Artificial Organ and Bionic Implants Market Outlook:

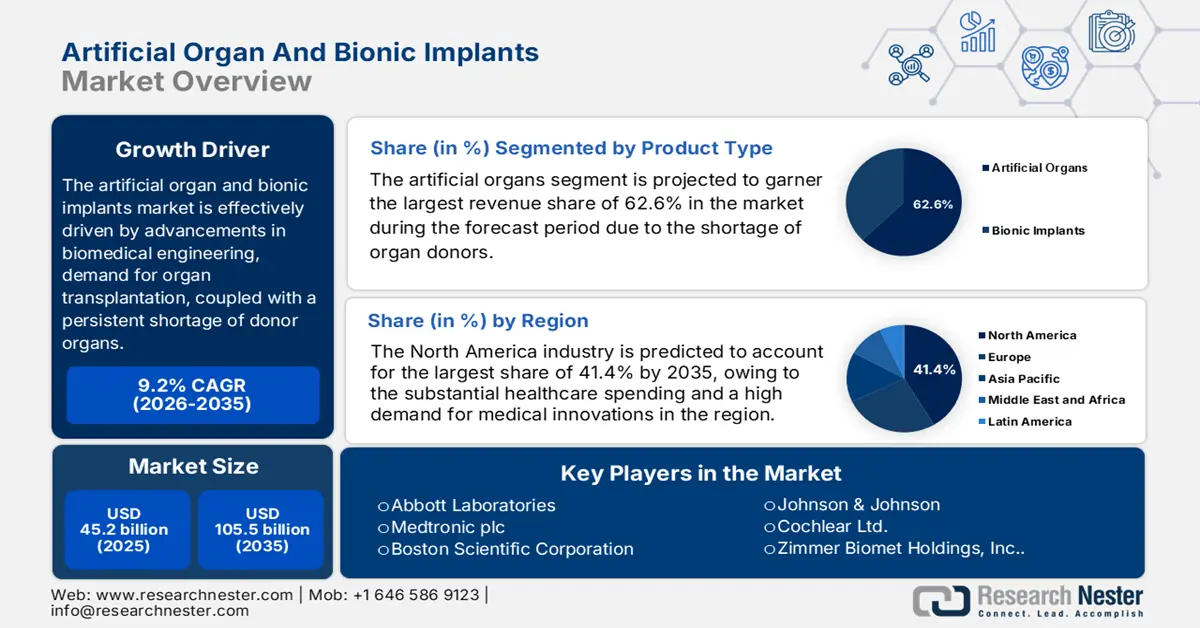

Artificial Organ and Bionic Implants Market size was valued at USD 45.2 billion in 2025 and is projected to reach USD 105.5 billion by the end of 2035, rising at a CAGR of 9.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the artificial organs and bionic implants is estimated at USD 49.2 billion.

The market is effectively driven by advancements in biomedical engineering, demand for organ transplantation, coupled with a persistent shortage of donor organs, which is accelerating the development and adoption of artificial organs. This can be testified by the report from GODT, which states that in 2023, a total of 172,409 organ transplants were performed across all nations, which marks a 9.5% increase when compared to 2022. The report further highlighted that on average, 18 transplants are being conducted every hour throughout the year, reflecting the growing scale and efficiency of global transplant systems.

Furthermore, as the global healthcare infrastructure is expanding, especially in terms of emerging economies, the market is expected to experience strong growth across various therapeutic applications. In this regard, the December 2024 Sansad article revealed that under the Central Government Health Scheme, specific cost ceilings have been defined for various organ transplants for eligible beneficiaries, which include ₹25 lakhs ($30,120) for a lung transplant, ₹15 lakhs ($30,120) for a heart transplant, and ₹35 lakhs ($42,168) for a combined heart and lung transplant.

Key Artificial Organ And Bionic Implants Market Insights Summary:

Regional Highlights:

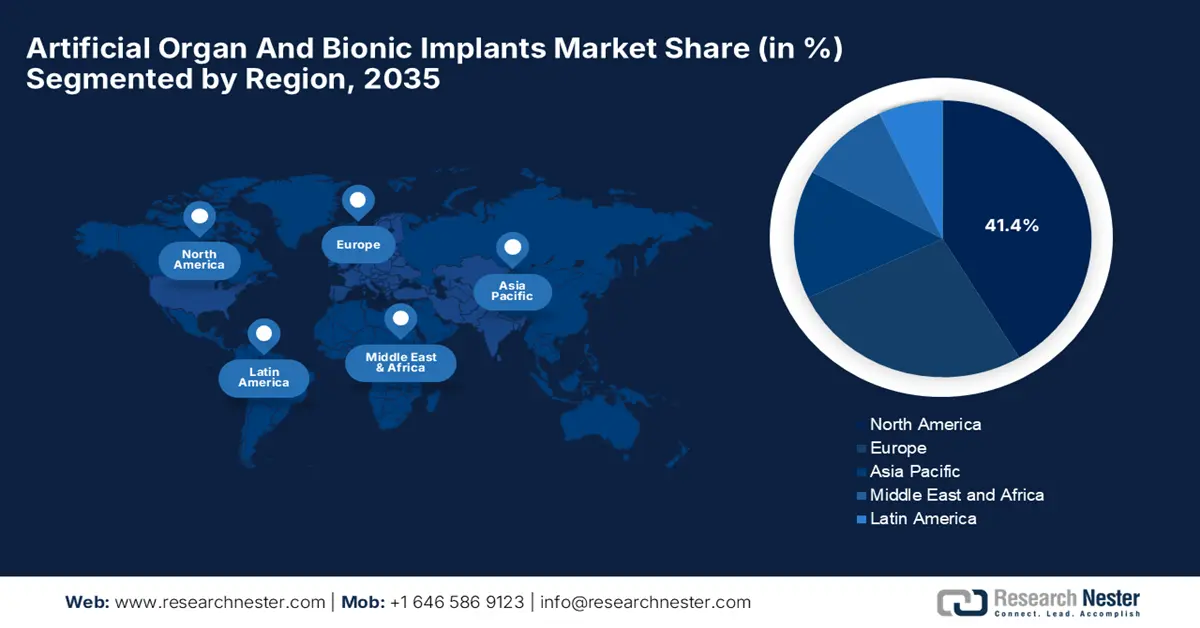

- By 2035, North America is projected to secure a 41.4% share in the artificial organ and bionic implants market, underpinned by its advanced healthcare infrastructure, substantial spending, and strong demand for medical innovation.

- Over 2026–2035, Asia Pacific is set to emerge as the fastest-growing region, reinforced by rapid medical technology advancements, increasing organ-failure cases, and rising demand for high-quality healthcare solutions.

Segment Insights:

- By 2035, the artificial organs segment is anticipated to command a 62.6% share in the artificial organ and bionic implants market, steered by the global shortage of organ donors.

- By the end of 2035, the mechanical bionic segment is projected to secure a 58.5% share, propelled by advanced robotics and AI integration for neural control.

Key Growth Trends:Abbott Laboratories,Medtronic plc,Boston Scientific Corporation,Johnson & Johnson,Cochlear Ltd.,Zimmer Biomet Holdings, Inc.,Siemens Healthineers AG,B. Braun Melsungen AG,LivaNova PLC,Getinge AB,Ottobock SE & Co. KGaA,Edwards Lifesciences Corporation,Second Sight Medical Products, Inc.,SynCardia Systems, LLC,Baxter International Inc.

Major Challenges:

- Increasing prevalence of organ failures & chronic diseases

- Preceding advancements

Key Players:

- High cost & reimbursement hurdles

- Long-term reliability concerns

Global Artificial Organ And Bionic Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.2 billion

- 2026 Market Size: USD 49.2 billion

- Projected Market Size: USD 105.5 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 3 September, 2025

Artificial Organ and Bionic Implants Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of organ failures & chronic diseases: This aspect creates an extremely critical and growing patient population. Besides the massive disparities between the supply of donor organs and demand is the fundamental driver for artificial organ adoption. In this regard, the data from OTPN revealed that as of September 2024, the kidney transplants topped the list, with 89,792 patients waiting for a donor, and liver transplants with 9,424 patients. Hence, these figures highlight the urgent global need for advanced artificial organs and bionic implants to reduce dependency on donor availability.

- Preceding advancements: The breakthroughs in biomedical engineering, robotics, and AI are revolutionizing this field. In June 2025, CARMAT announced the first commercial implants of the device outside the European Union, which were performed in Israel during the week of May 2025. Besides, these cases mark the first commercial use of Aeson outside the region, expanding the list of countries with commercial implants to Germany, Italy, Spain, Poland, and Israel, thereby accelerating market growth.

- Supportive government policies: The existence of supportive governing bodies, increased government funding for R&D, and expanding insurance coverage are significantly enhancing accessibility in the market. In this regard, the August 2025 MoHFW article revealed that India performed a total of 18,900 organ transplants in 2024, which ranks third among all nations, followed by the U.S. and China, and thereby leading the world in hand transplants.

Transplants Performed by Organ - 2023

|

Organ |

Number of Transplants |

|

Kidney |

27,332 |

|

Liver |

10,659 |

|

Pancreas |

102 |

|

Kidney/Pancreas |

812 |

|

Heart |

4,545 |

|

Lung |

3,026 |

|

Other |

153 |

Source: OrganDonor.gov

CGHS Approved Transplantation Rates as of 2023

|

Transplant Type |

Non-NABH Hospital Rate |

NABH Hospital Rate |

|

Lung Transplant |

₹25,00,000 (~$30,120) |

₹25,00,000 (~$30,120) |

|

Heart Transplant |

₹15,00,000 (~$18,070) |

₹15,00,000 (~$18,070) |

|

Heart & Lung Transplant (Combined) |

₹35,00,000 (~$42,170) |

₹35,00,000 (~$42,170) |

|

Kidney Transplant (Related Donor) |

₹2,00,000 (~$2,410) |

₹2,30,000 (~$2,770) |

|

Kidney Transplant (Unrelated Donor, incl. Immunotherapy) |

₹3,00,000 (~$3,620) |

₹3,45,000 (~$4,160) |

Source: Sansad

Challenges

- High cost & reimbursement hurdles: The market faces a major obstacle posed by the exacerbated costs and reimbursements. The development, manufacturing, and surgical implantation of these devices involve complex procedures, adding extremely high costs. This, in turn, creates an affordability issue both for patients and healthcare systems. Furthermore, the reimbursements from both government and private payers are often complex, thereby limiting patient access and market growth.

- Long-term reliability concerns: This is yet another restraint negatively impacting growth in the market. The considerable risk of complications such as inflammation, fibrosis, and blood clots raises a question regarding patient safety. Therefore, the assurance of long-term reliability and durability of these systems within the human body presents a significant hurdle, further necessitating complete research.

Artificial Organ and Bionic Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 45.2 billion |

|

Forecast Year Market Size (2035) |

USD 105.5 billion |

|

Regional Scope |

|

Artificial Organ and Bionic Implants Market Segmentation:

Product Type Segment Analysis

Based on product type artificial organs segment is projected to garner the largest revenue share of 62.6% in the market during the forecast period. The dominance in this segment is attributed to the global shortage of organ donors. In March 2024, the International Center of Artificial Organs & Transplantation announced that it added Nikkiso Collection to the Virtual Collections, highlighting the company’s significant contributions to artificial organ technologies in hearts, dialysis equipment, and bedside artificial pancreas devices, hence denoting a wider market scope.

Technology Segment Analysis

In terms of technology mechanical bionic segment is expected to grow at a considerable rate, with a share of 58.5% in the artificial organ and bionic implants market by the end of 2035. The advanced robotics and AI integration for neural control are key factors propelling the leadership. In June 2025, VUB spin-off Axiles Bionics stated that it has secured €6 million in the first tranche of an €8 million Series A funding round. This investment will accelerate the rollout of Lunaris, which is their advanced biomimetic prosthetic foot, and support the development of next-generation bionic devices.

Application Segment Analysis

Based on the application cardiovascular segment is predicted to gain a share of 28.3% in the market during the discussed timeframe. The growth in the segment originates from the increasing prevalence of cardiovascular diseases. In June 2025, Sheba Medical Center reported that it had successfully implanted the Aeson artificial heart, developed by CARMAT, in a patient suffering from severe heart failure. The report also stated that this advanced device replaces both ventricles, providing a vital lifeline for patients who cannot wait for a donor heart, hence enabling a positive market outlook.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

Application |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Organ and Bionic Implants Market - Regional Analysis

North America Market Insights

North America is expected to hold the largest revenue share of 41.4% in the artificial organ and bionic implants market by the end of 2035. The growth in the region originates from its advanced healthcare infrastructure, substantial healthcare spending, and a high demand for medical innovations. In April 2024, United Therapeutics Corporation announced the world’s first successful transplant of a UThymoKidney into a living person, which included the implantation of a heart pump, marking a major milestone in xenotransplantation, hence benefiting the overall market growth.

The U.S. is augmenting its leadership in the regional, effectively attributed to its well-established healthcare system and the presence of major biotechnology and medical device companies. Medicare in September 2025 stated that all the approved organ transplant programs must meet strict Conditions of Participation that include clinical outcomes, data submission, and procedural standards. It also stated that the State Operations Manual Appendix X will be the major reference for audits and compliance, which ensures patient safety and consistent transplant care across certified centers.

Canada has gained enhanced recognition in the artificial organ and bionic implants market, facilitated by its strong medical ecosystem, which is fostering continued innovation. Therefore, in Government of Canada in April 2022 allocated a total of USD 2 million toward AI-based organ matching tools, with a prime focus on reducing waitlist deaths. Furthermore, such initiatives reflect broader administrative efforts to address transplant limitations, wherein artificial organs and bionic implants are emerging as pivotal alternatives.

U.S. Transplant Safety & Statistics Overview 2022

|

Category |

Statistic |

|

Active organ waiting list |

>100,000 people (U.S.) |

|

Deceased organ donors (2022) |

~15,000 donors |

|

Average organs per deceased donor |

2.5 organs |

|

Living donors (annual average) |

~6,000 organs donated |

|

Tissue grafts are performed yearly |

~3.3 million grafts |

|

Tissue grafts are transplanted yearly |

~2.5 million grafts |

|

Estimated transplant infection rate |

~1% of transplants |

Source: CDC

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the artificial organ and bionic implants market from 2026 to 2035. The market’s development in the region is primarily fueled by vigorous advancements in medical technology, increasing incidences of organ failure, and rising consumer demand for high-quality healthcare solutions. Besides, the healthcare systems across the region’s prominent countries are readily progressing, providing an encouraging opportunity for national and international players.

China is the dominating country in the Asia Pacific’s market owing to the presence of factors such as increasing prevalence of chronic diseases, a rising geriatric population, and advancements in medical technology. In January 2025, Biocon Pharma Limited reported that it had received approval from China’s National Medical Products Administration (NMPA) for its Tacrolimus capsules in 0.5 mg, 1 mg, and 5 mg strengths, which an immunosuppressants used to prevent organ rejection in transplant patients.

India has become the target landscape for artificial organs and bionic implants market investors around the world due to the well-established research ecosystem. In August 2024, an article published by the Ministry of Health and Family Welfare (MoHFW) stated that reforms in technology, processes, and legislation are highly essential to advance organ and tissue donation and transplantation in India. The report also noted that improving healthcare infrastructure, increasing deceased donations, and ensuring that organ transplants are affordable, accessible, and transparent will solidify the country’s position in this field.

Government Schemes for Organ Transplantation in India 2024

|

Scheme Name |

Region |

Eligible Beneficiaries |

Supported Transplants |

|

Sushrusha Scheme |

Assam (State) |

Assam residents |

Kidney |

|

Organ Transplantation Scheme |

Karnataka (State) |

BPL patients |

Kidney, Liver (Live/Cadaver) |

|

Delhi Arogya Kosh |

Delhi (State) |

Delhi residents |

Multiple (incl. organ transplants) |

|

Central Government Health Scheme |

Central Government |

CGHS beneficiaries |

Liver (Live/Cadaver) |

Source: Milaap

Europe Market Insights

Europe is significantly growing in the artificial organ and bionic implants market, which is shaped by the supportive regulatory bodies and rising demand for artificial organ implants. In June 2024, Abbott notified that it received CE Mark approval in Europe for its AVEIR DR leadless pacemaker system, which is the world’s first-ever dual-chamber leadless pacemaker. The product is designed to treat patients with abnormal or slow heart rhythms. The AVEIR DR system expands advanced treatment options for people living with cardiovascular conditions.

Germany is the central player in Europe’s market due to its strong position in precision engineering and biomedical research. The country also benefits from the presence of innovative companies driving the adoption of advanced prosthetics and neuromodulation devices. In February 2025, Amparo finalized the acquisition of Adapttech to combine its expertise in direct-fit prosthetic sockets with Adapttech’s advanced data-driven solutions, thereby creating a highly integrated and innovative prosthetic care ecosystem.

France holds a strong position in the regional artificial organ and bionic implants market, effectively driven by the government-funded R&D programs and geographic expansions to meet the growing demand. In this regard, in February 2025, NETRI stated that it had inaugurated the country’s first organs-on-chip production plant in Lyon’s Gerland biodistrict, marking a major milestone for the country's medtech sector. Besides the facility, which spans over 1,100 m², which will significantly boost production capacity to up to 500,000 devices on a yearly basis, hence suitable for standard market development.

Key Artificial Organ and Bionic Implants Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic plc

- Boston Scientific Corporation

- Johnson & Johnson

- Cochlear Ltd.

- Zimmer Biomet Holdings, Inc.

- Siemens Healthineers AG

- B. Braun Melsungen AG

- LivaNova PLC

- Getinge AB

- Ottobock SE & Co. KGaA

- Edwards Lifesciences Corporation

- Second Sight Medical Products, Inc.

- SynCardia Systems, LLC

- Baxter International Inc.

- Össur hf.

The established prominent entities, such as Abbott, Medtronic, and Boston Scientific, are readily dominating the landscape of the market. The competitive edge in this field arises from the remarkable R&D budgets, exclusive product portfolios, and strong distribution networks. Besides, the firms are deliberately pursuing mergers and acquisitions to access the newest technologies and expand into new geographic markets, thereby fostering a dynamic and innovative environment.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, BiVACOR notified that its Total Artificial Heart received Breakthrough Device Designation from the U.S. FDA, which supports the TAH as a potential bridge to transplant for patients with severe biventricular or univentricular heart failure.

- In May 2025, OrganOx Ltd. reported that it had completed a second closing of its private placement with investments from Intuitive Ventures, Terumo Ventures, and Piper Heartland Healthcare LLC. The company raised USD 160 million to accelerate opportunities for its metra platform technology in this field.

- Report ID: 1373

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Organ And Bionic Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.