Cellulite Treatment Market Outlook:

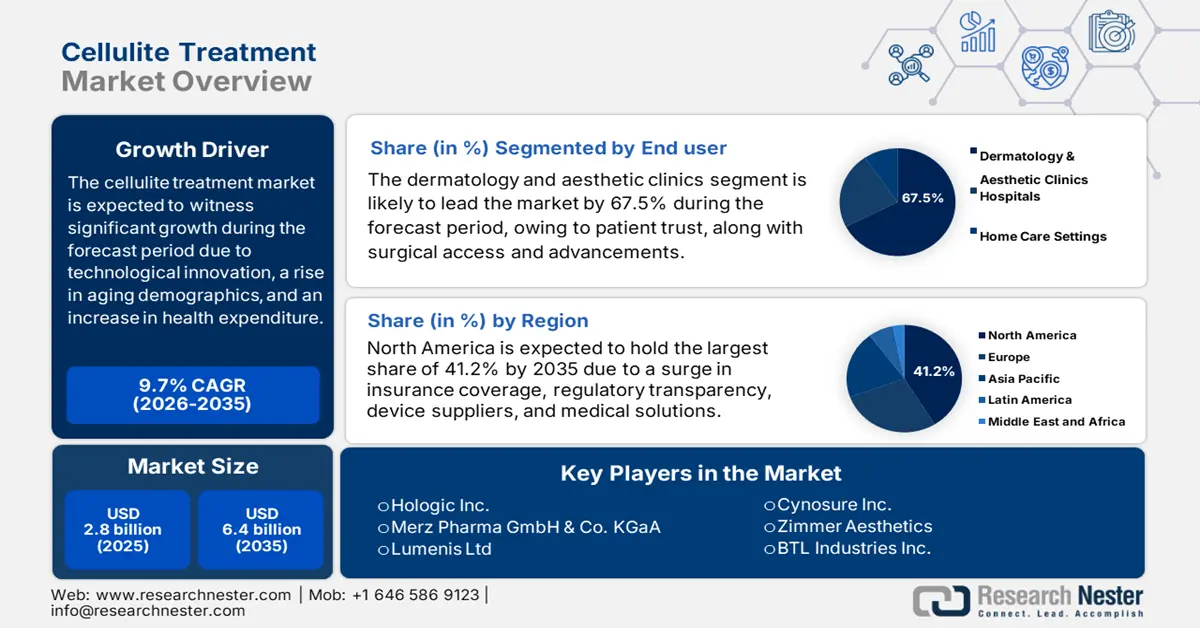

Cellulite Treatment Market size was USD 2.8 billion in 2025 and is estimated to reach USD 6.4 billion by the end of 2035, increasing at a CAGR of 9.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cellulite treatment is evaluated at USD 3 billion.

The international market is currently witnessing an outstanding expansion, which is readily driven by socio-economic, technological, and demographic factors. These factors include product efficiency, technological advancements, an expansion in target demographics, aesthetic consciousness, along with a rise in healthcare expenditure, and disposable income. According to an article published by NLM in June 2023, cellulite usually occurs among 80% to 90% of females, particularly on the hips, buttocks, and thighs, which is associated with negative psychosocial and life quality issues. Besides, for males, only 2% cellulite might develop, owing to androgen deficiency, which is secondary to hypogonadism, castration, and Klinefelter’s syndrome.

Moreover, as per an article published by MDPI in February 2023, 75% of hospitals in the U.S. readily utilize an electronic health record system, which is also contributing to the market’s growth. Besides, the presence of suitable regulatory approvals, as well as standard reimbursement policies, and the proliferation of aesthetic clinics are also boosting the market’s exposure across different countries. As stated in the 2024 NIH report, the medical device market in the U.S. is valued at USD 156 billion, which represents 40% of the overall market. Therefore, the existence of these devices is readily uplifting treatment facilities for cellulite globally, thereby suitable for both patients and healthcare providers.

Key Cellulite Treatment Market Insights Summary:

Regional Insights:

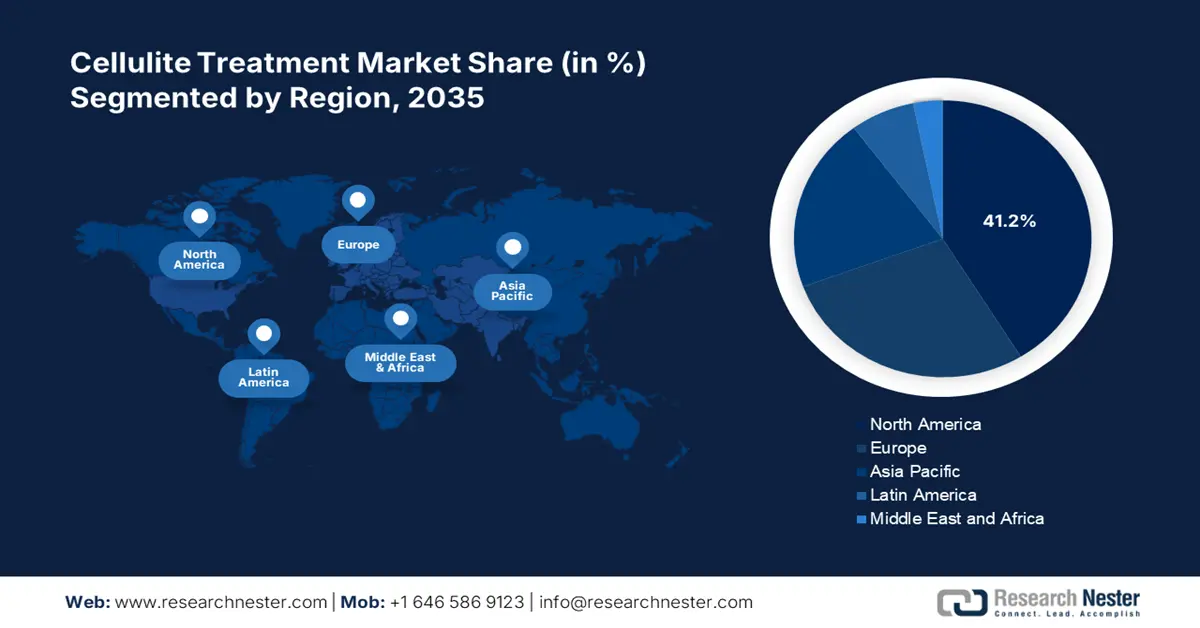

- North America in the Cellulite Treatment Market is forecasted to hold the largest 41.2% share by 2035, attributed to robust healthcare infrastructure, strong insurance penetration, and growing accessibility to non-invasive technologies.

- Asia Pacific region is projected to record the fastest growth during 2026–2035, owing to rapid medical tourism expansion, cost-effective treatment options, and rising disposable incomes.

Segment Insights:

- The dermatology and aesthetic clinics segment in the Cellulite Treatment Market is projected to capture a dominant 67.5% share by 2035, propelled by advanced medical expertise, patient confidence, and widespread adoption of innovative CE-marked and FDA-approved non-invasive solutions.

- The soft cellulite segment is anticipated to secure the second-highest share by 2035, fueled by increasing prevalence linked to sedentary lifestyles and poor circulation.

Key Growth Trends:

- Advancements in technological products

- Expansion in the demographic base

Major Challenges:

- Increased patient affordability and out-of-pocket expenses

- Market saturation and intensified competition

Key Players: Hologic Inc., Merz Pharma GmbH & Co. KGaA, Lumenis Ltd, Cynosure Inc., Zimmer Aesthetics, BTL Industries Inc., Cutera Inc., Candela Corporation, Venus Concept, Solta Medical, Fotona d.o.o., Alma Lasers Ltd., Viora Ltd., SharpLight Technologies Inc., LPG Systems.

Global Cellulite Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.8 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 1 October, 2025

Cellulite Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in technological products: The aspect of technological innovation plays a vital role in healthcare by optimizing patient outcomes, increasing operational efficacy, and extending care accessibility, which positively impacts the market globally. According to an article published by the Journal of Medical Internet Research in October 2024, 70% of hospitals are interoperable, with the majority of providers adopting electronic health record (EHR). Likewise, almost 92% of prescribers and all pharmacies readily possess e-prescribing capabilities, denoting an 85% point-based increase since the past years. Therefore, technologies are widely being utilized in health facilities, thus suitable for uplifting the market.

- Expansion in the demographic base: This is a huge growth opportunity for the market, providing increased data to recognize patterns in health demands, optimize public health strategy, along with resource allocation, particularly for aging and ethnic groups. As per an article published by the World Health Organization in October 2024, the proportion of the international population more than 60 years will almost double from 12% to 22%, and 80% of older people will be residing in low- and middle-income nations by the end of 2050. Therefore, owing to this, treatment facilities are being made cost-effective and readily available in such regions, thus uplifting the overall market.

- Provision of regulatory frameworks and safety assurance: This is extremely crucial for the market to ensure care quality, maintain trust, prevent harm, and patient safety by effectively setting standards for practices, equipment, and facilities. According to the August 2025 UK Government report, the personal care and cosmetic sector contributed £24.5 billion to the GDP, along with £6.8 billion to HM Treasury as of 2022. Besides, the Health and Care Act provided the Secretary of State the ability to unveil a licensing regime for non-surgical cosmetic procedures, thus suitable for the overall market.

Historical Healthcare Expenditure Across Different Countries Driving the Market

|

Countries/Years |

2020 |

2021 |

2022 |

2023 |

2024 |

|

U.S. |

15.6% |

14.5% |

13.9% |

13.9% |

14.3% |

|

Germany |

10.7% |

10.9% |

10.8% |

10.1% |

10.6% |

|

UK |

10.1% |

10.1% |

9.0% |

10.1% |

9.1% |

|

Japan |

9.8% |

10.4% |

10.6% |

9.1% |

9.0% |

|

Canada |

9.6% |

9.0% |

7.9% |

7.9% |

7.9% |

|

India |

1.2% |

1.4% |

1.3% |

- |

- |

Source: Our World In Data

Challenges

- Increased patient affordability and out-of-pocket expenses: With the complete absence of insurance coverage, the overall financial burden falls on patients, which negatively impacts the cellulite treatment market globally. A single treatment session tends to be expensive, with incomplete results frequently demanding different sessions, thereby causing a surge in overall expenses. This has developed high out-of-pocket costs, thereby developing a huge cost-effective barrier, which rapidly includes an increased portion of the potential market. Besides, it has confined the audience to a high-income and narrow demographic, critically capping the overall market.

- Market saturation and intensified competition: The presence of established markets, such as North America, is readily flooded with different key players, providing numerous energy-based devices, such as ultrasound, laser, and radiofrequency. This saturation has deliberately triggered intense price competition in the market, thus eroding profit margins for all participants. In addition, this also effectively pressured manufacturers to spend increasingly on direct-to-consumer advertising and marketing to create a differentiation in products, thereby significantly rising customer acquisition expenses.

Cellulite Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 2.8 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

Cellulite Treatment Market Segmentation:

End user Segment Analysis

Based on the end user, the dermatology and aesthetic clinics segment in the cellulite treatment market is anticipated to garner the highest share of 67.5% by the end of 2035. The segment’s upliftment is highly attributed to its specialization in medical expertise, high-cost capital equipment, established patient trust, and accessibility to innovations. These facilities have evolved as the ultimate channel for managing CE-marketed and FDA-approved non-invasive and minimally invasive procedures that further demand professional operation. Besides, consumer preference for conducting treatments that are supervised by board-based trained medical professionals and dermatologists is emphasized, thereby suitable for the market.

Cellulite Type Segment Analysis

Based on the cellulite type, the soft cellulite segment in the cellulite treatment market is expected to account for the second-highest share during the projected timeline. The segment’s development is highly fueled by its occurrence due to weight gain, sedentary lifestyle, and poor circulation, which can be optimized by lifestyle modifications, regular exercise, and healthy diet consumption. As per an article published by NLM in June 2023, after a single treatment of manual subcision, nearly 80% of patients are satisfied, with a follow-up period of 2 years. Besides, post-treatment severe events comprise areas of elevation, followed by painful bruising for almost 4 months, and hemosiderin pigmentation for 10 months, thus uplifting the market internationally.

Product Segment Analysis

Based on the product, the non-invasive devices segment in the cellulite treatment market is constituting for the third-highest share by the end of the forecast duration. The segment’s growth is highly subject to its ability to enable diagnostics and effective monitoring without inserting any instruments, resulting in a lower infection risk, optimized patient comfort, and rapid recovery times. For instance, in August 2025, Neuovalens declared that it has successfully secured £6m investment, which was readily led by the Investment Fund for Northern Ireland (IFNI). Therefore, this investment will effectively support the organization to commercially expand across the U.S. and international healthcare markets through FDA-approved non-invasive technologies.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Cellulite Type |

|

|

Product |

|

|

Procedure Type |

|

|

Treatment Duration |

|

|

Gender |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cellulite Treatment Market - Regional Analysis

North America Market Insights

North America in the cellulite treatment market is projected to garner the largest share of 41.2% by the end of 2035. The market’s growth in the region is highly attributed to the presence of strong healthcare facilities, comprehensive insurance coverage, increased awareness and need for non-invasive solutions, administrative transparency, strong distribution of device suppliers, and growth in clinics and e-commerce services. According to an article published by PAHO in 2025, countries in the region readily import over 80% of medical devices, which is positively impacting the market in the overall region.

The market in the U.S. is significantly growing, owing to the expansion in Medicare reimbursement for innovative treatments, significant Medicaid spending, insurance coverage services, increased prevalence of obesity, and the early adoption of FDA-approved AI-based devices. As per the September 2024 CDC data report, states and territories of the country comprised 20% more obesity prevalence, which is 1 in 5 adults. In addition, there has been a 36.0% prevalence in the Midwest, 34.7% in the South, and 29.1% in the West, thus uplifting the market’s demand.

The cellulite treatment market in Canada is also developing due to substantial government funding, along with federal and provincial budget allocation, the presence of direct-to-consumer (DTC) brands, enhanced and strong non-clinical demand, an expansion in public coverage, and wide insurance solutions. As stated in the March 2023 Canada Public Administration article, the country’s government boosted healthcare-based transfers by USD 46 billion for more than 10 years to ensure suitable and effortless health and medical service deliveries, thereby creating an optimistic approach for the overall market.

Medical Instruments 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

Mexico |

USD 3.1 billion |

USD 11.8 billion |

|

Canada |

USD 1.8 billion |

USD 876 million |

|

Costa Rica |

USD 582 million |

USD 3.5 billion |

|

U.S. |

USD 34.8 billion |

USD 37.7 billion |

|

Dominican Republic |

USD 92.3 million |

USD 1.4 billion |

Source: OEC

APAC Market Insights

Asia Pacific in the cellulite treatment market is expected to emerge as the fastest-growing region during the projected timeline. The market’s development in the region is effectively subject to a rapid increase in medical tourism, cost-effective treatment availability, high-quality healthcare facilities, a growing network of clinics, innovative and painless non-invasive technologies adoption, and a rise in disposable income. As per an article published by the NIH in April 2025, the drug expense of TDF is USD 30 and ETV is USD 36 per person per year. In addition, the ETV cost in Malaysia is USD 2,640, and TDF is USD 12 in Mainland China and USD 2,446 in Hong Kong. Besides, in Australia, patients usually pay 1.4% of the minimum annual wage to achieve a year of CHB treatment, thus suitable for uplifting the overall market in the region.

The market in China is gaining increased traction, owing to the existence of aggressive government support, rapid device clearances by the NMPA, highly developed e-commerce services, robust urban trends, and an increase in the number of skilled professionals. As stated in the March 2025 NLM article, the Medical Device Evaluation Center of NMPA has successfully approved 250 advanced medical devices. Besides, in particular, the organization has cleared 61 devices as of 2023, denoting an 11% increase in comparison to 2022, while an increase in electromagnet sourcing is also suitable for the market’s growth.

The market in India is also developing due to an upsurge in government spending, the presence of an increased untreated population, a rise in private and public clinics, and a surge in affordable combination and non-invasive therapies. According to an article published by NLM in July 2024, a clinical study was conducted on 300 drug-sensitive pulmonary TB cases with the utilization of combination therapy in Bengaluru. This resulted in 86.3% patients treated, of which 4% witnessed complete treatment, thereby creating a positive outlook for the overall market to uplift in the country.

Electromagnets 2023 Export and Import in Asia

|

Countries |

Export |

Import |

|

China |

USD 5.3 billion |

USD 665 million |

|

Japan |

USD 974 million |

USD 1.0 billion |

|

South Korea |

USD 234 million |

USD 626 million |

|

Malaysia |

USD 152 million |

USD 173 million |

|

India |

USD 62.5 million |

USD 363 million |

|

Vietnam |

USD 463 million |

USD 481 million |

Source: OEC, August 2025

Europe Market Insights

Europe in the cellulite treatment market is expected to account for a considerable share by the end of the projected duration. The market’s growth in the region is highly driven by an increase in awareness of topical and advanced laser treatments, market boost for product integration, robust administrative environment with EMA approvals, a surge in R&D-based investment, high treatment expenses, and reimbursement policies. As stated in the February 2025 MDPI article, the clinical improvement rates of the latest topical treatments, such as ciclopirox P-3051, are 20% to 27%, followed by 46% to 47% for mycological cure rates, and 10% to 11% for complete cure rates, thus suitable for the overall market.

The market in Germany is gaining increased importance, owing to the existence of government-based awareness programs, robust advanced health and medical infrastructure, proactive engagement in clinical trials and progressive co-funding by private sector and government, along with well-established device manufacturing industry. As per the 2024 Euro Health Observatory article, the health insurance system in the country constitutes the SHI system, which in turn, comprises 96 sickness funds that cover almost 89% of the overall population. Besides, employees and self-employed exceeding certain income can readily opt for PHI, which is provided by 44 insurance organizations.

The cellulite treatment market in the UK is also growing due to suitable approvals by the government for different treatment modalities, such as creams, pills, and injections, as well as increased consumer awareness, the NHS support, a surge in healthcare budget, and the presence of a robust private aesthetics sector. According to the May 2024 ONS Government data report, the healthcare spending in the country was £292 billion in 2023, while government-specific spending was almost £239 billion in the same year. Besides, there was an increase in long-lasting social and healthcare spending by 2.8% as of 2022, thereby suitable for bolstering the overall market.

Key Cellulite Treatment Market Players:

- Hologic Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merz Pharma GmbH & Co. KGaA

- Lumenis Ltd

- Cynosure Inc.

- Zimmer Aesthetics

- BTL Industries Inc.

- Cutera Inc.

- Candela Corporation

- Venus Concept

- Solta Medical

- Fotona d.o.o.

- Alma Lasers Ltd.

- Viora Ltd.

- SharpLight Technologies Inc.

- LPG Systems

The international market is highly dominated by the presence of large key players, which are primarily based in the U.S. and Europe, with emerging organizations achieving ground through geographic expansion and innovation. Notable key players readily focus on progressing minimally invasive and non-invasive treatment technologies, including combination, laser, and radiofrequency therapies. Besides, tactical strategies, such as collaborations to optimize distribution in developing economies, generous investments in R&D for portable and AI-based devices, as well as acquisitions to diversify product portfolios, are also creating an optimistic outlook for the market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In April 2024, Caliway Biopharmaceuticals declared the topline results of the CBL-0201EFP Phase 2 clinical study, which successfully met the primary and secondary efficiency endpoints in per-protocol and intent-to-treat analyses.

- In July 2025, Yole Group notified the launch of its Status of the RF Industry report by providing a panoramic view of the radiofrequency semiconductor market, which is the foundational industry, currently witnessing inflection points in technologies and applications.

- Report ID: 8150

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cellulite Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.