Organ Tumor on a Chip Market Outlook:

Organ Tumor‑on‑a‑chip Market size is valued at USD 214 million in 2025 and is projected to reach USD 4.53 billion by the end of 2035, rising at a CAGR of 35.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of organ tumor‑on‑a‑chip is estimated at USD 290.4 million.

The global organ tumor‑on‑a‑chip market is growing, with avenues opening in the pharmaceutical, chemical, and biodefense sectors in need of increasingly predictive and human-relevant platforms for drug development. According to a report by the U.S. Government Accountability Office in May 2025, experts said that only 10% to 20% of human cells purchased are of high enough quality for OOC studies. Additionally, the growth of these areas is moving in tandem with the ability of the technology to model complex human organ systems with adult human cells, thus giving better translational relevance over conventional animal models. Lack of translational relevance of an animal model keeps these platforms on the edge, which makes them great tools for drug efficacy and safety assessment.

The presence of engineered human tissues in early testing establishes validation parallelism with patient data mechanisms, eliminating unnecessary wastage of decision-making time, thus allowing for neater, inexpensive, purposeful, and focused deployment of therapies and technologies. As per a report by NLM in February 2022, drug discovery and development is a long, costly, and high-risk process that takes over 10 to 15 years with an average cost of over 1 to 2 billion USD for each new drug to be approved for clinical use. In response to these challenges, initiatives such as funding tissue chip models for diseases including prostate cancer and muscular dystrophy are being promoted. By funding tissue chip models for diseases, including prostate cancer and muscular dystrophy, the program supports more accurate preclinical evaluation of drug products, reducing the need for the usual API and medical device clinical trial routes.

Key Organ Tumor-on-a-chip Market Insights Summary:

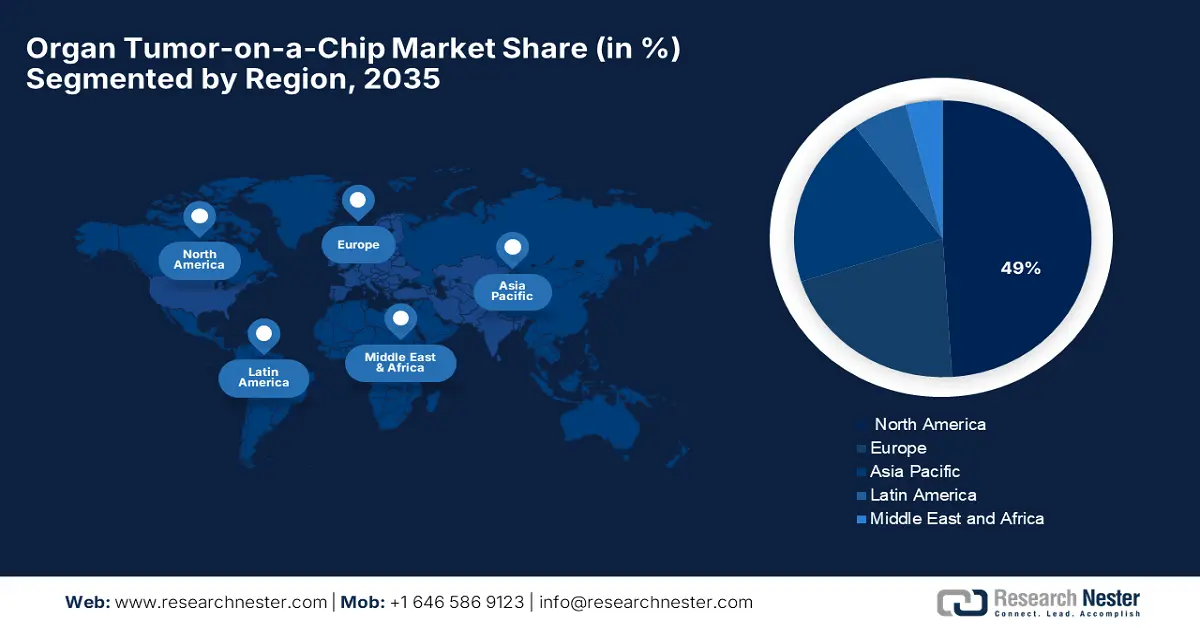

Regional Insights:

- North America is expected to hold a 49% share by 2035, owing to massive pharmaceutical collaborations, regulatory support, and an advanced healthcare ecosystem.

- Asia Pacific is projected to grow rapidly during 2026–2035, impelled by government initiatives like China’s Organ Reconstruction and Manufacturing program and investment in microfluidics technologies.

Segment Insights:

- Drug Screening & Discovery segment is projected to account for 32% share by 2035, propelled by constant pressure on pharmaceutical companies to reduce costs and accelerate oncology drug development using human-relevant models.

- Tumor-on-a-Liver Chip segment is expected to hold 30% share by 2035, driven by its pivotal role in modeling liver metabolism and toxicity for personalized cancer therapy.

Key Growth Trends:

- Advanced disease modeling via space-based tissue chip research

- Accelerated drug screening with Integrated Human Tissue Models

Major Challenges:

- High development and manufacturing costs

- Technical and biological limitations

Key Players: Charles River, Emulate Inc., Mimetas B.V., InSphero AG, CN Bio Innovations, TissUse GmbH, Nortis Inc., AxoSim Technologies, TARA Biosystems Inc., SynVivo, Inc., Hesperos, Inc., Altis Biosystems, Inc., BioIVT LLC, Micronit Microtechnologies, Cherry Biotech SAS.

Global Organ Tumor-on-a-chip Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 214 million

- 2026 Market Size: USD 290.4 million

- Projected Market Size: USD 4.53 billion on by 2035

- Growth Forecasts: 35.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, South Korea, India, Singapore, Australia

Last updated on : 10 September, 2025

Organ Tumor on a Chip Market - Growth Drivers and Challenges

Growth Drivers

- Advanced disease modeling via space-based tissue chip research: One of the significant growth factors in the Organ Tumor-on-a-Chip market is the NCATS-supported Tissue Chips. As per a report by NIH 2023, in the space program, the NCATS-supported Tissue Chips uses microgravity aboard the International Space Station to study human heart tissue responses. This approach offers an improvement in cardiac disease modeling and drug testing accuracy. Over the last 8 years, the launch of several tissue chips that mimicked organs such as the lung and kidney has accelerated translational research, which has maximally promoted the investment and innovation of organ-on-chip technologies for more precise biomedical applications.

- Accelerated drug screening with Integrated Human Tissue Models: The pharmaceutical development is being transformed by advancements in predictive drug testing. According to a report by NIH 2025, the Tissue Chip for Drug Screening program promotes development to explain the high rate of medication failure in clinical trials after having seemingly worked in the preclinical settings. Through the use of human cell-based organ-on-chip models, this program provides drug safety and efficacy tests with more rapid and accurate methodologies across various organ systems. This is expected to allow the discoveries to be propelled and to be able to make quick translations into clinical applications with flexible funding from the Cures Acceleration Network, minimizing the use of animal models that are less predictive.

- Multi-organ modeling adoption: The MPS enables more rapid drug development by providing models of human tissue with greater fidelity. According to a study by NIH 2022, unlike simple 3-D spheroids or organoids squeezed into slides or the bottom of a multi-well plate, tissue chips about the size of a USB stick mimic organ structure, blood flow, and inter-organ communication, all of which have huge implications on predictive power. These multi-organ chip studies help fill the void in advanced human-relevant testing that lowers attrition rates. This enhanced physiological relevance improves the ability to predict human responses to drugs more accurately, ultimately reducing costly late-stage failures in clinical trials.

Organ/Tumor-on-a-Chip Market: Export & Import Price Trends

|

Country |

Exports to (2023) |

Imports from (2023) |

|

Netherlands |

$5.91B |

— |

|

Mexico |

$3.15B |

$11.8B |

|

Germany |

$3.17B |

$3.9B |

|

China |

$3.26B |

$2.24B |

|

Japan |

$2.8B |

$1.94B |

|

Ireland |

$725M |

$2.75B |

Source: OEC, August 2024

Challenges

- High development and manufacturing costs: The microfabrication complexity and the integration of living cells in organ tumor-on-a-chip devices lead to high production costs. These expenses limit affordability and scale, thus limiting widespread adoption by pharmaceutical companies and research institutions and slowing overall market expansion and innovation. Additionally, these costs often deter small and mid-sized enterprises from entering the market. Limited manufacturing infrastructure and lack of economies of scale further hinder cost optimization efforts.

- Technical and biological limitations: It is still challenging to replicate the full tumor microenvironment and human physiological responses on a chip. An incomplete simulation reduces the accuracy and reliability of the drug test results, thus making pharmaceutical companies reluctant to completely substitute their traditional models. This technical barrier becomes a limiting factor of market penetration and thus adds to the delay of regulatory acceptance. Variability in chip performance and lack of long-term viability of cultured tissues also pose challenges. Moreover, standardization across platforms remains a critical hurdle for regulatory harmonization.

Organ Tumor on a Chip Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

35.7% |

|

Base Year Market Size (2025) |

USD 214 million |

|

Forecast Year Market Size (2035) |

USD 4.53 billion |

|

Regional Scope |

|

Organ Tumor on a Chip Market Segmentation:

Application Segment Analysis

Drug screening & discovery segment expected to hold 32% market share, as there is constant pressure on pharmaceutical companies to keep costs down and shorten time in oncology drug development. According to NLM 2021, the Organ-Tumor-on-a-Chip platforms provide more predictive and, importantly, human-relevant models as compared to animal testing and thus speed up the identification of lead compounds. Emphasizing regulatory acceptance of organ-on-chip technologies for the safety evaluation of drugs, FDA initiatives such as the collaboration with Emulate Inc. have been a great motivation for their adoption.

Organ Type Segment Analysis

The tumor-on-a-liver chip segment in organ type is expected to hold 30% market share within the forecast period. Liver tumor chips play a central role due to the central positioning of the liver for drug metabolism and toxicity. Microfluidic tumor-on-a-chip platforms allowed the precise modeling of HCC microenvironments, revealing activated HSCs to be the protagonists in drug resistance and immune evasion. Targeting LCN-2 improved sorafenib's efficiency, suppressed angiogenesis, and augmented NK affecting activities, testimony to the chip-based system as a translational asset in oncology drug development. These advancements underscore the growing importance of liver tumor chips in accelerating personalized cancer therapies.

End user Segment Analysis

The end-user market under pharmaceutical & biotech companies is expected to hold 73% for 2023 and is likely to remain the leader until the year 2035. Players from these industries are most willing to invest in tumor-on-chip platforms, improve R&D accuracy, speed up their oncology drug pipelines, and adopt non-animal testing models. Implementation in personalized medicine and oncology enjoys regulatory incentives and ethical duties, attracting the widespread application of the technology in pharma R&D units and venture-backed biotech firms. Furthermore, the partnerships between pharmaceutical companies, technology companies, and innovators are speeding up the development and commercialization of tumor-on-chip platforms.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Organ Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Material Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organ Tumor on a Chip Market - Regional Analysis

North America Market Insight

The North America organ tumor-on-a-chip market is expected to dominate within the forecast period with a 49% share. This is attributed to a huge government expenditure on healthcare and a highly innovative ecosystem, as they might adopt the change from 2D and 3D cell cultures. The growth increases due to massive pharmaceutical collaborations in alternatives to animal testing and an advanced supply chain infrastructure, rendering the region a frontrunner in tumor-on-a-chip technology development and adoption. This market is being further augmented by regulatory support and an increased number of clinical trials.

The organ tumor-on-a-chip market in U.S. is advancing through NIH and DARPA funding, FDA regulatory shifts, and enhanced clinical trial support. According to a report by NBTS 2022, over 2,500 brain tumor trials have been listed, accelerating patient access. The U.S. National Center for Advancing Translational Science has cooperated with other agencies to launch a series of Organ-on-a-Chip programs to foster the use of this technology for practical drug development. The NBTS Clinical Trial Finder raises awareness to boost participation and streamline translational cancer research nationwide. The growing demand for predictive preclinical models and the reduction in animal testing continue to create partnerships. Having strategic value for pharmaceutical firms, the technology makes the R&D run faster with the input of data from the information.

The organ tumor-on-a-chip market is growing as the biomedical innovation in Canada is increasingly emphasized, providing a significant thrust for next-generation preclinical. As per a report by the Government of Canada January 2023, the government has invested 23 million USD in pediatric cancer research, which forms a key occasion for the market in Canada. As the country invests in drug development, precision therapies, and expedited clinical trials, microphysiological systems such as tumor-on-a-chip platforms are to nurture pre-clinical pediatric oncology research. These initiatives enhance drug access and efficiencies, while chip-based models share the same interest to do so by limiting animal testing and ensuring faster and more authentic tumor modeling.

Asia Pacific Market Insight

The Asia Pacific market is the fastest-growing market in the organ tumor-on-a-chip market. The Asia-Pacific market progresses rapidly due to robust government support, including China's 5-year Organ Reconstruction and Manufacturing program. These developments aim at real-time, multi-parameter monitoring via integrated biosensors, which, in turn, promotes pharmaceutical integration. Investment in these industries, microfluidics in particular, further supports the supply chain and cost efficiency. With investment rising steadily, technologies are improving. However, costs are capable of decreasing in the market for organ-on-a-chip products, and it is poised for acceptance in the pharmaceutical industry.

The organ tumor-on-a-chip market in China is growing due to its high demand, the prevalence of pulmonary cancers, and the research in lung cell modeling and drug testing. As per a report by NLM in April 2022, a bone marrow-liver-kidney multi-organ chip accurately replicated cisplatin’s in vivo effects, showing myeloid and kidney toxicity without liver damage at 160 μM for 24 hours. Yet, cancer prevention in China is currently being promoted at a high speed through the integration of traditional and Western medicine by way of AI, alongside fostering multiomics research, organ-on-a-chip technologies, and interdisciplinary collaboration toward early detection and personalized treatment avenues. These government-propelled undertakings are geared at expediting innovation and improving clinical results through the implementation of modern technologies.

The organ tumor-on-a-chip market in is growing as India is fast-tracking the use of innovative, human-relevant models in biomedical research. The New Drugs and Clinical Trial Rules, recent amendments encourage the use of organoids, 3D cultures, and organ-on-chip technologies rather than resorting to animal testing. Administration and New Drugs and Clinical Trial Rules encourage the replacement of animal testing with cell culture methods relevant to the human system. According to a report by NLM February 2025, India encourages the use of non-animal model systems relevant to humans, such as organoids, 3D cultures, and OOC, for drug testing. 18 Under the new drugs and clinical trial rules, guidelines on the use of microfluidics technology for GTP testing are expected to come into being in the coming years.

Europe Market Insight

The organ tumor-on-a-chip market in Europe is expected to hold a considerable market share during the forecast period. The organ chip research in Europe is characterized by strong institutional diversity, spirited public-private partnerships, and well-funded collaborative networks. The various top academic and industrial centers backing research in a multitude of countries further spur innovation by strengthening multidisciplinary approaches and fostering cross-border cooperation, thereby placing Europe in a competitive position within the global organ chip knowledge ecosystem. All these are supported by targeted governmental initiatives and science policies for sustainable growth and for fast-track translation into clinical and drug development applications.

The organ tumor-on-chip market in Germany is growing, driven by a robust and collaborative ecosystem spanning academia, industry, and government sectors. Integrated data platforms. Targeted government initiatives and funding schemes advance bioengineering and microfluidics research, benefiting the entire country. Collaborative initiatives are increasingly aimed at optimizing organ chip development through artificial intelligence and high-throughput screening. Germany’s strong focus on translational research and its public-private partnerships continue to foster innovation and enhance its position as a hub for the next-generation organ-on-chip technologies in Europe, even while there is still the challenge of capturing private sector R&D data and integrating it fully.

The organ-tumor-on-chip market in the UK is revolutionizing cancer research through the exact recreation of complex tumor microenvironments with biochemical and mechanical controls. AS per a report by The Health Foundation, November 2024, Department of Health and Social Care (DHSC) DHSC total funding is expected to increase from £211.0 billion in 2025 and 2026 to £229.0 billion in 2028 and 2029, reflecting a steady annual growth in health spending. In the UK, both academic and commercial platforms utilize microfluidic organ chips to study various cancers, including rare sarcomas and metastasis. Running in support of innovation, the UK Organ-on-a-Chip Technologies Network develops preclinical models incorporating organoids and spheroids to speed therapeutics discovery and testing.

Health Spending by Funding Type and Year for England

|

Funding Type |

2025/26 Nominal (£bn) |

2026/27 Nominal (£bn) |

2027/28 Nominal (£bn) |

2028/29 Nominal (£bn) |

2025/26 Real (£bn)* |

2026/27 Real (£bn)* |

2027/28 Real (£bn)* |

2028/29 Real (£bn)* |

Real-terms Annual Growth Rate (2025/26 to 2028/29) |

|

DHSC revenue |

202.0 |

211.0 |

221.3 |

232.0 |

197.4 |

203.0 |

208.9 |

215.0 |

2.9% |

|

NHSE revenue |

195.6 |

204.9 |

215.4 |

226.1 |

190.8 |

196.8 |

203.0 |

209.3 |

3.1% |

|

DHSC capital |

13.6 |

14.0 |

13.5 |

14.8 |

13.6 |

13.8 |

13.0 |

14.0 |

1.0% |

|

DHSC total |

215.6 |

225.0 |

234.8 |

246.8 |

211.0 |

216.8 |

221.9 |

- |

- |

Source: The Health Foundation, November 2024

Key Organ Tumor on a Chip Market Players:

- Charles River

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Emulate Inc.

- Mimetas B.V.

- InSphero AG

- CN Bio Innovations

- TissUse GmbH

- Nortis Inc.

- AxoSim Technologies

- TARA Biosystems Inc.

- SynVivo, Inc.

- Hesperos, Inc.

- Altis Biosystems, Inc.

- BioIVT LLC

- Micronit Microtechnologies

- Cherry Biotech SAS

Major U.S. players in the market are in tough competition. Companies in Europe continue on with their microfluidics and tissue-engineering innovations, whilst firms in Japan are pursuing market activity in increasing measure, with a view to local technology development and collaboration. Key strategic moves include mergers and acquisitions, product innovation, and increasing collaborations with pharmaceutical companies for drug discovery. Supply chain management issues and alignment of regulations further pull growth along, giving the players a competitive advantage in an ever-changing, highly dynamic market.

Here is a list of key players operating in the global market:

Recent Developments

- In July 2025 Cedars-Sinai developed a stem-cell-based, pocket-size organ-on-a-chip model for early-stage sporadic ALS. Published in Cell Stem Cell. It serves as a hopeful platform to study the disease and hasten the development of new treatments to accelerate discoveries in regenerative medicine and grow and diversify the cohort of stem cell researchers in the state.

- In March 2025, the biotech company Dynamic42, a specialist in organ-on-chip technology, announced a collaboration with Heinrich Heine University Düsseldorf to develop a tumor-on-a-chip model for pancreatic ductal adenocarcinoma (PDAC).

- Report ID: 8081

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organ Tumor-on-a-chip Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.