Single-use Mixers Market Outlook:

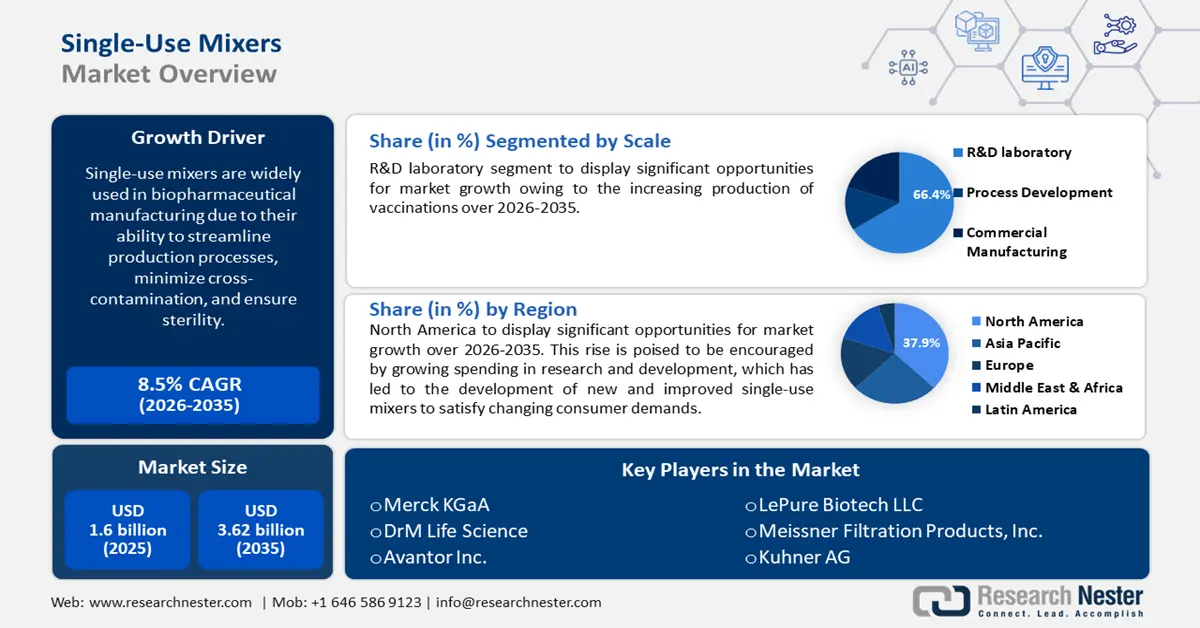

Single-use Mixers Market size was over USD 1.6 billion in 2025 and is poised to exceed USD 3.62 billion by 2035, growing at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of single-use mixers is estimated at USD 1.72 billion.

The single-use mixers market pertains to mixing equipment designed for one-time or limited use, typically in industries such as pharmaceuticals, biotechnology, and food and beverage. Single-use mixers are widely used in biopharmaceutical manufacturing due to their ability to streamline production processes, minimize cross-contamination, and ensure sterility. The adoption of single-use technologies in biopharmaceutical manufacturing grew from 17% in 2015 to 38% in 2021. Moreover, single-use mixers reduce the need for cleaning, validation, and maintenance, lowering overall operational costs and making them ideal for both small and large-scale production.

Key Single-use Mixers Market Insights Summary:

Regional Highlights:

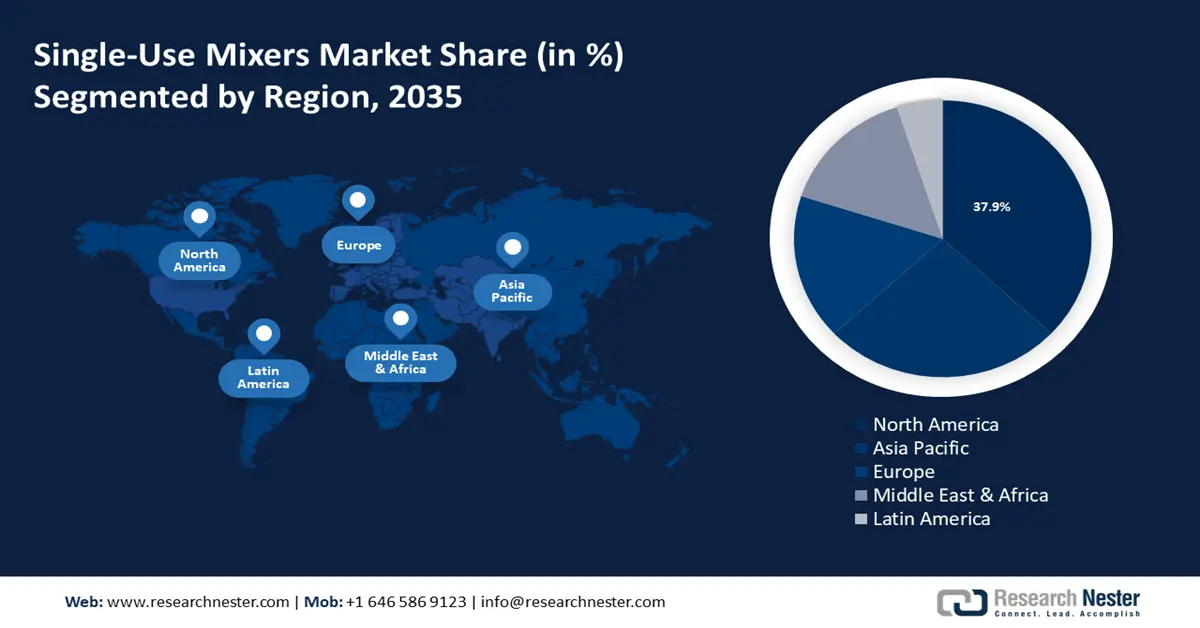

- The North America single-use mixers market achieves a 38% share by 2035, driven by increased spending in research and development leading to new, improved single-use mixers satisfying changing demands.

- The Asia Pacific market will exhibit significant growth during the forecast timeline, driven by interest from domestic and international firms in pharmaceutical development and investment in single-use technologies.

Segment Insights:

- The r&d laboratory segment segment in the single-use mixers market is projected to hold a 66.40% share by 2035, driven by increasing production of vaccinations necessitating extensive R&D.

- The consumables & accessories segment in the single-use mixers market is expected to experience significant growth till 2035, driven by the rising need for sterility in biotechnology and pharmaceutical businesses.

Key Growth Trends:

- Rising demand for personalized medicine

- Growing burden of chronic diseases

Major Challenges:

- Environmental impact

- Regulatory and compliance concerns

Key Players: Merck KGaA, DrM Life Science, Avantor Inc., LePure Biotech LLC, Meissner Filtration Products, Inc., Kuhner AG, Sartorius AG, Danaher Corporation, Agilitech.

Global Single-use Mixers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.72 billion

- Projected Market Size: USD 3.62 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Single-use Mixers Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for personalized medicine - The shift toward personalized medicine emphasizes the need for flexible, efficient, and contamination-free production methods, making single-use mixers an essential component in meeting the demands. Personalized medicine often involves the production of small, customized batches of drugs or therapies. Single-use mixers are well-suited for these smaller-scale flexible production needs due to their ease of use and quick setup.

Additionally, personalized medicine involves handling unique biological materials that require stringent sterility controls. Single-use mixers reduce the risk of cross-contamination, helping manufacturers meet regulatory standards. - Growing burden of chronic diseases - Chronic diseases, such as diabetes, cardiovascular diseases, and cancer, require advanced and scalable manufacturing solutions for the development and production of therapeutic treatments. Single-use mixers meet these needs by providing adaptable and contamination-free production capabilities, which supports the overall growth of the single-use mixers market. According to the United Nations, the global burden of disease is predicted to reach 56% by 2030, with 70% of all fatalities worldwide attributed to chronic illnesses.

- Increased investment and funding - Increased funding accelerates research and development in single-use mixer technologies, leading to innovations such as improved materials, more efficient mixing designs, and enhanced performance features. Investments by major companies and governments in biopharmaceuticals often lead to advancements in single-use systems, making them more effective for complex applications.

Challenges

- Environmental impact: Single-use mixers are made from plastic and are intended for one-time use, leading to substantial plastic waste. This waste can contribute to environmental pollution and landfill accumulation. Moreover, many components of single-use mixers are difficult to recycle due to material complexity and contamination, complicating waste management efforts.

- Regulatory and compliance concerns: Navigating regulatory requirements and ensuring compliance with stringent industry standards can be complex and time-consuming. Extensive validation and documentation are needed to ensure the safety and effectiveness of single-use systems, adding to implementation complexity.

Single-use Mixers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.62 billion |

|

Regional Scope |

|

Single-use Mixers Market Segmentation:

Scale (R&D laboratory, Process Development, Commercial Manufacturing)

The R&D laboratory segment in the single-use mixers market is estimated to gain the largest revenue share of 66.4% by 2035 on account of the increasing production of vaccinations that necessitates extensive research and development (R&D). Single-use mixers enhance production efficiency by eliminating the need for cleaning and sterilization between batches. This is crucial for the vaccine industry, where rapid production and turnaround are essential. Additionally, vaccine production often requires scaling up from clinical trials to large-scale manufacturing. Single-use mixers provide the flexibility to easily scale up operations without extensive reconfiguration or validation.

Product (Mixing Systems, Consumables & Accessories)

The consumables & accessories segment in the single-use mixers market is estimated to register a significant CAGR in the coming years propelled by the rising need for sterility which is essential for biotechnology and pharmaceutical businesses to avoid the introduction of serious infections. More than 20 billion medical devices are sterilized annually to help shield millions of people from the threats posed by fungus, viruses, and bacteria that cause infectious diseases.

In a single-use mixer, consumables and accessories cover a broad range of goods, such as flow pathways, pump heads, conductivity and pressure sensors, filters, bags, and liners offer several advantages, such as fewer capital costs, more flexibility, and fewer requirements for validation, cleaning, and sterilization. To reduce the danger of contamination, a single-use mixer uses fully sterilized bags and components to mix pharmaceutical materials from intermediate to final drug products using cutting-edge technology. For instance, bioprocess bags which are frequently composed of sterile materials are utilized in biopharmaceutical process chains to provide safety when it comes to the storage and transportation of liquids and powders and decrease the possibility of cross-contamination between batches and across products to increase process security.

End-user (Biopharmaceutical Companies, CROs & CMOs, Academic & Research Institutes)

By the end of 2035, the biopharmaceutical companies segment in the single-use mixers market is predicted to have a significant revenue share. The growth of the segment is set to be encouraged by the growing biologics sector which has led to the use of cutting-edge methods to enhance the manufacturing process. The biologics sector is expanding rapidly, with increased production of monoclonal antibodies, gene therapies, and other complex biologics.

Our in-depth analysis of the single-use mixers market includes the following segments:

|

Product |

|

|

Scale |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Single-use Mixers Market Regional Analysis:

North America Market Statistics

The single-use mixers market in North America industry is poised to dominate majority revenue share of 38% by 2035. This rise is poised to be encouraged by growing spending in research and development, which has led to the development of new and improved single-use mixers to satisfy changing consumer demands. Increased investment in healthcare research and development, including precision medicine and personalized therapies, boosts the demand for single-use mixers in research laboratories.

Furthermore, the presence of numerous industry players in the region, including GE Healthcare, PBS Biotech, Inc., Cole-Parmer Instrument Company, LLC., Avantor, Inc., and Pall Corporation, along with heightened awareness of the use of single-use technology, may spur greater innovation and customization in single-use mixers. For instance, in January 2021, Pall Corporation spent over USD 110 million to boost the capacity of single-use bioprocessing systems production worldwide to notably shorten lead times and boost output for essential biopharmaceutical manufacturing systems.

The stringent regulatory environment in the U.S. necessitates advanced manufacturing technologies. Single-use mixers help companies meet FDA requirements by simplifying validation processes and reducing the risk of contamination. Moreover, increased investment in healthcare and research, including funding for new drug development and personalized medicine, drives demand for efficient and flexible manufacturing solutions. According to the National Science Foundation's National Center for Science and Engineering Statistics (NCSES), research and experimental development (R&D) spending in the US in 2021 was USD 789.1 billion. According to performer-reported predictions, the total for 2022 was USD 885.6 billion.

In Canada, innovative biologics and tailored medicine are in high demand, which calls for small quantities and stringent control. This has led to an increase in the need for single-use mixers in recent years.

APAC Market Analysis

Asia Pacific single-use mixers market is estimated to record a significant growth during the forecast period. The market in the region has drawn interest from both domestic and international firms in recent years as a center for pharmaceutical development and investment, which is one of the main reasons for the growth of single-use technologies.

The single-use mixers market is expanding in China and India, led by the increased government funding for research and development in vaccine manufacturing and other studies. For instance, the Chinese government has prioritized boosting biotechnology research and development (R&D) in the framework of a healthy China, resulting in the production and provision of efficient preventative vaccines.

Single-use Mixers Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- DrM Life Science

- Avantor Inc.

- LePure Biotech LLC

- Meissner Filtration Products, Inc.

- Kuhner AG

- Sartorius AG

- Danaher Corporation

- Agilitech

Numerous important companies in the single-use mixers market are starting several tactical projects to increase their market share and strengthen their positions in the industry. It is predicted that the top five companies will control the majority of the market share by taking calculated risks, expanding, forming agreements, and participating in joint ventures.

Recent Developments

- In April 2022, Merck KGaA a leading science and technology company announced a partnership with the Administrative Management Committee of Wuxi National High-Tech Industrial Development Zone to expand the size of Merck's first Mobius Single-use production center in Asia-Pacific, to continue the creation and production of Covid-19 vaccines, medications, and other therapies.

- In April 2021, Avantor Inc. declared to expand the world's supply of superior single-use technology used in the manufacture of vaccines and biologics to allow clients to promptly provide patients with therapies. To meet the increasing demand from customers for vaccines, innovative cell and gene therapies for cancer and other diseases, and monoclonal antibodies (mAbs), the company also planned to expand its single-use production footprint by more than 25%.

- Report ID: 6319

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Single-use Mixers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.