Cellular Tumor Antigen P53 Market Outlook:

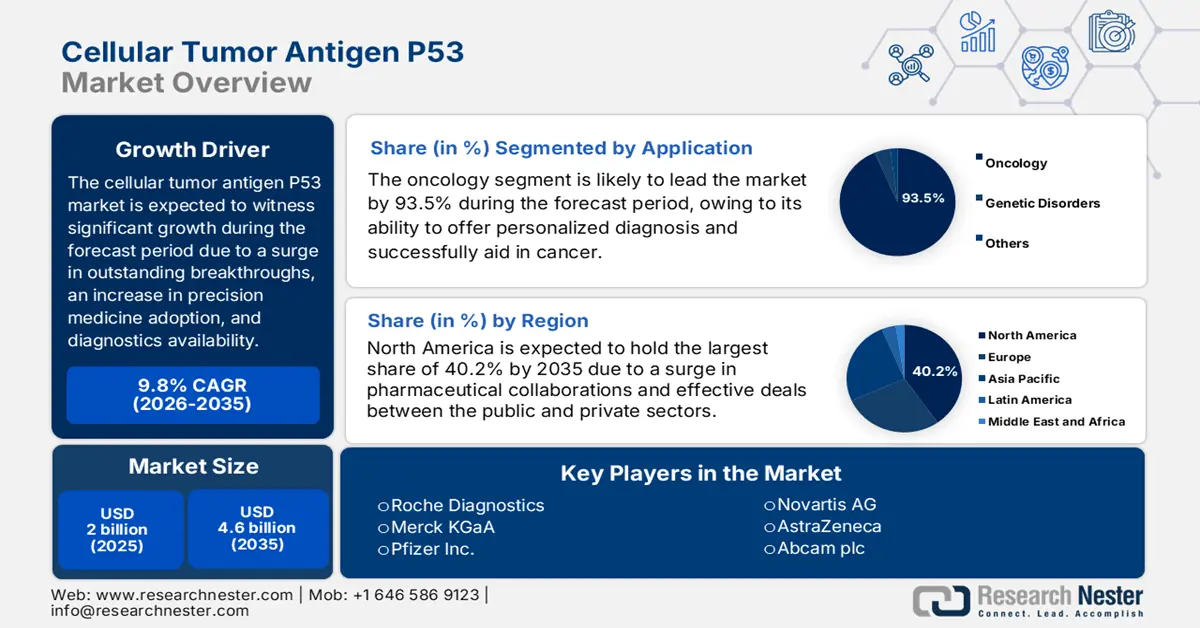

Cellular Tumor Antigen P53 Market size was USD 2 billion in 2025 and is anticipated to reach USD 4.6 billion by the end of 2035, increasing at a CAGR of 9.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cellular tumor antigen P53 is estimated at USD 2.2 billion.

The cellular tumor antigen P53 market is effectively poised for suitable expansion, which is highly attributed to the convergence of commercial, clinical, and scientific catalysts. These include remarkable breakthroughs in p-53 targeted therapeutics, advancements in gene editing and delivery, a rise in precision medicine, and the use of companion diagnostics. According to an article published by NLM in January 2023, mutation in the tumor suppressor p53 usually occurs in almost 50% of human cancers, the majority of which result in missense mutations. Besides, these mutations tend to promote malignant progression, drug resistance, and metastasis, which are positively impacting the overall market.

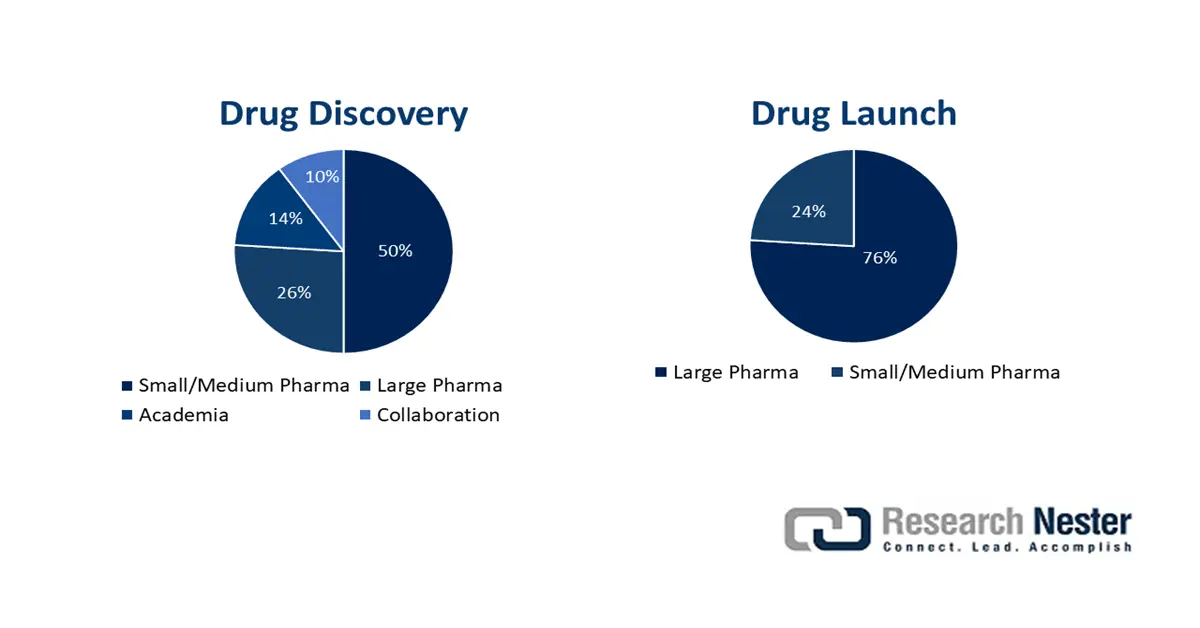

Source: Human Specific Research Organization

Moreover, regulations regarding orphan drug designations, fast-track pathways, tactical partnerships, mergers and acquisitions, as well as the successful integration of artificial intelligence (AI) and big data in drug discovery, are also bolstering the cellular tumor antigen P53 market internationally. As per an article published by Human Specific Research Organization in December 2023, almost 20 biopharma organizations collectively allocated USD 145.5 billion into R&D, which reflected a 4.5% surge from previous years. This results in the drug’s potentiality to be effectively lucrative, which creates an optimistic outlook for the overall market internationally.

Key Cellular Tumor Antigen P53 Market Insights Summary:

Regional Insights:

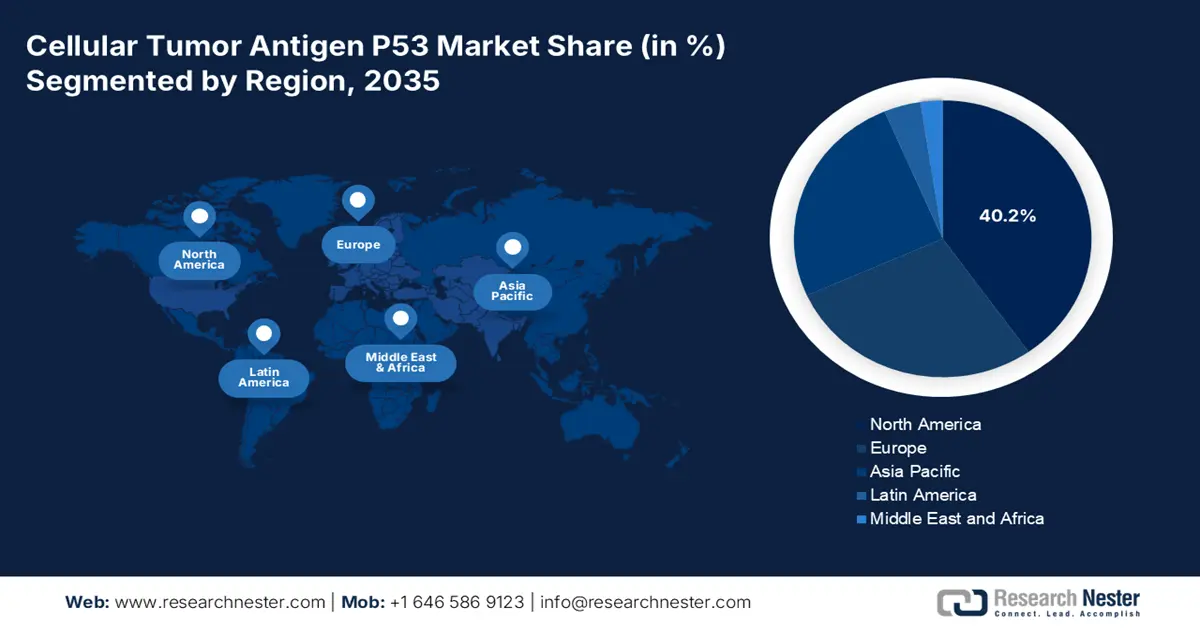

- North America in the Cellular Tumor Antigen P53 Market is expected to secure a 40.2% share by 2035, attributed to the presence of integrated clinical ecosystems, strategic pharma collaborations, and an increase in FDA-based approvals.

- Asia Pacific is projected to witness the fastest growth during 2026–2035, supported by rising cancer prevalence, expanding healthcare expenditure, and the swift adoption of precision oncology technologies.

Segment Insights:

- The oncology segment in the Cellular Tumor Antigen P53 Market is projected to capture a 93.5% share by 2035, fueled by its personalized and multidisciplinary approach to diagnosing, aiding, and preventing cancer.

- The therapeutics segment is expected to hold a significant share by 2035, propelled by a robust late-stage clinical pipeline addressing the rising unmet needs in TP53-mutated cancers.

Key Growth Trends:

- Advancements in gene editing

- Big Data integration

Major Challenges:

- Out-of-pocket expenses and patient cost-effectiveness

- Heterogeneous requirements and regulatory hurdles

Key Players: Roche Diagnostics, Merck KGaA, Pfizer Inc., Novartis AG, AstraZeneca, Abcam plc, Stemline Therapeutics Inc., Sino Biological Inc, Thermo Fisher Scientific Inc., Cell Signaling Technology Inc., RayBiotech Life Inc, GeneTex, Bioss Inc., Creative Diagnostics, Active Motif Inc.

Global Cellular Tumor Antigen P53 Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.2 billion

- Projected Market Size: USD 4.6 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 1 October, 2025

Cellular Tumor Antigen P53 Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in gene editing: The importance lies in its capability to alter DNA precisely, with the intention to combat and aid genetic disorders, create the latest biotechnology applications, and optimize crops, which is positively impacting the cellular tumor antigen P53 market globally. According to an article published by the Genes & Diseases in January 2024, as per a clinical trial, the target frequency of gene mutations in peripheral blood mononuclear cells usually ranged from 5% to 10%, without the need for effective modifications or adverse effects, thus suitable for deliberately uplifting the overall market.

- Big Data integration: These are extremely crucial for the market for ensuring early diagnosis, personalized treatment, and optimized outcomes by carefully analyzing large-scale datasets to recognize complicated patterns, develop new targeted therapies, and predict drug responses. As per an article published by NLM in August 2024, the application of the CNN model, along with a flow of cytometry-based datasets, was suitable for achieving precision in gaining cancer cells within a few milliseconds, with over 95% accuracy, thus suitable for skyrocketing the overall market.

- Rise in precision medicine: This is crucial for bolstering the cellular tumor antigen P53 market since it has the capability to tailor treatments as well as prevention strategies to a patient’s outstanding genetic, lifestyle, and environmental factors. As stated in the December 2023 NLM article, the successful establishment of particular clinical protocols by implementing a precision medicine strategy, especially in community-specific oncology practices, involves conducting clinical studies wherein 85% of cancer patients achieve standard treatment. Therefore, this eventually provides an effective opportunity to ensure a precision medicine trial, which is readily achievable through suitable operationalization.

AI Application for Tumor Microenvironment (TME) Cells Assessments for Numerous Tumors (2024)

|

Tumor Type |

AI Type |

Training |

Validation |

Testing |

|

Triple-Negative Breast Cancer (TNBC) |

Deep Learning |

33 WSIs |

- |

- |

|

Various Tumors |

Convolutional Neural Network |

48 WSIs |

11 WSIs |

47 WSIs |

|

Neuroblastoma |

Deep Learning |

- |

20 WSIs |

- |

|

Non-Small Cell Lung Carcinoma (NSCLC) |

Deep Learning |

3,166 |

2,389 |

- |

|

Breast Cancer |

Convolutional Neural Network |

102 |

7 |

284 |

|

Colorectal Cancer |

Deep Learning |

9,582 patches |

1,198 patches |

1,198 patches |

Source: NLM

Challenges

- Out-of-pocket expenses and patient cost-effectiveness: Even with the presence of insurance coverage, an increase in co-insurance and deductibles can leave patients with increased out-of-pocket costs for notable therapies, which negatively impacts the cellular tumor antigen P53 market globally. This financial risk results in non-adherence, negative publicity, and worsened health outcomes, eventually restricting commercial uptake. Therefore, to overcome this, manufacturers are advised to create extensive patient assistance programs, along with co-payment support foundations to bridge this affordability barrier, which tends to add non-recoverable and complicated expenses to product’s commercial launch.

- Heterogeneous requirements and regulatory hurdles: The aspect of diversified regulatory requirements across international markets effectively delays launch sequences and enhances development expenses, which has caused a hindrance in the market. For instance, a drug, which is cleared by the FDA, might require additional clinical data, frequently from a localized patient population, to achieve clearance in countries such as China and Japan. Besides, Japan’s PDMA frequently demands pharmacokinetic data, particularly from regional patients, which has limited the market’s development.

Cellular Tumor Antigen P53 Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 4.6 billion |

|

Regional Scope |

|

Cellular Tumor Antigen P53 Market Segmentation:

Application Segment Analysis

Based on the application, the oncology segment in the cellular tumor antigen P53 market is anticipated to garner the largest share of 93.5% by the end of 2035. The segment’s growth is highly driven by its provision of a personalized as well as multidisciplinary strategy to diagnose, aid, and prevent cancer. According to an article published by the National Cancer Institute in May 2025, approximately 2,041,910 new cases of cancer are expected to be diagnosed in the U.S., while 618,120 people are expected to die from the disease. Besides, colorectal, lung, and prostate cancers cater to an estimated 48% of all cancers, thus driving the segment’s growth.

Product Type Segment Analysis

Based on the product type, the therapeutics segment in the cellular tumor antigen P53 market is predicted to account for the second-largest share during the predicted duration. The segment’s upliftment is highly driven by a strong, along with a late-stage clinical pipeline, which tends to target the high increased unmet demand in TP53-mutated cancers. The shift of first-in-class drugs, such as PC14586 and eprenetapopt, from pivotal Phase II and III clinical trials towards commercialization and anticipated regulatory approval, deliberately representing the actual value proposition. Besides, the segment has also encompassed diversified modalities, which include immunotherapies, small molecule reactivators, and gene therapies, thus attracting huge R&D investment from both large-scale pharmaceutical and biotech organizations.

Therapy Segment Analysis

Based on therapy, the targeted therapy segment in the cellular tumor antigen P53 market is constituted to gain the third-largest share by the end of the forecast duration. The segment’s development is highly fueled by it varies significantly by relying on the particular cancer type, along with the targeted mutation. As per the October 2022 Biochemical Pharmacology article, a clinical study was conducted, wherein an overall 2-year survival rate of 78.3% has been observed among patients receiving palbociclib plus letrozole, in comparison to 68.0% for patients with letrozole, which in turn is uplifting the overall segment internationally.

Our in-depth analysis of the cellular tumor antigen P53 market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product Type |

|

|

Therapy |

|

|

End user |

|

|

Machine Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cellular Tumor Antigen P53 Market - Regional Analysis

North America Market Insights

North America in the cellular tumor antigen P53 market is expected to garner the highest share of 40.2% by the end of 2035. The market’s exposure in the region is highly attributed to the strong presence of integrated clinical and ecosystem, pharma collaborations, next-generation diagnostic adoption, private and public partnerships, regulatory escalation, and FDA-based approvals. For instance, in February 2025, Foundation Medicine, Inc. declared an effective collaboration with Sumitomo PharmaAmerica, Inc. to successfully develop the FoundationOneHeme platform as a suitable companion diagnostic to recognize patients with acute leukemia with a KMT2A rearrangement.

The cellular tumor antigen P53 market in the U.S. is growing significantly, owing to numerous federal allocations, an expansion in Medicare and Medicaid, particularly for p53-based cancer therapies and diagnostics, robust and regional biotech industry, increased prevalence of p53 mutation, and policy-specific incentives for pharmaceutical development. According to an article published by America Cancer Society in 2025, 1 out of every 18 people in the overall region is a cancer survivor, which is expected to exceed 22 million. In addition, an estimated 5.3 million, which is almost 1 million, will account for breast cancer survivors, thus suitable for the market’s growth.

The cellular tumor antigen p53 market in Canada is growing due to the presence of provincial and national budget provisions for scaling up the latest therapies and diagnostics, increased focus on population health, early cancer detection, government-based partnerships, emphasis on broad accessibility and cost control, and suitable molecular diagnostics. As per an article published by NLM in April 2022, cancer-based expenses in the country has been CAD 26.2 billion, of which 30% of expenses are readily borne by patients and their families. Additionally, patients and families’ costs amounted to CAD 4.8 billion, thus denoting an optimistic outlook for the overall market.

Cancer Incidence in America Driving the Market

|

U.S. (2025) |

Canada (2024) |

||

|

Components |

Incidence/Rate |

Components |

Incidence/Rate |

|

Cancer diagnosis |

2,041,910 |

Cancer cases |

247,100 |

|

Death from the disease |

618,120 |

Cancer death |

88,100 |

|

Prostate, lung, and colorectal cancers for males |

48% diagnosis |

Incidence among men |

562.2 per 100,000 |

|

Breast, lung, and colorectal cancer in females |

51% diagnosis |

Incidence among women |

209.6 per 100,000 |

|

New cancer cases |

445.8 per 100,000 |

Decreased mortality rate among males |

495.9 per 100,000 |

|

Cancer death rate |

145.4 per 100,000 |

Decreased mortality rate among females |

152.8 per 100,000 |

|

Cancer mortality rate |

171.5 per 100,000 for men |

Cancer diagnostic rate |

45% |

|

Race, ethnicity, and gender |

203.6 per 100,000 for Non-Hispanic Black and 83.1 per 100,000 for non-Hispanic Asia/ Pacific Islander |

Cancer economic burden |

USD 26.2 billion |

Source: NLM; National Cancer Institute

APAC Market Insights

Asia Pacific in the cellular tumor antigen P53 market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by a surge in cancer rates, an increase in healthcare expenditures, and the rapid implementation of cutting-edge sequencing, along with precision in oncology. As stated in the June 2022 NLM article, the cancer incidence in the overall region has been 169.1 per 100,000, accounting for 49.3%. This included 13.8% of lung cancer, followed by 10.8% for breast, and 10.6% for colorectal cancer, thereby enhancing the market’s exposure.

The cellular tumor antigen p53 market in China is gaining increased traction, owing to government-based funding, multi-level public hospital expansion, aggressive administrative approvals, an increased volume of diagnosed cases, and a robust regional genomics and biopharma industry, as well as the effective development of large-scale population-based screening programs. According to the September 2024 Journal of the National Cancer Center article, the 2030 Health China Program has initiated the milestone objective to achieve a 5-year cancer survival rate of 43.3% as of 2022. Besides, an estimated 6,410,940 newly diagnosed cancer patients have been recorded, which denotes a huge growth opportunity for the market.

The cellular tumor antigen p53 market in India is also developing due to an expansion in the patient pool, increased government-based health coverage for cancer treatments, state and central government incentives for implementing molecular diagnostics, generous investments to ensure cost-effective diagnostic accessibility, and increased emphasis on early detection through national awareness campaigns, as well as health check-up initiatives. As stated in the February 2025 MOHFW data report, 20 million cancer cases have been recorded as of 2022, and 9.7 million have died. In addition, almost 100 out of every 1 lakh (100,000) people are readily diagnosed with cancer, which is uplifting the market demand in the country.

2022 Healthcare Expenditure in Asia

|

Countries |

% of GDP |

|

Australia |

9.95 |

|

China |

5.3% |

|

Indonesia |

2.6% |

|

Japan |

11.4% |

|

Korea |

9.4% |

|

Malaysia |

3.9% |

Source: World Bank Organization, 2025

Europe Market Insights

Europe in the cellular tumor antigen P53 market is projected to account for a considerable share by the end of the forecast timeline. The market’s upliftment in the region is highly driven by rapid advancements in technologies, continuous innovation in targeted therapies and diagnostics, comprehensive incorporation across pharmaceuticals, healthcare, and industrial sectors, administrative support, and financial investments for R&D. Besides, in July 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) has declared essential new steps to achieve patient accessibility regarding the current medical technologies that are readily available in the region.

The cellular tumor antigen P53 market in Germany is gaining increased exposure, owing to an increase in government funding, along with reimbursement programs resulting in sustained growth, a robust presence of biotech and pharmaceutical R&D initiatives, progressive clinical trials, along with an increase in the adoption of next-generation diagnostics. As per an article published by NLM in May 2022, the overall incidence of malignant and benign neoplasms decreased to 23.0%, denoting a 11.6% reduction, with the implementation of advanced diagnostic techniques, thus suitable for the market development in the country.

The cellular tumor antigen P53 market in France is also developing due to a steady increase in the healthcare budget allocation for P53 therapies and diagnostics, strong partnerships between public and private sectors for precision oncology, expansion in molecular diagnostics integration, and enhanced focus on patient outcomes, along with digital health records for innovation. Besides, digital healthcare has enabled the population to play an essential role in their respective health and life, which is possible by retrieving their health and care pathway documents, which positively impacts the overall market in the country.

Key Cellular Tumor Antigen P53 Market Players:

- Roche Diagnostics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Pfizer Inc.

- Novartis AG

- AstraZeneca

- Abcam plc

- Stemline Therapeutics Inc.

- Sino Biological Inc

- Thermo Fisher Scientific Inc.

- Cell Signaling Technology Inc.

- RayBiotech Life Inc

- GeneTex

- Bioss Inc.

- Creative Diagnostics

- Active Motif Inc

The cellular tumor antigen P53 market is extremely competitive, with a combination of specialized biotechnology and international pharmaceutical giants, readily dominating the overall landscape. Major notable players, including Novartis, Pfizer, KGaA, Merck, and Roche, have leveraged extended R&D capabilities to create targeted therapies, along with precision diagnostic tools, which are focused on p53, and are essential for cancer research and treatment. Besides, different organizations are gradually engaging in tactical collaborations, acquisitions, and progressive partnerships to escalate product development and extend their respective global presence, which is proliferating the overall market.

Here is a list of key players operating in the global market:

Recent Developments

- In January 2025, Amgen, along with Kite Pharma, declared that they entered into a tactical license and research collaboration to create and commercialize the cutting-edge generation of the notable Chimeric Antigen Receptor T-cell immunotherapies based on Kite's engineered autologous cell therapy platform, as well as Amgen's extensive array of cancer targets.

- In November 2023, Jazz Pharmaceuticals plc and the University of Texas MD Anderson Cancer Society notified a research-based collaboration for five years, with the intention of evaluating zanidatamab, which is Jazz's investigational HER2-targeted bispecific antibody, in numerous HER2-expressing cancers.

- Report ID: 8144

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cellular Tumor Antigen P53 Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.