Non-invasive Monitoring Devices Market Outlook:

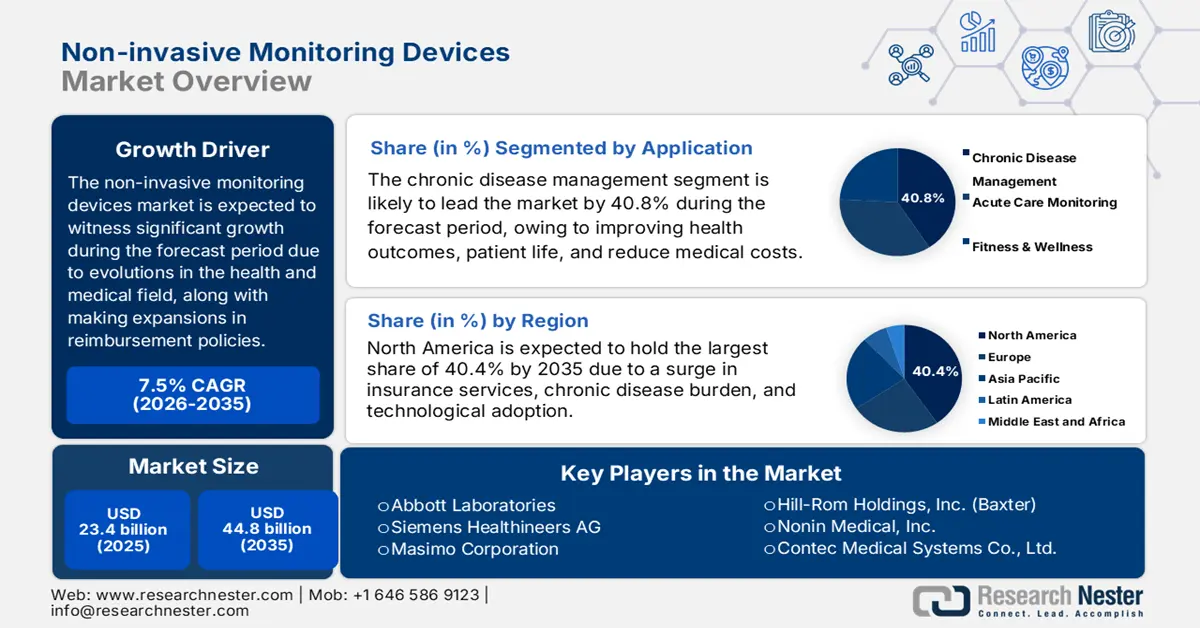

Non-invasive Monitoring Devices Market size was over USD 23.4 billion in 2025 and is estimated to reach USD 44.8 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of non-invasive monitoring devices is assessed at USD 25.1 billion.

The worldwide market is currently witnessing a paradigm transition, which is effectively fueled by evolving health and medical demands, along with technological advancement. According to an article published by NLM in October 2024, the wearable devices landscape deliberately reflects technological solutions, in the case of heart failure, denoting 20% of the population in the U.S. utilizing smart watches. This is followed by 18% using smart brands, 14% patches, 8% rings, 11% smart shirts, another 8% chest straps, 3% undertaking smart pills or carrying smart bottles, 7% wearing vests, 6% fingertip sensors, 5% phone attachments, thus creating an optimistic outlook for the overall market.

Moreover, the aspect of initiating expansions in reimbursement models to ensure remote patient monitoring, which economically incentivizes health and medical providers to implement these devices, is also driving the non-invasive monitoring devices market globally. Besides, as per an article published by NLM in March 2024, a clinical study was conducted on 186 patients with chronic conditions to evaluate remote monitoring through telemedicine services. This resulted in a decrease in health expenses for disease-specific markers from USD 12,000 to USD 11,000. Additionally, there was a reduction in cost for symptom severity from USD 3,500 to USD 2,000, thus creating a positive impact for the market across different nations.

Key Non-invasive Monitoring Devices Market Insights Summary:

Regional Highlights:

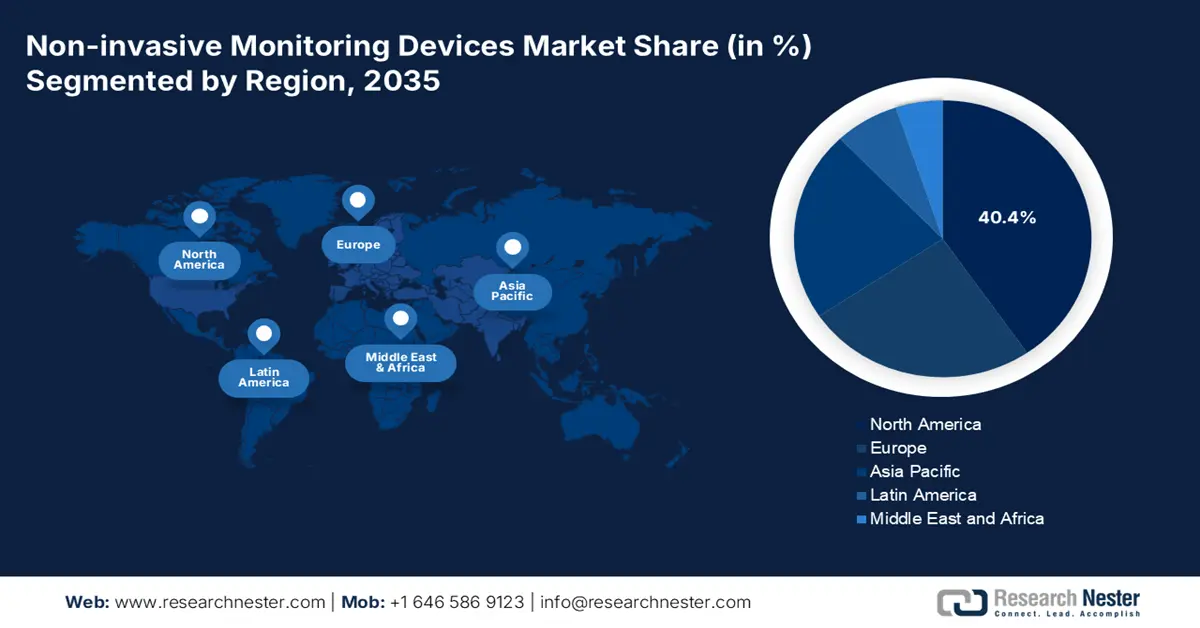

- North America in the non-invasive monitoring devices market is expected to secure the largest share of 40.4% by 2035, owing to robust reimbursement policies, an increasing chronic disease burden, the adoption of home-based care services, and advanced technological integration.

- Asia Pacific is anticipated to witness the fastest growth through 2026–2035, impelled by the region’s massive aging population, government-led digital health initiatives, expanding patient pool, and the growing implementation of home-based monitoring solutions.

Segment Insights:

- The chronic disease management segment in the non-invasive monitoring devices market is projected to hold the largest share of 40.8% by 2035, propelled by its crucial role in optimizing health outcomes, enhancing quality of life, and reducing healthcare expenditures.

- The home care settings segment is anticipated to capture a significant share by 2035, supported by the convergence of technological, economic, and demographic forces driving the shift toward decentralized and home-based care models.

Key Growth Trends:

- Rise in cardiovascular disease

- Integration of machine learning and artificial intelligence

Major Challenges:

- Regulatory validation and obstacles

- Clinical integration and adoption into workflows

Key Players: Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE Healthcare (U.S.), Abbott Laboratories (U.S.), Siemens Healthineers AG (Germany), Masimo Corporation (U.S.), Nihon Kohden Corporation (Japan), Hill-Rom Holdings, Inc. (Baxter) (U.S.), Nonin Medical, Inc. (U.S.), Contec Medical Systems Co., Ltd. (China), Omron Corporation (Japan), Drägerwerk AG & Co. KGaA (Germany), Smiths Medical (U.S.), Mindray Bio-Medical Electronics Co., Ltd. (China), Biotronik SE & Co. KG (Germany), Boston Scientific Corporation (U.S.), Dexcom, Inc. (U.S.), iRhythm Technologies, Inc. (U.S.), AliveCor, Inc. (U.S.), Sotera Wireless (U.S.)

Global Non-invasive Monitoring Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.4 billion

- 2026 Market Size: USD 25.1 billion

- Projected Market Size: USD 44.8 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, China

- Emerging Countries: India, South Korea, Australia, Singapore, Brazil

Last updated on : 23 October, 2025

Non-invasive Monitoring Devices Market - Growth Drivers and Challenges

Growth Drivers

- Rise in cardiovascular disease: The escalation in the international burden of cardiovascular diseases is a primary growth driver for the non-invasive monitoring devices market. This has created a critical and sustained need for long-lasting management and accessible diagnostic tools. According to an article published by the World Health Organization (WHO) in July 2025, approximately 19.8 million people died from cardiovascular diseases as of 2022, which represents an estimated 32% of the international population. In addition, 85% of these deaths were caused owing to heart stroke and attack, thus increasingly bolstering the market’s need.

- Integration of machine learning and artificial intelligence: The significant infusion of AI and machine learning caters to the fundamental transformation of devices from passive data collectors to intelligent diagnostic partners. This results in predicting adverse events, and enables proactive and personalized health and medical interventions, which is suitable for the non-invasive monitoring devices market. As per an article published by NLM in May 2023, the FDA approved 343 AI-based solutions for remote monitoring devices, of which 74% of cardiovascular dominated the U.S. market. This is followed by 9% each for anesthesiology and neurology, 6% for clinical chemistry, and 2% care management.

- Consumerization of medical devices: A robust trend for direct-to-consumer access and user-centric design is combating gaps between home and clinical settings. This is further empowering patients with medical-grade monitoring through wearable and intuitive form factors, which is positively fueling the non-invasive monitoring devices market. According to the January 2025 MEDPAC Government data report, large-scale medical device organizations are continuously profitable and usually account for profit margins ranging from 20% to 30% globally. Therefore, this denotes a huge growth opportunity for the market, which is readily possible through organizational contributions.

Video Displays 2023 Export and Import Uplifting the Non-invasive Monitoring Devices Market

|

Countries |

Export |

Import |

|

China |

USD 22.4 billion |

- |

|

Mexico |

USD 12.7 billion |

- |

|

Vietnam |

USD 4.6 billion |

- |

|

U.S. |

- |

USD 17.3 billion |

|

Germany |

- |

USD 3.4 billion |

|

UK |

- |

USD 3.2 billion |

|

Global Trade |

USD 70.8 billion |

|

|

Global Trade Share |

0.3% |

|

|

Product Complexity |

0.1 |

|

Source: OEC

Historical Diabetes Incidence Boosting the on-invasive Monitoring Devices Market Demand

|

Year |

Incidence |

|

2000 |

151 million |

|

2003 |

194 million |

|

2007 |

246 million |

|

2010 |

285 million |

|

2011 |

366 million |

|

2013 |

382 million |

|

2015 |

415 million |

|

2017 |

425 million |

|

2019 |

463 million |

|

2021 |

537 million |

|

2030 |

643 million |

|

2045 |

783 million |

Source: NLM

Challenges

- Regulatory validation and obstacles: The roadmap to commercialize advanced non-invasive devices is frequently complicated and protracted, owing to fragmented and rigorous landscapes across different nations. While agencies, such as the U.S. FDA are modifying their policies for digitalized health technologies, algorithmic accuracy is still considered a hurdle, which is causing a hindrance in the non-invasive monitoring devices market. Besides, the achievement of administrative clearance in a particular region do not guarantee authorization in another region, thus pressuring organization to navigate distinct and multiple processes.

- Clinical integration and adoption into workflows: The aspect of comprehensive clinical adoption seems to be a formidable challenge in the non-invasive monitoring devices market, despite the presence of regulatory approval. Health and medical professionals, therefore, are bound to be hesitant to implement data from the latest devices, particularly consumer-grade wearables, into clinical-based decision-making without clinical utility and overwhelming proof of accuracy from reviewed studies, thereby negatively impacting the market’s growth.

Non-invasive Monitoring Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 23.4 billion |

|

Forecast Year Market Size (2035) |

USD 44.8 billion |

|

Regional Scope |

|

Non-invasive Monitoring Devices Market Segmentation:

Application Segment Analysis

Based on the application, the chronic disease management segment in the non-invasive monitoring devices market is projected to account for the highest share of 40.8% by the end of 2035. The segment’s upliftment is extremely driven by its importance for optimizing health results, improve quality of life, and diminish health and medical expenses. According to an article published by NLM in July 2024, the urban primary healthcare facility in Poland caters to an estimated 4,000 patients, along with 21,700 visits as of 2022. This denotes a huge opportunity for health professionals to manage patients with extreme chronic conditions, thereby making it suitable for the overall segment’s growth.

End user Segment Analysis

Based on the end user, the home care settings segment in the non-invasive monitoring devices market is projected to garner the second-highest share during the forecast period. The segment’s development is fueled by a strong convergence of technological, economic, and demographical forces. The rising incidence of rare diseases, along with a surge in the aging population, are creating unsettling pressure among conventional healthcare infrastructures and transitioning care paradigms towards home-based and decentralized models. In addition, this transition is financially assisted by extending reimbursement policies to ensure remote patient monitoring.

Acuity Level Segment Analysis

Based on the acuity level, the low-acuity and ambulatory monitoring segment in the non-invasive monitoring devices market is expected to cater to the third-highest share by the end of the predicted duration. The segment’s development is propelled by its capability to ensure early patient deterioration detection, optimize patient comfort, diminish medical costs, and increase workflow efficacy. As stated in the November 2023 article, implantable cardioverter-defibrillators and permanent pacemakers are considered suitable ambulatory ECG monitoring devices, and these exhibit a specificity and sensitivity of more than 95% in identifying atrial fibrillation, thereby enhancing the segment’s exposure.

Our in-depth analysis of the non-invasive monitoring devices market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Acuity Level |

|

|

Component |

|

|

Product |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-invasive Monitoring Devices Market - Regional Analysis

North America Market Insights

North America in the non-invasive monitoring devices market is anticipated to garner the largest share of 40.4% by the end of 2035. The market’s growth in the region is highly attributed to the presence of a robust reimbursement policy, an increase in the chronic disease burden, the shift to home-based care services, and technological integration. According to an article published by the FDA Government in October 2023, the organization declared the Federal Register notice pertaining to Guidance Documents Related to Coronavirus Disease that was revised for 180 days to provide suitable guidance. Therefore, this policy is useful for the device to measure and detect the following physiological parameters and ensure patient monitoring.

FDA Policy for Non-invasive Monitoring Devices in North America (2023)

|

Device Type |

Classification Administration |

Product Code |

Class Category |

|

Monitoring spirometer |

21 CFR 868.1850 |

BZK |

II |

|

Noninvasive blood pressure measurement system |

21 CFR 870.1130 |

DXN |

II |

|

Cardiac monitor (including cardiotachometer and rate alarm) |

21 CFR 870.2300 |

DRT, MWI, MSX, PLB |

II |

|

Audiometer |

21 CFR 874.1050 |

EWO, LYN |

II (510(k) exempt) |

|

Otoscope |

21 CFR 874.4770 |

ERA |

I (510(k) exempt) |

|

Computerized cognitive assessment aid |

21 CFR 882.1470 |

PKQ, PTY |

II, II (510(k) exempt) |

Source: FDA

The non-invasive monitoring devices market in the U.S. is growing significantly, owing to the existence of supportive administrative frameworks, chronic disease management, the role of the CMS in establishing reimbursement pathways, Medicare spending, and generous funding allocation from the National Institutes of Health (NIH). As per a data report published by the Health of Health Organization in 2025, the Medicare spending was USD 1.0 trillion and Medicaid was USD 87.1 billion as of 2023. This represents a 4.6% and 4.5% rise since 2022, making it suitable for catering to patients with chronic conditions in the country.

The non-invasive monitoring devices market in Canada is also growing due to the robust federal push for decentralized healthcare, aiming at combating geographic disparities in accessibility. In addition, the increased prevalence of rare disorders, a surge in the demand for remote monitoring solutions, and support through governmental investments are also uplifting the market in the country. As stated in the November 2023 ITA data report, the country’s medical device market has been estimated to be USD 6.8 billion as of 2022, which is projected to grow at 5.4% till 2028. Based on this surge, the overall healthcare expenditure in the country amounts to approximately CAD 331 billion or CAD 8,563 per capita, thereby positively impacting the market’s growth.

APAC Market Insights

Asia Pacific in the non-invasive monitoring devices market is predicted to emerge as the fastest-growing region during the forecast period. The market’s exposure in the region is propelled by the presence massive aging population, suitable government-based health and medical digitalization techniques, an increased patient pool, and the implementation of home-based monitoring services. According to the 2025 UNFPA article, 1 in 4 people in the region will be more than 60 years of age by the end of 2050, while the older population will triple and reach 1.3 billion people in the same year. This upsurge leads to increased chronic disorders, for which there is a huge growth opportunity for the overall market in the region.

Aging and Medical Components in the Asia Pacific Driving the Non-invasive Monitoring Devices Market (2025)

|

Indicators |

Cambodia |

Indonesia |

Malaysia |

Japan |

|

Population (thousand) |

17,424 |

281,190 |

35,126 |

124,371 |

|

People aged more than 65 years |

6.0% |

7.0% |

7.5% |

29.6% |

|

Age-based diabetes prevalence |

7.3% |

10.6% |

19.0% |

6.6% |

|

Obesity among adults |

4.4% |

11.2% |

22.1% |

5.5% |

|

TB incidence (per 100,000 population) |

320 |

385 |

113 |

10 |

|

Medical doctors per 10,000 |

2.1 |

6.9 |

23.2 |

26.1 |

Source: NLM

The non-invasive monitoring devices market in China is gaining increased importance, owing to the existence of governmental policies, an increase in diabetes prevalence, which results in the glucose monitoring device demand, and effective alignment with the Healthy China 2030 initiative. According to an article published by NLM in July 2024, a survey-based study was conducted on 111,943 participants between 2005 to 2022, wherein there was an increase by 9.6% to 13.9% for diabetes prevalence among adults in Beijing aged 18 to 79 years. Additionally, there was also a surge in undiagnosed diabetes from 3.5% to 7.2%, thus creating an optimistic outlook for the market.

The non-invasive monitoring devices market in India is also developing due to the presence of the government’s Ayushman Bharat Digital Mission (ABDM), which is developing a unified and digitalized health ecosystem for directly bolstering the need for compatible and standard monitoring devices. Additionally, the Union Health Ministry’s generous fund allocation for the digital health strategy is also boosting the market’s growth. As stated in the October 2024 Ministry of Health and Family Welfare data report, more than 67 crore Ayushman Bharat Health Accounts have been created, and 42 crore health records have been linked. In addition, over 1.3 lakh infrastructures are ABDM-based, which include 17,000 private facilities, 4.7 lakh health and medical professionals, and 3.3 lakh health centers, thereby denoting massive development for the market in the country.

Europe Market Insights

Europe in the non-invasive monitoring devices market is expected to grow steadily by the end of the projected timeline. The market’s upliftment in the region is highly driven by a tactical push towards digitalized health integration, aging demographics, the requirement for efficient care models, and the Europe Health Data Space’s (EHDS) facilitation to promote telehealth services. As stated in the November 2024 NLM article, a survey-based study was conducted, wherein 53 countries of the region participated to evaluate telehealth services. This resulted in 9 countries, which is 26%, reporting unveiling telemedicine services, and almost 21, which is 60% of countries, stating that these services have been optimized, thus making it suitable for the market’s development.

The non-invasive monitoring devices market in Germany is gaining increased exposure, owing to its leadership, which is driven by the Digital Health Application, DiGA framework, to offer fast-track clearance as well as create a reimbursement pathway for digitalized health strategies. As per an article published by JMIR Publications Organizations in August 2024, Levidex, one of the most preliminary DiGA, provides a long-term license at a high expense, amounting to €2077.4. Additionally, there are other DiGAs that are effective for 3 months, ranging from an estimated €200 to €700, along with a median price of €535.4, thereby denoting the market’s growth.

Key Non-invasive Monitoring Devices Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- Abbott Laboratories (U.S.)

- Siemens Healthineers AG (Germany)

- Masimo Corporation (U.S.)

- Nihon Kohden Corporation (Japan)

- Hill-Rom Holdings, Inc. (Baxter) (U.S.)

- Nonin Medical, Inc. (U.S.)

- Contec Medical Systems Co., Ltd. (China)

- Omron Corporation (Japan)

- Drägerwerk AG & Co. KGaA (Germany)

- Smiths Medical (U.S.)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

- Biotronik SE & Co. KG (Germany)

- Boston Scientific Corporation (U.S.)

- Dexcom, Inc. (U.S.)

- iRhythm Technologies, Inc. (U.S.)

- AliveCor, Inc. (U.S.)

- Sotera Wireless (U.S.)

- Medtronic plc is one of the global healthcare technology leaders, well-known for its extended chronic disease management solutions portfolio. It is dominant in providing non-invasive cardiac monitoring, along with innovative systems for home-based patient data management. In its 2024 quarter fiscal 2024 financial report, the company’s revenue increased by 0.5%, accounting for USD 8.6 billion, with USD 0.49 as earnings per share.

- Koninklijke Philips N.V. has successfully positioned itself by developing and implementing solutions for both home and hospital settings. Its wide-ranging suite comprises wearable sensors, telehealth platforms, and vital sign monitors, designed to provide patient-centric and continuous monitoring.

- GE Healthcare is considered one of the leading diagnostic and medical technology organizations since it offers comprehensive non-invasive monitoring systems for high-acuity hospitals. The organization has made generous investments in AI-based and digitally integrated analytics to improve patient monitoring. Besides, as per the 2024 annual report published in February 2025, the revenue growth surged by 2.0%, with diluted earnings per share amounting to USD 1.5 in comparison to USD 0.8 the previous year, thereby denoting advancement.

- Abbott Laboratories is a consumer-friendly and medical-grade company for its notable FreeStyle Libre system, which is appropriate for continuous glucose monitoring. The company continues to uplift progression in biosensor technology and empower patients with diabetes to successfully and proactively manage their conditions.

- Siemens Healthineers AG is one of the key players in innovative monitoring and diagnostic solutions, and effectively leverages its robust imaging heritage. The firm has readily focused on adopting monitoring data with diagnostic results to offer a wide-ranging patient health view across the care facility.

Here is a list of key players operating in the global market:

The international non-invasive monitoring devices market is significantly competitive, and is characterized by a mix of advanced start-ups and established medical technology firms. Notable players, such as GE Healthcare, Philips, and Medtronic, have jointly leveraged their extended research and development strategies, along with worldwide distribution networks, to effectively maintain dominance. For instance, in May 2025, Afon Technology Ltd received over £2million in funding from Horizon Europe and is currently operating on a first-ever wearable non-invasive blood glucose sensor. The purpose is to measure real-time and eliminate the need for frequent finger pricking, thus uplifting the market.

Corporate Landscape of the Non-invasive Monitoring Devices Market:

Recent Developments

- In December 2024, Liom has successfully cracked the holy grail of non-invasive glucose monitoring and effectively achieved more than USD 25 million as a generous fund to commence with its Series A, suitable for creating and evaluating wrist-worn devices by over 100 people by the 2025 end.

- In November 2024, Asahi Kasei Microdevices unveiled sensor technologies, which include contactless and millimeter-wave radar monitoring, thereby making AgeTech more accessible and dependable by integrating AI.

- In June 2024, Medasense proudly declared its tactical collaboration with Nihon Kohden for the outstanding distribution of its evolving pain monitoring device in Japan, with the intention of transforming pain management solutions across Japan-based healthcare infrastructures.

- Report ID: 1386

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.