Cell Culture Consumables Market Outlook:

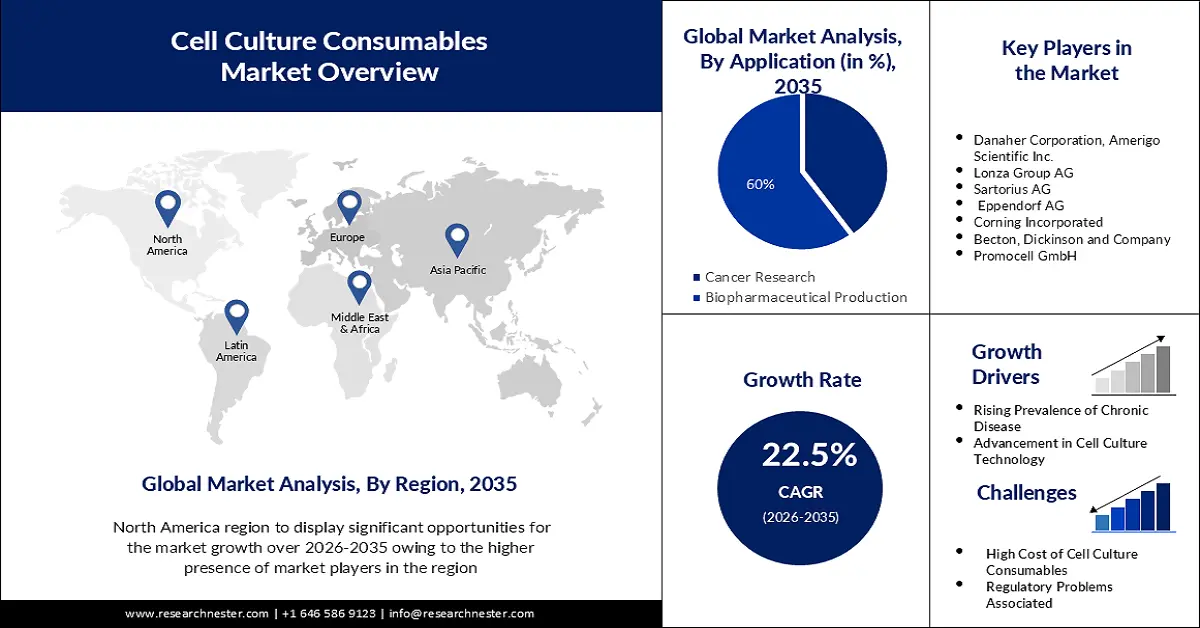

Cell Culture Consumables Market size was valued at USD 16.63 billion in 2025 and is expected to reach USD 126.55 billion by 2035, expanding at around 22.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cell culture consumables is evaluated at USD 20 billion.

The growth of the market can be driven by increasing demand for monoclonal antibodies. The production of monoclonal antibodies is being carried out on a wide scale employing group, ongoing, and perfusion culture techniques. To support the development of monoclonal antibodies, manufacturers have constructed sizable manufacturing facilities with several cell culture bioreactors. The Lonzas cell culture manufacturing plant in Tuas, Singapore, for instance, includes a full spectrum of mammalian fermenter manufacturing equipment (200-liter to 20,000-liter capacity) for both medical and business purposes. Four 20,000-liter stirred nuclei and three 5,000-liter airlift nuclei have also been established by the company in the US.

Emerging market trends include improvements in the creation and formulation of cell culture medium. Numerous improvements have been made in the production and growth of cell culture medium. Eliminating animal-origin components while creating cell culture media is one technique that is gaining popularity in the market. As a result, a number of extremely effective alternatives have been developed, resolving many of the early formulations' flaws. For instance, the batch-to-batch variability has decreased as a result of the application of serum-free and chemically controlled media for bioproduction. To lower the risk of variation during production procedures, the majority of biopharmaceutical manufacturing businesses have converted to serum-free media and biologically specified media.

Key Cell Culture Consumables Market Insights Summary:

Regional Highlights:

- By 2035, North America is projected to secure a 32% share of the cell culture consumables market, fueled by rising stem-cell and cancer research activity alongside expanding healthcare spending.

- The APAC region is expected to witness strong growth through 2026-2035, supported by the availability of low-cost skilled labor driving expansion in cell culture research and manufacturing.

Segment Insights:

- By 2035, the biopharmaceutical production segment in the cell culture consumables market is anticipated to command a 60% share, propelled by recurring demand for media, sera, and reagents across diverse cell-culture-based production workflows.

- During 2026-2035, the biotechnology segment is predicted to advance significantly, underpinned by increasing reliance on cell culture technology in applications such as bioremediation, drug discovery, and biomass generation.

Key Growth Trends:

- Escalating Prevalence of Chronic Diseases

- Advancement in Cell Culture Technologies

Major Challenges:

- High Cost of Cell Culture Consumables

- Regulatory Problems Associated with Cell Culture Consumables

Key Players: Danaher Corporation, Amerigo Scientific Inc., Lonza Group AG, Sartorius AG, Eppendorf AG, Corning Incorporated, Becton, Dickinson and Company, Promocell GmbH,.

Global Cell Culture Consumables Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.63 billion

- 2026 Market Size: USD 20 billion

- Projected Market Size: USD 126.55 billion by 2035

- Growth Forecasts: 22.5%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 25 November, 2025

Cell Culture Consumables Market - Growth Drivers and Challenges

Growth Drivers

- Escalating Prevalence of Chronic Diseases - Due to the rising incidence of chronic diseases like cancer, diabetes, heart disease, obesity, and hypertension, the market for cell culture consumables is expanding. Therefore, there is an increasing demand for machinery that can produce new cells far removed from their natural environment as the prevalence of chronic diseases rises. Due to chronic disease globally 41 million people die which is 74% of world population reported as World Health Organization report.

- Advancement in Cell Culture Technologies – There have been notable improvements in cell culture technologies in the past few times that had made it possible to grow cells more efficiently and effectively. These developments have led to an increased demand for cell culture consumables.

- Growing Investment in Cell-based Research – Government and private firms are widely funding for cell-based research. This is owing to the potential of cell-based research to develop new treatments for diseases, such as cancer.

Challenges

- High Cost of Cell Culture Consumables - The development of the global market for cell culture consumables is anticipated to be constrained by the expensive nature of these products. Small research institutes or businesses with tight budgets may find it difficult to invest in the newest methods and technology due to the high cost of these items. The price of cell culture consumables may prevent them from being widely used in emerging areas, where cost-effectiveness is crucial.

- Regulatory Problems Associated with Cell Culture Consumables

- Contamination Problems Associated with Cell Culture Consumables

Cell Culture Consumables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.5% |

|

Base Year Market Size (2025) |

USD 16.63 billion |

|

Forecast Year Market Size (2035) |

USD 126.55 billion |

|

Regional Scope |

|

Cell Culture Consumables Market Segmentation:

Application Segment Analysis

In terms of application, the biopharmaceutical production segment in the cell culture consumables market is predicted to hold the largest revenue share of 60% by the end of 2035. The growth is explained by repeated purchases of media, sera, and reagents for a variety of applications in cell culture, such as the production of vaccines as well as reconstituting therapeutic proteins. In addition, pharmaceutical recombinant proteins are increasingly used to treat various diseases including diabetes, anemia, cancer, and hepatitis, increasing the demand for cell culture consumables as they are used in cell culture techniques.

End User Segment Analysis

Cell culture consumables market from the biotechnology segment is set to grow notably during the forecast period. Cell culture technology is a major part of the biotechnology sector’s use in various applications, including bioremediation, drug discovery and biomass production. There is a strong need for consumables such as cell culture media or bioreactors to be used in this reliance on cell culture technology. As a result, the biotechnology sector is one of the most important end users of cell culture consumables that can contribute to its market share in this industry.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Culture Consumables Market - Regional Analysis

North American Market Insights

The cell culture consumables market in the North America is estimated to hold the largest revenue share of 32% by the end of the forecast period. The increase in research into stem cells and cancer, the increased expenditure on healthcare at the local level as well and the presence of major industry participants are also contributing to the growth of the market in the region. Danaher, Thermo Fisher, General Electric, and Corning are market players based in North America that drive the market growth in the region. They invest considerable sums of money in research and development, as well as new production facilities with the necessary equipment for cell culture processing.

APAC Market Insights

The APAC cell culture consumables market is set to grow substantially during the anticipated period. The APAC region has large and growing number of skilled labors. This labor is available at low cost as compared to other regions which is making the region an attractive destination cell culture research and manufacturing as a result driving the market expansion in the region.

Cell Culture Consumables Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Danaher Corporation

- Amerigo Scientific Inc.

- Lonza Group AG

- Sartorius AG

- Eppendorf AG

- Corning Incorporated

- Becton, Dickinson and Company

- Promocell GmbH

Recent Developments

- In July 2021, Sartorius, a lab equipment manufacturer located in Germany, bought Xell AG for an undisclosed sum to expand the range of products offered by Sartorius towards media and additional cell culture products.

- In August 2021, Amerigo Scientific a biomedical and life science product manufacturer in the United States launched #D cell culture for research applications.

- Report ID: 5254

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Culture Consumables Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.