Scaffold Free 3D Cell Culture Market Outlook:

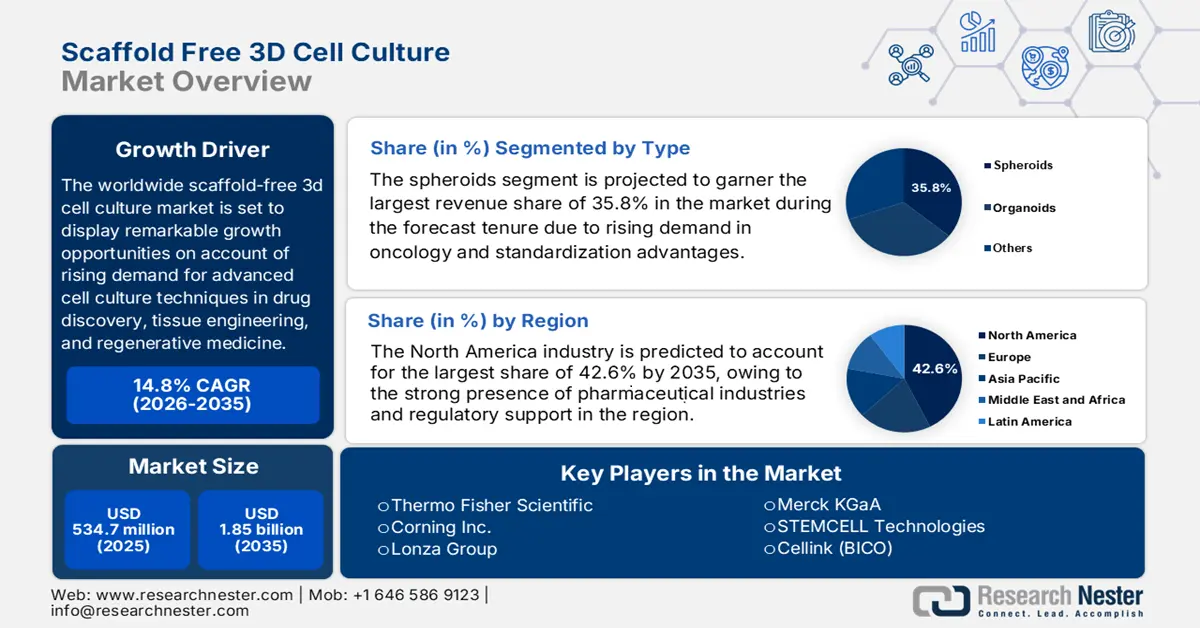

Scaffold Free 3d Cell Culture Market size was valued at USD 534.7 million in 2025 and is projected to reach USD 1.85 billion by the end of 2035, rising at a CAGR of 14.8% during the forecast period, i.e., 2026-2035. In 2025, the industry size of scaffold free 3d cell culture is evaluated at USD 611.8 million.

The worldwide market is set to display remarkable growth opportunities on account of rising demand for advanced cell culture techniques in drug discovery, tissue engineering, and regenerative medicine. Meanwhile, the increasing instances of cancer, neurodegenerative, respiratory, and autoimmune ailments also foster a profitable business environment in this industry since they necessitate the need for personalized therapies. As per an article published by Sjögren’s Foundation in March 2025, more than 50 million individuals in the U.S., marking 8% of the total, are affected by autoimmune disorders and are growing by 19.1% on an annual basis, wherein 3D cultures support the study of immune cell interactions and drug effects.

Furthermore, the pharmaceutical firms and research institutions are extensively seeking alternatives to traditional 2D cultures since the scaffold-based 3D cultures have a better ability to mimic in vivo conditions. Therefore, the study by the National Institute of Health (NIH) in January 2024 revealed that Scaffold-free 3D cell cultures rely on cells self-assembling into tissue-like structures without external support, thereby allowing high cell density and a wide range of applications. It also underscored that scaffold-based approaches provide a 3D environment for cell growth and interaction, benefiting researchers and hence positively influencing market growth.

Key Scaffold Free 3D Cell Culture Market Insights Summary:

Regional Highlights:

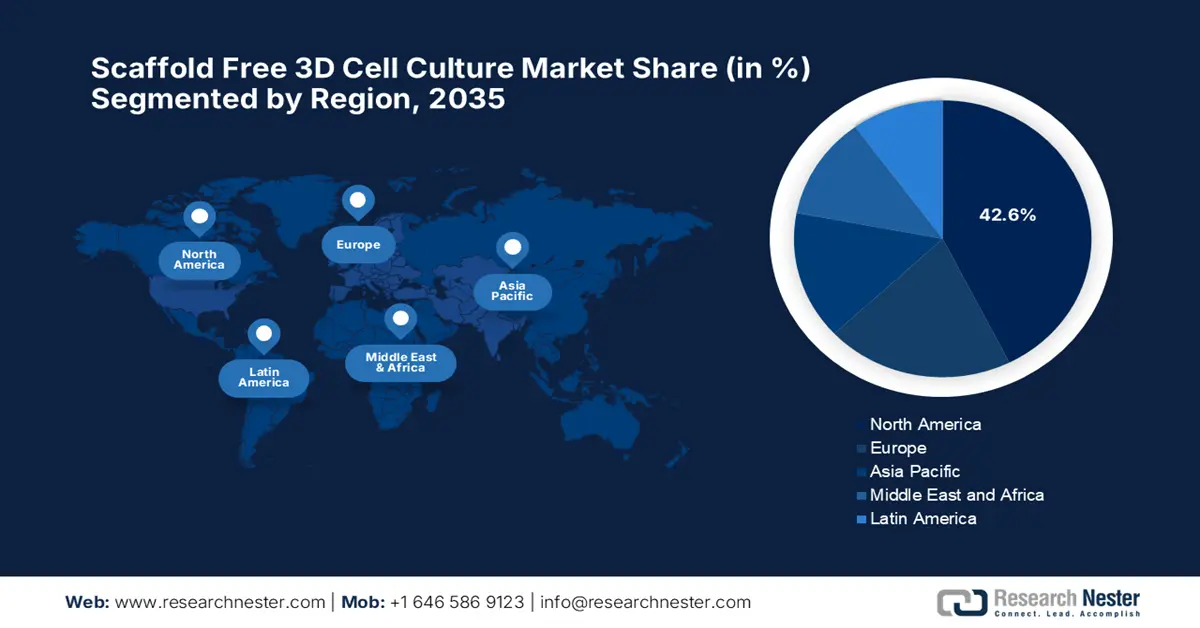

- By 2035, North America is anticipated to secure a 42.6% share in the scaffold free 3d cell culture market, bolstered by expansive R&D infrastructure, a robust pharma–biotech ecosystem, and supportive regulatory initiatives.

- Asia Pacific is forecast to witness the fastest expansion from 2026–2035, propelled by escalating demand for advanced drug-discovery models and rising regenerative-medicine research.

Segment Insights:

- By 2035, the spheroids segment is projected to command a 35.8% share in the scaffold free 3d cell culture market, underpinned by increasing oncology adoption, model standardization, and cost-efficient workflows.

- By 2035, the drug discovery segment is expected to attain a notable share, supported by modernization initiatives, expanding high-throughput capabilities, and enhanced toxicity-prediction platforms.

Key Growth Trends:

- Rising demand for physiologically relevant models

- Regulatory pressure to reduce animal testing

Major Challenges:

- Limited mechanical support

- Standardization concerns

Key Players: Thermo Fisher Scientific, Corning Inc., Lonza Group, Merck KGaA, STEMCELL Technologies, Cellink (BICO), Greiner Bio-One, 3D Biomatrix, InSphero, TissUse, Organovo, Amsbio, Cellesce, Cynata Therapeutics, Korea Biotechnology, BioLamina

Global Scaffold Free 3D Cell Culture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size:USD 534.7 million

- 2026 Market Size: USD 611.8 million

- Projected Market Size: USD 1.85 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: South Korea, India, Singapore, Australia, Brazil

Last updated on : 20 August, 2025

Scaffold Free 3D Cell Culture Market - Growth Drivers and Challenges

Growth Drivers

-

Rising demand for physiologically relevant models: This is the primary driver behind the robust growth of the market. This culture enables enhanced research accuracy in terms of drug discovery, cancer, and disease modelling, thereby allowing a steady cash influx in this field. In this regard, the study by AIP in October 2024 revealed that Cell sheet engineering is a scaffold-free approach that preserves cell structures and functions without enzymatic treatment, thereby productively enhancing stem cell retention and therapeutic effects. Besides, this method supports regeneration in diverse tissues such as the heart, skin, cartilage, and nerves, hence further boosting demand.

-

Regulatory pressure to reduce animal testing: There has been constant pressure from the governing bodies to reduce animal testing, thereby increasing the adoption of the 3Rs principle, which is replacement, reduction, and refinement. Therefore, in April 2025, the U.S. FDA stated that it is planning to phase out animal testing for monoclonal antibodies, promoting non-animal methods such as organoids, organ-on-a-chip, and AI models. Hence, this initiative aims to improve safety, reduce R&D costs, and accelerate development timelines, thus creating a positive market outlook.

-

Vigorous advancements in cell culture technologies: The existence of continued and amplifying advancements in the cell culture technologies reshapes the foundation of the scaffold-free 3d cell culture market. For instance, in November 2023, Ajinomoto CELLiST Korea notified the launch of CELLiST F7, an advanced cell culture medium utilizing cysteine stabilization and Digital Twin technology to enhance CHO cell productivity. The company stated that the product is a response to the heightened global demand for antibody drugs, vaccines, and cell therapies, hence benefiting the overall market growth.

Clinical Trials/Studies Utilizing Scaffold-Free 3D Stem Cell Cultures 2024

|

Target Tissue |

Stem Cell Construct |

Model Tested |

|

Periodontal Tissue |

PDL-derived stem cell sheet |

Periodontitis |

|

PDL-derived cell sheet |

Periodontitis |

|

|

PDL-MSC sheet |

Periodontitis |

|

|

Corneal Epithelium |

Limbal epithelial cell sheet |

Unilateral limbal stem cell deficiency |

|

Articular Cartilage |

ASC spheroid |

Knee osteoarthritis |

|

Lumbar Disc |

ASC spheroid |

Discogenic low back pain |

|

Retinal Tissue |

UC-MSC spheroid |

Retinitis pigmentosa |

Source: AIP Publishing

Scaffold-Based Cell Therapies: Products in the Market and Clinical Pipeline 2021

|

Clinical Indication |

Product (Manufacturer) |

Description |

Status |

|

Skin |

Apligraf (Organogenesis, U.S.) |

Bovine collagen I + allogeneic neonatal DF & EKs |

Approved |

|

Dermagraft (Organogenesis, U.S.) |

Polyglactin mesh + allogeneic neonatal DFs |

Approved |

|

|

DenovoDerm (Cutiss, Switzerland) |

Bovine collagen I + autologous DFs |

Phase II |

|

|

DenovoSkin (Cutiss, Switzerland) |

Bovine collagen I hydrogel + autologous DFs & EKs |

Phase II |

|

|

OrCel (Ortec Intl, U.S.) |

Bovine collagen I sponge + allogeneic DFs & EKs |

Approved |

|

|

TransCyte (Advanced BioHealing) |

Polyglycolic acid mesh + allogeneic neonatal DFs |

Approved |

|

|

Cartilage |

Biocart II (Histogenics, U.S.) |

Fibrin + hyaluronic acid scaffold + autologous chondrocytes |

Phase II |

|

BioSeed-C (Biotissue, Switzerland) |

Synthetic scaffold + autologous chondrocytes |

Approved |

|

|

CaReS (Arthro Kinetics, Germany) |

Rat collagen I hydrogel + autologous chondrocytes |

Approved |

|

|

MACI (Vericel, U.S.) |

Porcine collagen I/III scaffold + autologous chondrocytes |

Approved |

|

|

NeoCart (Histogenics, U.S.) |

Bovine collagen I porous scaffold + autologous chondrocytes |

Phase III |

|

|

NOVOCART 3D (B. Braun, Germany) |

Collagen I sponge + chondroitin sulfate + autologous chondrocytes |

Phase III |

|

|

Bone |

BIO4 (Osiris, U.S.) |

Bone matrix + allogenic MSCs, osteoblasts |

Approved (Allograft) |

|

Osteocel Plus (NuVasive, U.S.) |

Bone matrix + allogenic MSCs |

Approved (Allograft) |

|

|

Trinity Elite (Orthofix, U.S.) |

Cancellous bone + allogenic MSCs, osteoprogenitors |

Approved (Allograft) |

|

|

ViBone (AZIYO Biologics, U.S.) |

Cancellous bone + allogenic MSCs, osteoprogenitors |

Approved (Allograft) |

|

|

ViviGen (J&J, U.S.) |

Cortico-cancellous bone + allogenic osteoprogenitor cells |

Approved (Allograft) |

|

|

Cornea |

NT‑501 (Neurotech, U.S.) |

Encapsulated engineered RPE cells in polyether-sulfone fibers |

Phase III |

|

Blood Vessels |

VascuGel (Pervasis, U.S.) |

Gelatin matrix + allogenic aortic endothelial cells |

Phase III |

|

Oesophagus |

Cellspan (Biostage, U.S.) |

Polyurethane scaffold + autologous adipose-derived stem cells |

Approved |

Source: NIH

Challenges

-

Limited mechanical support: The existence of inadequate mechanical support and structural complexity creates a major hurdle for the scaffold free 3d cell culture market to capture the required consumer base. Besides, the scaffold-based systems provide a physical framework for cell organization and shape retention, whereas the scaffold-free models rely only on the cell-cell interactions. Therefore, this can cause hindrance to the development of thick, organized tissues and restrict their application in modeling certain organs or replicating the mechanical cues present in vivo, hence limiting market propagation in almost all nations.

- Standardization concerns: The market faces a significant hurdle in terms of achieving extremely consistent and reproducible results across a wide range of experiments and laboratories. Besides the differences in cell types, culture conditions, and techniques, such as hanging drop or magnetic levitation, can lead to differences in spheroid size, viability, and function. Therefore, this lack of standardization ultimately creates complications in the interpretation of experimental data and limits scalability for high-throughput screening or industrial use.

Scaffold Free 3D Cell Culture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 534.7 million |

|

Forecast Year Market Size (2035) |

USD 1.85 billion |

|

Regional Scope |

|

Scaffold Free 3D Cell Culture Market Segmentation:

Type Segment Analysis

Based on type, the spheroids segment is projected to garner the largest revenue share of 35.8% in the scaffold free 3d cell culture market during the forecast tenure. The segment’s dominance originates from rising demand in oncology, standardization advantages, and cost efficiency. This can be testified by the study by the Journal of Drug Delivery Science and Technology in October 2024, which revealed that 3D spheroid models enable huge physiological relevance when compared to 2D cultures, especially in analyzing anticancer drug responses. Therefore, the study further underscored that these spheroids are extremely supportive in enabling predictions for drug efficacy, resistance, and cellular behavior, particularly in the case of complex tumor microenvironments.

Application Segment Analysis

In terms of application drug discovery segment is expected to gain a significant market share in the scaffold free 3d cell culture market by the end of 2035. The growth in the segment is subject to the emergence of modernization acts, high throughput capacity, and toxicity prediction. As of August 2021, the U.S. FDA reports that FDA or CDER scientists are developing 3D microphysiological systems (MPS) to replicate human organ functions, such as the liver, heart, for highly accurate drug testing, reducing reliance on animal trials. Also, these platforms leverage iPSC-derived cells and interconnected organ models to study complex drug interactions and disease mechanisms, hence denoting a wider market scope.

End user Segment Analysis

Based on the end user, the pharma/biotech segment is anticipated to grow at a considerable rate in the scaffold free 3d cell culture market during the discussed timeframe. The personalized medicine push, organoid biobanking, and therapeutic developments are key factors behind this expedited growth. In December 2024, Merck declared a definitive agreement to acquire HUB Organoids Holding B.V., a Dutch-based player leading in organoid technology. The company stated that organoids, which mimic organ function, can accelerate drug development, support personalized medicine, and reduce animal testing, hence fostering a favourable business environment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

|

Technology |

|

|

Cellular Components |

|

|

Culture Duration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Scaffold Free 3D Cell Culture Market - Regional Analysis

North America Market Insights

North America is expected to capture the largest share of 42.6% in the worldwide market. The dominance of the region is pledged to extensive R&D infrastructure, a strong presence of pharmaceutical & biotechnological industries, and regulatory support. For instance, in February 2025, Cellevate AB announced that it has launched Cellevat3d, which is a nanofiber-based cell culture system that especially focuses on faster bioprocessing, efficient scaling, and three tomes viral vector yield. Therefore, such moves mark profitable expansion into the North America’s market for advanced scaffold-free cell culture technologies, hence a positive market outlook.

U.S. is remarkably augmenting its leadership in the scaffold free 3d cell culture market on account of huge investments in biotechnology and regenerative medicine, rapid adoption of advanced in vitro models by pharmaceutical and academic institutions. In this regard, Fujifilm Corporation in April 2024 declared that it had additionally made an investment of USD 1.2 billion to expand its large-scale cell culture CDMO facility in Holly Springs, North Carolina, which makes it the total of USD 3.2 billion. Besides, this expansion will deliberately add 8 x 20,000L mammalian cell culture bioreactors by the end of 2028, enhancing FUJIFILM Diosynth Biotechnologies’ global manufacturing capabilities.

There is a huge opportunity for Canada in the scaffold-free 3d cell culture market, extensively facilitated by increasing investments in stem cell research and collaborative programs between academic institutions and industry. Therefore, in July 2025, Health Canada reported that Aspect Biosystems (Vancouver, BC) received funding as part of a USD 10.5 million contribution through Canada’s Advanced Manufacturing Cluster in September 2022. Besides, the firm specializes in bioprinting and tissue engineering with a prime focus on the creation of functional human tissues. Furthermore, this also supports 3d tissue constructs that are extensively utilized in drug testing and regenerative medicine.

Major Government Investments in Canada’s Biomanufacturing and Advanced Therapies

|

Organization |

Investment |

Year |

Type of Support |

|

OmniaBio & partners |

$34.8 million project |

2022 |

Advanced therapies, cell manufacturing |

|

CFI (Budget 2021) |

$500 million over 4 years |

2021 |

Research infrastructure |

|

VIDO |

>$100 million |

2021 |

Biomanufacturing & imaging tools |

Source: Health Canada

APAC Market Insights

Asia Pacific is predicted to represent the fastest growth in the scaffold free 3d cell culture market from 2026 to 2035. This became possible with the existence of rising demand for advanced drug discovery models and growing research activities in regenerative medicine across the region’s vast geography. In addition to government support, expanding pharmaceutical industries also propel growth. For instance, in April 2022, Mitsubishi Chemical Holdings Group declared that it invested in Myoridge, a Kyoto University spin-out specializing in innovative cell culture media and services to advance cell cultures with cost efficiency, leveraging ethical and stable solutions.

China represents huge dominance in the regional market that is readily facilitated by its strong research ecosystem in terms of biotechnology and regenerative medicine. In January 2025, the country’s first stem cell therapy, called Amimestrocel Injection, which was developed by Platinum Life Excellence Biotech, received conditional market approval to treat steroid-refractory acute graft-versus-host disease. The therapy extensively received support from Professor Du Yanan’s team at Tsinghua University, who developed an innovative 3D microcarrier-based stem cell culture technology, thereby lowering production costs while ensuring high quality and safety for clinical use.

India is gaining enhanced recognition in the Asia Pacific scaffold free 3d cell culture market due to the vigorous advancements in stem cell research and regenerative medicine. Besides, the country also benefits from increased government funding and a growing emphasis on personalized medicine and alternative testing methods. For instance, in July 2024, Bioserve India introduced advanced stem cell products from REPROCELL to boost scientific research and drug development in the country. The product line includes media and tools for stem cell culture, cell reprogramming kits, 3D cell culture systems, and cellular assays to support regenerative medicine and disease modeling; hence, such instances accelerate advancements in stem cell therapy.

Cancer Prevalence Metrics for 3D Cell Culture Research: APAC Region 2022

|

Cancer Site |

5-Year Prevalent Cases |

Proportion per 100,000 |

|

Lung |

2,058,202 |

44.3 |

|

Breast |

3,197,043 |

140.6 |

|

Colorectum |

2,784,388 |

59.9 |

|

Stomach |

1,230,467 |

26.5 |

|

Liver |

833,450 |

17.9 |

|

Thyroid |

2,075,961 |

44.7 |

|

Cervix Uteri |

1,186,812 |

52.2 |

|

Prostate |

1,116,947 |

47.0 |

|

Oesophagus |

538,504 |

11.6 |

|

Lip, Oral Cavity |

683,010 |

14.7 |

Source: Global Cancer Observatory 2022

Europe Market Insights

The scaffold free 3d cell culture market in Europe is poised for extensive growth during the discussed time frame, owing to the increased adoption of scaffold-free technologies such as spheroids and organoids. In addition, the region also benefits from the constant efforts of administrative bodies to reduce animal testing procedures. This can be testified by the report by the European Medicines Agency published in September 2021 that states that it is supporting 3Rs in animal use in medicine development through its Innovation Task Force (ITF). This initiative proactively promotes New Approach Methodologies (NAMs), such as organoids, organ-on-chips, and in silico models, aligning with the region’s animal protection laws.

Germany is gaining traction in the scaffold-free 3D cell culture market, highly attributed to the advancements in drug development. The country also benefits from an advanced biotechnological infrastructure and a focus on innovation, supporting the adoption of scaffold-free techniques. For instance, in October 2024, Evonik announced the launch of a Global Competence Network for Cell Culture Solutions to address the upstream challenges in cell culture. This network effectively unites experts from chemistry, cell biology, bioprocessing, and media optimization across Europe, hence benefiting the overall market growth.

The scaffold free 3d cell culture market in Switzerland is continuously thriving, highly subject to the presence of strong firms and academic institutions that are pioneers in developing advanced organoid and spheroid-based models. In November 2024, InSphero reported that it took a key role in the EU-funded UNLOOC Project that is aimed at advancing organ-on-chip technologies. Besides the €68 million initiative, which involves 51 partners from 10 European nations, focuses on industrializing organ-on-chip systems with advanced readouts using microfluidics, AI, and big data. Further, the firm also aims to develop cutting-edge analytical methods to enhance drug development and personalized medicine.

Key Scaffold Free 3D Cell Culture Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Inc.

- Lonza Group

- Merck KGaA

- STEMCELL Technologies

- Cellink (BICO)

- Greiner Bio-One

- 3D Biomatrix

- InSphero

- TissUse

- Organovo

- Amsbio

- Cellesce

- Cynata Therapeutics

- Korea Biotechnology

- BioLamina

The worldwide market is extremely consolidated, wherein the pioneers Thermo Fisher and Corning dominate through mergers & acquisitions. On the other hand, Japan Japan-based players such as ReproCELL lead in terms of iPSC-organoids. Strategic collaborations, investments, R&D investments, and AI-integrated bioprinting are a few tactics implemented by the key players to uplift market growth internationally. Furthermore, the existence of regulatory shifts and organoid standardization also readily propels growth in the global market.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In November 2024, InSphero notified that it entered into a strategic alliance with Seoul-based Chayon to distribute its advanced 3D in vitro and organ-on-chip technologies in South Korea. Besides, this partnership allows broader access to InSphero’s Akura Plate and Organ-on-Chip platforms, thereby enhancing domestic capabilities in drug development and safety testing.

- In June 2022, Fujifilm Corporation readily invested a total of USD 1.6 billion to expand the global cell culture manufacturing capabilities of its subsidiary called Fujifilm Biotechnologies. The funding is projected to deliberately enhance facilities located in Hillerød, Denmark, and Texas, U.S., significantly increasing large-scale cGMP production capacity.

- Report ID: 3934

- Published Date: Aug 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.