Thoracic Surgery Devices Market Outlook:

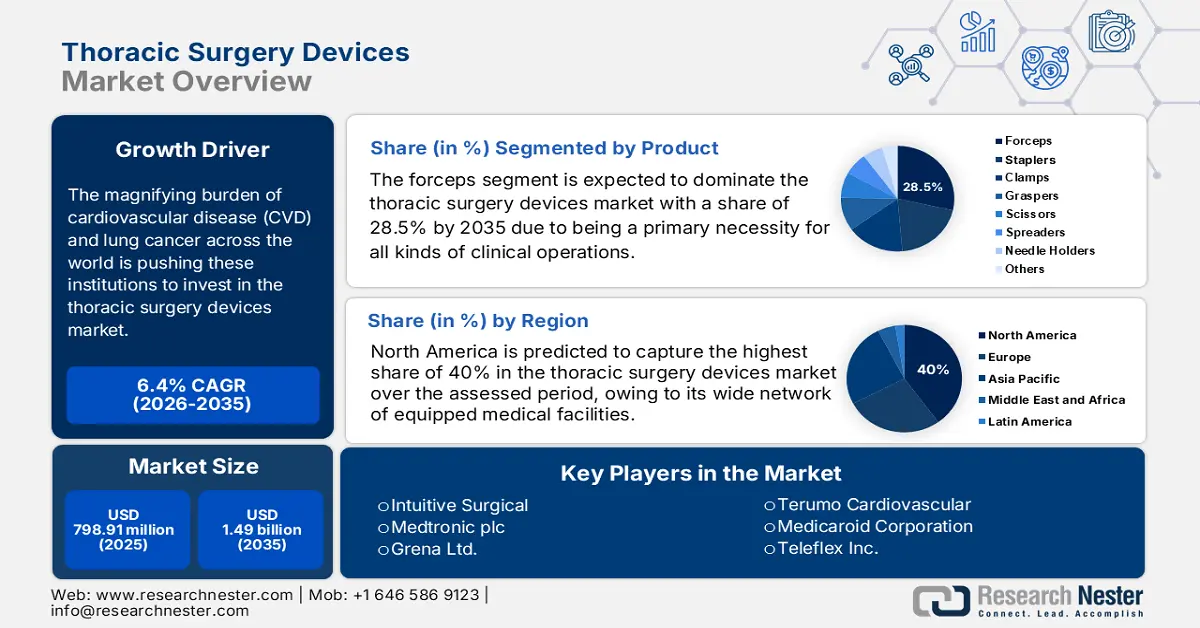

Thoracic Surgery Devices Market size was valued at USD 798.91 million in 2025 and is set to exceed USD 1.49 billion by 2035, expanding at over 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thoracic surgery devices is estimated at USD 844.93 million.

The severe impact of thoracic disorders on the overall health of blood vessels and the heart is dragging the focus of global healthcare settings to accommodate adequate infrastructure for better outcomes. Surgery is the most effective and widely used method to eliminate this medical issue for preventing cardiovascular disease (CVD). As a result, the magnifying burden of CVD is pushing these institutions to invest in the market. According to an NLM article, published in September 2024, globally, ischemic heart disease (IHD) and systolic hypertension caused 2,275.9 per 100,000 and 2,564.9 per 100,000 age-standardized CVD disability-adjusted life years (DALYs) by 2022 respectively. This showcases the need for immediate and long-acting curative solutions such as surgical resection.

The thoracic surgery devices market is evolving its offerings to provide less invasive and expensive treatment for patients, particularly in weak financial states. With advanced procedures, such as thoracotomy and sternotomy, medical institutions are now able to offer healthcare savings, presenting standardized payers’ pricing. On this note, a clinical study backed by Elsevier Inc. was published in November 2020, comparing the cost-effectiveness of these commodities. It revealed a per-patient cost reduction and per-procedure savings of 21.6% and USD 56,385.0 respectively during hospitalization in the case of thoracotomy rather than sternotomy, as thoracotomy implantable devices were more affordable. This implies the rising urge for innovations in this field, offering better resolutions.

Comparative Analysis of Hospitalization Costs for Thoracic Surgeries (Thoracotomy vs. Sternotomy) (2020)

|

Resource Category |

Thoracotomy (per Patient) (in USD) |

Sternotomy (per Patient) (in USD) |

Savings in Thoracotomy (in USD) |

|

Operating Room |

17,469.0 |

19,794.0 |

2325.0 |

|

MRI Scans |

15.0 |

25.0 |

10.0 |

|

CT Scans |

1495.0 |

1821.0 |

326.0 |

|

Cardiac Catheterization |

3571.0 |

3454.0 |

-117.0 |

|

Supplies & Equipment |

29,759.0 |

37,209.0 |

7450.0 |

|

Implantable Devices |

60,957.0 |

65,012.0 |

4055.0 |

Source: The Annals of Thoracic Surgery Journal

Key Thoracic Surgery Devices Market Insights Summary:

Regional Highlights:

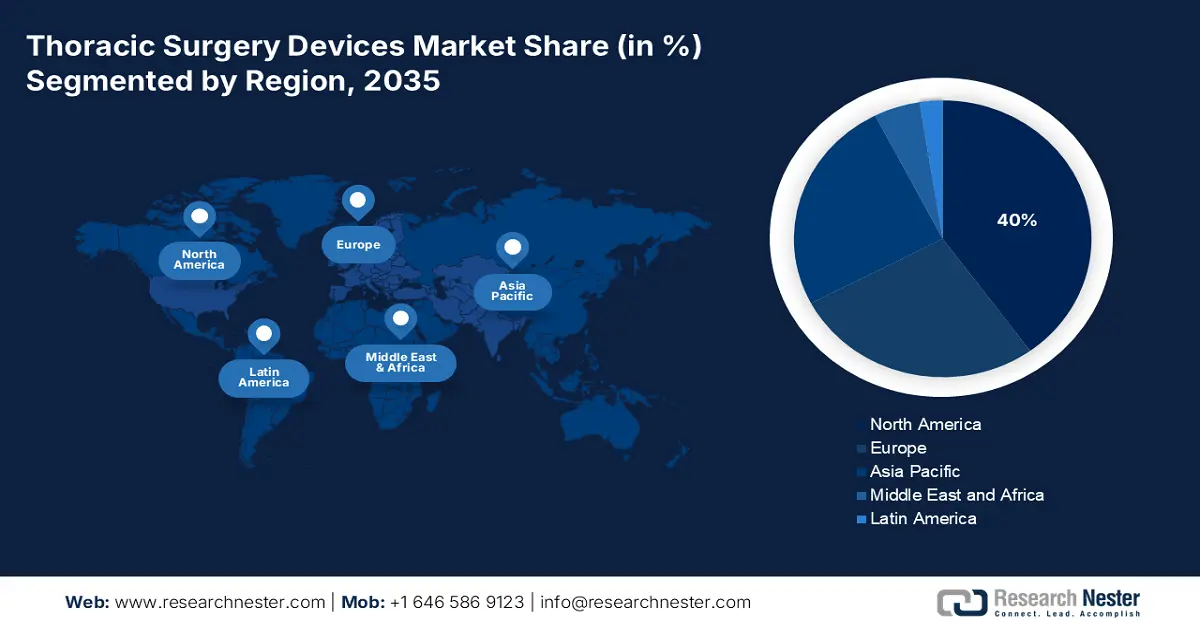

- North America's 40% share in the Thoracic Surgery Devices Market is driven by a wide network of equipped medical facilities and dedicated research institutions, fostering growth through 2035.

- Asia Pacific's thoracic surgery devices market anticipates the fastest CAGR through 2026–2035, fueled by stable capital influx and growing patient populations in China and India.

Segment Insights:

- The Forceps segment is anticipated to capture 28.5% market share by 2035, driven by innovations in forceps with better ergonomics and robotic system compatibility.

Key Growth Trends:

- Growing adoption of robotics in surgeries

- Increased investments in respiratory interventions

Major Challenges:

- Economic barriers and disparities

- Limitations in skills and reimbursement

- Key Players: Medtronic plc, Intuitive Surgical, Dextera Surgical Inc., Medela Healthcare.

Global Thoracic Surgery Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 798.91 million

- 2026 Market Size: USD 844.93 million

- Projected Market Size: USD 1.49 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 12 August, 2025

Thoracic Surgery Devices Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of robotics in surgeries: With the shifting consumer preferences toward procedures with reduced invasiveness and expense, the thoracic surgery devices market has introduced surgical robots. The worldwide robotic surgery and surgical robot industries are predicted to reach USD 19.0 billion and USD 9.5 billion by 2027 and 2026 respectively: as per ScienceDirect & UK-RAS Network. In this regard, a 2020 NLM study presented a lesser length of hospital stays and a lower total direct mean cost of USD 16,502.0 (vs. USD 20,012.0) for robot-assisted thoracic surgeries, in comparison to others. Thus, these advanced tools can deliver enhanced dexterity and precision during interventions, making them a crucial growth factor in this field.

- Increased investments in respiratory interventions: Considering the close association with cardiac issues, many public and private investors are now prioritizing the market. This is securing a continuous capital influx, fueling innovation, commercialization, and globalization of this field. For instance, in November 2021, New View Surgical earned USD 9.0 million of worth series B funding, empowering its aim to market its diagnostic and therapeutic tool, VisionPort System, for thoracic and abdominal procedures. Such financial support is propelling the adoption of the minimally invasive surgery industry across the globe, inspiring others to bring advancements to this sector.

Challenges

- Economic barriers and disparities: Despite the efforts to minimize operational and production costs, the thoracic surgery devices market still faces restrictions in wide adoption. The associated advanced procedures often create difficulties for residents in terms of affordability, limiting their access to these offerings. In addition, various medical settings from low- and middle-income countries fail to accommodate available solutions due to budget constraints and lack of funding, hindering the sector’s expansion and wide adoption.

- Limitations in skills and reimbursement: The use of advanced products, such as robotic assistance, from the market may require special knowledge to be handled, where there is limited availability of educational programs and campaigns. Additionally, the lack of insurance coverage for specific devices develops hesitation among patients due to insufficient funds. This may make the process delayed, impacting the effectiveness of the treatment and discouraging consumers from investing in this field.

Thoracic Surgery Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 798.91 million |

|

Forecast Year Market Size (2035) |

USD 1.49 billion |

|

Regional Scope |

|

Thoracic Surgery Devices Market Segmentation:

Product (Clamps, Forceps, Graspers, Staplers, Scissors, Spreaders, Needle Holders, Others)

Based on product, the forceps segment is set to hold thoracic surgery devices market share of over 28.5% by the end of 2035. Being a primary necessity for all kinds of clinical operations, this product is highly desired across the world. The use of forceps has become crucial due to their precise tissue-handling abilities and improved functionality. The newly developed forceps feature better ergonomics, grip, and compatibility with robotic systems. For instance, in March 2024, Günter Bissinger Medizintechnik GmbH launched CLARIS REVERSE Non-Stick Bipolar Forceps, delivering enhanced preparation performance with unique opening and closing behavior. This CE-authorized and FDA-approved tool is an excellent option for thoracic surgeons. Such innovations are securing a continuous business flow for this segment.

Surgery Type (Lobectomy, Wedge Resection, Pneumonectomy, Others)

In terms of surgery type, the lobectomy segment is predicted to captivate a significant share of the thoracic surgery devices market throughout the forecasted timeframe. This method of treatment is majorly used in lung cancer (LC), which is the highest occurring and deadliest malignancy across the globe. In 2022, 2.5 million new and 1.8 million death cases, caused by this condition, were registered worldwide: WHO report. Another NLM projection reported that the world is poised to witness 4·6 million and 3·5 million new cases and deaths due to lung cancer by the end of 2050. Many clinical studies have established that this type of surgery is one of the most cost-effective and safest ways of treating this disease while enhancing survival and recovery. Thus, with the rising patient population, demand in this segment is heightening.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Surgery Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thoracic Surgery Devices Market Regional Analysis:

North America Market Analysis

North America thoracic surgery devices market is projected to hold revenue share of more than 40% by 2035. The region encompasses a wide network of equipped medical facilities with high-tech infrastructure, which increases availability and accessibility in this field. In addition, there are dedicated academic institutions and organizations, which are meticulously conducting extensive research on this category to develop innovative solutions. For instance, in April 2024, three risk calculators were introduced for isolated tricuspid valve repair and replacement surgeries by the Society of Thoracic Surgeons (STS). This technology helps surgeons with predictability and informed decision-making, improving outcomes.

According to government data, the U.S. retained its leadership in the medical device industry with USD 103.0 billion worth of exports and 2.0 million employments. This signifies that the U.S. market is pledged with the strong presence of global MedTech pioneers such as Johnson & Johnson, Medtronic, and Abbott. For instance, in October 2024, Johnson & Johnson MedTech unveiled a buttressing device, ECHELON ENDOPATH Staple Line Reinforcement for bariatric, thoracic, and general operations. These firms are garnering a stable and secure supply channel for consumers, which ensures a lucrative line of business and expands the territory of this merchandise.

Canada consists of a large patient pool of LC, which is pushing the country to focus on bringing advancements to the thoracic surgery devices market. Despite the absence of proper government funding, the nationwide high economic status allows citizens to engage their financial forces to implement extended research networks for this field. This tendency to spend out-of-pocket is further testified by a survey conducted by the Canadian Journal of Surgery, published in October 2022. The statistics revealed that 70.5% of the 411 candidates were ready to pay a supplemental cost of USD 2000.0, along with the reimbursement coverage, to access robotic-assisted thoracoscopic surgery.

APAC Market Statistics

Asia Pacific is projected to register the fastest CAGR in the thoracic surgery devices market during the forecasted timeline. The region is witnessing rapid emergence in this field due to a stable capital influx in the healthcare infrastructure of developing countries such as China and India. In addition, their emphasizing capacity of manufacturing medical devices is commendably stimulating progress. Additionally, the notably magnified population of heart failure (HF) and LC patients is pushing governments to spread awareness about early diagnosis and intervention, fueling demand in this sector. On this note, the Journal of Thoracic Oncology stated that the rates of LC incidences and mortalities in the eastern region of APAC were 34.4 and 28.1 per 100,000 citizens till 2022.

The governing bodies in India are proactively contributing to the region’s progress by allocating heavy investments in the market. The conjugated efforts from both public and private institutions in accommodating the domestic healthcare infrastructure with advanced technologies are propelling augmentation in this field. For instance, in July 2024, DPU Super Specialty Hospital inaugurated a dedicated department of robotic thoracic surgery in Pune, India. The specific facility is now equipped with expertise in minimally invasive thoracic surgeries, addressing cardiological and pulmonary ailments. This is evidence of the increasing adaptation of tech-based solutions in nationwide streamlined medical settings.

China is becoming a hub of manufacturing forces for solidifying its proprietorship in the regional market. With a well-established international trading channel, the country is propagating this field with sufficient distribution networks. In this regard, China secured its place among the top importers and exporters of medical instruments, accounting for USD 10.6 billion and USD 12.3 billion in 2024 respectively, as per OEC data. These figures highlight the nation’s strength in accumulating and cultivating resources for supporting interventional operations including thoracic surgery. Furthermore, China is also investing in technologically advanced tools.

Key Thoracic Surgery Devices Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cardio Medical GmbH

- Intuitive Surgical

- Richard Wolf GmbH

- Grena Ltd.

- Dextera Surgical Inc.

- Teleflex Inc.

- Medela Healthcare

- LivaNovaplc

- Sklar Surgical Instruments

- DePuy Synthes

The thoracic surgery devices market encompasses a wide range of product lines, from basic to advanced, which enables a healthy business environment for key players. They focus on consolidating their leadership through continuous discoveries and globalization. For instance, in November 2023, Medtronic expanded its cardiac surgery portfolio with the launch of its Penditure Left Atrial Appendage (LAA) Exclusion System in the U.S. marketplace. The innovative and implantable clip features single-use delivery in left atrial appendage management (LAAM), enabling better hand control for surgeons. Similarly, in January 2024, Olympus Corporation introduced an energy platform, ESG-410, to assist in procedures such as thoracic surgery. Such key players are:

Recent Developments

- In October 2024, Medtronic introduced Avalus Ultra Bioprosthesis valve at the annual congress of the European Association for Cardio-Thoracic Surgery (EACTS), held in Lisbon. The device is engineered to offer user convenience in implantation and lifetime patient management.

- In August 2024, DePuy Synthes launched a plate and screw fixation system, MatrixSTERNUM, for use in stabilizing and securing the front part of the chest wall after procedures. The tool is crafted to provide stronger locking strength, faster chest fixation, and thinner, low-profile plates during thoracic surgeries.

- Report ID: 7385

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thoracic Surgery Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.