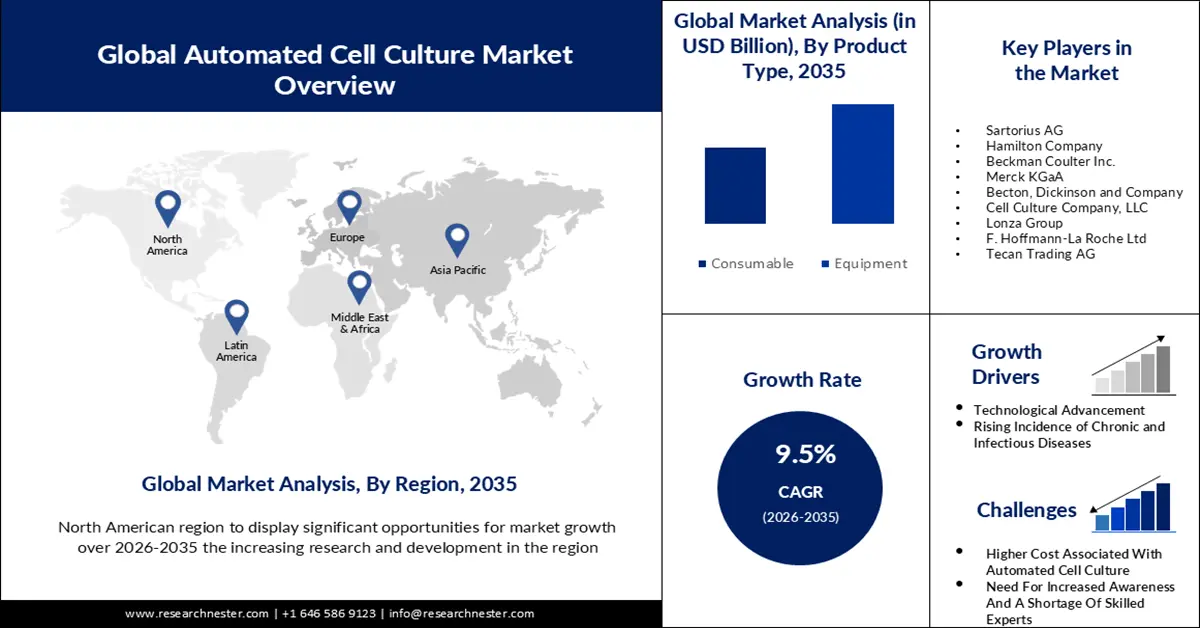

Automated Cell Culture Market Outlook:

Automated Cell Culture Market size was over USD 17.75 billion in 2025 and is poised to exceed USD 43.99 billion by 2035, witnessing over 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated cell culture is estimated at USD 19.27 billion.

The market for automated cell culture is expanding due in large part to an increase in clinical trials and investments in customized medications in developing nations like Australia, China, the US, India, and others. Automated cell culture systems are mostly used in labs that perform tasks like drug discovery, protein expression, cell signaling, and other related tasks. These solutions assist save time and prevent mistakes made by technicians. It is undoubtedly a very useful tool for researching diseases in humans. Approximately USD 97 million was the suggested investment value for the Indian pharmaceutical and medicine industries in the fiscal year 2022.

In addition to these, numerous elements have shown themselves to be accountable for the automated cell culture market expansion for automated cell culture. Among the few are stem cell development and research, drug discovery, and greater investments in the creation of new products. Gene therapy and vaccine production have grown, among other things.

Key Automated Cell Culture Market Insights Summary:

Regional Highlights:

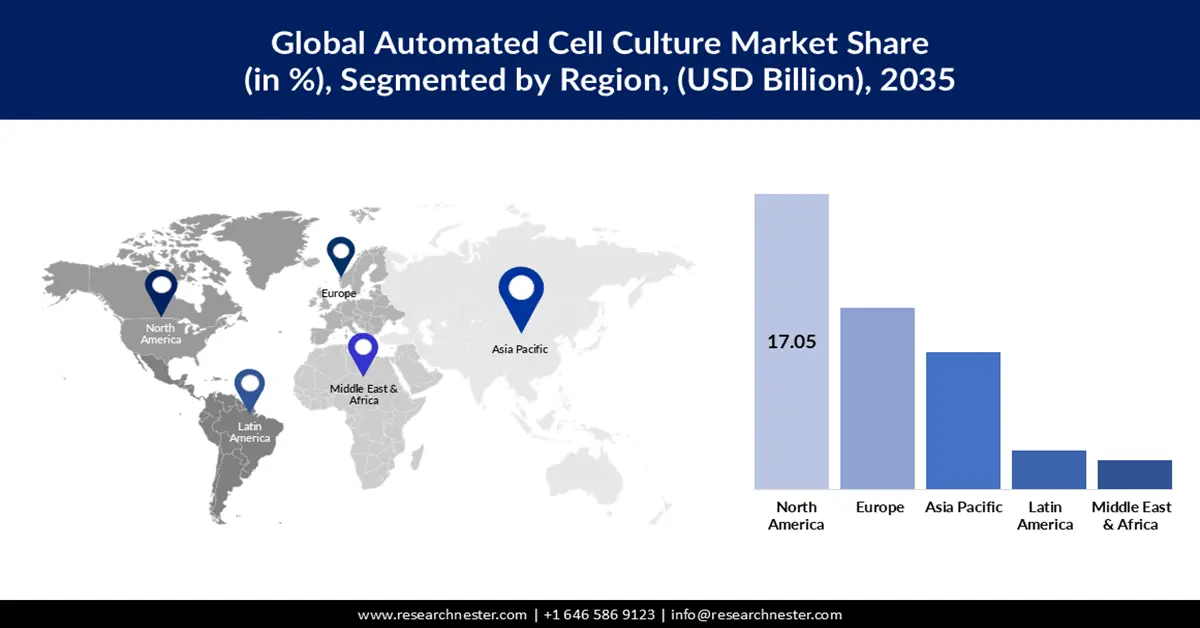

- North America automated cell culture market will dominate over 43% share by 2035, driven by rising cancer R&D, biotech advances, and demand for vaccine production.

- Europe market will secure 25% share by 2035, attributed to increased government R&D funding and demand for customized treatments.

Segment Insights:

- The equipment segment in the automated cell culture market is forecasted to dominate with a substantial share by 2035, fueled by demand for high-throughput automation in drug discovery processes.

- The pharmaceutical & biotechnology companies segment in the automated cell culture market is forecasted to hold a 45% share by 2035, driven by the rise in R&D activities and biopharma investments.

Key Growth Trends:

- Rising Incidence of Chronic and Infectious Diseases

- Technological Advancement

Major Challenges:

- Higher cost associated with automated cell culture

- Development and maintenance of expertise may hinder the growth of the market.

Key Players: Sartorius AG, Hamilton Company, Beckman Coulter Inc., Merck KGaA, Becton, Dickinson and Company, Cell Culture Company, LLC, Lonza Group, F. Hoffmann-La Roche Ltd, Tecan Trading AG, Hitachi, Ltd., Panasonic Production Engineering Co., Ltd., CellScale, JTEC CORPORATION, SINFONIA TECHNOLOGY CO., LTD.

Global Automated Cell Culture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.75 billion

- 2026 Market Size: USD 19.27 billion

- Projected Market Size: USD 43.99 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Automated Cell Culture Market Growth Drivers and Challenges:

Growth Drivers

- Rising Incidence of Chronic and Infectious Diseases- Finding and developing effective therapies and medications for infectious and chronic diseases requires significant research and development efforts. The automated cell culture market is expanding as a result of the rise in long-term illnesses like HIV, TB, and cancer. Automated cell culture helps with drug research and development as well as the knowledge of the causes and mechanisms of these diseases. It enhances the well-being and standard of living for individuals with genetic disorders and cancer patients. Seven in ten US deaths occur from chronic conditions each year, according to the CDC. Six out of ten Americans suffer from at least one chronic illness, such as diabetes, heart disease, stroke, or cancer. Roughly 10 million deaths, or roughly one in six deaths, globally will be attributable to cancer in 2020. The increase in chronic illness cases will have a beneficial effect on the automated cell culture market expansion.

- Technological Advancement- Excellent consistency in 3-D cultures has been achieved by automation. There are several reasons why 3D cell culture is gaining traction over 2D culture. On flat surfaces, 2D cell culture techniques are used to grow cells as 2D monolayers. However, the fact that these cells only attach to and adhere to cells at the edge of cell culture vessels poses a limitation to multi-dimensional cell culture. Researchers have come up with a way to deal with these issues: 3D cell culturing. Numerous studies on fundamental biological systems, such as cell survival, proliferation, number monitoring, and morphology, have demonstrated the effectiveness of these cultures. Furthermore, compared to 2D culture, 3D cell culture exhibits better stability and longer lifespans.

- Growing Focus on Regenerative Medicines- It looks like the cutting-edge science of regenerative medicine may open doors for treating underlying conditions like incurable diseases. Hitachi has adopted an open innovation policy and worked with partners in academia and the pharmaceutical industry to develop automated cell culture technologies for therapeutic cells. Because Hitachi's automated cell culture method is a closed system, it has an advantage. Automating the current manual cell production procedures will enable the production of cells at a reasonable cost. Applications of regenerative medicine that use donor-induced pluripotent stem cells and may provide long-lasting therapy may benefit a large number of patients. Autologous regenerative medicine, or autologous cell transplantation, is another potentially more promising area that enhances the patient quality of life because of its incredibly low risk of immune rejection. Given that autologous transplantation involves patient-specific cell conditions, Hitachi's intelligent automated cell culture equipment ought to be a helpful resource.

Challenges

- Higher cost associated with automated cell culture- Research centers and organizations need to invest heavily to automate cell culture. In addition, the stringent production guidelines necessary to obtain market certification for the equipment from many governmental bodies raise the cost of these systems. Furthermore, the integration of information technology (IT) into laboratory automation instruments requires significant production expenditures, leading to increased equipment expenses. The significant upfront and recurring expenses associated with automated cell culture are expected to limit the global market's growth since small-scale research labs and organizations cannot afford to construct such costly equipment.

- It is projected that the market growth will be hindered throughout the assessment period by the need for increased awareness and a shortage of skilled experts.

- Development and maintenance of expertise may hinder the growth of the market.

Automated Cell Culture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 17.75 billion |

|

Forecast Year Market Size (2035) |

USD 43.99 billion |

|

Regional Scope |

|

Automated Cell Culture Market Segmentation:

Product Type Segment Analysis

The equipment segment share in the automated cell culture market is expected to reach 61% by 2035. Equipment for automated cell culture is designed to streamline and expedite any cell culture process. Because automated cell culture instruments perform the necessary duties to establish and maintain a cell culture mechanically, they are used in laboratories. Automated cell culture equipment can perform several activities, such as plating cultures, dilution of samples, continuous spinning of cultures in liquid culture, and well-depositing of cultures. Because automated cell culture systems can generate the best cell lines over the whole range of seeding, feeding, massaging, and cell multiplication, their popularity has grown. They help achieve high standards and criteria while reducing human error. The need for automated cell culture equipment is growing as high-throughput cell lines are used in more drug discovery studies.

End User Segment Analysis

Automated cell culture market from the pharmaceutical & biotechnology companies segment is expected to hold 45% revenue share by 2035. Over the course of the projected period, the pharmaceutical and biotechnology businesses segment is anticipated to keep the majority share. The growing prevalence of chronic illnesses and the growth of research and development in the biotechnology and pharmaceutical industries are factors contributing to this sector's sizeable market share. Furthermore, the expanding network of biopharmaceuticals and biotech companies will propel segmental expansion. FUJIFILM Diosynth Biotechnologies, for example, celebrated the launch of its USD 2 billion large-scale cell culture manufacturing facility in November 2023. When completed, the new building will house state-of-the-art biopharmaceutical manufacturing technology and be the largest CDMO in North America. The new building will serve as a key component of FUJIFILM Diosynth Biotechnologies' global network for the production of biopharmaceuticals for major US and European customers.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Equipment Type |

|

|

End User |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Cell Culture Market Regional Analysis:

North American Market Insights

The North America automated cell culture market is projected to be the largest with a revenue share of 43% by the end of 2035. The need for customized medication, the amount of research and development being done on cancer, and the existence of major rivals in the industry are all factors contributing to the growth of the automated cell culture market. An estimated 1.9 million new instances of cancer will be identified in the US in 2021, and 608,570 people will die from cancer. The market is growing as a result of developing biotechnology sectors, better cell culture technology systems, and an increased need for cell culture technology in the production of vaccines. The growing cost of healthcare is driving up demand in the market in the region. Medical research is supported by the government since healthcare is one of the main goals in the United States. Growing government funding for cell-based research is one of the main factors propelling the market's growth.

European Market Insights

The Europe automated cell culture market share is estimated to cross 25% by 2035. The European market for automated cell culture is growing rapidly due to increased government support from important countries such as Russia, Germany, the United Kingdom, and Spain. Research activity in the region is also stimulated by rising R&D spending in the main European countries. For instance, the UK government announced in March 2020 the highest-ever research and development budget of USD 50.04 billion. The increasing demand for customized treatments, coupled with population aging and the advancement of new production techniques, is one of the primary factors propelling the pharmaceutical industry's growth in Europe. These factors also tend to increase the region's need for automated cell culture.

Automated Cell Culture Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sartorius AG

- Hamilton Company

- Beckman Coulter Inc.

- Merck KGaA

- Becton, Dickinson and Company

- Cell Culture Company, LLC

- Lonza Group

- F. Hoffmann-La Roche Ltd

- Tecan Trading AG

- Hitachi, Ltd.

- Panasonic Production Engineering Co., Ltd.

- CellScale

- JTEC CORPORATION

- SINFONIA TECHNOLOGY CO., LTD

Recent Developments

- SINFONIA TECHNOLOGY CO., LTD. has been developing a fully automated cell culture instrument in collaboration with the Foundation for Biomedical Research and Innovation at Kobe, with the successful results of demonstration experiments with human iPS cells and mesenchymal stem cells, SINFONIA announces the official product launch starting from October 2021.

- Panasonic Corporation announced that its Heating & Ventilation A/C Company has recently started the operation of a new building, constructed at Panasonic Appliances Air-Conditioning R&D Malaysia Sdn. Bhd. in Malaysia. This new building includes the Company's first multi-purpose laboratory for simultaneously testing water heaters and air conditioning equipment, designed to shorten the lead time for developing air conditioning equipment for the global market, mainly in ASEAN and Europe, and allowing it to accelerate development that meets local needs.

- Report ID: 4105

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Cell Culture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.