Cardiovascular Devices Market Outlook:

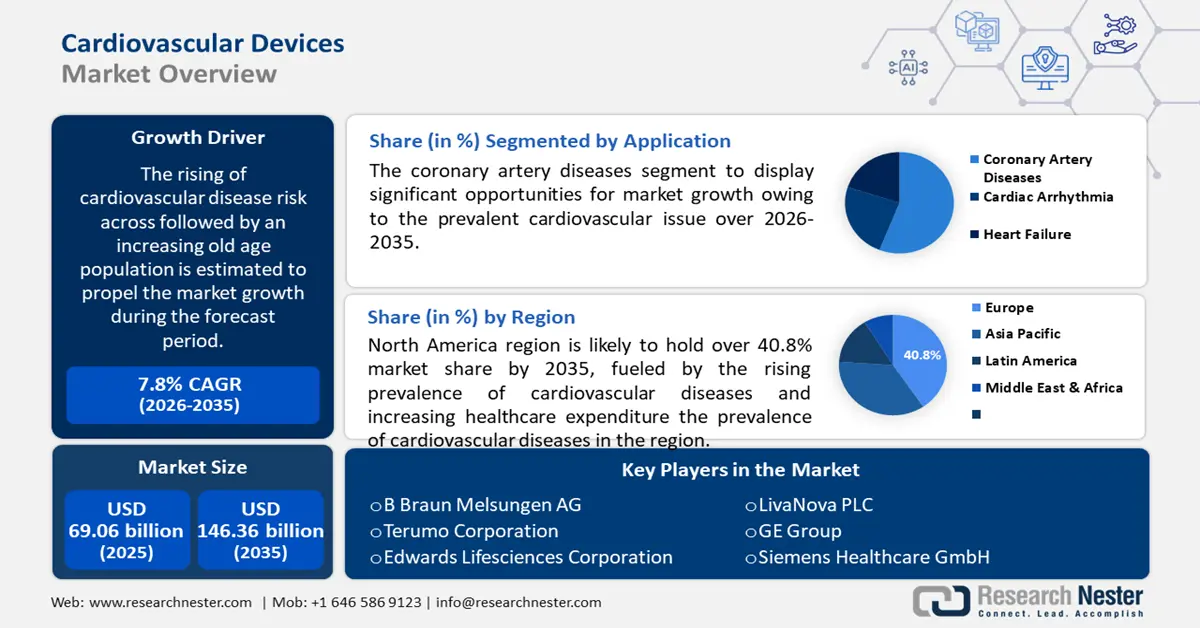

Cardiovascular Devices Market size was over USD 69.06 billion in 2025 and is poised to exceed USD 146.36 billion by 2035, growing at over 7.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cardiovascular devices is evaluated at USD 73.91 billion.

The rising of cardiovascular disease risk across followed by an increasing old age population will propel the market growth. As per the World Health Organization, the number of old people aged 60 and above in the U.S. is greater than the number of children less than 5 years of age as of 2020. Also, the number of old people aged 60 and over will double by 2050 to reach 2.1 billion, and the number of old people aged 80 years and above is estimated to grow thrice from 2020 to 2050 and reach 426 million.

In addition, factors such as increase in over-the-counter medicine availability, rising investments, and the expanding number of awareness campaigns on the administration of cardiovascular devices are thought to be driving the global cardiovascular devices market growth. Moreover, an increase in incidences of cardiac diseases such as heart attacks, coronary heart disease, and cardiac arrhythmia will boost the market revenue. According to the Centers for Disease Control and Prevention, heart disease claimed the lives of almost 697,000 Americans in 2020.

Key Cardiovascular Devices Market Insights Summary:

Regional Highlights:

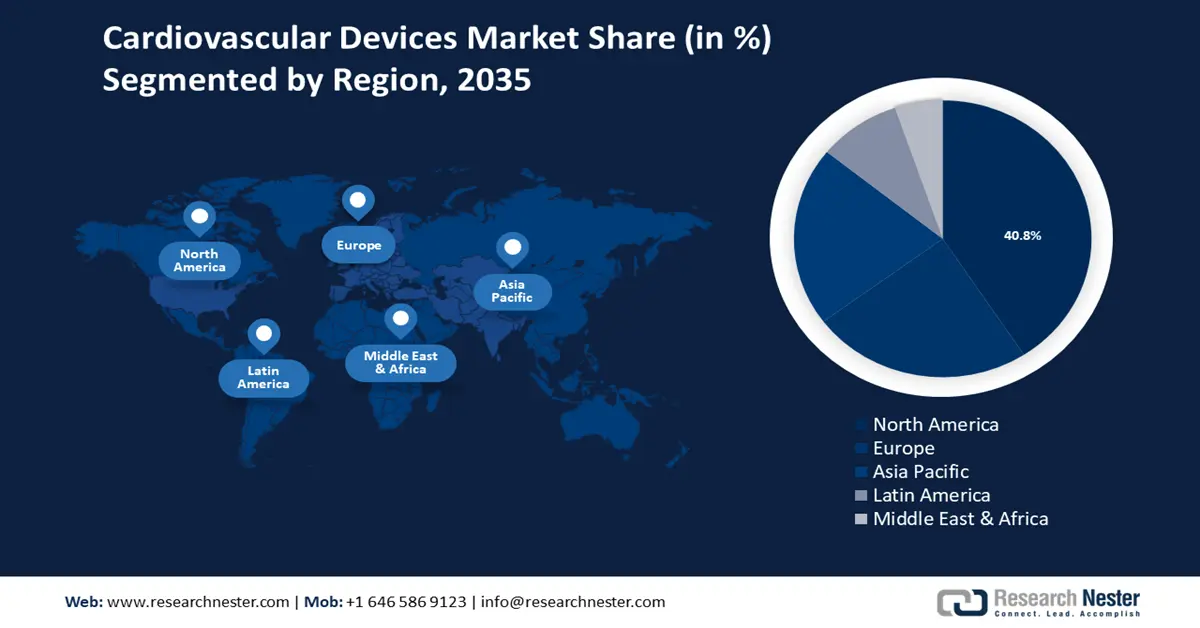

- North America cardiovascular devices market will dominate over 40.8% share by 2035, driven by the rising prevalence of cardiovascular diseases and increasing healthcare expenditure.

Segment Insights:

- The coronary artery diseases segment in the cardiovascular devices market is anticipated to achieve the largest share by 2035, propelled by the high prevalence of coronary artery disease globally.

- The hospital segment in the cardiovascular devices market is projected to maintain the largest share by 2035, fueled by advanced healthcare infrastructure and increased adoption of cardiovascular devices.

Key Growth Trends:

- Growing Minimal Invasive Medical Procedures

- Rising Consumption of Tobacco

Major Challenges:

- Lack of Reimbursement Policies and Medical Insurance

- Unavailability of Investors for R&D

Key Players: B Braun Melsungen AG, Abbott, Johnson & Johnson Services, Inc., Terumo Corporation, Edwards Lifesciences Corporation, Medtronic plc, Boston Scientific Corporation, LivaNova PLC, GE Group, Siemens Healthcare GmbH.

Global Cardiovascular Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 69.06 billion

- 2026 Market Size: USD 73.91 billion

- Projected Market Size: USD 146.36 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Cardiovascular Devices Market Growth Drivers and Challenges:

Growth Drivers

- Growing Minimal Invasive Medical Procedures – The use of minimally invasive surgery (MIS) in various operations grew rapidly between 2003 to 2018. The application rate of MIS rose from 87% to 92% in cholecystectomy, 21% to 45% in inguinal hernia repair, 9% to 41% in colectomy, 40% to 85% in gastrectomy, and 70% to 90% in Nissen UK.

- Rising Consumption of Tobacco – Tobacco consumption has been linked to poor cardiovascular health, and it is projected to boost the market’s growth. As per the World Health Organization, in 2020, about 22.3% of people across the world consumed tobacco which includes 36.7% of men and 7.8% of women.

- Increasing Compact Devices and Pacemakers – Growing awareness and developing technology have given rise to user-friendly and compact health measuring devices, and it is anticipated to boost the global cardiovascular devices market. For instance, about 30% of the population in China wears connected health devices such as fitness trackers.

- Rising Awareness and Adoption of Remote Healthcare – Remote interactions and online consultations have become one of the primary ways to seek medical advice, especially since the pandemic. As per the estimations, 75% of hospitals in the U.S. associate with patients and concerned physicians through audio and video consultation.

- Increasing Obese Population – Poor lifestyle choices and eating disorders give rise to obesity, which can severely impact a person’s cardiovascular health. The prevalence of obesity in the U.S. in 2020 rose from 30.5% in 2017 to 41.9% in 2020 as per the Centers for Disease Control and Prevention.

Challenges

- Lack of Reimbursement Policies and Medical Insurance – In the United States, those without insurance have less access to healthcare than those with insurance. In 2021, one in 5 people without insurance neglects vital medical care owing of expense. Moreover, nearly, 27.5 million non-elderly people lacked health insurance in 2021 in the United States.

- Unavailability of Investors for R&D

- Lack of Awareness about Devices and their Operation

Cardiovascular Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 69.06 billion |

|

Forecast Year Market Size (2035) |

USD 146.36 billion |

|

Regional Scope |

|

Cardiovascular Devices Market Segmentation:

Application Segment Analysis

The coronary artery diseases segment is expected to hold largest market share by 2035. In CAD, the coronary arteries, the main blood channels feeding the heart, have difficulty supplying the heart muscle with adequate blood, oxygen, and nutrients, owing to inflammation and cholesterol deposits (plaques) in the major heart arteries. For instance, according to research, it is also a common cause of death in the US, and is estimated to cause over 600,000 deaths yearly, is responsible for 18 million deaths per year worldwide, and is the third biggest cause of mortality.

End User Segment Analysis

The hospital segment is expected to dominate largest market share by 2035, on the back of developed and advanced healthcare infrastructure, improved access to healthcare facilities, growing adoption of innovative healthcare devices, and the rising practice of sedentary lifestyle. Moreover, there has been an increase in the number of hospitals across the globe adopting advanced cardiovascular devices, which is expected to boost the segment growth.

Our in-depth analysis of the global cardiovascular devices market includes the following segments:

|

By Device Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cardiovascular Devices Market Regional Analysis:

North America region is likely to hold over 40.8% market share by 2035, on the back of rising prevalence of cardiovascular diseases, increasing healthcare expenditure, and growing adoption of advanced devices. Moreover, there has been surging awareness among the people in the region related to the cardiovascular devices available on the market. As per the U.S. Centers for Medicare & Medicaid Services, the national health expenditure rose by 9.7% and reached USD 4.1 trillion in 2020, accounting for USD 12,350 per person.

Cardiovascular Devices Market Players:

- B Braun Melsungen AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Johnson & Johnson Services, Inc.

- Terumo Corporation

- Edwards Lifesciences Corporation

- Medtronic plc

- Boston Scientific Corporation

- LivaNova PLC

- GE Group

- Siemens Healthcare GmbH

Recent Developments

-

Abbott declared data from five late-breaking presentations showing the advantage of minimally invasive devices to treat heart diseases associated with structural diseases such as value disease or opening in the heart. Also, the data included the findings of Mitraclip and Triclip.

-

GE Group associated with Boston Scientific Corporation to afford end-to-end innovative interventional cardiac care solutions in India. This first Medtech association is to enhance and allow easy cardiac care access to patients and thus focused on the prevailing disease burden in the country.

- Report ID: 3272

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cardiovascular Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.