Cellulite Reduction Devices Market Outlook:

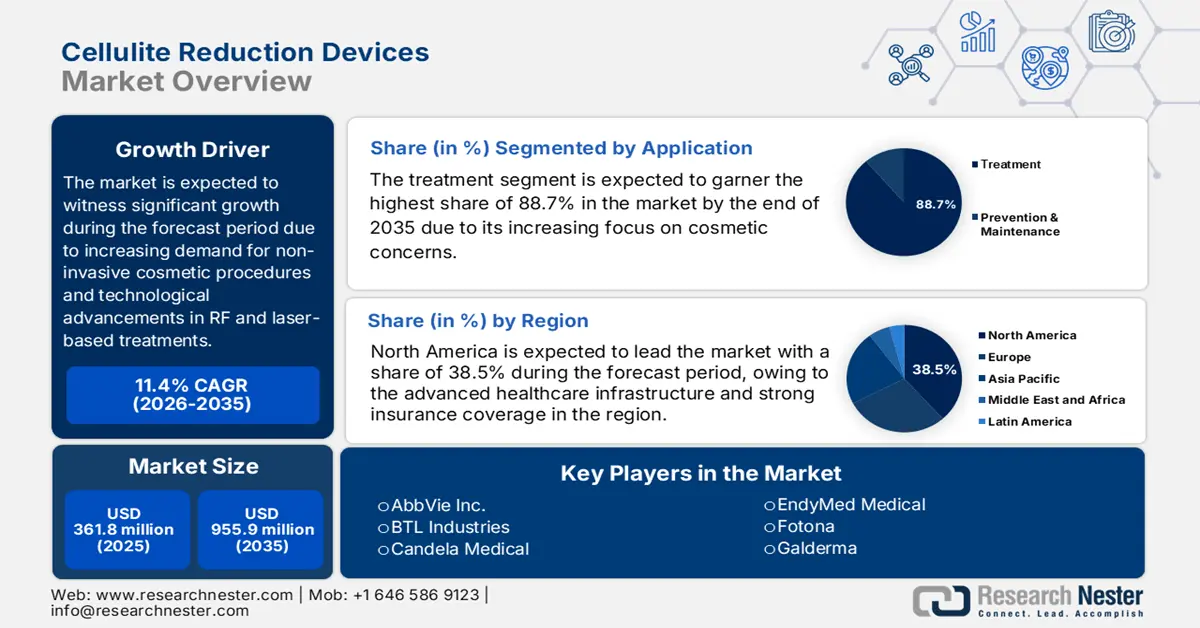

Cellulite Reduction Devices Market size was over USD 361.8 million in 2025 and is estimated to reach USD 955.9 million by the end of 2035, expanding at a CAGR of 11.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of cellulite reduction devices is assessed at USD 403 million.

The international market is being readily shaped by factors such as an increase in social media influence, aesthetic consciousness, a surge in disposable income, technological innovation, and proven efficiency. According to an article published by NLM in January 2023, there exists more than 3.6 million social media users, and the number is expected to increase to 4.4 billion by the end of 2025. In this regard, online social media platforms constitute a huge potential for public health campaigns. For instance, these platforms are able to connect huge audiences, with Facebook comprising 1.1 billion users on a monthly basis.

Furthermore, the aspect of at-home revolution, increased focus on medical credibility and clinical validation, along with treatment protocols personalization, tactical market consolidation, and a surge in non-surgical procedures, are also driving the cellulite reduction devices market. According to an article published by Bioactive Materials in April 2022, combination products in the healthcare sector are effectively reported to cater to almost 30% of medical products. Besides, the April 2024 Journal of Pharmaceutical Sciences article indicated that the U.S. Food and Drug Administration (FDA) has listed 98 biologic-device combination products, which were readily approved by the Biologic License Application by August 2023, thus suitable for cellulite reduction devices.

Key Cellulite Reduction Devices Market Insights Summary:

Regional Highlights:

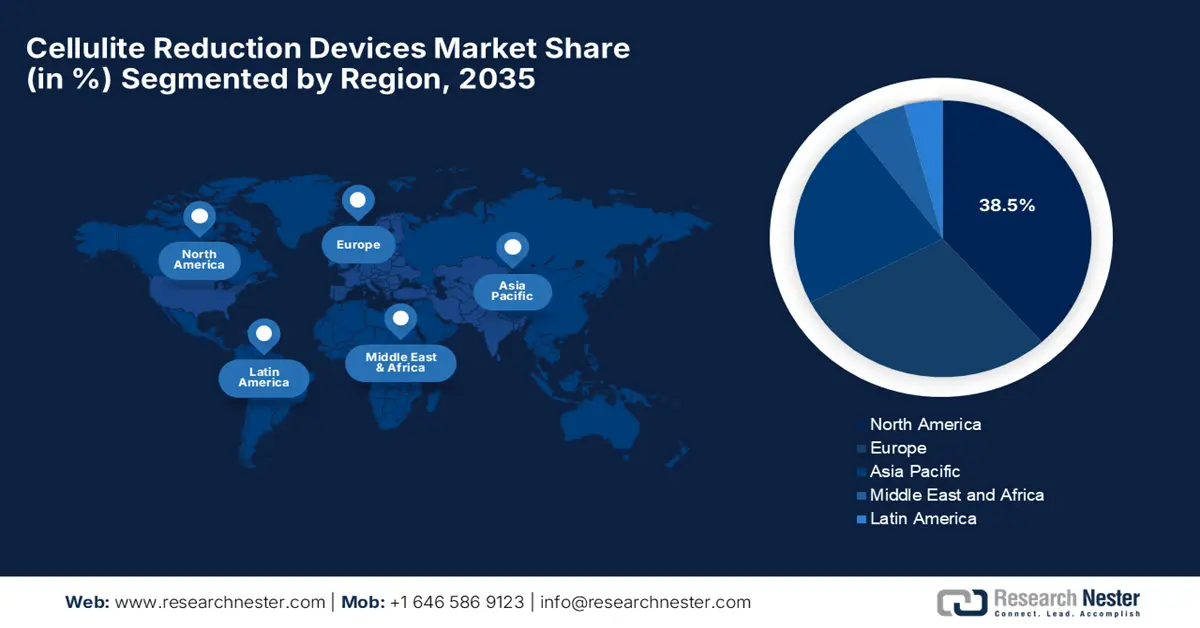

- North America in the cellulite reduction devices market is anticipated to lead with a commanding 38.5% share by 2035, owing to advanced healthcare infrastructure and strong insurance coverage across the region.

- Asia Pacific is expected to witness the fastest growth from 2026-2035, supported by the rapid rise in medical tourism, heightened aesthetic awareness, and expanding disposable income.

Segment Insights:

- The treatment segment in the cellulite reduction devices market is projected to hold the dominant 88.7% share by 2035, primarily propelled by its strong focus on addressing visible cosmetic concerns and providing clinically validated improvements in skin texture.

- The energy-based devices segment is expected to secure the second-largest share by 2035, impelled by its expanding utilization across community, medical, and aesthetic applications for precise therapeutic and surgical procedures.

Key Growth Trends:

- Ongoing fund provision from governing organizations

- An increase in the acceptance of technologically advanced devices

Major Challenges:

- Strict and evolving administrative obstacles

- Unreal expectations and consumer skepticism

Key Players: AbbVie Inc. (U.S.), BTL Industries (Czech Republic), Candela Medical (U.S.), Cynosure LLC (a Hologic company) (U.S.), Cutera Inc. (U.S.), EndyMed Medical (Israel), Fotona (Slovenia), Galderma (Switzerland), InMode (Israel), Lumenis Ltd. (U.S.), Lutronic (South Korea), Merz Pharma (Germany), Sciton Inc. (U.S.), Sisram Medical Ltd. (Israel), Solta Medical (U.S.), Syneron Medical Ltd. (U.S./Israel), Venus Concept (Canada/U.S.), Zimmer MedizinSysteme (Germany), Fosun Pharma (China), Lynton Lasers (UK).

Global Cellulite Reduction Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 361.8 million

- 2026 Market Size: USD 403 million

- Projected Market Size: USD 955.9 million by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 20 October, 2025

Cellulite Reduction Devices Market - Growth Drivers and Challenges

Growth Drivers:

- Ongoing fund provision from governing organizations: The increasing growth in the patient population has successfully pushed governments across different nations to offer generous funds to the market. According to a data report published by the CMS in 2023, Medicare spending has significantly reached USD 1.0 trillion as of 2023, denoting an upsurge by 8.1% from 6.4% in 2022. Likewise, the Medicaid expenditure has also increased by 7.9%, amounting to USD 871.1 billion in 2023, thereby making it suitable for boosting the overall market globally.

- An increase in the acceptance of technologically advanced devices: Based on the efficiency of medical devices, dedicated consumers and healthcare facilities are displaying interest in adopting combinational technologies from the cellulite reduction devices market. For instance, as per the October 2022 NLM article, body temperature is one of the most essential indicators for a patient’s physiological status, which is maintained at an average of 37 degrees Celsius. Based on this, wearable body temperature sensors are usually utilized in healthcare settings and are placed on the body with an estimated 5 degrees Celsius temperature.

- Increased focus on radiofrequency: The market has gained more importance, owing to the clinical validation and development of innovative energy-specific technologies, with the major focus on radiofrequency. According to a clinical study conducted by Interventional Pain Medicine in June 2025, a total of 193 patients were considered, and 55% of females were readily suffering from lumbar facetogenic joint syndrome. Of these, 80% suffered from rare low back pain and 85% from cripling disability. However, to overcome the pain, the lumbar radiofrequency ablation was readily implemented, thus creating an optimistic outlook for the market.

Widely Used Social Networks for Creating Awareness Regarding Medical Health (2022)

|

Media Type |

Utilization (%) |

|

|

22 |

|

YouTube |

19 |

|

|

15 |

|

Wein/WeChat |

10 |

|

TikTok |

8 |

|

Telegram |

4 |

|

|

3 |

|

Quora |

2 |

Sources: NLM

Challenges:

- Strict and evolving administrative obstacles: The aspect of navigating the international regulatory landscape is time-consuming, expensive, and a complicated process, which negatively impacts the market. The presence of agencies, such as Europe’s Medical Device Regulation (MDR) and the U.S. FDA, demands strong clinical data for clearance, thereby delaying product launches and enhancing research and development expenses. For instance, the MDR has developed backlogs and heightened scrutiny for aesthetic devices, which is causing a gap in the market’s development.

- Unreal expectations and consumer skepticism: Despite technological innovations, the aspect of lingering consumer skepticism regarding non-invasive treatments is considered a massive hurdle in the market. The market is also hindered by unrealistic expectations, frequently driven by robust marketing that ensures miracle cures. In addition, this particular skepticism has increased expenses for acquisition and consumer education for providers, who are expected to initiate payment for resource management and considerable time expectations, along with differentiating clinically-based technologies.

Cellulite Reduction Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 361.8 million |

|

Forecast Year Market Size (2035) |

USD 955.9 million |

|

Regional Scope |

|

Cellulite Reduction Devices Market Segmentation:

Application Segment Analysis

The treatment segment in the cellulite reduction devices market is anticipated to account for the largest share of 88.7% by the end of 2035. The segment’s upliftment is extremely fueled by effectively addressing present cosmetic concerns rather than preventive care services. This readily reflects a customer behavior pattern, where the action is frequently triggered by the visible existence of cellulite. Besides, the segment’s demand is significantly focused on solutions that provide perceptible optimization and clinical validation in dimpling and skin texture. Additionally, the treatment aspect has encompassed the overall spectrum of device-specific interventions, denoting an optimistic outlook for the market.

Technology Segment Analysis

The energy-based devices segment in the market is expected to cater to the second-largest share during the projected timeline. The segment’s growth is accelerated by its importance for utilization in community, medical, and aesthetic applications. These have been incorporated for precise procedures, such as hemostasis in surgery, and are further explored for therapeutic effects. As per an article published by NLM in June 2024, a split-faced and fractional 2,940 nm Eribum:YAG, along with a fractional 10,600 nm carbon dioxide laser, is extremely suitable for aiding acne scars, thus uplifting the segment’s exposure internationally.

Product Type Segment Analysis

The standalone devices segment in the cellulite reduction devices market is predicted to account for the third-largest share by the end of the projected duration. The segment’s development is extremely propelled by its capability to provide convenience and simplicity for single-user tanks, offer offline functionality, and enhance privacy and security by operating offline. According to an article published by Orthogonal in October 2024, software as a medical device (SaMD), a standalone device, has been adopted to utilize AI and machine learning, and the FDA has readily approved 950 such medical devices, which is positively impacting the segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Technology |

|

|

Product Type |

|

|

End user |

|

|

Treatment Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cellulite Reduction Devices Market - Regional Analysis

North America Market Insights

North America market is set to dominate by capturing the highest share of 38.5% by the end of 2035. The major factors escalating the market in the region include strong healthcare facilities and robust insurance coverage. According to an article published by NLM in January 2024, the healthcare expenditure in the U.S. increased by 4.1%, thereby amounting to USD 4.5 trillion as of 2022, in comparison to 3.2% in 2021. In addition, the economy's share of the regional health industry was 17.3% in the same year, thus denoting a huge growth opportunity for the market.

The cellulite reduction devices market in the U.S. is growing significantly, owing to disposable income, aesthetic awareness, increased adoption of minimally invasive devices for outpatient settings, and the presence of the FDA to clear processes, with currently approved radiofrequency and laser-based devices. For instance, in November 2023, Medtronic plc declared that the U.S. FDA has successfully cleared the Simplicity Spyral renal denervation system, which is a minimally invasive device, for aiding hypertension. This resulted in immediate commercialization, thus making it suitable for the overall market’s growth in the country.

The market in Canada is also growing due to the existence of a stringent administrative framework, along with the predominantly public healthcare and medical system. Besides, Health Canada has made regulations for medical devices, and these approvals are frequently followed in the U.S. and Europe. As per an article published by the ITA in March 2023, the medical device market in the country was valued at USD 6.8 billion, and is projected to expand by 5.4% every year by the end of 2028. In addition, the overall healthcare spending has been estimated to be CAD 331 billion or CAD 8,563 per person, thereby creating an optimistic outlook for cellulite reduction devices in the country.

Personal Healthcare Expenditures in North America (2022)

|

Components |

Percentage Distribution |

|

Total |

USD 3.7 trillion |

|

Private Health Insurance |

31 |

|

Medicare |

24 |

|

Medicaid |

19 |

|

Out of Pocket |

13 |

|

Other Third-Party Payers |

9 |

|

CHIP, DoD, and VA |

4 |

Source: MEDPAC

APAC Market Insights

Asia Pacific in the cellulite reduction devices market is expected to emerge as the fastest-growing region during the projected period. The market in the region is gaining utmost importance, owing to the strong confluence of rapid medical tourism, intensified aesthetic consciousness, and a rise in disposable income. According to the July 2025 OECD data report, the median tax-to-GDP ratio in the overall region enhanced by 0.1% between 2022 and 2023, and meanwhile, 19.6% was readily covered across 37 Asia and Pacific economies. Besides, regional governments are also positively responding by strengthening administrative policies, with India’s CDSCO and China’s NMPA, thus suitable for the market’s upliftment.

China market is rapidly propelling, owing to social media influence, economic expansion, the streamlined approval for imported medical aesthetic devices by the NMPA, and an upsurge in non-invasive body shaping devices. For instance, in September 2025, Pier 88 Health, along with Theranica, declared that the Nerivio REN wearable, which is a notable treatment for migraine, has successfully achieved regulatory clearance from China’s NMPA. Migraine is considered a public health concern in the country, with approximately 130 million people being readily affected. Therefore, with the clearance of such devices, there is a huge growth opportunity for the overall market in the country.

The market in South Korea is also developing due to an increase in the number of cosmetic procedures, the existence of the Ministry of Food and Drug Safety (MFDS) for strictly regulating medical devices, cutting-edge technology adoption, and the aspect of medical tourism. All these factors have created a technologically and hyper-competitive advanced market for aesthetic devices in the country. Besides, the market in the country is highly focused on an innovative combination of laser and radiofrequency devices and electromagnetic devices, thus creating a positive outlook for the overall market.

Europe Market Insights

Europe in the cellulite reduction devices market is projected to grow steadily by the end of the predicted timeline. The market’s exposure in the region is highly driven by the strict regulatory oversight, increased level of technological adoption, an increase in disposable income, and the presence of a conscious population. Besides, according to an article published by the Regulatory Rapporteur Organization in February 2025, the EMA has successfully established a suitable procedure for manufacturers with high-risk Class 11b and III medical devices. The purpose was to optimize the efficiency of these devices and ensure patient safety and maintain the quality.

Germany market is gaining increased traction, owing to the presence of a strong medical technological industry, an increase in customer purchasing power, and a wide-ranging network of cosmetic surgeons and dermatologists to incorporate the current technologies. As stated in the August 2025 ITA data report, the medical device market in the country is valued at EUR 38 billion (approximately USD 44 billion) in yearly revenue, which is almost 26.5% of the regional market. In addition, 1 in 6 jobs in the country is associated with the health industry, which effectively generates 12.8% of the GDP, thus suitable for uplifting the market.

The cellulite reduction devices market in France is also growing due to the increased density of private and aesthetic clinics, the ingrained aesthetic medicine culture, and the existence of the French National Authority for Health, for ensuring a suitable framework for professional practice standards. Additionally, consumers in the country highly prefer energy-efficient and technologically advanced devices that are either CE-marked or FDA-approved. Besides, the market is also witnessing sufficient development in franchised center chains for driving volume sales and standardizing treatments for popular devices, thus making it suitable for increased traction in the country.

Key Cellulite Reduction Devices Market Players:

- AbbVie Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BTL Industries (Czech Republic)

- Candela Medical (U.S.)

- Cynosure LLC (a Hologic company) (U.S.)

- Cutera Inc. (U.S.)

- EndyMed Medical (Israel)

- Fotona (Slovenia)

- Galderma (Switzerland)

- InMode (Israel)

- Lumenis Ltd. (U.S.)

- Lutronic (South Korea)

- Merz Pharma (Germany)

- Sciton Inc. (U.S.)

- Sisram Medical Ltd. (Israel)

- Solta Medical (U.S.)

- Syneron Medical Ltd. (U.S./Israel)

- Venus Concept (Canada/U.S.)

- Zimmer MedizinSysteme (Germany)

- Fosun Pharma (China)

- Lynton Lasers (UK)

- AbbVie Inc. is considered a dominating force within the CoolSculpting Elite system, which readily uses cryolipolysis for body contouring and fat reduction. This suitable clinical support and international commercial footprint have made the company a benchmark in the market for non-invasive devices. Besides, according to its 2024 annual report, the international net revenue is valued at USD 7.2 billion for the immunology portfolio, denoting an increase of 4.9%.

- BTL Industries is well-known for its Emtone and Emsculpt devices, effectively pioneering the utilization of targeted pressure energy and high-intensity focused electromagnetic technology for skin tightening and muscle building. Besides, the company’s innovation particularly targets textural and structural aspects of cellulite by providing non-invasive solutions.

- Candela Medical is one of the leaders in energy-based aesthetic devices, providing solutions, such as the Profound system, which utilizes radiofrequency for subdermal tissue remodeling to cater to skin cellulite and laxity. Its robust clinical research and comprehensive portfolio support the position as the ultimate technological provider to clinics internationally.

- Cynosure LLC is considered a pioneer in the market, with its signature Cellulaze system, which is one of the first-ever minimally invasive laser devices to receive FDA approval by directly targeting structural aspects of cellulite. Its ongoing advancement in light-based and laser technologies has solidified its role as the topmost innovator in body contouring.

- Cutera Inc. offers aesthetic platforms, which include truSculpt flex and truSculpt iD, that deliberately use 3DEEP and radiofrequency technology for muscle stimulation and non-surgical fat reduction. Besides, according to its 2024 financial results, the revenue for the third quarter amounts to USD 32.5 million, with restricted cash of USD 59.0 million and a 7% international core capital growth.

Here is a list of key players operating in the global market:

The global cellulite reduction devices market is highly fragmented but comprises a consolidating landscape, which is characterized by advanced specialists and intensified competition among established firms. Notable players such as InMode, Cynosure, and AbbVie (Allergen), readily dominate through tactical acquisitions and an ongoing pipeline of multi-modality platforms that tend to combine suction, laser, and radiofrequency technologies. For instance, in November 2024, Forefront RF declared the successful closure of its £16 million Series A funding round, which has been supported by Foresight Group and existing BGF investors, along with VC partners including Cambridge Innovation Capital and Octopus Ventures.

Corporate Landscape of the Peanut Butter Market:

Recent Developments

- In April 2025, Fujitsu Limited, along with Tokai University, Ishida Tec Co., Ltd., and Sonofai Inc. declared the unveiling of an automated inspection device that can determine the overall fat content of frozen albacore tuna, particularly in a non-destructive manner.

- In July 2024, Venus Concept Inc. notified that it has successfully achieved a medical dveice license, which has been issued by Health Canada to significantly market the Venus Bliss MAX system in Canada.

- In January 2024, Bausch Health Companies Inc. as well as Solta Medical, announced the clearance for the TR-4 Return Pad and Thermage FLX by China’s NMPA and the U.S. FDA, suitable to utilize radiofrequency technology for treatment purposes.

- Report ID: 7764

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cellulite Reduction Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.