Coronary Artery Bypass Graft Devices Market Outlook:

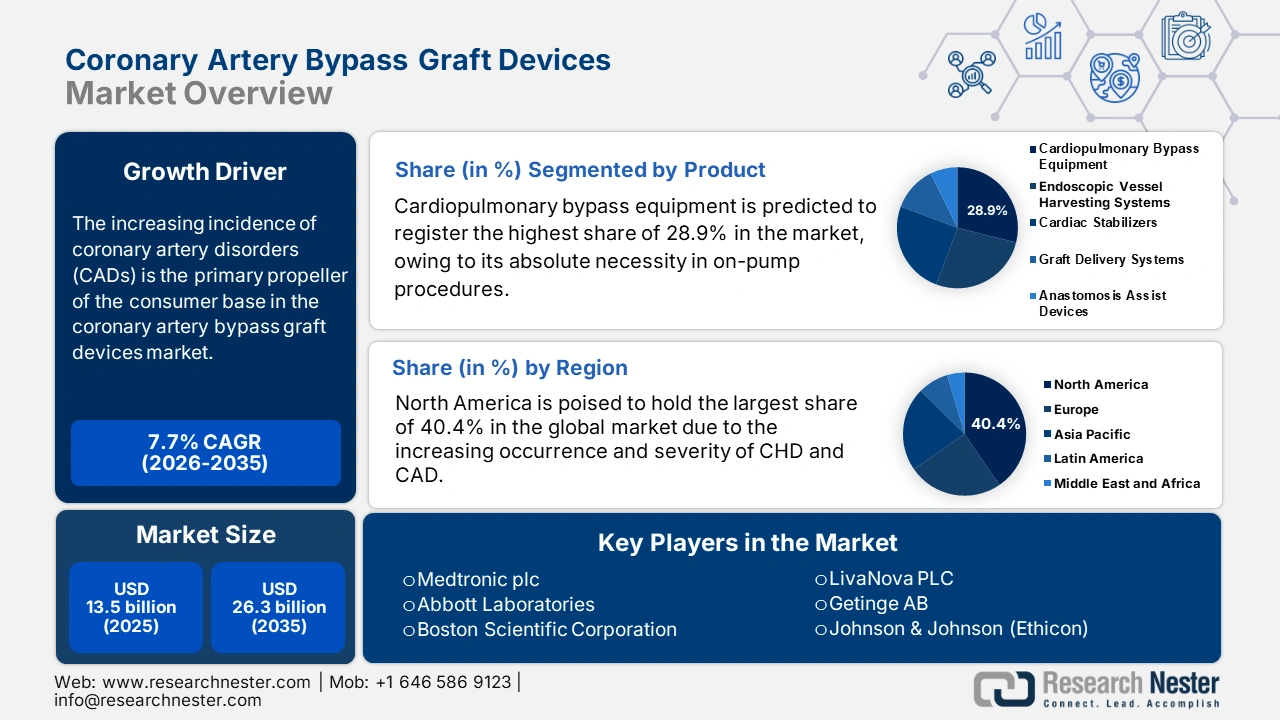

Coronary Artery Bypass Graft Devices Market size was over USD 13.5 billion in 2025 and is estimated to reach USD 26.3 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of coronary artery bypass graft devices is evaluated at USD 14.5 billion.

The increasing incidence of coronary artery disorders (CADs) is the primary propeller of the consumer base in the market. Testifying to the same, a report from the World Health Organization (WHO) unveiled that approximately 19.8 million worldwide died due to cardiovascular diseases (CVDs) in 2022, and 85% of these cases were caused by heart attack and stroke. Another NLM study underscored that CAD accounted for the highest age-standardized disability-adjusted life-years (DALYs), 2,275.9 per 100,000, around the globe out of all CVD types from 1990 to 2022. These figures indicate the substantial nature of demand in this sector.

Reimbursement policies and cost-containment strategies of payers are some of the pivotal contributors to shaping the pricing dynamics of the coronary artery bypass graft devices sector. As these financial backing service providers prioritize value-based models, the sector is gaining traction on account of the economic advantages of this treatment method. Testifying to the same, in 2022, the American Heart Association (AHA) published a comparative analysis on the cost-effectiveness of coronary artery bypass grafting (CABG) vs medical therapy (MED) in treating ischemic cardiomyopathy. It found out that CABG had a higher incremental cost-effectiveness ratio (ICER) of USD 63,989 for each quality-adjusted life-year (QALY), in comparison to MED.

Key Coronary Artery Bypass Graft Devices Market Insights Summary:

Regional Highlights:

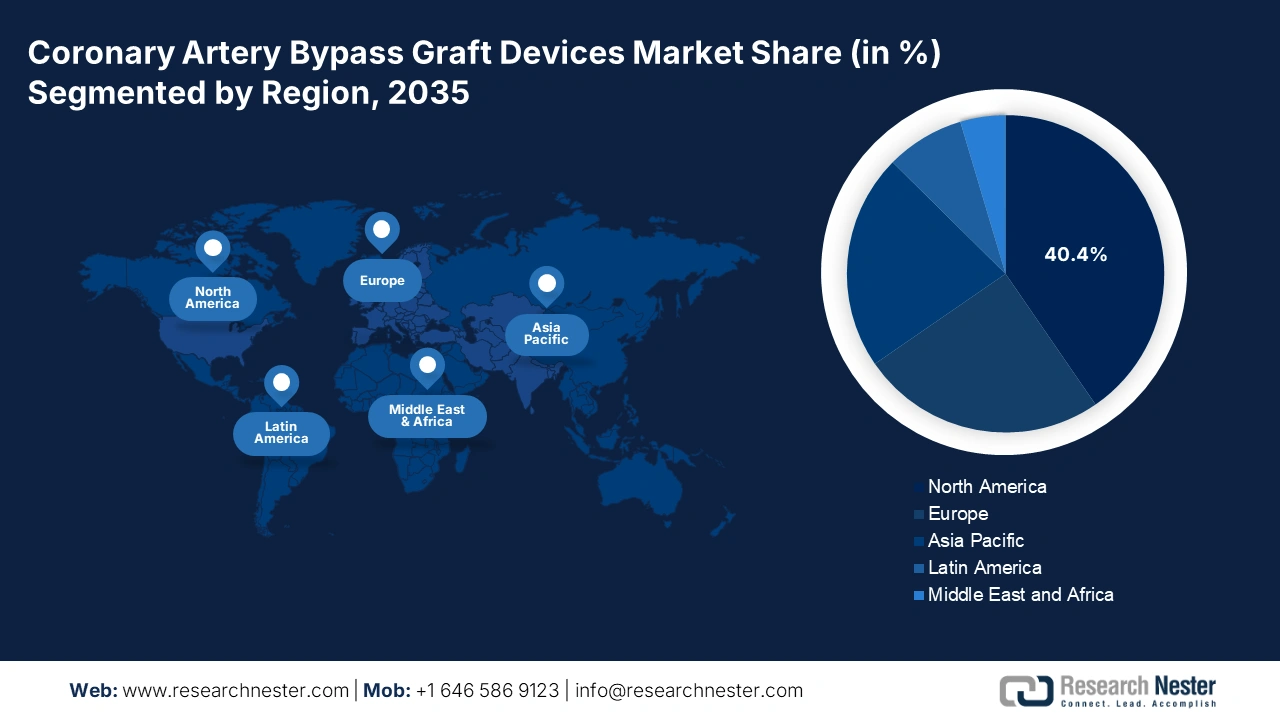

- North America is anticipated to command a 40.4% share in the global coronary artery bypass graft devices market by 2035, supported by the high prevalence of coronary heart diseases and favorable reimbursement structures.

- Asia Pacific is projected to witness the fastest growth by 2035, owing to the rising cardiovascular disease burden driven by urbanization and aging demographics.

Segment Insights:

- The cardiopulmonary bypass equipment segment is projected to hold a 28.9% share in the coronary artery bypass graft devices market by 2035, propelled by its indispensable role in on-pump CABG procedures and ongoing technological advancements.

- The hospitals segment is estimated to account for a dominant 75.4% share by 2035, driven by their extensive infrastructure, specialized surgical teams, and accessibility to post-operative care resources.

Key Growth Trends:

- Increasing population of high-risk individuals

- Emergence of less invasive and robotic surgeries

Major Challenges:

- Stringent pricing and reimbursement policies

- Pressures from alternative therapies

Key Players: Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, LivaNova PLC, Getinge AB, Johnson & Johnson (Ethicon), Edwards Lifesciences Corp., Teleflex Incorporated, Becton, Dickinson and Co., B. Braun SE, Cardinal Health, Haemonetics Corporation, CryoLife, Inc., Euroflex, Genesee Biomedical, Inc., Microline Surgical, Vitalcor, Inc., AngioDynamics, Sorin Group (LivaNova), AMT Medical BV, SS Innovations International, Inc., Terumo Corporation, Olympus Corporation

Global Coronary Artery Bypass Graft Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.5 billion

- 2026 Market Size: USD 14.5 billion

- Projected Market Size: USD 26.3 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 1 October, 2025

Coronary Artery Bypass Graft Devices Market - Growth Drivers and Challenges

Growth Drivers

- Increasing population of high-risk individuals: Underlying conditions, such as diabetes and hypertension, contribute to the severity of CAD, leading to an increased demand for advanced surgical treatments, including CABG. As the global rise in these chronic ailments results in higher procedural volume, the consumer base of the coronary artery bypass graft devices industry continues to expand. Evidencing the same, a 2025 NLM study found that diabetes mellitus (DM) increases the severity of CAD, with higher rates of multi-vessel disease (68.6% vs. 50.9%), three-vessel disease (36.2% vs. 24.5%), and severe stenosis (62.7% vs. 50.9%), in comparison to non-diabetics.

- Emergence of less invasive and robotic surgeries: The growing trend of choosing minimally invasive and robot-assisted surgeries over traditional open surgery is heightening the adoption rates in the market. The lower levels of post-operative complications, hospital stays, and recovery times are fueling traction in surgical robot utilization in this sector. Thus, the necessity of specialized, sophisticated devices to conduct these procedures is fostering a greater demand in this field. This surge can also be exemplified by the completion of 2,000 surgeries with the SSi Mantra Surgical Robotic System in September 2024, as per the press release from SS Innovations International.

- Advances and innovations in devices’ efficacy: Introduction of cutting-edge graft materials, next-generation surgical technologies, and multi-specialty tools reflect continuous advancement of the market. These innovations notably enhanced the safety, efficacy, and recovery times associated with CABG procedures, making them more attractive to both surgeons and patients. Enhanced device precision and patient outcomes further encourage higher procedure volumes, boosting the surge in the sector. Currently, the integration of smart monitoring and imaging tools is supporting the pipeline to deliver better procedural success.

Historic Patient Pool Trends in the Coronary Artery Bypass Graft Devices Market

National Occurrence Rates of Ischemic Heart Disease (IHD)

(2017)

|

Region |

Prevalence (rate per 100,000) |

Disability-Adjusted Life Years (rate per 100,000) |

|

Germany |

3,432 |

2,855 |

|

France |

2,696 |

1,237 |

|

Italy |

3,468 |

1,831 |

|

Spain |

2,733 |

1,503 |

|

Netherlands |

3,502 |

1,451 |

|

Switzerland |

2,581 |

1,461 |

|

Sweden |

3,858 |

2,192 |

|

Turkey |

2,418 |

1,960 |

|

Russia |

4,198 |

6,568 |

|

UK |

3,337 |

1,864 |

|

China |

1,612 |

2,131 |

|

India |

1,197 |

2,679 |

|

Japan |

2,928 |

1,427 |

|

South Korea |

1,352 |

704 |

|

Taiwan |

1,759 |

1,241 |

|

Saudi Arabia |

1,509 |

1,643 |

|

Iran |

1,599 |

2,149 |

|

Australia |

2,576 |

1,450 |

|

U.S. |

2,929 |

2,470 |

|

Canada |

2,335 |

1,837 |

|

Brazil |

1,685 |

1,736 |

|

South Africa |

1,227 |

1,184 |

Recent/Ongoing Development Cohorts in the Market

|

Study/Trial Name |

Motive |

Current Status |

Year |

|

No-Touch Vein Grafts in CABG |

Examine if no-touch saphenous vein harvesting improves graft patency and outcomes |

Completed, primary endpoint negative; increased leg wound complications |

2025 |

|

ROMA Trial (Multiple vs Single Arterial Grafts) |

Compare outcomes of single vs multiple arterial grafts in CABG patients |

Ongoing or recently completed |

2024 |

|

Thiamine in CABG (NCT06326996) |

Assess if low-cost thiamine improves post-CABG outcomes |

Recruiting/Active |

2024 |

|

Preoperative Flow Assessment Before CABG (RCT) |

Determine if pre-operative flow metrics improve surgical results in CABG |

Study ongoing, mixed results |

2025 |

|

Elana Device for Multi-Artery Heart Bypass (NCT07005843) |

Evaluate the feasibility and safety of the Elana Anastomotic System for multi-artery anastomosis in CABG |

Recruiting |

2025 |

Challenges

- Stringent pricing and reimbursement policies: In many markets, public payers set fixed coverage rates for entire procedure bundles, severely limiting the scope for premium-priced products in the coronary artery bypass graft devices market. Besides, these insurers demand additional real-world evidence for clinical and economic outcomes, extending the budget for research while shrinking profit margins. Moreover, the limitations in designing a product that delivers both high-end functions and potential to justify the extra cost within the fixed diagnosis-related groups (DRG) payment impose a notable adoption barrier in this sector, particularly for hospitals.

- Pressures from alternative therapies: The expansion of the market is often pressurized by the increasing advancement and preference for percutaneous coronary interventions (PCIs). Such evolving treatment trends ultimately hinder consistency in revenue generation from this sector. To combat this problem, manufacturers are forced to compete for a share of a confined procedural volume that is not substantial in all geographies, intensifying the economic barriers for patients and budget-constrained medical settings.

Coronary Artery Bypass Graft Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 13.5 billion |

|

Forecast Year Market Size (2035) |

USD 26.3 billion |

|

Regional Scope |

|

Coronary Artery Bypass Graft Devices Market Segmentation:

Product Segment Analysis

Cardiopulmonary bypass equipment is predicted to register the highest share of 28.9% in the coronary artery bypass graft devices market over the assessed period. The leadership is primarily attributed to its absolute necessity in the majority of on-pump CABG procedures. Complex multi-vessel grafts often require the hemodynamic stability and motionless field provided by cardiopulmonary bypass machines, which solidifies the segment’s position in this sector. Besides, ongoing advances are also propelling adoption in this segment, which can be exemplified by the FDA 510(k) Clearance for the Essenz Heart-Lung Machine by LivaNova for cardiopulmonary bypass procedures in March 2023. This broadened the pathway of the product’s commercial release in the U.S. marketplace.

End user Segment Analysis

Hospitals are estimated to dominate the coronary artery bypass graft devices market with a 75.4% share by the end of 2035. These facilities earned worldwide recognition as the primary end-user on account of their capacity in conducting high-complexity CABG procedures. Besides, the availability of public subsidies and post-operative management also makes them the first choice and point of care for a majority of cardiac surgeries. Moreover, the essential resources, such as integrated teams of surgeons, anesthesiologists, perfusionists, and specialized cardiac ICU nursing, are typically consolidated within major hospital settings, reinforcing their foundational role in this sector.

Procedure Segment Analysis

he on-pump CABG is expected to remain the leading procedure in the coronary artery bypass graft devices market throughout the discussed timeframe, while acquiring 55.7% of the total share. This technique involves heavy use of a heart-lung machine to temporarily take over the heart’s function during a complex surgery and is widely preferred due to its established track record of effectiveness. This method enables better precision and better control, making it the gold standard for professionals in treating patients with multiple or severe blockages. Further, despite the rise of off-pump and minimally invasive alternatives, the reliability and widespread clinical acceptance maintain a strong presence of the segment in this field.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Product |

|

|

Procedure |

|

|

End user |

|

|

Source of Graft |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coronary Artery Bypass Graft Devices Market - Regional Analysis

North America Market Insights

North America is poised to hold the largest share of 40.4% in the global coronary artery bypass graft devices market during the analyzed tenure. The increasing severity of CHD and CAD among high-risk populations and advanced medical systems collectively foster a lucrative business environment for the merchandise in this region. The wide acceptance of next-generation technologies, including minimally invasive and robot-assisted procedures, also ensures greater adoption in this field. In addition, strong government support, expanded reimbursement coverage, and robust investments in cardiac care facilities fuel growth in this landscape.

The presence of globally leading medical device manufacturers and research institutions in the U.S. solidifies its position in the North America market. Besides, the dominance of CABG in both procedural volumes and expenditure in the country also reflects the nation’s suitable environment for greater revenue generation in this category. As evidence, a 2024 NLM article unveiled that the total spending on CABG procedures was higher, accounting for approximately USD 16 billion, than PCIs, with an estimated total expenditure of USD 12 billion.

Canada is also one of the prominent contributors to the North America coronary artery bypass graft devices market. The country’s augmentation in this sector is primarily supported by its publicly funded healthcare system that ensures broad access to cardiac surgical procedures. Additionally, the substantial aging population and growing government focus on elderly care are fueling demand in this category. Thus, based on such an enlarging consumer base, hospitals in Canada are progressively adopting advanced CABG devices and minimally invasive techniques to improve patient outcomes and reduce recovery times.

Overview of Country-wise Procedural Volumes

|

Country |

Procedural Volume |

Timeline |

|

U.S. |

400,000 CABG procedures are performed annually, representing more than 70% of all cardiac surgery cases |

2022-2024 |

|

Canada |

Over 1,900 open-heart procedures are performed annually by the University of Ottawa Heart Institute alone |

2025 |

Source: NLM and University of Ottawa Heart Institute

APAC Market Insights

The growing awareness about heart health and early diagnosis is increasing the demand in the China market. The country’s growing focus on adopting innovative surgical technologies and minimally invasive CABG assets is further propelling its growth at a remarkable pace. On the other hand, the strong emphasis of China on medical device technology development and production, along with alliance formation with global device manufacturers, further accelerates the expansion of the landscape.

Rigorous efforts to improve healthcare infrastructure in India, coupled with the rising disposable incomes and expanding health insurance coverage, are strengthening the country’s foundation in the coronary artery bypass graft devices market. Both government and private organizations are participating in this cohort of development, attracting a massive capital influx in this sector. Evidencing the same, in October 2023, SS Innovations launched a revolutionary robotic cardiac surgery program in India by utilizing its flagship SSi Mantra surgical robotic system, where more than 20 surgeries were already performed successfully in the country.

Europe Market Insights

Europe is estimated to continue being the second-largest shareholder in the global market over the timeline between 2026 and 2035. The presence of a well-established healthcare system, aging populations, and strong reimbursement policies is cumulatively establishing an attractive landscape for both domestic and foreign companies in this sector. Evidencing such expansion in the potential demography, a report from MedTech Europe estimated more than 155 million people living across the region to be aged over 65 by 2040.

With strong medical financial backing from the National Health Service (NHS), the UK is augmenting the coronary artery bypass graft devices market notably. In addition, the country has a well-established cohort of early screening and prevention programs, amplifying procedural volumes while improving surgical outcomes. This encourages more local and international pioneers to invest in this sector by enabling a greater scope of innovation and future expansion for the merchandise.

The expanding geriatric demography and growing demand for minimally invasive and off-pump procedures are amplifying the utilization rates in the Germany market. Additionally, favorable reimbursement policies and continuous investment in medical research further bolster the country’s growth in the regional landscape. Moreover, the strong emphasis of Germany on widespread cardiac care centers and the adoption of innovative surgical technologies are consolidating its proprietary position in Europe.

Country-wise Density of CABG Performed (2018-2023)

|

Country |

Count of CABG Performed in 2018 (per 100,000) |

Count of CABG Performed in 2023 (per 100,000) |

|

Ireland |

19.3 |

33.1 |

|

Cyprus |

41.0 |

68.8 |

|

Luxembourg |

15.6 |

20.2 |

|

Romania |

20.8 |

23.8 |

|

Turkey |

50.6 |

55.1 |

Source: Eurostat

Key Coronary Artery Bypass Graft Devices Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Boston Scientific Corporation

- LivaNova PLC

- Getinge AB

- Johnson & Johnson (Ethicon)

- Edwards Lifesciences Corp.

- Teleflex Incorporated

- Becton, Dickinson and Co.

- B. Braun SE

- Cardinal Health

- Haemonetics Corporation

- CryoLife, Inc.

- Euroflex

- Genesee Biomedical, Inc.

- Microline Surgical

- Vitalcor, Inc.

- AngioDynamics

- Sorin Group (LivaNova)

- AMT Medical BV

- SS Innovations International, Inc.

- Terumo Corporation

- Olympus Corporation

The commercial dynamics of the market feature the consolidated presence of global and regional MedTech pioneers who are focused on innovation, product development, and strategic partnerships. These innovators are primarily empowered by their extensive product portfolios and strong distribution networks. The competitive landscape in this sector is further structured by the ongoing emergence of less invasive surgical methods and robot-assistance, which are complemented by the continuous development of novel graft materials and devices.

Such key players are:

Recent Developments

- In April 2025, AMT Medical raised a Series B funding of USD 25 million to accelerate the development of its revolutionary ELANA Heart Bypass System. This sutureless technology for coronary bypass surgery eliminates the need for open-heart surgery and opens the door to minimally invasive and even robot-assisted procedures.

- In January 2024, SS Innovations signed a partnership with Medikabazaar to facilitate sales of its flagship SSi Mantra Surgical Robotic System to hospitals and medical facilities across India. The advanced, affordable, and accessible product offers multi-specialty usage with improved safety and efficiency.

- Report ID: 8154

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coronary Artery Bypass Graft Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.