Cutaneous T-cell Lymphoma Treatment Market Outlook:

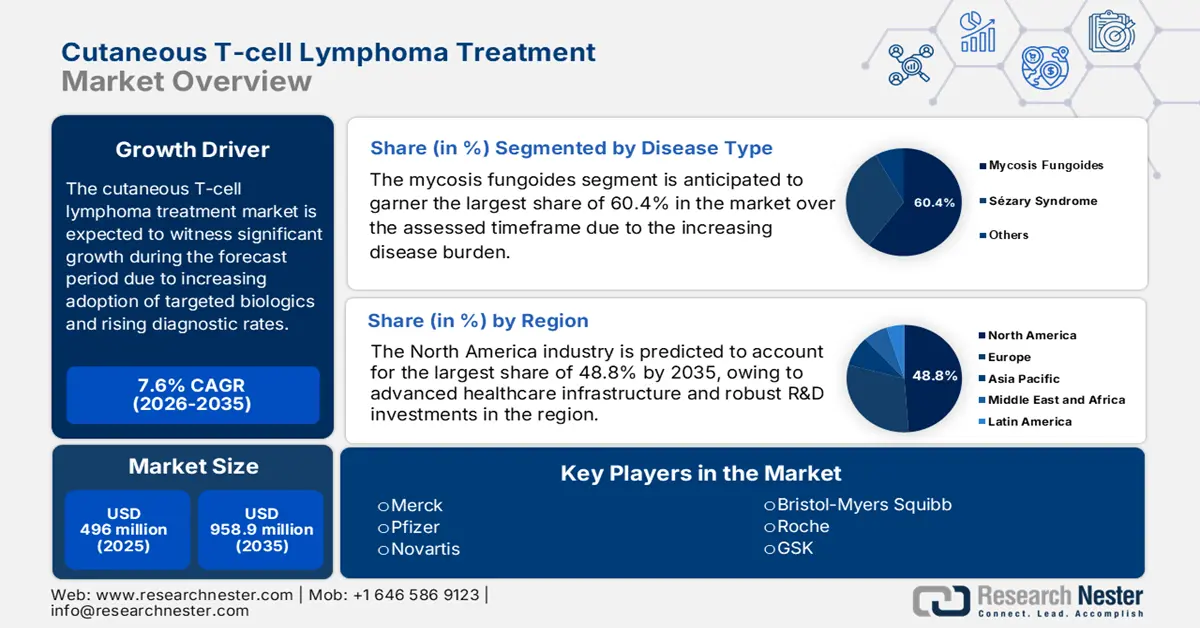

Cutaneous T-cell Lymphoma Treatment Market size was valued at USD 496 million in 2025 and is projected to reach USD 958.9 million by the end of 2035, rising at a CAGR of 7.6% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of cutaneous T-cell lymphoma treatment is estimated at USD 533.7 million.

There is an immense exposure for the worldwide market owing to the long-term needs of the afflicted population. Despite being a rare disease, its mortality rate is exceptionally higher, where the 2025 NLM study identified this condition to be the most prevalent cause of death in individuals with Sézary syndrome. Moreover, approximately 66.7% of deaths are attributed to the primary lymphoma. On the other hand, the NIH Surveillance, Epidemiology, and End Results Program observed that the demand for adequate therapies is further fueled by the presence of a rapidly aging population, with diagnostic rates improving in established economies.

Thus, to meet this surging demand, the supply chain of the cutaneous T-cell lymphoma treatment market relies on active pharmaceutical ingredients for targeted therapies such as brentuximab vedotin and mogamulizumab, where China is reported as a major supplier. Currently, payers are highly focused on demonstrating value in therapies available in this sector, especially as newer biologics and targeted therapies carry high acquisition costs. As a result, cost-effectiveness analyses are playing a larger role in justifying the inflated payers’ pricing of these therapeutics. However, the economic barriers are still evident in the case of widespread adoption. This can be displayed through the mean direct annual cost of treating cutaneous T-cell lymphoma (CTCL), accounting for USD 40516.7 for each patient, as per the 2024 NLM findings.

Key Cutaneous T-cell Lymphoma Treatment Market Insights Summary:

Regional Insights:

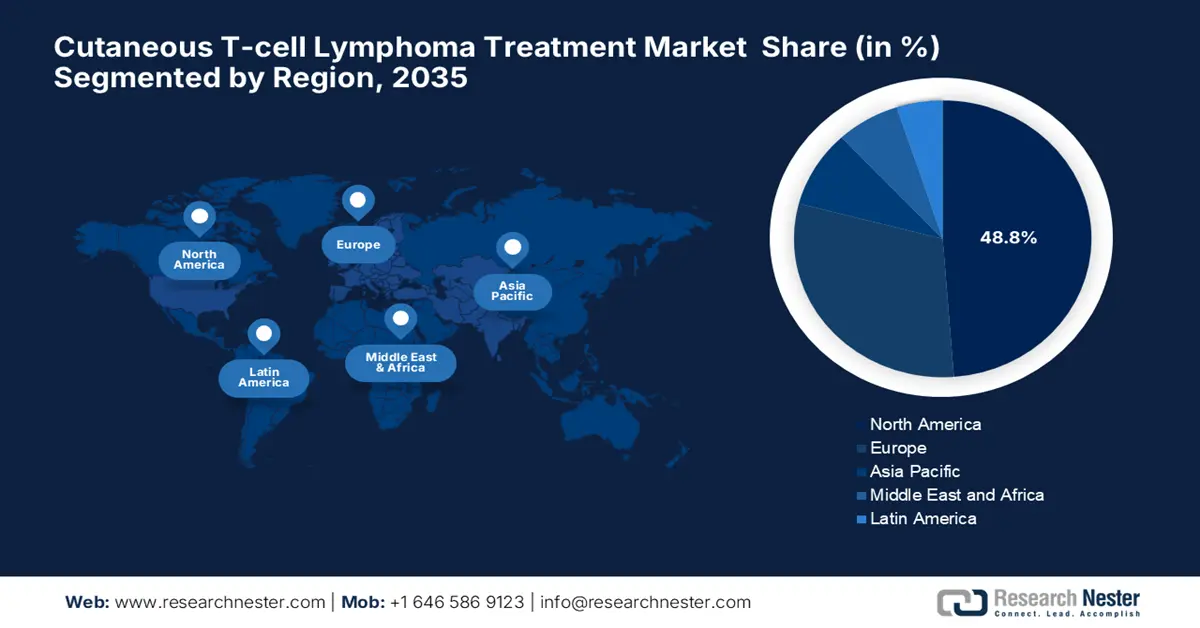

- North America is projected to account for 48.8% share by 2035, impelled by advanced healthcare infrastructure and robust R&D investments in the Cutaneous T-cell Lymphoma Treatment Market.

- Asia Pacific is likely to register the fastest growth from 2026–2035, owing to rising disease awareness, biosimilar adoption, and government-backed healthcare reforms.

Segment Insights:

- Mycosis Fungoides is projected to account for 60.4% share by 2035, fueled by its high prevalence and the growing demand from aging populations.

- Targeted Therapy is expected to capture a 48.4% share by 2035, propelled by accelerated FDA approvals and expanded public insurance coverage.

Key Growth Trends:

- Growing awareness of early diagnosis and intervention

- Benefits from biologics and targeted therapy innovation

Major Challenges:

- Stringent regulations and administrative price caps

Key Players: Seagen Inc. (Pfizer),Kyowa Kirin Co., Ltd.,Bausch Health Companies Inc.,Novartis AG,Pfizer Inc.,Janssen (Johnson & Johnson),Merck & Co., Inc.,GSK plc,Takeda Pharmaceutical Co.,Soligenix, Inc.,F. Hoffmann-La Roche Ltd,Bristol Myers Squibb,Sanofi,Eisai Co., Ltd.,Celltrion Inc.,Teva Pharmaceutical Industries Ltd.,Viatris Inc.,Dr. Reddy's Laboratories Ltd.,Mayne Pharma Group Limited,Hikma Pharmaceuticals PLC,BioInvent International AB,Innate Pharma

Global Cutaneous T-cell Lymphoma Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 496 million

- 2026 Market Size: USD 533.7 million

- Projected Market Size: USD 958.9 million by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, South Korea, France

- Emerging Countries: Malaysia, India, China, Brazil, Singapore

Last updated on : 25 September, 2025

Cutaneous T-cell Lymphoma Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Growing awareness of early diagnosis and intervention: As more healthcare providers and patients become aware of the clinical and economic benefits of identifying CTCL before worsening, investment in the cutaneous T-cell lymphoma treatment market increases. Educational initiatives and improved screening guidelines are further supporting this cohort by enhancing accessibility. For instance, in May 2024, Kyowa Kirin, in collaboration with patient advocacy groups, published a patient-focused global consensus statement to improve CTCL-related diagnosis and care, prompting medical authorities, hospitals, clinics, and clinicians to undertake 12 specific actions to support afflicted patients with adequate resources.

- Benefits from biologics and targeted therapy innovation: The emergence of personalized therapies is evolving the dynamics of patient outcomes in the cutaneous T-cell lymphoma treatment market. Particularly, the amplifying surge in precision medicine and target biomarkers in oncology is helping companies tailor therapeutics according to individual needs. Following the same pathway, in March 2025, a team of researchers at the Medical University of Vienna identified a new drug target, the CD74 protein, to treat deadly skin lymphoma. These approaches not only improve clinical outcomes but also drive demand for advanced therapies available in this field.

- Increased investment and participation in R&D: Notable allocations from pharmaceutical companies, biotech firms, research institutions, and even public authorities have been observed across the territory of the market. Such capital influx supports fast-tracked clinical trials, biomarker discovery, and the development of combination therapies, inspiring more pioneers to engage their resources in extensive R&D cohorts. As evidence, till 2025, Soligenix continued to gain success in treating early-stage CTCL with its synthetic hypericin, HyBryte, which is empowered by a USD 2.6 Million Orphan Products Development Grant from the FDA.

Demographic Analysis of the Cutaneous T-cell Lymphoma Treatment Market

Overview of Cutaneous T-Cell Lymphoma (CTCL): Epidemiology, Treatment, and Prognosis (2022)

|

Category |

Details |

|

Incidence & Prevalence |

~0.8 per 100,000 person-years globally |

|

Prevalence up to 10x higher |

|

|

Common Subtypes |

Mycosis Fungoides (MF): ~62% of CTCL |

|

Sézary Syndrome (SS): 3–5% |

|

|

Staging System |

TNMB (Tumor, Node, Metastasis, Blood) staging guides treatment decisions |

|

Prognostic Indices |

CLIPi (Early-Stage MF): Male, >60 yrs, plaques, folliculotropism, N1/Nx nodes |

|

CLIPi (Advanced): Male, >60 yrs, N2/N3, B1/B2, M1 |

|

|

CLIC (Advanced MF/SS): Age > 60, LCT, stage IV, high LDH |

|

|

Prognosis |

- MF: ~18 years OS |

|

- SS: ~3 years OS |

Overview of the Ongoing/Recent Clinical Trials in the Cutaneous T-cell Lymphoma Treatment Market

Summary of Selected Clinical Trials

|

Evaluation Goals |

Sponsor |

Study Type |

Population |

Timeline |

|

Systemic Therapies in the Treatment of CTCL |

Fondazione Italiana Linfomi - ETS |

Observational Retrospective Multicenter |

18 Years and older (Adult, Older Adult) |

2025-2026 |

|

IPH4102 Alone or in Combination with Chemotherapy in Advanced CTCL |

Innate Pharma |

Interventional (Phase 2) |

18 Years and older (Adult, Older Adult) |

2019-2026 |

|

Real World Experience with Mogamulizumab in the Treatment of CTCL |

Fondazione Italiana Linfomi - ETS |

Observational |

Age ≥18 years (with at least one previous line of systemic therapy)

|

2024-2025 |

|

Romidepsin and Lenalidomide in Treating Untreated CTCL |

Northwestern University |

Interventional (Phase 2) |

Age >= 18 years to < 60 years |

2015-2024 |

|

Confirmatory Study of Topical HyBryte vs. Placebo for CTCL |

Soligenix |

Interventional (Phase 3) |

18 Years and older |

2025-2026 |

Source: Clinicaltrials.gov

Challenge

- Stringent regulations and administrative price caps: The aspect of complex, time-consuming regulatory procedures and government price controls creates a significant economic as well as bureaucratic disparity in the cutaneous T-cell lymphoma treatment market. Besides, the strict cost-effectiveness thresholds potentially limit the scale of profitability for drug developers and manufacturers. On the other hand, the fragmented regulations for novel biologics in different regions increase the cost of compliance by demanding additional real-world and patient-specific clinical trials.

Cutaneous T-cell Lymphoma Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 496 million |

|

Forecast Year Market Size (2035) |

USD 958.9 million |

|

Regional Scope |

|

Cutaneous T-cell Lymphoma Treatment Market Segmentation:

Disease Type Segment Analysis

Mycosis fungoides is anticipated to remain the biggest source of revenue generation in the cutaneous T-cell lymphoma treatment market with a 60.4% share over the assessed timeframe. The leadership is highly facilitated by the condition being the most prevalent subtype, accounting for an annual incidence rate of 6 cases per million people in the U.S. and Europe. MF is also the root cause of 4% of all non-Hodgkin lymphoma cases, which is highly common among adults over 50, as reported by the 2023 NLM report. Thus, the rapidly aging populations around the globe are fostering a substantial demand for this segment in the upcoming years, where the proportion of people aged over 60 worldwide is poised to double from 12% to 22% by 2050 from 2015, according to the WHO.

Therapy Type Segment Analysis

The targeted therapy segment is predicted to attain a lucrative share of 48.4% in the cutaneous T-cell lymphoma treatment market by the end of 2035. The accelerated FDA approvals and the expanded coverage of public insurance are key factors propelling growth in this segment. Exemplifying the same, in July 2024, Kyowa Kirin International, in alliance with Swixx BioPharma AG, attained approval for the reimbursement of POTELIGEO (mogamulizumab) as a second-line monotherapy for adult patients with Stage IB and above MF and SS from the Polish Ministry of Health. This was a major milestone for this targeted therapy after the company signed a Promotion and Distribution Agreement with Swixx in October 2022.

Route of Administration Segment Analysis

The parenteral route of administration is poised to dominate the cutaneous T-cell lymphoma treatment market throughout the discussed timeline. The widespread use of intravenous and subcutaneous therapies, such as brentuximab vedotin and mogamulizumab, is largely attributed to a greater bioavailability and more controlled dosing. This makes them the most preferred and critical component for managing advanced or refractory CTCL cases in a majority of medical settings. The segment’s leadership is further supported by the fast-tracked approval of novel biologics and antibody-drug conjugates that require parenteral delivery, where ongoing clinical trials demonstrate their superior efficacy.

Our in-depth analysis of the cutaneous T-cell lymphoma treatment market includes the following segments

| Segment | Subsegment |

|

Disease Type |

|

|

Therapy Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cutaneous T-cell Lymphoma Treatment Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global cutaneous T-cell lymphoma treatment market with a share of 48.8% during the assessed time frame. The region benefits from an advanced healthcare infrastructure and robust R&D investments. The U.S. leads the landscape with maximum regional revenue, owing to the supportive governing bodies. Besides, by 2025, the region had 73 NCI-designated cancer centers that offer multidisciplinary CTCL care, denoting a profitable business opportunity. Furthermore, a majority portion of oncology practices in North America are emphasizing AI-based histopathology, solidifying the region’s dominance over this sector.

The U.S. is maintaining its strong dominance over the regional cutaneous T-cell lymphoma treatment market, efficiently backed by reimbursement coverage expansions and robust R&D investments. Exemplifying this, till February 2025, Citius Pharma alone invested more than USD 90 million in upfront purchase, development, pre-commercial efforts, and spinout of its revolutionary therapy LYMPHIR. The company further targeted the addressable U.S. market with approximately 3,000 CTCL patient pool that consists of a USD 400 million revenue opportunity.

There is an immense exposure for the Canada cutaneous T-cell lymphoma treatment market, which is backed by the substantial federal and provincial healthcare allocations and grants. In this context, in January 2025, the Governments of Canada and the province of Ontario collaboratively decided to invest more than USD 535 million over three years under the National Strategy for Drugs for Rare Disease (DRD) agreement. This funding was specifically intended to improve access to new and existing drugs, early diagnosis, and screening programs for residents of Ontario living with rare diseases.

Analysis of Overall and Cause‐Specific Mortality of CTCL in the U.S. (2025)

|

Metrics |

MF |

SS |

pcALCL |

SPTCL |

|

Patients diagnosed |

7957 |

272 |

1452 |

205 |

|

Incidence (per 1,000,000) |

6.1 |

0.21 |

1.1 |

0.16 |

|

Patient deaths |

1474 |

120 |

470 |

69 |

|

Follow‐up in months (median, range) |

66, 0-227 |

26, 0-216 |

66, 0-226 |

48, 0-218 |

|

2‐year OS, % |

93 |

67.7 |

88 |

79 |

|

5‐year OS, % |

83.6 |

38.4 |

79.9 |

71.3 |

Source: NLM

APAC Market Insights

Asia Pacific is likely to showcase the fastest growth in the global cutaneous T-cell lymphoma treatment market with an estimated CAGR of 7.6% from 2026 to 2035. The rigorous progress is a result of rising disease awareness, biosimilar adoption, and government-backed healthcare reforms. Japan is dominating in this region with the aspect of fast-track approvals and reimbursement coverage for novel therapies. On the other hand, South Korea’s CAR-T research and Malaysia’s telemedicine aspect provide a strong opportunity for players to capitalize on the region’s merchandise.

China commands the regional cutaneous T-cell lymphoma treatment market on account of accelerated NRDL inclusions of novel biologics. In addition, the domestic CAR-T trials and AI-based diagnostics adoption are gaining traction, which further secures steady progress for the country in this field. As evidence, in November 2022, the results from a multicenter and retrospective study conducted upon CD30‐positive lymphoma-afflicted patients in China showed a promising potential of Brentuximab vedotin (BV). The evaluation of dosage from August 2020 to September 2022 recorded 77.2% and 79.9% progression‐free survival (PFS) and overall survival (OS) rates among the study cohort after a median follow‐up of 11 months.

India is presenting lucrative opportunities for the cutaneous T-cell lymphoma treatment market with supportive government schemes and notable accessibility gaps. In this regard, the National Policy for Rare Diseases recorded a milestone in this category by offering a coverage of USD 56929.7 for the treatment of 63 rare diseases at 14 designated Centres of Excellence, reducing the financial burden of afflicted patients. Such initiatives inspire a greater volume of targeted or high-risk individuals to enroll for advanced therapy initiation, ultimately fostering lucrative opportunities for both domestic and foreign companies in this sector.

Europe Market Insights

Europe is representing consistent growth in the cutaneous T-cell lymphoma treatment market with the presence of favorable reimbursement policies and cross-border collaborations. Germany is the leading country in this landscape, holding a 32.6% of regional share owing to its strong captivity on pharmaceutical advances. Besides, the European Union (EU) undertook a Cancer Mission Initiative, which allocated a considerable fund to rare cancer research, including CTCL. Furthermore, the current innovations in CAR-T and targeted therapy development reflect its commitment towards establishing a progressive environment for the merchandise.

Germany shows a greater potential in the cutaneous T-cell lymphoma treatment market, effectively attributed to strategic pricing and yearly expenditure on advanced therapeutics. The Pharmaceutical Market Reorganization Act in the country imposes value-based pricing, which enhances patient access to required biologics. Besides, the country’s public and private spending on healthcare accounted for 12.8% of the national GDP in 2021 alone, with more than USD 8.5 billion in the pharmaceutical industry-based R&D expenditure. These figures indicate the presence of lucrative revenue opportunities in Germany.

The U.K. is offering a reliable business environment for the cutaneous T-cell lymphoma treatment market, which is empowered by pioneers with advanced drug development technologies and a strong emphasis on clinical trials. Additionally, the National Health Service (NHS) leverages the volume of capital influx through its Cancer Vaccine Launchpad, benefiting the pharma innovators in this sector. Besides, the NICE-imposed flexible pricing for orphan drugs expands patient access to cutting-edge therapeutics, whereas Genomics England is strengthening consumer trust by enabling real-world evidence.

Cost of Treating MF/SS by Stage in Public Hospitals in Spain (2024)

|

Stage |

Per-Patient Annual Cost (in USD) |

Share of Total Cost (in %) |

|

Stage I |

14154.2 |

81 |

|

Stage II |

27836.4 |

7 |

|

Stage III |

45914.1 |

6 |

|

Stage IV |

86150.2 |

6 |

|

Total National Cost |

92725421.2 |

100% |

Source: NLM

Key Cutaneous T-cell Lymphoma Treatment Market Players:

- Seagen Inc. (Pfizer)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kyowa Kirin Co., Ltd.

- Bausch Health Companies Inc.

- Novartis AG

- Pfizer Inc.

- Janssen (Johnson & Johnson)

- Merck & Co., Inc.

- GSK plc

- Takeda Pharmaceutical Co.

- Soligenix, Inc.

- F. Hoffmann-La Roche Ltd

- Bristol Myers Squibb

- Sanofi

- Eisai Co., Ltd.

- Celltrion Inc.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Dr. Reddy's Laboratories Ltd.

- Mayne Pharma Group Limited

- Hikma Pharmaceuticals PLC

- BioInvent International AB

- Innate Pharma

The cutaneous T-cell lymphoma treatment market is characterized by its oligopolistic nature, where Merck, Pfizer, and Novartis are dominating with the greater market share. The U.S. and Europe-based firms lead in terms of biologics and targeted therapies. Meanwhile, Asia-based organizations such as Dr. Reddy’s and Shanghai Henlius are leveraging biosimilars. Furthermore, the pioneers also adopt collaborations and cost optimizations, demonstrating a greater revenue potential in this landscape.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, BioInvent attained FDA clearance for Fast Track Designation to its first-in-class anti-TNFR2 antibody, BI-1808, for the treatment of adults with relapsed or refractory mycosis fungoides and Sézary syndrome, subtypes of cutaneous T-cell lymphoma (CTCL).

- In February 2025, Innate Pharma received approvals for Breakthrough Therapy Designation (BTD) for its anti-KIR3DL2 cytotoxicity-inducing antibody, lacutamab, from the FDA to treat adult patients with relapsed or refractory (r/r) Sézary syndrome (SS) after at least 2 prior systemic therapies, including mogamulizumab.

- Report ID: 3805

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cutaneous T-cell Lymphoma Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.