming financial years. As revealed by the National Library of Medicine in March 2021, the proportion of recombinant therapeutic protein (RTP) production using CHO cells and serum-free medium surpassed 70%. The use of amino acids, inorganic salts, vitamins, lipids, surfactants, and recombinant growth factors, eliminating the association of animal-derived components, makes CHO cell culture media chemically defined and serum-free.

- Expansion of the cell culture media: Key players in the market are driving the expansion of cell culture media to achieve improved cell numbers through involvement in research and development. For example, in July 2023, Lonza launched the TheraPRO CHO Media System. It is a novel cell culture platform capable of simplifying processes and optimizing protein quality and productivity as soon as utilized with GS-CHO cell lines. With the expansion of the cell culture media, biopharmaceutical companies involved in the production of therapeutic proteins are expected to get the opportunity to enhance their product quality.

Challenges

- Regulatory push on the CHO cell culture market: Regulators globally are necessitating rigorous process controls in the market. This is pressuring the key producers of the media to go beyond the provision of simple nutrients to encompass metabolic pathways’ finely tuned modulation. Regulators are also scrutinizing the transparency of bioprocesses, obligating the key players to access more ethically sourced and traceable raw materials required in the production of CHO cell culture media.

- Process complexity and optimization challenges: The development of technologies that are applicable in the cell cultivation process is influencing complexity and optimization challenges in the global market. The association of a vast pool of interacting components in the process of producing CHO cells is another factor, including the risk of deterioration in cell growth and protein production. As a result, the demand for advanced and data-driven solutions surges in companies, inflating rising operating expenses and hindering speed-to-market.

CHO Cell Culture Media Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 21,17,140.7 thousand |

|

Forecast Year Market Size (2036) |

USD 96,59,760.7 thousand |

|

Regional Scope |

|

CHO Cell Culture Media Market Segmentation:

Product Type Segmentation Analysis

The customized media segment is expected to account for a market share of 66.1% by the end of 2036, owing to growing demand, driven by the expansion of the biopharmaceutical industry, increasing focus on biomanufacturing, and surging investment in relevant research and development. The development of technologies applicable to cell modulation is also fostering the dominance of the segment in the upcoming business years. Companies are also initiating heavy investments in the development of customized CHO cell culture media. For instance, in September 2023, Thermo Fisher Scientific launched Gibco Efficient-Pro Medium and Feeds System. It is a high-performance solution applicable in mAb production and enhancing titers, protein quality, and cell viability in CHO cell lines.

Media Type Segment Analysis

The serum-free media segment is projected to witness a rapid expansion, acquiring a revenue share of 43.8% during the stipulated timeframe, on account of the rising demand in the biopharmaceutical sector to achieve sustainability. The regulators are pushing the biopharmaceutical sector for a transition that eliminates the use of animal-derived serum. For instance, in December 2022, the U.S. government enacted the FDA Modernization Act. The law eliminated the use of animal testing in the new drug applications. Companies are also active in the development of serum-free media. For example, in May 2023, Lonza launched an animal-origin component-free media, TheraPEAK T-VIVO Cell Culture Medium. The media enhances consistently and process control, and is simplifying the regulators' approvals for a quicker time-to-market.

End use Form Segment Analysis

The pharmaceutical and biotechnology companies are anticipated to acquire a revenue share of 47.8% in the end use segment of the global market. The mentioned groups of companies are witnessing a growing demand for CHO cell culture media for the production of biologics, vaccines, and therapeutic development. Large-scale production capability of the pharmaceutical and biotechnology industries is also expected to fuel the dominance of the segment with increased adoption of CHO cell culture media in biologics production. For instance, Samsung Biologics has a plan to increase its production capacity to 400,000 liters globally by 2027.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Media Type |

|

|

Formulation Form |

|

|

End use |

|

|

Media Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CHO Cell Culture Media Market - Regional Analysis

North America Market Insights

The North America CHO cell culture media market is expected to hold a revenue share of 39.8% by the end of 2036, owing to the presence of a vast number of biopharmaceutical companies within the region. This indicates a rising use of the media in the production of CHO cells, especially when the regulators are encouraging the use of alternatives to animal derivatives in biopharmaceutical applications. The initiation of relevant research and development is also expected to boost the advancement of the CHO cell culture media. For instance, in January 2022, Cytiva partnered with Nucleus Biologics to develop a solution for custom media formulation and fulfillment for the industry of cell and gene therapy. The plan of the companies included the use of an AI platform in the optimization of cell culture formulation.

The CHO cell culture media market in the U.S. is set to witness a CAGR of 14.7% throughout the forecast timeline, due to the growing demand for biologics, including monoclonal antibodies, driven by a surge in biopharmaceutical production. The use of the CHO cell culture media is also likely to be boosted, owing to the rising investment in the development of regenerative medicine and gene therapy. Updated in November 2023, outcomes from a simulation study conducted by the National Center for Biotechnology Information show that year-on-year spending on gene therapies is expected to reach around USD 20.4 billion. The use of CHO cell culture media is crucial in the production of therapeutic proteins required to enable cell therapies.

The Canada is poised to emerge as an expanding CHO cell culture media market between 2026 and 2036, owing to public-private partnerships in stem cell research and the development of regenerative medicine. For instance, in June 2025, the Stem Cell Network (SCN) raised funding of USD 13.5 million to undertake 36 new research projects and clinical trials on regenerative medicine. A total of 63 partner organizations supported the research initiative with an investment of USD 19.5 million, which led to a collective spending of USD 33 million to fuel the regenerative medicine ecosystem of the country. Stringent regulations for biologics and cellular therapies are also fostering innovation in CHO cell culture media to make biopharmaceutical organizations comply with the set standards.

Europe Market Insights

The Europe is anticipated to account for a revenue share of 30.8% in the global CHO cell culture media market during the forecast timeline, as a consequence of the growing prevalence of rare and chronic diseases, including autoimmune disorders, and cancer. In March 2025, the European Federation of Pharmaceutical Industries and Associations reported that the count of new cancer cases increased by around 60% in Europe since 1995, causing 23% of adult deaths, and is poised to be the leading cause of deaths by 2035. As a result, the demand for CHO cell culture media is likely to increase rapidly for the production of therapeutic proteins used in cancer treatment. The consumption of the media is also estimated to increase with the rapid expansion of the biosimilar market across the region.

The CHO cell culture media market in the UK can experience a CAGR of 16.1% by 2026, owing to the plan of government to make the country the global leader in life sciences. In July 2025, the government launched the Life Sciences Sector Plan, a part of the Industrial Strategy. The aim behind the initiative is to bolster the science and innovation of the country so that long-term economic growth and a strengthened, prevention-focused national health service can be enabled. This is likely to lead to a growing demand for CHO cell culture media in bioproduction. The adoption of the media is also likely to be accelerated with increasing investment in the biotechnology industry in the upcoming years. For instance, according to the disclosure by the BioIndustry Association in July 2025, the life science sector of the country secured a venture capital investment of around USD 1.6 billion during the first half of 2025.

The Germany CHO cell culture media market is estimated to go through a rapid expansion throughout the forecast period, on account of the rapid involvement of key biopharmaceutical products and research institutions in the development of the new vaccines and therapeutics. Growing investment in pharmaceutical research and development is also expected to fuel the consumption of the CHO cell culture media. As disclosed by the European Federation of Pharmaceutical Industries and Associations (EFPIA) in November 2024, Germany spent approximately USD 11.4 billion in pharmaceutical research and development in 2023.

Asia Pacific Market Insights

The CHO cell culture media market in the Asia Pacific is poised to witness a 15.4% CAGR from 2026 to 2036, owing to the emergence of the region as the hub for contract research and manufacturing of the biopharmaceutical and biotechnology products. Governments of different countries are also attracting foreign direct investments for the biopharmaceutical production. As a result, the consumption of the CHO cell culture media is estimated to surge in the forthcoming business period. Technological advancements in the region are driving improvements in media formulation. For example, in November 2023, Ajinomoto CELLiST Korea launched the innovative CELLiST F7, featuring cysteine stabilization technology. This enables the delivery of higher cysteine concentrations to cells, enhancing culture performance and overall productivity.

The CHO cell culture media industry in China is projected to witness robust growth during the forecast timeline, with adequate government support in the advancement of life sciences. According to the update by the Information Technology and Innovation Foundation in September 2024, the government of China is providing remarkable direct and indirect subsidies to chemical firms as part of the Made in China 2025 strategy. This development enhances accessibility to CHO cell culture media for companies, while the growing foreign direct investment in cell therapy in China is expected to further drive its adoption.

The CHO cell culture media market is poised to grow exponentially in India over the forecast horizon, as a consequence of the growing demand for biopharmaceuticals. The demand is driven by an aging population and the increasing prevalence of chronic diseases. As revealed by the International Society for Pharmaceutical Engineering in April 2025, India is currently the largest supplier of vaccines, fulfilling 62% of the global demand by exporting two-thirds of the vaccines produced. The growing adoption of cell-based therapies is also expected to boost the consumption of the CHO cell culture media across the country in the years ahead.

Key CHO Cell Culture Media Market Players:

- Thermo Fisher Scientific Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Sartorius AG (Germany)

- Lonza Group AG (Switzerland)

- Corning Incorporated (U.S.)

- Fujifilm Holdings Corporation (Japan)

- Becton, Dickinson and Company (BD) (U.S.)

- STEMCELL Technologies Inc. (Canada)

- Miltenyi Biotec (Germany)

- Takara Bio (Japan)

- HiMedia Laboratories Pvt. Ltd. (India)

- PromoCell GmbH (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Cell Applications, Inc. (U.S.)

- Thermo Fisher Scientific is a global leader in life sciences, offering a wide portfolio of cell culture media, reagents, and bioprocessing solutions. In the CHO cell culture media segment, the company provides advanced formulations that support high-yield protein expression and consistent cell growth. Its robust R&D capabilities and global distribution network enable tailored solutions for biopharmaceutical manufacturing, research, and development. Thermo Fisher focuses on scalability, reproducibility, and regulatory compliance, strengthening its position in the bioprocessing market.

- Merck KGaA, through its Life Science division, supplies a comprehensive range of CHO cell culture media and bioprocessing tools. The company emphasizes chemically defined, animal-component-free media designed to enhance productivity and maintain product quality in monoclonal antibody and recombinant protein production. Leveraging strong R&D and global operations, Merck supports both academic research and commercial-scale biomanufacturing. Sustainability and process efficiency are key priorities in its CHO media offerings.

- Danaher Corporation provides a broad suite of bioprocessing solutions, including CHO cell culture media under its life sciences subsidiaries. Its media are engineered to optimize cell growth, protein yield, and bioprocess reproducibility for monoclonal antibody and recombinant protein production. Danaher leverages advanced technologies and automation in bioreactor systems, enabling integrated solutions for cell culture. The company’s global footprint ensures reliable supply and support for both research and industrial biomanufacturing applications.

- Sartorius AG specializes in bioprocess solutions and upstream biomanufacturing, offering high-performance CHO cell culture media designed for optimized growth and productivity. The company’s media are compatible with fed-batch and perfusion processes, supporting large-scale biopharmaceutical production. Sartorius emphasizes innovation, quality, and regulatory compliance, providing comprehensive solutions from media development to bioreactor integration. Its strong presence in Europe, the U.S., and Asia strengthens its global market position.

- Lonza Group AG is a leading provider of biologics manufacturing solutions, including chemically defined CHO cell culture media for monoclonal antibody and recombinant protein production. The company offers customized media development services to enhance productivity, stability, and process scalability. Lonza combines deep expertise in cell line engineering and upstream processing with global manufacturing capabilities, making it a preferred partner for biopharmaceutical companies. Its solutions focus on efficiency, quality, and regulatory compliance.

Below is the list of the key players operating in the global CHO cell culture media market:

The key players in the global CHO cell culture media market are operating in a highly competitive market. The competition in the market is expected to intensify more in the years to come, due to the emergence of a vast pool of small players. The majority of the market share is acquired by the large key players in the market, which makes the industry moderately concentrated. At the same time, small players significantly dominate the regional markets. Public-private partnerships for research and development are welcomed by the key players, seeking further advancement of CHO cell culture media.

Corporate Landscape of the Global CHO Culture Media Market:

Recent Developments

- In September 2025, Thermo Fisher Scientific Inc., a global leader in serving science, launched the Gibco Efficient-Pro Medium (+) Insulin, a next-generation medium designed to boost titers, maximize productivity, and enhance the performance of insulin-dependent CHO cell lines. This new formulation complements Thermo Fisher’s existing Efficient-Pro medium and feed system, offering optimized cell growth and protein expression with streamlined workflow and simplified handling for biopharmaceutical applications.

- In July 2023, Lonza launched the TheraPRO CHO Media System, a new cell culture platform designed to simplify workflows and enhance both productivity and protein quality in GS-CHO cell lines. This launch provides pharmaceutical and biotechnology companies with a solution to improve therapeutic protein production efficiency, elevate product quality, and accelerate time-to-market.

- Report ID: 8214

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

CHO Cell Culture Media Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.