Cell Culture Media Market Outlook:

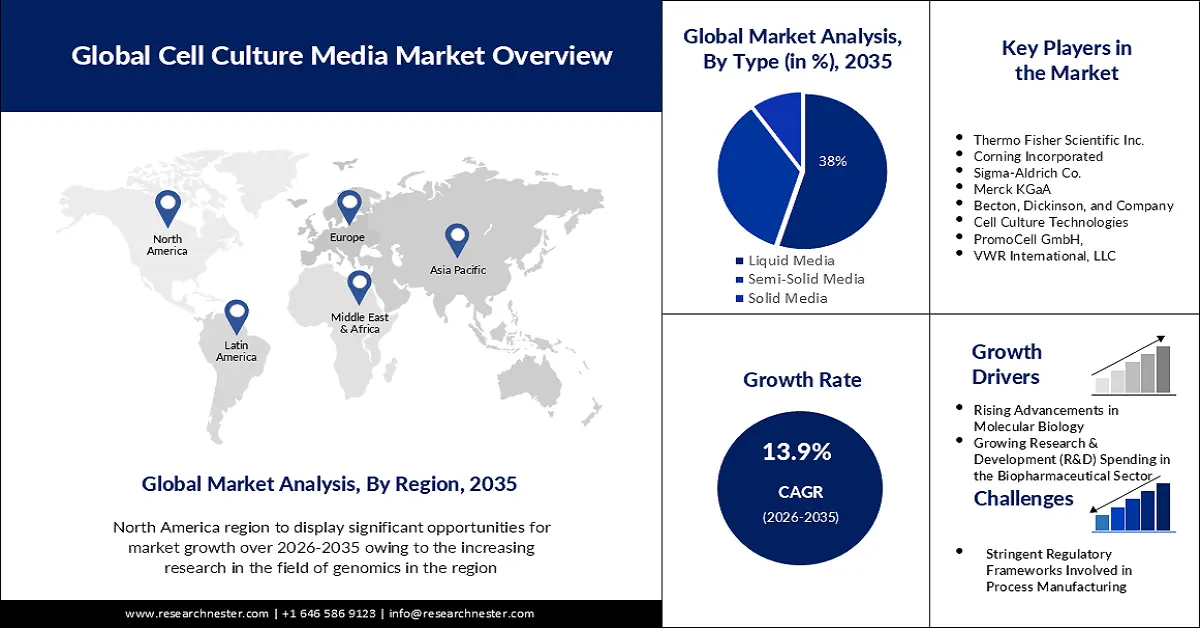

Cell Culture Media Market size was over USD 5.56 billion in 2025 and is poised to exceed USD 20.43 billion by 2035, growing at over 13.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell culture media is estimated at USD 6.26 billion.

The growth of the market can be attributed to the increasing advancements in the field of molecular biology along with the rising advances in biological science accelerating the bio revolution globally. For instance, researchers worldwide estimate that biological applications alone are expected to exhibit a direct positive economic impact of almost USD 4 trillion a year globally over the next 10 to 20 years.

The cell culture media is vital to the culture environment. It provides those components that essentially support cell growth and function. Further, as the environmental conditions in cell culture, including osmotic pressure and pH, can be regulated with the formulation of media, a variety of cell culture media formulations have been developed to support a wide range of cell types and experimental applications. Hence, with the growing global burden of diseases, as well as the rising focus and expenditure on research and development proficiencies concerning cell-based research, cell culture media is predicted to present the potential for cell culture media market expansion over the projected period. For instance, according to the World Health Organization, ischemic heart disease alone was responsible for the largest

Key Cell Culture Media Market Insights Summary:

Regional Highlights:

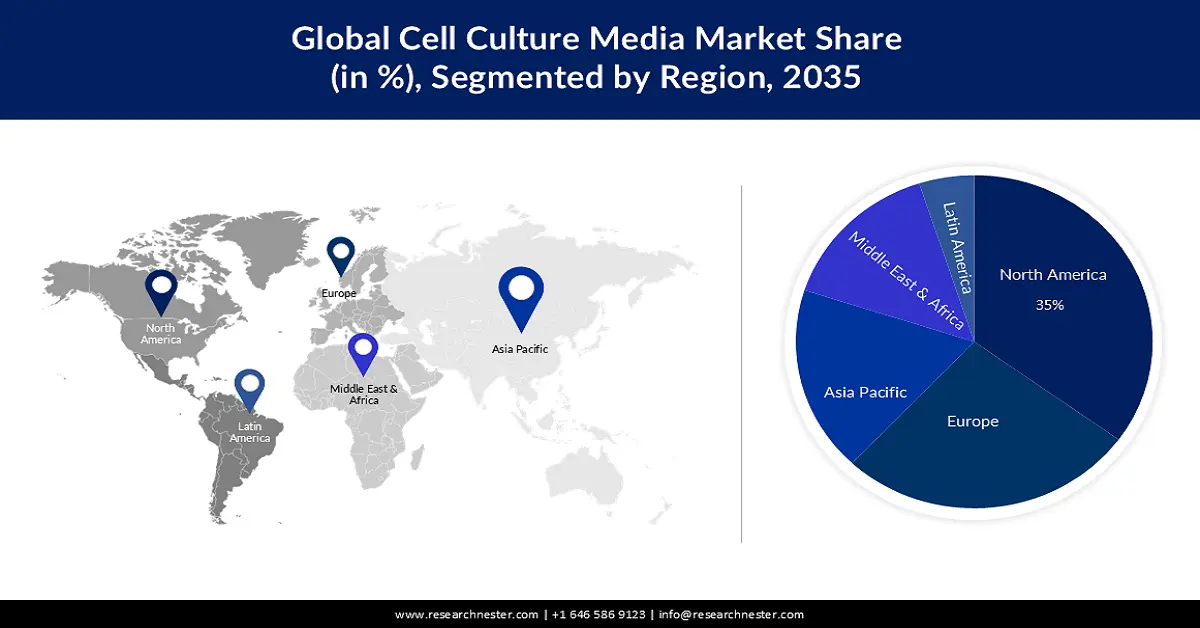

- North America cell culture media market is expected to capture 35% share by 2035, growing investment in the biopharmaceutical sector, advancements in gene therapy and tissue engineering, rising number of organ transplants, and increasing popularity of in vitro fertilization and cryo-preservation.

- North America cell culture media market will capture a 35% share by 2035, growing investment in the biopharmaceutical sector, advancements in gene therapy and tissue engineering, rising number of organ transplants, and increasing popularity of in vitro fertilization and cryo-preservation.

Segment Insights:

- The pharmaceutical & biotechnology segment in the cell culture media market is projected to achieve a 46% share by 2035, attributed to the rising sales of biotechnology drugs globally.

- The liquid media segment in the cell culture media market is expected to capture a 38% share by 2035, driven by rising pharmaceutical investments and collaborations in drug development and research.

Key Growth Trends:

- Increasing Advancements in Human Genetics and Genome Research

- Rising Research & Development (R&D) Spending in the Biopharmaceutical Sector

Major Challenges:

- Stringent regulatory frameworks involved in process manufacturing

- Dearth of skilled professional

Key Players: Thermo Fisher Scientific Inc., Corning Incorporated, Sigma-Aldrich Co., Merck KGaA, Becton, Dickinson, and Company, Cell Culture Technologies, PromoCell GmbH, VWR International, LLC, Bio-Rad Laboratories, Inc., Fujifilm Holdings Corporation, Sartorius AG.

Global Cell Culture Media Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.56 billion

- 2026 Market Size: USD 6.26 billion

- Projected Market Size: USD 20.43 billion by 2035

- Growth Forecasts: 13.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 10 September, 2025

Cell Culture Media Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Advancements in Human Genetics and Genome Research – Rising attempts to understand the structure and function of genetic sequences and of downstream biological products that determine the genetic bases of many diseases are leading toward the surging exploration in the field of genomics. The potential of the human genetics and the genomics industry is anticipated by the direct economy generated by this industry in America in 2020 which exceeded USD 108 billion. Hence, the growing advancements in the field of genetic engineering as well as the increasing use of cell medium for tissue preservation and modification of cells are expected to boost the cell culture media market over the forecast period.

- Rising Research & Development (R&D) Spending in the Biopharmaceutical Sector – The surge in the demand for vaccines, blood, and blood components, allergenic to treat allergies, body cells and tissues, living cells used in cell therapies, gene therapies, and recombinant therapeutic proteins is responsible for the increasing R&D by the biopharma companies. For instance, as per findings, the biopharmaceutical industry in the U.S. invested around USD 102 billion into R&D in 2018. This surge in investments is also anticipated to propel the market expansion of cell culture media in the upcoming years as many of these products are designed to support the growth and maintenance of a variety of human cells and cell lines which enables various drug development.

- Growing Number of Regenerative Medicine Companies - the rising prevalence of chronic diseases as well as the increasing number of organ transplantation cases, and advancements in new product launches are all attributed to the growth of the regenerative medicine facilities. As of 2023, there are over 1,457 companies of regenerative medicine worldwide. This robust expansion is anticipated to propel market growth.

- Increasing Investment in Healthcare Sector with Rising Healthcare Expenditure - The elevated burden of chronic diseases along with the surge in the number of surgical procedures is leading to rising investment in the healthcare sector across the globe. According to the data provided by the sources, when it comes to health care the United States is the highest-spending country worldwide. The overall health expenditure in the U.S. rose beyond USD 4 trillion in 2020. Moreover, expenditure as a percentage of GDP is anticipated to rise by about 20% by the year 2028.

Challenges

- Challenges related to reproducibility, contamination, viability, and the transition to automation – prevail despite the adoption of different approaches and techniques and this is anticipated to hamper the market growth over the forecast period. The market is facing difficulty to grow viable cells in the desired quantity to obtain reproducible results, owing to which the growth of the market is restricted. Moreover, as isolated cells are highly vulnerable to contamination, their preventive handling and processing is a major threat.

- Stringent regulatory frameworks involved in process manufacturing

- Dearth of skilled professional

Cell Culture Media Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.9% |

|

Base Year Market Size (2025) |

USD 5.56 billion |

|

Forecast Year Market Size (2035) |

USD 20.43 billion |

|

Regional Scope |

|

Cell Culture Media Market Segmentation:

Type Segment Analysis

The global cell culture media market is segmented and analyzed for demand and supply by type into liquid media, semi-solid media, and solid media. Out of the three types of cell culture media, the liquid segment is estimated to gain the largest market share of about 38% in the year 2035. The growth of the segment can be attributed to the rising investment in the pharmaceutical sector as well as the increasing collaborations amongst major players as well as R&D in the field of life sciences for novel drug development and therapeutic research. For instance, recently in March 2023, Nucleus Biologics, The Cell Performance Company, a leading provider of custom cell culture media solutions for the cell and gene therapy industry, and Stoic Bio, a provider of sustainable technology for cell media manufacturing, in a joint effort to accelerate high-quality therapies to market, announced plans for a supply agreement with the Center for Breakthrough Medicines (CBM), leading contract development and manufacturing organization (CDMO). The mission of CDMO is to save lives by accelerating the development and manufacture of advanced therapies.

End-user Segment Analysis

The global cell culture media market is also segmented and analyzed for demand and supply by end-user into hospitals & diagnostic laboratories, pharmaceutical & biotechnology companies, research & academic institutes, and others. Amongst these segments, the pharmaceutical & biotechnology segment is expected to garner a significant share of around 46% in the year 2035. The rising share of sales of biotechnology drugs worldwide which amounted to over USD 400 billion in 2022 is anticipated to boost the segment growth. On the other hand, the research & academics segment is projected to witness a massive CAGR during the forecast period, owing to the increasing research and development proficiencies in the direction of cell culture media along with the rising advancement in stem cell therapies. This, as a result, is also anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Culture Media Market Regional Analysis:

North American Market Insights

The cell culture media market in North America is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the growing investment in the biopharmaceutical sector as well as growing advancements in the field of gene therapy, tissue engineering, production of vaccines, antibiotics, and artificial hormones. As per findings, federal research funding, in the field of human genetics and genomics research reached about USD 3.3 billion in 2019. Moreover, the rising number of organ transplants as well as the increasing popularity of processes such as in vitro fertilization, and cryo-preservation is also anticipated to boost the regional market growth.

APAC Market Insights

The Asia Pacific cell culture media market is estimated to be the second largest, registering a share of about 27% by the end of 2035. The growth of the market can be attributed majorly to the rising investment in the field of biotechnology and the growing investigations of basic cell biology together with the rising approvals for cell culture-based vaccines and therapeutics. Moreover, the rising prevalence of immune diseases along with increasing incidence owing to diseases such as cancer that necessitates the replication of disease mechanisms, besides investigating the toxicity of novel drug compounds is also anticipated to boost the market growth in the region.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035. The growth of the market in the region can primarily be attributed to the growing geriatric population as well as the surge in demand for personalized medicine, along with the expanding R&D activities for various chronic diseases. Additionally, the presence, as well as the expansion of some major players in the region, is further expected to boost regional market growth.

Cell Culture Media Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corning Incorporated

- Sigma-Aldrich Co.

- Merck KGaA

- Becton, Dickinson, and Company

- Cell Culture Technologies

- PromoCell GmbH,

- VWR International, LLC

- Bio-Rad Laboratories, Inc.

- Fujifilm Holdings Corporation

- Sartorius AG

Recent Developments

-

Thermo Fisher Scientific Inc., announced the expansion of cell culture media manufacturing site in Grand Island, New York, to meet increasing global demand for cell culture media used in the manufacturing of new vaccines and biologics. It’s a dry powder media manufacturing facility that provides the redundant capacity to support a global supply of media needed for the development and commercial manufacturing of vaccines and biological therapies.

-

Merck KGaA, a leading science and technology company, announced the completion of a USD 2.8 million expansion to its Irvine biopharmaceutical production facility which is Merck’s only location where both liquid and powder cell culture media are manufactured.

- Report ID: 4829

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Culture Media Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.