Giardiasis Treatment Market Outlook:

Giardiasis Treatment Market size was valued at USD 1.18 billion in 2025 and is projected to reach USD 1.75 billion by the end of 2035, rising at a CAGR of 3.99% during the forecast period, i.e., 2026-2035. In 2026, the industry size of giardiasis treatment is assessed at USD 1.23 billion.

Over the last several years, treatment options for giardiasis have shifted dramatically, with advancements in both research and knowledge of the epidemiology of pathogens. New formulations, including both combination therapies and sustained-release products, are leading the way for efforts to improve compliance and efficacy. There are also more avenues of efforts to repurpose older antiparasitic medications in treatment programs to address Giardia duodenalis and resistance issues. Progress in methods for diagnosis, including rapid screening potential with rapid antigen detection tests, immunoassays and molecular diagnostics, is allowing for better identifying infections earlier and with significantly greater accuracy, which can lead to improvement in therapy initiation and, ultimately, outcomes.

In addition to treatment improvements, there is a concerted effort worldwide to improve access to treatment. Governments and NGOs are working to understand access to treatment as they partner to develop health system capacity and to promote messaging campaigns related to water, sanitation. The growth of telehealth and digital health platforms can allow diagnosis and communication around treatment in remote or distant locations. Increased investment in the vaccine development against giardiasis indicates the shift from treatment to prevention, which could change the face of giardiasis control in the next decade.

Key Giardiasis Treatment Market Insights Summary:

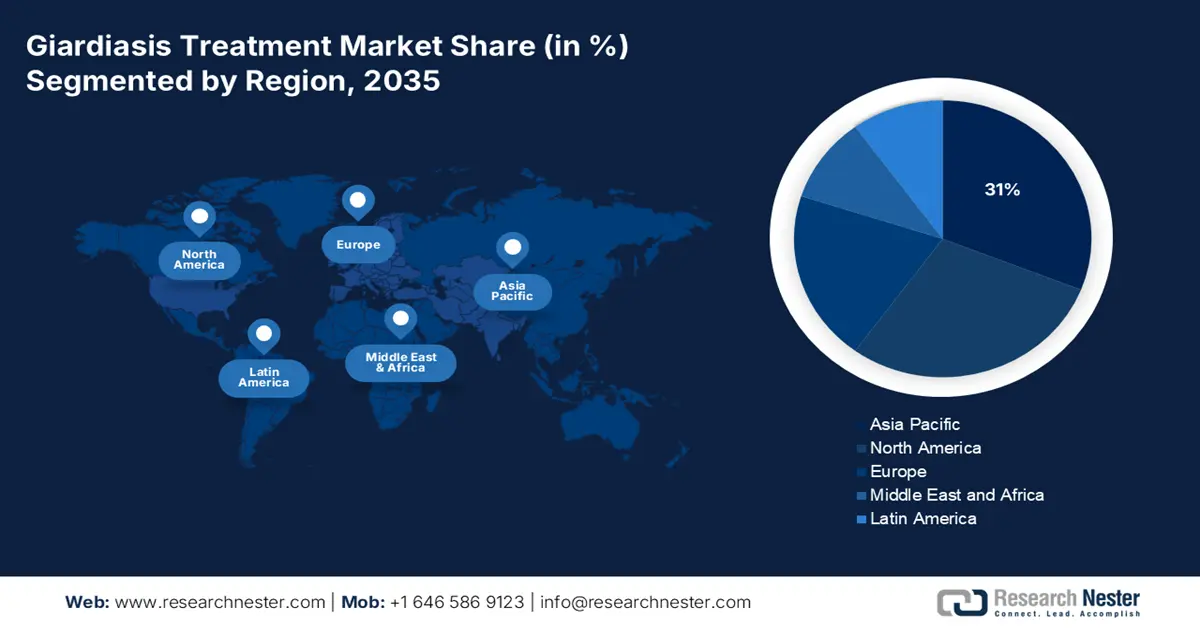

Regional Insights:

- Asia Pacific is projected to hold the largest 31% share of the Giardiasis Treatment Market by 2035, supported by expanding healthcare infrastructure and sanitation improvement programs across developing countries.

- North America is anticipated to witness robust CAGR through 2026–2035, spurred by advanced healthcare systems and substantial government funding for parasitic infection management.

Segment Insights:

- The hospitals segment is estimated to capture a 46% share by 2035 in the Giardiasis Treatment Market, propelled by the availability of advanced diagnostics and prioritization of hospital-based infectious disease programs.

- The antiprotozoals segment is forecast to command a 41% share by 2035, driven by the proven efficacy and global adoption of Metronidazole and Tinidazole for giardiasis treatment.

Key Growth Trends:

- Rising prevalence of waterborne diseases

- Growing access to generic antiparasitic drugs

Major Challenges:

- Drug resistance to first-line treatments

- Lack of awareness in endemic regions

Key Players: Pfizer Inc., Roche, Bristol-Myers Squibb, Bayer AG, Mylan N.V., Lupin Pharmaceuticals, Teva Pharmaceutical Industries Ltd., AstraZeneca, Merck & Co., Inc., Hikma Pharmaceuticals PLC, AbbVie Inc., Zydus Cadila, GSK (GlaxoSmithKline), Novartis AG, Sanofi, Sun Pharmaceutical Industries Ltd., Heritage Pharmaceuticals Inc., Aurobindo Pharma Ltd., Roxane Laboratories, Inc., CSL Limited (via Seqirus).

Global Giardiasis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.18 billion

- 2026 Market Size: USD 1.23 billion

- Projected Market Size: USD 1.75 billion by 2035

- Growth Forecasts: 3.99% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, South Africa

Last updated on : 12 September, 2025

Giardiasis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of waterborne diseases: A 2023 World Health Organization report estimates that an estimated 1 million people die from diarrhea every year as a result of poor hand hygiene, sanitation, and drinking water. The increased frequency of waterborne diseases—especially in developing countries—is still increasing the demand for effective giardiasis treatment. Giardia lamblia is a major protozoan cause of diarrheal disease. The increase in diarrheal disease burden could be due to improper sanitation and safe drinking-water practices, and increased human occupancy. There has been an increase in access to antiparasitic medications in endemic regions, allowing for greater access to treatment and creating further demand in what is seen as a very precise market segment.

- Growing access to generic antiparasitic drugs: The global supply of affordable generic medication such as metronidazole, tinidazole, and nitazoxanide - which has previously limited treatment access, particularly in low- and middle-income countries - is increasing. Manufacturers of generic drugs, mainly within India, the USA, and Israel, are expanding production to accommodate a greater demand. Their efforts are accompanied by funding from government procurement and NGO-led distribution programs. Furthermore, cheaper drugs lead to increased patient adherence to improved access, which also expands the population treated and the market growth.

- Improved diagnostic technologies: Over the last two decades, advances in molecular diagnostics, including PCR-based tests and rapid antigen detection kits, have led to the detection of giardiasis at earlier and more accurate levels. Rapid developments in these diagnostic technologies decrease the risk of making a wrong diagnosis and reduce the time to treatment initiation, thereby decreasing complications and the delay of spread. This advancement of diagnostic technologies improves disease surveillance and creates a greater demand for treatment through health care systems.

Challenges

- Drug resistance to first-line treatments: The increasing resistance to metronidazole and tinidazole, the most common drug therapies for giardiasis, is perhaps the most important issue. Studies published by the CDC reported developing resistance in strains of Giardia lamblia, especially in geographic locations where there are other high rates of re-infection and self-medication practices, limiting treatment effectiveness, necessitating the use of alternative or combination therapies that generally are more expensive and limited access.

- Lack of awareness in endemic regions: Low-income and rural communities where giardiasis is endemic have poor awareness surrounding giardiasis and its symptoms. Many cases either go undiagnosed when treated or are confused for generic gastrointestinal problems and accommodation of a public health problem or disease with a 'non-specific' GI issue isn't directly impacted. The under-reporting of giardiasis poses as a significant problem for not only surveillance; it is difficult to track funding dollars which impedes a disease prevention aspect and a poorly educated public health and citizenry impairs long-term prevention, treatment when diagnosed and leads to failure of the epidemiologic cycle of intervention.

Reported Giardiasis Cases in Georgia (2012–2021)

|

Year |

Reported Cases |

|

2012 |

570 |

|

2013 |

650 |

|

2014 |

670 |

|

2015 |

740 |

|

2016 |

760 |

|

2017 |

610 |

|

2018 |

660 |

|

2019 |

480 |

|

2020 |

220 |

|

2021 |

260 |

Source: Georgia Department of Public Health

Health Impact of Unsafe Water, Sanitation, and Hygiene (WASH) in 2019

|

Category |

Value |

Description |

|

Mortality |

1.4 million deaths |

Deaths preventable with safe WASH in 2019 |

|

Morbidity |

74 million DALYs |

Disability-Adjusted Life Years preventable with safe WASH in 2019 |

|

Attributable Fraction |

69% |

Percentage of all diarrhoea deaths attributed to unsafe WASH services in 2019 |

|

Diarrhoea Deaths |

>1 million deaths |

Deaths from diarrhoea due to unsafe WASH in 2019 |

|

Acute Respiratory Infection Deaths |

356,000 deaths |

Deaths due to acute respiratory infections from unsafe hand hygiene in 2019 |

Source: WHO

Giardiasis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.99% |

|

Base Year Market Size (2025) |

USD 1.18 billion |

|

Forecast Year Market Size (2035) |

USD 1.75 billion |

|

Regional Scope |

|

Giardiasis Treatment Market Segmentation:

End User Segment Analysis

The hospitals segment is estimated to account for the largest share of 46% in the giardiasis treatment market over the discussed timeframe. Hospitals dominate the end-user segment due to the stakes of diagnosis and treatment in the clinical environment, especially for acute and chronic cases of giardiasis. The World Health Organization (WHO) emphasizes that health care infrastructure is vital for the early detection and management of parasitology. Hospitals have resources for advanced diagnostics, such as PCR or antigen tests, that support targeted treatment therapy. In addition, government health systems worldwide that manage infectious disease programs prioritize hospitals when pursuing treatment as part of an infectious disease control strategy; especially in high-burden areas, these are seen as stable revenues in this segment.

Drug Class Segment Analysis

The antiprotozoals segment is poised to dominate the giardiasis treatment market with a share of 41% during the analyzed period. Other drug categories are effective in treating giardiasis, but still have yet to have similar success as antiprotozoals. Antiprotozoals have consistently dominated as a drug category in whichever country, with Metronidazole and tinidazole, with their published effectiveness and recommendations in the CDC Pink Book globally. Metronidazole and tinidazole are both known for their high cure rates and availability. There have been different selling focuses on the generic landscape, but these compounds provide reliable treatment in developed and developing countries.

Treatment Setting Segment Analysis

During the examined period, the inpatient segment is expected to hold a 31% market share in the giardiasis treatment industry. The inpatient treatment setting dominates the giardiasis treatment market due to especially severe and complicated cases that require hospitalization and intensive clinical oversight and supervision. Even the Centers for Disease Control and Prevention notes that most cases of giardiasis are treated in an outpatient setting, while hospitalized patients are usually representing patients with severe dehydration or malnutrition and/or patients who are significantly immunocompromised and possibly requiring intravenous therapy and supportive care. The sheer complexity of patients' conditions dictates that they receive care under inpatient status, justifying such a significant revenue share for the inpatient treatment portion of the market.

Our in-depth analysis of the giardiasis treatment market includes the following segments:

|

Segments |

Subsegments |

|

Drug Class |

|

|

Drug Type |

|

|

Distribution Channel |

|

|

Treatment Setting |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Giardiasis Treatment Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to capture the highest share of 31% in the global market by the end of 2035. The area has a high incidence of giardiasis cases due to poor access to safe drinking water and sanitation in many poverty-stricken developing countries. Countries across the Asia Pacific are investing heavily in healthcare infrastructure and public health programs aimed at water quality improvements and sanitation improvements, which creates a higher demand for effective treatments. In addition, the giardiasis market is supported by the area’s enlarging pharmaceutical and biotechnology industries, which create and make available new giardiasis treatments.

India has a very high burden of giardiasis, as many rural and peri-urban parts of the country still lack access to clean drinking water and sanitation. Various government initiatives, such as Jal Jeevan Mission and the Swachh Bharat Abhiyan, seek to prepare the water infrastructure and access to sanitation, which is driving the demand for diagnostics and treatment of giardiasis. As per the Department of Drinking Water and Sanitation

Ministry of Jal Shakti, through individual family tap connections, the Jal Jeevan Mission aims to supply all rural Indian households with safe and sufficient drinking water by 2024. Additionally, strong market growth may be attributed to India's increasing population, growing health care access, and increased knowledge of parasitic infections.

China is currently experiencing rapid urbanization, and consequently, some regions within the country have limited access to clean water. The Chinese government is heavily investing in water purification and sanitation efforts and rural health programs. China's increased spending on health care, the advancement of R&D into pharmaceuticals, and a strong public health surveillance program will continue to enable the early diagnosis and treatment of giardiasis in its population.

North America Market Insights

Throughout the projection period, North America is anticipated to experience a strong CAGR in the global giardiasis treatment market as a result of its developed healthcare system and full backing from well-financed government programs. The amount spent on healthcare, especially sizable amounts funded through Medicare and Medicaid programs, guarantees that treatment for giardiasis is widely available when successfully managed. Well-constructed disease surveillance and public health programs are already in place to mitigate the impact of waterborne infections. Because there is increasing awareness of giardiasis and other parasitic infections, there is an upward trajectory in demand. Additionally, with major pharmaceutical companies and constant investment in research and development, innovative treatment approaches are continually being introduced into the market.

Canada's healthcare system, along with provincial government-funded opportunities, contributes to giardiasis treatment choice in Canada. Safe drinking-water systems continue to be problematic, especially for remote and indigenous communities, keeping giardiasis relevant in federal and provincial First Nations health policy. Public health campaigns, budgets associated with sustained federal government transfer payments to provinces (as outlined by Health Canada and PHAC), and universal access to healthcare services in most provinces (Ontario and British Columbia) reflect growth opportunities in the market.

In the U.S., the healthcare system is among the most developed in the world, and giardiasis treatment is well funded with federal support through CDC, Medicare, and Medicaid for giardiasis surveillance, treatment, and interest in outpatient treatment options based on higher-than-expected numbers of cases of giardiasis. According to estimates made by the CDC, giardiasis is still the most common parasitic infection in the USA and among children and immunocompromised populations. Other opportunities for growth in the market are the awareness about giardiasis, support for diagnostic testing, strong insurance provider coverage, and pharmaceutical research and development activities.

Europe Market Insights

Europe is expected to have a substantial CAGR in the global giardiasis treatment market during the forecast period because of strict regulatory frameworks that govern hygiene and the water quality standards throughout the continent. These regulations will enhance the emphasis on preventative health care and early treatments, which will increase the demand for Giardiasis therapies. The high level of healthcare expenditure and the universal health systems within many countries in the region allow for a larger patient base to access the therapies.

France benefits from universal healthcare access and a comprehensive public health system. In addition to providing universal healthcare access, France has an extensive public health system that allows people to receive quick diagnosis and treatment for waterborne diseases. The French government actively monitors waterborne diseases and established great systems for monitoring water safety under the EU Drinking Water Directives. Increasing campaigns to raise awareness of watery diarrhea leading to dehydration and government funding for infectious disease control leads to increased demand for diagnostic and treatment services. France has active pharmaceutical development and government funding for research and development which contributes to its presence on the world stage.

With ongoing innovations in healthcare, Germany’s heavily regulated healthcare environment, and its design of proactive government initiatives for the prevention of infectious diseases, Germany has one of the largest markets for giardiasis treatment. Also one of the largest health spending in Europe, Germany has the means to aid in the early diagnosis and treatment of waterborne diseases. Germany is home to several pharmaceutical companies focused on developing antiparasitic drugs. Germany has strict water safety protocols to protect individuals from waterborne diseases, however, the unbiased access to health care and equity in access to healthcare can help it make significant strides towards increasing the market share of giardiasis treatment.

Key Giardiasis Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roche

- Bristol-Myers Squibb

- Bayer AG

- Mylan N.V.

- Lupin Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca

- Merck & Co., Inc.

- Hikma Pharmaceuticals PLC

- AbbVie Inc.

- Zydus Cadila

- GSK (GlaxoSmithKline)

- Novartis AG

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- Heritage Pharmaceuticals Inc.

- Aurobindo Pharma Ltd.

- Roxane Laboratories, Inc.

- CSL Limited (via Seqirus)

The market for Giardiasis Treatment has intense competition and it features a mix of multinational pharmaceutical companies and regional generic companies. The major players in this market, such as Pfizer, Roche, and Merck, are in the midst of developing and innovating new antiparasitic compounds through research and development. Companies such as Teva, Lupin, Mylan, and Sun Pharma are concentrating on efforts to expand access and affordability within the branded product segment. Strategic partnerships, such as those between Hikma and AbbVie, are helping to strengthen market position. The market consists of both branded formulations, which are innovation-led, and high-volume generics, increasing potential entry even within both developed and developing regions.

Here is a list of key players operating in the global giardiasis treatment market:

Recent Developments

- In March 2021, Lupin announced the launch of Nitazoxanide tablets (500 mg), used to treat diarrhoea, in the US market. For patients 12 years of age and above, 500 mg nitazoxanide tablets are recommended for the treatment of diarrhea brought on by Giardia lamblia or Cryptosporidium parvum.

In September 2021, Researchers released additional information regarding the first known giardiasis outbreak in Italy that was connected to tap water. Over 200 people were impacted over the course of several months, and two of them required hospitalization for the parasite infestations. Additionally, eating raw fruits and vegetables was linked to a decreased risk of contracting Giardia. According to the study, this might occur as a result of exposure to modest concentrations of Giardia cysts on such objects, which can induce protective antibodies. The bacteria Giardia duodenalis are resistant to the normal chlorine treatment.

- Report ID: 8098

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Giardiasis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.