Bacterial Cell Culture Market Outlook:

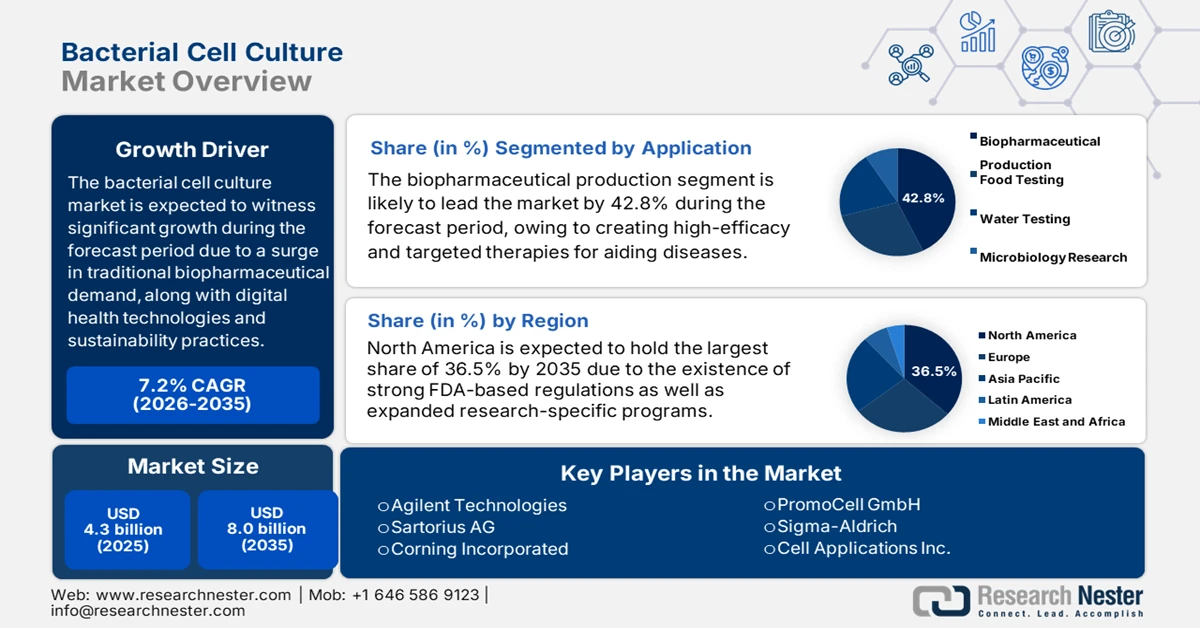

Bacterial Cell Culture Market size was over USD 4.3 billion in 2025 and is estimated to reach USD 8 billion by the end of 2035, expanding at a CAGR of 7.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of bacterial cell culture is assessed at USD 4.6 billion.

The international bacterial cell culture market is steadily expanding, significantly shaped by unique technological, societal, and regulatory factors that go beyond conventional biopharmaceutical demand. According to official statistics published by NLM in July 2024, the revenue of the international digital healthcare industry market has been estimated to be USD 268.0 billion. In addition, there was a slight reduction to USD 142.9 billion as of 2022, but it further surged to USD 180.2 billion in 2023. Moreover, the industry is expected to effectively reach USD 549.7 billion by the end of 2028, along with a 25% growth rate within the same timeline. Therefore, this particular driver is uplifting the market and also creating opportunities for both new entrants and established players for reshaping competitive dynamics across different regions.

Furthermore, the implementation of digital twin technology in bioprocessing, decentralized diagnostics by utilizing portable culture systems, the adoption of supply chain and blockchain transparency, and the existence of circular bioeconomy and sustainability practices are also responsible for uplifting the bacterial cell culture market globally. As stated in an article published by NLM in February 2025, the emerging sector for medical digital twins is expected to reach USD 183 billion by the end of 2031. This has effectively led in different industrial efforts to create and adopt digital twins for healthcare, which is positively impacting the market’s growth internationally. This particular technology is immensely suitable for diagnosing more than 200 million people in America, suffering from comorbid diseases, thus creating a huge growth opportunity for the bacterial cell culture market.

Key Bacterial Cell Culture Market Insights Summary:

Regional Highlights:

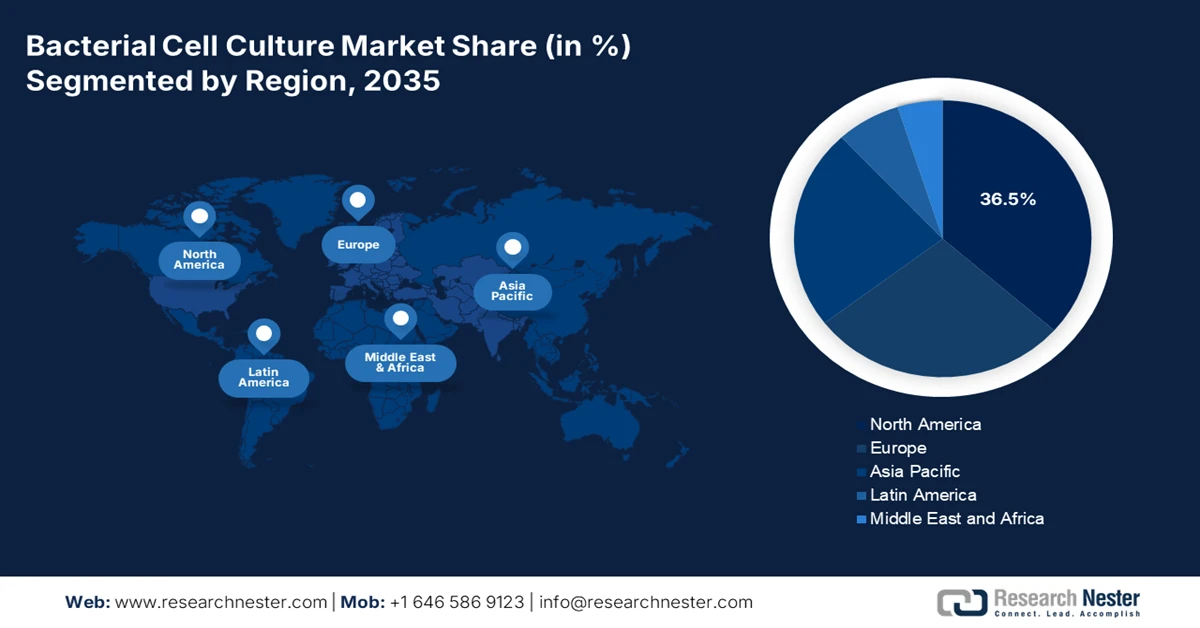

- North America is anticipated to command the largest share of 36.5% by 2035, supported by a strong biopharmaceutical ecosystem, FDA-aligned regulatory rigor, and expanding NIH-backed research initiatives accelerating vaccine and therapeutic development.

- Asia Pacific bacterial cell culture market is expected to emerge as the fastest-growing region during the forecast period, reinforced by a vast patient pool, rising healthcare expenditure, government-funded R&D programs, and expanding infectious disease diagnostics infrastructure.

Segment Insights:

- The biopharmaceutical production sub-segment within the application segment of the bacterial cell culture market is projected to account for a dominant 42.8% share by 2035, underpinned by its critical role in enabling high-efficacy gene therapies, vaccines, and monoclonal antibodies for complex diseases such as cancer, autoimmune disorders, and rare genetic conditions.

- The consumables (media) sub-segment, part of the product segment, is expected to secure the second-largest share during the 2026–2035 forecast period, supported by continuous replenishment needs and the rising adoption of chemically defined and animal-free media for reproducible, biosafe bacterial growth applications.

Key Growth Trends:

- Expansion of synthetic biological applications

- Rise of personalized medicine

Major Challenges:

- Increased cost of advanced media and reagents

- Regulatory complexity and compliance burden

Key Players: Thermo Fisher Scientific (U.S.), Merck KGaA (Germany), Bio-Rad Laboratories (U.S.), Lonza Group (Switzerland), HiMedia Laboratories (India), Takara Bio Inc. (Japan), Eppendorf AG (Germany), Agilent Technologies (U.S.), Sartorius AG (Germany), Corning Incorporated (U.S.), GE Healthcare Life Sciences (U.S.), Fujifilm Wako Pure Chemical Corporation (Japan), PromoCell GmbH (Germany), Sigma-Aldrich (U.S.), Cell Applications Inc. (U.S.), Kaketsuken (Japan), CSL Limited (Australia), Medipost Co., Ltd. (South Korea), BioVision Inc. (U.S.), Malaysian Bioeconomy Corporation (Malaysia)

Global Bacterial Cell Culture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 8 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Israel

Last updated on : 28 January, 2026

Bacterial Cell Culture Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of synthetic biological applications: Bacterial cultures are increasingly utilized as platforms for synthetic biology, significantly ensuring the production of novel therapeutics, biodegradable plastics, and biofuels. According to official statistics published by the OECD Organization in 2024, mRNA is one of the synthetic biology applications that constitutes an estimated USD 250 million in venture investment to optimize the technology as of 2022. This is readily indicated as a market interest in designer mRNA as the most suitable platform for vaccines. Besides, the aspect of gene-editing technologies is useful for applying to crops, for instance, the utilization of drought-resistant maize is demonstrated to be 62% increased, thereby proliferating the bacterial cell culture market growth.

- Rise of personalized medicine: The bacterial cell culture market is centralized to microbiome-based therapies that are gradually being tailored to individual patients globally. For instance, in April 2025, Illumina Inc. and Tempus AI, Inc. declared their collaboration to escalate the clinical adoption of cutting-edge sequencing evaluations through notable evidence generation. This collaboration combined Illumina AI technologies with Tempus's wide-ranging multimodal data platform to train genomic algorithms, which is effectively suitable for uplifting the market across different nations. Besides, there has been continuous provision of generous investments from microbiome start-ups, which is also accelerating the increased need for specialized bacterial culture techniques.

- Increase in localized biomanufacturing: Countries are providing tax incentives and subsidies to readily establish domestic bacterial culture production facilities that reduce dependency on imports. According to official statistics published by the IBEF Organization in April 2023, India is deliberately emerging as one of the most notable biomanufacturing and bio-innovation industries, and has emerged as a USD 5 trillion economy as of 2024. Additionally, the country’s bioeconomy industry has also expanded from USD 10 billion to USD 80 billion as of 2022, USD 150 billion in 2025, and is further projected to be USD 300 billion by the end of 2030. Therefore, this continuous growth in the industry denotes a huge growth opportunity for the market, not only in the country but also across other nations.

Challenges

- Increased cost of advanced media and reagents: The bacterial cell culture market faces a significant challenge in the high cost of specialized media, reagents, and consumables. Advanced formulations, particularly those designed for recombinant protein production or vaccine development, require stringent quality control and complicated manufacturing processes. This drives up costs, making them less accessible to small-scale laboratories and research institutions. For instance, animal-free or chemically defined media are priced substantially higher than conventional nutrient broths, limiting widespread adoption. Additionally, recurring demand for consumables creates a continuous financial burden for end users. In developing regions, where healthcare budgets are constrained, these costs hinder the expansion of bacterial culture-based diagnostics and biopharmaceutical production.

- Regulatory complexity and compliance burden: Another major roadblock is the complex regulatory landscape governing applications in the bacterial cell culture market. Regulatory agencies such as the FDA, EMA, and WHO impose strict guidelines on microbial safety, bioburden testing, and contamination control. While these regulations are essential for ensuring patient safety, they create significant compliance burdens for manufacturers and laboratories. Companies must invest heavily in documentation, validation, and quality assurance systems, which increases operational costs and slows down product launches. Small-scale firms frequently lack the resources to navigate these requirements, limiting their ability to enter or expand in the bacterial cell culture market.

Bacterial Cell Culture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 8 billion |

|

Regional Scope |

|

Bacterial Cell Culture Market Segmentation:

Application Segment Analysis

The biopharmaceutical production sub-segment, which is part of the application segment, is anticipated to garner the highest share of 42.8% in the bacterial cell culture market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance for developing high-efficacy and targeted therapies, including gene therapies, vaccines, and monoclonal antibodies for aiding complicated diseases, such as rare genomic conditions, autoimmune disorders, and cancer. According to official statistics published by NLM in August 2022, there exist 77 biopharmaceutical enterprises, with 46.8% in East China, followed by 33.8% in Central China. Besides, the overall sales of biological products amounted to 26.2 billion yuan, with a further rise of almost 67.9 billion yuan. Moreover, Camrelizumab is one of the topmost biopharmaceutical products on sale, amounting to 5.1 billion yuan, human albumin with 4.5 billion yuan, and human immunoglobulin with 3.7 billion yuan, thus bolstering the sub-segment’s growth.

Product Segment Analysis

During the forecast duration, the consumables (media) sub-segment, part of the product segment, is projected to hold the second-largest share in the bacterial cell culture market. The sub-segment’s growth is highly fueled by the provision of essential nutrients required for bacterial growth, which are consumed continuously in both research and industrial applications, creating a recurring demand cycle. Unlike equipment, which is a one-time investment, consumables must be replenished regularly, making them a high-margin and stable revenue stream for suppliers. The market is witnessing a shift toward chemically defined and animal-free media, driven by regulatory requirements for reproducibility and biosafety. Additionally, specialized media tailored for recombinant protein production, vaccine development, and antimicrobial resistance testing are gaining traction.

End user Segment Analysis

The biopharmaceutical companies segment in end user is expected to account for the third-largest share in the bacterial cell culture market by the end of the stipulated timeline. The segment’s development is highly propelled by the aspect of bacterial systems for the production of vaccines, recombinant proteins, enzymes, and therapeutic molecules, making bacterial culture indispensable to their operations. The scalability of bacterial fermentation allows biopharma companies to produce large volumes of biologics efficiently, supporting both domestic healthcare needs and global supply chains. Increasing investment in precision medicine and biologics pipelines has amplified demand for bacterial culture systems, particularly in the development of next-generation vaccines and protein-based therapies. Regulatory agencies such as the FDA and EMA mandate rigorous microbial testing, further embedding bacterial culture into quality assurance processes.

Our in-depth analysis of the bacterial cell culture market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product |

|

|

End user |

|

|

Distribution Channel |

|

|

Technique |

|

|

Ingredient Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bacterial Cell Culture Market - Regional Analysis

North America Market Insights

North America bacterial cell culture market is anticipated to garner the highest share of 36.5% by the end of 2035. The market’s upliftment in the region is highly driven by the presence of an innovative biopharmaceutical sector, robust FDA-based regulatory framework, and expanded NIH-funded research programs. According to official statistics published by the Disease and Therapeutics in 2025, the overall yearly adult vaccine doses in the U.S. are expected to increase from 169 million in 2024 to 419 million by the end of 2035. In addition, the peak weekly demand is also projected to increase by approximately 6 million doses per week under seasonality, and high-uptake cases are projected to surge 23 million doses per week. Therefore, the adult immunization demand is rapidly increasing, which in turn, is making it suitable for uplifting the bacterial cell culture market in the overall region.

2023 Vaccines Export and Import in North America

|

Countries |

Export (USD) |

Import (USD) |

|

U.S. |

8.1 billion |

10.4 billion |

|

Canada |

551 million |

1.4 billion |

|

Mexico |

90.8 million |

313 million |

|

Nicaragua |

8.0 million |

71.3 million |

|

Panama |

3.9 million |

38.1 million |

|

Curacao |

1.4 million |

- |

Source: OEC

The bacterial cell culture market in the U.S. is growing significantly due to the aspect of NIH funding, biopharmaceutical innovation, FDA regulatory framework, advanced automation and manufacturing, along with public health preparedness. As per an article published by the CSIS Organization in January 2026, based on a deal with the governing administration, Pfizer declared its plans to generously invest USD 70 billion in the country for the upcoming years for gaining a 3-year waiver from pharmaceutical tariffs. Besides, research-specific biopharmaceutical organizations in the country are expected to spend over USD 425 million in domestic research and development as well as manufacturing. Likewise, Merck has commenced with a USD 3 billion center for manufacturing excellence in Virginia. Therefore, all these organizational investments are highly responsible for bolstering the market in the overall country.

The aspect of government life sciences investment, water and food safety regulations, the presence of a collaborative research ecosystem, along with green bioprocessing and sustainability, are factors that are driving the bacterial cell culture market in Canada. As stated in an article published by Invest Canada in 2026, USD 82.1 billion has been readily contributed by medical and pharmaceutical manufacturing to the country’s gross domestic product (GDP) as of 2023. Simultaneously, USD 2.2 billion in federal funding has been committed for the nation’s biomanufacturing and life science strategy. Besides, AstraZeneca, based in the UK, notified a USD 500 million investment in Ontario as of 2023, while France’s Sanofi Pasteur developed a vaccine infrastructure in Toronto as part of the USD 925 million investment. All these investment provisions are effectively boosting the market’s growth and demand in the country.

APAC Market Insights

The Asia Pacific bacterial cell culture market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the presence of a massive patient base, government-funded innovation and research, along with an increase in healthcare expenditure, and a rise in infectious disease diagnostics. Based on government estimates published by NLM in February 2023, an estimated 4% to 7% has been significantly invested in the regional health industry. Besides, as per an article published by the WHO in February 2025, there has been an expected growth in the number of older adults, increasing from 77.4 million to 173.3 million by the end of 2050. This marks one of the fastest demographic transitions internationally, which is also bolstering the market’s exposure in the overall region.

The bacterial cell culture market in China is gaining increased traction due to an upsurge in the incidence of bacterial infections, sustained demand in diagnostic laboratories and hospitals, as well as pharmaceutical manufacturing capacity and government-based biopharma investment. As stated in an article published by NLM in February 2023, the experimentation and research spending of industrial pharmaceutical manufacturing firms in the country was nearly 60.9 billion yuan, denoting a 75.3% rise. In addition, this comprised about 122,720 research and development personnel and 32,296 development projects, with a yearly growth rate of global sales of over 30%. Therefore, the domestic biopharmaceutical sector is continuously escalating to emerge as the upcoming hardcore technology, which is creating an optimistic outlook for the overall market.

The aspects of government healthcare expenditure, rise in diseases, biotech cluster expansion, and cost-effective healthcare strategies are certain drivers that are readily fueling the bacterial cell culture market in India. Based on government estimates published by the PIB Government in June 2025, the country’s government introduced the Ayushman Bharat- Pradhan Mantri Jan Arogya Yojana (PM-JAY), targeting 40% of the population. Additionally, the scheme covers an estimated 12.3 crore families, significantly benefiting almost 55 crore individuals. Besides, the government also unveiled Ayushman Vay Vandana, extending beyond AB-PMJAY benefits to senior citizens aged more than 70 years. This particular scheme constituted more than 58 lakh senior citizens, with over 2.6 lakh treatment facilities, amounting to ₹496 crore, thus making it suitable for bolstering the market in the country.

Europe Market Insights

Europe bacterial cell culture market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by the presence of innovative healthcare systems, robust government support, and expansion in research and diagnostic applications. According to official statistics published by the Europe Commission in 2025, the Europe Health Data Space (EHDS) improves the utilization of health data to enhance healthcare, foster advancement, and support evidence-specific policymaking by generating €11 billion in savings for the upcoming decade by boosting data accessibility. In addition, the EHDS also uplifts 20% to 30% expansion in the digitalized health industry, strengthens scientific research and policy development, thus leading to suitable health outcomes for the population and fueling the market’s growth.

The bacterial cell culture market in Germany is gaining increased exposure due to an increase in government expenditure, advanced healthcare facilities, and a rise in the biopharmaceutical industry. As per an article published by the ITA in August 2024, the medical devices industry in the country is one of the largest globally, accounting for an estimated EUR 38 billion (USD 44 billion) in yearly revenue, thus making 26.5% of the regional market. Besides, 1 out of 6 jobs in the country is associated with the healthcare industry, generating a yearly economic footprint of EUR 775 billion (USD 838 billion) or approximately 12.8% of the nation’s GDP. Moreover, as of 2024, the gross value added of the industry amounted to EUR 435 billion (USD 496 billion), which effectively corresponds to 11.5% of the gross value added of the total domestic economy. Moreover, the continuous medical equipment industry is also making it suitable for boosting the market in the overall country.

German Medical Equipment Industry Analysis (2022-2025)

|

Components |

2022 (USD Billion) |

2023 (USD Billion) |

2024 (USD Billion) |

2025 (USD Billion) |

|

Exports |

27.1 |

30.0 |

31.0 |

36.4 |

|

Imports |

24.0 |

25.3 |

26.0 |

27.5 |

|

Imports from the U.S. |

5.2 |

5.6 (estimated) |

6.0 |

27.5 (estimated) |

|

Exchange Rates |

1.05 |

1.08 |

1.08 |

1.07 |

Source: ITA

The aspects of vaccine development, antimicrobial resistance monitoring, and clinical diagnostics are certain drivers that are responsible for uplifting the bacterial cell culture market in the UK. As stated in an article published by the Office for National Statistics in April 2025, the nominal healthcare spending in the UK was estimated to be £317 billion as of 2024. Additionally, between 2023 and 2024, the overall expenditure surged by 6.5% in nominal terms, and after making adjustments for inflation, by 2.4% in real terms. Besides, the healthcare spending as a share of GDP was 11.1% as of 2024, while government-funded healthcare makes up the majority of the spending in the country, amounting to £258 billion in 2024, denoting a 2.5% rise from 2023. Besides, the overall long-lasting care spending boosted by 3.1% in real terms as of 2023, thereby proliferating the market’s expansion in the country.

Key Bacterial Cell Culture Market Players:

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories (U.S.)

- Lonza Group (Switzerland)

- HiMedia Laboratories (India)

- Takara Bio Inc. (Japan)

- Eppendorf AG (Germany)

- Agilent Technologies (U.S.)

- Sartorius AG (Germany)

- Corning Incorporated (U.S.)

- GE Healthcare Life Sciences (U.S.)

- Fujifilm Wako Pure Chemical Corporation (Japan)

- PromoCell GmbH (Germany)

- Sigma-Aldrich (U.S.)

- Cell Applications Inc. (U.S.)

- Kaketsuken (Japan)

- CSL Limited (Australia)

- Medipost Co., Ltd. (South Korea)

- BioVision Inc. (U.S.)

- Malaysian Bioeconomy Corporation (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Thermo Fisher Scientific is a global leader in life sciences, offering a wide range of bacterial culture media, reagents, and laboratory equipment. Its strong distribution network and continuous investment in research and development make it a dominant player in supporting biopharmaceutical production and diagnostics.

- Merck KGaA provides advanced bacterial culture consumables and bioprocessing solutions, with a focus on high-quality media formulations. The company’s emphasis on innovation and compliance with Europe-based regulatory standards strengthens its position in the European market.

- Bio-Rad Laboratories specializes in bacterial culture instruments and consumables used in clinical diagnostics and research. Its reputation for precision tools and diagnostic kits has made it a trusted supplier for hospitals and laboratories worldwide.

- Lonza Group is one of the major suppliers of bacterial fermentation technologies and cell culture consumables. Its expertise in large-scale biopharmaceutical manufacturing makes it a key partner for vaccine and recombinant protein production.

- HiMedia Laboratories is one of India’s leading suppliers of bacterial culture media and reagents, serving both domestic and international markets. Its cost-effective solutions and expanding global footprint have positioned it as a competitive player in the Asia Pacific.

Here is a list of key players operating in the global bacterial cell culture market:

The international bacterial cell culture market is highly competitive, with leading players from the U.S., Europe, and the Asia Pacific dominating through diversified portfolios and strong research and development investments. Companies such as Thermo Fisher, Merck, and Lonza leverage advanced technologies and global distribution networks to maintain market leadership. Asian firms, including Takara Bio and HiMedia, are expanding rapidly through cost-effective solutions and regional partnerships. Strategic initiatives include mergers, acquisitions, and collaborations with research institutions to strengthen innovation pipelines. Besides, in November 2025, Hitachi, Ltd., Epistra Inc., and Fermelanta Inc. successfully accomplished the first phase of lab-scale joint proof-of-concept. This has significantly aimed to cater to risks in establishing microbial culture conditions for producing (S)-Reticuline, thereby boosting the bacterial cell culture market globally.

Corporate Landscape of the Bacterial Cell Culture Market:

Recent Developments

- In June 2025, FUJIFILM Corporation’s Life Sciences Group organizations declared the newest identities, which are considered a part of the tactical positioning effort. The Group Companies’ collaborative and strategic focus, along with structural alignment reflects the organization’s commitment to life sciences.

- In May 2025, DewCell Biotherapeutics signed a Letter of Intent (LOI) with PL BioScience GmbH for effectively supplying artificial platelet raw material and strengthening its ability to cater to the growing international demand for animal-free and high-quality cell culture media.

- In March 2025, PHC Corporation, along with Cyfuse Biomedical K.K. notified the creation of the latest production technology for commercializing the field of cell and regenerative therapy, which has been made possible through the tactical collaboration and joint research.

- Report ID: 8369

- Published Date: Jan 28, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bacterial Cell Culture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.